f+h Intralogistics 5/2016

f+h Intralogistics 5/2016

f+h Intralogistics 5/2016

- TAGS

- fuh

- intralogistics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

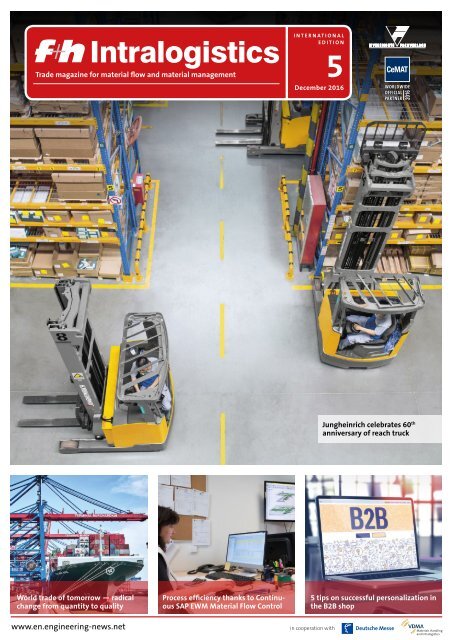

<strong>Intralogistics</strong><br />

Trade magazine for material flow and material management<br />

INTERNATIONAL<br />

EDITION<br />

5<br />

December <strong>2016</strong><br />

Jungheinrich celebrates 60 th<br />

anniversary of reach truck<br />

World trade of tomorrow — radical<br />

change from quantity to quality<br />

Process efficiency thanks to Continuous<br />

SAP EWM Material Flow Control<br />

5 tips on successful personalization in<br />

the B2B shop<br />

www.en.engineering-news.net in cooperation with<br />

Materials Handling<br />

and <strong>Intralogistics</strong>

Join the No. 1 trade show network<br />

for intralogistics, transport logistics<br />

and supply chain management<br />

Germany Hannover 23 - 27 Apr 2018<br />

India Mumbai 1 - 3 Dec <strong>2016</strong><br />

Indonesia Jakarta 2 - 4 Mar 2017<br />

Turkey Istanbul 16 - 19 Mar 2017<br />

Brazil São Paulo 16 - 19 May 2017<br />

China Shenzhen 28 - 30 Jun 2017<br />

Shanghai 30 Oct - 3 Nov 2017<br />

Russia Moscow 19 - 21 Sep 2017<br />

Canada Mississauga 25 - 28 Sep 2017<br />

Italy Milan 29 May - 1 Jun 2018<br />

Australia Melbourne 24 - 26 Jul 2018<br />

cemat.com<br />

Global Fairs. Global Business.

EDITORIAL<br />

Reachable any time<br />

and everywhere?<br />

My home is my castle, as they say. But increasingly the peace and tranquility of<br />

that castle is being disturbed. By what, you may ask? Smartphone and friends are<br />

the villains. On the one hand, our mobile devices accompany us day to day so we<br />

can be reached at any time for business and social matters. On the other hand,<br />

communication doesn’t stop at the moat, or rather the door to our houses. And so<br />

we find ourselves often reaching for the smartphone to keep up with the communication<br />

process. But sometimes we should also turn those devices off, or at least<br />

be able to do so, although not infrequently many of us seem to forget that. At least<br />

that’s the conclusion of the Yougov opinion survey institute. According to a recent<br />

survey of market researchers, almost half of the labor force in Germany receives<br />

business e-mails after hours. About a third of the respondents checked their<br />

business e-mail account at least once during their<br />

last vacation. And while that may not appear<br />

dramatic at first, being constantly reachable does<br />

have its dark side. This is confirmed by a study of<br />

the German Initiative for Health and Work (Iga).<br />

About a fifth of those surveyed felt that being<br />

constantly reachable had negatively impacted their sleep or recreation time.<br />

Possible downsides include health problems caused by stress such as high blood<br />

pressure and mental-health disorders including depression. Given these consequences,<br />

each of us would be well advised to see to it that our home remains our<br />

castle – at least now and then. Ultimately your job will benefit from it.<br />

Being constantly reachable<br />

does have its dark side<br />

Winfried Bauer<br />

Editor-in-chief<br />

(w.bauer@vfmz.de)

News and information from the<br />

entire world of intralogistics<br />

An overview of the overall dynamics<br />

of the growth of logistics sector in<br />

India<br />

Beumer uses its CL-Systems<br />

division to implement complex<br />

conveyor solutions worldwide<br />

<strong>Intralogistics</strong><br />

Trade magazine for material flow and material management<br />

Visitors to CeMAT India can get<br />

an initial impression of the<br />

competence of Indian industry<br />

A study gives an insight into existing<br />

success models of strategic supplier<br />

management<br />

TABLE OF CONTENT<br />

COLUMNS<br />

Editorial<br />

Worldwide news<br />

Imprint<br />

Product news<br />

GLOBAL BUSINESS<br />

World trade is experiencing radical<br />

change – shifting from quantity to<br />

quality<br />

India’s logistics industry is poised for<br />

huge growth<br />

BULK MATERIAL<br />

HANDLING<br />

Conveying & Loading Systems:<br />

a powerful global partner<br />

CEMAT INDIA PREVIEW<br />

Guest commentary:<br />

CeMAT India – <strong>Intralogistics</strong> showcase,<br />

embedded in industry<br />

Product innovations<br />

INDUSTRIAL TRUCKS<br />

Jungheinrich celebrates<br />

60 th anniversary of reach truck<br />

WAREHOUSING<br />

Process efficiency thanks to continuous<br />

SAP EWM Material Flow Control<br />

LOGISTICS MANAGEMENT<br />

Study about strategic supplier<br />

management for agile process<br />

design<br />

E-BUSINESS<br />

5 tips on successful personalization<br />

in the B2B shop<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

More endurance. More performance.<br />

16 hours with one single battery charge.<br />

Learn more now at:<br />

jungheinrich.com/2shifts<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 3/<strong>2016</strong> 5

1<br />

2<br />

WORLDWIDE NEWS<br />

3<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

1<br />

2<br />

Rhenus opens its first office in South Korea<br />

The Rhenus Group opens its own business site in South Korea. The<br />

logistics sercice provider also founded the national company known as<br />

Rhenus Logistics Korea at the same time. The office in the South Korean<br />

capital Seoul will organize sea and air freight operations, third-party logistics<br />

and domestic transport services in future.<br />

www.rhenus.com<br />

Siemens extends service agreement with<br />

Cathay Pacific Services Ltd<br />

Siemens Postal, Parcel & Airport Logistics (SPPAL) has received an order for<br />

the continued operation and maintenance of the cargo handling system of<br />

the Cathay Pacific Cargo Terminal in Hong Kong. The extension of the<br />

service agreement by several years is based on jointly defined key performance<br />

indicators (KPIs) and ensures the highest standards throughout the<br />

terminal. With a floor area of about 240,000 m 2 – the size of almost 34 soccer<br />

fields – it is one of the world’s largest cargo terminals<br />

www.siemens.com<br />

4<br />

3<br />

Dunajska Streda Logistics Centre expands<br />

The hub terminal operated by the HHLA rail company, Metrans, in<br />

the Slovakian town of Dunajská Streda has become the heart of a trans-European<br />

logistics center. A new rail connection to Trieste and the expansion<br />

of the adjacent logistics areas are intended to ensure further growth.<br />

The success of the hub terminal is based on centrally pooling container<br />

shipments, which are regularly hauled by block train to the ports of Hamburg,<br />

Bremerhaven, Koper and Trieste, or which come from there. Trucks<br />

are usually used for transportation to or from the core markets of Slovakia,<br />

Austria and Hungary.<br />

5<br />

www.hhla.de/en/home.html<br />

4<br />

Christophe Lautray at the head of FEM<br />

The European Materials Handling Federation (FEM) elected<br />

Christophe Lautray, Chief Sales Officer Linde Material Handling, as its new<br />

