BUSN 278 Budgeting and Forecasting Entire Course

BUSN 278 Budgeting and Forecasting Entire Course

BUSN 278 Budgeting and Forecasting Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

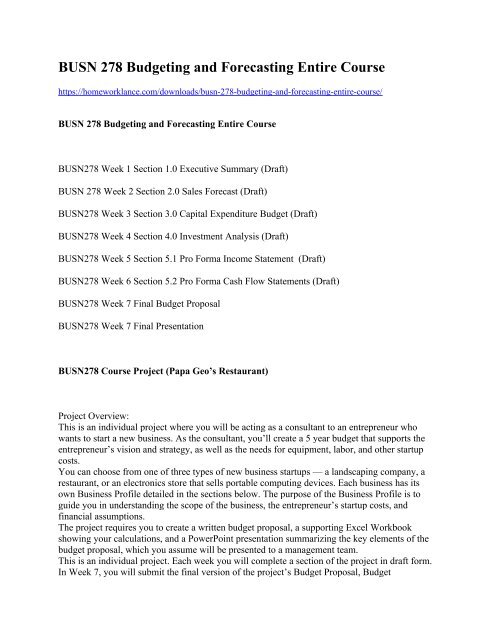

<strong>BUSN</strong> <strong>278</strong> <strong>Budgeting</strong> <strong>and</strong> <strong>Forecasting</strong> <strong>Entire</strong> <strong>Course</strong><br />

https://homeworklance.com/downloads/busn-<strong>278</strong>-budgeting-<strong>and</strong>-forecasting-entire-course/<br />

<strong>BUSN</strong> <strong>278</strong> <strong>Budgeting</strong> <strong>and</strong> <strong>Forecasting</strong> <strong>Entire</strong> <strong>Course</strong><br />

<strong>BUSN</strong><strong>278</strong> Week 1 Section 1.0 Executive Summary (Draft)<br />

<strong>BUSN</strong> <strong>278</strong> Week 2 Section 2.0 Sales Forecast (Draft)<br />

<strong>BUSN</strong><strong>278</strong> Week 3 Section 3.0 Capital Expenditure Budget (Draft)<br />

<strong>BUSN</strong><strong>278</strong> Week 4 Section 4.0 Investment Analysis (Draft)<br />

<strong>BUSN</strong><strong>278</strong> Week 5 Section 5.1 Pro Forma Income Statement (Draft)<br />

<strong>BUSN</strong><strong>278</strong> Week 6 Section 5.2 Pro Forma Cash Flow Statements (Draft)<br />

<strong>BUSN</strong><strong>278</strong> Week 7 Final Budget Proposal<br />

<strong>BUSN</strong><strong>278</strong> Week 7 Final Presentation<br />

<strong>BUSN</strong><strong>278</strong> <strong>Course</strong> Project (Papa Geo’s Restaurant)<br />

Project Overview:<br />

This is an individual project where you will be acting as a consultant to an entrepreneur who<br />

wants to start a new business. As the consultant, you’ll create a 5 year budget that supports the<br />

entrepreneur’s vision <strong>and</strong> strategy, as well as the needs for equipment, labor, <strong>and</strong> other startup<br />

costs.<br />

You can choose from one of three types of new business startups — a l<strong>and</strong>scaping company, a<br />

restaurant, or an electronics store that sells portable computing devices. Each business has its<br />

own Business Profile detailed in the sections below. The purpose of the Business Profile is to<br />

guide you in underst<strong>and</strong>ing the scope of the business, the entrepreneur’s startup costs, <strong>and</strong><br />

financial assumptions.<br />

The project requires you to create a written budget proposal, a supporting Excel Workbook<br />

showing your calculations, <strong>and</strong> a PowerPoint presentation summarizing the key elements of the<br />

budget proposal, which you assume will be presented to a management team.<br />

This is an individual project. Each week you will complete a section of the project in draft form.<br />

In Week 7, you will submit the final version of the project’s Budget Proposal, Budget

