You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 in-depth<br />

<strong>May</strong> 11<br />

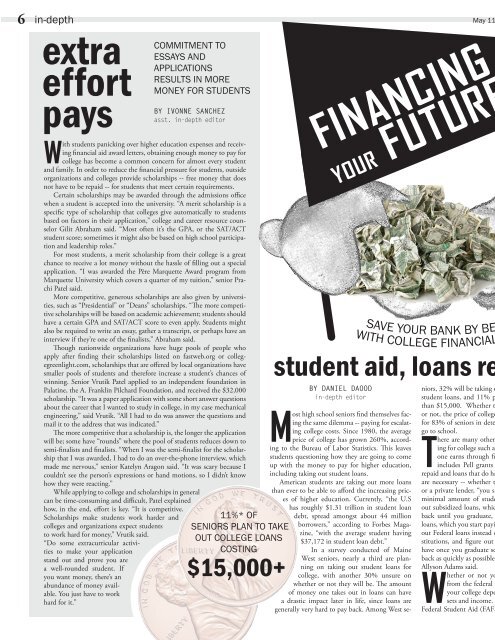

extra<br />

effort<br />

pays<br />

With students panicking over higher education expenses and receiving<br />

financial aid award letters, obtaining enough money to pay for<br />

college has become a common concern for almost every student<br />

and family. In order to reduce the financial pressure for students, outside<br />

organizations and colleges provide scholarships -- free money that does<br />

not have to be repaid -- for students that meet certain requirements.<br />

Certain scholarships may be awarded through the admissions office<br />

when a student is accepted into the university. “A merit scholarship is a<br />

specific type of scholarship that colleges give automatically to students<br />

based on factors in their application,” college and career resource counselor<br />

Gilit Abraham said. “Most often it’s the GPA, or the SAT/ACT<br />

student score; sometimes it might also be based on high school participation<br />

and leadership roles.”<br />

For most students, a merit scholarship from their college is a great<br />

chance to receive a lot money without the hassle of filling out a special<br />

application. “I was awarded the Père Marquette Award program from<br />

Marquette University which covers a quarter of my tuition,” senior Prachi<br />

Patel said.<br />

More competitive, generous scholarships are also given by universities,<br />

such as “Presidential” or “Deans” scholarships. “The more competitive<br />

scholarships will be based on academic achievement; students should<br />

have a certain GPA and SAT/ACT score to even apply. Students might<br />

also be required to write an essay, gather a transcript, or perhaps have an<br />

interview if they’re one of the finalists,” Abraham said.<br />

Though nationwide organizations have huge pools of people who<br />

apply after finding their scholarships listed on fastweb.org or collegegreenlight.com,<br />

scholarships that are offered by local organizations have<br />

smaller pools of students and therefore increase a student’s chances of<br />

winning. Senior Vrutik Patel applied to an independent foundation in<br />

Palatine, the A. Franklin Pilchard Foundation, and received the $32,000<br />

scholarship. “It was a paper application with some short answer questions<br />

about the career that I wanted to study in college, in my case mechanical<br />

engineering,” said Vrutik. “All I had to do was answer the questions and<br />

mail it to the address that was indicated.”<br />

The more competitive that a scholarship is, the longer the application<br />

will be; some have “rounds” where the pool of students reduces down to<br />

semi-finalists and finalists. “When I was the semi-finalist for the scholarship<br />

that I was awarded, I had to do an over-the-phone interview, which<br />

made me nervous,” senior Katelyn Aragon said. “It was scary because I<br />

couldn’t see the person’s expressions or hand motions, so I didn’t know<br />

how they were reacting.”<br />

While applying to college and scholarships in general<br />

can be time-consuming and difficult, Patel explained<br />

how, in the end, effort is key. “It is competitive.<br />

Scholarships make students work harder and<br />

colleges and organizations expect students<br />

to work hard for money,” Vrutik said.<br />

“Do some extracurricular activities<br />

to make your application<br />

stand out and prove you are<br />

a well-rounded student. If<br />

you want money, there’s an<br />

abundance of money available.<br />

You just have to work<br />

hard for it.”<br />

COMMITMENT TO<br />

ESSAYS AND<br />

APPLICATIONS<br />

RESULTS IN MORE<br />

MONEY FOR STUDENTS<br />

BY IVONNE SANCHEZ<br />

asst. in-depth editor<br />

11%* OF<br />

SENIORS PLAN TO TAKE<br />

OUT COLLEGE LOANS<br />

COSTING<br />

$15,000+<br />

FINANCING<br />

YOUR FUTURE<br />

BY DANIEL DAOOD<br />

in-depth editor<br />

Most high school seniors find themselves facing<br />

the same dilemma -- paying for escalating<br />

college costs. Since 1980, the average<br />

price of college has grown 260%, according<br />

to the Bureau of Labor Statistics. This leaves<br />

students questioning how they are going to come<br />

up with the money to pay for higher education,<br />

including taking out student loans.<br />

American students are taking out more loans<br />

than ever to be able to afford the increasing prices<br />

of higher education. Currently, “the U.S<br />

has roughly $1.31 trillion in student loan<br />

debt, spread amongst about 44 million<br />

SAVE YOUR BANK BY BE<br />

WITH COLLEGE FINANCIAL<br />

student aid, loans re<br />

borrowers,” according to Forbes Magazine,<br />

“with the average student having<br />

$37,172 in student loan debt.”<br />

In a survey conducted of Maine<br />

West seniors, nearly a third are planning<br />

on taking out student loans for<br />

college, with another 30% unsure on<br />

whether or not they will be. The amount<br />

of money one takes out in loans can have<br />

a drastic impact later in life, since loans are<br />

generally very hard to pay back. Among West seniors,<br />

32% will be taking o<br />

student loans, and 11% p<br />

than $15,000. Whether t<br />

or not, the price of college<br />

for 83% of seniors in dete<br />

go to school.<br />

There are many other<br />

ing for college such as<br />

one earns through fi<br />

includes Pell grants<br />

repaid and loans that do ha<br />

are necessary -- whether t<br />

or a private lender, “you sh<br />

minimal amount of stude<br />

out subsidized loans, whic<br />

back until you graduate,<br />

loans, which you start payi<br />

out Federal loans instead o<br />

stitutions, and figure out<br />

have once you graduate so<br />

back as quickly as possible,<br />

Allyson Adams said.<br />

Whether or not yo<br />

from the federal g<br />

your college depe<br />

sets and income. Th<br />

Federal Student Aid (FAFS