Celebrating individuality! - Exception!

Celebrating individuality! - Exception!

Celebrating individuality! - Exception!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Rezidor SAS Annual Report 2005<br />

Rezidor SAS Annual Report 2005<br />

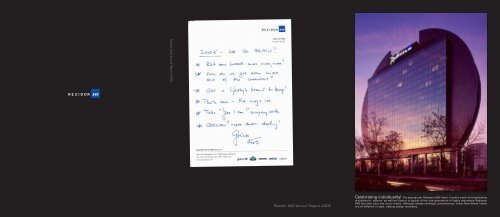

<strong>Celebrating</strong> <strong>individuality</strong>! The spectacular Radisson SAS Hotel, Frankfurt with its breathtaking<br />

architecture, exterior as well as interior is typical of the new generation of highly expressive Radisson<br />

SAS four-star plus and luxury hotels. Although always strikingly contemporary, these New Breed hotels<br />

are all different in style, defying design monotony.

This is Rezidor SAS<br />

there are 22,000+ rezidorites committed to Yes i Can! in 49<br />

countries worldwide. Rezidor SAS is one of the fastest growing hospitality<br />

companies in the world with 263 hotels in operation and/or under<br />

development in 49 countries across Europe, the Middle East, Africa and<br />

Asia. The SAS Group has a 75% share in the company while Carlson<br />

Hotels Worldwide has a 25% stake in the company and works closely<br />

FiVe stroNG brANDs<br />

n radisson sAs – First Class – 179 hotels<br />

At Radisson SAS, the Yes I Can! culture translates into treating each and every guest as a true individual. Radisson SAS<br />

aims to achieve its goal of being a market leader by combining one-to-one hospitality with clever service concepts and<br />

New Breed hotel design.<br />

n Country inn – Mid-market – 6 hotels<br />

Offering a unique Country Concept with a cosy atmosphere and friendly staff, Country Inn is all about fireplaces in the hall,<br />

comfortable lounges and relaxing rooms. Country Inn has positioned itself as a mid-market alternative for travellers who<br />

want a high level of comfort and excellent value for their money.<br />

n Missoni – Lifestyle – 2 hotels<br />

Missoni is a new lifestyle hotel brand developed in partnership with the international fashion house of the same name and<br />

aims to attract the design and style conscious traveller with hotels in city centres and resorts, designed in a strong<br />

contemporary style. Given Missoni’s growing global brand awareness, it serves not only as a suitable replacement for<br />

Cerruti, but is fundamentally a better proposition.<br />

n Park inn – Mid-market – 68 hotels<br />

At Park Inn, the focus is on offering the hospitality essentials better than any competitor within the same market.<br />

An international, mid-market, highly efficient, fresh and innovative brand, Park Inn is an uncomplicated and affordable<br />

hospitality product that offers consistently well executed service with a warm and friendly approach.<br />

n regent – Luxury – 4 hotels<br />

An international hospitality legend, Regent is virtually synonymous with luxury hotels. With a well-defined service concept<br />

inspired by the Tao from the Far East, Regent has set the standard for high-end customer service by continuously<br />