Workbook, <strong>and</strong> Budget Presentation in PowerPoint.<br />

Deliverables Schedule / Points<br />

Week<br />

Deliverable<br />

Points<br />

1<br />

Section 1.0 Executive Summary (Draft)<br />

10<br />

2<br />

Section 2.0 Sales Forecast (Draft)<br />

10<br />

3<br />

Section 3.0 Capital Expenditure Budget (Draft)<br />

10<br />

4<br />

Section 4.0 Investment Analysis (Draft)<br />

10<br />

5<br />

Section 5.1 Pro Forma Income Statement (Draft)<br />

10<br />

6<br />

Section 5.2 Pro Forma Cash Flow Statements (Draft)<br />

10<br />

7<br />

Final Budget Proposal<br />

90<br />

7<br />

Final Presentation w/ PowerPoint<br />

30<br />

Total project points<br />

180<br />

Business Profile:Papa Geo’s – Restaurant<br />

Vision<br />

The vision of the entrepreneur is to create a single-location, sit-down Italian restaurant called<br />

Papa Geo’s. The goal is to generate an income of $40,000 per year, starting sometime in the<br />

second year of operation, as wells as profit that is at least 2% of sales.<br />

Strategy<br />

a) Market Focus/Analysis<br />

The restaurant targets middle to lower-middle class families with children, as well as adults <strong>and</strong><br />

seniors, located in Orl<strong>and</strong>o, Florida. The area within 15 minutes of the store has 10,000 families,<br />

mostly from lower to middle class neighborhoods. Average family size is 4 people per<br />

household. There is no direct competition; however, there are fast food restaurants like<br />

McDonald’s, Taco Bell <strong>and</strong> Wendy’s in the geographical target market. The lower to middle<br />

class population is growing at about 6% per year over the next five years in this area.<br />

b) Product<br />

The product is Italian food served buffet style, in an all-you-can-eat format, with a salad bar,

pizza, several different types of pasta with three or four types of sauces, soup, desserts, <strong>and</strong> a<br />

self-serve soda bar. The restaurant is also to have a 500 square foot gaming area which has game<br />

machines that children would be interested in using.<br />

c) Basis of Competition<br />

Customers come to this restaurant because of the good Italian food at a low price – you can get a<br />

meal for $7, including drinks. Customers also eat at Papa Geo’s due to the cleanliness of the<br />

facility, the speed of getting their seat <strong>and</strong> food, <strong>and</strong> the vending machines which keep the<br />

children busy while adults enjoy their meal.<br />

Startup Requirements*<br />

Given Costs<br />

• The cost of registering a limited liability company in Florida – filing fees listed at the bottom of<br />

the application for located at: http://form.sunbiz.org/pdf/cr2e047.pdf<br />

• Renovation of the facility expected to cost $15,000<br />

• Business insurance, estimated at $1,000 per year<br />

• Health <strong>and</strong> other benefits are 20% of the salaries of the manager <strong>and</strong> assistant manager<br />

Costs you should estimate through research, experience or other methods<br />

Soda fountain bar 2 pizza ovens Salad <strong>and</strong> pizza/dessert bar Approximately 100 square foot<br />

commercial refrigerator 2 cash registers 6 video game vending machines Management office<br />

with desk <strong>and</strong> lower-priced laptop computer Staff lunchroom equipment such as microwave,<br />

sink, cupboards <strong>and</strong> refrigerator 20 four-seater tables with chairs Busing cart for transporting<br />

dirty dishes from the dining area to the dishwashing area 140 sets of dishes, including cutlery<br />

<strong>and</strong> drinking cups Commercial dishwasher Miscellaneous cooking <strong>and</strong> food h<strong>and</strong>ling equipment<br />

like trays, lifters, spoons, pots etcetera The cost of an average of 7 employees on the payroll. All<br />

operating costs, such as advertising, rent for a 3,500 square foot facility with male <strong>and</strong> female<br />

washrooms (already installed), utilities, maintenance, <strong>and</strong> annual depreciation<br />

