Notes for Payroll Software Developers - HM Revenue & Customs

Notes for Payroll Software Developers - HM Revenue & Customs

Notes for Payroll Software Developers - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

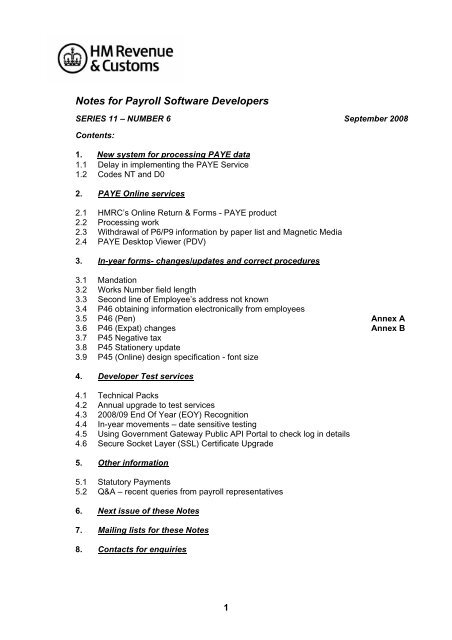

<strong>Notes</strong> <strong>for</strong> <strong>Payroll</strong> <strong>Software</strong> <strong>Developers</strong><br />

SERIES 11 – NUMBER 6 September 2008<br />

Contents:<br />

1. New system <strong>for</strong> processing PAYE data<br />

1.1 Delay in implementing the PAYE Service<br />

1.2 Codes NT and D0<br />

2. PAYE Online services<br />

2.1 <strong>HM</strong>RC’s Online Return & Forms - PAYE product<br />

2.2 Processing work<br />

2.3 Withdrawal of P6/P9 in<strong>for</strong>mation by paper list and Magnetic Media<br />

2.4 PAYE Desktop Viewer (PDV)<br />

3. In-year <strong>for</strong>ms- changes/updates and correct procedures<br />

3.1 Mandation<br />

3.2 Works Number field length<br />

3.3 Second line of Employee’s address not known<br />

3.4 P46 obtaining in<strong>for</strong>mation electronically from employees<br />

3.5 P46 (Pen) Annex A<br />

3.6 P46 (Expat) changes Annex B<br />

3.7 P45 Negative tax<br />

3.8 P45 Stationery update<br />

3.9 P45 (Online) design specification - font size<br />

4. Developer Test services<br />

4.1 Technical Packs<br />

4.2 Annual upgrade to test services<br />

4.3 2008/09 End Of Year (EOY) Recognition<br />

4.4 In-year movements – date sensitive testing<br />

4.5 Using Government Gateway Public API Portal to check log in details<br />

4.6 Secure Socket Layer (SSL) Certificate Upgrade<br />

5. Other in<strong>for</strong>mation<br />

5.1 Statutory Payments<br />

5.2 Q&A – recent queries from payroll representatives<br />

6. Next issue of these <strong>Notes</strong><br />

7. Mailing lists <strong>for</strong> these <strong>Notes</strong><br />

8. Contacts <strong>for</strong> enquiries<br />

1

1. New system <strong>for</strong> processing PAYE data<br />

1.1 Delay in implementing the PAYE Service<br />

We told you in Part 2 of the June 2008 issue of these <strong>Notes</strong> that there would be a<br />

disruption to PAYE services from 6 to 26 October 2008 while we moved all PAYE data to<br />

the NIRS computer in readiness <strong>for</strong> the introduction of the new PAYE Service.<br />

<strong>HM</strong>RC’s Executive Committee subsequently took the decision to defer the implementation<br />

of the new PAYE Service from October 2008. A new implementation date, will be<br />

determined by a number of factors, including the best time in the annual PAYE cycle, and<br />

we will let you know when this has been decided. Meanwhile, we will continue to process<br />

taxpayer data using the existing COP systems.<br />

As a result of this decision, there will not be a reduction in the service that we provide<br />

employers except <strong>for</strong> the five days to 27 October when they will be unable to use <strong>HM</strong>RC’s<br />

Online Return and Forms - PAYE product to send us in-year and end of year <strong>for</strong>ms.<br />

1.2 Codes NT and D0<br />

We told you in the November 2007 issue of <strong>Notes</strong> (Series 11 Number 2, para 2.7 item 5)<br />

that from April 2009, following employer requests that we intended to change code NT<br />

and D0 issue routines. This change was dependent on the availability of the new PAYE<br />

Service which has now been deferred.<br />

As a result, the procedures and notification of codes NT and D0 will remain the same <strong>for</strong><br />

the present time and both codes should be operated on a Week 1/Month 1 basis unless<br />

<strong>HM</strong>RC authorise otherwise.<br />

As this particular change needs to be made from the start of a tax year, implementation is<br />

now being planned <strong>for</strong> April 2010.<br />

2. PAYE Online Services<br />

2.1 <strong>HM</strong>RC’s Online Return and Forms – PAYE product<br />

From 22 - 26 October (inclusive) employers and agents will not be able to use <strong>HM</strong>RC's<br />

Online Return and Forms – PAYE product while we make improvements to it.<br />

Submissions using third party software or by Electronic Data Interchange (EDI) will not be<br />

affected. During these five days we will be deleting:<br />

• all Employer Annual Return (including amended Returns) submitted <strong>for</strong> tax years<br />