reinventing the luxury experience for guests.<br />

Rezidor SAS also has 4 unbranded hotels in its portfolio.<br />

owNersHiP<br />

sAs GroUP<br />

CArLsoN<br />

HoteLs<br />

worLDwiDe<br />

75% 25%<br />

reziDor sAs<br />

executive Summary executive Summary<br />

with Rezidor SAS in several areas such as distribution, loyalty programmes<br />

and sales. In the year 2005, Rezidor SAS saw a 11% RevPAR<br />

growth and group wide revenues reached MEUR 1,478 (1,247). Rezidor<br />

SAS had 22,854 employees, of which 19,928 worked under the Radisson<br />

SAS brand; 2,071 under Park Inn; 139 under Country Inn and 716<br />

under Regent.<br />

75% – Europe’s fourth largest airline, the SAS<br />

Group is listed on the stock exchanges in<br />

Stockholm, Copenhagen and Oslo.<br />

25% – Carlson Hotels Worldwide is ranked<br />

amongst the largest privately held corporations<br />

in the United States and is based in Minneapolis,<br />

Minnesota, USA.<br />

CoVeriNG 49 CoUNtries iN eUroPe, tHe MiDDLe eAst, AFriCA 1AND<br />

AsiA<br />

1<br />

AHr, oCC AND reVPAr<br />

MANAGed ANd LeASed oPeRATioNS,<br />

3<br />

RoLLiNG (PR deC)<br />

1<br />

1<br />

120<br />

100<br />

80<br />

60<br />

40<br />

01<br />

02<br />

03<br />

Priorities -05<br />

n Continue to increase financial performance<br />

1<br />

04<br />

3<br />

1<br />

12<br />

n Substantially grow the Park Inn brand<br />

n Form a viable partnership with a design<br />

house to launch a lifestyle brand<br />

n Establish a higher level of integration<br />

with Carlson<br />

05<br />

AHR (eUR) RevPAR (eUR) oCC (%)<br />

29<br />

19<br />

2<br />

7<br />

1<br />

7<br />

24<br />

12<br />

35<br />

NUMber oF HoteLs<br />

RezidoR 1<br />

2<br />

SAS 2<br />

1<br />

4 1<br />

7 2<br />

Radisson SAS (179) 1<br />

Country inn (6)<br />

Missoni (2)<br />

1<br />

Park inn (68)<br />

Regent (4)<br />

5<br />

Unbranded (4)<br />

2<br />

29<br />

1<br />

1<br />

6<br />

4<br />

n RevPAR growth increased by 11%<br />

n Park Inn grew from 0 to 68 hotels<br />

in just three years<br />

1<br />

n Rezidor SAS has partnered with design<br />

house Missoni and the first Missoni Hotel<br />

will open in 2007<br />

n Carlson acquired a 25% stake in Rezidor SAS<br />

7<br />

1<br />

2<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

2<br />

8<br />

4<br />

1<br />

3<br />

1<br />

1<br />

2<br />

19<br />

1<br />

7<br />

2<br />

1<br />

1<br />

3<br />

7<br />

35<br />

1<br />

1<br />

1<br />

1<br />

2<br />

2<br />

4 1<br />

7<br />

FiNANCiAL HiGHLiGHts (Pro ForMA)<br />

RezidoR SAS<br />

1<br />

1<br />

2<br />

5<br />

1<br />

2<br />

1<br />

2<br />

TeUR 2005 2004<br />

Group-wide revenues 1,478,000 1,247,000<br />

operating revenue 587,046 498,728<br />

eBiTdA 48,780 27,191<br />

eBiTdA Growth, % + 179,4 + 234,2<br />

RoCe, % 12,2 4,3<br />

Total investments 34,605 53,828<br />

ACHieVeD -05 Priorities -06<br />

n Continue to increase financial performance<br />

n Re-integrate Yes I Can! in the psyche<br />

and culture of the company in a more<br />

prominent way<br />

n Acquire a higher level of self sufficiency<br />

n Increase portfolio with a particular focus<br />

on Russia, CIS, the Middle East and<br />

Eastern Europe<br />

1<br />

1<br />

6<br />

4<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

2<br />

2<br />

4 1<br />

7<br />

1<br />

1<br />

2<br />

2<br />

1<br />

2<br />

1<br />

1<br />

4<br />

1<br />

1<br />

4<br />

Rezidor SAS locations<br />

AUSTRiA<br />

Radisson SAS: Salzburg, Vienna (2)<br />

Park Inn: Vienna (opening 2006)<br />

Country Inn: Vienna<br />

1<br />

AzeRBAijAN<br />

Radisson SAS: Baku<br />

Park Inn: Baku 1<br />

BAHRAiN<br />

2<br />

1<br />

Radisson SAS: Manama<br />

BeLGiUM<br />

Radisson SAS: Antwerp, Brussels (2), Hasselt, Spa (2)<br />

Park Inn: Liège<br />

BULGARiA<br />

Radisson SAS: Sofia<br />

CHiNA<br />

Radisson SAS: Beijing<br />

CRoATiA<br />

Regent: Zagreb<br />

CzeCH RePUBLiC<br />

Radisson SAS: Prague<br />

deNMARk<br />

Radisson SAS: Aalborg, Aarhus, Copenhagen (3),<br />

Frederikshavn, Odense, Bornholm, Silkeborg<br />

Park Inn: Aalborg, Copenhagen, Vejle<br />

eGyPT<br />

Radisson SAS: El Quseir, Sharm El Sheikh, Taba<br />

Unbranded: Sharm El Sheikh<br />

eSToNiA<br />

Radisson SAS: Tallinn<br />

FiNLANd<br />

Radisson SAS: Espoo, Helsinki (3), Oulu, Turku, Vaasa<br />

FRANCe<br />

Radisson SAS: Aix-Les-Bains, Les Arcs, Biarritz,<br />

Bordeaux (opening 2007), Lyon, Marseille (opening<br />

2007), Nice, Disneyland Resort Paris, Paris (2),<br />

Paris-Boulogne<br />

Park Inn: Arcachon, Lyon Ouest, Mâcon, Nancy,<br />

Nice, Orange<br />

Country Inn: Paris<br />

Unbranded: Aix-Les-Bains<br />

GeRMANy<br />

Radisson SAS: Berlin, Cologne, Cottbus, Dresden,<br />

Düsseldorf (2), Erfurt, Fleesensee, Frankfurt, Halle-<br />

Merseburg, Hamburg, Hannover, Karlsruhe, Leipzig<br />

(opening 2006), Lübeck, Neubrandenburg, Rostock,<br />

Rügen, Wiesbaden, Wutzschleife<br />

Park Inn: Berlin, Bochum, Chemnitz-Hartmannsdorf,<br />

Cologne (2), Dortmund, Düsseldorf, Erfurt, Hannover,<br />

Kamen, Munich (2)<br />

Country Inn: Timmendorfer Strand<br />

Regent: Berlin<br />

2<br />

1<br />

2<br />

HUNGARy<br />

Radisson SAS: Budapest, Bükfürdö<br />

Park Inn: Sarvar<br />

iCeLANd<br />

Radisson SAS: Reykjavik (2)<br />

Park Inn: Reykjavik<br />

iRAN<br />

Unbranded: Kish Island<br />

iReLANd<br />

Radisson SAS: Athlone, Cavan (opening 2006), Cork,<br />

Dublin (2; one opening 2007), Galway, Letterkenny,<br />

Limerick, Sligo<br />

Park Inn: Dublin, Dundalk, Mulranny<br />

iTALy<br />

Radisson SAS: Rome<br />

joRdAN<br />

Radisson SAS: Amman, Aqaba<br />

kAzAkHSTAN<br />

Radisson SAS: Astana (opening 2006), Medeu–<br />

Almaty (opening 2007)<br />

Regent: Almaty<br />

kUwAiT<br />

Radisson SAS: Kuwait City<br />

LATviA<br />

Radisson SAS: Riga<br />

LeBANoN<br />

Radisson SAS: Beirut<br />

LiTHUANiA<br />

Radisson SAS: Klaipeda, Vilnius<br />

MALTA<br />

Radisson SAS: Malta (2)<br />

THe NeTHeRLANdS<br />

Radisson SAS: Amsterdam (2)<br />

NiGeRiA<br />

Radisson SAS: Lagos<br />

NoRwAy<br />

Radisson SAS: Ålesund, Beitostølen, Bergen (2),<br />

Bodø, Frederikstad (opening 2007), Haugesund,<br />

Kristiansand, Lillehammer, Oslo (5), Spitsbergen,<br />

Stavanger (2), Tromsø, Trondheim, Trysil (opening 2008)<br />

Park Inn: Geilo, Haugesund, Stavanger, Rauland<br />

oMAN<br />

Radisson SAS: Muscat<br />

PoLANd<br />

Radisson SAS: Gdansk (opening 2007), Krakow,<br />

Poznan (opening 2007), Szczecin, Warsaw, Wroclaw<br />

PoRTUGAL<br />

Radisson SAS: Lisbon<br />

RoMANiA<br />

Radisson SAS: Bucharest (opening 2007)<br />

RUSSiA<br />

Radisson SAS: Moscow (3; two opening 2007),<br />

St. Petersburg, Sochi (3)<br />

Park Inn: Ekaterinburg<br />

SAUdi ARABiA<br />

Radisson SAS: Jeddah (2), Al Madina (opening 2007),<br />

Riyadh, Yanbu Al Bahr<br />

Park Inn: Al Khobar (opening 2007), Riyadh<br />

SLovAkiA<br />

Radisson SAS: Bratislava<br />

SoUTH AFRiCA<br />

Radisson SAS: Cape Town<br />

Park inn: Cape Town<br />

SPAiN<br />

Radisson SAS: Mijas (opening 2007)<br />

SwedeN<br />

Radisson SAS: Gothenburg, Helsingborg, Karlstad,<br />

Linköping, Malmö, Örebro, Östersund, Stockholm (5),<br />

Uppsala<br />

Park Inn: Borlänge, Falun, Gislaved, Gävle, Haninge,<br />

Karlskrona, Kvänum, Nyköping, Sandviken,<br />

Stockholm, Solna, Täby, Uppsala, Vargön, Värnamo<br />

SwiTzeRLANd<br />

Radisson SAS: Basel, Lucerne (opening 2006),<br />

St. Gallen<br />

Park Inn: Lully, Zurich<br />

TUNiSiA<br />

Radisson SAS: Djerba (opening 2006)<br />

TURkey<br />

Radisson SAS: Ankara, Istanbul (2)<br />

UkRAiNe<br />

Radisson SAS: Kiev<br />

UNiTed ARAB eMiRATeS<br />

Radisson SAS: Dubai–Media City, Sharjah<br />

UNiTed kiNGdoM<br />

Radisson SAS: Birmingham, Bristol (opening 2008),<br />

Durham (opening 2008), Leeds, Liverpool, London,<br />

Manchester, Stansted, Belfast, Limavady, Edinburgh,<br />

Glasgow, Jersey (opening 2007)<br />

Park Inn: Bedford, Cardiff, Harlow, Lakeside, London<br />

(2), Northampton, Nottingham, Telford, Watford, West<br />

Bromwich, Newry<br />

Country Inn: London (2)<br />

UzBekiSTAN<br />

Radisson SAS: Tashkent

TABLE OF CONTENTS<br />

2005 HIGHLIGHTS<br />

paGe 8<br />

LeTTeR FROM THe CeO<br />

paGe 0<br />

THE GROUP<br />

PAGE 14<br />

Financials 20<br />

Operations 24<br />

Markets 26<br />

THE BRANDS<br />

PAGE 28<br />

Brands 32<br />

Marketing, Sales & Distribution 36<br />

THE PROPERTIES<br />

PAGE 38<br />

Properties 42<br />

Property Highlights 44<br />

Business Development 48<br />

THE RELATIONSHIPS<br />

PAGE 52<br />

Employees 58<br />

Awards 60<br />

Customers 62<br />

Partners & Owners 64<br />

Purchasing 65<br />

Community & Environment 66<br />

Governance & Management 68<br />

THE FINANCIALS<br />

PAGE 76<br />

Statement Of The Board Of Directors<br />

And Managing Director 77<br />

Auditor’s Compilation Report 78<br />

Board Of Directors’ Report 79<br />

Group Highlights 82<br />

Income Statement 83<br />

Balance Sheet 84<br />

Statement Of Changes In Equity 86<br />

Cash Flow Statement 87<br />

Notes To The Pro Forma Group Account 88

It has many nicknames: Blue Heaven, Giant Coin, Cube in a Coin and so on and so forth. as cute as the nicknames are, the Radisson SaS<br />

Hotel in Frankfurt is not to be trifled with. This futuristic building, designed by London-based architect John Seifert and hospitality designers<br />

Matteo Thun and adam Tihany, is the first thing to catch the eye as one drives away from the airport towards the centre of Frankfurt.

Whether guests want their shirts laundered<br />

in three hours, check-out late at p.m. or<br />

log on to the Internet for free from anywhere<br />

in the hotel, at Radisson SaS, it’s all part of<br />

the service package.

Resisting generic design solutions, the New<br />

Breed of Radisson SaS hotels are kicking<br />

hospitality design up a notch to surpass all<br />

expectations and offer travellers an experience<br />

and an adventure, a story that can be<br />

taken home without packing anything extra in<br />

the suitcase.

8<br />

NEw BRAND:<br />

The Missoni Deal<br />

Rezidor SaS chose Missoni to make<br />

its mark in the lifestyle hotel market<br />

due to the truly unique and identifiable<br />

style of the famous fashion house.<br />

2005 Highlights<br />

PERFORmANCE:<br />

RevpaR reached eUR ,<br />

an increase of %.<br />

Group wide revenues grew<br />

to MeUR , 8 up 8.5%.<br />

eBITDa increased to<br />

MeUR 8.8 (2 .2).<br />

DEALS:<br />

expanding park Inn<br />

in the UK<br />

park Inn took over management of nine<br />

hotels across the UK and there are plans<br />

to renovate and upgrade the current<br />

product to park Inn standards for approximately<br />

MeUR 2 over the next two years.