President on the occasion of the Biennial Congress Bordeaux/France.<br />

Previously, Lautray had served as Vice President. Following this election, he<br />

will lead the European Materials Handling Federation for two years. The<br />

FEM based in Brussels/Belgium represents manufacturers of materials<br />

handling, lifting and storage equipment and their interests vis-à-vis the<br />

European institutions and partners.<br />

www.linde-mh.com<br />

5<br />

“The King of the Caribbean” −<br />

Liebherr mobile harbour crane LHM 600<br />

Liebherr Maritime Crane recently delivered the biggest mobile harbour<br />

crane of the Caribbean to Kingston Wharves Limited in Jamaica. The new<br />

Liebherr MHC, type LHM 600 high rise version is equipped with an<br />

elongated tower extension that ensures high visibility into deep cargo holds.<br />

With a maximum outreach of 58 meters, twin lift capability and a lifting<br />

capacity of 104 tons, the LHM 600 is capable of servicing vessels up to 19<br />

container rows wide and 9 container stacks high.<br />

www.liebherr.com<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

World trade is experiencing radical change<br />

– shifting from quantity to quality<br />

New production methods, comprehensive networking<br />

solutions, and increasingly rapid flows of goods and<br />

information are setting the parameters for world trade<br />

of tomorrow. Logistics are not just part of these<br />

changes but are driving them.<br />

There’s something big in the offing for Hamburg! Mega-ships with<br />

a capacity of more than 20,000 standard containers are headed<br />

for one of the most important ports in northern Europe. Hamburger<br />

Hafen und Logistik AG (HHLA) has already prepared berths 5/6 of<br />

its container terminals for the arrival of the mega-freighters. Five of<br />

the most modern tandem container bridges with their 74-meterlong<br />

jibs will process the largest ships in the world, lifting a payload<br />

of almost 100 tons.<br />

According to HHLA’s estimates, when a 20,000 TEU ship docks,<br />

between 11,000 and 14,000 TEU are handled at one terminal per<br />

call. “The peak loads that must be handled are enormous, whether<br />

it’s water-side handling, warehouse storage, or port-to-hinterland<br />

transport,” says Jens Hansen, Managing Director of the Burchardkai<br />

Container Terminal (CTB). Hamburg is an important hub on the<br />

route between Asia and northern Europe, one of the world’s “trade<br />

superhighways.” On the harshly competitive transport markets,<br />

About Dachser SE<br />

As one of the leading logistics specialists worldwide,<br />

Dachser posted total sales of 5.6 billion euros in 2015.<br />

Founded in 1930, the family business has 26,506<br />

employees around the world at 428 locations. The<br />

Dachser business model includes transport logistics,<br />

warehousing and customer-specific services within two<br />

business divisions: Dachser Road Logistics and Dachser<br />

Air & Sea Logistics.<br />

shipowners and port operators have to stay one step ahead of the<br />

competition by implementing efficiency measures and managing<br />

capacity utilization wisely.<br />

While these container giants may seem like the prestigious<br />

flagships of globalization, the environment in which they will be<br />

operating is anything but simple. The container shipping industry is<br />

battling overcapacity. But it isn’t just the volatility on the sea freight<br />

market that is depressing the overall mood. The World Trade Organization<br />

(WTO) just recently downgraded its growth forecast for<br />

world trade: 2.8 percent are predicted for <strong>2016</strong>. “The curve is moving<br />

upward for world trade, but its speed is disappointingly slow,” says<br />

Roberto Azevêdo, Director General of the WTO.<br />

RUBRIK GLOBAL BUSINESS

As some of the reasons for this, the WTO mentions the cooldown of<br />

the Chinese economy, the increasing unpredictability of the<br />

financial markets, and low commodity prices. Nevertheless, Asia is<br />

still leading the pack with 3.5 percent growth, followed by Europe<br />

and North America at 3.1 percent.<br />

Monday, April 18, <strong>2016</strong>, Shanghai:<br />

As a sales market, China is<br />

constantly growing. This<br />

means that the demand for<br />

high-quality logistics services,<br />

for example, warehousing and<br />

contract logistics, is also<br />

increasing<br />

Edoardo Podestá,<br />

Managing Director Dachser<br />

Air & Sea Logistics<br />

Asia Pacific<br />

Yangshan port in Shanghai is bustling. It is one of the largest freight<br />

terminals in the world, handling more than 33 million standard<br />

containers every year. The cranes and container bridges are working<br />

at full tilt, moving the huge steel boxes around like so many<br />

colorful Lego bricks. China’s biggest gateway to world trade is just as<br />

busy as ever. This afternoon, there’s no sign of a sluggish Chinese<br />

economy. Edoardo Podestá, Managing Director Dachser Air & Sea<br />

Logistics Asia Pacific, is not surprised: “Due to its dynamic nature<br />

and its multifaceted potential, China is and continues to be a market<br />

of superlatives—and people always have very high expectations<br />

of it.” Dachser has been doing business in China since 1976; the first<br />

stepping stone back then was an office in Hong Kong. Today, the<br />

logistics provider not only has several offices in China but is represented<br />

in Singapore, Taiwan, Bangladesh, India, Indonesia, Malaysia,<br />

South Korea, Thailand, and Vietnam as well. The company has<br />

roughly 1,500 employees at more than 55 locations in the APAC<br />

region.<br />

As a sales market, China is constantly growing. “This means that<br />

the demand for high-quality logistics services, for example, warehousing<br />

and contract logistics, is also increasing,” Podestá says.<br />

Dachser has registered high growth rates in the intra-Asian<br />

market. Trade routes have long since ceased to run solely between<br />

the Old and New Worlds and China. Now emerging markets play a<br />

major role in Asia’s economic development, too — for example,<br />

when Chinese consumers furnish their bathrooms with fittings<br />

from India or equip their homes and businesses with solar panels<br />

from Taiwan, one of the largest producers of solar cell technology in<br />

the world. In recent years, India, Bangladesh, and Thailand, in<br />

particular, have established themselves successfully as locations for<br />

industry and hubs for intra-Asian trade. In these three countries<br />

alone, Dachser now has more than 700 employees.<br />

“The complexity of our services has grown substantially,” Podestá<br />

points out. “For example, these days we do more for automotive<br />

OEMs and second- and third-tier suppliers than just import parts<br />

from Europe: we offer them our entire range of logistics services.”<br />

In the Asia Pacific region, Dachser is focusing particularly on multinational<br />

companies and SMEs, who value having an experienced<br />

partner like Dachser. According to Podestá, more and more<br />

customers are interested specifically in a one-carrier strategy:<br />

“They want to take advantage of Dachser’s tried-and-trusted quality<br />

services in Asia, too – maximum transparency, integrated overland,<br />

air, and sea freight networks, standardized IT systems, and<br />

customer interfaces.”<br />

Networked logistics leads directly from the water to the street<br />

Reset button for reindustrialization<br />

The Wall Street Journal detects a fundamental structural change in<br />

the global economy. A glance at the foreign investments that result<br />

in the outsourcing of jobs to emerging economies suffices. While in<br />

2,000 these jobs were producing four percent of global economic<br />

output, that figure is since down by 50 percent. “Internationalization<br />

is not destiny,” the Wall Street Journal concludes; even trends<br />

that seem set in stone “falter, sputter, or are reversed.”<br />

All of this impacts the worldwide flow of goods. Imports into the<br />

US reached their highest level in 2012 and have been declining ever<br />

since. Additionally, the largest global economy is currently undergoing<br />

a reindustrialization. Because, according to the Wall Street<br />

Journal, China in its role as “workbench of the world” has recently<br />

become increasingly expensive, North America has already recovered<br />

a million jobs.<br />

Thomas Straubhaar, professor of economics at the University of<br />

Hamburg, believes that the “golden age” of trade in the sense of a<br />

mass market is over. “As far as the quantity of trade is concerned, we<br />

have reached—or passed—the peak. We have to pay far more attention<br />

to quality than in the past and reflect this in the changes that<br />

digitalization makes possible.” He concludes that it is imperative to<br />

increase the intrinsic value of exports. According to Professor<br />

Straubhaar, today, it is less about being world champion in the<br />

volume of exports than in value creation.<br />

Friday, April 29, <strong>2016</strong>, Mexico City:<br />

Guido Gries, Managing Director Air & Sea Logistics Dachser America,<br />

has arrived from Miami and is on his way to the local Dachser<br />

office. On one of the major arterials, he drives past a car carrier trailer,<br />