2003-04 and 2004-05<br />

• any other <strong>for</strong>ms and returns sent to us be<strong>for</strong>e 6 April 2005<br />

• anything else that has been entered on to the current system (including amended<br />

Returns) but has never actually been sent to us, irrespective of the date it was<br />

created.<br />

Once we have deleted this in<strong>for</strong>mation it will not be possible to access it.<br />

Also from 22 October - 26 October (inclusive) you will not be able to use our Domestic<br />

scheme or Charities, Assets and Residency (CAR) scheme. This involves <strong>for</strong>ms P12 and<br />

P37 (Domestics) and <strong>for</strong>ms CA3831 and CA3822 <strong>for</strong> applications of E101(CAR).<br />

2

The Regulations do not require employers to retain the 2003-04 or 2004-05 in<strong>for</strong>mation.<br />

But if employers or agents wish to keep it <strong>for</strong> their own purposes, we recommend they<br />

review all the pre-6 April 2005 in<strong>for</strong>mation they hold on Online Return and Forms – PAYE<br />

and decide whether they want to save it to their own system, print it off <strong>for</strong> their records, or<br />

send it to us. They should also review all the unsubmitted data and send it to <strong>HM</strong>RC if it is<br />

still required.<br />

2.2 Processing Work<br />

Processing of paper in-year <strong>for</strong>ms (P45, P46 and variations), PAYE repayments and<br />

re-referencing whole PAYE schemes are all unaffected by the ‘five days’ downtime <strong>for</strong><br />

the <strong>HM</strong>RC Online Returns and Forms – PAYE product.<br />

2.3 Withdrawal of P6/P9 in<strong>for</strong>mation by paper list and Magnetic Media<br />

As part of the planning work to move PAYE records, the facility to issue notification of bulk<br />

P6/P9 tax code changes by paper list and Magnetic Media has been withdrawn. The lists<br />

issued in August <strong>for</strong> the additional Personal Allowance <strong>for</strong> 2008-09 were the last. P9<br />

codes issued as a result of the 2009-10 Annual coding review in January/February will be<br />

the last to be issued by Magnetic Media. We wrote to all affected employers (or their<br />

agents) at the end of August to tell them of our plans.<br />

Because the default alternative is that employers will receive these tax codes in future as<br />

individual notices, we recommend that employers look to use an online option to receive<br />

codes and notices in the future. The current online options are:<br />

• receiving codes and notices through enabled software (if it has the facility to do so)<br />

• viewing codes through <strong>HM</strong>RC’s Data Provisioning Service (DPS)<br />

• Electronic Data Interchange (EDI)<br />

Employers not currently registered <strong>for</strong> online services will need to register and activate the<br />

service be<strong>for</strong>e receiving codes and notices. Employers who have registered, but have<br />

currently opted out of receiving codes and notices over the Internet, will need to use DPS<br />

to opt back in if they want to receive codes and notices through their software or DPS.<br />

There are demonstrations showing how to register <strong>for</strong> online services and opt in or out of<br />

receiving codes and notices online at www.hmrc.gov.uk/demo<br />

2.4 PAYE Desktop Viewer (PDV)<br />

We are aware that the current Data Provisioning Service (DPS) has limitations <strong>for</strong><br />

employers and agents who receive large numbers of codes and notices. We are working<br />

on an additional service that employers can download onto their own desktop which will<br />

allow them to download, manage and view the codes and notices they receive more<br />

effectively. More details about the PAYE Desktop Viewer (PDV) will be in the next edition<br />

of the notes.<br />

3

3. In-year <strong>for</strong>ms – changes/updates and correct procedures<br />

3.1 Mandation<br />

From 6 April 2009, employers with 50 or more employees must send starter and leaver<br />

in<strong>for</strong>mation (<strong>for</strong>ms P45, P46 and similar pension details) to <strong>HM</strong>RC online.<br />

A small analysis of employers with between 50 and 249 employees has indicated that<br />

significant numbers may be unaware of their responsibility to send in-year PAYE<br />

in<strong>for</strong>mation online. Please ensure that your customers are using in-year online enabled<br />

software and are starting to make online submissions sooner rather than later to get over<br />

any teething difficulties ahead of April 2009.<br />

We intend to do some further work to establish the reason <strong>for</strong> this lack of understanding.<br />

But it may highlight issues that arise when an agent submits the End of Year Return and<br />

leaves the employer responsible <strong>for</strong> the submission of all in-year <strong>for</strong>ms and whether in<br />

these circumstances the employer is aware of the changes and prepared <strong>for</strong> them.<br />

Additionally in some instances employers do not centralise the in-year payroll reporting<br />

function. In these circumstances the responsibility to notify <strong>HM</strong>RC of starters and leavers<br />

may rest with the local manager. You may want to confirm with your customers that their<br />

local managers have the right software to fulfil their online filing responsibility.<br />

We will continue to advertise the changes in our own publications (Employer Bulletin, <strong>for</strong><br />

example) but would be grateful <strong>for</strong> any help you are able to give when supporting your<br />

customers to introduce this change.<br />

Under current Government proposals, employers with fewer than 50 employees will have<br />

to file their PAYE End of Year Return online from 6 April 2010 and PAYE in-year <strong>for</strong>ms<br />

online from 6 April 2011.<br />

3.2 Works Number field length<br />

From April 2008, the field length <strong>for</strong> Works Numbers has increased to 35 characters <strong>for</strong><br />

starter and leaver <strong>for</strong>ms (P45, P46 and similar pension details).<br />

