iCPARQuarterlyBulletin-March2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Journal<br />

The iCPAR<br />

ISSUE 3<br />

JANUARY - MARCH 2018<br />

iCPAR QUARTERLY BULLETIN<br />

NOT FOR SALE<br />

IFRS<br />

9<br />

IFRS 9 Financial Instruments,<br />

is likely to affect all sectors but mostly; banks<br />

A publication of the Institute of Certified Public Accountants of Rwanda

About us<br />

The Institute is the sole professional accountancy<br />

organization established by law No. 11/2008 of 6 th May<br />

2008 with a broad mandate to grow and regulate the<br />

accountancy profession<br />

What we do<br />

We regulate the accountancy profession; We preserve<br />

the integrity of the accounting profession; We promote<br />

the competence and the capacities of own members.<br />

We deliver accounting qualifications, programs<br />

and examinations.We promote compliance with<br />

professional standards<br />

Vision<br />

A strong, relevant and sustainable profession<br />

Mission<br />

To build a strong and engaged professional<br />

accountancy organization that anticipates stakeholder<br />

expectations and acts in the public interest<br />

Our Office<br />

KG 501 St 21, behind Career Center Building<br />

P.o.Box: 3213 Kigali Rwanda<br />

T: +250 784103930<br />

F: +250 280103930<br />

E: info@icparwanda.com

THE iCPAR JOURNAL<br />

3<br />

Inside this Issue<br />

13<br />

17 18<br />

4. Foreword<br />

5. Annual AGM notice<br />

7. The Commission for<br />

Inspection<br />

8. IFRS 9 Financial<br />

Instruments, is likely<br />

to affect all sectors but<br />

mostly; banks<br />

11. Release of December<br />

2017 examination results<br />

11. Updates on the<br />

upcoming new CAT<br />

qualification<br />

12. New CPD policy to be<br />

effective 1st July 2018<br />

13. KIM University; One of<br />

the tuition providers of<br />

CPA and CAT Rwanda<br />

16. If you want to be<br />

and remain relevant<br />

in the business and<br />

finance world, it is<br />

critical that you attain<br />

Professional Accounting<br />

Qualifications- Kajungu<br />

Clode<br />

18. Accountants in history<br />

19. List of accounting firms<br />

licenced by iCPAR as at<br />

31 January 2018<br />

21. 2018 CPD Calendar<br />

22. Humour, Crossword<br />

DISCLAIMER<br />

PUBLISHER<br />

Reproduction of any article in this journal<br />

without permission is prohibited. The editor<br />

reserves the right to use, edit or shorten<br />

articles for accuracy, space and relevance<br />

Copyright © iCPAR 2017. All rights reserved.<br />

Copyrights and all / or other intelectual property rights on<br />

all designs, graphics, logos, images, phots, texts, trade<br />

names, trademarks, etc in this publication are reserved.<br />

The reproduction, transmission or modification of any part<br />

of the contents of this publication is strictly prohibited.<br />

Our Office<br />

KG 501 St 21, behind Career Center Building<br />

P.o.Box: 3213 Kigali Rwanda<br />

T: +250 784103930<br />

F: +250 280103930<br />

E: info@icparwanda.com<br />

Disclaimer<br />

Views expressed in the journal are not necessarily those of the institute, management<br />

and employees.<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

4 Journal<br />

The iCPAR<br />

Foreword<br />

Dear ICPAR Member,<br />

Happy new year once again!<br />

As per our commitment of ensuring that we regularly keep you<br />

abreast of the developments in the accountancy profession and<br />

beyond, here we are with the 3 rd issue.<br />

Firstly, I would like to thank all firms that managed to submit their<br />

Audit Quality Assurance (AQA) progress report which was purposely<br />

intended for monitoring the firm’s compliance with International<br />

Standards on Quality Control 1 (ISQC 1) relating to firm-wide audit<br />

quality control policies and procedures, and the IESBA Code of<br />

Ethics for Professional Accountants. Well done!<br />

It is important that we enhance the quality of reporting by ensuring<br />

that service providers in the accountancy profession adhere to all<br />

the relevant requirements. Similarly, professional accountants must<br />

constantly upgrade their skills; improve on the processes and work<br />

together effectively so that they continue to instill confidence and<br />

public trust.<br />

We believe our member firms will walk the talk by ensuring that what<br />

they submitted in the AQA progress report is actually implemented.<br />

This year, in collaboration with both the Inspection and Disciplinary<br />

Commissions, the institute will carry out a monitoring exercise<br />

towards ISQC 1 compliance. We request maximum collaboration<br />

with the team that will be carrying out that exercise.<br />

I would like to thank all firms<br />

that managed to submit their<br />

Audit Quality Assurance<br />

(AQA) progress report which<br />

was purposely intended for<br />

monitoring the firm’s compliance<br />

with International Standards<br />

on Quality Control 1 (ISQC 1)<br />

relating to firm-wide audit quality<br />

control policies and procedures,<br />

and the IESBA Code of Ethics for<br />

Professional Accountants. Well<br />

done!<br />

Amin Miramago<br />

iCPAR CEO | SG<br />

I would like to take this opportunity to remind our members that<br />

we shall have an ordinary meeting of general assembly in line<br />

with article 11 of law no. 11/2008 on Friday, 23 rd of March 2018.<br />

A notice of the same has also been issued and we expect all our<br />

members to attend. Please ensure that you are a member in good<br />

standing by fulfilling all the requirements prior to the meeting.<br />

Congratulations to all our students who passed their exams and<br />

to those who became iCPAR members this year. So sorry for those<br />

that never managed to pass their papers; and we believe next time<br />

they will, if they promptly follow guidance of their tuition providers<br />

whilst preparing themselves thoroughly in good time.<br />

Wishing you all the best for 2018 and looking forward to working<br />

more closely with you in the development of our profession and the<br />

nation at large.<br />

Amin Miramago<br />

Chief Executive Officer | Secretary General<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

5<br />

Annual AGM notice<br />

NOTICE IS HEREBY GIVEN THAT THE 9 TH ANNUAL GENERAL MEETING (AGM) WILL BE HELD ON FRIDAY,<br />

23 RD MARCH 2018 FROM 3:00 PM AT SERENA HOTEL, KIGALI.<br />

Article 14: Without prejudice to the provisions of article 12 of this law, the meetings of the General Assembly<br />

shall be presided over by the President of the Governing Council of the Institute, who is also the President and Legal<br />

Representation of the Institute. In case of his or her absence, he or she shall be replaced by the Vice President.<br />

