APR23_High Res

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

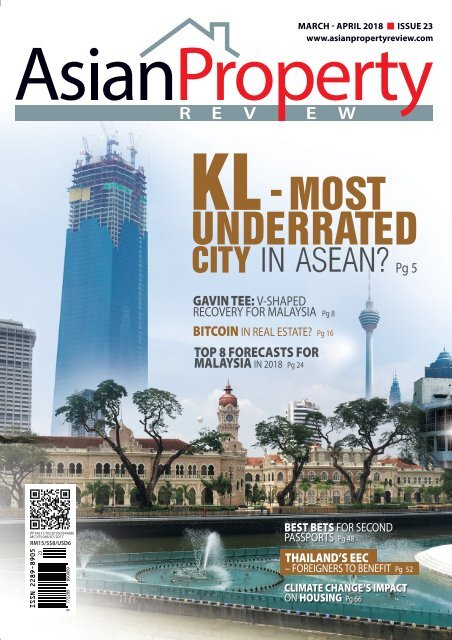

MARCH - APRIL 2018 ISSUE 23<br />

KL<br />

- MOST<br />

UNDERRATED<br />

CITY IN ASEAN? Pg 5<br />

GAVIN TEE: V-SHAPED<br />

RECOVERY FOR MALAYSIA Pg 8<br />

BITCOIN IN REAL ESTATE? Pg 16<br />

TOP 8 FORECASTS FOR<br />

MALAYSIA IN 2018 Pg 24<br />

PP18617/10/2014(034059)<br />

MICA (P) 125/07/2015<br />

PP18617/05/2016(034488)<br />

MCI (P) 046/07/2017<br />

BEST BETS FOR SECOND<br />

PASSPORTS Pg 48<br />

THAILAND’S EEC<br />

– FOREIGNERS TO BENEFIT Pg 52<br />

CLIMATE CHANGE’S IMPACT<br />

ON HOUSING Pg 66

The Largest Real Estate Convention in Malaysia.

EDITOR’S NOTE<br />

KL TAKES CENTRESTAGE<br />

IN 2018<br />

KL takes the spotlight in this issue – the city that a lot of people overlook in favour of<br />

Singapore, Bangkok, Ho Chi Minh City and even Manila. But that’s where they fail<br />

to note the many advantages of KL.<br />

By mid-2018, most likely after the general election, whether or not there is a change of<br />

government, things will move very swiftly for Malaysia due to the political uncertainty factor<br />

being taken out; in fact, one expert, Dato Sri Gavin Tee predicted that 2018 is the year the<br />

property market will make a V-shaped recovery especially KL.<br />

Although there are plenty to dislike about KL – its endemic traffic jam,<br />

red tape, it seems the authorities are bent on making KL a showcase for<br />

all that’s big, bright and beautiful. It’s an ambitious city constantly giving<br />

out a ‘work in progress’ vibe. Very soon, KL will reign supreme again as<br />

the city with the tallest building in ASEAN. That’s not counting a few<br />

more over 100-storey buildings on the way.<br />

There will be a lot of changes as well for the entire country; for example,<br />

durians which was once Malaysia’s best kept secret is now the most<br />

sought-after fruit in China with the highest price tag. That means<br />

durian plantations are doing well. That’s just one of the 8 top forecasts<br />

for Malaysia by Gavin Tee.<br />

Jan at the Taj Mahal<br />

Is bitcoin too speculative to be used for property deals? KL See, deputy<br />

president of MIPEAC thinks so. We examine the issue and think<br />

it can still be used as an alternative payment option especially for<br />

deferred purchases.<br />

Khalil Adis explains what happens when a HDB owner breaks the law; not a good idea in<br />

the ‘fine’ city of Singapore. Plus, having just renovated his studio apartment pretty much<br />

hands-on in Singapore, he will also give tips on how to give your compact living space a more<br />

spacious look.<br />

Knight Frank’s first ever ranking of Belt & Road countries is an eye-opener; it gives you<br />

an idea of which countries have the most to offer and benefit from the biggest project of<br />

the century.<br />

Not to be outdone by its neighbours, Thailand has its own free trade zone coming up<br />

strongly, the Eastern Economic Corridor. The best thing about this is that it would lift many<br />

restrictions against foreigners in terms of property and residency rights.<br />

Of late, alarm bells have been rung about climate change; from the real estate perspective,<br />

it certainly has some impact. Florida’s case is just but one example. We expect many more<br />

climate change refugees and the destruction of property including residential in the coming<br />

years if this crisis is not addressed soon enough.<br />

JAN YONG<br />

Editor-in-Chief<br />

editor@asianpropertyreview.com

March - April 2018<br />

COVER STORY<br />

5 Kuala Lumpur is the most underrated city<br />

in ASEAN, maybe the entire Asia. Asian<br />

Property Review examines why.<br />

8 Most experts believe that Malaysia’s property<br />

market will stage a strong recovery after the<br />

general election which must be held before<br />

August. One expert, Dato Sri Gavin Tee even<br />

predicted that 2018 is the year the market will make<br />

a V-shaped recovery especially KL.<br />

12 Beautiful KL – a work in progress<br />

The KL downtown historic core is undergoing<br />

a renaissance of sorts – a number of projects<br />

have made this part of downtown more<br />

accessible, safer and a place to hangout.<br />

There is certainly a lot of character there compared<br />

with many other places in KL.<br />

16 Would you buy property using bitcoin? Asian<br />

Property Review examines whether it is<br />

prudent.<br />

18 ‘Bitcoin is too speculative for property deals’,<br />

says KL See, deputy president of MIPEAC. In a<br />

Q & A with him, See reveals why.<br />

INVESTMENT<br />

24 Top 8 Forecasts in 2018 by Gavin Tee<br />

“The Malaysian property world as we know it will<br />

evolve into a different landscape with noticeable<br />

changes starting from 2017 and becoming more<br />

pronounced in 2018.”<br />

30 HDB confiscation – Khalil Adis explains what<br />

happens when you break the law.<br />

32 Japan in 2018 as the Olympics nears. Ziv<br />

Nakajima-Magen gives his opinion on condos,<br />

shared offices, budget hotels and bitcoin.<br />

34 Noted land expert, Tan Hwa Chuan reveals<br />

where foreigners should buy in KL.<br />

12<br />

5<br />

24

62<br />

36 Priti Donnelly gives you her take on what<br />

factors to consider when you want to rent out<br />

your property in Japan.<br />

40 Office space demand to surge in most<br />

cities, according to Cushman & Wakefield<br />

WORLDVIEW<br />

48 Should you get a second passport? Asian<br />

Property Review finds out which countries are<br />

your best bet.<br />

52 Thailand’s Eastern Economic Corridor is<br />

making an impact – it’s good news for foreigners<br />

as many foreign restrictions are expected to<br />

be lifted.<br />

54 Knight Frank’s first ever ranking of Belt & Road<br />

countries is an eye-opener.<br />

62 How is Japan coping with climate change?<br />

66 Catherine Ridu tells Asian Property Review<br />

why climate change is an important factor when<br />

it comes to housing.<br />

73 Which Asian countries are most vulnerable to<br />

climate change?<br />

80<br />

74<br />

DESIGN<br />

74 Khalil Adis gives tips on how to renovate your<br />

‘tiny’ home.<br />

TOURISM<br />

80 KL luxury hotels buck trend in a generally<br />

oversupplied market.<br />

FENG SHUI<br />

87 Prof Joe Choo explains why some residential and<br />

commercial properties remain unpopular<br />

despite being located in sought-after locations.