Please remember our current systems only allow a Works Number with a maximum of 20<br />

characters to be included on P14 <strong>for</strong>ms and we will only include a Works Number with a<br />

maximum of 20 characters on any output <strong>for</strong>ms (P6, P9).<br />

If employers include a Works Number with more than 20 characters on a starter or leaver<br />

<strong>for</strong>m, this would be truncated to 20 characters on any output <strong>for</strong>m.<br />

3.3 Second line of employee’s address not known<br />

Under PAYE Regulations 42 and 46 we expect employers to obtain, and provide <strong>HM</strong>RC<br />

with, a full address from their employee when the employment starts. But we do<br />

appreciate that this may not always be possible as only part of an address may be<br />

available.<br />

We have become aware that, in exceptional cases, employers do not hold a second line<br />

of address <strong>for</strong> some of their employees and as a result do not complete the online in-year<br />

<strong>for</strong>m’s address fields correctly. For example, they enter ‘Not Known’ or add the postcode<br />

of the employee on to the second line of the address. While entries of this kind will pass<br />

validation, it can cause problems with the data held <strong>for</strong> the employee when it is<br />

processed.<br />

4

Employers are asked to make every ef<strong>for</strong>t to obtain a full address <strong>for</strong> their employees. In<br />

exceptional cases, where they do not have any in<strong>for</strong>mation to complete the second line of<br />

the address field they should simply enter a single full stop and no other characters should<br />

be used. As this character is part of the normal allowable data character set, it will enable<br />

the in<strong>for</strong>mation to pass through our validation process more smoothly.<br />

In these circumstances we still require a full first line of address and wherever possible the<br />

employee’s postcode as this will enable us to data match the in<strong>for</strong>mation on our records.<br />

3.4 P46 - Obtaining in<strong>for</strong>mation electronically from employees<br />

From April 2008 we have allowed employers submitting <strong>for</strong>ms P46 online to obtain the<br />

P46 in<strong>for</strong>mation from new employees without the need <strong>for</strong> the employee to complete an<br />

actual hard copy <strong>for</strong>m. This is acceptable as long as the employee has been asked all the<br />

questions on the <strong>for</strong>m, and a suitable audit trail is held by the employer showing that the<br />

in<strong>for</strong>mation was provided by the employee.<br />

We are aware that some employers obtain this in<strong>for</strong>mation electronically from their<br />

employees and we would remind you that, should you have provided such a facility in your<br />

software products, the instructions to employers on page two of <strong>for</strong>m P46 now refer to<br />

earnings reaching the NIC lower earnings limit, rather than earnings reaching the tax<br />

threshold. You must ensure that this change is reflected in any product you have provided<br />

to ensure the employer follows the correct procedure.<br />

In some instances your product may refer to the tax threshold which from 7 September<br />

2008 is £116 per week.<br />

3.5 P46(Pen)<br />

In the November 2007 edition of these <strong>Notes</strong> (Series 11 Number 2 paragraph 2.7) we told<br />

you about a new <strong>for</strong>m P46(Pen) – Notification of pension starting, <strong>for</strong> use from April 2009.<br />

It will replace the P160 and PENNOT, but the field validations will follow those used <strong>for</strong><br />

other <strong>for</strong>ms in the P46 series. We realise that software developers may use the term<br />

PENNOT <strong>for</strong> development purposes, but it would be helpful if users of your software<br />

products could see this as a P46(Pen) and no reference is made to PENNOT. This will be<br />

in line with publicity given in our Guidance to employers.<br />

Employers who file online will be able to obtain the P46(Pen) in<strong>for</strong>mation from the pension<br />

recipient electronically provided that:<br />

• the in<strong>for</strong>mation from the pension recipient replicates exactly the same in<strong>for</strong>mation as<br />

required by the P46(Pen)<br />

• safeguards are in place to confirm that it was the pension recipient, and no one else,<br />

who had provided the in<strong>for</strong>mation<br />

• an adequate audit trail is maintained and is available to <strong>HM</strong>RC in support of any<br />

future query or compliance visit.<br />

The paper <strong>for</strong>m will be available from the Employer Orderline and employers will also be<br />

able to obtain the <strong>for</strong>m as a download from our website. General guidance <strong>for</strong> employers<br />

will be provided in the 2009 CWG2 booklet and on the 2009 Employer CD ROM.<br />

The dimensions <strong>for</strong> this <strong>for</strong>m, a copy of which is attached at Annex A of these <strong>Notes</strong>, are<br />

as follows:<br />

5

• Standard A4 portrait = 210mm wide x 297mm deep.<br />

The PDF of <strong>for</strong>m P46(Pen) is also held on the software developers pages of our website<br />

at http://www.hmrc.gov.uk/ebu/p46-pension.pdf<br />

3.6 Form P46(Expat) changes<br />

In the June issue of these <strong>Notes</strong> (Series 11 Number 5 paragraph 3.1) we provided further<br />

details of the new <strong>for</strong>m P46(Expat) to be introduced from April 2009 and included a PDF<br />

of the new <strong>for</strong>m. Since providing these details we have made 2 changes to the<br />

guidance/instruction text on the <strong>for</strong>m, the details are below.<br />