Agenda Item Facilitator Time Explanation<br />

1. ARRIVAL AND<br />

REGISTRATION<br />

2. QUORUM - To<br />

note if quorum is<br />

achieved. Quorum<br />

to be based on the<br />

members in good<br />

standing.<br />

3. WELCOME NOTE<br />

AND APOLOGIES<br />

4. MATTERS ARISING<br />

- from the AGM<br />

held on 24 th March<br />

2017<br />

5. GOVERNING<br />

COUNCIL REPORT<br />

To receive the<br />

President’s report<br />

6. ICPAR LOYALTY<br />

CARD presentation<br />

to members<br />

7. NEW CPD POLICY<br />

presentation to<br />

members<br />

iCPAR Secretariat 3:00 to 3:30 Receive members<br />

President 3:30 to 4:00 Article 13: The General Assembly<br />

shall be valid if attended by at<br />

least one half (1/2) of its members.<br />

If a quorum is not attained, the<br />

meeting of the General Assembly<br />

shall be adjourned to another day.<br />

During the next meeting, convened<br />

in ordinary way, the members<br />

present shall validly take decisions,<br />

irrespective of the quorum required.<br />

President 4:00 to 4:10 All members in attendance<br />

President 4:10 to 4:30 For information and follow up<br />

President 4:30 to 5:00 Article 20: The Governing Council<br />

shall prepare the Annual Activity<br />

Report for the previous year ended<br />

Dec, 2017.<br />

CEO|SG 5:00 to 5:10 For information<br />

President 5:10 to 5:30 For information<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