www.asianpropertyreview.com<br />

March - April 2018<br />

EDITORIAL<br />

Editor-in-Chief<br />

Writer<br />

Contributors<br />

JAN YONG<br />

BENJAMIN K. YONG<br />

ZIV NAKAJIMA-MAGEN<br />

KHALIL ADIS<br />

PRITI DONNELLY<br />

DR ULRICH EDER<br />

PROF JOE CHOO<br />

DISTRIBUTION TO OVER<br />

500 DIRECT POINTS<br />

Bookstores<br />

Designers<br />

IVY LO<br />

CHAN SIOW SWEN<br />

KO JA YEE<br />

Department Stores<br />

CORPORATE<br />

Publisher<br />

DATO’ SRI GAVIN TEE<br />

Accounts executive SHARON LAI<br />

Sales & Marketing ERIC LEE, Senior Manager +6012 376 0020<br />

KHALIL ADIS (Singapore Rep) +65 8201 9254<br />

Café<br />

SUBSCRIBE @<br />

www.asianpropertyreview.com<br />

or email us at info@asianpropertyreview.com<br />

For enquiries or to give feedback, please contact us @<br />

Tel: +603 2288 8588<br />

e-mail: editor@asianpropertyreview.com<br />

PUBLISHED BI-MONTHLY BY:<br />

Genetic Media Sdn Bhd (1056451 M)<br />

29-5, The Boulevard,<br />

Lingkaran Syed Putra,<br />

Mid Valley City,<br />

59200 Kuala Lumpur, Malaysia<br />

PRINTED BY:<br />

Unipress Printer Sdn Bhd (731378-P)<br />

117-G, Jln Tiaj 1/4<br />

Tmn Industri Alam Jaya<br />

42300 Selangor<br />

Tel: +603 6038 5578<br />

Any content of Asian Property Review may only be reproduced, in any shape or format, with the<br />

expressed permission of Genetic Media Sdn Bhd. For reprints, please consult the Chief Editor.<br />

DISCLAIMER<br />

The materials in this publication and its related online sites including<br />

Facebook have no regard to the specific investment objectives,<br />

financial situation, or particular needs of any visitor. The materials<br />

are published solely for informational and educational purposes and<br />

are not to be construed as a solicitation or an offer to buy or sell any<br />

properties or related financial instruments. You are advised to consult<br />

with a licensed, qualified professional before making any investment<br />

decisions.<br />

The content of contributed articles does not necessarily represent<br />

the views of this publication/its staff or advertisers. We make no<br />

representation, warranty, or guarantee as to the completeness and/<br />

or accuracy of the information here. Any opinions expressed here are<br />

subject to change without notice and we and our contributors are<br />

not under any obligation to update or keep current the information<br />

contained herein.<br />

References made to third parties are based on information obtained<br />

from sources believed to be reliable, but are not guaranteed as being<br />

accurate, complete or updated. We accept no liability whatsoever for<br />

any loss or damage of any kind arising out of the use of all or any part<br />

of the materials herein or on our affiliate sites.<br />

Currencies quoted are for information purposes.

March - April 2018<br />

5<br />

KL<br />

A TOWERING GEM

6 ASIAN PROPERTY REVIEW COVER STORY<br />

KL – THE MOST<br />

UNDERRATED CITY<br />

IN ASEAN?<br />

Often overlooked in favour of Singapore and Bangkok, KL is in fact<br />

a hidden gem with stunning skylines and world-class infrastructure,<br />

which are complemented by highly ranked education and medical care,<br />

yet it comes with a very affordable price tag.<br />

Text by Benjamin K. Yong<br />

If you google ‘KL underrated city’, you will find a<br />

number of websites including the UK’s Daily Express<br />

newspaper waxing lyrical about KL’s uniqueness and<br />

how it’s been overlooked. Quoting excerpts (edited)<br />

from the said article (published in August 2017): “Friendly,<br />

fascinating and fun, the Malaysian capital offers the best<br />

of Southeast Asia, it has got it all. Kuala Lumpur enjoys<br />

the very best of Southeast Asia without the downsides.<br />

It offers all the glitz and modernity of Singapore without<br />

the tiresome rules and regulations, and its street life has<br />

all the enlivening buzz of Bangkok without the grime or<br />

occasional seediness.”<br />

Quoting the writer further: “While Singapore is<br />

undoubtedly clean, efficient and easy on the eye, it can<br />

also be a little, well… dull. And the Thai capital may be a<br />

thrilling riot of colour and energy but it can be exhausting,<br />

exasperating and the service - outside of top establishments<br />

- is often sketchy, at best.”<br />

“Not only is English widely spoken, there is glorious colonial<br />

architecture and the finest and most varied cuisine in Asia.<br />

It is extraordinarily good value too - accommodation, eating<br />

out and getting around is inexpensive. KL also teems with<br />

quality four and five-star hotels with room rates at a fraction<br />

of that even in other Asian countries.<br />

“Travelling around KL is a breeze, there’s a light railway<br />

system, metro and even a monorail, plus a kilometre-long<br />

elevated Bintang Walkway, an air-conditioned walkway<br />

high above the traffic leading to the tourist, commercial and<br />

nightlife centre of Bukit Bintang.<br />

“It emerges at the Pavilion, one of the city’s largest and<br />

glossiest malls. Just three minutes from Jalan Alor is<br />

Changkat Bukit Bintang, which has cocktail lounges,<br />

classy whisky bars, and pubs. Petaling Street Night Market<br />

in Chinatown is judged by many to be the best in all of<br />

Southeast Asia.”<br />

Panoramic view of a residential area off Old Klang Road,<br />

which is one of the most sought-after locations in KL.

March - April 2018<br />

7<br />

There – the writer spelled out what’s so unique about KL –<br />

from the perspective of a European tourist.<br />

GREAT DIVERSITY<br />

For digital nomad Barbara Riedel who has been travelling<br />

around the world since 2014 and has written a book<br />

entitled “My Trip Around the World”, she has this to say<br />

about KL: “Malaysia gets overlooked. Plain and simple. I’ve<br />

listed Kuala Lumpur as one of the five most liveable cities<br />

in Southeast Asia, but with Thailand next door, Malaysia is<br />

easily overlooked and underrated.<br />

“Malaysia is a great location for expat living. In fact,<br />

Malaysia provides a better standard of living and is a<br />

wealthier country than Thailand. You also have the diversity<br />

of three different cultures, plus a number of expats.<br />

“As a result, I’ve often said that Malaysia is the United<br />

States of Southeast Asia — for all the good things<br />

and none of the bad. The diversity is one of its greatest<br />

characteristics. Malaysia offers so many amenities,<br />

including a great airport. KL is the home for AirAsia and<br />

you’ve also got Singapore next door with more connections.<br />

“Malaysia is a bit of a mix between the two countries<br />

it’s nestled between: Singapore and Thailand. KL, with<br />

its famous twin towers, which are still the highest in the<br />

world, and impressive shopping malls, has many modern<br />

aspects similar to Singapore but without the expensive<br />

price tag. The prices are more comparable to Thailand.<br />

Additionally, Malaysia has a range of beautiful islands that<br />

are worth a visit. The climate in Malaysia is tropical, warm<br />

and sunny, but with abundant rainfall.”<br />

As you can see, Malaysia and in particular KL, gets high<br />

marks from more discerning travellers. Prior to the 2014<br />

twin Malaysian Airlines flight disasters, there had been a<br />

lot of visitors from China but following the unfortunate<br />

incidents, the number had dropped to a trickle at one<br />

point. For the past one year however, it seems they have<br />

returned in big numbers again, no doubt seduced by<br />

Malaysia’s uniqueness and in recent months, its Musang<br />

King durians.<br />

HIGH LIVEABILITY<br />

More Chinese are also choosing KL as a retirement<br />

destination under the Malaysia My Second Home (MM2H)<br />

programme. In fact, Malaysia was ranked top as the ideal<br />

retirement destination in Asia in 2018, according to a new<br />

Retirement Index from International Living.com. The index,<br />

which takes into consideration criteria such as cost of living,<br />

healthcare and climate, ranked Malaysia fifth globally.<br />

Last year, CNN had ranked Kuala Lumpur 6th place<br />

globally for the best place to retire abroad. That’s not<br />

surprising given that KL was also ranked as Southeast Asia’s<br />

second most liveable city after Singapore in the Global<br />

Liveability Ranking released by the Economist Intelligence<br />

Unit (EIU) last year.<br />

Also in 2017, Euromonitor International placed KL at 10th<br />

place in its Top 10 most visited city in the world at 12.3<br />

million visitors.<br />

And the list goes on and on…<br />

Like most of the world’s capital cities, KL is the economic,<br />

trade, financial and business heart of the country. Since the<br />

ringgit depreciated significantly three years ago, Malaysia’s<br />

properties have become one of the cheapest, if not, the<br />

cheapest among all capital cities in ASEAN. It also has<br />

some of the friendliest and most transparent property rules<br />

for foreigners in Asia.<br />

This means, considering KL’s world class infrastructure<br />

(several 100+ storey buildings are about to be completed<br />

soon), and high liveability ranking, it is the best value<br />

capital city possibly in the entire world.