*If you have questions about startup requirements, or think other startup costs necessary for the<br />

business are missing, then make an assumption <strong>and</strong> state it in the relevant section of the report.<br />

Given Financial Assumptions*<br />

The owner will be granted a loan for the initial startup, repayable over 10 years at current interest<br />

rates for small business loans. The owner will use personal funds to operate the business until it<br />

generates enough cash flow to fund itself. Essentially, all sales are made by credit card. All credit<br />

card sales are paid to the restaurant daily by the credit card company. 2.5% of sales is paid to the<br />

credit card company in fees. Food suppliers give 30 days of trade credit. Inventories are expected<br />

to be approximately 10% of the following month’s sales. The average meal costs $4.00 in<br />

materials <strong>and</strong> labor. The average family spends $4.00 on vending machine tokens. Equipment is<br />

depreciated on a straight-line basis over 5 years. Managers have health benefits, other workers do<br />

not. The company will operate from 10:00 am to 9:00 pm, 7 days a week. The entrepreneur will<br />

manage the store <strong>and</strong> draw a salary. Every shift has one person on the cash register, one keeping<br />

the food bars stocked with food, two cooking the food, one on busing <strong>and</strong> table cleaning, a<br />

manager, <strong>and</strong> assistant manager.<br />

*If you believe any other assumptions are necessary, please state them in your budget proposal.<br />

All Discussion Questions<br />

w1 dq1 <strong>Budgeting</strong> <strong>and</strong> Planning<br />

w1 dq2 <strong>Forecasting</strong> Techniques

w2 dq1 Linear Regression<br />

w2 dq2 Seasonal Variations<br />

w3 dq1 Revenue Budget<br />

w3 dq2 Capital Expenditures Budget<br />

w4 dq1 Capital <strong>Budgeting</strong><br />

w4 dq2 New Business Startups<br />

w5 dq1 Master Budget<br />

w5 dq2 Cash <strong>Budgeting</strong><br />

w6 dq1 Cost Behavior<br />

w6 dq2 Variance Analysis<br />

w7 dq1 Administering the Budget<br />

w7 dq2 Presenting <strong>and</strong> Defending a Budget<br />

<strong>BUSN</strong> <strong>278</strong> Week 4 Midterm<br />

(TCO 1) The type of budget that is updated on a regular basis is known as a ________________<br />

(TCO 2) The quantitative forecasting method that uses actual sales from recent time periods to<br />

predict future sales assuming that the closest time period is a more accurate predictor of future<br />

sales is:<br />

(TCO 3) The regression statistic that measures how many st<strong>and</strong>ard errors the coefficient is from<br />

zero is the ________________<br />

(TCO 4) Capital expenditures are incurred for all of the following reasons except:<br />

(TCO 5) Which of the following is not true when ranking proposals using zero-base budgeting?<br />

(TCO 6) Which of the following ignores the time value of money?<br />

(TCO 1) There are several approaches that may be used to develop the budget. Managers<br />

typically prefer an approach known as participative budgeting. Discuss this form of budgeting<br />

<strong>and</strong> identify its advantages <strong>and</strong> disadvantages.<br />

(TCO 2) There are a variety of forecasting techniques that a company may use. Identify <strong>and</strong><br />

discuss the three main quantitative approaches used for time series forecasting models.<br />

(TCO 2) The Federal Election Commission maintains data showing the voting age population,<br />

the number of registered voters, <strong>and</strong> the turnout for federal elections. The following table shows<br />

the national voter turnout as a percentage of the voting age population from 1972 to 1996 (The<br />

Wall Street Journal Almanac; 1998):<br />

(TCO 3) Use the table “Food <strong>and</strong> Beverage Sales for Paul’s Pizzeria” to answer the questions<br />

below.<br />

(TCO 6) Jackson Company is considering two capital investment proposals. Estimates regarding<br />

each project are provided below:<br />

(TCO 6) Top Growth Farms, a farming cooperative, is considering purchasing a tractor for<br />

$468,000. The machine has a 10-year life <strong>and</strong> an estimated salvage value of $32,000. Top<br />

Growth uses straight-line depreciation. Top Growth estimates that the annual cash flow will be<br />

$78,000. The required rate of return is 9%.

