You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

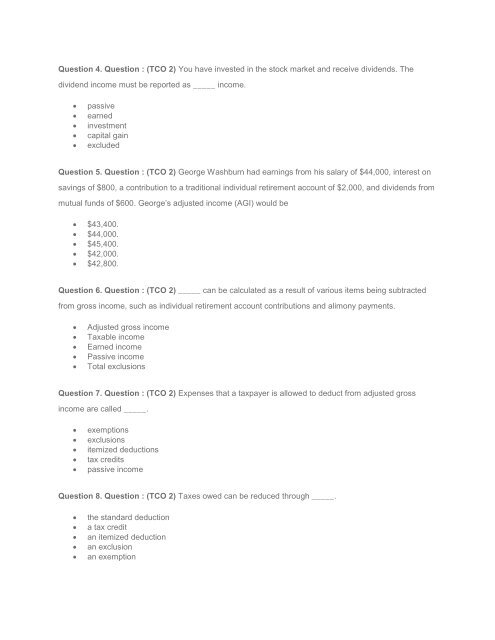

Question 4. Question : (TCO 2) You have invested in the stock market and receive dividends. The<br />

dividend income must be reported as _____ income.<br />

<br />

<br />

<br />

<br />

<br />

passive<br />

earned<br />

investment<br />

capital gain<br />

excluded<br />

Question 5. Question : (TCO 2) George Washburn had earnings from his salary of $44,000, interest on<br />

savings of $800, a contribution to a traditional individual retirement account of $2,000, and dividends from<br />

mutual funds of $600. George’s adjusted income (AGI) would be<br />

$43,400.<br />

$44,000.<br />

$45,400.<br />

$42,000.<br />

$42,800.<br />

Question 6. Question : (TCO 2) _____ can be calculated as a result of various items being subtracted<br />

from gross income, such as individual retirement account contributions and alimony payments.<br />

<br />

<br />

<br />

<br />

<br />

Adjusted gross income<br />

Taxable income<br />

Earned income<br />

Passive income<br />

Total exclusions<br />

Question 7. Question : (TCO 2) Expenses that a taxpayer is allowed to deduct from adjusted gross<br />

income are called _____.<br />

<br />

<br />

<br />

<br />

<br />

exemptions<br />

exclusions<br />

itemized deductions<br />

tax credits<br />

passive income<br />

Question 8. Question : (TCO 2) Taxes owed can be reduced through _____.<br />

<br />

<br />

<br />

<br />

<br />

the standard deduction<br />

a tax credit<br />

an itemized deduction<br />

an exclusion<br />

an exemption