6 Journal<br />

The iCPAR<br />

8. AUDITED<br />

FINANCIAL<br />

STATEMENTS:<br />

Auditor/CEO|SG 5:30 to 5:50 For adoption and approval<br />

a. To receive the<br />

Auditor’s report<br />

b. to adopt the<br />

audited financial<br />

statements<br />

9. APPOINTMENT OF<br />

AUDITORS:<br />

To appoint or<br />

reappoint institute’s<br />

auditors for the year<br />

2018<br />

President 5:50 to 5:55 Article 78: Any member of the<br />

Institute in public practice of<br />

accountancy, not being a member<br />

of the Governing Council of the<br />

Institute, may be elected the auditor<br />

of the Institute. The auditor is<br />

elected by simple majority of the<br />

members present at the annual<br />

general meeting for a renewable<br />

term of two (2) years.<br />

10. 2018 BUDGET President 5:55 to 6:15 Article 20: The GC shall prepare<br />

the draft budget of the Institute and<br />

submit it to the General Assembly<br />

for approval;<br />

11. DISCUSSION OF<br />

MEMBER ISSUES<br />

President 6:15 to 6:45 Contributions over the building<br />

fund;<br />

Implementation support for the<br />

AQA action plan<br />

12. A.O.B: To discuss<br />

any other business<br />

whose notice will<br />

have been received<br />

President 6:45 to 7:15 For information Purposes<br />

13. DINNER All 7:15 to 9:30 Enjoyment and Networking<br />

CPA Mkombozi Karake Bosco<br />

President of the Governing Council<br />

21 st February 2018<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

GET TO KNOW<br />

YOUR COMMISSIONS<br />

THE iCPAR JOURNAL<br />

7<br />

The Commission<br />

for Inspection<br />

CPA Felix Turatsinze<br />

Chairman<br />

CPA Boniface Mutua<br />

Secretary<br />

CPA Stephen Ineget<br />

Member<br />

The law, article 31 elaborates on the<br />

composition of the Commission. It<br />

states that the Commission shall be<br />

composed of 4 persons appointed as follows:<br />

I). Chairman of the Commission and two<br />

other members elected by the General<br />

Assembly of the Institute from among<br />

the Certified Public Accountants. And<br />

the Chairperson should not engage individually<br />

in the practice of accounting or<br />

auditing.<br />

II). The other person should be experienced<br />

in accounting and elected by a consortium<br />

of recognized universities and colleges<br />

offering courses leading to a qualification<br />

in accountancy. The members<br />

of the Commission shall elect a secretary<br />

from among themselves.<br />

The current chairperson is CPA Felix<br />

Turatsinze and the Commission secretary<br />

is Boniface Mutua, where the former is<br />

serving his first term while the later is in<br />

his second term.<br />

Article 32: Commissions roles<br />

and Responsibilities<br />

The Responsibilities of the Inspection Commission<br />

are as follows:<br />

• Monitor Compliance with the National<br />

Accounting Standards;<br />

• Monitor the conduct of firms exercising<br />

the accounting profession;<br />

• Provision of necessary recommendations<br />

to the Governing Council;<br />

• Advise on the draft national standards in<br />

preparation of financial statements, auditing<br />

and accounting in Rwanda to be<br />

published by a Ministerial order;<br />

• Recommend to the Governing Council<br />

of the Institute or the General Assembly<br />

to suspend or withdraw a member who<br />

is guilty of professional misconduct, the<br />

right to practice public accountancy;<br />

• Carry out any other necessary activity<br />

for the fulfilment of the institute’s responsibilities.<br />

The term of office for the<br />

members of the Commission is three<br />

(3) years renewable only once.<br />

While performing its duties, the commission<br />

is allowed to seek technical assistance<br />

from any person. They currently<br />

meet every Thursday of the third week of<br />

each Quarter i.e. January, April, July and<br />

October.<br />

The Commission for Inspection submit its<br />

reports to the governing Council of the Institute.<br />

Any inspected person who is not<br />

satisfied with the decision taken by the<br />

Governing Council, may appeal to the<br />

General assembly. This has to be done in<br />

writing.<br />

The Commission is entitled to perform<br />

general inspection of any firm and or<br />

member who has been given a license to<br />

practice as may be appropriate. To facilitate<br />

a smooth operation of this activity, the<br />

inspected person or his or her employees<br />

may be asked to provide explanations<br />

and present the accounting records or<br />

any other necessary documents and may<br />

photocopy them – this act is not treated<br />

as a breach of professional secrecy.<br />

Similarly, the Commission may be requested<br />

to perform a special inspection<br />

at such a time as may be appropriate or<br />

upon request by the Governing Council<br />

of the Institute.<br />

It is prohibited to the Commission for<br />

Inspection or its staff to disclose professional<br />

secrecy, unless it provided for by<br />

the law or required by a competent court.<br />

Any person who discloses professional<br />

secrecy shall be liable to sanctions in accordance<br />

with the code of professional<br />

conduct and ethics.<br />

The commission for inspection has contributed<br />

a lot towards getting the accountancy<br />

profession to the next level and<br />

it has promised to work hand in hand<br />

with the secretariat to ensure that ICPAR<br />

mandate is realized especially in regard<br />

to firm’s compliance with International<br />

standards on Quality Control 1 (ISQC 1)<br />

as we endeavor to obtain full IFAC membership<br />

soonest.<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

8 Journal<br />

The iCPAR<br />

IFRS 9 Financial<br />

Instruments, is<br />

likely to affect<br />

all sectors but<br />

mostly; banks<br />

In July 2014, the International Accounting<br />

Standards Board (IASB)<br />

completed its response to the<br />

financial crisis by issuing the final<br />

version of IFRS 9, Financial Instruments.<br />

IFRS 9 sets out a model for<br />

classification and measurement,<br />

an ’expected loss’ impairment<br />

model and a transformed approach<br />

to hedge accounting.<br />

The IASB had previously issued<br />

versions of IFRS 9 that introduced<br />

new classification and measurement<br />

requirements in 2009 and<br />

2010 and a new hedge accounting<br />

model in 2013. The latest publication<br />

consolidates the previous versions<br />

of the standard, and replaces<br />

IAS 39, Financial Instruments: Recognition<br />

and Measurement. It also<br />

changes some of the requirements<br />

of the previous publications. IFRS<br />

9 is effective for annual periods beginning<br />

on or after 1 January 2018.<br />

Classification determines how financial<br />

assets and financial liabilities<br />

are accounted for and measured<br />

in financial statements. The<br />

requirements for impairment and<br />

hedge accounting are based upon<br />

the instruments classification.<br />

The standard introduces a principle-based<br />

system for the classification<br />

and measurement of financial<br />

assets, which depends upon two<br />

characteristics: The entity’s business<br />

model for managing the financial<br />

asset and the financial asset’s<br />

contractual cash flow characteristics.<br />

IFRS 9 utilises a single classification<br />

approach for all types of<br />

financial assets, which includes<br />

those that contain embedded derivative<br />

features. Financial assets<br />

are now not subject to complicated<br />

bifurcation requirements.<br />

The business model approach refers<br />

to how an entity manages its<br />

financial assets in order to generate<br />

cash flows either by collecting<br />

contractual cash flows, selling<br />

financial assets or both. Financial<br />

assets are measured at amortised<br />

cost where the business model’s<br />

objective is to hold assets in order<br />

to collect contractual cash flows.<br />

The new standard clarifies the existing<br />

guidance the collection of<br />

the assets’ contractual cash flows.<br />

When determining the applicability<br />

of this business model, an entity<br />

should consider past and future<br />

sales information. If an entity holds<br />

financial assets for sale then it will<br />

fail the business model test for accounting<br />

for the financial assets<br />

at amortised cost. However, sales<br />

activity is not necessarily inconsistent<br />

with the business model if they<br />

are infrequent and insignificant in<br />

value but where these sales are<br />

frequent and significant in value,<br />

an entity needs to assess whether<br />

such sales are consistent with an<br />

objective of collecting contractual<br />

cash flows.<br />

The sales may be consistent with<br />

that objective if they ‘are made<br />

close to the maturity of the financial<br />

assets and the proceeds from<br />

the sales approximate the collection<br />

of the remaining contractual<br />

cash flows’. For many entities,<br />

the assessment will be relatively<br />

straightforward as their financial<br />

assets may be simply trade receivables<br />

and bank deposits for which<br />

the amortised cost criteria are likely<br />

to be met. For those entities with<br />

a broader range of financial assets<br />

such as investors in debt securities,<br />

and insurance companies, the motivations<br />

behind the disposal of the<br />

assets will have to be considered.<br />

NEW MEASUREMENT<br />

CATEGORY<br />

IFRS 9 includes a new measurement<br />

category whereby financial<br />

assets are measured at Fair Value<br />

Through Other Comprehensive<br />

Income (FVTOCI). This category is<br />

used when financial assets are held<br />

in a business model whose objective<br />

is both collecting contractual<br />

cash flows and selling financial assets.<br />

Unlike the available-for-sale<br />

criteria in IAS 39, the criteria<br />

for measuring at FVTO-<br />

CI are based on the<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

9<br />

financial asset’s cash flow characteristics<br />

and the entity’s business<br />

model. This business model will<br />

involve a greater frequency and<br />

volume of sales with the possible<br />

objectives of managing liquidity<br />

or matching the duration of financial<br />

liabilities to the duration of the<br />

assets they are funding. This category<br />

was introduced because of<br />

the concerns raised by preparers<br />

who sold financial assets in greater<br />

volume than was consistent with<br />

the previous business model and<br />

would, without this category, have<br />

to record such assets at Fair Value<br />

Through Profit or Loss (FVTPL).<br />

Financial assets may qualify for<br />

amortised cost or FVOCI only if<br />

they give rise to ‘Solely Payments<br />

of Principal and<br />

Interest’<br />

(SPPI) under the contractual cash<br />

flows characteristics test. Many<br />

instruments have features that are<br />

not in line with the SPPI condition.<br />

IFRS 9 makes it clear that such features<br />

are disregarded if they are<br />

‘non-genuine’ or ‘de minimis’.<br />

IFRS 9 now provides more guidance<br />

on SPPI. For contractual cash<br />

flows to be SPPI, they must include<br />

returns that are consistent with the<br />

return on a basic lending arrangement<br />

to the holder, which generally<br />

includes consideration for the<br />

time value of money, credit risk,<br />

liquidity risk, a profit margin and<br />

consideration for costs associated<br />

with holding the financial asset<br />

over time such as servicing costs.<br />

Thus if the contractual<br />

arrange-<br />

ment includes a return for equity<br />

price risk, then this would be inconsistent<br />

with SPPI.<br />

IFRS 9 introduces new guidance<br />

on how the contractual cash flows<br />

characteristics assessment applies<br />

to debt instruments that may<br />

contain a modified time value element.<br />

For example, those instruments<br />

that may contain a variable<br />

interest rate. These characteristics<br />

will result in an instrument failing<br />

the contractual cash flow characteristics<br />

test if the resulting undiscounted<br />

contractual cash flows<br />

could be ‘significantly different’<br />

from the undiscounted cash flows<br />

of a benchmark instrument that<br />

does not have such features.<br />

Interest rates set by a government<br />

or a regulatory authority are accepted<br />

as a proxy for the consideration<br />

for the time value of money<br />

if those rates provide consideration<br />

that is ‘broadly consistent with<br />

consideration for the passage<br />

of time’. Such cash flows are<br />

considered SPPI as long as<br />

they do not introduce risk<br />

or volatility, which is inconsistent<br />

with a basic<br />

lending arrangement.<br />

Any financial assets<br />

that are not held in<br />

one of the two business<br />

models above are<br />

measured at FVTPL,<br />

which is essentially a<br />

residual category. Also<br />

included in this category<br />

are financial assets that are<br />

held for trading and those<br />

managed on a fair value basis.<br />

Financial assets are reclassified<br />

when, the entity’s business model<br />

for managing them changes. This<br />

is not expected to occur frequently<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

