Hivetec-DES-Report-V1.4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

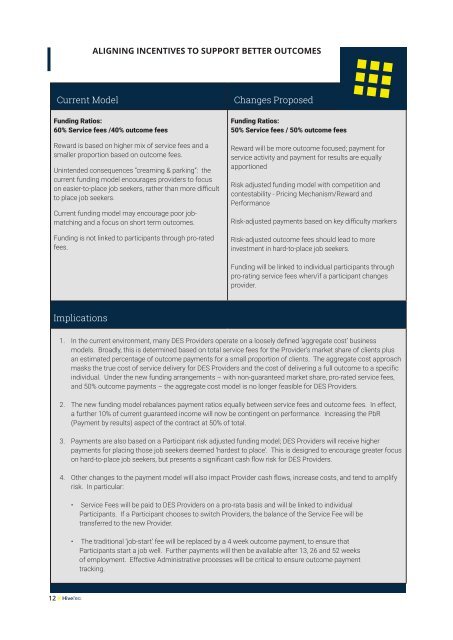

ALIGNING INCENTIVES TO SUPPORT BETTER OUTCOMES<br />

Current Model<br />

Funding Ratios:<br />

60% Service fees /40% outcome fees<br />

Reward is based on higher mix of service fees and a<br />

smaller proportion based on outcome fees.<br />

Unintended consequences “creaming & parking”: the<br />

current funding model encourages providers to focus<br />

on easier-to-place job seekers, rather than more difficult<br />

to place job seekers.<br />

Current funding model may encourage poor jobmatching<br />

and a focus on short term outcomes.<br />

Funding is not linked to participants through pro-rated<br />

fees.<br />

Changes Proposed<br />

Funding Ratios:<br />

50% Service fees / 50% outcome fees<br />

Reward will be more outcome focused; payment for<br />

service activity and payment for results are equally<br />

apportioned<br />

Risk adjusted funding model with competition and<br />

contestability - Pricing Mechanism/Reward and<br />

Performance<br />

Risk-adjusted payments based on key difficulty markers<br />

Risk-adjusted outcome fees should lead to more<br />

investment in hard-to-place job seekers.<br />

Funding will be linked to individual participants through<br />

pro-rating service fees when/if a participant changes<br />

provider.<br />

Implications<br />

1. In the current environment, many <strong>DES</strong> Providers operate on a loosely defined ‘aggregate cost’ business<br />

models. Broadly, this is determined based on total service fees for the Provider’s market share of clients plus<br />

an estimated percentage of outcome payments for a small proportion of clients. The aggregate cost approach<br />

masks the true cost of service delivery for <strong>DES</strong> Providers and the cost of delivering a full outcome to a specific<br />

individual. Under the new funding arrangements – with non-guaranteed market share, pro-rated service fees,<br />

and 50% outcome payments – the aggregate cost model is no longer feasible for <strong>DES</strong> Providers.<br />

2. The new funding model rebalances payment ratios equally between service fees and outcome fees. In effect,<br />

a further 10% of current guaranteed income will now be contingent on performance. Increasing the PbR<br />

(Payment by results) aspect of the contract at 50% of total.<br />

3. Payments are also based on a Participant risk adjusted funding model; <strong>DES</strong> Providers will receive higher<br />

payments for placing those job seekers deemed ‘hardest to place’. This is designed to encourage greater focus<br />

on hard-to-place job seekers, but presents a significant cash flow risk for <strong>DES</strong> Providers.<br />

4. Other changes to the payment model will also impact Provider cash flows, increase costs, and tend to amplify<br />

risk. In particular:<br />

• Service Fees will be paid to <strong>DES</strong> Providers on a pro-rata basis and will be linked to individual<br />

Participants. If a Participant chooses to switch Providers, the balance of the Service Fee will be<br />

transferred to the new Provider.<br />

• The traditional ‘job-start’ fee will be replaced by a 4 week outcome payment, to ensure that<br />

Participants start a job well. Further payments will then be available after 13, 26 and 52 weeks<br />

of employment. Effective Administrative processes will be critical to ensure outcome payment<br />

tracking.<br />

12