8 ASIAN PROPERTY REVIEW COVER STORY<br />

‘V-SHAPED<br />

RECOVERY<br />

FOR<br />

MALAYSIA<br />

FROM 2018’,<br />

SAYS EXPERT<br />

Most experts are optimistic on prospects for<br />

Malaysia during this critical general election<br />

year – with many convinced that KL will lead the<br />

beleaguered country’s recovery post-GE.<br />

The Exchange 106 is part of TRX and will be Malaysia’s<br />

tallest building when completed soon.

March - April 2018<br />

9<br />

From July onwards after the general<br />

election, Malaysia will start a market<br />

recovery that will last for the next 5 years,<br />

predicts Dato’ Sri Gavin Tee, a prominent<br />

property consultant.<br />

“After a very difficult 4 ½ years for the property<br />

market, Malaysia will come out of the bottom<br />

sometime in late December 2017 till early 2018<br />

and emerge stronger than ever before,” he told a<br />

crowd of about 300 property investors in Johor<br />

Bahru recently.<br />

“The sharp decline of the market lasting almost 5<br />

years while an expected strong recovery starting<br />

from this year and lasting for the next 5 years is<br />

similar to a 10-year V-shaped property cycle,” Tee,<br />

who is also the Founder and President of Swhengtee<br />

Group elaborated.<br />

The recovery will be led by tourism related activities<br />

followed by China’s Belt & Road projects, as well as<br />

the completion of the early phases of several mega<br />

projects such as the Tun Razak Exchange (TRX),<br />

Malaysia’s next financial district, and the MRT and<br />

LRT extension.<br />

Also helping the economy are rising oil prices which<br />

recently topped USD65 per barrel for the first time<br />

since 2014 and the strengthening Ringgit, Tee said.<br />

He further explained that Malaysia has lost out on<br />

its competitiveness since the last 4 years starting<br />

with the disappearance of MH370 followed by<br />

the shooting down of MH17, the 1MDB issue<br />

and the kidnapping in Sabah, among other<br />

factors. The international community has to a<br />

large extent lost confidence and for a few years,<br />

Malaysia was not in the radar of many foreign<br />

investors. “Malaysia even lost out to Thailand, the<br />

Philippines and Indonesia; we are still moving<br />

forward, but moving at a much slower pace than<br />

our neighbouring countries,” he said.<br />

Being an international<br />

destination and the seat of<br />

political power, it has suffered<br />

the worst but KL will also be<br />

the first and fastest to rebound<br />

when the upturn comes.<br />

– Tee<br />

But as with any market cycle, there are peaks and<br />

bottoms; in Malaysia’s case, Tee was confident that<br />

we have seen the worst and this year will see a new<br />

beginning. He emphasised that it will not be a<br />

sudden boom but “there will be a lot of significant<br />

changes in the capital city, Kuala Lumpur, which will<br />

then spread throughout the country until 2022.”<br />

Citing the tourism example, Tee said it will bring<br />

massive changes even to second tier cities like lpoh,<br />

Pangkor, Kuantan, Bentong, Kuching and Taiping<br />

from 2020 – 2022.<br />

“Kuala Lumpur tourism will experience the fastest<br />

rebound followed by Melaka, Iskandar, Penang<br />

and Kota Kinabalu. In fact, KK’s airport is the<br />

second busiest in Malaysia and is being expanded,<br />

while a new international airport is being<br />

considered,” Tee said.<br />

Kuala Lumpur will also for the first time become a<br />

financial, trading, transportation and even an Islamic<br />

hub for ASEAN. “Being an international destination<br />

and the seat of political power, it has suffered the<br />

worst but KL will also be the first and fastest to<br />

rebound when the upturn comes,” he continued,<br />

adding that KL’s property prices are still relatively<br />

low compared to Penang and Johor Bahru even<br />

though it is at the heart of the action.<br />

Dato’ Sri Gavin Tee

10 ASIAN PROPERTY REVIEW COVER STORY<br />

‘MOST COMPETITIVE’<br />

“Malaysia has built up the most competitive<br />

infrastructure in ASEAN – we have the best<br />

strategic location next to Melaka Straits, the best<br />

relationship with China as well as the best cultural<br />

and historical ties with China. We also have the<br />

most investor-friendly policies, a transparent legal<br />

system and multilingual talent force.<br />

“With all these in place, it’s only a matter of time<br />

after the general election that everything will start<br />

moving very fast. It’s as if we are on a standby mode<br />

now – once the political uncertainty clears, Malaysia<br />

will shift to high gears to catch up with the rest of<br />

its neighbours.<br />

He further said: “We will see more contracts signed<br />

for BRI-related projects, more Foreign Direct<br />

Investments (FDI), more land transactions, more<br />

development and construction activities especially<br />

infrastructure projects, megastructures and hubs in<br />

various fields.”<br />

In addition, 2020 has been designated as Visit<br />

Malaysia Year, hence there will be a lot of tourism<br />

activities. Budget 2018 has proposed a lot of<br />

incentives for SMEs in the tourism industry as well<br />

as for hotels.<br />

The tourism boom will benefit Malaysia overall and<br />

will cause demand to spike for tourism-related and<br />

commercial properties. Medical tourism and MM2H<br />

applications will become even more popular among<br />

foreigners as more investments enter the country, the<br />

consultant predicted.<br />

“The tourism spots will also spread out to small<br />

towns and kampongs or villages, giving eco-tourism<br />

a big boost. Malaysia is fortunate to be home to<br />

the world’s oldest tropical rainforest estimated<br />

to be as old as 130 million years. It is located at<br />

Taman Negara which straddles 3 states – Pahang,<br />

Terengganu and Kelantan – another reason for it to<br />

be an eco-tourism hub.”<br />

In terms of man-made attractions, Malaysia’s<br />

UNESCO World Heritage sites in the old quarters<br />

of Melaka and Penang still continue to draw the<br />

crowds; the small town of Bentong meanwhile is<br />

gaining more prominence as Malaysia’s first and only<br />

‘durian town’ as durians start becoming one of the<br />

hottest exports from Malaysia.<br />

Malaysia also has its very own unique culture, for<br />

example, the Malay traditional costumes such as<br />

the sarong kebaya and baju Melayu in addition to<br />

the Malay kampong house and Malaysia’s famed<br />

multicultural array of food.<br />

Photography by Jan Yong<br />

It’s as if we are on a<br />

standby mode now<br />

– once the political<br />

uncertainty clears,<br />

Malaysia will shift to<br />

high gears to catch<br />

up with the rest of its<br />

neighbours.<br />

- Tee<br />

“Tourists nowadays especially those from China<br />

prefer authentic cultural experiences which we have<br />

in abundance. They don’t come here to see the tallest<br />

buildings or the biggest shopping malls anymore<br />

because their own buildings and malls in China are<br />

even taller and bigger than ours,” Tee quipped.<br />

In summing up, the popular speaker believed KL’s<br />

potential as a hub or international centre in many<br />

fields is very strong due to its strategic position<br />

within the BRI – especially if the ‘Project of the<br />

Century’ extends all the way to Australia, America<br />

and Europe.

March - April 2018<br />

11<br />

With climate change being a hot topic<br />

due to extreme weather conditions<br />

worldwide, it is a relief to know that KL<br />

is mostly free from all natural disasters.<br />

– See<br />

See Kok Loong<br />

Prof Joe Choo<br />

KL TO FARE THE BEST<br />

On the same note, Metro Homes director See Kok<br />

Loong believed that KL will fare the best due to<br />

its status as Malaysia’s international city. “KL is<br />

international investors’ target market.”<br />

“KLites also have the highest disposable income<br />

among Malaysians. Its population, which is<br />

reaching 7-8 million (Greater KL) is relatively<br />

younger compared to countries like Hong Kong,<br />

China and Japan.”<br />

“As the capital city, it is home to most of the 9<br />

mega projects in Malaysia, such as the TRX, Bandar<br />

Malaysia and infrastructure-related projects such as<br />

the KL-Singapore <strong>High</strong> Speed Rail.<br />

“Best of all, prices of property are still relatively<br />

cheap compared to its counterparts in the region like<br />

Singapore, Jakarta and Bangkok. Lately too, with<br />

climate change being a hot topic due to extreme<br />

weather conditions worldwide, it is a relief to know<br />

that KL is mostly free from all natural disasters.”<br />

The property expert also believed that a recovery<br />

is possible during the 2nd half of 2018 after the<br />

general election. “It depends on the GE result and<br />

government policies. In order for the market to<br />

recover, there has to be certainty,” he said, adding<br />

that the market during the 1st half of 2018 will<br />

remain the same (as last year).<br />

From a Feng Shui perspective, the 2nd half of the<br />

year will have plenty of opportunities with many<br />

Photography by Jan Yong<br />

Lunch time crowd at Medan Pasar in KL’s historic core.<br />

good deals, predicted Prof Joe Choo, President<br />

of the Malaysian Institute of Geomancy<br />

Sciences (MINGS).<br />

Choo however cautioned buyers in the Klang<br />

Valley to be careful when buying Transit-Oriented<br />

Development (TOD) projects which have become<br />

ubiquitous with the recent completion of the Klang<br />

Valley MRT (KVMRT) Line 1 project. “Although<br />

properties close to MRT lines tend to enjoy better<br />

capital appreciation and rental price, homes that are<br />

exposed directly to the track tend to be rundown<br />

leading to depreciation in property values. This is a<br />

result of the good energy which is being pulled out<br />

from the property due to the moving train.”