10 Journal<br />

The iCPAR<br />

and it ensures that users of financial<br />

statements are provided with<br />

information on the realisation of<br />

cash flows.<br />

IAS 39 was felt to work well as<br />

regards the accounting for financial<br />

liabilities, therefore the IASB<br />

felt that there was little need for<br />

change. Thus, most financial liabilities<br />

will continue to be measured<br />

at amortised cost. IAS 39 also permitted<br />

entities to elect to measure<br />

financial liabilities at fair value<br />

through profit or loss (fair value<br />

option). The changes introduced<br />

by IFRS 9 are restricted to those liabilities<br />

designated at FVPL using<br />

the fair value option. Fair value<br />

changes of these financial liabilities<br />

are presented in other comprehensive<br />

income to the extent that<br />

they are attributable to the change<br />

in the entity’s own credit risk. If<br />

this would cause an accounting<br />

mismatch, then the total fair value<br />

change is presented in profit<br />

or loss. This change in IFRS 9 is<br />

designed to eliminate volatility in<br />

profit or loss caused by changes in<br />

the credit risk of financial liabilities<br />

that an entity has elected to measure<br />

at fair value.<br />

NEW IMPAIRMENT MODEL<br />

IFRS 9 introduces a new impairment<br />

model for financial assets<br />

that is based on expected losses<br />

rather than incurred losses. It applies<br />

to amortised-cost financial<br />

assets and those categorised as<br />

FVTOCI.It also applies to certain<br />

loan commitments, financial guarantees,<br />

lease receivables, and contract<br />

assets. An entity recognises<br />

expected credit losses at all times<br />

and updates the assessment at<br />

each reporting date to reflect any<br />

changes in the credit risk. It is no<br />

longer necessary for there to be a<br />

trigger event for credit losses to be<br />

recognized and the same impairment<br />

model is used for all financial<br />

instruments that are impairment<br />

tested.<br />

Other than purchased or originated<br />

credit-impaired financial assets,<br />

IFRS 9 requires entities to measure<br />

expected credit losses by recognising<br />

a loss allowance equal to either<br />

of the following:<br />

• 12-month expected credit losses.<br />

This measurement is required if<br />

the credit risk is low at the reporting<br />

date or the credit risk has not<br />

increased significantly since initial<br />

recognition.<br />

• Full lifetime expected credit losses.<br />

This measurement is required<br />

If the credit risk has increased significantly<br />

since recognition and the<br />

resulting credit quality is not considered<br />

to be low credit risk. Entities<br />

can elect for an accounting policy<br />

of always recognising full lifetime<br />

expected losses for contract assets,<br />

trade receivables, and lease receivables.<br />

When measuring expected<br />

credit losses, an entity should consider<br />

the probability-weighted outcome,<br />

the time value of money and<br />

information that is available without<br />

undue cost or effort.<br />

IFRS 9 introduces a reformed<br />

model for hedge accounting with<br />

enhanced disclosures about risk<br />

management activity. Under IFRS<br />

9, a hedging relationship qualifies<br />

for hedge accounting only if all of<br />

the following criteria are met:<br />

• The hedging relationship consists<br />

only of eligible hedging instruments<br />

and eligible hedged items.<br />

• At the inception of the hedging<br />

relationship there is formal designation<br />

and documentation of the<br />

hedging relationship and the entity’s<br />

risk management objective<br />

and strategy for undertaking the<br />

hedge.<br />

IFRS 9 includes a new<br />

measurement category<br />

whereby financial assets are<br />

measured at Fair Value Through<br />

Other Comprehensive Income<br />

(FVTOCI). This category is used<br />

when financial assets are held<br />

in a business model whose<br />

objective is both collecting<br />

contractual cash flows and<br />

selling financial assets.<br />

• The hedging relationship meets all<br />

of the hedge effectiveness requirements<br />

In order to qualify for hedge accounting,<br />

the hedge relationship<br />

must meet the effectiveness criteria<br />

at the beginning of each hedged<br />

period:<br />

• There is an economic relationship<br />

between the hedged item and the<br />

hedging instrument.<br />

• The effect of credit risk does not<br />

dominate the value changes that<br />

result from that economic relationship.<br />

• The hedge ratio of the hedging relationship<br />

is the same as that actually<br />

used in the economic hedge<br />

IFRS 9 will affect all sectors though<br />

the introduction of an expected<br />

loss model for loan loss provisioning,<br />

but will impact mostly on<br />

banks. IFRS 9 should give investors<br />

better insight into the credit quality<br />

of all financial assets. However,<br />

putting the new requirements into<br />

practice by the effective date will<br />

be quite a challenge.<br />

Source;<br />

First published by ACCA on 1 st February<br />

2018<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

11<br />

Release of December<br />

2017 examination results<br />

iCPAR released the 11th professional<br />

examinations results<br />

of Certified Public Accountant<br />

(CPA) and Certified Accounting<br />

Technician (CAT) conducted in<br />

December 2017. The 11th iCPAR<br />

examination sitting was held from<br />

November 27th to December 1st<br />

2017 in two examination centers:<br />

Kigali Independent University and<br />

University of Rwanda, Huye campus.<br />

The total number of candidates<br />

who sat for professional exams in<br />

December 2017 was 1,357 subdivided<br />

into 925 candidates for CPA<br />

examinations and 432 candidates<br />

who sat for CAT examinations.<br />

The overall pass rates for CAT and<br />

CPA increased by 15% compared<br />

to June 2017 sitting. The pass rates<br />

were 57% CAT and 44% CPA in<br />

December, 2017 compared to<br />

38% CAT and 33% CPA in June<br />

2017. In December 2017, 20 students<br />

completed CPA qualification<br />

and 9 students completed CAT<br />

qualification. iCPAR has so far produced<br />

39 CPAs and 41 CATs. With<br />

that composition, 2 are females<br />

(5%), 32 are Males (95%) and 17<br />

are Females (41%) while 24 are<br />

Males (59%) respectively. It’s the<br />

first time the institute has produced<br />

a big number of finalists since its<br />

inception. Congratulations to all<br />

students that made it!<br />

In line with iCPAR 5 year strategic<br />

plan, we shall work together with<br />

all stakeholders to create a critical<br />

mass of qualified professional accountants<br />

required in Rwanda. The<br />

Institute is engaging with higher<br />

learning institutions and Technical<br />

and Vocational Education and<br />

Training (TVET) institutions together<br />

with other relevant stakeholders<br />

to increase the number of students<br />

whilst strengthening the quality of<br />

learning.<br />

Updates on the upcoming<br />

new CAT qualification<br />

iCPAR in collaboration with<br />

ACCA is revamping the CAT<br />

qualification, the process is in its<br />

final stages and it is anticipated to<br />

be launched in July, 2018. Upon<br />

completion, the new competency<br />

based CAT will have three levels<br />

which incorporates Public Financial<br />

Management (PFM) components.<br />

This approach was adopted<br />

as a response to market demand<br />

for CAT competency framework to<br />

cover all market needs at a technician<br />

level.<br />

Upon completion of CAT review,<br />

the CPA (Certified Public Accountants)<br />

qualification review will as<br />

well start and the same approach<br />

will be used to maintain consistency<br />

of offering demand driven qualifications<br />

which are locally relevant<br />

and internationally recognized.<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

