Inside this Issue - First Eagle Funds

Inside this Issue - First Eagle Funds

Inside this Issue - First Eagle Funds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

extremely large reserve base and extensive<br />

refining capacity are being significantly<br />

undervalued. The company has<br />

generated average annual EBITDA of €25<br />

billion, so even with a low multiple on<br />

that of six to seven times, the stock has<br />

50% upside. We’ve been buyers of Total<br />

directly as well.<br />

You described Cintas [CTAS] recently as<br />

a quintessential <strong>First</strong> <strong>Eagle</strong> idea. Why?<br />

AD: It’s a company that’s very easy to<br />

understand, with clear, basic competitive<br />

strengths and a cheap stock price. Its primary<br />

business is designing, manufacturing<br />

and servicing employee uniforms, and<br />

over time it has expanded the product line<br />

to include things like linens, fire extinguishers<br />

and janitorial supplies. It also<br />

has a document-management business,<br />

not unlike Iron Mountain’s.<br />

The key to Cintas’ business is the route<br />

density around centralized laundry and<br />

warehouse facilities. The more clients<br />

serviced within the radius of the facility,<br />

the higher the incremental margin earned<br />

on each additional client. Drivers are<br />

much more than just delivery people, they<br />

are customer-service contacts and are at<br />

least partly responsible for cross-selling<br />

additional services.<br />

The Cintas growth story was built<br />

around successfully driving the consolidation<br />

of a very fragmented industry. As<br />

the market leader in a business with significant<br />

scale economies, they’ve been<br />

able to translate their size into higher<br />

margins than their competitors, and have<br />

also made it difficult to compete with<br />

them on price.<br />

For a high-quality business, the share<br />

price hasn’t painted a happy picture for a<br />

long time.<br />

AD: As the business matured, the Street<br />

consistently marked down Cintas’ valuation.<br />

The share-price damage only accelerated<br />

as the economy went south in the<br />

latter half of last year. The company has<br />

responded by quickly reducing headcount<br />

and capital spending, but earnings have<br />

still been hit.<br />

We know what we’re getting here,<br />

which is a high-quality franchise, growing<br />

in the mid to low single-digits on the top<br />

line, that is trading at a low valuation<br />

based on muddle-through earnings<br />

power. That may be rather mundane, but<br />

we’ve historically done very well with<br />

these types of situations.<br />

Others have characterized the documentmanagement<br />

business as an interesting<br />

growth area. Do you agree?<br />

AD: There is potential for them to apply<br />

the same model to document management<br />

that they’ve used successfully in the<br />

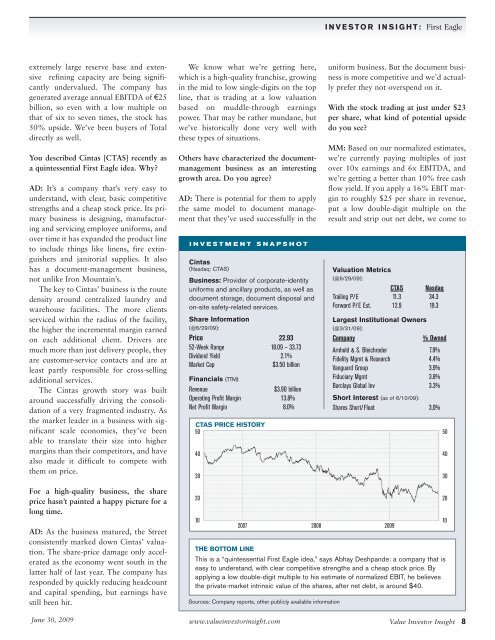

INVESTMENT SNAPSHOT<br />

Cintas<br />

(Nasdaq: CTAS)<br />

Business: Provider of corporate-identity<br />

uniforms and ancillary products, as well as<br />

document storage, document disposal and<br />

on-site safety-related services.<br />

Share Information<br />

(@6/29/09):<br />

Price 22.93<br />

52-Week Range 18.09 – 33.73<br />

Dividend Yield 2.1%<br />

Market Cap $3.50 billion<br />

Financials (TTM):<br />

Revenue $3.90 billion<br />

Operating Profit Margin 13.8%<br />

Net Profit Margin 8.0%<br />

CTAS PRICE HISTORY<br />

50<br />

June 30, 2009 www.valueinvestorinsight.com<br />

40<br />

30<br />

20<br />

10<br />

INVESTOR INSIGHT: <strong>First</strong> <strong>Eagle</strong><br />

2007 2008 2009<br />

uniform business. But the document business<br />

is more competitive and we’d actually<br />

prefer they not overspend on it.<br />

With the stock trading at just under $23<br />

per share, what kind of potential upside<br />

do you see?<br />

MM: Based on our normalized estimates,<br />

we’re currently paying multiples of just<br />

over 10x earnings and 6x EBITDA, and<br />

we’re getting a better than 10% free cash<br />

flow yield. If you apply a 16% EBIT margin<br />

to roughly $25 per share in revenue,<br />

put a low double-digit multiple on the<br />

result and strip out net debt, we come to<br />

THE BOTTOM LINE<br />

This is a “quintessential <strong>First</strong> <strong>Eagle</strong> idea,” says Abhay Deshpande: a company that is<br />

easy to understand, with clear competitive strengths and a cheap stock price. By<br />

applying a low double-digit multiple to his estimate of normalized EBIT, he believes<br />

the private-market intrinsic value of the shares, after net debt, is around $40.<br />

Sources: Company reports, other publicly available information<br />

Valuation Metrics<br />

(@6/29/09):<br />

CTAS Nasdaq<br />

Trailing P/E 11.3 34.3<br />

Forward P/E Est. 12.9 19.3<br />

Largest Institutional Owners<br />

(@3/31/09):<br />

Company % Owned<br />

Arnhold & S. Bleichroder 7.9%<br />

Fidelity Mgmt & Research 4.4%<br />

Vanguard Group 3.9%<br />

Fiduciary Mgmt 3.8%<br />

Barclays Global Inv<br />

Short Interest (as of 6/10/09):<br />

3.3%<br />

Shares Short/Float 3.0%<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Value Investor Insight 8