12 ASIAN PROPERTY REVIEW COVER STORY<br />

BEAUTIFUL KL<br />

A WORK IN PROGRESS<br />

The KL downtown historic core is undergoing a renaissance of sorts –<br />

a number of projects have made this part of downtown more accessible,<br />

safer and a place to hangout for both locals and visitors instead of their<br />

typically visiting the city’s shopping malls.<br />

Text and Photography by Jan Yong<br />

Granted, Kuala Lumpur is nothing like the<br />

acclaimed beautiful cities in the world like<br />

Vancouver, Sydney, Auckland, Venice or even<br />

Hong Kong and Singapore. One thing though<br />

that they all share in common is having a water body next to<br />

it such as the sea or river, and having a historic downtown<br />

core. In KL’s case, there is the Klang and Gombak rivers<br />

which are part of the ambitious RM4.4 bil ‘River of Life’<br />

(RoL) project; and a historic downtown core that has a lot<br />

of inbuilt character.<br />

Old shophouses in KL historic core.<br />

‘River of life’ where water will sprout<br />

from the sides of the 2 rivers with Masjid<br />

Jamek being the focal point.<br />

The focal point of the RoL project is the “Blue Pool”,<br />

which aims to visually transform the convergence point<br />

of the Klang and Gombak rivers into vibrant and bustling<br />

waterfronts. It will provide a view of the river with colourful<br />

lights and water fountains accompanied by music where<br />

visitors can chill out.<br />

Expected to be completed by 2020, the project also includes<br />

a plan to build a pedestrian bridge linking Masjid Jamek<br />

with the Sultan Abdul Samad Building and Dataran<br />

Merdeka - all 3 historic buildings - by cutting travelling<br />

time by half.