Part (a) Calculate the payback period.<br />

Part (b) Calculate the net present value.<br />

Part (c) Calculate the accounting rate of return<br />

<strong>BUSN</strong> <strong>278</strong> Final Exam Answers<br />

(TCO 1) Which of the following statements regarding research <strong>and</strong> development is incorrect?<br />

(TCO 2) Priority budgeting that ranks activities is known as:<br />

(TCO 3) The regression statistic that measures how many st<strong>and</strong>ard errors the coefficient is from<br />

zero is the ________________<br />

(TCO 4) It is important that budgets be accepted by:<br />

(TCO 5) The qualitative forecasting method that individually questions a panel of experts is<br />

________________<br />

(TCO 6) Which of the following is a disadvantage of the payback technique?<br />

(TCO 1) There are several approaches that may be used to develop the budget. Managers<br />

typically prefer an approach known as participative budgeting. Discuss this form of budgeting<br />

<strong>and</strong> identify its advantages <strong>and</strong> disadvantages.<br />

(TCO 2) There are a variety of forecasting techniques that a company may use. Identify <strong>and</strong><br />

discuss the three main quantitative approaches used for time series forecasting models.

(TCO 2) Use the table “Manufacturing Capacity Utilization” to answer the questions below.<br />

Manufacturing Capacity Utilization<br />

In Percentages<br />

Day Utilization Day Utilization<br />

1 82.5 9 78.8<br />

2 81.3 10 78.7<br />

3 81.3 11 78.4<br />

4 79.0 12 80.0<br />

5 76.6 13 80.7<br />

6 78.0 14 80.7<br />

7 78.4 15 80.8<br />

8 78.0<br />

Part (a) What is the project manufacturing capacity utilization for Day 16 using a three day<br />

moving average?<br />

Part (b) What is the project manufacturing capacity utilization for Day 16 using a six day moving<br />

average?<br />

Part (c) Use the mean absolute deviation (MAD) <strong>and</strong> mean square error<br />

(TCO 3) Use the table “Food <strong>and</strong> Beverage Sales for Luigi’s Italian Restaurant” to answer the<br />

questions below.<br />

Food <strong>and</strong> Beverage Sales for Luigi’s Italian Restaurant<br />

($000s)<br />

Month First Year Second Year<br />

January 218 237<br />

February 212 215<br />

March 209 223<br />

April 251 174<br />

May 256 174<br />

June 216 135<br />

July 131 142<br />

August 137 145<br />

September 99 110<br />

October 117 117<br />

November 137 151<br />

December 213 208<br />

Part (a) Calculate the regression line <strong>and</strong> forecast sales for February of Year 3.<br />

Part (b) Calculate the seasonal forecast of sales for February of Year 3.<br />

Part (c) Which forecast do you think is most accurate <strong>and</strong> why?

(TCO 6) Davis Company is considering two capital investment proposals. Estimates regarding<br />

each project are provided below:<br />

Project A Project B<br />

Initial Investment $800,000 $650,000<br />

Annual Net Income $50,000 45,000<br />

Annual Cash Inflow $220,000 $200,000<br />

Salvage Value $0 $0<br />

Estimated Useful Life 5 years 4 years<br />

The company requires a 10% rate of return on all new investments.<br />

Part (a) Calculate the payback period for each project.<br />

Part (b) Calculate the net present value for each project.<br />

Part (c) Which project should Jackson Company accept <strong>and</strong> why?<br />

(TCO 6) Top Growth Farms, a farming cooperative, is considering purchasing a tractor for<br />

$468,000. The machine has a 10-year life <strong>and</strong> an estimated salvage value of $32,000. Top<br />

Growth uses straight-line depreciation. Top Growth estimates that the annual cash flow will be<br />

$78,000. The required rate of return is 9%.<br />

Part (a) Calculate the payback period.<br />

Part (b) Calculate the net present value.<br />

Part (c) Calculate the accounting rate of return.