You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

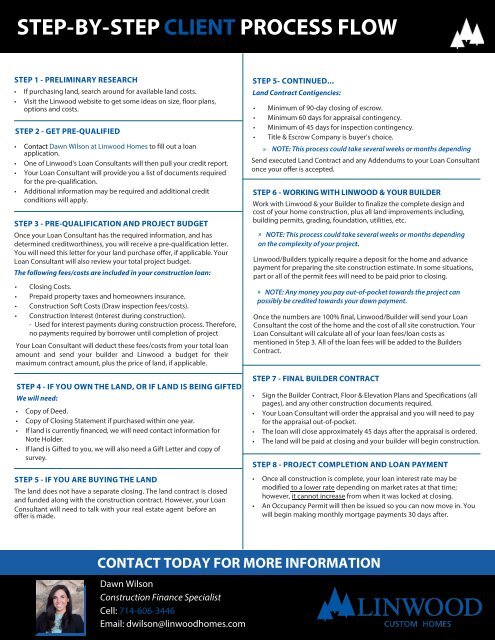

STEP-BY-STEP CLIENT PROCESS FLOW<br />

STEP 1 - PRELIMINARY RESEARCH<br />

• If purchasing land, search around for available land costs.<br />

• Visit to get some ideas on size, floor plans,<br />

options and costs.<br />

STEP 2 - GET PRE-QUALIFIED<br />

• Contact Dawn Wilson at Linwood Homes to fill out a loan<br />

application.<br />

• One of Linwood's Loan Consultants will then pull your credit report.<br />

• Your Loan Consultant will provide you a list of documents required<br />

for the pre-qualification.<br />

• Additional information may be required and additional credit<br />

conditions will apply.<br />

STEP 3 - PRE-QUALIFICATION AND PROJECT BUDGET<br />

Once your Loan Consultant has the required information, and has<br />

determined creditworthiness, you will receive a pre-qualification letter.<br />

You will need this letter for your land purchase offer, if applicable. Your<br />

Loan Consultant will also review your total project budget.<br />

The following fees/costs are included in your construction loan:<br />

• Closing Costs.<br />

• Prepaid property taxes and homeowners insurance.<br />

• Construction Soft Costs (Draw inspection fees/costs).<br />

• Construction Interest (Interest during construction).<br />

- Used for interest payments during construction process. Therefore,<br />

no payments required by borrower until completion of project<br />

Your Loan Consultant will deduct these fees/costs from your total loan<br />

amount and send your builder a budget for their<br />

maximum contract amount, plus the price of land, if applicable.<br />

STEP 4 - IF YOU OWN THE LAND, OR IF LAND IS BEING GIFTED<br />

We will need:<br />

• Copy of Deed.<br />

• Copy of Closing Statement if purchased within one year.<br />

• If land is currently financed, we will need contact information for<br />

Note Holder.<br />

• If land is Gifted to you, we will also need a Gift Letter and copy of<br />

survey.<br />

STEP 5 - IF YOU ARE BUYING THE LAND<br />

The land does not have a separate closing. The land contract is closed<br />

and funded along with the construction contract. However, your Loan<br />

Consultant will need to talk with your real estate agent before an<br />

offer is made.<br />

STEP 5- CONTINUED...<br />

Land Contract Contigencies:<br />

• Minimum of 90-day closing of escrow.<br />

• Minimum 60 days for appraisal contingency.<br />

• Minimum of 45 days for inspection contingency.<br />

• Title & Escrow Company is buyer’s choice.<br />

» NOTE: This process could take several weeks or months depending<br />

Send executed Land Contract and any Addendums to your Loan Consultant<br />

once your offer is accepted.<br />

STEP 6 - WORKING WITH LINWOOD & YOUR BUILDER<br />

Work with to finalize the complete design and<br />

cost of your home construction, plus all land improvements including,<br />

building permits, grading, foundation, utilities, etc.<br />

» NOTE: This process could take several weeks or months depending<br />

on the complexity of your project.<br />

typically require a deposit for the home and advance<br />

payment for preparing the site construction estimate. In some situations,<br />

part or all of the permit fees will need to be paid prior to closing.<br />

» NOTE: Any money you pay out-of-pocket towards the project can<br />

possibly be credited towards your down payment.<br />

Once the numbers are 100% final, will send your Loan<br />

Consultant the cost of the home and the cost of all site construction. Your<br />

Loan Consultant will calculate all of your loan fees/loan costs as<br />

mentioned in Step 3. All of the loan fees will be added to the Builders<br />

Contract.<br />

STEP 7 - FINAL BUILDER CONTRACT<br />

• Sign the BuilderContract, Floor & Elevation Plans and Specifications (all<br />

pages), and any other construction documents required.<br />

• Your Loan Consultant will order the appraisal and you will need to pay<br />

for the appraisal out-of-pocket.<br />

• The loan will close approximately 45 days after the appraisal is ordered.<br />

• The land will be paid at closing and your builder will begin construction.<br />

STEP 8 - PROJECT COMPLETION AND LOAN PAYMENT<br />

• Once all construction is complete, your loan interest rate may be<br />

modified to a lower rate depending on market rates at that time;<br />

however, it cannot increase from when it was locked at closing.<br />

• An Occupancy Permit will then be issued so you can now move in. You<br />

will begin making monthly mortgage payments 30 days after.<br />

CONTACT TODAY FOR MORE INFORMATION<br />

Dawn Wilson<br />

Construction Finance Specialist<br />

Cell: 714-606-3446<br />

Email: dwilson@linwoodhomes.com