12 Journal<br />

The iCPAR<br />

New CPD policy to be<br />

effective 1 st July 2018<br />

In line with the institute’s bylaws<br />

regarding Continuing Professional<br />

Education, the new CPD Policy<br />

was approved by the Governing<br />

Council on 26 January 2018.<br />

The New CPD Policy stipulates<br />

that members of the Institute shall<br />

be required to, at the end of each<br />

year, furnish the Institute with information<br />

on their CPD activities<br />

for each year, not later than three<br />

months after the end of that year.<br />

CPD hours shall be assessed on a<br />

three year rolling basis as per the<br />

IFAC Education Standard No. 7. A<br />

total of 120 hours (60 structured<br />

and 60 unstructured) shall at a<br />

minimum be accumulated over the<br />

three-year period. It continues to<br />

elaborate that, in the event that the<br />

member fails to comply with the<br />

laid down regulations concerning<br />

Continuing Professional Development<br />

requirements, existing at the<br />

time, they shall be required to ensure<br />

such compliance is achieved<br />

in the ensuing calendar year.<br />

All members of the Institute irrespective<br />

of category of membership<br />

must attain the minimum CPD<br />

hours set by the Governing Council.<br />

A member who fails to comply<br />

with these provisions shall be<br />

deemed guilty of professional misconduct<br />

as prescribed by the code<br />

of ethics and Accountants Law No.<br />

11/2008 in article 43 and shall be<br />

liable to disciplinary action.<br />

This new Policy applies to all CPA<br />

and CAT; follows the combined /<br />

mixed approach; requires CPD<br />

declaration annually; requires submission<br />

of evidence records for<br />

monitoring; calls for sanctions for<br />

non-compliance; provides support<br />

and guidance; and complies with<br />

IFAC’s IES 7 and IES 8.<br />

In compliance with IES 8, Professional<br />

Competence for Engagement<br />

Partners Responsible for Audits<br />

of Financial Statements, which<br />

appears to also be of interest to<br />

employers, regulators, government<br />

authorities, educational organizations,<br />

and any other stakeholders<br />

who support the learning and development<br />

of professional accountants<br />

– the institute will organize a<br />

two-day mandatory workshop for<br />

practitioners and voluntarily for<br />

potential practitioners on 29 to 30<br />

May, 2018 as an opportunity and<br />

support to them and to ensure that<br />

they maintain competence in their<br />

specialist areas of practice in a bid<br />

to meet the learning outcomes of<br />

IES 8. This requirement is mainly<br />

due to the public interest nature of<br />

their role and the need to ensure<br />

that outstanding practice – mainly<br />

in regard to International Standard<br />

on Quality Control 1 (ISQC<br />

1) compliance, is demonstrated,<br />

thereby enhancing public trust and<br />

confidence of the accountancy<br />

profession in Rwanda.<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

13<br />

KIM University; One of<br />

the tuition providers of<br />

CPA and CAT Rwanda<br />

Dear Reader<br />

I feel privileged and honored to<br />

share with you our valued reader<br />

about KIM University. KIM University<br />

is a decade old institution<br />

which traces its origins to a 2005<br />

decision by the Board of Directors<br />

that transformed the International<br />

College of Accountancy and<br />

Management (ICAM) into a degree<br />

awarding Institution. This gave<br />

birth to Kigali Institute of Management<br />

(KIM). At the beginning of<br />

2016 KIM transformed itself into<br />

KIM University (KIMU), an institution<br />

of higher learning accredited<br />

by the Higher Education Council<br />

as a degree awarding institution in<br />

Rwanda.<br />

The core objective of the institution<br />

is to deliver employable graduates<br />

with ability to apply knowledge<br />

for self, local and national<br />

development. In a bid to fulfill this<br />

objective, KIM University collaborates<br />

with professional Bodies such<br />

as ICPAR, KASNEB, ACCA (UK),<br />

IIA-USA, ICPAU, KISM, HRMPEB,<br />

OTHM-UK and CIPS (UK) among<br />

others.<br />

Your gateway to the heart<br />

of many organisations<br />

KIM University provides courses<br />

that are popular for students looking<br />

to move directly into a professional<br />

career as well as those whose<br />

ambitions lie in broader Computer<br />

Science as well as Business Management<br />

disciplines. Through the<br />

acquisition of comprehensive<br />

qualitative, computational and analytical<br />

skills, our student is well<br />

positioned and qualified to continue<br />

into specialized and professional<br />

qualifications or to take the first<br />

steps in their life-long careers.<br />

Gold standard teaching<br />

and thinking<br />

Students at KIMU learn about the<br />

role and operation of wide range of<br />

course contexts, informed by contemporary<br />

thinking and research in<br />

their respective disciplines. Many<br />

of our lecturers have extensive<br />

industry experience<br />

which<br />

they draw on<br />

through structured<br />

courses that<br />

include lectures, tutorials,<br />

essays and practical assignments.<br />

Why study at KIM<br />

University:<br />

We mentor our students and encourage<br />

a culture of excellence<br />

in the undergraduate and<br />

graduate academic programs<br />

as well as professional<br />

studies. Through this<br />

culture of ambition, the<br />

majority of them aim at getting a<br />

bachelor’s degree and a relevant<br />

professional qualification in their<br />

first three years of study at KIMU.<br />

KIMU offers an opportunity for a<br />

double qualification combining an<br />

honors degree with a professional<br />

course. The double qualification<br />

makes our graduates more competitive<br />

on the labor market. KIMU<br />

also offers merit scholarships for<br />

enrolled students to pursue studies<br />

towards professional qualification.<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