According to reports, the beautification will focus on a<br />

10.7km stretch along the Klang and Gombak river corridors<br />

(by 2019), while commercialisation and tourism within the<br />

same riverfront will take place from 2020 onwards.<br />

OLD WORLD CHARM OF SHOPHOUSES<br />

That’s not all – the historic core of KL, covering the area<br />

within 1km radius from Masjid Jamek, will be reimagined<br />

especially the public spaces and even the shophouses.<br />

Unfortunately for KL, the old shophouses do not enjoy the<br />

same UNESCO protection as those in Georgetown and<br />

Melaka. Thus, many have been demolished and redeveloped<br />

while some have been inappropriately adapted.<br />

Still, if you walk around that area, you could still see a<br />

number of those shophouses’ old character being preserved<br />

despite having been converted into budget guesthouses, cafes<br />

and an assortment of shops. You could still get a feel of the<br />

old KL of some 50 years ago when you walk along Jalan<br />

Tun HS Lee where you will encounter an old mom and pop<br />

convenience shop (kedai runcit), an old bookshop and coffee<br />

shops reminiscent of those in the 1950s and 1960s.<br />

Recently, there have been ideas mooted to repurpose<br />

the upper floors of some of these old shophouses into<br />

affordable micro houses to accommodate young working<br />

adults working in the city centre. The grand scheme is to<br />

repopulate the downtown city centre after the ‘suburban<br />

flight’ which saw many KLites moving to suburban<br />

residential estates.<br />

Prototype 2 of the micro house which is envisioned for<br />

the upper floors of old shophouses.<br />

Other ideas that have been executed are kerblets and<br />

parklets. The first are basically outdoor lounges that utilise<br />

upcycled furniture to make use of underutilized pedestrian<br />

space. There are two so far – one outside a decades-old<br />

bookshop and another outside a famous beef noodle shop<br />

along Jalan Tun HS Lee.<br />

Parklets are another new idea - to repurpose former car<br />

park lots into spaces for passerby and pedestrians to rest<br />

and watch the world go by. The first one, located at Jalan<br />

Panggong, features a small edible garden and a seating area.<br />

The second one is located along Jalan Hang Kasturi.<br />

Another highlight are the murals on the<br />

outer walls of the corner shoplots. An<br />

example seen here is one highlighting an<br />

idyllic urban scene which celebrates KL’s<br />

history and diversity.<br />

Even the laneways are not spared – a<br />

few have been beautified as part of the<br />

Laneway Improvement Programme in<br />

downtown KL. The programme aims<br />

to create safer, cleaner, more functional<br />

and attractive laneways/backlanes in the<br />

downtown area.<br />

An example is Lorong Bandar 13, one<br />

block away from the Medan Pasar clock<br />

tower, which has a functional court<br />

for badminton and seating areas in an<br />

outdoor lounge. These are all part of an<br />

experiment in turning an underutilised<br />

space into a place for socialising, respite<br />

and activity within the city.<br />

The cycling lane on Jalan Hang Kasturi, seen from the third<br />

floor of a art deco building across the road.<br />

Cycling lane (identified in blue) is an ongoing<br />

project in the KL historic core

Other attractions include:<br />

KL FOREST ECO PARK<br />

The KL Forest Eco Park is the last remaining tropical<br />

forest within downtown KL. With a 200m canopy walk,<br />

visitors can enjoy an aerial view of both nature and the city<br />

surrounding it.<br />

Popup kerblets along Jalan Tun HS Lee utilise upcycled furniture to make<br />

use of underutilized space.<br />

CYCLING – COOLEST TRANSPORT<br />

Another project that has been 5 years in the making is the<br />

cycle lane that aims to reduce traffic congestion in the city<br />

centre and reduce the use of cars for short point-to-point<br />

journeys within the city. Commonly known as Bike4U<br />

project, it is part of the DBKL cycling and pedestrian<br />

master plan. The lanes connect the Kuala Lumpur<br />

Convention Centre to various hotels as well as span the<br />

core historic centre of downtown KL. So far, five kilometres<br />

of lane have been painted, with city officials aiming for 11<br />

kilometres of usable path within the next five years.<br />

LORONG PANGGUNG<br />

A hidden street next to Chinatown, Lorong Panggung<br />

is reminiscent of 1960s KL. On this street, the charming<br />

past of KL is preserved through old shophouses and truly<br />

local food.<br />

SERANI ROW<br />

Built in 1930, Serani Row was once the residence of<br />

the Eurasian community. Today, this row of abandoned<br />

buildings are brought to life by colourful murals.<br />

REIMAGINED BUS SHELTER<br />

Parisign, in partnership with DBKL and Think City, had<br />

launched a design competition to reimagine KL’s bus stops.<br />

The winning entry incorporates a green roof, rainwater<br />

harvesting and solar power and is located at the Go KL<br />

bus shelter along Jalan Raja Chulan. There is also a kinetic<br />

energy cycle that allows passersby to charge their phone or<br />

laptop with just a few minutes of cycling.<br />

Beautifying the<br />

backlane and<br />

utilizing the space<br />

for activities such<br />

as badminton<br />

and other social<br />

interaction. The<br />

lane, Lorong<br />

Bandar 13, is one<br />

block away from<br />

the Medan Pasar<br />

clock tower.<br />

Street art on the wall of a shophouse along Jalan Tun HS Lee, KL

16 ASIAN PROPERTY REVIEW COVER STORY<br />

BUYING PROPERTY<br />

WITH BITCOIN?<br />

Asian Property Review examines whether it is prudent to<br />

transact real estate in bitcoin.<br />

Text by Jan Yong<br />

On January 9 this year, it was reported that a<br />

Sabahan businessman sold his 1.22ha of land<br />

on an island for half a bitcoin (equivalent to<br />

RM38,000 at the time). Payment was made by<br />

transferring the bitcoin via their Luno wallets. Luno is a<br />

Singapore-incorporated bitcoin platform where people can<br />

buy, sell and trade bitcoins.<br />

The sale price was quoted in both ringgit and bitcoin value.<br />

Malaysia’s Central Bank (Bank Negara) has said bitcoin is<br />

not legal tender but has not banned it outright. As such,<br />

Malaysians can still trade in bitcoin exchanges and if<br />

parties to a deal agree, they could use bitcoin as the primary<br />

or alternative payment method.<br />

Since private contracts are on a willing buyer, willing<br />

seller basis, parties to a contract including the sale<br />

of land or property can agree to whatever terms they<br />

like including the type of currency as long as it is not<br />

illegal. There is nothing in the laws of Malaysia as yet<br />

that prohibits the sale of property in a currency other<br />

than the ringgit; this is likely because this problem<br />

has never been encountered before. It has always been<br />

assumed that property would be paid for in a currency<br />

denominated in ringgit.<br />

Four days following the landmark deal, the Inland Revenue<br />

Department (IRD) froze Luno’s account and requested for<br />

details of all of its customers and their transactions.<br />

Earlier, in December 2017, Bank Negara had proposed<br />

draft regulations for digital currency activities, in particular,<br />

Know Your Customer (KYC) and Anti-Money Laundering<br />

(AML) guidelines in an attempt to provide more<br />

transparency to an industry where the anonymous nature<br />

of its transactions facilitate money-laundering, terrorism<br />

financing and tax evasion.<br />

What happened in Malaysia is symptomatic of the dilemma<br />

faced by regulatory authorities all over the world when<br />

dealing with the new cryptocurrency revolution. 2017 was<br />

the ‘Year of the Cryptocurrency’ which saw the value of<br />

cryptocurrencies skyrocket and the creation of new ones.<br />

Imagine a 1,700% return in about 11 months’ time!

March - April 2018<br />

17<br />

DIVERGENT VIEWS<br />

While some countries have embraced it, for example, Japan<br />

and the state of Arizona in the US, both of which hope<br />

to be the hub of the digital currency revolution, there are<br />

others such as China, India and South Korea which have<br />

clamped down hard on cryptocurrencies. China is said to be<br />

working on blocking all on-shore and off-shore platforms<br />

related to cryptocurrency trading ICOs in an attempt to<br />

quash the market completely. Likewise for India which<br />

plans to eliminate cryptocurrencies altogether from its<br />

payments system. South Korea meanwhile, has banned<br />

anonymous transactions.<br />

Some countries like Malaysia, Vietnam, Indonesia and the<br />

Philippines are taking the middle path by coming up in the<br />

near future with draft legislations to regulate the industry<br />

without totally banning the virtual currency.<br />

More developed financial centres like Hong Kong and<br />

Singapore are fine-tuning their laws – Hong Kong and<br />

Singapore deem some forms of cryptocurrency as securities<br />

to be regulated and subject to various disclosure, licensing<br />

and other laws.<br />

Following the massive Coincheck theft, Japan is now<br />

ensuring stricter monitoring of cryptocurrency exchanges.<br />

It is also creating a database of cryptocurrency investors to<br />

ensure enforcement of its tax laws which impose taxes of<br />

between 15 and 55% on their virtual currency profits.<br />

There are extremely divergent views on its long-term<br />

potential – some think bitcoin will eventually be the gold<br />

standard for digital currencies and may reach the dizzying<br />

price of USD100,000 per bitcoin. Others contend that the<br />

value of all cryptocurrencies will nosedive to zero and will<br />

eventually disappear given its lack of intrinsic value and<br />

practical applications other than as a means of payment.<br />

In January 2018, the plunge in bitcoin value has many<br />

proclaiming that the bitcoin bubble has finally burst.<br />

Prior to that, due to its surge in value to about USD20,000<br />

per coin at its height in 2017, some in the property industry<br />

decided to use it instead of fiat currency.<br />

A few developers in Dubai, followed by Turkey announced<br />

that buyers can purchase their properties using bitcoin.<br />

In the US too, an excited agent raved about a real estate<br />

transaction that he claimed took only 10 minutes for the<br />

bitcoin to be changed to US dollars.<br />

In London, a house owner was willing to accept bitcoin<br />

as payment while a co-living realtor was accepting rental<br />

payment in bitcoin.<br />

In 2017, some property sellers in<br />

Dubai, Turkey, US and London<br />

accept payment in bitcoin.<br />

WHY NOT?<br />

Its excessive volatility is what makes bitcoin totally<br />

unsuitable for real estate transactions, says a realtor in<br />

Malaysia. Imagine the value of your house skyrocketing or<br />

plunging in a matter of days!<br />

Furthermore, transactions in Bitcoin are slow because its<br />

network can only process a few transactions per second.<br />

Compare that to Visa or Mastercard, which can reportedly<br />

process 24,000 transactions per second – nearly 10,000<br />

times more. Transaction costs are also very high.<br />

Then there is the danger of theft of bitcoin wallets as had<br />

happened to Coincheck in Tokyo in January where a mindblowing<br />

46.3 billion yen (US$425 million) was stolen when<br />

the exchange was hacked. Although the exchange owners<br />

had promised to return all the money to its customers,<br />

there was no timeframe set. And what if a bitcoin exchange<br />

suddenly closes down?<br />

While the underlying technology of cryptocurrency,<br />

blockchain, is great and is the basis of the trust in<br />

cryptocurrency (blockchain is decentralised with many<br />

computers around the world recording a transaction), it<br />

is still not backed by a trusted entity as is the case of fiat<br />

money which is backed by governments.<br />

Therefore, when it comes to property, it is recommended<br />

that buyers and sellers refrain for the time being from using<br />

bitcoin as a payment currency.<br />

However, in the case of deferred purchase or rent-to-buy<br />

where the buyer rents first with an option to purchase a<br />

few years later, the contract can fix the price in both the fiat<br />

currency and the equivalent value in bitcoin. To resolve the<br />

issue of volatility, it would be prudent to introduce a clause<br />

stating that should the bitcoin value diverges by say, 10% in<br />

either direction of the price stated in fiat currency, then the<br />

parties must transact in the fiat money.

18 ASIAN PROPERTY REVIEW COVER STORY<br />

‘BITCOIN TOO<br />

SPECULATIVE<br />

FOR PROPERTY DEALS’<br />

Asian Property Review interviews KL See, director of Metro Homes Sdn Bhd<br />

who is also the deputy president of the Malaysian Institute of Professional<br />

Estate Agents and Consultants (MIPEAC) on his views on bitcoin.<br />

Bitcoin should be banned<br />

in Malaysia - this is to<br />

prevent the general public<br />

with no knowledge of<br />

bitcoin being cheated in the<br />

cryptocurrency game.<br />

1. APR: Which countries are you aware<br />

of that have not allowed bitcoin to be used as<br />

payment for property?<br />

KL: While most countries favour bitcoin, others<br />

don’t. They see it as an illegal currency. The fact<br />

that bitcoin can be anonymously used to conduct<br />

transactions between any account holders, anywhere<br />

and anytime across the globe, makes it attractive to<br />

criminal elements.<br />

Among those countries which are not in favour are:<br />

1) Bolivia: The Central Bank of Bolivia has<br />

prohibited the use of cryptocurrencies across<br />

the country.<br />

2) China: It bans bitcoin as a means of official<br />

payment. The banks have also banned it but<br />

individuals are free to use it.

