2005 Annual Report – "Thriving" - Royal Canadian Mint

2005 Annual Report – "Thriving" - Royal Canadian Mint

2005 Annual Report – "Thriving" - Royal Canadian Mint

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

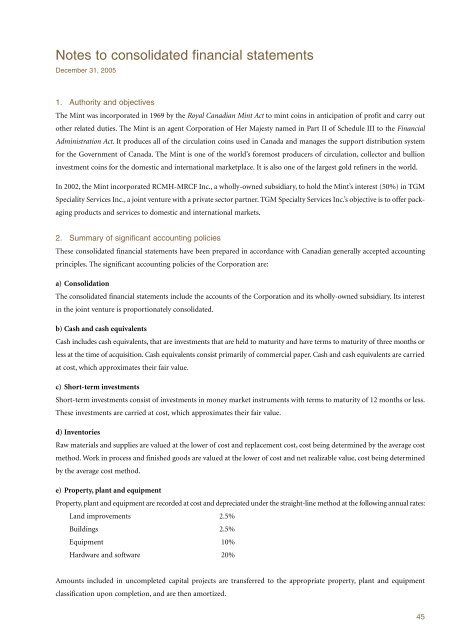

Notes to consolidated financial statements<br />

December 31, <strong>2005</strong><br />

1. Authority and objectives<br />

The <strong>Mint</strong> was incorporated in 1969 by the <strong>Royal</strong> <strong>Canadian</strong> <strong>Mint</strong> Act to mint coins in anticipation of profit and carry out<br />

other related duties. The <strong>Mint</strong> is an agent Corporation of Her Majesty named in Part II of Schedule III to the Financial<br />

Administration Act. It produces all of the circulation coins used in Canada and manages the support distribution system<br />

for the Government of Canada. The <strong>Mint</strong> is one of the world’s foremost producers of circulation, collector and bullion<br />

investment coins for the domestic and international marketplace. It is also one of the largest gold refiners in the world.<br />

In 2002, the <strong>Mint</strong> incorporated RCMH-MRCF Inc., a wholly-owned subsidiary, to hold the <strong>Mint</strong>’s interest (50%) in TGM<br />

Speciality Services Inc., a joint venture with a private sector partner. TGM Specialty Services Inc.’s objective is to offer packaging<br />

products and services to domestic and international markets.<br />

2. Summary of significant accounting policies<br />

These consolidated financial statements have been prepared in accordance with <strong>Canadian</strong> generally accepted accounting<br />

principles. The significant accounting policies of the Corporation are:<br />

a) Consolidation<br />

The consolidated financial statements include the accounts of the Corporation and its wholly-owned subsidiary. Its interest<br />

in the joint venture is proportionately consolidated.<br />

b) Cash and cash equivalents<br />

Cash includes cash equivalents, that are investments that are held to maturity and have terms to maturity of three months or<br />

less at the time of acquisition. Cash equivalents consist primarily of commercial paper. Cash and cash equivalents are carried<br />

at cost, which approximates their fair value.<br />

c) Short-term investments<br />

Short-term investments consist of investments in money market instruments with terms to maturity of 12 months or less.<br />

These investments are carried at cost, which approximates their fair value.<br />

d) Inventories<br />

Raw materials and supplies are valued at the lower of cost and replacement cost, cost being determined by the average cost<br />

method. Work in process and finished goods are valued at the lower of cost and net realizable value, cost being determined<br />

by the average cost method.<br />

e) Property, plant and equipment<br />

Property, plant and equipment are recorded at cost and depreciated under the straight-line method at the following annual rates:<br />

Land improvements 2.5%<br />

Buildings 2.5%<br />

Equipment 10%<br />

Hardware and software 20%<br />

Amounts included in uncompleted capital projects are transferred to the appropriate property, plant and equipment<br />

classification upon completion, and are then amortized.<br />

45