14 Journal<br />

The iCPAR<br />

Professional Programmes of Study<br />

Short Certificate Courses<br />

• Certified Public Accountant (CPA) ICPAR<br />

• Certified Accounting Technicians (CAT) ICPAR<br />

• Accounting Technicians Diploma (ATD)<br />

KASNEB<br />

• Certified Public Accountant (CPA) KASNEB<br />

• Human Resource Management Professional<br />

• The Certified Associate in Project<br />

Management (CAPM)<br />

• Project Management Professional (PMP)<br />

Certification<br />

• Certified Procurement & Supply Professional<br />

of Kenya (CPSP-K)<br />

• Associate in Procurement & Supply of Kenya<br />

(APS-K)<br />

• Professional Certificate in Procurement &<br />

Supplies (CIPS-UK)<br />

• Diploma in Insurance<br />

• Craft Course in Insurance (CCI)<br />

• Certificate of Proficiency (COP)<br />

• Certified Internal Auditor certification (CIA)<br />

USA<br />

• Association of Chartered Certified Accountant<br />

(ACCA-UK)<br />

• Foundations in Accountancy (FIA-UK)<br />

• Chartered Institute of Purchasing and Supply<br />

(CIPS-UK)<br />

• Certified Investment and Financial Analyst<br />

(CIFA)<br />

• Cisco Certified Network Professional (CCNP)<br />

• Cisco Certified Network Associate (CCNA)<br />

• Cisco Certified Network Associate-Security<br />

(CCNA-Security)<br />

• Information Technology Essentials (CCENT)<br />

• Linux Essential Level (LPI 1 &2)<br />

• Computer Graphics & Animation<br />

• Website Development<br />

• Certificate in Computer Applications<br />

• Computer Repairs and Maintenance<br />

• Certificate in Book Keeping<br />

• Cost and Management Accounting<br />

• Computerized Accounting Packages: Quick<br />

Books, Sage, Tally, …<br />

• Data Analysis packages: SPSS, SATA, TORA,<br />

EPI Info<br />

• Sales and Marketing Management<br />

• Taxation administration and Compliance in<br />

Rwanda<br />

• Customer Service and Sales Management<br />

• Human Resource Planning and Management<br />

• Logistics and Supplies Management<br />

• Business Administration & Office<br />

Management<br />

• Strategic Plan Development<br />

• Entrepreneurship & Leadership skills<br />

• Retirement Planning<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

15<br />

Masters Programs<br />

Masters Degree Specializations<br />

Master’s in Business Administration (MBA)<br />

• Finance and Accounting<br />

• Strategic Management<br />

• Logistics & Supply Chain Management<br />

• Human Resource Management<br />

• Marketing<br />

• Project Management<br />

Undergraduate Programmes<br />

Undergraduate Degree Specializations<br />

Bachelor of Business Management (BBM)<br />

• Accounting<br />

• Finance and Banking<br />

• Procurement and Logistics Management<br />

Bachelor of Science in Economics<br />

• Health Economics<br />

• Labor and demography<br />

• Financial Economics<br />

• Environmental Economics<br />

Bachelor of Science in Computer Science<br />

• Information Technology<br />

• Information systems<br />

• Computer science<br />

Bachelor of Science in logistics and Supply Chain<br />

Management<br />

• Logistics and Supply Chain Management<br />

Join KIMU now and thereafter your life will<br />

change for the better<br />

• Highly qualified, experienced, skilled and<br />

competent facilitators<br />

• Flexible mode of study (Day, Evening and Weekend)<br />

• Distance learning<br />

• Computer labs with high speed internet<br />

• Job placement and career guidance<br />

• Life skills training<br />

• Spacious class rooms<br />

• High pass rate<br />

Contacts:<br />

KK 3 Rd – KIGALI, RWANDA<br />

Tel: +250 788 865 088<br />

Email: info@kimuniversity.ac.rw<br />

Website: www.kimuniversity.ac.rw<br />

JANUARY - MARCH 2018

16 Journal<br />

The iCPAR<br />

Q&A<br />

WITH<br />

CPA FINALIST<br />

Kajungu Clode<br />

At just 25 years of age,<br />

Kajungu Clode is a CPA<br />

finalist. Kajungu joined the<br />

University of Kigali in 2014 with<br />

the aim of attaining a Bachelors of<br />

Business Administration. One year<br />

into the BBA course, his lecturers<br />

had noticed his prowess with<br />

numbers and urged him to pursue<br />

CPA qualification in addition to the<br />

BBA course.<br />

In 2015 Kajungu continued to<br />

perform well and his grades were<br />

noticed by the University of Kigali<br />

administration which offered to<br />

sponsor him if he chose to take up<br />

Professional Accountancy Course.<br />

With continued encouragement<br />

from his lecturers, Kajungu jumped<br />

to the offer and enrolled for the<br />

CPA program in 2016. Motivated<br />

to succeed, he immediately begun<br />

preparing for and passed his exams<br />

in only four sittings, that is exactly<br />

two years which is not an easy feat.<br />

Kajungu is very ambitious. As a<br />

beginning, he wants to become<br />

a member iCPAR, pursue<br />

his continuous professional<br />

development (CPD) sessions in<br />

If you want to<br />

be and remain<br />

relevant in the<br />

business and<br />

finance world,<br />

it is critical<br />

that you attain<br />

Professional<br />

Accounting<br />

Qualifications-<br />

Kajungu Clode<br />

I encourage anyone who envisions their future in<br />

accounting, auditing, finance and generally the business<br />

arena to take up professional accounting courses if they<br />

intend to succeed. The CPA qualifications have been truly<br />

an eye opener for me. It would indeed do them a lot of<br />

good.<br />

Kajungu Clode<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

17<br />

CPA Finalist - Kajungu Clode<br />

a bid to remaining relevant and<br />

innovative in this uncertain and<br />

dynamic world of business.<br />

Kajungu worked as an intern at<br />

University of Kigali, Office of Vice<br />

Chancellor while still studying for<br />

his CPA qualifications. Now that<br />

he has completed his professional<br />

qualification, the university plans<br />

to retain him as its internal auditor.<br />

Meanwhile, Kajungu awaits to<br />

graduate this year after completing<br />

his Bachelors of Business<br />

Administration course. He shared<br />

his story with Jean Marie Vianney<br />

Muhire, the director of Education<br />

Development Services at iCPAR.<br />

Below are the excerpts<br />

JMV Muhire: Tell us about<br />

your journey towards<br />

attaining your CPA<br />

qualifications?<br />

Kajungu: I think it is one of the<br />

fascinating experiences of my<br />

life. When I joined the University<br />

of Kigali for my BBA program, I<br />

had not realized the importance<br />

of professional qualification<br />

courses. After my first year, with<br />

heavy encouragement from my<br />

lectures, it downed on me that I<br />

needed to enroll for a professional<br />

qualification. Luckily, I got<br />

sponsorship from the University<br />

and I decided to give it my all. I<br />

enrolled in 2016 and wanted to<br />

do eight modules. I gave myself<br />

a target of two years to complete<br />

the CPA qualification. My focus<br />

was the end results. I was a bit<br />

obsessed.<br />

JMV Muhire: You just<br />

qualified as a CPA how<br />

do you feel after all the<br />

hard work you put in?<br />

Kajungu: I am excited and ready<br />

to venture into the real world of<br />

professional accountants. I am<br />

looking forward to learning from<br />

more experienced professionals<br />

and translate theory into practice.<br />

Hard work is a priority for me.<br />

JMV Muhire: Where do you<br />

see yourself in the next<br />

five years?<br />

Kajungu: To be quite honest, I<br />

am an ambitious individual. At<br />