March - April 2018<br />

19<br />

3) Iceland: It is practising strict capital controls<br />

which enable it to prevent the outflow of<br />

Icelandic currency resulting in transactions in<br />

bitcoin being banned as part of the country’s<br />

Foreign Exchange Act.<br />

4) Ecuador: The government has banned<br />

cryptocurrency in the country. Additionally, the<br />

nation has created its own Ecuador’s Sistema<br />

de Dinero Electrónico (electronic money<br />

system).<br />

5) Vietnam: The authorities believe that this<br />

cryptocurrency is not a legitimate payment<br />

method.<br />

6) Kyrgyzstan: All Cryptos are illegal form of<br />

payment in this country.<br />

7) Taiwan: The authorities believe that bitcoin is<br />

not a currency and thus should not be accepted<br />

by individuals or banking institutions. They<br />

have banned Bitcoin ATM Installations.<br />

8) Russia: The legal adoption of bitcoin is<br />

uncertain in Russia. The Ministry of Finance<br />

is seeking to pass the law to ban the digital<br />

currency in the near future.<br />

As bitcoin is not regulated by any central bank of<br />

any country, therefore the only way to make it legal<br />

is for the country to say yes to bitcoin.<br />

Countries where bitcoin is legal are as follows:<br />

• United States<br />

• Canada<br />

• Australia<br />

• European Union<br />

2. APR: Can you give examples of such<br />

property transactions? For example, the recent<br />

Sabah transaction where bitcoin was used as<br />

payment for a few acres of land.<br />

KL: I checked online and many parties are open<br />

to accepting bitcoin but the actual transactions<br />

might not be a lot yet. The recent Sabah case saw<br />

the acceptance of bitcoin as deposit for the land<br />

transaction but other related payments for the<br />

deal still need cash such as fees for the transfer of<br />

title, etc.<br />

3. APR: With such volatility, is bitcoin really<br />

viable as an alternative payment method for<br />

property?<br />

KL: A volatile bitcoin is not good as a payment<br />

method for property as property transactions do<br />

not complete within a short period. For example,<br />

See Kok Loong<br />

in Malaysia, it would need about 90 days for full<br />

ownership to be transferred to the new buyer.<br />

By then the value of bitcoin can be very much<br />

different; hence it’s not fair for one party unless<br />

there are other measures in place which could make<br />

it very complicated.<br />

4. APR: The recent (February 2018) 60% crash<br />

of bitcoin value is causing a lot of uncertainty<br />

about bitcoin’s future. What’s your opinion?<br />

KL: My opinion is that the value of bitcoin will<br />

continue to be uncertain as there is nothing ‘real’<br />

backing the bitcoin. Its value mainly depends on<br />

demand and supply; hence it is easily subject to<br />

speculation. It tends to be more of a speculative tool<br />

than an actual currency. Furthermore, every now and<br />

then, there is a new cryptocurrency created because<br />

“anyone” can just create a new cryptocurrency using<br />

blockchain technology. The new currency will have<br />

no standard and format. Therefore, I believe it is not<br />

going to work and is merely hype.<br />

5. APR: Another threat to bitcoin is theft of<br />

the virtual currency as had happened end January<br />

in Japan with cryptocurrency exchange Coincheck<br />

which lost a whopping 58 billion yen (US$534<br />

million) in customers’ virtual currency holdings or<br />

‘wallets’ through hacking. How will the customers<br />

get back their money or would they lose them all if<br />

the exchange closes down?<br />

KL: Virtual currencies like bitcoin are subject to<br />

cybercrime globally and is no longer just a local<br />

issue. Cryptocurrency exchange closing down is<br />

another risk that customers need to face.<br />

Bitcoin and other virtual<br />

currencies would not<br />

have a bright future in<br />

Asia for the time being<br />

because most countries<br />

would not legalise it.

20 ASIAN PROPERTY REVIEW COVER STORY<br />

6. APR: Would regulation be better than a<br />

direct ban on bitcoin? Or should bitcoin be totally<br />

unregulated? If regulation is better, what would<br />

be the ideal sort of regulation for this virtual<br />

currency?<br />

KL: Bitcoin should be banned in Malaysia but<br />

people who are into it can still trade offshore. This is<br />

to prevent the general public with no knowledge of<br />

bitcoin being cheated in the cryptocurrency game.<br />

Cryptocurrency<br />

exchange closing down<br />

is another risk that<br />

customers need to face.<br />

7. APR: Other cryptocurrencies like ethereum<br />

and ripple are also popular. With so many to<br />

choose from, how do you decide which one to buy?<br />

KL: If I were to buy a virtual currency, it would be<br />

a speculative move and I would buy the one that is<br />

low in value at the initial stage. Also, be prepared<br />

to lose 100% of the value. To me, it does not have<br />

the value yet and is merely speculation or similar to<br />

buying a lottery or gambling.<br />

8. APR: With China, South Korea and India<br />

not looking favourably at bitcoin (the exception is<br />

Japan), bitcoin doesn’t seem to have a bright future<br />

in Asia. What’s your take on that?<br />

KL: Bitcoin and other virtual currencies would<br />

not have a bright future in Asia for the time being<br />

because most countries would not legalise it.<br />

9. APR: Do you think the value of bitcoin can<br />

be wiped off completely one day?<br />

KL: Goldman Sachs’ Steve Strongin has said in<br />

a report dated Feb. 5: “Most digital currencies<br />

are unlikely to survive in their current form, and<br />

investors should be prepared for coins to lose all<br />

their value as they’re replaced by a small set of<br />

future competitors.”<br />

Personally, I believe the value cannot be completely<br />

wiped off one day as there is still a group of hardcore<br />

bitcoin supporters and the moment there is demand,<br />

there is a price for Bitcoin.<br />

10. APR: What’s your advice now for<br />

bitcoin investors especially those in Malaysia who<br />

are now being investigated by the Central Bank<br />

and/or Income Tax department?<br />

KL: My advice is that as a citizen, please follow the<br />

law and declare your income to the Income Tax<br />

department and if you are not involved in any money<br />

laundering or illegal business, Bitcoin is just a form<br />

of high risk investment for you. If you have made<br />

huge profits from bitcoin, then declare it to the IRB<br />

and if they feel that it is income in nature, then pay<br />

your tax. If they exempt it because they deem it as<br />

capital in nature, then you can save your tax. The<br />

Central Bank controls the outflow and inflow of<br />

the ringgit and you need to declare your purpose<br />

accordingly. If they approve the fund transfer, then<br />

it is good to use to buy anything including bitcoin.<br />

Also, any cryptocurrency exchange operating in<br />

Malaysia should supply their customers’ details to the<br />

Central Bank/Income Tax Department if required to<br />

do so. This is because it involves the financial market<br />

of Malaysia if the amount is not tracked properly.<br />

11. APR: Would you say anonymity is still<br />

preferred for bitcoin transactions in view of its<br />

potential to be used for money laundering and<br />

tax evasion?<br />

KL: I don’t think it is a good idea to use bitcoin for<br />

transactions because of its uncertain and speculative<br />

nature. It is also being looked upon as a moneylaundering<br />

and tax evasion tool, therefore, it will<br />

be subject to a lot of unnecessary hassles especially<br />

for big transactions. Furthermore, for property<br />

transactions, many other parties are involved, for<br />

example the land office, legal firm and financial<br />

institutions, etc.

INVESTMENT<br />

What, where, when and how - are crucial questions<br />

real estate investors want to know.<br />

We give you all that sourced from around the world.

March - April 2018<br />

23

24 ASIAN PROPERTY REVIEW INVESTMENT<br />

TOP 8 FORECASTS<br />

IN 2018<br />

BY GAVIN TEE<br />

The Malaysian property world as we know it will evolve into a different landscape<br />

with noticeable changes starting from 2017 and becoming more pronounced in 2018,<br />

said renowned expert, Dato Sri Gavin Tee.<br />

“After the bad times from 2014 – 2018<br />

(1st quarter), I foresee a change of luck,”<br />

property consultant Dato Sri Gavin Tee<br />

said during a press conference recently. He<br />

described the change as similar to a V-shape<br />

development curve. “From 2018, we will be<br />

starting to climb up,” he forecasted, adding<br />

that this was based on his analysis of factors<br />

influencing the past, present and future.<br />

Tee was speaking at Swhengtee’s 11th Annual<br />

Property Forecast Talk, which was held on 28th<br />

Jan 2018 at Swiss Garden Hotel, Kuala Lumpur.<br />

His 8 predictions are as follows:<br />

1.<br />

EVOLUTION TO SHARING<br />

AND CORPORATE TYPES<br />

OF INVESTMENT<br />

Our investment strategy has to adjust to<br />

world market changes. We cannot just invest<br />

individually unless it’s in a matured market.<br />

However, we can pool together our resources and<br />

invest as a corporate entity such as in the case of<br />

crowdfunding, managing hotels, projects or even<br />

offices. So, the future of property investment may<br />

evolve into sharing types of investment. In some<br />

cases, we may not even own the share but only the<br />

right of use, for example, in China, citizens can<br />

only have the right of use of the property for 30<br />

years or longer. Other new examples are co-living<br />

or adult dormitories. Gone are the days when<br />

people traditionally buy for the next generation.

