White paper For MiniStry oF neW and reneWable energy (Mnre)

White paper For MiniStry oF neW and reneWable energy (Mnre)

White paper For MiniStry oF neW and reneWable energy (Mnre)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

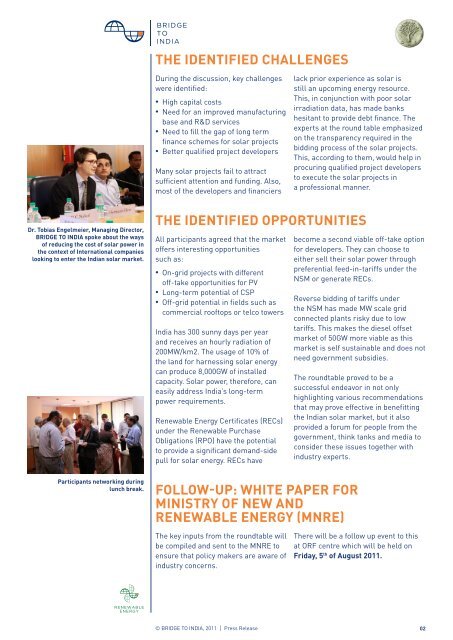

dr. tobias engelmeier, Managing director,<br />

bridge to india spoke about the ways<br />

of reducing the cost of solar power in<br />

the context of international companies<br />

looking to enter the indian solar market.<br />

participants networking during<br />

lunch break.<br />

the identiFied challengeS<br />

During the discussion, key challenges<br />

were identified:<br />

• High capital costs<br />

• Need for an improved manufacturing<br />

base <strong>and</strong> R&D services<br />

• Need to fill the gap of long term<br />

finance schemes for solar projects<br />

• Better qualified project developers<br />

Many solar projects fail to attract<br />

sufficient attention <strong>and</strong> funding. Also,<br />

most of the developers <strong>and</strong> financiers<br />

the identiFied opportunitieS<br />

All participants agreed that the market<br />

offers interesting opportunities<br />

such as:<br />

• On-grid projects with different<br />

off-take opportunities for PV<br />

• Long-term potential of CSP<br />

• Off-grid potential in fields such as<br />

commercial rooftops or telco towers<br />

India has 300 sunny days per year<br />

<strong>and</strong> receives an hourly radiation of<br />

200MW/km2. The usage of 10% of<br />

the l<strong>and</strong> for harnessing solar <strong>energy</strong><br />

can produce 8,000GW of installed<br />

capacity. Solar power, therefore, can<br />

easily address India’s long-term<br />

power requirements.<br />

Renewable Energy Certificates (RECs)<br />

under the Renewable Purchase<br />

Obligations (RPO) have the potential<br />

to provide a significant dem<strong>and</strong>-side<br />

pull for solar <strong>energy</strong>. RECs have<br />

FolloW-up: <strong>White</strong> <strong>paper</strong> <strong>For</strong><br />

<strong>MiniStry</strong> <strong>oF</strong> <strong>neW</strong> <strong>and</strong><br />

re<strong>neW</strong>able <strong>energy</strong> (<strong>Mnre</strong>)<br />

The key inputs from the roundtable will<br />

be compiled <strong>and</strong> sent to the MNRE to<br />

ensure that policy makers are aware of<br />

industry concerns.<br />

© BRIDGE TO INDIA, 2011 | Press Release<br />

lack prior experience as solar is<br />

still an upcoming <strong>energy</strong> resource.<br />

This, in conjunction with poor solar<br />

irradiation data, has made banks<br />

hesitant to provide debt finance. The<br />

experts at the round table emphasized<br />

on the transparency required in the<br />

bidding process of the solar projects.<br />

This, according to them, would help in<br />

procuring qualified project developers<br />

to execute the solar projects in<br />

a professional manner.<br />

become a second viable off-take option<br />

for developers. They can choose to<br />

either sell their solar power through<br />

preferential feed-in-tariffs under the<br />

NSM or generate RECs.<br />

Reverse bidding of tariffs under<br />

the NSM has made MW scale grid<br />

connected plants risky due to low<br />

tariffs. This makes the diesel offset<br />

market of 50GW more viable as this<br />

market is self sustainable <strong>and</strong> does not<br />

need government subsidies.<br />

The roundtable proved to be a<br />

successful endeavor in not only<br />

highlighting various recommendations<br />

that may prove effective in benefitting<br />

the Indian solar market, but it also<br />

provided a forum for people from the<br />

government, think tanks <strong>and</strong> media to<br />

consider these issues together with<br />

industry experts.<br />

There will be a follow up event to this<br />

at ORF centre which will be held on<br />

Friday, 5 th of august 2011.<br />

02