GROwTH:<br />

In 2005, Rezidor SaS<br />

opened hotels and<br />

increased the supply of<br />

number of rooms by<br />

%. This is the most<br />

significant organic growth<br />

in the industry in europe.<br />

2005 Highlights<br />

CORPORATE:<br />

The Carlson Deal<br />

Carlson Hotels Worldwide, chaired by<br />

Marilyn Carlson Nelson, acquired a<br />

25% stake in Rezidor SaS, securing<br />

the brand portfolio until 2052 and<br />

reducing licensing costs.<br />

SCALE:<br />

Radisson SaS, known for<br />

its innovative design and<br />

striking architecture, is<br />

now ranked the second<br />

largest upscale brand in<br />

europe.

0<br />

Letter from the CeO<br />

”Yes I Can! is the driving mechanism<br />

of the genuine hospitality culture<br />

that energises all our brands and<br />

proves our commitment to superior<br />

guest service and satisfaction.<br />

Through Yes I Can! we constantly<br />

build on an enthusiastic hospitality<br />

culture that creates true value for<br />

customers and owners alike.”

Turning an enthusiastic Hospitality Culture into Value<br />

Today, Radisson SAS is the second largest<br />

upscale brand in Europe and second<br />

to none when measured on organic<br />

growth. Its younger sibling, Park Inn, has<br />

had a flying start, going from 0 to 68 hotels<br />

in just three years.<br />

I have sometimes been accused of being a<br />

growth junkie and there is certainly some truth to<br />

this. I do believe that outgrowing the competition<br />

is the only way to secure a position in a marketplace<br />

as dynamic as ours. The hotel industry has<br />

changed drastically in the last decade, as have<br />

all travel-related industries. Our industry is challenged<br />

by complex business patterns dictated<br />

by contrasting developments. However, there<br />

are a number of strong underlying currents that<br />

you have to deal with to stay in business, especially<br />

if you want to stay ahead.<br />

To have sharply defined and widely recognized<br />

brands has become a major success factor.<br />

Global brands and industry majors are<br />

consistently increasing their market share, while<br />

local brands and regional companies are finding<br />

it hard to compete. To a great extent, success<br />

in this business is about critical mass – to be eligible<br />

in the hotel business race you have to be<br />

there. And to be there, you must grow.<br />

We have a long history of fast growth. We<br />

have multiplied tenfold since we started operating<br />

as a separate company in 1993 and now<br />

rank among the five largest hotel management<br />

companies in Europe. In fact, Rezidor SAS is<br />

one of the fastest growing hospitality management<br />

companies in the world. We intend not<br />

only to keep up this pace but to accelerate it. By<br />

2015, we aim to have 700 hotels and to achieve<br />

this goal we will need to grow by at least 40<br />

properties annually, across all brands.<br />

But it’s not only a question of growing fast, it’s<br />

vitally important to have profitable growth. To a<br />

great extent that depends on how we fuel the<br />

growth. Mergers and acquisitions are a fast track<br />

to growth, but nothing matches the power of primarily<br />

growing organically, building momentum<br />

from within. In 2005, we increased our supply by<br />

16% in terms of number of rooms, the most significant<br />

organic growth in the industry in Europe.<br />

Letter from the CeO<br />

To grow organically, it is necessary to have truly<br />

competitive brands and products, that not only<br />

proactively meet the needs and preferences of<br />

customers but are also easy to find and easy to<br />

buy. An aggressive growth strategy coupled<br />

with a clear understanding of customers and<br />

what they want are our key value drivers. This is<br />

true at every level: brand, hotel and individual<br />

service provider.<br />

Each of our five brands has a distinctive<br />

brand promise which meets clearly defined<br />

consumer needs and profiles and is delivered<br />

by committed people. As customer needs and<br />

preferences change, so do our brands and what<br />

they offer. Radisson SAS is a good example of<br />

how we’re responding to change in buyer needs<br />

and preferences. Although clever functionality is<br />

still the backbone of the Radisson SAS brand,<br />

we know that upscale guests are looking for a<br />

great experience, something truly memorable<br />

from their stay. The New Breed of Radisson<br />

SAS hotels with their spectacular architecture<br />

and design – with service elements to match –<br />

are redefining contemporary upscale hospitality.<br />

Some of these new hotels clearly have “destinational”<br />

qualities, while all of them create delight<br />

and add value to a holiday or business trip. Increasingly,<br />

we are building share of market by<br />

gaining share of heart!<br />

We will also bring more heart to the market<br />

with our new lifestyle brand, Hotel Missoni. Bold<br />

and highly contemporary, Hotel Missoni will build<br />

on the typical Missoni look of iconic home-ware<br />

design and offer the next generation of lifestyle<br />

hotels. We entered into an agreement with the<br />

famous Italian fashion house after exhaustive<br />

partner evaluation that led us to conclude that<br />

Missoni is one of few fashion houses with a truly<br />

unique and identifiable style, well-suited for rescale<br />

in a hospitality format. If Hotel Missoni can<br />

capture any of the wonderful warmth and remarkable<br />

finesse of the Missoni family, and not<br />

least the spirit of Rosita Missoni herself, I know<br />

it will be a great success. The first Hotel Missoni<br />

will open for business in 2007, and the aim is to<br />

have 30 hotels by 2015.<br />

Our brand portfolio with focussed hospitality<br />

products from mid-market to full luxury reflects<br />

another key strategy – diversification. We believe<br />

it’s important to explore various avenues for<br />

growth and consolidation, and at the same time<br />

hedge against market and country risk. Today,<br />

we have hotels in operation and/or under development<br />

in 49 countries in Europe, the Middle<br />

East, Africa and Asia. We manage city centre and<br />

suburban hotels, airport hotels and resort hotels.<br />

Our properties vary from 900+ room high-rises to<br />

boutique properties with just 46 rooms.<br />

By 20 5, we aim to have 00<br />

hotels and to achieve this goal<br />

we will need to grow by at least<br />

0 properties annually, across<br />

all brands.<br />

The year 2005, was a year of change, of the<br />

market turning around, of progress and also,<br />

sadly a year in which the world witnessed natural<br />

disasters of large magnitudes and terrorism<br />

found its way to our doorstep. On the 9th of<br />

November, the Radisson SAS Hotel, Amman in<br />

Jordan was the target of a vicious attack and a<br />

member of the Rezidor SAS family, Yousef Homaisi,<br />

a young waiter, lost his life, along with 30<br />

of our guests. Seeing the damage saddened<br />

and enraged me, as this company, in many<br />

ways, is my life. The team at Amman showed<br />

the true value of Yes I Can! and kept the hotel<br />

running while cooperating with authorities and<br />

taking care of guests.<br />

This year saw the long-time franchise partnership<br />

with Carlson Hotels Worldwide develop into<br />

a shareholder agreement when Carlson acquired<br />

a 25% shareholding in Rezidor SAS from the SAS<br />

Group in return for renegotiated commercial terms<br />

of the current Master Franchise Agreement (MFA).<br />

The Carlson deal was a major step towards securing<br />

our future, and made a favourable impact on<br />

our bottom-line from the day the deal was signed.<br />

Licensing costs were reduced as part of the deal,<br />

improving pre-tax profits for the company by<br />

MEUR 6 in 2005. The agreement brings additional<br />

scale and profitability to Rezidor SAS and further<br />

enhances development opportunities by giving us<br />

an even better platform for growth.

Goals and targets<br />

CORPORATE<br />

2<br />

FINANCIAL<br />

mARkET<br />

■ To be the preferred alternative in hotel management with<br />

distinctive brands and treating hotels as individual units in<br />

order to optimize profitability.<br />

■ EBITDA margin of 10% and annual EBITDA growth of 15%<br />

over a business cycle.<br />

■ At least 700 hotels by 2015, as a result of growing the<br />

number of hotels by at least 40 properties annually, across all<br />

brands.<br />

Letter from the CeO<br />

properties in operation/under development and revenue growth<br />

���<br />

���<br />

���<br />

���<br />

���<br />

��<br />

�<br />

LOCAL<br />

COmPETITION<br />

No. of hotels<br />

61<br />

��<br />

80<br />

��<br />

100<br />

��<br />

113<br />

��<br />

127<br />

��<br />

146<br />

��<br />

■ Continually improving RevPAR penetration to become the<br />

leader within our competitive set in every market we serve.<br />

160<br />

��<br />

CUSTOmERS<br />

EmPLOyEES<br />

RESPONSIBLE<br />

BUSINESS<br />

182<br />

��<br />

200<br />

��<br />

Group-wide revenue (MeUR)<br />

247<br />

��<br />

263<br />

��<br />

�����<br />

�����<br />

���<br />

���<br />

���<br />

■ To achieve 93% customer satisfaction and loyalty for each<br />

brand in 2006, with year on year improvement.<br />

■ To be the employer of choice by accentuating personal<br />

development, career development and empowerment. For each<br />

brand to achieve a consistent and improved level of employee<br />

engagement/retention. To increase Rezidor SAS overall Climate<br />

Analysis scores with 2 percentage points in 2006.<br />

■ Maintain industry leadership in environmental performance<br />

by continuing to increase efficiency per guest night at<br />

property, brand and group level and ensure compliance with<br />

corporate ethical and human rights standards.