• On page 1 new text has been entered underneath the date field at the bottom of the<br />

page as follows:<br />

“Please now pass the <strong>for</strong>m back to your present employer <strong>for</strong> them to fill in<br />

page 2”<br />

• At the top of page 2, under the heading ‘Section two’ and at the end of the 3 rd line,<br />

NIC’s has been changed to NICs.<br />

You should reflect the above changes to the new <strong>for</strong>m in your software development<br />

plans. A copy of the revised PDF <strong>for</strong> the <strong>for</strong>m is held at Annex B of these <strong>Notes</strong>.<br />

There have been no changes to the layout of any field entry boxes or associated text.<br />

The PDF of <strong>for</strong>m P46(Expat) is also held on the software developers pages of our website<br />

at http://www.hmrc.gov.uk/ebu/p46-expat.pdf.<br />

3.7 P45 Negative tax<br />

We understand employers sometimes include negative tax figures on <strong>for</strong>m P45(1) under<br />

‘Total tax to date’ and Total tax in this employment’. This is incorrect. Where a tax refund<br />

is greater than tax paid the amount should be shown as £0.00 in accordance with<br />

Employer Handbook E13 Day to day payroll, part 7.<br />

3.8 P45 Stationery update<br />

In October 2008 new A4 sized <strong>for</strong>ms P45 will become available <strong>for</strong> use by employers,<br />

these will run alongside existing A5 sized <strong>for</strong>ms until 5 April 2009 when the smaller, A5<br />

size <strong>for</strong>ms, will be withdrawn. From 6 April 2009 employers should only use the new A4<br />

sized <strong>for</strong>ms P45.<br />

We are asking employers to note this and to consider this when requesting in-year<br />

stationery from October 2008 and April 2009. We are encouraging employers to switch to<br />

the new style <strong>for</strong>ms as soon as possible but we would like them to use any existing<br />

stationery stocks up to 5 April 2009. We are aware however that employers may need to<br />

use the existing P45s until they receive updated <strong>Payroll</strong> <strong>Software</strong>. Employers will need to<br />

be aware that if they wish to continue to use the old size <strong>for</strong>ms up to 5 April 2009 they will<br />

need to specify this when contacting the Employer Orderline. We are also asking<br />

6

employers not to order large quantities of the old sized stationery (unless actually<br />

required) as this will become obsolete.<br />

Employers are also being reminded that the introduction of the facility to print <strong>for</strong>m P45 on<br />

to plain paper using <strong>HM</strong>RCs Online Return and Forms – PAYE product from October<br />

2008 may also impact on the amount of P45 stationery they actually need to order.<br />

3.9 Form P45 (Online) design specification - font size<br />

Following the publication of the specification in the January 2008 issue of <strong>Notes</strong> (Series<br />

11 – Number 3 para 2.1) some software developers have reported problems in developing<br />

the P45(Online) as they only have the facility to work with integer font sizes and the<br />

specification requires they use intermediate sizes (e.g. 10.5 & 8.5 point). They have asked<br />

whether another font size can be used.<br />

We are checking the legal position but <strong>for</strong> the moment the font size in the technical<br />

specification must be used.<br />

We will issue a <strong>Software</strong> Developer Support Team (SDST) update as soon as we are<br />

able.<br />

4. Developer Test services<br />

4.1 Technical Packs<br />

End of Year (EOY)<br />

The 2009-10 EOY basic technical pack containing the main documents needed <strong>for</strong><br />

development is now available at http://www.hmrc.gov.uk/ebu/endofyear2010.htm<br />

Other documents will be added to the technical pack as they become available.<br />

The Quality Standards <strong>for</strong> the 2009/10 P35, P14 and 2009/10 P38A are now available and<br />

are located at http://www.hmrc.gov.uk/ebu/qual_stand.htm#6<br />

The 2009/10 EOY & P38A Desk Top Checker (DTC) will be available from mid-October<br />

2008<br />

For Electronic Data Interchange (EDI) developers, the Message Implementation<br />

Guidelines (MIG) <strong>for</strong> EOY 2009 -10 P14, P35 & P38A messages will be published in<br />

October 2008.<br />

In-year movement <strong>for</strong>ms<br />

Version 1.0 of the RIM Artefacts <strong>for</strong> 2009-10 in-year movements submissions were<br />

published at the end of August. Further supporting documentation will be included in the<br />

technical pack in the near future. The technical pack can be found at<br />

http://www.hmrc.gov.uk/ebu/paye_techpack/inyear09-10.htm<br />

From April 2009 all in-year movements <strong>for</strong>ms submitted over the Internet must be based<br />

on these latest validations. Submissions based on the current 2008-09 specifications will<br />

not be accepted after 5 April 2009.<br />

7

EDI MIGs version 6.0 <strong>for</strong> the P45(1), P45(3), P46 and PENNOT <strong>for</strong>ms are now available.<br />

We are planning to support both test and live submissions based on version 6 <strong>for</strong> the<br />

P45(1), P45(3), P46 and PENNOT from mid-October 2008 onwards, the P46(Expat) will<br />

be supported in test from mid-October 2008 and in live from April 2009. These can be<br />

found at http://www.hmrc.gov.uk/ebu/ebu_paye_ts.htm<br />

From April 2009 all in-year Movement <strong>for</strong>ms must be submitted using version 6 of the<br />

