Sumitomo Trust Group at a Glance (2820 KB

Sumitomo Trust Group at a Glance (2820 KB

Sumitomo Trust Group at a Glance (2820 KB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4<br />

The <strong>Sumitomo</strong> <strong>Trust</strong> & Banking Co., Ltd. Annual Report 2004 — <strong>Sumitomo</strong> <strong>Trust</strong> <strong>Group</strong> <strong>at</strong> a <strong>Glance</strong><br />

<strong>Sumitomo</strong> <strong>Trust</strong> <strong>Group</strong> <strong>at</strong> a <strong>Glance</strong><br />

Aiming to become Japan's top trust bank group, the <strong>Sumitomo</strong> <strong>Trust</strong> <strong>Group</strong> is leveraging its trust and commercial<br />

banking strengths to achieve integr<strong>at</strong>ed business growth.<br />

Our Differenti<strong>at</strong>ing Characteristics<br />

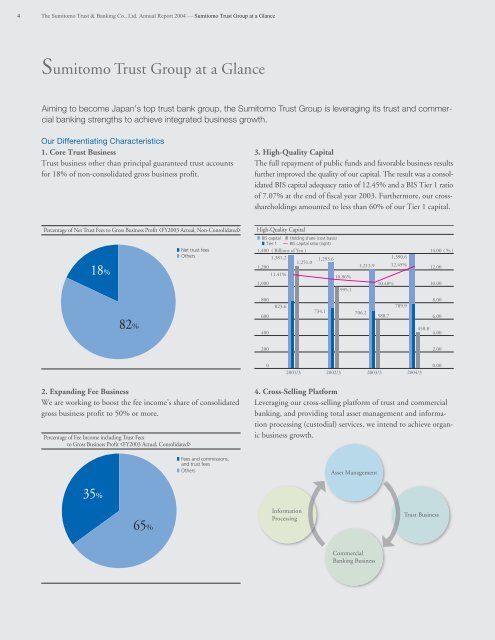

1. Core <strong>Trust</strong> Business<br />

<strong>Trust</strong> business other than principal guaranteed trust accounts<br />

for 18% of non-consolid<strong>at</strong>ed gross business profit.<br />

Percentage of Net <strong>Trust</strong> Fees to Gross Business Profit <br />

18%<br />

2. Expanding Fee Business<br />

We are working to boost the fee income’s share of consolid<strong>at</strong>ed<br />

gross business profit to 50% or more.<br />

Percentage of Fee Income including <strong>Trust</strong> Fees<br />

to Gross Business Profit <br />

35%<br />

82%<br />

65%<br />

Net trust fees<br />

Others<br />

Fees and commissions,<br />

and trust fees<br />

Others<br />

3. High-Quality Capital<br />

The full repayment of public funds and favorable business results<br />

further improved the quality of our capital. The result was a consolid<strong>at</strong>ed<br />

BIS capital adequacy r<strong>at</strong>io of 12.45% and a BIS Tier 1 r<strong>at</strong>io<br />

of 7.07% <strong>at</strong> the end of fiscal year 2003. Furthermore, our crossshareholdings<br />

amounted to less than 60% of our Tier 1 capital.<br />

High-Quality Capital<br />

BIS capital Holding share (cost basis)<br />

Tier 1 BIS capital r<strong>at</strong>io (right)<br />

1,400 ( Billions of Yen ) 14.00 ( % )<br />

1,381.2<br />

1,200<br />

1,251.0<br />

1,293.6<br />

1,213.9<br />

1,390.6<br />

12.45%<br />

12.00<br />

11.41%<br />

10.86%<br />

1,000 10.48%<br />

10.00<br />

995.1<br />

800 8.00<br />

823.6<br />

789.9<br />

600<br />

734.1<br />

706.2<br />

588.7<br />

6.00<br />

450.8<br />

400 4.00<br />

200 2.00<br />

0 0.00<br />

2001/3 2002/3 2003/3 2004/3<br />

4. Cross-Selling Pl<strong>at</strong>form<br />

Leveraging our cross-selling pl<strong>at</strong>form of trust and commercial<br />

banking, and providing total asset management and inform<strong>at</strong>ion<br />

processing (custodial) services, we intend to achieve organic<br />

business growth.<br />

Inform<strong>at</strong>ion<br />

Processing<br />

Asset Management<br />

Commercial<br />

Banking Business<br />

<strong>Trust</strong> Business

Overview of Our Business and Business <strong>Group</strong> Management System<br />

At the beginning of fiscal year 2000, <strong>Sumitomo</strong> <strong>Trust</strong> introduced<br />

the business group management system, consisting of five<br />

business groups: the Consumer and Corpor<strong>at</strong>e Finance <strong>Group</strong>,<br />

the Global Credit Investment <strong>Group</strong>, the Treasury and<br />

Financial Products <strong>Group</strong>, the Fiduciary Services <strong>Group</strong> and<br />

the Real Est<strong>at</strong>e <strong>Group</strong>.<br />

The <strong>Sumitomo</strong> <strong>Trust</strong> & Banking Co., Ltd. Annual Report 2004 — <strong>Sumitomo</strong> <strong>Trust</strong> <strong>Group</strong> <strong>at</strong> a <strong>Glance</strong> 5<br />

In April 2002, the retail customer section and corpor<strong>at</strong>e customer<br />

section in the Consumer and Corpor<strong>at</strong>e Finance <strong>Group</strong><br />

were separ<strong>at</strong>ed, with the former becoming the independent<br />

“Retail Financial Services <strong>Group</strong>,” and the l<strong>at</strong>ter merging with<br />

the Global Credit Investment <strong>Group</strong> and forming the<br />

“Wholesale Financial Services <strong>Group</strong>.”