You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

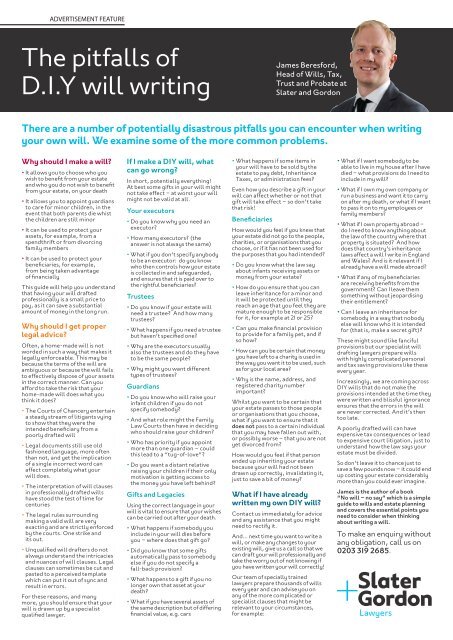

ADVERTISEMENT FEATURE<br />

The pitfalls of<br />

D.I.Y will writing<br />

James Beresford,<br />

Head of Wills, Tax,<br />

Trust and Probate at<br />

Slater and Gordon<br />

There are a number of potentially disastrous pitfalls you can encounter when writing<br />

