DOING BUSINESS IN TURKEY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Doing Business in Turkey<br />

41<br />

BUS<strong>IN</strong>ES<br />

<strong>IN</strong>CENTIVES<br />

<strong>IN</strong> <strong>TURKEY</strong><br />

<strong>IN</strong>CENTIVES<br />

Local and foreign investors can<br />

benefit from incentives equally in<br />

Turkey.<br />

There are 4 types of investment<br />

schemes in the incentive system<br />

of Turkey, which are:<br />

• General Investment<br />

Incentives<br />

• Regional Investment<br />

Incentives<br />

• Large Scale Investment<br />

Incentives<br />

• Strategic Investment<br />

Incentives<br />

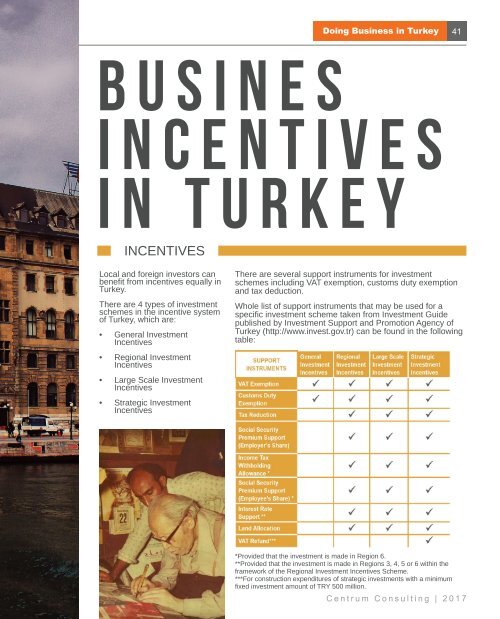

There are several support instruments for investment<br />

schemes including VAT exemption, customs duty exemption<br />

and tax deduction.<br />

Whole list of support instruments that may be used for a<br />

specific investment scheme taken from Investment Guide<br />

published by Investment Support and Promotion Agency of<br />

Turkey (http://www.invest.gov.tr) can be found in the following<br />

table:<br />

*Provided that the investment is made in Region 6.<br />

**Provided that the investment is made in Regions 3, 4, 5 or 6 within the<br />

framework of the Regional Investment Incentives Scheme.<br />

***For construction expenditures of strategic investments with a minimum<br />

fixed investment amount of TRY 500 million.<br />

Centrum Consulting | 2017