More importantly, the agreement secured our<br />

brand portfolio until 2052, extending the original<br />

MFA by 20 years. It also ensures that the companies<br />

align and grow the brands globally,<br />

through loyalty and rewards programmes as<br />

well as a commitment to re-energise service<br />

delivery across all brands.<br />

Initially a Carlson programme, Yes I Can! is the<br />

driving mechanism of the genuine hospitality culture<br />

that we have taken fully into our hearts. We<br />

introduced Yes I Can! at Rezidor SAS 10 years<br />

ago, and it has been at the core of our operation<br />

ever since. It is our mission and vision alike. It is<br />

our policy to hire by a Yes I Can! attitude and to<br />

train our people in Yes I Can! scenarios, not only<br />

In 2005, we increased our<br />

supply by % in terms of<br />

number of rooms. This is the<br />

most significant organic growth<br />

in the industry in europe.<br />

frontline but on all levels and in all areas in the<br />

company. Everyone in Rezidor SAS embodies<br />

Yes I Can! and creates value in all the company<br />

functions, in good times as well as bad.<br />

In fact, we attacked the many challenges of<br />

the economic downturn in the last couple of<br />

years with our Yes I Can! approach.<br />

“Yes I Can! secure a fifty percent profit conversion<br />

of every revenue increase and all cost<br />

savings.”<br />

“Yes I Can! get more customer value out of<br />

less resource consumption.”<br />

The past years have made us very good at<br />

cost management. I dare say that we are industry<br />

leaders in this respect! However, from 2005,<br />

we have shifted our focus to revenue generation,<br />

while keeping costs on a very short leash.<br />

In March 2005, we organized the Revenue Generation<br />

conference in Berlin for Rezidor SAS<br />

employees and partners to shift the whole company<br />

into an accelerated growth phase.<br />

To take full advantage of the upturn we relaunched<br />

Yes I Can! by taking it to a higher level<br />

of intensity and enthusiasm across all our<br />

brands. A system-wide refresher training pro-<br />

Letter from the CeO<br />

gramme was rolled out in December 2005 and<br />

will continuously be in action from now on.<br />

Yes I Can! is about attitude – about Yes! Having<br />

the right attitude is what makes Rezidor SAS<br />

people different from everyone else. Not everything<br />

is possible, but almost everything is. At<br />

Rezidor SAS we do our utmost to make things<br />

happen, to say Yes and mean it.<br />

Yes I Can! – it’s personal. It’s about me as an<br />

individual service provider. We never forget that<br />

hospitality is delivered on a one-to-one basis<br />

and it’s up to each of us to create that memorable<br />

hospitality experience for our guests. This is<br />

a personal responsibility. Our industry has now<br />

become so sophisticated that sometimes it’s<br />

easy to forget the very foundation of it all – to be<br />

a good host. I can assure you that this will not<br />

happen in our company.<br />

Finally, Yes I Can! is about competence and<br />

empowerment – about Can! To be able to actually<br />

deliver you must not only know what to do,<br />

how to solve the problem, but also be empowered<br />

to make decisions to do the right thing in<br />

the first place, or make it right if it is not. In 2003,<br />

we reorganised the company, moving decisionmaking<br />

as close to the customer as possible,<br />

empowering front line staff to make the best out<br />

of each situation, be it a good one or initially a<br />

not so good one. Things go wrong, that’s the<br />

nature of business, which is why service recovery<br />

is a very important aspect of Yes I Can!<br />

I’m very proud of how strongly we have managed<br />

to reset our minds to Yes I Can! on an<br />

even higher level. I’m confident that it will energise<br />

all our brands and prove our commitment<br />

to superior guest service and satisfaction.<br />

Through Yes I Can! we constantly build on an<br />

enthusiastic hospitality culture, that creates true<br />

value for customers and owners alike.<br />

The year 2005 showed healthy commercial and<br />

financial development. The company generated<br />

group wide revenue of MEUR 1.478, an increase<br />

of 18%. Earnings Before Taxes (EBT) was MEUR<br />

31 versus MEUR 4.2 in 2004. This includes MEUR<br />

6.2 gain from the sale of shares of Radisson SAS<br />

Hotel, London Stansted Airport. With this sale we<br />

have divested all real estate and operate as a pure<br />

hospitality management company.<br />

The key driver of our financial development is a<br />

11% growth in the company’s Revenue Per Available<br />

Room (RevPAR). The European hotel market<br />

as a whole continued to develop favourably with a<br />

RevPAR increase of 4-5% on average, but Rezidor<br />

SAS was able to capitalize on this growth by being<br />

present in the right markets at the right time and<br />

by doing the right things to maximise potential.<br />

A multi-continental company with Scandinavian<br />

roots, Rezidor SAS has a very strong presence<br />

in Scandinavia. With the Nordic capitals<br />

gaining strongest RevPAR in 2005, Rezidor SAS<br />

has benefited significantly from the market recovery<br />

in these regions. Despite the terrorist attacks<br />

in London, the UK hotel market performed at 4%<br />

increase in RevPAR over the last year. The Middle<br />

East, Russia and Eastern Europe have shown<br />

tremendous growth potential for revenue yield.<br />

In 2006, the company will continue with its assertive<br />

development strategy with an increased<br />

focus on developing Russia, CIS, the Middle East<br />

and East European markets while reinforcing a<br />

strong presence in the home markets. In first<br />

quarter of 2006, we opened eight new properties<br />

for business and signed another 10.<br />

I believe we have found the right rhythm in<br />

our trading cycle with the ability to sustain and<br />

even accelerate organic growth from existing<br />

hotels, new properties won over one by one or<br />

in portfolios, as well as newly-built hotels starting<br />

to trade. That said, I certainly do not rule out<br />

acting on bigger business opportunities that<br />

may cross our path.<br />

I’m very confident that the platform we have<br />

built positions us well for future growth. The<br />

right market conditions are there. The right initiative<br />

is here.<br />

Brussels, 30 March 2006<br />

Kurt Ritter<br />

A devoted Yes I Can! Rezidorite since 1976

Generating revenue! Rezidor SaS is one of the fastest growing hospitality companies in the world working rapidly<br />

towards its goal of 00 hotels by 20 5. The company is aggressively growing new home markets, seeking out new opportunities<br />

and taking full advantage of the market upturn while growing critical mass and facilitating behind the scenes efficiency.

time to<br />

TRAVEL<br />

www.rzgp.com<br />

www.rzgp.com<br />

*Europe, Middle East and Africa<br />

AND YOU CAN SPEND GOLD POINTS ON WHAT MATTERS MOST TO YOU<br />

Gold Points can be exchanged for great experiences close to home and worldwide, such as Award Stays in EMEA* and the<br />

Americas, as well as points exchange for miles with more than 11 airline partners, charity donations or in-hotel Express Awards.<br />

Just visit www.rzgp.com, login and simply choose how to spend your Gold Points. And we will keep you up to date with offers we<br />

know that you will like.<br />

EARNING GOLD POINTS ® IS EASY<br />

You can earn Gold Points every time you stay at Radisson SAS, Park Inn or Country Inn hotels in EMEA*. All you have to do is just<br />

quote your goldpoints plus membership number when making a reservation and present your membership card when checking in.<br />

Your account will be credited with 20 Gold Points for every 1€ of qualifying spend at Radisson SAS hotels (10 Gold Points for every<br />

1€ spend at Park Inn and Country Inn hotels) including your room and meals. So, with Award Nights starting from as little as 10,000<br />

points you’ll soon have earned enough for your first free stay. And remember, you can book an Award Stay in EMEA* before having<br />

accumulated the necessary points, so book now and earn later.<br />

TIME IS THE MOST PRECIOUS COMMODITY YOU POSSESS. WE UNDERSTAND<br />

THAT – WHICH IS WHY EVERYTHING WE DO IS DESIGNED TO HELP YOU MAKE<br />

THE MOST OF EVERY MOMENT YOU SPEND WITH US – ON BUSINESS OR PLEASURE.<br />

GOLDPOINTS PLUS IS OUR WAY OF THANKING YOU FOR TRUSTING US WITH<br />

YOUR TIME.<br />

Join goldpoints plus now and earn<br />

time to spend on the things you love.<br />

UK - Travel

The latest ad campaigns strongly deliver the<br />

brand message that Radisson SaS hotels are<br />

stylish, upscale, innovative, contemporary,<br />

edgy, easy, friendly and unpretentious. With<br />

targeted outdoor advertising on billboards<br />

and in print media, Radisson SaS gives travellers<br />

a sense of always being with them.

