Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Treasury bond rate<br />

corporate bond<br />

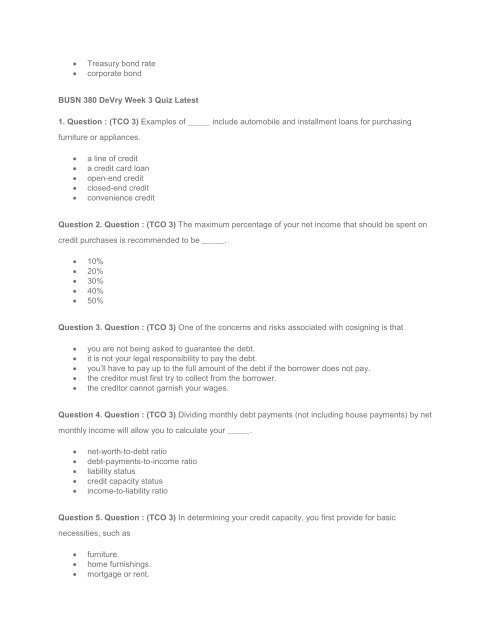

<strong>BUSN</strong> <strong>380</strong> DeVry Week 3 Quiz Latest<br />

1. Question : (TCO 3) Examples of _____ include automobile and installment loans for purchasing<br />

furniture or appliances.<br />

<br />

<br />

<br />

<br />

<br />

a line of credit<br />

a credit card loan<br />

open-end credit<br />

closed-end credit<br />

convenience credit<br />

Question 2. Question : (TCO 3) The maximum percentage of your net income that should be spent on<br />

credit purchases is recommended to be _____.<br />

10%<br />

20%<br />

30%<br />

40%<br />

50%<br />

Question 3. Question : (TCO 3) One of the concerns and risks associated with cosigning is that<br />

<br />

<br />

<br />

<br />

<br />

you are not being asked to guarantee the debt.<br />

it is not your legal responsibility to pay the debt.<br />

you’ll have to pay up to the full amount of the debt if the borrower does not pay.<br />

the creditor must first try to collect from the borrower.<br />

the creditor cannot garnish your wages.<br />

Question 4. Question : (TCO 3) Dividing monthly debt payments (not including house payments) by net<br />

monthly income will allow you to calculate your _____.<br />

<br />

<br />

<br />

<br />

<br />

net-worth-to-debt ratio<br />

debt-payments-to-income ratio<br />

liability status<br />

credit capacity status<br />

income-to-liability ratio<br />

Question 5. Question : (TCO 3) In determining your credit capacity, you first provide for basic<br />

necessities, such as<br />

<br />

<br />

<br />

furniture.<br />

home furnishings.<br />

mortgage or rent.