your own will. We examine some of the more common problems.<br />

Why should I make a will?<br />

• It allows you to choose who you<br />

wish to benefit from your estate<br />

and who you do not wish to benefit<br />

from your estate, on your death<br />

• It allows you to appoint guardians<br />

to care for minor children, in the<br />

event that both parents die whist<br />

the children are still minor<br />

• It can be used to protect your<br />

assets, for example, from a<br />

spendthrift or from divorcing<br />

family members<br />

• It can be used to protect your<br />

beneficiaries, for example,<br />

from being taken advantage<br />

of financially<br />

This guide will help you understand<br />

that having your will drafted<br />

professionally is a small price to<br />

pay, as it can save a substantial<br />

amount of money in the long run.<br />

Why should I get proper<br />

legal advice?<br />

Often, a home-made will is not<br />

worded in such a way that makes it<br />

legally enforceable. This may be<br />

because the terms of the will are<br />

ambiguous or because the will fails<br />

to effectively dispose of your assets<br />

in the correct manner. Can you<br />

afford to take the risk that your<br />

home-made will does what you<br />

think it does?<br />

• The Courts of Chancery entertain<br />

a steady stream of litigants vying<br />

to show that they were the<br />

intended beneficiary from a<br />

poorly drafted will<br />

• Legal documents still use old<br />

fashioned language, more often<br />

than not, and yet the implication<br />

of a single incorrect word can<br />

affect completely what your<br />

will does.<br />

• The interpretation of will clauses<br />

in professionally drafted wills<br />

have stood the test of time for<br />

centuries<br />

• The legal rules surrounding<br />

making a valid will are very<br />

exacting and are strictly enforced<br />

by the courts. One strike and<br />

its out.<br />

• Unqualified will drafters do not<br />

always understand the intricacies<br />

and nuances of will clauses. Legal<br />

clauses can sometimes be cut and<br />

pasted to a perceived template<br />

which can put it out of sync and<br />

result in errors.<br />

For these reasons, and many<br />

more, you should ensure that your<br />

will is drawn up by a specialist<br />

qualified lawyer.<br />

If I make a DIY will, what<br />

can go wrong?<br />

In short, potentially everything!<br />

At best some gifts in your will might<br />

not take effect – at worst your will<br />

might not be valid at all.<br />

Your executors<br />

• Do you know why you need an<br />

executor?<br />

• How many executors? (the<br />

answer is not always the same)<br />

• What if you don’t specify anybody<br />

to be an executor: do you know<br />

who then controls how your estate<br />

is collected in and safeguarded,<br />

and ensures that it is paid over to<br />

the rightful beneficiaries?<br />

Trustees<br />

• Do you know if your estate will<br />

need a trustee? And how many<br />

trustees?<br />

• What happens if you need a trustee<br />

but haven’t specified one?<br />

• Why are the executors usually<br />

also the trustees and do they have<br />

to be the same people?<br />

• Why might you want different<br />

types of trustees?<br />

Guardians<br />

• Do you know who will raise your<br />

infant children if you do not<br />

specify somebody?<br />

• And what role might the Family<br />

Law Courts then have in deciding<br />

who should raise your children?<br />

• Who has priority if you appoint<br />

more than one guardian – could<br />

this lead to a “tug-of-love”?<br />

• Do you want a distant relative<br />

raising your children if their only<br />

motivation is getting access to<br />

the money you have left behind?<br />

Gifts and Legacies<br />

Using the correct language in your<br />

will is vital to ensure that your wishes<br />

can be carried out after your death.<br />

• What happens if somebody you<br />

include in your will dies before<br />

you – where does that gift go?<br />

• Did you know that some gifts<br />

automatically pass to somebody<br />

else if you do not specify a<br />

fall-back provision?<br />

• What happens to a gift if you no<br />

longer own that asset at your<br />

death?<br />

• What if you have several assets of<br />

the same description but of differing<br />

financial value, e.g. cars<br />

• What happens if some items in<br />

your will have to be sold by the<br />

estate to pay debt, Inheritance<br />

Taxes, or administration fees?<br />

Even how you describe a gift in your<br />

will can affect whether or not that<br />

gift will take effect – so don’t take<br />

that risk!<br />

Beneficiaries<br />

How would you feel if you knew that<br />

your estate did not go to the people,<br />

charities, or organisations that you<br />

choose, or if it has not been used for<br />

the purposes that you had intended?<br />

• Do you know what the law say<br />

about infants receiving assets or<br />

money from your estate?<br />

• How do you ensure that you can<br />

leave inheritance for a minor and<br />

it will be protected until they<br />

reach an age that you feel they are<br />

mature enough to be responsible<br />

for it, for example at 21 or 25?<br />

• Can you make financial provision<br />

to provide for a family pet, and if<br />

so how?<br />

• How can you be certain that money<br />

you have left to a charity is used in<br />

the way you want it to be used, such<br />

as for your local area?<br />

• Why is the name, address, and<br />

registered charity number<br />

important?<br />

Whilst you want to be certain that<br />

your estate passes to those people<br />

or organisations that you choose,<br />

what if you want to ensure that it<br />

does not pass to a certain individual<br />

that you may have fallen out with,<br />

or possibly worse – that you are not<br />

yet divorced from?<br />

How would you feel if that person<br />

ended up inheriting your estate<br />

because your will had not been<br />

drawn up correctly, invalidating it,<br />

just to save a bit of money?<br />

What if I have already<br />

written my own DIY will?<br />

Contact us immediately for advice<br />

and any assistance that you might<br />

need to rectify it.<br />

And… next time you want to write a<br />

will, or make any changes to your<br />

existing will, give us a call so that we<br />

can draft your will professionally and<br />

take the worry out of not knowing if<br />

you have written your will correctly!<br />

Our team of specially trained<br />

lawyers prepare thousands of wills<br />

every year and can advise you on<br />

any of the more complicated or<br />

specialist clauses that might be<br />

relevant to your circumstances,<br />

for example:<br />

• What if I want somebody to be<br />

able to live in my house after I have<br />

died – what provisions do I need to<br />

include in my will?<br />

• What if I own my own company or<br />

run a business and want it to carry<br />

on after my death, or what if I want<br />

to pass it on to my employees or<br />

family members?<br />

• What if I own property abroad –<br />

do I need to know anything about<br />

the law of the country where that<br />

property is situated? And how<br />

does that country’s inheritance<br />

laws affect a will I write in England<br />

and Wales? And is it relevant if I<br />

already have a will made abroad?<br />

• What if any of my beneficiaries<br />

are receiving benefits from the<br />

government? Can I leave them<br />

something without jeopardising<br />

their entitlement?<br />

• Can I leave an inheritance for<br />

somebody in a way that nobody<br />

else will know who it is intended<br />

for (that is, make a secret gift)?<br />

These might sound like fanciful<br />

provisions but our specialist will<br />

drafting lawyers prepare wills<br />

with highly complicated personal<br />

and tax saving provisions like these<br />

every year.<br />

Increasingly, we are coming across<br />

DIY wills that do not make the<br />

provisions intended at the time they<br />

were written and blissful ignorance<br />

ensures that the errors in the will<br />

are never corrected. And it’s then<br />

too late.<br />

A poorly drafted will can have<br />

expensive tax consequences or lead<br />

to expensive court litigation, just to<br />

understand how the law says your<br />

estate must be divided.<br />

So don’t leave it to chance just to<br />

save a few pounds now – it could end<br />

up costing your estate considerably<br />

more than you could ever imagine.<br />

James is the author of a book<br />

“No will – no say” which is a simple<br />

guide to wills and estate planning<br />

and covers the essential points you<br />

need to consider when thinking<br />

about writing a will.<br />

To make an enquiry without<br />

any obligation, call us on<br />

0203 319 2685.