its warning lights flashing, which is in the process of unloading a<br />

truck-full of brand new mid-size cars and SUVs at a car dealership.<br />

For the automotive industry, Mexico is a kind of El Dorado. In 2014,<br />

3.2 million cars came off the assembly lines of Mexican automobile<br />

Logistics is creating the<br />

foundation for globalized<br />

value chains, which, in turn,<br />

create more growth<br />

Guido Gries, Managing Director<br />

Air & Sea Logistics<br />

Dachser America<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

GLOBAL BUSINESS<br />

factories, thus leaving Brazil far behind. Today, with its production<br />

of 3.5 million cars (2015), Mexico is the seventh largest automobile<br />

manufacturer worldwide. They have their eye on the five million<br />

mark by 2020, which would then make them the fifth largest automobile-producing<br />

country in the world. Guido Gries and his team<br />

want to make a contribution to this goal. “Logistics is creating the<br />

foundation for globalized value chains, which, in turn, create more<br />

growth,” he says. Most of Dachser’s customers—both large companies<br />

and SMEs—want to make their mark on the attractive growth<br />

markets in Latin America and the US. “We can support them in<br />

Europe or Asia as they make their way there,” Gries says. As an international<br />

logistics provider, Dachser Americas can score with<br />

customers on markets in the Americas by providing end-to-end<br />

logistics, tailored solutions, and comprehensive one-stop services.<br />

For most of Dachser’s customers in Latin America, the US is their<br />

number one trade partner because it is the largest global economy<br />

and because an increasing number of US companies are relocating<br />

their production facilities closer to their home markets, i.e., away<br />

from Asia to the US and Latin America. “This so-called nearshoring<br />

is a trend among US customers,” Gries says. Argentina, Brazil, Chile,<br />

and Peru, which traditionally have had close trade relations with<br />

Germany and Spain and are key trade partners of the US and China,<br />

are also betting on this trend. “It’s an advantage for Dachser that it<br />

already has a presence on these markets and can provide services<br />

for the automotive suppliers, life sciences, and health care industries<br />

as well as for industrial goods and civil engineering.”<br />

Data that impact the world<br />

A new quality of value creation is that the global economy is more<br />

connected than ever. A recently published study by the McKinsey<br />

Global Institute “Digital globalization: The new era of global flows”<br />

shows that, for the first time, international data flows contribute more<br />

to global economic growth than the classic goods trade. According to<br />

the study, global flows of goods, capital, and data have increased<br />

global economic output by ten percent overall. In 2014, this corresponded<br />

to USD 7.8 trillion, of which USD 2.8 trillion resulted from<br />

international data flows, while only USD 2.7 trillion was generated by<br />

the movement of goods. In the international exchange of goods,<br />

services, finance, people, and data, the United States, Singapore, the<br />

Netherlands, and Germany top the global connectedness rankings.<br />

“International connectedness provides substantial opportunities<br />

for small and midsize companies,” the authors of the study<br />

conclude. “They can develop new markets and customer groups<br />

with relative ease using online platforms.” For example, around<br />

50 million so-called micromultinationals are operating on Facebook.<br />

Of all the start-ups examined in the study, 86 percent are<br />

operating across borders. And 360 million people have already<br />

made online purchases in another country.<br />

Wednesday, May 4, <strong>2016</strong>, Johannesburg, South<br />

Africa:<br />

A customer is visiting Dachser South Africa in Kempton Park. Econo-<br />

Heat wants everything—the right thing at the right place at the right<br />

time. For the Cape Town company, this is the formula that makes for<br />

satisfied customers. Econo-Heat is one of the market leaders for wall<br />

panel heaters and heating pads. Today, the company has twelve<br />

branch offices worldwide, providing direct supply to its retailers. In<br />

other countries, sales are being expanded through distributors.<br />

For years, the heating specialist has been utilizing a combination of<br />

Dachser Air & Sea Logistics and Dachser European Logistics. “Econo-<br />

Heat especially appreciates the tracking & tracing option available in<br />

European Logistics, which provides the company with precise information<br />

about the supplied units,” explains Thomas Krüger, Managing<br />

Director Air & Sea Logistics EMEA at Dachser. The units are delivered<br />

throughout Europe from a warehouse in the Dutch town of Waddinxveen<br />

in accordance with Econo-Heat’s requirements.<br />

The task for the logistics experts is both exciting and challenging.<br />

“As a result of the extremely volatile sea freight rates from Asia to<br />

Europe, capacity has been removed from this market and utilized in<br />

other markets instead, for example, transatlantic routes,” Krüger<br />

explains. At the same time, the seasonal peaks, for example, around<br />

the Chinese New Year, have recently been noticeably lower. According<br />

to Krüger one reason is that the order cycles of the major importers<br />

are changing. In the past, there were two customer catalogs,<br />

one in the winter and one in the summer, which contained any special<br />

offers. Today, there are usually four seasonal cycles, and special<br />

offers sometimes change on a weekly basis. “Customer demand is<br />

increasingly short-term, requiring logistics to be more and more<br />

flexible,” Krüger says.<br />

This is also noticeable in the air freight sector. “Customers are<br />

steadily being forced to adhere to certain deadlines although their<br />

production can’t keep up. For example, premium automakers don’t<br />

order the leather for the leather seats until the vehicle has been<br />

completely configured and ordered so that nothing more can be<br />

changed. This is usually four weeks prior to delivery,” Krüger<br />

explains. “As a result, the leather has to be shipped by air freight.”<br />

New smartphone models are also shipped by air freight worldwide<br />

on short notice because companies like Apple or Samsung want to<br />

take advantage of the first rush on the new devices. “World trade is<br />

moving closer and closer to customers and what they want,” Krüger<br />

maintains. “And that’s a good thing. For decades, Beaujolais Nouveau,<br />

a young French red wine, has been flown to its destinations in<br />

full charters so that it is available in stores punctually on the third<br />

Thursday in November when it officially goes on sale.”<br />

The home factory isn’t happening<br />

Where are digitalization and the possibilities that Industry 4.0<br />

offers going to end up? Even though many economists are forecasting<br />

that 3-D printing will change on-demand production<br />

chains, especially in the automotive industry, and will eliminate<br />

trade with certain goods, digitalization should bring positive<br />

effects for the logistics industry. Cyrus de la Rubia, chief economist<br />

at HSH Nordbank AG, is convinced that “digitalization will<br />

enable value chains, in particular, to be made more efficient. In<br />

other words, digitalization and trade are complementary to one<br />

another.” In the long term, de la Rubia does not think that<br />

consumers producing their own products with 3-D printers and<br />

bailing out of customary supply chains will be a realistic option.<br />

On the UPo Entrepreneur Platform, he estimated the demand for<br />

imported goods and commodities to be undiminished, especially<br />

for emerging nations; “We are noticing a reduction in container<br />

transport in China, however, we see a moderate increase in bulk<br />

carriers and tankers. So a widespread decline or an end of trade is<br />

not likely by any means.”<br />

Photos: lead HHLA, others Dachser SE<br />

www.dachser.com<br />

Customer demand is<br />

increasingly short-term,<br />

requiring logistics to be more<br />

and more flexible<br />

Thomas Krüger,<br />

Managing Director Air & Sea<br />

Logistics EMEA at Dachser<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

SOME THINK<br />

DELIVERY<br />

ERRORS ARE<br />

INEVITABLE.<br />

WE THINK<br />

DIFFERENT.<br />

Running an efficient distribution centre makes a big difference to profitability<br />