March - April 2018<br />

25<br />

2.<br />

SHIFTING OF<br />

COMMERCIAL HOTSPOTS<br />

Due to the way cities are developed especially<br />

developing cities in ASEAN, new areas or cities<br />

are always being built. As such, new hotspots<br />

are created all the time. For example, in Kuala<br />

Lumpur, the commercial hotspot used to be<br />

the Golden Triangle ( Jalan Sultan Ismail, Jalan<br />

Raja Chulan) and Jalan Ampang. However, with<br />

new mega developments coming up such as<br />

TRX, Bandar Malaysia and even Cyberjaya and<br />

Putrajaya, the hotspots are shifting to the latter.<br />

Technology has also played a part.<br />

Tenants, especially multinationals and globalised<br />

businesses prefer newer premises with more<br />

modern infrastructure like upscale amenities and<br />

facilities including proximity to transportation<br />

links such as the MRT, LRT, and energy<br />

saving facilities like solar power panels, green<br />

environment as well as super fast Internet and even<br />

the office space configuration which tends towards<br />

large open spaces with co-sharing. Some are<br />

even integrated with lifestyle elements including<br />

shopping malls and eateries like those in TRX.<br />

This is the new reality of office spaces and is the<br />

future. Kuala Lumpur is currently transitioning<br />

into such a metropolis.<br />

This phenomenon can be seen all over ASEAN<br />

cities including Jakarta, Bangkok, Phnom Penh<br />

and Vientiane and not just in Kuala Lumpur. A<br />

combination of factors such as globalisation, BRI,<br />

and ASEAN integration are creating new zones<br />

where regional headquarters are attracted to. These<br />

offices which are built using the latest technology<br />

will also demand higher rentals and price points.<br />

Kuala Lumpur is currently transitioning into such<br />

a metropolis.<br />

So, unless the older office buildings can adapt or<br />

modify to the new requirements or even refurbish,<br />

more tenants from these will move to the new<br />

modern offices.<br />

To survive, these older office buildings can either<br />

be repurposed to spaces that are in demand such as<br />

storage, budget hotels, or tech hub. It’s the same<br />

story with the oversupply of shopping malls. Some<br />

20% may close down in the near future – so in<br />

order to survive, they need to be repurposed. Even<br />

the biggest and most popular shopping malls like<br />

One Utama have added in entertainment elements<br />

to attract more footfall.<br />

Gone are the days when<br />

people traditionally buy<br />

for the next generation.

26 ASIAN PROPERTY REVIEW INVESTMENT<br />

4.<br />

TOURISM BOOM IN NEXT<br />

5 YEARS<br />

People on Petaling Street in Kuala Lumpur.<br />

3.<br />

LIGHT INDUSTRIAL ZONE<br />

CRISIS<br />

As Internet commerce undergoes exponential<br />

growth, ways of storage and delivery have<br />

totally changed. Most retailers now place their<br />

inventories for the purpose of online sales in<br />

a centralised centre such as Jack Ma’s Alibaba<br />

regional distribution hub (part of the Digital<br />

Free Trade Zone at Aeropolis KLIA). This leaves<br />

many light industrial zones with few takers<br />

especially those built on small sites with a lack<br />

of infrastructure support. They will be overtaken<br />

by the big new industrial parks coming up which<br />

has the added advantage of government support<br />

and which attracts international players due to the<br />

many supporting infrastructure built around it not<br />

to mention its strategic location.<br />

Tourism properties will be Malaysia’s best<br />

investment from 2018 onwards partly due to the<br />

government’s push in this direction. Budget 2018<br />

has designated 2020 as Visit Malaysia Year and<br />

has proposed to set up an RM2 billion fund for<br />

SMEs in the tourism sector.<br />

Malaysia has so far enjoyed the privilege of an<br />

abundance of natural and man-made attractions<br />

attracting a flood of tourists from China and<br />

ASEAN. We are also comparatively matured<br />

in our infrastructure, education, medical and<br />

tourism services; and are more organised with less<br />

environmental and security problems compared<br />

to our neighbours. Best of all, our multi-cuisine<br />

food is the talk of international travellers. In<br />

recent years, there is a spike in eco-tourism as local<br />

tourism players realise this is one of the top draws<br />

in Malaysia.<br />

However, Malaysia should not rest on our laurels<br />

as our neighbours such as Thailand, Indonesia,<br />

Vietnam and the Philippines are increasingly<br />

attracting the share of the tourist receipts. This is<br />

also partly due to their fast developing economies<br />

which are attracting a lot of foreign investments.<br />

These investments go into building new cities or<br />

industrial areas, hence increasing the number of<br />

attractions. In addition, the increasing population<br />

and higher disposal incomes of the locals also<br />

contribute to their domestic tourism economy.

5.<br />

DURIAN – THE NEW<br />

‘GOLD’<br />

‘A durian tree can be a property’ – believe it or<br />

not. The future of Malaysian durian exports looks<br />

very rosy as increasing appetite for the pungent<br />

smelling thorny fruit exceeded all expectations.<br />

As the world finally wakes up to the fact that<br />

Malaysian durians are the best in the world,<br />

demand started to spike especially since the last<br />

2 years after the Musang King variety became<br />

spectacularly popular with Chinese Mainlanders.<br />

Durian tours and buffets became very popular<br />

and durian smallholders and sellers were reaping<br />

immense benefits.<br />

With the government now getting in on the<br />

action, expect more innovation in the number<br />

of varieties, shorter and year-round harvesting<br />

periods, storage methods, and the development<br />

of tourist durian towns including a durian<br />

museum (Bentong).<br />

As scientists start manipulating the genes of<br />

durians, expect shorter trees with more fruits<br />

and even trees that can have structures built<br />

on top. In Perak, thousands of acres of durian<br />

plantations have been started with an increasing<br />

number of varieties and quantities. The supply is<br />

indeed multiplying at a pace not seen previously<br />

anywhere, any time in history. However,<br />

oversupply is not an issue due to the increasing<br />

industrialisation and centralisation of the<br />

production process.<br />

At the most advanced durian plantations, there<br />

are machines that can immediately freeze the<br />

durian after it drops to the ground; and thereafter<br />

deliver immediately to you. The industrialisation<br />

of the durian supply process ensures that supply<br />

and prices stay constant as much as possible.<br />

Downstream activities are also increasing to bring<br />

a bigger variety of preserved durian products such<br />

as cakes, biscuits, chocolates, ice cream, sweets and<br />

et cetera to the market.<br />

The supply of durians is<br />

indeed multiplying at a pace<br />

not seen previously anywhere,<br />

any time in history.

28 ASIAN PROPERTY REVIEW INVESTMENT<br />

6.<br />

MEDIUM-COST<br />

OVERSUPPLY<br />

With the government’s encouragement, a lot of<br />

low medium-cost housing has been built in the<br />

last few years and more are coming onstream in<br />

the next few years. If there are too many in one<br />

area, say, 10,000 units, this causes an oversupply.<br />

And if these properties are built far away from<br />

transportation hubs, there is a problem with high<br />

vacancies. This causes prices and rentals to fall.<br />

Under such circumstances, it is better to rent than<br />

buy as owning a home can be a burden. It will no<br />

longer be a practical business proposal. This entire<br />

scenario will change the property purchasing and<br />

financing landscape which will never be the same<br />

again like before.<br />

The trend now is if it is a<br />

medium cost place, it will be<br />

forever medium cost if there<br />

are too many of such units<br />

within the same area.<br />

In the past, medium cost housing can be renovated<br />

to become like high end properties but if there<br />

is a concentration of high density medium cost<br />

units in an area, to upgrade is a near impossible<br />

task due to the fact that these units might be of<br />

lower quality build (due to the price pressure to<br />

make them affordable). The uniformity of the<br />

units also makes it more difficult to upgrade its<br />

characteristics, not to mention the difficulty of<br />

attracting new types of tenants, for example,<br />

foreigners or students.<br />

So, the trend now is if it is a medium cost place, it<br />

will be forever medium cost if there are too many<br />

of such units within the same area.