Message Implementation Guidelines (MIGs), version 5 messages will not be accepted<br />

after 5 April 2009.<br />

Expenses and Benefits<br />

In<strong>for</strong>mation and documentation <strong>for</strong> developers to commence development <strong>for</strong> Expenses<br />

and Benefits 2008/09 are available and can be found at<br />

http://www.hmrc.gov.uk/ebu/paye_techpack/expben2009.htm<br />

The technical pack will be updated once other documents and in<strong>for</strong>mation becomes<br />

available.<br />

4.2 Annual upgrade to test services<br />

The Internet test services, Third Party Validation Service (TPVS) <strong>for</strong> EOY & P38A<br />

2009-10, 2008-09 Expenses and Benefits and in-year movements <strong>for</strong>ms will be available<br />

to developers on 6th October 2008.<br />

We released an update to the in-year movements Local Testing Service (LTS) on<br />

15 September 2008.<br />

As a result of the annual upgrade to the developer test services, there will be a period of<br />

unavailability between 3rd October and 6th October 2008. The SDS team have already<br />

notified developers of this unavailability by email. <strong>Developers</strong> are requested to check the<br />

‘<strong>Developers</strong> Service Availability Page’ found within the Online services section of <strong>HM</strong>RC’s<br />

website under ‘In<strong>for</strong>mation <strong>for</strong> software developers’ as more specific details will be given<br />

nearer to the upgrade.<br />

4.3 2008-09 End of Year (EOY) Recognition<br />

The 2008-09 EOY recognition service is already available to developers. Amended<br />

2008/09 recognition scenarios which take into account the change to the rate band will be<br />

published to developers by the end of September 2008.<br />

4.4 In-year movements - date sensitive testing<br />

We told you about our plans to enhance the way in which date-sensitive testing are<br />

per<strong>for</strong>med in the June 08 <strong>Notes</strong> (para 4.4). LTS and TPVS test services <strong>for</strong> 2009-10<br />

in-year movements will validate dates in ‘real time’ in order to match the live service,<br />

meaning that any starting or leaving dates must be within the current date plus 30 days or<br />

earlier. To test payroll data which contains dates that occur further into the future than<br />

this, it will be possible to override the system clock within TPVS/LTS by including a<br />

pseudo test-date within the element of the GovTalkEnvelope. If no such<br />

value is present in the submission, the system date will be used by default.<br />

This functionality will not apply to submissions made by your customers using the live<br />

Internet service.<br />

The EDI test service can accept dates in the future – see MIG <strong>for</strong> details.<br />

8

4.5 Using Government Gateway Public API Portal to check log in details<br />

Earlier this year, new functionality was made available to allow third party software<br />

developers to extract additional in<strong>for</strong>mation via the Government Gateway <strong>for</strong> enrolments<br />

and service availability.<br />

Previously, feedback from developers advised their customers were only aware of a<br />

problem with their ‘log in’ details after a return was submitted online to <strong>HM</strong>RC.<br />

One of the key features now available is the ability to check the enrolment details <strong>for</strong> a<br />

specified user ID and password. As well as checking what services have been enrolled<br />

<strong>for</strong>, the user ID and password will also be validated whilst making the ‘SOAP’ call to the<br />

Public API Portal. The ‘SOAP’ calls to do this are:<br />

• GsoGetAssignedEnrolments - This method returns all of the enrolments that are<br />

assigned to the specified user ID & password.<br />

• GsoGetUserDetails - This method validates details of the calling user ID &<br />

password.<br />

4.6 Secure Socket Layer (SSL) Certificate Upgrade<br />

The Government Gateway is upgrading the SSL certificates from standard validation to<br />

extended validation in 2009. The VSIPS (Vendor Single Integrated Proving Service) test<br />

environment will be upgraded in March 2009 and the live service in November 2009.<br />

For more in<strong>for</strong>mation on these Gateway related features, as well other available features,<br />

please see the technical pack at:<br />

http://www.hmrc.gov.uk/ebu/gateway-techpack.htm or<br />

contact the <strong>Software</strong> <strong>Developers</strong> Support Team on 01274 534666 or by email at<br />

sdsteam@hmrc.gsi.gov.uk<br />

5. Other in<strong>for</strong>mation<br />

5.1 Statutory Payments<br />

Statutory Maternity Leave – salary sacrifice and non-cash benefits<br />

Employers often provide benefits under salary sacrifice arrangements. This is when an<br />

employee gives up the right to receive part of the cash pay due under their contract of<br />

employment – usually in return <strong>for</strong> the employer’s agreement to provide them with some<br />

sort of non-cash benefit.<br />

Following changes in the law in 2008 on what benefits employers must provide to<br />

employees on Statutory Maternity Leave (SML) we have published further in<strong>for</strong>mation and<br />

guidance. Note this guidance also applies to employees on Statutory Adoption Leave and<br />

is available to view at<br />

http://www.hmrc.gov.uk/employers/sml-salary-sacrifice.pdf<br />

9

Changes to Statutory Sick Pay (SSP) Forms<br />

We told you in the June issue of <strong>Notes</strong> (Series 11 No 5, para 4.8 item 3) that <strong>for</strong>m SSP1 is<br />

to change. The new style <strong>for</strong>m (version 10/08, has important changes which should be<br />

used by all employers from 27 October 2008 when Employment Support Allowance (ESA)<br />

replaces Incapacity Benefit and Income Support <strong>for</strong> new customers. The changes to<br />