With tactical advertising, brand-specific imagery, coordinated<br />

marketing programmes and strategic partnerships, Rezidor<br />

SaS brings its brands to life and effectively educates customers<br />

about how each brand meets their needs better than anyone<br />

else in the market.<br />

8

63128 BRUZT Elite Hotels Ad_Zagreb 12/12/05 10:51 AM Page 1<br />

WHERE THE ALLURE<br />

OF ZAGREB IS MOST<br />

KEENLY FELT<br />

LIVE THE LUXURY<br />

True luxury is faithful to the heart of Zagreb!<br />

For reservations worldwide visit www.regenthotels.com or call toll free 1 800 545 4000.<br />

Almaty Berlin Beverly Hills Kuala Lumpur Shanghai Singapore Taipei Zagreb<br />

63128 BRUZT Elite Hotels Ad_ Berlin 12/12/05 10:58 AM Page 1<br />

REDISCOVER TRUE<br />

LUXURY IN THE HEART<br />

OF BERLIN<br />

LIVE THE LUXURY<br />

Rediscover a new definition of luxury in the heart of this fascinating city!<br />

For reservations worldwide visit www.regenthotels.com or call toll free 1 800 545 4000.<br />

Almaty Berlin Beverly Hills Kuala Lumpur Shanghai Singapore Taipei Zagreb

even though europe saw an average<br />

RevpaR growth of just –5%,<br />

Rezidor was ahead of the market<br />

with a RevpaR increase of %<br />

due to being in the right markets at<br />

the right time and by doing the<br />

right things to perform optimally.

Restoring profitability in a Tricky Business environment<br />

It was yet another banner year for Rezidor<br />

SAS, a year that saw the financial results<br />

taking a big jump towards reaching the<br />

company’s overall goals. In 2005, Rezidor<br />

SAS signed 29 new hotel contracts (15<br />

Radisson SAS, 13 Park Inn and one lifestyle)<br />

totalling almost 5,000 rooms. A bold<br />

business development strategy resulted<br />

in the opening of 21 new Park Inn and 16<br />

new Radisson SAS hotels across Europe<br />

and the Middle East. At the end of 2005,<br />

the Rezidor SAS portfolio included 263<br />

hotels, of which 46 are under development,<br />

encompassing approximately 50,000 rooms<br />

in 49 countries.<br />

Rezidor SAS capitalised on strong market<br />

demand and growth to have very favourable<br />

results. In 2005, all key ratios including Occupancy,<br />

AHR (Average House Rate), RevPAR<br />

(Revenue Per Available Room), and GOPPAR<br />

(Gross Operating Profit Per Available Room)<br />

were well above the previous year.<br />

FINANCIAL HIGHLIGHTS<br />

Financials<br />

CONTINUING TO PROSPER<br />

In the year 2005, operating revenues, including<br />

owned and leased hotels reached MEUR 587<br />

(498,7); an increase of 17.7% Earnings Before<br />

Tax (EBT) was MEUR 31. This result includes a<br />

gain of MEUR 6.2 from the sales of the shares<br />

of Radisson SAS Hotel, London Stansted Airport.<br />

The key driver of this healthy financial development<br />

is a 11% growth in the company’s<br />

RevPAR.<br />

RevPAR reached EUR 67 (61) and Earnings<br />

Before Interest, Tax, Depreciation and Amortisation<br />

(EBITDA) was MEUR 48,8 (27,2). This<br />

positive development in 2005 is mainly due to<br />

comparable units increasing EBITDA by MEUR<br />

20,0 over 2004.<br />

This was the eleventh year of consecutive<br />

growth in terms of number of hotels and business<br />

volume.<br />

At the end of 2005, 217 (190) hotels were<br />

under operation and 46 (57) were under development,<br />

totalling 263 (247) hotels in 49 (48)<br />

countries. The number of rooms in the reserva-<br />

tion system were 43,900 (39,400) – an increase<br />

of 11.4 (16)%. In total, 22,854 (18,642), fulltime<br />

equivalent employees worked under the five<br />

Rezidor SAS brands, 19,928 (16,400) of whom<br />

worked for Radisson SAS.<br />

Of the 217 hotels in operation, none (1) are<br />

owned, 60 (49) are leased, 81 (66) are managed<br />

and 76 (72) are under franchise agreements.<br />

While lease or management operation is the<br />

core business for Rezidor SAS, franchising is<br />

playing an increasingly important role in reaching<br />

critical market awareness. In addition, franchise<br />

fees are a secure income source,<br />

regardless of the health of the local economy.<br />

Owned and leased hotels contributed to 89.6<br />

(89.6)% of the operative revenue and the remainder<br />

came from management and franchise<br />

contracts as well as other income sources.<br />

Room revenue accounted for 55 (53)% of the<br />

operating revenue, and Food & Beverage revenue<br />

accounted for 31 (31)%.<br />

2005 PRO FORmA 200 pRO FORMa 200 2002 200<br />

Group-wide revenue, TeUR ) 1,478,000 ,2 ,000 , 2 ,000 , 0 ,000 ,0 0,000<br />

Operating revenue, TeUR 587,046 8, 28 8 , 8 , 5 ,<br />

eBIT, TeUR 34,987 , 22 –2 , 50 ,0 8 2 , 22<br />

Financial items, net, TeUR 487 – , – ,0 8 – ,80 –2, 5<br />

Net income, TeUR 26,448 ,5 2 – 2,5 ,8 ,<br />

eBITDa Margin % 8.3 5.5 – .0 .2 –<br />

eBIDTa, Growth, %* 179.4 2 .2 – 8 – –<br />

equity, TeUR ) 158,520 28, ,52 ,8 0 , 20<br />

Balance sheet total, TeUR 364,433 8 , 2 2 , 2 , 0 28 ,88<br />

Dividends paid, TeUR 2) 0 , , 8 , ,<br />

Total investments, TeUR<br />

key ratios<br />

34,605 5 ,828 5 ,280 0, 8,<br />

profit Margin %, (GOp %) ) 35 0<br />

Return on capital employed %<br />

) Including minority interest, following IFRS.<br />

12.2 . – . 8. .<br />

2) Group Contribution in Norway in 200 , 200 and 2005.<br />

) Gross Operating profit (GOp), including leased and managed hotels.<br />

) Revenue in leased, managed and franchised hotels.<br />

* pro forma for 2005 and 200 – prior years are also prepared in accordance with IFRS.<br />