March - April 2018<br />

29<br />

7.<br />

TECHNOLOGY CAN<br />

CHANGE THE FORTUNE<br />

OF A BUILDING<br />

AirBnb for example has transformed ordinary<br />

homes into commercial ventures while hotspot<br />

locations have changed due to the ability of<br />

technology to do away with certain types of<br />

commuting. Think remote working and digital<br />

nomads. People are able to stay further away<br />

from their workplaces. At the same time, the<br />

technology integrated into a building such<br />

as sensors and high end security systems has<br />

increased its value. Smart buildings are becoming<br />

commonplace and sought after.<br />

With the use of technology, a remote area can<br />

be transformed into a livable, comfortable place<br />

giving rise to small resort areas. This enables them<br />

to be turned into eco resorts allowing small SME<br />

operators an additional source of revenue. This is<br />

not just happening in Malaysia but throughout<br />

ASEAN where hotspots are now scattered due to<br />

the advances in technology.<br />

With the use of technology, a<br />

remote area can be transformed<br />

into a livable, comfortable place<br />

giving rise to small resort areas.<br />

8.<br />

MORE G2G AND<br />

CORPORATE CHINESE<br />

INVESTMENTS<br />

The Chinese were leading worldwide property<br />

investments in a big way from 2013 but from<br />

2017, they were hit by Chinese government<br />

controls. Since then, investments from retail and<br />

corporate investors have dipped but in terms of<br />

government-to-government (G2G) investments<br />

and corporate investments related to the Belt &<br />

Road Initiative (BRI), they have risen. From 2018,<br />

I foresee more players going into more functional<br />

types of investments such as those related to<br />

medical, education and tourism.

30 ASIAN PROPERTY REVIEW INVESTMENT<br />

CONFISCATING<br />

YOUR HDB FLAT<br />

– WHAT YOU SHOULD KNOW<br />

While this is the stuff of every Singaporean homeowner’s nightmare,<br />

it is better to err on the side of caution by knowing<br />

what happens when you break the law.<br />

Khalil Adis is a speaker<br />

and author behind<br />

“Property Buying for<br />

Gen Y”. You can reach<br />

him at investorsclub@<br />

khaliladis.com<br />

In Singapore where 80 per cent of<br />

the population lives in governmentowned<br />

flats, (popularly known as<br />

Housing & Development Board or<br />

HDB flats), losing the roof over your head<br />

is really a big deal.<br />

Being government-owned, there are strict<br />

laws and regulations in place governing HDB<br />

flats. They include a minimum occupation<br />

period (MOP) of five years and a minimum<br />

rental period of six months per application<br />

when renting out your HDB flats.<br />

According to the Housing & Development<br />

Board, this is necessary “as it may disrupt<br />

the living environment and pose security<br />

concerns for our residents”.<br />

Take the example of two home owners<br />

whose flats were seized in 2014 for<br />

illegally renting them out to tourists. In<br />

both cases, the two owners had openly<br />

flouted HDB laws by renting them out<br />

on a daily basis.<br />

While there is no latest data as of 2018,<br />

the numbers could be higher due to the<br />

popularity of AirBnb listings. Between<br />

January 2012 to 2014, for instance, the<br />

HDB had seized 202 flats for breaking<br />

the law.

March - April 2018<br />

31<br />

So what can lead to such confiscations?<br />

Here are some of the common scenarios:<br />

You illegally rent out your<br />

property<br />

Every HDB flat has a MOP of five<br />

years. Thus, you are not allowed to<br />

rent out your flat if you have not<br />

reached the MOP.<br />

You rent out for a short-term period<br />

AirBnb type of accommodations<br />

are not allowed in HDB flats as<br />

the minimum rental period for<br />

each tenant must be 6 months per<br />

application. Thus, flat owners are<br />

not allowed to rent out their flats or<br />

bedrooms on a short-term basis.<br />

You did not register with the HDB<br />

after renting out your flat<br />

Granted, you have fulfilled the MOP,<br />

it is still against the law if you do not<br />

register the particulars of your tenants<br />

with the HDB.<br />

Your tenants are involved in illegal<br />

activities<br />

Illicit businesses like prostitution in<br />

the heartlands have become rife and<br />

a common problem nowadays. While<br />

the tenants are the ones breaking<br />

the law, the onus is on the owners to<br />

do regular spotchecks to make sure<br />

your tenants are not involved in such<br />

illegal businesses as this may affect<br />

the harmony of your neighbourhood.<br />

You bought a private property<br />

before the minimum occupation<br />

period is up<br />

Owning a HDB flat is a privilege<br />

and not a right. By buying a<br />

private property in Singapore or<br />

overseas, before the minimum<br />

occupation period is up, you are<br />

essentially denying a more deserving<br />

Singaporean a roof over their head.<br />

You have not been paying your<br />

mortgage<br />

This is a last minute resort if you have<br />

persistently not been clearing your<br />

arrears despite HDB’s best intentions.<br />

In this case, the HDB has the right<br />

to confiscate your flat. However, such<br />

households will be given alternative<br />

accommodation such as downsizing<br />

to a flat that they can afford or<br />

renting a flat directly with the HDB.<br />

With the exception of the last scenario,<br />

losing your HDB flat can have very grave<br />

implications. Let’s take a look at them:<br />

Implication No: 1<br />

FINANCIAL LOSSES<br />

Assuming you had broken the laws, the<br />

HDB has the right to take back your flat<br />

at the price that it was purchased after<br />

deducting a penalty.<br />

While the HDB does not leave you<br />

financially destitute, this also means you will<br />

not be able to enjoy the capital appreciation<br />

on your flat.<br />

Let’s take the case of a property agent, Poh<br />

Boon Kay whose HDB flat was repossessed<br />

by the HDB in 2010 after he and his wife<br />

was found to have illegally sublet his home.<br />

While they both had bought the HDB<br />

flat from the open market at S$150,000,<br />

he was reportedly paid S$125,000 after<br />

deducting the penalties. At the time of the<br />

confiscation, his flat was worth S$320,000.<br />

That’s almost a loss of S$200,000!<br />

Implication No: 2<br />

NO ROOF OVER YOUR HEAD<br />

Unlike the last scenario, because you had<br />

broken the law, you’re on your own. This not<br />

only creates a huge financial burden as you<br />

will now have to either rent or buy a private<br />

property, but also deal with the emotional<br />

stress and uncertainty of not having a roof<br />

over your head.<br />

TAKEAWAYS<br />

While HDB is an asset, it can also lead to<br />

huge financial losses if you break the law.<br />

The takeaway is this, it is always better to<br />

err on the side of caution when it comes to<br />

government-owned flats in Singapore as the<br />

repercussions far outweigh one’s ignorance<br />

and financial greed.

32 ASIAN PROPERTY REVIEW INVESTMENT<br />

JAPAN IN 2018<br />

CONDOS, BUDGET HOTELS,<br />

SHARED OFFICES AND BITCOIN<br />

As the Olympics nears, accommodation demand starts to soar; at<br />

the same time, shared offices are becoming popular while BitCoin<br />

inches closer to general acceptance despite wholesale theft of an<br />

exchange’s entire virtual currency reserves through hacking.<br />

Ziv Nakajima-Magen<br />

is Partner & Executive<br />

Manager, Asia-Pacific,<br />

Nippon Tradings<br />

International (NTI), which<br />

specialises in assisting<br />

investors in capitalising<br />

on Japan’s vast property<br />

market. He can be<br />

contacted at: info@<br />

nippontradings.com or<br />

mobile +81 92 600 1613<br />

Condos – or, more accurately, newly<br />

or recently built residential condos, are<br />

one of the only assets that’s gained in value in<br />

2017 – not only in Tokyo, but all over the country. In<br />

contrast, prices of land, houses and commercial property<br />

have flattened out. A lot of investors have been moving from<br />

commercial to residential, simply because yields are higher,<br />

and the residential market is considered to be more stable overall.<br />

Commercial rents are also forecast to drop, at least in Tokyo, which is<br />

another reason to go for residential properties.<br />

In central Tokyo specifically, as the 2020 Olympics draws closer, demand<br />

is very high, and oversupply hasn’t really hit that hard yet – hotel vacancies<br />

are going to be closer and closer to zero in the next few years, and a lot of<br />

these buyers are local or foreign investors with an eye to the short term stay<br />

hospitality market. Luxury or at least very comfortable, well sized properties,<br />

in close proximity to major train stations, and with good facilities, are going at<br />

a premium these days – but that doesn’t necessarily mean a sustainable market<br />

post-Olympics, so still a case of “buyer beware”.<br />

Hotel vacancies are<br />

going to be closer and<br />

closer to zero in the<br />

next few years, and<br />

a lot of these buyers<br />

are local or foreign<br />

investors with an eye<br />

to the short term stay<br />

hospitality market.<br />

Budget accommodation –<br />