BIS 311 DeVry Week 3 iLab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

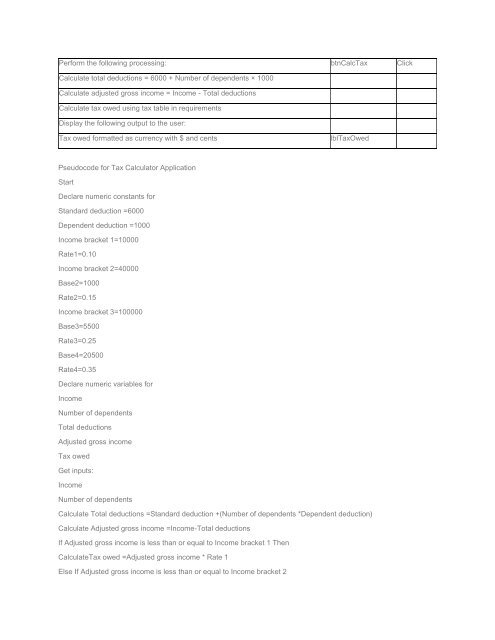

Perform the following processing: btnCalcTax Click<br />

Calculate total deductions = 6000 + Number of dependents × 1000<br />

Calculate adjusted gross income = Income - Total deductions<br />

Calculate tax owed using tax table in requirements<br />

Display the following output to the user:<br />

Tax owed formatted as currency with $ and cents<br />

lblTaxOwed<br />

Pseudocode for Tax Calculator Application<br />

Start<br />

Declare numeric constants for<br />

Standard deduction =6000<br />

Dependent deduction =1000<br />

Income bracket 1=10000<br />

Rate1=0.10<br />

Income bracket 2=40000<br />

Base2=1000<br />

Rate2=0.15<br />

Income bracket 3=100000<br />

Base3=5500<br />

Rate3=0.25<br />

Base4=20500<br />

Rate4=0.35<br />

Declare numeric variables for<br />

Income<br />

Number of dependents<br />

Total deductions<br />

Adjusted gross income<br />

Tax owed<br />

Get inputs:<br />

Income<br />

Number of dependents<br />

Calculate Total deductions =Standard deduction +(Number of dependents *Dependent deduction)<br />

Calculate Adjusted gross income =Income-Total deductions<br />

If Adjusted gross income is less than or equal to Income bracket 1 Then<br />

CalculateTax owed =Adjusted gross income * Rate 1<br />

Else If Adjusted gross income is less than or equal to Income bracket 2