and customer satisfaction. That’s why many leading brands put sortation<br />

systems from BEUMER Group at the heart of their supply chain. Through<br />

operational insight and analysis, BEUMER Group is able to deliver complete<br />

automated material handling systems that fit seamlessly into your process.<br />

Offering exceptional speed, capacity and accuracy, our technology makes<br />

a difference to your customers, your brand and your bottom line.<br />

For more information, visit www.beumergroup.com

India’s logistics industry<br />

is poised for huge growth<br />

RUBRIK GLOBAL BUSINESS<br />

Sushen Doshi<br />

An overview of the overall dynamics of the logistics<br />

sector in India, along with a short analysis of the top<br />

Indian cities with high potential to be effective<br />

logistics clusters and the effect of government’s latest<br />

taxation policy that is aimed to create a big boom for<br />

the industry.<br />

In the recent times, India’s logistics sector has been transforming<br />

constantly. With the country’s economy continuously expanding,<br />

the growth of entire logistics network is absolutely essential in<br />

assisting Government of India’s “Make in India” strategy. The logistics<br />

industry plays a pivotal role in reducing costs by improving<br />

efficiency and increasing competitiveness. The chemistry between<br />

developing infrastructure, technological advancements and evolving<br />

demand is likely to define how the logistics in India, is going to<br />

help the companies in reducing costs. Interestingly, the change in<br />

government taxation policies and regulation of logistics service providers<br />

is going to be one of the most important factors in the process<br />

of development of this industry.<br />

Sushen Doshi, correspondent India for <strong>f+h</strong> <strong>Intralogistics</strong><br />

Logistics<br />

Compared to the situation at the end of 1990s, the Indian logistics<br />

sector has come a long way. The integration of the fragmented components<br />

of the logistics sector such as services, transportation,<br />

packaging, tracking and warehousing etc., has brought India’s logistics<br />

industry to its current growth state. Shifting from its traditional<br />

“godowns” to functional warehouses has surely made the logistics<br />

sector much more efficient. To understand where India’s logistics<br />

sector stands today, let’s take a look in comparison to United States<br />

– developed economy and China – a market similar to India.<br />

In the context of logistics costs as a percentage of GDP, India<br />

stands at 13 %, United States roughly between 8-9 % and China at<br />

18 %. If we split up the cost of logistics into 3 parts namely transports,<br />

warehousing and miscellaneous, let’s see which of the parts<br />

contributes more towards the overall logistics costs. In India’s case<br />

the share of transport in the overall logistics cost stands to 63 %,<br />

warehousing at 29 %, whereas the US has 67 % in transport and 22 %<br />

in warehousing and China has 52 % and 45 % in transport and warehousing<br />

respectively. Major industry sectors driving the logistics<br />

market in India are Auto components, Cement, Pharmaceuticals<br />

and textiles. Whereas the e-commerce along with food and beverages<br />

drive the US market. China’s logistics market is driven mainly<br />

by the metals, electronics and textiles due to its high exports. Major<br />

challenges that India’s logistics companies face are inadequate road<br />

and rail infrastructure, lack of inland waterways and huge waiting<br />

times at the state-borders for inter-state taxation. The US has highly<br />

sophisticated transport network from rail, road and inland waterways<br />

as well, but the higher employee wages is a major challenge for<br />

the Americans. While the employee cost in China is obviously not as<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

high as America, but China will certainly be facing a shortage of<br />

trained manpower in not so distant future.<br />

When you compare the numbers with America and China, India<br />

doesn’t seem to be far off. But this is not the case, although India’s<br />

logistics sector has come a long way, it still has a lot more to achieve<br />

in order to stand out in the global market. Primarily, there has to be<br />

further more improvement of the transportation as well as warehousing<br />

and storage.<br />

A strong infrastructure is backbone of the country<br />

India has the second largest road network in the world at 4.7 million<br />

km. Transportation, the largest stakeholder in the logistics pie in<br />

India, is primarily by roadways, with nearly 60 % of the goods transported<br />

via road. Thus, India depends on the costliest mode of travel<br />

(road) for majority of its domestic freight transfers. Although India<br />

has the 2 nd largest roads network in the world after USA, in terms of<br />

quality of road, its lags significantly behind others. However, a lot is<br />

proposed in India for infrastructure development, Government of<br />

India has earmarked an investment of $ 1 trillion for infrastructure<br />

during the 12 th Five-Year Plan (2012–17). The construction of highways<br />

had reached an all-time high of more than 6,000 km during<br />

2015-16, and the increased pace of construction is expected to<br />

continue for the coming years.<br />

GST: bringing India under a single market without<br />

any state borders<br />

In the story of modern India, i.e. post liberalization of the Indian<br />

economy in 1991, GST is the biggest reform in the country yet. GST<br />

is the “Goods and Services Tax”, a comprehensive indirect tax on<br />

manufacture, sale and consumption of goods and services throughout<br />

India. Basically under the GST system, all the taxes from the<br />

central government to the state government are amalgamated into<br />

one. This would mitigate cascading or double taxation, facilitating a<br />

common national market. This creates a more efficient, neutral and<br />

a systematic tax system throughout the country. From the consumer<br />

point of view, the biggest advantage would be in terms of a reduction<br />

in the overall tax burden on goods, which is currently estimated<br />

at 25 %. GST would replace most taxes currently in place such as<br />

(Table).<br />

Central government taxes<br />

Central Excise Duty<br />

Service Tax<br />

Customs Duty<br />

Central Sales Tax<br />

Central Surcharges<br />

State government taxes<br />

Value Added Tax<br />

Value Added Tax<br />

Value Added Tax<br />

Luxury Tax<br />

Sales Tax<br />

With the onset of GST, the physical state boundaries lose their significance<br />

from the taxation point of view, supply chain dynamics<br />

and market forces of demand would rule supreme. Free movement<br />

of goods from one state to another without stopping at state borders<br />

for hours for payment of state tax or entry tax would result in huge<br />

improvement in efficiency and timely delivery of goods. The implementation<br />

of GST would add 2-4 % to the logistics growth in India.<br />

At present, a complicated tax regime with poor infrastructure has<br />

resulted in exorbitant logistics costs in India. It is now 14 % of the<br />

total value of goods as compared to 7-8 % in developed countries.<br />

The reforms proposed in the GST will look at re-engineering the<br />

supply chain architecture with fewer and larger strategically placed<br />

distribution centers along with smaller warehouses for daily “to and<br />

fro” runs. Apart from harmonization of warehousing space, companies<br />

are also taking this opportunity to give high importance to<br />

operational efficiencies and safety standards in the new warehouses<br />

with the use of vertical racking, automated conveyor systems, fire<br />

sprinklers, hydrant systems, etc. Thus, GST is expected not only to<br />

optimize the supply chain networks, but also to bring in high-quality<br />

international standard warehouses in the Indian market.<br />

Warehousing<br />

Storage and warehousing is the second most important component<br />

in India’s logistics sector. The Indian warehousing sector is gradually<br />

shifting from unorganized to organized mode, and more highquality<br />

warehouse spaces are being developed. With the modernization<br />

of the supply chain, warehousing has become a critical function,<br />

and today, warehouses not only provide safe custody for<br />

goods, but also offer value-added services, such as sorting, packing,<br />

blending and processing. These high-quality warehouses require<br />

automation and safety in operations and would be equipped with<br />

vertical racking, reach trucks, automated conveyor systems, and fire<br />

sprinkler and hydrant systems. Based on the type of goods stored,<br />

storage and warehousing are categorized under five major heads:<br />

Industry/Retail warehousing, liquid storage, Agri – warehousing,<br />

Cold storage, Container storage.<br />

Growth drivers for warehousing<br />

In India, export/import (EXIM) cargo, agriculture and manufacturing<br />

(textiles, auto and auto ancillary) have been identified as the traditional<br />