SSP1 will make it quicker to complete – there will be less in<strong>for</strong>mation to report <strong>for</strong> benefit<br />

claims starting on or after 27 October 2008. Details of the changes can be found on the<br />

Department <strong>for</strong> Work and Pensions (DWP) website) at<br />

http://www.dwp.gov.uk/lifeevent/benefits/statutory_sick_pay.asp<br />

There will be no change to the list of reasons or the order of the reasons <strong>for</strong> non payment;<br />

and there will be no change to the category letters.<br />

SSP1 is given to an employee, by their employer, when SSP stops or is not payable. The<br />

old style <strong>for</strong>m may still be used in these circumstances after 27 October 2008 but some of<br />

the in<strong>for</strong>mation it asks <strong>for</strong> will no longer be necessary and it will be withdrawn in January<br />

2009. The new SSP1 is available now <strong>for</strong> cases where the employer knows that<br />

entitlement to SSP will end after 27 October 2008 but the period of sickness will continue,<br />

this is to allow <strong>for</strong> a smooth transition from SSP to ESA.<br />

SSP1 Northern Ireland<br />

A Northern Ireland version of the SSP1 will shortly be made available. This will be <strong>for</strong> use<br />

by employers in Northern Ireland and <strong>for</strong> employers based outside Northern Ireland in<br />

respect of their employees residing in Northern Ireland. Once this is published we will<br />

place a message in the “Whats New” section of our website at<br />

http://www.hmrc.gov.uk/news/index.htm<br />

5.2 Q&A – recent queries from payroll representatives<br />

1. I submitted a P45(3) to <strong>HM</strong>RC that included incorrect pay and tax details –<br />

what should I do?<br />

You should include the correct pay and tax on your P11 Deductions Working Sheet<br />

but notify <strong>HM</strong>RC of the error immediately either by letter or telephone. Do not<br />

submit a further P45(3).<br />

2. An existing employee wants to give me a P45(3) from a second job they’ve<br />

just left – can I accept it?<br />

No. Please advise the employee to send the P45(3) to their local office. The local<br />

office will review the code and issue an amended one if appropriate.<br />

3. I have already sent in a P46 <strong>for</strong> a new employee & received a P6, but now the<br />

employee has given me a P45(3) - can I destroy it?<br />

Yes. Do NOT include the pay and tax figures shown on the P45(3) in your tax<br />

calculations. Operate the code number shown on the P6 coding notification together<br />

with any pay and tax that have been included on that <strong>for</strong>m.<br />

10

4. What steps do I need to take if I sent you a P45(1) <strong>for</strong> an employee that I<br />

thought had left but they hadn’t?<br />

You should send a letter to the PAYE tax office confirming that the P45(1) was sent<br />

by mistake. You should also destroy all other parts of the <strong>for</strong>m.<br />

5. I am completing <strong>for</strong>m P45(3) <strong>for</strong> a new employee but I’m not sure if they will<br />

be paid be<strong>for</strong>e the next 5 th April – how do I show this?<br />

You should enter ‘P’ in box 11 or set the indicator if you are filing online and know<br />

the employee will not be paid between the start date and 5 April. Leave the<br />

box/indicator field blank if you are unsure.<br />

6. Can I continue issuing tax rebates to staff either on termination of<br />

employment and/or after the last pay day of the tax year, if there are no<br />

earnings every week?<br />

If a tax rebate is due at the date of termination or at the last pay day of the tax year<br />

you should make it. No further rebates should be given after either of these dates.<br />

7. I need to send <strong>HM</strong>RC a P45(3) or P46 but the employment start date and the<br />

date of the first payment do not always coincide – what do I need to do?<br />

Send the P45(3), showing the employment start date, to us as soon as a new<br />

employee hands one in (unless the circumstances at Q3 above apply). If you<br />

haven’t got a P45(3) from your new employee then you should send us a completed<br />

<strong>for</strong>m P46, again showing the employment start date, when the first payment is made<br />

to the employee.<br />

8. I am making a pension payment <strong>for</strong> the first time that includes some previous<br />

outstanding monthly pension payments. How do I tax this payment?<br />

You should tax the payment as one lump sum using the appropriate tax code<br />

number on a week 1 or month 1 basis. Please refer to booklet CWG2(2008)<br />

Employer Further Guide to PAYE and NICs, chapter 2, <strong>for</strong> advice on which tax code<br />

to use.<br />

9. My P45(3) submissions have been rejected because I have shown a<br />

cumulative tax code but haven't provided any previous pay or tax as the<br />

values relate to the previous tax year. The employee commenced within the<br />

first 6 weeks of this tax year – can you please advise on what we need to do in<br />

order <strong>for</strong> P45(3) to be accepted?<br />

You should submit the P45(3) including the previous pay and tax details even if they<br />

relate to a previous tax year. However, you should not include the amounts on your<br />

P11 Deductions Working Sheet <strong>for</strong> the current year. Please see page 2 of the<br />