the moment I am focusing on<br />

attaining enough experience in<br />

the profession. I would like to take<br />

on managerial responsibilities<br />

in the near future. Being a Chief<br />

Financial Officer would be a great<br />

achievement.<br />

JMV Muhire: What is your<br />

advice to others who are<br />

yet to start professional<br />

qualifications?<br />

Kajungu: I encourage anyone<br />

who envisions their future in<br />

accounting, auditing, finance and<br />

generally the business arena to<br />

take up professional accounting<br />

courses if they intend to succeed.<br />

The CPA qualification has been<br />

truly an eye opener for me. It<br />

would indeed do them a lot of<br />

good.<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

18 Journal<br />

The iCPAR<br />

Accountants in history<br />

Luca Pacioli<br />

1. Luca Pacioli: The father of accounting<br />

Italian mathematician Luca Pacioli published the first<br />

book about double-entry bookkeeping on 10 November<br />

1494 - and it is in his honour that International<br />

Accountants Day was started. His book, Summa de<br />

Arithmetica, Geometria, Proportioni et Proportionalita,<br />

described keeping accounts for assets, liabilities,<br />

capital, income, and expenses, much like the systems<br />

we use today in balance sheets and income statements.<br />

He advocated the use of ledgers and is known for<br />

saying a person should not go to sleep at night until<br />

their debits and credits are equal.<br />

2. The world’s first accountants originated<br />

in Ancient Mesopotamia:<br />

Accounting is thousands of years old and can be<br />

traced as far back as ancient Mesopotamia.<br />

The world’s first accountants worked for the temples,<br />

keeping track of taxes paid in sheep and agricultural<br />

produce for the religious authorities of the day. In the<br />

process, many historians believe they invented the<br />

practice of writing in order to keep receipts. Prior to<br />

this development in record keeping, token systems<br />

were often used to document the exchange of goods<br />

and services. Early forms of bookkeeping have also<br />

been found in ancient Iran.<br />

3. Many accounting terms have Latin<br />

roots:<br />

Accounting may be called ‘the language of business’,<br />

but did you know that many well-known accounting<br />

terms are derived from Latin? The word ‘debit’ means<br />

‘he owes’ in Latin, while ‘credit’ means ‘he trusts’. The<br />

word ‘accountant’ is derived from the Latin ‘computare’,<br />

which means ‘count’.<br />

4. ICAS is the oldest professional body of<br />

chartered accountants in the world:<br />

ICAS was founded in 1854 by Royal Charter, making<br />

it the oldest professional body of chartered accountants.<br />

ICAS originated from the Edinburgh Society of<br />

Accountants, the Glasgow Institute of Accountants<br />

and Actuaries, and the Aberdeen Society of Accountants.<br />

James Brown, James McClelland and John Smith<br />

were the first presidents of the three institutes. Robert<br />

Gordon Simpson CA was named as the first president<br />

of ICAS in 1951.<br />

5. Bubblegum was invented by an accountant:<br />

US accountant Walter Diemer worked for the Fleer<br />

Corporation in the 1920s. But his big claim to fame is<br />

that he invented bubble gum in his spare time!<br />

Source;<br />

First published in CA today on 10 th November 2017<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

19<br />

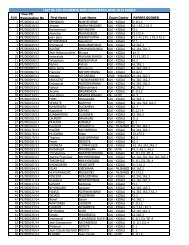

List of accounting firms<br />

licenced by iCPAR as at 31<br />

January 2018<br />

Firm Names Partners Telephone Emails<br />

ABC Consultants Ltd<br />

Wenceslaus<br />

Ndabagayire Ndiyo<br />

+250788517093 ndiyonda@yahoo.co.uk<br />

Anil R T& Co Ltd Anil Gupta +250788307473 anilrtco@gmail.com<br />

Baker Tilly Meralis CPA Ltd Madhav S. Bhandari +250788407373 madhav@meraliscpa.com<br />

BDO EA Rwanda Ltd Emmanuel Habineza +250788304070 emmanuel.habineza@bdo-ea.com<br />

BIKO & Associates Ltd Francois Bikolimana +250785828020 bikolimana@hotmail.com<br />

BM & Associates Ltd Boniface N. Mutua +250788713619 bnmutua@gmail.com<br />

Deloitte Rwanda Ltd David Waweru +250784442958 dwaweru@deloitte.com<br />

DMU & Partners Ltd Deogratias Musonera +250785354961 deomusonera@gmail.com<br />

EDES & Associates<br />

Consultants Ltd<br />

Emmanuel Muwazi +250788312335<br />

emmanuel.muwazi@<br />

edesassociates.com<br />

Ernst & Young Rwanda Ltd Allan K. Gichuhi +250788387085 allan.gichuhi@rw.ey.com<br />

Financial Advisory Services<br />

& Training Ltd<br />

Lindsay Hodgson +250788302895 lhodgson@fast-global.com<br />

FJ Consultant Ltd Julian Nabawanuka +250783098905 junaba3007@yahoo.com<br />

GK CPA Ltd<br />

Wilfred Gichia<br />

Kiunyu<br />

+250783353795 gichiawilfred@gmail.com<br />

GNI CPA Ltd Ibrahim N. Gatimu +250782117222 gnicpar@gmail.com<br />

GPO Partners RWANDA Ltd Patrick Gashagaza +250788300832 gporw@gpopartners.com<br />

IDENT CPA Ltd Ian Dent +250786978988 ian.dent@yahoo.com<br />

ITAU Auditors Ltd Vincent O. Nyauma +250788754870 vnyauma@yahoo.com<br />

JDD & Associates Ltd<br />

Dusengimana Jean<br />

Damascene<br />

+250788621378 dusenge2@gmail.com<br />

JNN CPA Ltd Job Ngatho Njoroge +250782274442 jobngatho@yahoo.co.uk<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

20 Journal<br />

The iCPAR<br />

Firm Names Partners Telephone Emails<br />

J.K Partners Ltd<br />

KMD Partners Limited<br />

Kizza Koperi<br />

Mutwalume Joseph<br />

Solomon Kalibwanyi<br />

Musoke<br />

+250786765422 jalipartners@gmail.com<br />

+250782173513 skmusoke@yahoo.co.uk<br />

KPMG Rwanda Stephen Ineget +250252579792 sineget@kpmg.com<br />

Maurice Associates Ltd<br />

Mazars Rwanda<br />

Maurice Kinyanjui<br />

Njaoh<br />

Joshua Ouma<br />

Odhuno<br />

+250788307472 mnjaoh@yahoo.com<br />

+250736595830 joshua.odhuno@mazars.co.ke<br />

MIT Partners Ltd Ivan Mbabazi +250788307642 imbabazi@mitpartners.co.ug<br />

M.N & Associates CPA Michael M. Ndungu +250788853063 mnassociatesrw@yahoo.com<br />

MOM Associates Olive Mukankwaya +250783373382 olivia.mukankwaya@gmail.com<br />

Nambiar Grant Thornton<br />

CPA Ltd<br />

Raghavan Nambiar +250788307654 raghavan.nambiar@rw.gt.com<br />

OA & Associates CPA Otieno H.Ayany +250788418001 oayanyjnr@yahoo.co.uk<br />

OGC CPA Ltd Charles G. Otieno +250788987798 charlesguya2000@yahoo.com<br />

ON & Associates Ltd<br />

Ntawuyirushintege<br />

Olivier<br />

+250788303061 ntawolivier@gmail.com<br />

PEWMU Associates Ltd Muchiri Waititu +250785835735 muchiriwaititupete@gmail.com<br />

PKF Rwanda Ltd Gurmit Singh Santokh +250788300428 gsantokh@rw.pkfea.com<br />

PwC Rwanda Ltd<br />

RAJ, Ashiwal & Mehta(RAM)<br />

Associates Ltd<br />

Florence Wangu<br />

Gatome<br />

+250785704449 florence.w.gatome@pwc.com<br />

Niranjan Rajagopalan +250784445844 niranjan.rajagopalan@gmail.com<br />

RSK Associates Moses Mugadde +250786653828 mmugadde@yahoo.com<br />

RUMA CPA Peter Rutaremara +250788301220 rutare@rumacpa.com<br />

SECAF Ltd Vedaste Habimana +250788892514 vhabimana2@yahoo.fr<br />

Sharma & Vaswani<br />

Associates Ltd<br />

SRC Rwanda Ltd<br />

Susan Irungu & Associates<br />

Ltd<br />

Abhinav Sharma +250738316914 abhisharma+250@gmail.com<br />

Robert Muriithi<br />

Muthike<br />

+250782637247 info.srcrwanda@gmail.com<br />

Susan Wanjiku Irungu +250737821956 siicsassociates@gmail.com<br />

UT CPA Ltd Therese Uwamariya +250788303980 utcpa.ltd@gmail.com<br />

Wamira and Associates Ltd<br />

Francis Ojwangi<br />

Wamira<br />

+250788381007 fwamira@yahoo.com<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