2

GETTING AHEAD OF THE mARkET<br />

In the year 2005, the European hotel market<br />

continued to develop favourably with a RevPAR<br />

increase of 4–5% on an average. With a 11%<br />

increase in RevPAR, Rezidor SAS has been able<br />

to capitalize on this growth due its strong presence<br />

in Scandinavia. Nordic capitals gained<br />

strongest RevPAR in 2005: Copenhagen<br />

+19.4%, Oslo +13%, Stockholm +10.2% and<br />

Helsinki +9% and Rezidor SAS benefited significantly<br />

from the market recovery in these regions.<br />

Despite the terrorist attacks in London,<br />

the hotel market there performed at 4% increase<br />

in RevPAR over the last year. The Middle<br />

East continues to perform at a mixed pace,<br />

while Russia and Eastern Europe have shown<br />

tremendous growth potential for revenue yield.<br />

Occupancy for comparable unites increased<br />

to 70 (65)% due to an increase in demand and<br />

rates. AHR went up to EUR 99 (95), and RevPAR<br />

rose by EUR 67 (61). As a result, the Gross Operating<br />

Profit (GOP) margin increased to 35<br />

(34)%. The GOP, the total operating revenue<br />

minus operating expenses, is the basic operation<br />

efficiency indicator.<br />

Rezidor SAS maintained a RevPAR advantage<br />

after taking operational efficiency into account,<br />

with a GOPPAR above the industry average.<br />

OPERATIONAL PROFILES<br />

22<br />

RADISSON SAS<br />

By the end of the year 2005, 147 (138) Radisson<br />

SAS hotels were in operation, offering 33,287<br />

(31,400) rooms through the reservation system.<br />

In addition, 32 hotels are under development.<br />

Group-wide Radisson SAS revenues including<br />

owned, leased, managed and franchised<br />

hotels, reached MEUR 1,242 (1,095) in 2005.<br />

operating revenues for owned and leased hotels<br />

rose to TEUR 460.3 (406.6). Revenues from<br />

comparable units increased by 13 (0.8)%. The<br />

GOP margin increased to 37 (34)% in 2005 for<br />

owned, leased and managed hotels.<br />

Occupancy for comparable units increased<br />

to 70 (65)%, due to increase in volume, both in<br />

the business travel and meetings and events<br />

segment. RevPAR increased to EUR 72 (63)<br />

and AHR rose to EUR 102 (97).<br />

PARk INN<br />

Financials<br />

At the end of the year 58 (40) Park Inn hotels were<br />

in operation, representing 8,728 (6,300) rooms in<br />

the reservation system. Park Inn grew by leaps<br />

and bounds in 2005, establishing its presence in<br />

the UK, Germany and France. In addition, 10 (18)<br />

Park Inn hotels are under development.<br />

Group-wide revenues for Park Inn, including<br />

leased, managed and franchised hotels reached<br />

MEUR 173.6 (102.0) in 2005. Occupancy was<br />

at 56.5 (56.7)% and RevPAR was EUR 36 (32),<br />

while AHR reached EUR 64 (57). The GOP for<br />

leased and managed was 35 (32)% in 2005.<br />

COUNTRy INN<br />

At the end of the year, 6 (6) Country Inn hotels<br />

were in operation, representing 515 rooms in<br />

the reservation system. Group-wide revenues<br />

for Country Inn, including leased, managed<br />

and franchised hotels, reached MEUR 13.6<br />

(13.5) in 2005.<br />

REGENT<br />

At the end of 2005, 3 (3) Regent hotels were in<br />

operation offering 703 rooms in the high-end<br />

luxury market segment. Group-wide revenue for<br />

Regent, including leased, managed and franchised<br />

hotels was MEUR 25.9 (18.0) in 2005.<br />

BY DeC , 2005 REzIDOR SAS RaDISSON SaS paRK INN COUNTRY INN ReGeNT MISSONI<br />

Number of hotels 263 8 *** 8 2<br />

Number of hotels in operation* 217 50*** 58 0<br />

Number of rooms 43,900 , 8 , 0 –<br />

Number of rooms currently trading* 33,354 , 8 5 0 0<br />

Countries of operation* 48 0 0<br />

Occupancy**, % 70 0 5 – – –<br />

aHR**, eUR 99 02 – – –<br />

RevpaR**, eUR 67 2 – – –<br />

GOp**, % 35 5 – – –<br />

* Including franchise hotels<br />

** Not including franchise hotels<br />

*** Includes unbranded hotels

UNIT COST DEvELOPmENT, 2001– 2005<br />

RezIDOR SaS, eUR<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

REvENUE PER AvAILABLE ROOm, 2001– 2005<br />

RezIDOR SaS, eUR<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

GROUP-wIDE REvENUE, 2001– 2005<br />

RezIDOR SaS, TeUR<br />

1,500<br />

1,200<br />

900<br />

600<br />

300<br />

01<br />

01<br />

01<br />

02<br />

02<br />

02<br />

03<br />

03<br />

03<br />

04<br />

04<br />

04<br />

05<br />

05<br />

05<br />

Financials<br />

NUmBER OF ROOmS, 2001– 2005<br />

RezIDOR SaS, GROUp-WIDe<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

01<br />

02<br />

OCCUPANCy, 2001– 2005<br />

RezIDOR SaS, peR CeNT<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

01<br />

02<br />

03<br />

03<br />

GOP PERCENTAGE, 2001– 2005<br />

RezIDOR SaS, peR CeNT<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

01<br />

02<br />

03<br />

04<br />

04<br />

04<br />

05<br />

05<br />

05<br />

2

Operations<br />

Building excellence from the Bottom Up<br />

De-centralisation has been the main focus<br />

for Rezidor SAS for the past couple of<br />

years as rapid growth and the need to<br />

support expansion has made it vital to increase<br />

hotel autonomy and accountability.<br />

Rezidor SAS has evolved from being<br />

a top-down company to becoming a<br />

bottom-up company with every General<br />

Manager carrying full responsibility for his<br />

or her hotel.<br />

A new operations structure, headed by Executive<br />

Vice President and Chief Operating Officer,<br />

Werner Kuendig, was introduced in 2005 to<br />

strengthen decentralisation and empowerment.<br />

This new structure is supported by the Corporate<br />

Sales, Marketing, Finance & Accounting,<br />

Revenue Development, People Development,<br />

Safety & Security and Future Openings departments.<br />

The goal is to streamline hotel operations,<br />

offer support to increase revenue and<br />

maintain a high standard of quality and customer<br />

satisfaction.<br />

OFFERING SUPPORT<br />

– THE BIG REORGANISATION<br />

General Managers are supported by Regional<br />

Directors and Area Vice Presidents, who work<br />

closely with the COO to define strategies and<br />

develop tools designed to increase revenue and<br />

optimise operations.<br />

Hotels propose their own revenue goalsbased<br />

on local parameters. Once the revenue goals are<br />

accepted by the head office in Brussels, hotels<br />

decide on how best to reach those targets.<br />

Hotels now determine locally the best course<br />

of action in terms of sales and marketing and<br />

are supported in their efforts by the regional and<br />

corporate offices. The marketing and sales<br />

teams offer brand guidelines and support the<br />

hotels by helping to create advertisements, brochures<br />

and other print and online collateral.<br />

Hotels are given communications and public<br />

relations support from regional PR teams that<br />

work closely with the Area Vice Presidents and<br />

Regional Directors. The local Global Sales Office<br />

help hotels by going on targeted sales calls,<br />

2<br />

while the distribution team looks for various online<br />

opportunities to promote individual hotels<br />

and drive revenue.<br />

NEw OPENINGS<br />

A dedicated team, which is part of the Brusselsbased<br />

operations together with their respective<br />

Area Vice President/Regional Director facilitates<br />

and coordinates the entire pre-opening process.<br />

The main aim of this team is to open all new<br />

hotels, whether new builds or conversions, on<br />

time, on budget and with all key executives well<br />

placed and well trained.<br />

The Directors of Revenue Development<br />

(DRDs) together with their respective Regional<br />

Directors/Area Vice Presidents are responsible<br />

for the efficient launch of hotels in terms of identifying<br />

and optimising revenue opportunities<br />

with the help of established tools and checklists.<br />

New hotel profiles, fact sheets and hotel<br />

web content is created based on market studies<br />

conducted by DRDs, and this collateral is<br />

then distributed to the Global Sales Organization<br />

(GSO). The GSOs then start driving sales<br />

long before the hotel opens its doors.<br />

For new openings, the corporate and regional<br />

team is responsible for managing the pre-opening<br />

budget, room configuration and defining the<br />

scope of work in order to manage the overall<br />

development of the project. This includes regular<br />

interaction and dialogue with the technical<br />

development and regional operations team.<br />

Conversions on the other hand require extensive<br />

employee training and coaching, and support<br />

for the General Manager, Director of Sales<br />

and Revenue Manager. The main focus in a<br />

conversion is on transforming the hotel into a<br />

true brand representative.<br />

TOOLS FOR SUCCESS<br />

Rezidor SAS pays special attention to the<br />

needs of hotels that are performing below par.<br />

The operations team follows up with these hotels<br />

every month and coaches the hotel General<br />

Manager on a regular basis to keep<br />

communication lines open and offer help and<br />

tools to increase revenue.<br />

Part of this process includes the creation of an<br />

Activity Plan by the General Manager of the<br />

hotel to raise the Gross Operating Profit (GOP)<br />

by an achievable percentage. The Regional Director<br />

and Area Vice President work closely with<br />

the General Manager to ensure success.<br />

The Director of Revenue Development in<br />

each region is responsible for sustaining and<br />

supporting revenue generation. Tools provided<br />

to each hotel include a checklist, a best practices<br />

guide, profiles and fact sheets to help revenue<br />

development.<br />

ALL ABOUT QUALITy<br />

The Quality Performance Review (QPR) Programme<br />

aids the consistent delivery of the<br />

brand promise. The QPR involves quality inspections<br />

and has been developed around specific<br />

brand service and operating standards. It<br />

focuses exclusively on the customer experience<br />

in relation to product, service and brand. The<br />

QPR is performed by an impartial consultant<br />

who uses a checklist to inspect specific areas<br />

of the hotel with a focus on ensuring the continuous<br />

adherence to the Yes I Can! culture.<br />

The QPR monitors basics such as the checkin<br />

experience, the quality and service of the restaurants<br />

and bars, hotel security, meetings and<br />

events facilities and the check-out experience.<br />

The consultant also reports on the overall cleanliness,<br />

maintenance and repair, interior décor<br />

and design plus the service and friendliness of<br />

hotel staff.<br />

The QPR goal for both Radisson SAS and<br />

Park Inn was set for 85 for 2005. Both brands<br />

effectively achieved the required target and the<br />

company plans to raise the bar in upcoming<br />

year/s, by setting the goal to 87% for both<br />

brands in 2006.<br />

Hotels that scored below 85 are required to<br />

develop a Management Action Plan (MAP) to<br />

rectify issues and report to the relevant Regional<br />

Director/Area Vice President, who in turn are<br />

responsible for follow up. Information regarding<br />

QPR, including reports, check lists and brand<br />

information are available on the company’s intranet<br />

library for reference.