Employer Helpbook E12(2008) PAYE and NICs rates and limits <strong>for</strong> more<br />

in<strong>for</strong>mation on which tax code to use.<br />

10. I sent a P46 <strong>for</strong> someone I thought would start an employment with me but<br />

didn’t, what should I do to avoid this scenario arising again?<br />

You should only send a P46 when making the first payment to the employee even<br />

if the first payment is not made until some months after the start date. The P46<br />

should show the ‘start’ date not the date the first payment is made.<br />

11

11. Can I accept P46 in<strong>for</strong>mation from my employee electronically?<br />

It is up to you to obtain the in<strong>for</strong>mation in a way that best suits your business need.<br />

The in<strong>for</strong>mation may be obtained from the employee either online or by using the<br />

employer’s own stationery as long as you keep a record of where the in<strong>for</strong>mation<br />

came from.<br />

12. When should I start deducting NICs from my employee’s wages?<br />

You should deduct NICs from an employee's wages providing<br />

• they are over age 16;<br />

• they are under state retirement pension age and;<br />

• their earnings are above the weekly, or equivalent, Earnings Threshold (ET).<br />

For more in<strong>for</strong>mation about deductions please refer to the Employer Helpbook<br />

E13(2008) Day to day payroll.<br />

13. My new employee has given me part 1A of their P45(3) – can I accept & use<br />

details from this?<br />

No – you should return the P45(1A) to your employee and ask <strong>for</strong> P45(2&3). If your<br />

employee is unable to provide these you must use <strong>for</strong>m P46.<br />

14. My agent filed my Employer Annual Return online late and as a result I’ve<br />

been charged a penalty – what do I do?<br />

Confirm with your accountant/agent that they are continuing to file your return.<br />

Ultimately completion of the return is your responsibility and Section 98A TMA 1970<br />

allows us to charge penalties if it is late.<br />

6. Next issue of these <strong>Notes</strong><br />

The next edition of these <strong>Notes</strong> is scheduled to follow the Chancellor’s Pre-Budget<br />

Report announcement in autumn 2008.<br />

7. Mailing lists <strong>for</strong> these <strong>Notes</strong><br />

The mailing options <strong>for</strong> the <strong>Notes</strong> are:<br />

• notification by email<br />

• notification by post<br />

• paper issue of these notes.<br />

Notification by email is the quickest and our preferred option. If you hold an email account<br />

& currently receive the ‘<strong>Notes</strong>’ mailing by post we recommend that you change to the<br />

email option. You can do this by sending details of your email address and company<br />

name to hmrcnotes@replyservice.co.uk stating ‘change option’ in the subject field.<br />

New requests to be included on the mailing list and notification of address changes<br />

should include details of your preferred option, your email address, company name<br />

and address and be sent by email to hmrcnotes@replyservice.co.uk<br />

Or you can write to:<br />

12

<strong>Notes</strong> <strong>for</strong> <strong>Payroll</strong> <strong>Software</strong> <strong>Developers</strong><br />

PO Box 17289<br />

Edinburgh<br />

EH12 1WY.<br />

If you wish to be removed from the mailing list please send your request, including details<br />

of your company name and address, by email to hmrcnotes@replyservice.co.uk stating<br />

‘unsubscribe’ in the subject field or write to the address shown above.<br />

8. Contacts <strong>for</strong> enquiries<br />

Where helpline numbers are shown <strong>for</strong> a specific topic within the <strong>Notes</strong> please phone<br />

the number quoted <strong>for</strong> more in<strong>for</strong>mation.<br />

Any other queries about the contents of the <strong>Notes</strong> should be made to the Online<br />

Services Helpdesk:<br />

email helpdesk@ir-efile.gov.uk<br />

phone 0845 60 55 999 (opening times - 8am to 8pm, 7 days a week)<br />

fax 0845 366 7828<br />

minicom 0845 366 7805<br />

If you contact the Online Services Helpdesk by email please state ‘<strong>Notes</strong> <strong>for</strong> <strong>Payroll</strong><br />

<strong>Software</strong> <strong>Developers</strong>’ in the subject field.<br />

Note: The Online Services Helpdesk cannot deal with change of mailing address<br />

in<strong>for</strong>mation; these should be directed to hmrcnotes@replyservice.co.uk<br />

Other useful contacts<br />

<strong>Software</strong> <strong>Developers</strong> requiring help and advice about the development of payroll<br />

software <strong>for</strong> online submissions should contact the <strong>Software</strong> Developer Support<br />

Team (SDST) by email at: sdsteam@hmrc.gsi.gov.uk or phone 01274 534666.<br />

Employers requiring help and advice about general payroll matters should contact<br />

their local <strong>HM</strong> <strong>Revenue</strong> & <strong>Customs</strong> Office or phone the Employer Helpline on<br />

0845 7 143 143.<br />

13

Pension recipient<br />

National Insurance number<br />

Title – enter MR, MRS, MISS, MS or other title<br />

Surname or family name<br />

First or given name(s)<br />

Gender. Enter 'X' in the appropriate box<br />

Male Female<br />

Notification of pension starting<br />

Fill in this <strong>for</strong>m <strong>for</strong> someone starting a pension. Use capital letters when completing this <strong>for</strong>m.<br />

You can also file online at www.hmrc.gov.uk<br />

There is guidance available in the Employer Helpbook E13 Day-to-day payroll and at www.hmrc.gov.uk<br />