growth drivers to the demand for warehouse space. Meanwhile,<br />

new growth drivers such as organized retail including food and<br />

beverage, telecommunications, pharmaceutical and healthcare can<br />

be considered as high potential sectors. With the growth of these<br />

sectors, coupled with the dawn of technological advancements, the<br />

demand for organized and automated warehousing is set to increase.<br />

The following are the major demand drivers in the warehousing<br />

sector in India:<br />

1. Consumption-led demand: With a 10 % increase in the per capita<br />

income, the increased demand and consumption of fast moving<br />

consumer goods is proving to be a huge growth factor for warehousing<br />

industry.<br />

2. E-commerce led demand: A Booming e-commerce industry set<br />

to reach $ 20 billion by 2020. E-commerce is playing a major<br />

role in increasing the demand for warehousing in India, especially<br />

retail warehousing. As more customers rely on online<br />

portals for buying goods, the demand shifts from traditional<br />

retail space to warehouses. The e-commerce market has grown<br />

at a rate of 57 % from 2009 until 2014. India’s internet penetration<br />

is roughly around 20 % of the household in 2014 as compared<br />

to more than 80 % in the US and 40 % in China. The future<br />

growth potential in the e-commerce sector in India is going to<br />

be exponential, as India is all geared up to catch on the Internet<br />

penetration levels.<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

GLOBAL BUSINESS<br />

3. Manufacturing-led demand: The manufacturing<br />

sector spends nearly 2-20 % of its revenue on logistics<br />

depending on corresponding industry. But with the<br />

manufacturing sector growing at a compound annual<br />

growth rate of 7.3 % and further expected to grow even<br />

faster, the demand for logistics and warehousing service<br />

is set to grow at a massive rate. With policies like<br />

“Make in India” further providing a big boost to the<br />

manufacturing sector, the logistics, distribution and<br />

supply chain management experts can find themselves<br />

in an extremely sweet spot.<br />

4. Agriculture-based demand: India is the second largest<br />

producer of vegetables and fruits, due to lack of infrastructure<br />

and fragmented cold chains, more than 20 %<br />

of agri-produce are damaged before reaching the<br />

consumer. According to a report by the Associated<br />

Chambers of Commerce and Industry of India (ASSO-<br />

CHAM), there is a shortage of more than 10 million<br />

tons of cold storage for agri-produce in India.<br />

5. Export – Import (EXIM) based demand: In 2015, all<br />

major and non-major ports in India handled about 1050<br />

Million metric tonnes of cargo. EXIM cargo is expected<br />

to increase to 2,800 MMT by 2020. Container handling is<br />

growing at about 11 %, creating huge demands for the<br />

entire eco-system of port related logistics.<br />

Logistics hubs and clusters<br />

The primary logistics hubs in India based on three major<br />

factors:<br />

n Proximity to the sea: The locations are strategic being<br />

in proximity to sea ports which can cater to the Export-<br />

Import (EXIM) trade generated through the major<br />

seaports in India.<br />

n Proximity to consumption hubs: These locations are<br />

able to cater to about 60 % of Indian demand within<br />

12-hour drive time.<br />

n Facilitator-led locations: These locations have highlevel<br />

requirement of skilled manpower, support from<br />

government policies, infrastructure availability and<br />

presence of warehouse stock.<br />

Based on these factors and their significant contributions<br />

to the Indian economy, eight top cities including<br />

Ahmedabad, Bangalore, Chennai, Delhi NCR,<br />

Hyderabad, Kolkata, Mumbai and Pune can be considered<br />

as the country’s primary warehousing and logistic<br />

hubs. These eight hubs put together have a cumulative<br />

supply of organized warehouses to the tune of 97 million<br />

square feet in 2015, recording a remarkable 21 %<br />

annual growth rate between from 2010-15. With majority<br />

of the companies now realigning their supply chain<br />

networks, the market for warehouse spaces is expected to<br />

go northward in 2017 to around 120 million square feet.<br />

Ahmedabad: is home to several manufacturing sectors,<br />

including pharmaceutical and automobile and its<br />

components. A moderately large consumer market itself<br />

and a growing manufacturing base have made<br />

Ahmedabad one of the warehousing hubs in India.<br />

Ahmedabad’s connectivity to and location in the Delhi-<br />

Mumbai Industrial Corridor (DMIC) has given an<br />

impetus to the warehousing sector.<br />

Mumbai: The two busiest ports of India, JNPT and<br />

Mumbai port are major demand generators. The JNPT<br />

area has evolved as a major warehousing location in<br />

Mumbai because of its proximity to the port and availability<br />

of large expanse of land. Multiple free trade warehousing<br />

zones (FTWZs) are present here. Warehousing<br />

locations in Bhiwandi, Mankoli and Padgha along<br />

National and State Highway can be considered as the<br />

most vibrant and largest warehousing areas in Mumbai.<br />

Major supply of top class warehouses is available in this<br />

area, with the presence of FMCG and e-commerce companies.<br />

According to some statistics, the city offers more<br />

than 23 million square feet of warehousing space.<br />

Pune: Pune, just 160 kms from Mumbai, is also a huge<br />

manufacturing base from automobiles to machinery and<br />

equipment, food and beverage etc. The large consumer<br />

bases in Mumbai – Pune region and affordable land prices<br />

(compared to Mumbai) have helped Pune become a<br />

major warehousing location. The Chakan – Talegaon area<br />

in Pune, due to its proximity to large-scale manufacturing<br />

units and easy connectivity with Mumbai, as well<br />

as the presence of large organized warehousing parks<br />

has helped positioned Chakan – Talegaon as the prime<br />

warehousing area of the city. Pune has the presence of<br />

players such as Mahindra Logistics, Nippon, Bosch. Nagar<br />

Road and Shirwal are the two other warehousing corridors<br />

in Pune, with the presence of major occupiers in<br />

FMCG, engineering, auto accessories etc.<br />

After the implementation of the GST, cities like<br />

Belgaum, Kolhapur, Indore, Jaipur, Nagpur, Raipur, Patna<br />

and Ranchi are set to emerge as important warehousing<br />

locations.<br />

International trade fair: CeMAT India <strong>2016</strong><br />

When the world’s fastest growing large economy summons,<br />

there is ample reason to pay attention to it. This<br />

December that is exactly what the global as well as India’s<br />

heavyweights in the field of logistics and supply chain<br />

will do to drive themselves to the next level. On 1 st of<br />

December with the arrival of a pleasant winter season in<br />

Mumbai, the curtains will rise at the CeMAT India – one<br />

of the most comprehensive industrial trade fair in the<br />

country. The location of the trade fair in the city of Mumbai,<br />

the economic capital of the country suits perfectly<br />

well for all the stakeholders in this sector. The<br />

Ahmedabad-Mumbai-Pune belt is one of the most highly<br />

industrialized regions in the country. It is also a huge<br />

consumer market with 30-35 % of India’s consumer market<br />

share. This international exhibition focusing on the<br />

logistics and supply chain sector in the heart of India’s<br />

most promising region proves to be an excellent opportunity<br />

to broaden the customer base, to promote new<br />

products and equipment, new innovations and services<br />

that add value to the entire logistics chain. This international<br />

event is sure to attract decision makers from<br />

diverse industry sectors and is the ideal place to catch a<br />

glimpse of latest trends and technologies in Materials<br />

Handling / <strong>Intralogistics</strong>, Storage Systems, Warehousing<br />

and Logistic Services.<br />

For global as well as domestic players it is vital to understand<br />

the perspective about Indian customer’s requirements<br />

and necessities. CeMAT India provides a unique<br />

opportunity to gather this market intelligence and also to<br />

demonstrate their presence in the Indian market. For<br />

companies in the logistics and supply chain sector who<br />

are hunting for fresh markets to drive their growth,<br />

CeMAT-India offers an unparalleled access to the Indian<br />

market with high growth prospects for immediate as well<br />

as long term. This international trade fair attracts visitors<br />

from all parts of the country creating a great chance to<br />

strengthen relations with their existing customers and also<br />

find local distributors and sales partners.<br />

Photograph: Fotolia<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

xxx<br />

Increase your warehouse capacity<br />

Buildings cannot always be extended at will to provide additional storage<br />

space. Increasing storage density to release areas for production is often<br />

difficult. When those situations exist, one should think about mobile racking.<br />

With modern control concepts and well founded planning anything is possible.<br />

