BusinessDay 29 Mar 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Thursday <strong>29</strong> <strong>Mar</strong>ch <strong>2018</strong><br />

30 BUSINESS DAY<br />

C002D5556<br />

BD<br />

<strong>Mar</strong>kets + Finance<br />

‘Providing proprietary research, commentary, analysis and financial news coverage unmatched in<br />

today’s market. Published weekly, <strong>Mar</strong>kets & Finance provides all the key intelligence you need.’<br />

GTBank plc: Strong earnings growth<br />

enhanced by growth in interest income<br />

BALA AUGIE<br />

Guaranty Trust Bank<br />

(GTBank) Plc in its<br />

audited financial<br />

statement for the full<br />

year 2017 recently<br />

released showed an impressive<br />

performance, as it was able to grow<br />

profitability and other key financial<br />

indicators despite operational challenges<br />

arising as a result of macroeconomic<br />

headwinds.<br />

The Nigerian lender has utilized<br />

the resources of shareholders<br />

in generating higher profit than<br />

any other bank in Africa’s largest<br />

economy.<br />

The Bank has kept up with its<br />

regular dividend payment, and has<br />

recommended a final total dividend<br />

of N70.63 billion for the year (on the<br />

basis of 245 per share).<br />

Increase in interest income<br />

largely driven by rise in non interest<br />

income<br />

For the year ended December<br />

2017, GTBank’s gross interest income<br />

increased by 25 percent to<br />

N327.33 billion as against N262.49<br />

billon as at December 2016; driven<br />

by strong growth in fees and commission<br />

income and improved and<br />

non-interest income.<br />

The growth in interest income<br />

was driven by interest income on<br />

short term government securities<br />

and interest income on loans and<br />

advances.<br />

Net interest income surged by<br />

80 percent to N234.50 billion in the<br />

period under review from N130.86<br />

billion as at December 2016; thanks<br />

to a 81 percent decrease in loans and<br />

impairment charges to N12.16 billion.<br />

Net fees and commission income<br />

was up 9 percent to N40.732<br />

billion in December 2017 from<br />

N35.94 billion the previous year.<br />

The growth in fees and commission<br />

income was driven by a<br />

17 percent growth in volume of accounts<br />

turnover, increase in volume<br />

of e-banking transactions, which<br />

was aided by the lender’s drive to<br />

continuously create market leading<br />

payment capabilities as well as<br />

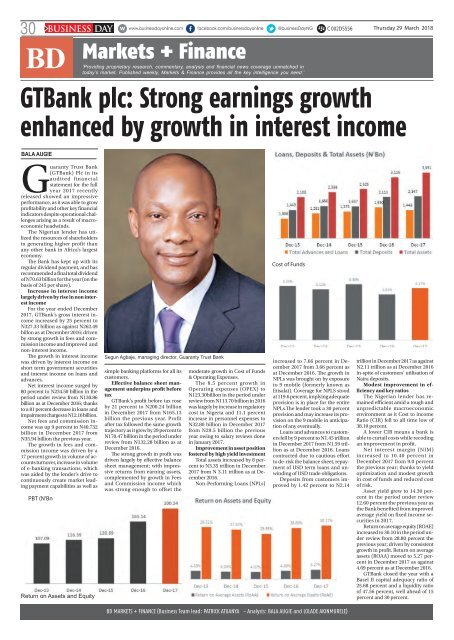

PBT (N’Bn<br />

Return on Assets and Equity<br />

Segun Agbaje, managing director, Guaranty Trust Bank<br />

simple banking platforms for all its<br />

customers.<br />

Effective balance sheet management<br />

underpins profit before<br />

tax<br />

GTBank’s profit before tax rose<br />

by 21 percent to N200.24 billion<br />

in December 2017 from N165.13<br />

billion the previous year. Profit<br />

after tax followed the same growth<br />

trajectory as it grew by <strong>29</strong> percent to<br />

N170.47 billion in the period under<br />

review from N132.28 billion as at<br />

December 2016.<br />

The strong growth in profit was<br />

driven largely by effective balance<br />

sheet management; with impressive<br />

returns from earning assets,<br />

complemented by growth in Fees<br />

and Commission income which<br />

was strong enough to offset the<br />

moderate growth in Cost of Funds<br />

& Operating Expenses.<br />

The 8.5 percent growth in<br />

Operating expenses (OPEX) to<br />

N123.30billion in the period under<br />

review from N113.70 billion in 2016<br />

was largely by increase in regulatory<br />

cost in Nigeria and 11.1 percent<br />

increase in personnel expenses to<br />

N32.80 billion in December 2017<br />

from N<strong>29</strong>.5 billion the previous<br />

year owing to salary reviews done<br />

in January 2017.<br />

Improvement in asset position<br />

fostered by high yield investment<br />

Total assets increased by 8 percent<br />

to N3.35 trillion in December<br />

2017 from N 3.11 trillion as at December<br />

2016.<br />

Non-Performing Loans (NPLs)<br />

Cost of Funds<br />

increased to 7.66 percent in December<br />

2017 from 3.66 percent as<br />

at December 2016. The growth in<br />

NPLs was brought on by exposure<br />

to 9 mobile (formerly known as<br />

Etisalat). Coverage for NPLS stood<br />

at 119.6 percent, implying adequate<br />

provision is in place for the entire<br />

NPLs.The lender took a 30 percent<br />

provision and may increase its provision<br />

on the 9 mobile in anticipation<br />

of any eventually.<br />

Loans and advances to customers<br />

fell by 9 percent to N1.45 trillion<br />

in December 2017 from N1.59 trillion<br />

as at December 2016. Loans<br />

contracted due to cautious effort<br />

to de-risk the balance sheet, repayment<br />

of USD term loans and unwinding<br />

of USD trade obligations.<br />

Deposits from customers improved<br />

by 1.42 percent to N2.14<br />

trillion in December 2017 as against<br />

N2.11 trillion as at December 2016<br />

in-spite of customers’ utilisation of<br />

Naira deposits.<br />

Modest improvement in efficiency<br />

and key ratios<br />

The Nigerian lender has remained<br />

efficient amid a tough and<br />

unpredictable macroeconomic<br />

environment as it Cost to income<br />

Ratio (CIR) fell to all time low of<br />

38.10 percent.<br />

A lower CIR means a bank is<br />

able to curtail costs while recoding<br />

an improvement in profit.<br />

Net interest margin (NIM)<br />

increased to 10.40 percent in<br />

December 2017 from 9.0 percent<br />

the previous year; thanks to yield<br />

optimization and modest growth<br />

in cost of funds and reduced cost<br />

of risk.<br />

Asset yield grew to 14.30 percent<br />

in the period under review<br />

12.60 percent the previous year as<br />

the Bank benefited from improved<br />

average yield on fixed income securities<br />

in 2017.<br />

Return on average equity (ROAE)<br />

increased to 30.10 in the period under<br />

review from 28.80 percent the<br />

previous year; driven by consistent<br />

growth in profit. Return on average<br />

assets (ROAA) moved to 5.27 percent<br />

in December 2017 as against<br />

4.69 percent as at December 2016.<br />

GTBank closed the year with a<br />

Basel II capital adequacy ratio of<br />

25.68 percent and a liquidity ratio<br />

of 47.56 percent, well ahead of 15<br />

percent and 30 percent.<br />

BD MARKETS + FINANCE (Business Team lead: PATRICK ATUANYA - Analysts: BALA AUGIE and LOLADE AKINMURELE)