usaid office of food for peace guatemala bellmon estimation

usaid office of food for peace guatemala bellmon estimation

usaid office of food for peace guatemala bellmon estimation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Prepared by Fintrac Inc.<br />

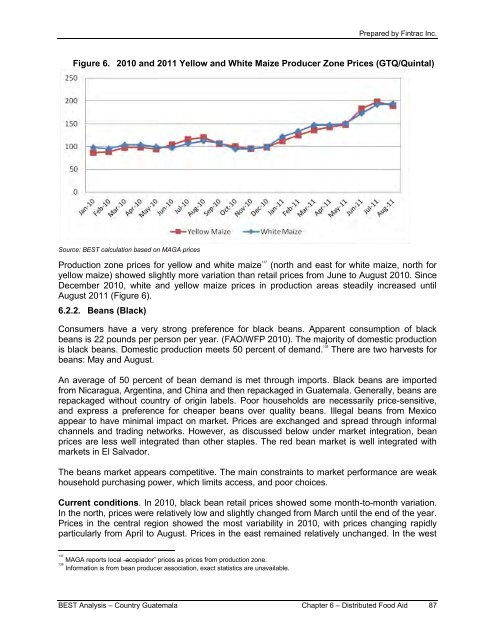

Figure 6. 2010 and 2011 Yellow and White Maize Producer Zone Prices (GTQ/Quintal)<br />

Source: BEST calculation based on MAGA prices<br />

Production zone prices <strong>for</strong> yellow and white maize 137<br />

(north and east <strong>for</strong> white maize, north <strong>for</strong><br />

yellow maize) showed slightly more variation than retail prices from June to August 2010. Since<br />

December 2010, white and yellow maize prices in production areas steadily increased until<br />

August 2011 (Figure 6).<br />

6.2.2. Beans (Black)<br />

Consumers have a very strong preference <strong>for</strong> black beans. Apparent consumption <strong>of</strong> black<br />

beans is 22 pounds per person per year. (FAO/WFP 2010). The majority <strong>of</strong> domestic production<br />

is black beans. Domestic production meets 50 percent <strong>of</strong> demand. 138<br />

There are two harvests <strong>for</strong><br />

beans: May and August.<br />

An average <strong>of</strong> 50 percent <strong>of</strong> bean demand is met through imports. Black beans are imported<br />

from Nicaragua, Argentina, and China and then repackaged in Guatemala. Generally, beans are<br />

repackaged without country <strong>of</strong> origin labels. Poor households are necessarily price-sensitive,<br />

and express a preference <strong>for</strong> cheaper beans over quality beans. Illegal beans from Mexico<br />

appear to have minimal impact on market. Prices are exchanged and spread through in<strong>for</strong>mal<br />

channels and trading networks. However, as discussed below under market integration, bean<br />

prices are less well integrated than other staples. The red bean market is well integrated with<br />

markets in El Salvador.<br />

The beans market appears competitive. The main constraints to market per<strong>for</strong>mance are weak<br />

household purchasing power, which limits access, and poor choices.<br />

Current conditions. In 2010, black bean retail prices showed some month-to-month variation.<br />

In the north, prices were relatively low and slightly changed from March until the end <strong>of</strong> the year.<br />

Prices in the central region showed the most variability in 2010, with prices changing rapidly<br />

particularly from April to August. Prices in the east remained relatively unchanged. In the west<br />

137<br />

MAGA reports local ―acopiador‖ prices as prices from production zone.<br />

138<br />

In<strong>for</strong>mation is from bean producer association, exact statistics are unavailable.<br />

BEST Analysis – Country Guatemala Chapter 6 – Distributed Food Aid 87