Quality is all about exceeding expectations,<br />

again and again! From Berlin<br />

to Beirut and Copenhagen to Cape<br />

Town, all Radisson SaS hotels offer<br />

a consistently high level of service<br />

and put a high emphasis on quality.

Taking advantage of the Market Upturn<br />

Throughout 2005, the hotel industry, in<br />

general, faced a number of challenges,<br />

including natural disasters and the continuing<br />

threat of terrorism. Hotel performance<br />

remained resilient despite these<br />

events and any adverse effects they had<br />

on trading were short lived. RevPAR continued<br />

to record positive growth throughout<br />

the year across Europe, the Middle<br />

East and Asia. International visitor arrivals<br />

rose during 2005 and are expected to increase<br />

in the coming years.<br />

Hotels in the Middle East posted a hugely impressive<br />

RevPAR growth of 21.4%. Hotel performance<br />

across Asia slowed during 2005: the<br />

region recorded a healthy increase in RevPAR of<br />

9.1%, but this is a far cry from record-breaking<br />

results achieved in 2004, when RevPAR grew<br />

by 25%. In Europe, growth was steady and the<br />

average RevPAR was up by 4–5% on average.<br />

The enlargement of the European Union created<br />

new opportunities for the hotel and travel<br />

industry, with a high demand for quality accommodation<br />

in the new member states. Hotel<br />

branding is expected to grow across all categories<br />

with a strong focus on mid-scale brands in<br />

Eastern Europe. A common currency and borderless<br />

Europe, coupled with the perception of<br />

safer tourism are expected to foster hotel revenues<br />

and increase tourism from countries like<br />

India and China that are experiencing an economic<br />

boom.<br />

Rezidor SAS anticipates that hotel performance<br />

across the Middle East and Asia will race<br />

ahead in 2006, while trading across Europe will<br />

remain steady. As the hotel industry begins to<br />

consolidate and new brands enter the market,<br />

a steady but sustainable growth in business<br />

performance is expected to help keep the industry<br />

moving in the right direction during the<br />

coming year.<br />

STRONG SCANDINAvIA<br />

Scandinavian hotels top the growth in Europe<br />

for 2005 as the region saw RevPAR growth of<br />

6.7% with Copenhagen recording the highest<br />

growth at 19.4%, followed by Oslo that saw a<br />

2<br />

Markets<br />

13% growth in RevPAR and Stockholm where<br />

RevPAR increased by 10.2%.<br />

Oslo also recorded the highest growth in occupancy<br />

in 2005, with an 11.5% increase to<br />

68%. The potential for growth in Scandinavia is<br />

for mid-market hotels, with limited growth for full<br />

service hotels. Norway is a very mature and<br />

consolidated hotel market with the major brands<br />

already established as the big players.<br />

Copenhagen is the most international market<br />

in Scandinavia, although there is a strong variation<br />

in demand with peak seasons in the summer<br />

and a low season in the winter. Any<br />

expectation of price increase is limited in this<br />

region where there is, currently, no dominating<br />

market leader.<br />

Unemployment is still a considerable problem<br />

in Sweden and the social system is being financed<br />

by high taxes to reduce the official unemployment<br />

numbers. In Sweden, as is in the<br />

rest of Scandinavia, growth will be seen in the<br />

mid-market brand with opportunities for portfolio<br />

deals.<br />

UP AND UP Uk & IRELAND<br />

The UK hotel market recorded a 4% RevPAR<br />

growth in 2005. While there were fluctuations in<br />

the fortunes of hoteliers around the country, the<br />

overall improvement in annual room yield clearly<br />

demonstrates the strength and resilience of both<br />

London and regional hotel markets.<br />

London recovered remarkably quickly from<br />

the July bombings to remain at the head of European<br />

performance rankings in terms of overall<br />

RevPAR, but the fact that the rest of the UK<br />

grew almost twice as much highlights the terrific<br />

performance of hotels in destinations such as<br />

Gatwick, Aberdeen and Liverpool.<br />

Nine UK destinations dominated the top 10<br />

European occupancy table and included<br />

Heathrow, Gatwick, Edinburgh, Manchester,<br />

London, Cardiff, Newcastle, Bath & Bristol, and<br />

Glasgow.<br />

However, the buoyancy of the UK economy<br />

is expected to marginally slow down in the coming<br />

years. The Bank of England is considering<br />

lowering interest rates in order to encourage<br />

customer spending and retail sales. But the<br />

property market is at the top of the cycle with<br />

yields dropping to their lowest levels for the last<br />

five years.<br />

Despite a plethora of new supply, the Irish<br />

economy in general, and the Irish hotel business<br />

in particular, continue to perform surprisingly<br />

well.<br />

EmERGING EASTERN EUROPE<br />

Hotels in Eastern Europe can be proud of their<br />

performance in 2005, as RevPAR increased<br />

12.5%. With the continued lack of internationally<br />

branded hotels and increasing demand,<br />

there seems to be no end in sight in the growth<br />

of average room rates in the big cities. In Warsaw,<br />

RevPAR grew an impressive 15%, driven<br />

primarily by increasing demand. An increase in<br />

the number of low-cost airlines servicing the city<br />

continues to bring in more tourists and consequently<br />

the supply demand imbalance that has<br />

existed for the last few years is finally being<br />

redressed.<br />

In addition, Hungary, the Czech Republic and<br />

Slovakia are also expected to experience strong<br />

economic growth in the coming years. A marked<br />

increase in prosperity is also predicted in the<br />

Baltic countries. Bulgaria is preparing to become<br />

a member of the EU in 2008 and is poised<br />

for growth across all industries. Expansion is<br />

also expected in key destinations such as Sarajevo,<br />

Ljubljana, Montenegro, Dubrovnik and<br />

Belgrade.<br />

Though existing hotels are doing well in the<br />

region and will continue to do well, the road to<br />

expansion in Eastern Europe is made somewhat<br />

bumpy by the emergent nations’ underdeveloped<br />

legal systems and high levels of<br />

bureaucracy.<br />

CRISP CENTRAL EUROPE<br />

Most large European countries showed positive<br />

results in 2005, with performance indicators<br />

generally on the rise. The economic downturn<br />

faced by the EU15 countries, especially Germany,<br />

France and the Netherlands is starting to<br />

reverse.<br />

Economic growth was moderate in Germany<br />

in 2005, as the German elections led to a wait-

and-see policy by many leading economic players<br />

over the third quarter. But now in the spotlight<br />

as host nation to the 2006 World Cup, Germany<br />

is enjoying a stable political situation and is<br />

showing a slight improvement in performance.<br />

SOmBRE SOUTHERN/mEDITERRANEAN<br />

EUROPE<br />

Southern Europe was the weakest performing<br />

region during 2005, with no RevPAR growth. Its<br />

performance was dragged down by the significant<br />

RevPAR declines in both Lisbon and<br />

Athens. Both cities hosted major sporting<br />

events in 2004 and naturally could not sustain<br />

this performance during 2005.<br />

A number of Spanish cities are suffering from<br />

over-supply and as a result the country only reported<br />

a very modest RevPAR growth of 1.3%.<br />

In 2006, in the four-star plus segment, RevPAR<br />

is expected to increase due to a rise in occupancy,<br />

while in the mid-scale segment, any increase<br />

will come from a rise in room rates.<br />

The strength of the individual business travel<br />

sector in France has helped compensate for the<br />

drop of the leisure clientele and the lack of any<br />

real movement in the seminars sector. Turkey<br />

and Greece continue to offer great potential, although<br />

the political instability in both countries<br />

creates difficult trading environments.<br />

mAJESTIC mIDDLE EAST<br />

The Middle East once again exceeded expectations<br />

by recording solid growth in 2005. Diverse<br />

and changing economic development show<br />

high GDP growth in Qatar, Bahrain and Kuwait.<br />

Middle East travel and tourism, growing nominally,<br />

is expected to increase by 4.4% per<br />

annum from 2006 through 2015.<br />

Governments are encouraging industries and<br />

services to reduce dependence on oil and drive<br />

revenues through other sources. Tourism is playing<br />

a major part in this effort to diversify, especially<br />

in Dubai, Oman and other main feeder markets.<br />

Dubai is slowly claiming the spot as one of the<br />

top tourist destinations in not just the Middle<br />

East, but the world and the hotel business in the<br />

city is booming. The future is, however, difficult to<br />

predict, due to instability within the region.<br />

ROARING RUSSIA<br />

Moscow performed exceptionally in 2005, with<br />

a RevPAR increase of 30.4%. The Russian travel<br />

market remains lucrative with the number of outbound<br />

travellers reaching more than 20 million in<br />

2005; Russians purchased approximately two<br />