If you are planning to build a new storage installation or to restructure an<br />

existing one, please check the following system characteristics:<br />

• 85% increase of storage capacity over the same surface area.<br />

• 60% decrease in building volume if you are planning to build new.<br />

• 40% increase in available space, without having to build a new facility.<br />

We can help you with the planning and will find the most economic<br />

solution for your logistic needs.<br />

www.ssi-schaefer.com

Conveying & Loading Systems:<br />

a powerful global partner<br />

The Beumer Group uses its newly created Conveying &<br />

Loading Systems (CL Systems) division to develop and<br />

implement complex system solutions throughout the<br />

world for different industries, such as mining and the<br />

cement industry. The team is made up of experienced<br />

staff from the branches distributed around the world<br />

who work together on the projects. What they all have<br />

in common is that they understand the user, which<br />

means that they can develop tailor-made solutions.<br />

About Beumer Group<br />

The Beumer Group is an international leader in the<br />

manufacture of intralogistics systems for conveying,<br />

loading, palletizing, packaging, sortation and distribution.<br />

Together with Crisplant a/s and Enexco Teknologies<br />

India Limited, the Beumer Group employs 4,000 people<br />

worldwide, and achieves an annual turnover of about 700<br />

million Euros. With its subsidiaries and sales agencies,<br />

the Beumer Group serves customers around the globe,<br />

across a wide range of industries.<br />

Dr. Andreas Echelmeyer, who has headed the Conveying and<br />

Loading Systems division in the Beumer Group at its headquarters<br />

in Beckum since August 2015, stated that: “We can use our<br />

comprehensive expertise in system solutions to advise our customers<br />

and provide them with complete plant systems. Each industry<br />

poses its own unique challenges”. The most important point is to listen<br />

carefully to the customer and then ask the right questions. This<br />

can only be done locally. Employees positioned around the world<br />

are therefore in close contact with the customer. They are familiar<br />

with the specific customs of the particular country, understand the<br />

language and are wise to the particular requirements of the market<br />

and the customer. They identify appropriate potential and any possible<br />

need for action. The operators for whom Beumer has successfully<br />

commissioned conveying plants includes the TPI Polene Public<br />

Company Ltd. The third largest cement producer in Thailand uses<br />

this complex system solution to transport crushed limestone<br />

from the quarry to the blending bed.<br />

Difficult environment safely overcome<br />

Echelmeyer: “The challenge lay in the nature of the ground between<br />

the quarry and the cement plant. It was exceptionally demanding.<br />

We had to make allowances not only for numerous obstacles but<br />

also for a steep downhill section of the conveyor”. The team designed<br />

a complex, but above all cost-effective, integrated system<br />

MULTIMEDIA CONTENT<br />

Learn more about the achievement<br />

spectrum of the enterprise<br />

RUBRIK BULK MATERIAL HANDLING<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

comprising a total of eight belt conveyors covering a distance of<br />

6,129 m. Beumer also supplied a PLC plant control system, transfer<br />

stations, filter systems and foreign body collectors.<br />

The system is designed for a conveying capacity of 2,200 t/h. The<br />

key items in the limestone transport system are two downhill belt<br />

conveyors operating in the generator mode followed by a troughed<br />

belt conveyor with horizontal curves. The material passes from the<br />

crusher discharge belt the first two troughed belt conveyors. The<br />

material is then transferred to a long overland conveyor with a<br />

speed of 4.5 m/s by an accelerator belt with a speed of 2.6 m/s.<br />

Three more conveyors finally transport the material to the blending<br />

bed.<br />

Cost-effective operation guaranteed<br />

One particular feature of the downhill conveyors is their power generation.<br />

With a total of 640 kW/h generated energy that is fed into<br />

the power grid they make a substantial contribution to the cost-effective<br />

operation of the overall system. “We have a great deal of experience<br />

with conveying systems that can negotiate horizontal and<br />

vertical curves and operate in the generator mode”, explained<br />

Echelmeyer. During the development it was necessary, for example,<br />

to ensure safe and carefully controlled stopping of the large belt system<br />

to avoid problems during unavoidable events, such as a power<br />

failure.<br />

Beumer supplied four further belt systems with a total length of<br />

989 m to deal with the discharge from the blending bed and supply<br />

the material to the raw mill feed hopper. The conveyors were all<br />

built and installed in eleven months. The commissioning phase,<br />

lasting three months, was followed by performance tests. The team<br />

We can use our<br />

comprehensive<br />

expertise in system<br />

solutions to advise our<br />

customers and provide<br />

them with complete<br />

plant systems<br />

Dr. Andreas Echelmeyer, Director<br />

Conveying & Loading Systems,<br />

Beumer Group<br />

then handed over the entire plant to the customer. Echelmeyer<br />

emphasized: “We supervised and monitored the installation and<br />

commissioning to ensure long-lasting, trouble-free, operation. This<br />

always forms part of our service. The standard scope of supply also<br />

includes intensive training of the operating and maintenance<br />

personnel”.<br />

Through the middle of the rainforest<br />

The CL Systems division has also been very successful in Indonesia.<br />

The plant construction company Sinoma International Engineering<br />

Co. Ltd. was awarded the contract by the Indonesian end customer,<br />

Cemindo Gemilang, to supply a turn-key cement plant to Java. It<br />

should reach a daily clinker production of 10,000 tons. Sinoma commissioned<br />

Beumer with the design and supply of an overland conveyor<br />

between the quarry and the plant.<br />

The challenges in this project were not only the demanding topographical<br />

routing but also the evergreen rainforest (Image). Joint<br />

discussions were held between the Beumer team, Sinoma and the<br />

end customer. The team worked various routes out and compared<br />

them. “The very narrow corridor of land in addition to the tropical<br />

The route of the overland conveyor for the end customer, Cemindo<br />

Gemilang, passes through the middle of the rain forest<br />

climate required a complex and sophisticated design”, explained<br />

Echelmeyer. Among other things his team designed a solution with<br />

tight horizontal curves that fitted optimally into the landscape.<br />

The entire system now comprises six conveying plants with a total<br />

of length of 7.6 km. Beumer also supplied acceleration and discharge<br />

conveyors and a PLC plant control system.<br />

Controlled loading ensured<br />

The system is designed for a maximum continuous conveying capacity<br />

of 3,000 t/h. The main component is a 7.4 km long overland<br />

conveyor. Upstream of this troughed belt conveyor is an intermediate<br />

hopper with a capacity of about 120 tones. The material passes<br />

from this hopper via a variable-speed discharge conveyor to a<br />

downstream acceleration belt that feeds the overland conveyor.<br />

This controlled loading system ensures cost-effective operation of<br />

the plant, especially during the start-up phase. It also has a favorable<br />

effect in the dimensioning of drive components and the belt,<br />

and reduces the operating costs.<br />

The acceleration belt with a speed of 4 m/s protects the belt of the<br />

overland conveyor and increases its service life. For further protection<br />

there are also upstream units for collecting any iron and nonferrous<br />

metals. The limestone is then transported to the blending<br />

bed on short troughed belt conveyors.<br />

The troughed belt conveyor has a width of 1,200 mm and a distance<br />

between centres of 7,381 m. One tail drive and two head<br />

drives are installed, each with a rating of 545 kW. The plant conveys<br />

the material at a speed of 5 m/s and negotiates a height difference of<br />

minus 188 m.<br />

Protection of people and animals<br />

The conveying system also runs past villages and for long sections<br />

passes through rainforest that deserves to be protected. The CL Systems<br />

team has taken numerous design measures to reduce the<br />

noise impact on people and animals. “Among other things, we have<br />

used low noise idler rollers and appropriately dimensioned protective<br />

hoods at the drive station”, explained Echelmeyer. “This means<br />

that the limestone passes through the rainforest in virtually silent<br />

mode. The construction time lasted only one year”.<br />

Photographs: Beumer Group<br />

www.beumergroup.com<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

RUBRIK CEMAT INDIA<br />

CeMAT India –<br />

<strong>Intralogistics</strong> showcase,<br />

embedded in industry<br />

Growing at an anticipated 7.5 percent in <strong>2016</strong>, the Indian economy continues to go from<br />

strength to strength. A lot has happened since the “Make in India” campaign was<br />

launched in 2014. By investing in the country’s infrastructure and lowering corporate tax<br />

rates, the Indian government has succeeded in attracting a growing number of international<br />

investors. Today, India stands not just for services and IT, but also for a commitment<br />

to modernizing the nation’s industry, with the goal of ramping up domestic<br />

production.<br />

Visitors to CeMAT India (1 to 3 December <strong>2016</strong> in Mumbai) can get an initial impression<br />

of the competence of Indian industry, with well-known enterprises like Carlstahl Craftsman<br />