THE iCPAR JOURNAL<br />

21<br />

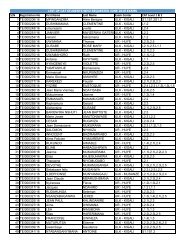

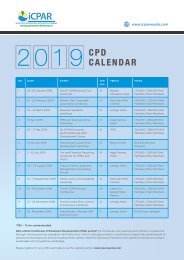

2018 CPD Calendar<br />

No Date Event<br />

1 26 January 2018 The 7 th Annual Tax<br />

Assessment Forum<br />

2 09 February 2018 Accounting and Finance<br />

aspects for Non Finance<br />

Managers<br />

3 23 February 2018 Corporate Governance<br />

Workshop<br />

4 14 - 16 March 2018 Training of Trainers (ToT)<br />

on Board Leadership<br />

CPD<br />

Hrs<br />

Venue<br />

7 Senera Hotel,<br />

Kigali<br />

7 Hotel des mille<br />

Collines<br />

Price<br />

65,000 / 85,000 Rwf<br />

Members/Non-Members<br />

65,000 / 85,000 Rwf<br />

Members/Non-Members<br />

7 Marriot Hotel 65,000 / 85,000 Rwf<br />

Members/Non-Members<br />

20 Kampala 195,000 / 225,000 Rwf<br />

Members/Non-Members<br />

5 26 - 28 April 2018 1 st ICPAR Economic Forum 20 Golden Tulip 420,000 / 450,000 Rwf<br />

Members/Non-Members<br />

6 29 - 30 May 2018 Practitioners /audit firms’<br />

development workshop<br />

7 21 - 22 June 2018 ISA’s update and Code of<br />

Ethics workshop<br />

8 22 June 2018 Evening Talk – Budget and<br />

other current matters<br />

9 12 -13 July 2018 Tax and Financial<br />

Reporting workshop for<br />

SME’s and NGO’s.<br />

10 26 - 27 August 2018 Financial Services and<br />

Reporting workshop<br />

14 Marriot Hotel 180,000 Rwf<br />

14 Senera Hotel,<br />

Kigali<br />

3 Senera Hotel,<br />

Kigali<br />

7 Hotel des mille<br />

Collines<br />

14 Senera Hotel,<br />

Kigali<br />

140,000 / 170,000 Rwf<br />

Members/Non-Members<br />

50,000 Rwf<br />

140,000 / 170,000 Rwf<br />

Members/Non-Members<br />

140,000 / 170,000 Rwf<br />

Members/Non-Members<br />

11 13 - 14 September<br />

2018<br />

Public Financial<br />

Management workshop<br />

12 04 - 05 October 2018 Modern Age Customer<br />

service and Professional<br />

skills development<br />

13 24 - 26 October 2018 The 7 th iCPAR Annual<br />

Conference<br />

14 8 -9 November 2018 Internal Audit, Risk,<br />

Control & Assurance<br />

Conference<br />

15 9 November CPA’s and Other Leaders<br />

Evening Talk<br />

16 14 December 2018 Evening talk – Practitioner’s<br />

Dinner<br />

14 Hotel des mille<br />

Collines<br />

140,000 / 170,000 Rwf<br />

Members/Non-Members<br />

14 Marriot Hotel 140,000 / 170,000 Rwf<br />

Members/Non-Members<br />

20 Golden Tulip 420,000 / 450,000 Rwf<br />

Members/Non-Members<br />

14 Hotel des mille<br />

Collines<br />

3 Hotel des mille<br />

Collines<br />

140,000 / 170,000 Rwf<br />

Members/Non-Members<br />

50,000 Rwf<br />

3 Marriot Hotel 50,000 Rwf<br />

NOTE: Prices indicated are VAT exclusive. Disclaimer: The Secretariat reserves the right to amend this Schedule as it may deem appropriate.<br />

A publication of the Institute of Certified Public Accountants of Rwanda<br />

JANUARY - MARCH 2018

22 Journal<br />

The iCPAR<br />

Humour<br />

Crossword<br />

How do you know if<br />

your son is going to be<br />

a CPA?<br />

When you read him<br />

the story of Cinderella<br />

and get to the part<br />

where the pumpkin<br />

turns into a golden<br />

carriage, he asks, “Is<br />

that ordinary income,<br />

or a capital gain?”<br />

You might be a tax<br />

accountant if ...<br />

… you refer to your<br />

child as Deduction<br />

214.<br />

How do you know<br />

when an accountant is<br />

on vacation?<br />

He doesn’t wear a tie<br />

and comes in after 8<br />

a.m.<br />

Office location<br />

Dear stakeholder,<br />

In a bid to serve you better and cater for future expansion,<br />

from October 1, 2017 we relocated to new<br />

office located at the former BRD student loan office<br />

on KG 501 Street ,21 behind Career Center Building.<br />

iCPAR QUATERLY BULLETIN<br />

JANUARY - MARCH 2018

About us<br />

The Institute is the sole professional accountancy<br />

organization established by law No. 11/2008 of 6 th May<br />

2008 with a broad mandate to grow and regulate the<br />

accountancy profession<br />

What we do<br />

We regulate the accountancy profession; We preserve<br />

the integrity of the accounting profession; We promote<br />

the competence and the capacities of own members.<br />

We deliver accounting qualifications, programs<br />

and examinations.We promote compliance with<br />

professional standards<br />

Vision<br />

A strong, relevant and sustainable profession<br />

Mission<br />

To build a strong and engaged professional<br />

accountancy organization that anticipates stakeholder<br />

expectations and acts in the public interest<br />

Our Office<br />

KG 501 St 21, behind Career Center Building<br />

P.o.Box: 3213 Kigali Rwanda<br />

T: +250 784103930<br />

F: +250 280103930<br />

E: info@icparwanda.com

Published by Institute of Certified Public Accountants of Rwanda<br />

KG 501 St 21, behind Career Center Building<br />

P.o.Box: 3213 Kigali Rwanda<br />

T: +250 784103930<br />

F: +250 280103930<br />

E: info@icparwanda.com<br />

www.icparrwanda.com<br />

Copyright © iCPAR 2017. All rights reserved.<br />

Copyrights and all / or other intelectual property rights on all designs,<br />

graphics, logos, images, phots, texts, trade names, trademarks, etc<br />

in this publication are reserved. The reproduction, transmission or<br />

modification of any part of the contents of this publication is strictly<br />

prohibited.