million package holidays during the year.<br />

As Russians continue to gain additional disposable<br />

income, the potential of the vast Russian<br />

market continues to expand and the speed<br />

of development will prove crucial to financial<br />

success. Russia is encouraging private investment<br />

through economic reforms, liberalisation,<br />

privatisation and greater transparency.<br />

However, government bureaucracy and inconsistencies<br />

in the rule of law have the same<br />

adverse effect on expanding business in Russia<br />

as they do in Eastern Europe.<br />

AmAzING AFRICA<br />

A number of African countries are on a healthy<br />

path of growth and recovery. The highest GDP<br />

real growth was seen in Equatorial Guinea, Angola,<br />

Morocco, Tunisia and Tanzania. The cur-<br />

The hotel industry in Stockholm<br />

did extremely well in 2005 with<br />

a 0.2% increase in RevpaR<br />

– the coming year promises to<br />

be just as good.<br />

rent unstable situation in the Middle East means<br />

that West Africa is becoming an increasingly<br />

important source of gas and oil. In many countries,<br />

the upward shift in both manufacturing<br />

and services is supported by diamond trading<br />

and government-sponsored economic reforms<br />

that attract foreign investments.<br />

Other destinations such as South Africa, Seychelles,<br />

Kenya, Tanzania, Morocco and Tunisia offer<br />

good, if limited, tourism potential and leisure traveller<br />

arrivals have increased in the sub-Saharan regions.<br />

Internationally branded hotels are achieving<br />

higher occupancies, rates and GOPs than in Europe.<br />

The vast majority of African accommodation<br />

is unbranded and offers great potential for hotel<br />

development and brand coverage.<br />

However, Africa is perceived as having low<br />

safety and security, which limits business and<br />

leisure travel. The continent suffers from corruption<br />

in certain countries and a lack of adequate<br />

infrastructure. Other challenges faced by the<br />

hospitality industry include mobilization of<br />

project financing and restriction on the import of<br />

equipment and materials.<br />

2

Redefining lifestyle hotels! Rezidor SaS is ready to make its mark in the lifestyle hotel market with its new,<br />

bold, highly contemporary Missoni brand. In 2005, Rezidor SaS entered into an agreement with the famous fashion house to<br />

develop and launch Missoni Hotels. The lifestyle hotels will interpret the current Missoni look of their iconic home-ware range<br />

and will develop this into the next phase of lifestyle hotel design.

Instantly identifiable, rich in colour, vibrant in<br />

texture! Missoni is not just a creation to fit a<br />

short-term marketing opportunity, but a historic<br />

brand with a great story. Three generation<br />

of Missoni women have stayed faithful to<br />

the deep emotional roots of the brand and<br />

are committed to doing the right things for<br />

its longevity and success.<br />

0

Brands<br />

Building Brands, Boosting Business<br />

A multi-brand organisation, Rezidor SAS<br />

offers hotel brands that meet the needs<br />

of every type of traveller, whether they<br />

are looking for the ultimate in luxury at a<br />

world-class hotel or simply seeking a<br />

good night’s sleep in a fresh and clean<br />

hotel. Rezidor SAS guests are guaranteed<br />

a consistent standard of service all<br />

over the world from Europe and the<br />

Middle East to Africa.<br />

2<br />

REzIDOR SAS, BRAND POSITIONING<br />

luxury<br />

first class<br />

mid market<br />

economy<br />

budget<br />

Formule 1<br />

Rezidor SAS brands are carefully positioned,<br />

both in the company’s portfolio and in their global<br />

competitive set, to create maximum portfolio<br />

and market dynamics. All brands have a<br />

distinctive personality and every new hotel in<br />

each brand helps carry the baton of individual<br />

brand identity one step further.<br />

To guard against brand confusion, all brands<br />

are meticulously and strictly defined with brand<br />

manuals and other brand identity collateral to<br />

secure strict brand control. In addition, quality<br />

assurance inspections follow up on individual<br />

hotel compliance and the audits involve hotel<br />

visits to monitor quality and performance, according<br />

to pre-defined service criteria.<br />

Ibis<br />

Park Inn<br />

Country Inn<br />

Holiday Inn<br />

Novotel<br />

Scandic<br />

Rezidor SAS, at the corporate level, also has<br />

defined core values and developed graphic<br />

guidelines. The multi-brand sales team uses<br />

multi-brand sales collateral, which include the<br />

Rezidor SAS World Wide Directory, a Rezidor<br />

SAS Meeting Planner Guide and brochures for<br />

the marketing and business development<br />

departments.<br />

All Rezidor SAS brands share a positive service<br />

attitude and have a strict focus on safety and<br />

security for guests and employees alike. This is<br />

the foundation of the company’s strong commitment<br />

to the environment, local community<br />

and the Rezidor SAS Responsible Business<br />

programme.<br />

missoni<br />

Four Seasons<br />

Regent<br />

Inter-Continental<br />

Radisson SAS<br />

Hilton<br />

Marriott<br />

Sheraton<br />

minimum service limited service full service

Rezidor SaS offers an impressive<br />

selection of hotel<br />

brands, designed to suit a<br />

variety of budgets, requirements<br />

and occasions.

Brands<br />

Radisson SaS defines the New Breed in hotel architecture and design as it scales<br />

new heights with spectacular properties. From the aquaDom in Berlin to the<br />

fabulous architecture of the new hotel in Frankfurt, Radisson SaS distinguishes<br />

itself as a contemporary and progressive, first class hotel brand.<br />

at Radisson SaS, the Yes I Can! service culture means treating every guest as a true<br />

individual. By combining attentive one-to-one hospitality with clever service concepts<br />

– most of them focusing on choice and making the stay easy – Radisson SaS offers<br />

a unique service experience which truly celebrates <strong>individuality</strong>.<br />

Country Inn is the hotel of choice for travellers looking for a cosier and homely<br />

experience as well as great value for money. Combining all the consistencies and<br />

standards expected from a major international hotel brand with all the comforts<br />

of home is the Country Inn way.<br />

Country Inn hotels are all about fireplaces in the hall, comfortable lounges, relaxing<br />

rooms and an all-embracing country hospitality that meets and greets each guest<br />

the moment they walk into the hotel.<br />

Contemporary in style and culture, Missoni hotels will put a great emphasis on<br />

design, plus certain key hardware and software elements, including – but not limited<br />

to – bars and restaurants, bathrooms and the service culture.<br />

Missoni is one of the very few fashion houses with a truly unique and identifiable<br />

image and the hotels will interpret the look currently exemplified by the iconic Missoni<br />

design. Missoni hotels will target well-travelled, stylish individuals who are willing to<br />

pay for an experience that is reflective of how they see themselves and their values.<br />

park Inn hotels focus on offering hospitality essentials better than anyone else in the<br />

same market. Spotlessly clean, easy and safe, park Inn hotels are youthful, colourful,<br />

energetic and fun with a warm and relaxed Yes I Can! approach to service. The brand<br />

is deeply committed to providing the key essential of any hotel experience, a good<br />

night’s sleep.<br />

a value-driven and flexible concept with the most striking new brand identity in the<br />

current hotel market, park Inn promises to be the best in its class, the hotel of<br />

choice in the mid-market segment.<br />

The brand heritage of Regent is one of unashamed luxury for all the senses. Regent<br />

follows its unique Tao, drawing service inspiration from the Far east: to serve others<br />

is to serve oneself, to hear without being told, to see without being shown and to<br />

know without being asked.<br />

Regent guests are a special breed of truly discerning and cosmopolitan individuals<br />

who value superior hospitality and timeless traditions. They choose Regent for<br />

business and pleasure knowing they are guaranteed a highly personalised level of<br />

world-class service from employees with a passion for excellence and the greatest<br />

attention to detail.<br />

Rezidor SAS also has 4 unbranded hotels in its portfolio.

Number of hotels:<br />

179<br />

Number of hotels:<br />

2<br />

Brands<br />

Number of hotels:<br />

6<br />

Number of hotels:<br />

4<br />

Number of hotels:<br />

68 58<br />

5

Marketing, Sales & Distribution<br />

Creating accessibility In all Channels<br />

Marketing brings brands to life and this<br />

life-giving marketing operation at Rezidor<br />

SAS is both aggressive and proactive. By<br />

implementing strategic and tactical advertising,<br />

co-ordinated marketing programmes<br />

and strong partner relationships,<br />

the company and its marketing staff embodies<br />

the key Rezidor SAS message of<br />

delivering positive brand associations<br />

through strong customer service and an<br />