Enterprises, Kompress India, Nash Robotics & Automation, Rajdlari Storage<br />

Systems, Godrej & Boyce, Cascade and Jungheinrich as exhibitors there. Embedded in<br />

the WIN India trade fair, these exhibitors will be demonstrating the key role played by<br />

intralogistics in automated systems. Manufacturing industries currently constitute only<br />

15 percent of India’s gross domestic product, with a concomitant huge potential for further<br />

development. According to the latest information supplied by GTAI (Germany Trade<br />

& Invest), private consumption in India is growing fast, resulting in above-average<br />

demand for the types of machines needed by consumer-related industries like textiles,<br />

chemicals, automotive and packaging.<br />

Not surprisingly, online retailing has also been growing in India the last few years. Whereas<br />

in 2013, Indian consumers bought some 10.7 billion US dollars’ worth of goods, one<br />

year later the figure had gone up by 34 percent, for a total of 16.4 billion, according to<br />

pwc. In 2015 sales had climbed to 22 billion dollars, with the curve continuing to point<br />

upward. This growth also means higher demands on the supply chain – which brings us<br />

to the intralogistics providers showcasing their comprehensive solutions at CeMAT India.<br />

The organizers of WIN India are expecting a total of<br />

some 200 exhibitors and more than 10,000 visitors at<br />

the upcoming event, where there will also be a<br />

wide-ranging program of forums on the latest<br />

challenges and developments involving the<br />

supply chain. The first day of the show will<br />

feature a discussion on the topic of “The Supply<br />

Chain in a Digital World”. On the second<br />

day, presentations and discussions will include<br />

techniques and strategies for minimizing<br />

supply chain risks, as well as the role that<br />

state-of-the-art technologies can play in the<br />

modernization process.<br />

I wish all of you a successful trade fair, with<br />

numerous successful leads, inspiring talks<br />

and outstanding business.<br />

Krister Sandvoss<br />

Project director “CeMAT Worldwide”<br />

Deutsche Messe AG<br />

<strong>Intralogistics</strong><br />

Trade magazine for material flow and material management<br />

Imprint<br />

Publisher:<br />

Dipl.-Ing. Reiner Wesselowski (We)<br />

Email: r.wesselowski@vfmz.de<br />

Editor-in-chief:<br />

Dipl.-Ing. (FH) Winfried Bauer (WB),<br />

Email: w.bauer@vfmz.de<br />

Editorial board:<br />

Dipl.-Medienwirtin (FH) Marie Krueger (MK),<br />

Holger Seybold (Sey)<br />

Dipl.-Ing. Manfred Weber (MW)<br />

Assistant editor:<br />

Svenja Stenner<br />

Design/layout:<br />

Sonja Schirmer, Doris Buchenau,<br />

Anette Fröder, Mario Wüst<br />

Epaper designer:<br />

Katja Rüdell, Mathias Göbel<br />

Managing editor:<br />

Dipl.-Ing. (FH) Winfried Bauer<br />

Publishing house:<br />

Vereinigte Fachverlage GmbH<br />

Lise-Meitner-Str. 2, 55129 Mainz, Germany<br />

Commercial Register No.:<br />

HRB 2270, District Court of Mainz<br />

VAT-ID:<br />

DE149063659<br />

Managing director:<br />

Dr. Olaf Theisen<br />

Publishing director:<br />

Dr. Michael Werner, Email: m.werner@vfmz.de<br />

Correspondent India:<br />

Sushen Haresh Doshi M.Sc.<br />

Advertising sales director:<br />

Beatrice Thomas-Meyer<br />

Email: b.thomas-meyer@vfmz.de<br />

Advertising sales manager:<br />

Andreas Zepig, Email: a.zepig@vfmz.de<br />

Advertising representatives:<br />

Austria<br />

Heinz-Joachim Greiner<br />

Email: verlagsbuero-greiner@vfmz.de<br />

China, India<br />

Andreas Zepig, Email: a.zepig@vfmz.de<br />

France<br />

Marc Jouanny, Email: marc-jouanny@wanadoo.fr<br />

Great Britain, Ireland<br />

Roberto Tondina,<br />

Email: roberto@ts-communications.co.uk<br />

Italy, Switzerland<br />

Hermann Jordi, Email: info@jordipublipress.de<br />

Sweden, Finland, Norway<br />

Malte Mezger<br />

Email: verlagsbuero-mezger@vfmz.de<br />

USA, Canada<br />

Bill Fox, Email: bfox@hfusa.com<br />

Advertising Disposition:<br />

Annemarie Benthin, Email: a.benthin@vfmz.de<br />

In cooperation with:<br />

Hannover Fairs International GmbH<br />

Messegelände, 30521 Hannover, Germany<br />

VDMA – German Engineering Federation<br />

Trade Association Materials Handling and <strong>Intralogistics</strong><br />

Lyoner Straße 18, 60528 Frankfurt, Germany<br />

Additional Partner:<br />

Moskauer Deutsche Zeitung<br />

Internet:<br />

www.fh-intralogistics.com<br />

8 th year (<strong>2016</strong>)<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

Product News<br />

User-friendly like a smartphone<br />

The MX-1000 series terminals from Cognex offer companies a new<br />

way to record data during inventory management and logistic<br />

processes, amongst other things. The mobile data recording<br />

terminal combines the user-friendly design, low costs and<br />

flexibility of a smartphone with a robust, portable unit with an<br />

integrated barcode scanner.<br />

www.cognex.com<br />

Stat Control now internationally certified<br />

Statistical inventory counts offer significant advantages compared<br />

with full inventory counts. They reduce the counting effort and<br />

therefore the costs and warehouse closing times, as well as error<br />

rates. Stat Control GmbH, a company specialising in inventory<br />

software, now has<br />

separate certifications<br />

for Germany, Austria<br />

and Switzerland for the<br />

first time. Alongside<br />

inventory management,<br />

companies are increasingly<br />

focusing on<br />

monitoring stock during<br />

the year. In contrast to<br />

value-based inventory<br />

counts, stock controls<br />

are risk oriented and designed to secure processes, which is where<br />

the systems currently offered by Stat Control provide manifold support.<br />

The Software Starwarp, for instance, can carry out a riskbased<br />

ABC analysis, which uses various factors to categorise stock<br />

items into risk clusters.<br />

www.statcontrol.net<br />

Gaining an extensive overview over the<br />

fleet of industrial trucks<br />

www.id-systems.com<br />

The business intelligence tool Powerfleet IQ<br />

from I.D. Systems is an analytical<br />

platform that can optionally be integrated<br />

in the Powerfleet fleet management<br />

system landscape. Data collected from<br />

the fleet of industrial trucks,<br />

especially from fleets across<br />

several locations, is continuously<br />

collated and visually prepared in<br />

the KPI dashboard.<br />

Click to read<br />

previous issues.<br />

Inspiration is just<br />

one click away.<br />

Full networking capability for easier<br />

operation<br />

Mosca meets the specific needs of the corrugated cardboard<br />

industry with the fully automated UATRI-2 XT inline strapping<br />

machine. This high-performance machine can be easily integrated<br />

into automated high-speed<br />

production lines for gentle,<br />

fast and reliable strapping of<br />

corrugated cardboard.<br />

Thanks to full network<br />

capability, these strapping<br />

machine can be monitored<br />

from a connected computer.<br />

News about the following markets:<br />

www.mosca.com<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

Jungheinrich celebrates<br />

60 th anniversary of reach truck<br />

RUBRIK INDUSTRIAL TRUCKS<br />

For 60 years reach trucks have been reliable workhorses<br />

for transporting and stacking goods in warehouses<br />

around the world. In 1956 Jungheinrich built the world’s<br />

first reach truck – the “Ameise Stand Retrak”.<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