About the pension/income drawdown/<br />

income withdrawal To be completed in all cases<br />

Employer PAYE reference<br />

Office number Reference number<br />

Employer name and address<br />

Postcode<br />

Date pension started DD MM YYYY<br />

Pension payroll number<br />

Annual pension<br />

£<br />

/<br />

Tax code in use Enter 'X' in box if Week 1/Month 1 applies<br />

•<br />

Date of birth DD MM YYYY<br />

Address<br />

Postcode<br />

Will this person receive this pension because they are a<br />

recently bereaved spouse or civil partner?<br />

No Yes<br />

Previous employment details If applicable please<br />

enter the following details.<br />

Previous employer PAYE reference<br />

Office number Reference number<br />

Previous employer name<br />

Date of leaving DD MM YYYY<br />

Total pay to date<br />

Total tax paid to date<br />

Tax code used Enter 'X' in box if Week 1/Month 1 applied<br />

Enter the week or month number below<br />

Week number Month number<br />

Complete this <strong>for</strong>m following the instructions in the Employer Helpbook E13 Day-to-day payroll.<br />

Send the completed <strong>for</strong>m to your <strong>HM</strong>RC office.<br />

P46(Pen) <strong>HM</strong>RC 07/08<br />

£<br />

£<br />

/<br />

•<br />

•

Section one To be completed by the employee<br />

Employee seconded to work in the UK<br />

Only fill in this <strong>for</strong>m if you have been seconded to work in the United Kingdom (UK).<br />

For the purposes of this <strong>for</strong>m only, a seconded employee includes:<br />

• individuals working wholly or partly in the UK <strong>for</strong> a UK resident employer on assignment whilst remaining employed by an<br />

overseas employer<br />

• individuals assigned to work wholly or partly in the UK at a recognised branch of their overseas employer’s business<br />

• all individuals included by an employer within a dedicated expatriate scheme<br />

• all individuals included by an employer within an expatriate modified PAYE scheme.<br />

Fill in section one, using capital letters, and then hand the <strong>for</strong>m back to your present employer.<br />

Your details<br />

National Insurance number<br />

Title - enter MR, MRS, MISS, MS or other title<br />

Surname or family name<br />

First or given name(s)<br />

Gender. Enter ‘X’ in the appropriate box<br />

Male Female<br />

Your present circumstances<br />

Read all the following statements carefully and<br />

enter ‘X’ in the one that applies to you.<br />

A – I intend to live in the UK <strong>for</strong><br />

more than six months<br />

OR<br />

B – I intend to live in the UK <strong>for</strong><br />

less than six months<br />

OR<br />

C – I will be working <strong>for</strong> the employer<br />

both inside and outside the UK,<br />

but will be living abroad<br />

A<br />

B<br />

C<br />

Date of birth DD MM YYYY<br />

UK address<br />

Postcode<br />

Enter ‘X’ if you are a European Economic Area<br />

or Commonwealth citizen<br />

Student Loans<br />

(UK Student Loans only – except Scotland)<br />

If you left a course of UK Higher Education be<strong>for</strong>e last<br />

6 April and received your first UK Student Loan<br />

instalment on or after 1 September 1998 and<br />

you have not fully repaid your Student Loan, enter<br />

an ‘X’ in box D. (If you are required to repay your<br />

Student Loan through your bank or building<br />

D<br />

society account do not enter an ‘X’ in box D.)<br />

Signature and date<br />

I can confirm that this in<strong>for</strong>mation is correct<br />

Signature<br />

Date DD MM YYYY<br />

Please now pass the <strong>for</strong>m back to your present employer<br />

<strong>for</strong> them to fill in page 2.<br />

P46(Expat) PDF Page 1 <strong>HM</strong>RC 06/08

Section two To be completed by the employer<br />

File your employee’s P46(Expat) online at www.hmrc.gov.uk<br />

Use capital letters when completing this <strong>for</strong>m. Guidance on how to fill it in is at www.hmrc.gov.uk<br />

Further in<strong>for</strong>mation is also held in booklet CWG2 Employer Further Guide to PAYE and NICs.<br />

Employment details<br />

Date employment started in UK DD MM YYYY<br />

Job title<br />

Employer’s details<br />

Employer PAYE reference<br />

Office number Reference number<br />

/<br />

Tax code used<br />

If you do not know the tax code to use or the current National Insurance contributions (NICs) lower earnings limit,<br />

go to www.hmrc.gov.uk<br />

Is there an entry in the box on page 1 asking if the employee<br />

is a European Economic Area or Commonwealth citizen?<br />

Yes Use the emergency code on a cumulative basis<br />

No If there is an entry in box A on page 1, use the<br />

emergency code on a cumulative basis.<br />

or,<br />

If there is an entry in boxes B or C on page 1,<br />

use the emergency code on a non-cumulative<br />

week 1 or month 1 basis.<br />

Page 2<br />

Works/payroll number and department or branch, if any<br />

Enter ‘X’ in this box if this is<br />

an EPM6 (Modified) scheme<br />

UK employer name and address<br />

Postcode<br />

Tax code used<br />

If week 1 or month 1 applies,<br />

enter 'X' in this box<br />

Send this <strong>for</strong>m to your <strong>HM</strong> <strong>Revenue</strong> & <strong>Customs</strong> office on date of arrival in the UK.