Equity Mag Sep_17 Book Folder

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCE<br />

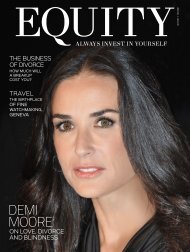

Above: Salma Shaheem<br />

from The Fine Art Group.<br />

Right: The "Untitled"<br />

Basquiat painting that<br />

sold for $110.5 million<br />

You either love a Basquiat or you don’t. It isn’t<br />

everyone’s cup of tea. But there are some who<br />

understand the value of art as an investment, and<br />

adding a contemporary piece from the late Jean-<br />

Michel Basquiat to your collection, makes for a great longterm<br />

investment. However, investing in art doesn’t mean you<br />

pass up on pieces of interest. In fact, it’s vital to buy a piece<br />

you love, one with a great history, that you connect with and<br />

speaks volume. After all, it will most likely be hung in your<br />

home or office. Take for instance the Japanese billionaire<br />

Yusaku Maezawa, who purchased the Basquiat ‘Untitled’<br />

impressionist, contemporary piece for $110.5 million at a<br />

Sotheby’s auction in New York earlier this year. Maezawa’s<br />

affection for the artist’s collection resulted in a recordbreaking<br />

sale, the most expensive piece ever bought, that was<br />

previously purchased by a couple (who left it to their two<br />

daughters) for a mere $19,000 in the Eighties. The piece<br />

appreciated by $109,981,000 in just 33 years, yielding a high<br />

return that could never be anticipated. This isn’t the only<br />

piece in Maezawa’s collection however, he previously bought<br />

another painting by Basquiat for $57.3 million. Other works<br />

in his collection include the likes of Jeff Koons, Christopher<br />

Wool and Richard Prince.<br />

Evidently, Maezawa has a penchant for contemporary art,<br />

but if we had to follow in his footsteps, where would we<br />

begin and how does one go about securing, or investing in, a<br />

piece that appreciates overtime? That’s where art advisors<br />

are brought into the equation. “There’s been a huge shift in<br />

appetite for art. We’re seeing great, exponential growth in<br />

the post warrant contemporary art genre in particular,” says<br />

Salma Shaheem, head of Middle Eastern Markets of The<br />

Fine Art Group (an art investment advisory house). “Over<br />

the last 10-15 years or so, art has been made accessible to<br />

everyone. Ten years ago, it probably wouldn’t make the<br />

headlines of the New York Times and no one would talk<br />

about it. Now, every time there’s a record-breaking auction,<br />

all the media outlets talk about it. So, people are constantly<br />

bombarded by this art news which I think is great,” says<br />

Sylvain Gaillard, who transitioned from private banker to<br />

an art advisor and Director of the Opera Gallery, to immerse<br />

himself and grow his adoration for art and curation.<br />

The sudden inflation can be attributed to the increase in<br />

wealth, people looking to build a collection for investment<br />

purposes and the fundamental law kind of mix, of supply and<br />

demand. “You have a lot more people who want to buy art.<br />

And the good pieces are either taken care of, spoken for, or in a<br />

private collection or museums. So, when a good piece comes<br />

out on the market, you have many who want to acquire it and<br />

that drives the price and demand up,” he goes on to say.<br />

The UAE, as Shaheem states, is an emerging market with a<br />

strong foundation for the future of arts. As an advisor, her<br />

job entails visiting museums, galleries, keeping an eye out for<br />

art that has just come up on the market, and helping clients<br />

pick the right piece for their specifically curated collection.<br />

There are several ways in which art advisory works. “I meet a<br />

client that knows they want to start collecting art and might<br />

have an affinity towards it but they don’t know where to<br />

begin. That's one scenario, the other is a person who began<br />

collecting a few years ago, or inherited art, and now has over<br />

40 pieces and doesn’t know what to do with it. We come in<br />

and help with disposing of that and reinvesting whatever<br />

money we can gain into better pieces,” she tells us.<br />

But with art comes a price tag that can be considered quite<br />

a risky investment. That’s where Shaheem stresses on the<br />

15<br />

EQUITY