Using the Retrak’s movable lift mast (Image 01),<br />

goods could be pulled back between the front<br />

and rear axle for transport purposes. As a result<br />

the stacker was shortened, requiring less aisle<br />

width between racks. This moreover improved<br />

driving stability while reducing the weight of offsetting<br />

counterbalances. This was a technological<br />

milestone from Jungheinrich, involving the<br />

development of an entirely new industrial truck<br />

category 60 years ago.<br />

As early as 1957 the Retrak was available not<br />

just with a simple, telescopic or dual lift telescopic<br />

mast, but even a triplex mast. Over the years numerous new technical<br />

features were added, including ergonomic improvements and<br />

an even more compact design combined with in part extremely<br />

high lift heights of 13 meters for payloads of up to a ton.<br />

02 For the anniversary the reach truck fleet was presented in a new<br />

design<br />

Broad product range to fit any customer requirement<br />

Today Jungheinrich is one of Europe’s leading provider of reach<br />

trucks, featuring numerous lift heights and lift capacity classes.<br />

Special variations are available for special applications like multiway<br />

stackers for outdoor applications involving payloads of up to<br />

15 tons.<br />

Since 1956 the company has continually set new standards in<br />

throughput, thanks to faster acceleration as well as faster lift and<br />

reaching speeds. These numerous technological innovations range<br />

from the introduction of three-phase AC technology all the way to a<br />

mast forward reach cushioning system to prevent mast vibrations<br />

when storing and retrieving payloads. All vehicle components<br />

as well as the software, motors and control systems<br />

are produced in-house and are perfectly<br />

compatible, offering maximum performance<br />

at a minimum rate of energy consumption, for<br />

example through energy recovery when braking. This is<br />

why Jungheinrich guarantees that its reach trucks can work<br />

for two full shifts with a single battery charge – in the form of<br />

its special “2Shifts1Charge” warranty. This saves the customer<br />

the expense of buying a second battery as well as the<br />

cost of the battery changing equipment, special charging<br />

stations and also the time needed to perform the battery<br />

change. If a battery fails to hold its charge for two full shifts,<br />

the company will deliver a second battery free of charge.<br />

Distinctive and striking new design<br />

Right on time for the anniversary Jungheinrich is presenting<br />

its reach truck fleet in a completely new design<br />

(Image 02). At the beginning of <strong>2016</strong> the company<br />

introduced a new grey in addition to the familiar yellow<br />

in a uniform colour distribution. All operating functions<br />

and model markings are uniformly highlighted<br />

striking accent green. And the “soloPILOT” and “multiPILOT”<br />

operating elements as well as the colour display<br />

showing the key reach truck operating data have<br />

01 In 1956 Jungheinrich built the first<br />

reach truck – the “Ameise Stand Retrak”<br />

likewise been revamped. The new design visibly reinforces the technical<br />

and ergonomic quality of the company’s products.<br />

Advantages of lithium-ion technology now applied<br />

to reach trucks<br />

At CeMAT <strong>2016</strong> Jungheinrich is expanding its portfolio of selfdeveloped<br />

lithium-ion batteries by a 48-V-battery with 360 or 480 Ah.<br />

This means that this completely maintenance-free technology can now<br />

also be used for reach trucks and counterbalance trucks. The lithiumion<br />

batteries’ high-performance energy cells are characterised by extremely<br />

short charging times. Even an interim charging time of just<br />

30 or 45 minutes is enough to charge the battery to 50 percent of its<br />

capacity. After two or 3.5 hours the battery is fully charged. And the<br />

battery’s high efficiency coefficient enables energy savings of 20 percent<br />

or more when charging and recovering braking energy.<br />

To guarantee a maximum of efficiency, safety and convenience in<br />

daily operations, the battery, charging device and vehicle are perfectly<br />

coordinated. And the battery is also permanently monitored<br />

by an innovative, integrated battery management system – with the<br />

result that lithium-ion batteries have a product life of around three<br />

times as long as conventional lead-acid batteries.<br />

Photographs: Jungheinrich<br />

www.jungheinrich.com<br />

About Jungheinrich<br />

Jungheinrich ranks among the world’s leading companies<br />

in the material handling equipment, warehousing and<br />

material flow engineering sectors. The company is an<br />

intralogistics service and solution provider with manufacturing<br />

operations, which offers its customers a comprehensive<br />

range of forklift trucks, logistics systems,<br />

services and advice. Jungheinrich shares are traded on all<br />

German stock exchanges.<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

Process efficiency thanks to continuous<br />

SAP EWM Material Flow Control<br />

SSI Schaefer has implemented a fully automatic<br />

production and distribution system for frozen products<br />

for the Belgian La Lorraine Bakery Group in the Czech<br />

Republic. For the first time, five 2-mast devices from<br />

the new storage and retrieval machine generation<br />

Exyz are used to guarantee process efficiency in a<br />

deep-freeze environment. SSI Schaefer’s SAP specialists<br />

also developed the necessary dialog structures for<br />

system and material flow control directly on SAP EWM.<br />

Appropriate storage and picking of frozen food products is one of<br />

the most challenging tasks in intralogistics, especially with<br />

automated processes. Frozen products continually have to be kept<br />

at a core temperature between -12 and -18 °C. They are stored at a<br />

surrounding temperature of -25 °C. In order to ensure an uninterrupted<br />

cold chain and hygienic standards according to Hazard<br />

Analysis Critical Control Point (HACCP) guidelines, high quality<br />

and performance requirements have to be met. Picking processes<br />

within a deep-freeze environment also have to be concluded within<br />

30 minutes at a maximum temperature of -5 °C. This represents a<br />

great challenge in terms of system and material flow concepts,<br />

performance of implemented system components and available<br />

functions of software systems. With this in mind, La Lorraine Bakery<br />

Group, one of the leading producers and distributors of frozen bakery<br />

products for retail and gastronomy in Europe, decided to work<br />

together with the intralogistics specialists of SSI Schaefer to plan<br />

and execute their new fully automatic production and distribution<br />

center at the Czech site of Kladno-Kročehlavy.<br />

Comprehensive project competence<br />

Based on an international tender, SSI Schaefer was awarded the<br />

contract to implement the project as general contractor. The commissioned<br />

scope of services ranged from drawing up the logistics<br />

and material flow concept, carrying out implementation planning<br />

and system equipment to establishing a communication structure<br />

allowing to control the entire system directly from the SAP Extended<br />

Warehouse Management (EWM). “Excellent references<br />

throughout Europe, a comprehensive solution based on modern<br />

systems of in-house production and the good organization of the<br />

company in the Czech Republic were the decisive factors for placing<br />

the order with SSI Schaefer”, Petr Kozojed, logistics manager of<br />

La Lorraine at the production site of Kladno-Kročehlavy, explains<br />

the choice of the supplier. “The effective implementation of the<br />

project and the overall positive result have confirmed that we<br />

made the right decision.”<br />

RUBRIK WAREHOUSING<br />

<strong>f+h</strong> <strong>Intralogistics</strong> 5/<strong>2016</strong>

The Belgian company group, which has won the “Entrepreneur of<br />

the Year 2012” award in its home country, is one of the ten most<br />

important producers of frozen bakery products in Europe. The company<br />

has been present on the Czech market since 1998, and since<br />

2008 under the name of La Lorraine. The 300 employees at this site<br />

produce more than 23,000 tons of frozen bakery products in gastight<br />

packaging per year. The sales territory extends from the Czech<br />

Republic to Poland and Belgium, as well as to South European countries.<br />

“Ensuring top product quality, production processes and<br />

logistics are an integral part of La Lorraine’s philosophy”, says Kozojed.<br />

Process optimization by SAP<br />

Due to the fast growth of the company, its logistics was no longer<br />

state of the art. “Our logistics approach was appropriate for the 90s”,<br />

explains the logistics manager. “However, by now we handle more<br />

than 400 different products and have to coordinate deliveries between<br />

our customers and production sites in five different countries,<br />

all of which entails an enormous expenditure in terms of processes,<br />