WCN April 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

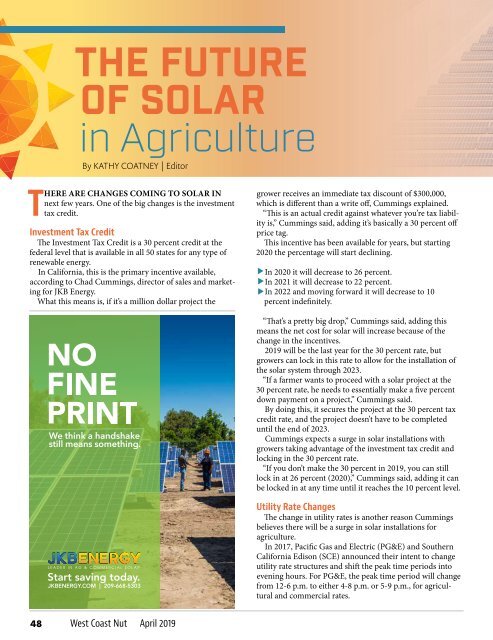

The Future<br />

of Solar<br />

in Agriculture<br />

By KATHY COATNEY | Editor<br />

THERE ARE CHANGES COMING TO SOLAR IN<br />

next few years. One of the big changes is the investment<br />

tax credit.<br />

Investment Tax Credit<br />

The Investment Tax Credit is a 30 percent credit at the<br />

federal level that is available in all 50 states for any type of<br />

renewable energy.<br />

In California, this is the primary incentive available,<br />

according to Chad Cummings, director of sales and marketing<br />

for JKB Energy.<br />

What this means is, if it’s a million dollar project the<br />

grower receives an immediate tax discount of $300,000,<br />

which is different than a write off, Cummings explained.<br />

“This is an actual credit against whatever you’re tax liability<br />

is,” Cummings said, adding it’s basically a 30 percent off<br />

price tag.<br />

This incentive has been available for years, but starting<br />

2020 the percentage will start declining.<br />

In 2020 it will decrease to 26 percent.<br />

In 2021 it will decrease to 22 percent.<br />

In 2022 and moving forward it will decrease to 10<br />

percent indefinitely.<br />

“That’s a pretty big drop,” Cummings said, adding this<br />

means the net cost for solar will increase because of the<br />

change in the incentives.<br />

<strong>2019</strong> will be the last year for the 30 percent rate, but<br />

growers can lock in this rate to allow for the installation of<br />

the solar system through 2023.<br />

“If a farmer wants to proceed with a solar project at the<br />

30 percent rate, he needs to essentially make a five percent<br />

down payment on a project,” Cummings said.<br />

By doing this, it secures the project at the 30 percent tax<br />

credit rate, and the project doesn’t have to be completed<br />

until the end of 2023.<br />

Cummings expects a surge in solar installations with<br />

growers taking advantage of the investment tax credit and<br />

locking in the 30 percent rate.<br />

“If you don’t make the 30 percent in <strong>2019</strong>, you can still<br />

lock in at 26 percent (2020),” Cummings said, adding it can<br />

be locked in at any time until it reaches the 10 percent level.<br />

Utility Rate Changes<br />

The change in utility rates is another reason Cummings<br />

believes there will be a surge in solar installations for<br />

agriculture.<br />

In 2017, Pacific Gas and Electric (PG&E) and Southern<br />

California Edison (SCE) announced their intent to change<br />

utility rate structures and shift the peak time periods into<br />

evening hours. For PG&E, the peak time period will change<br />

from 12-6 p.m. to either 4-8 p.m. or 5-9 p.m., for agricultural<br />

and commercial rates.<br />

48<br />

West Coast Nut <strong>April</strong> <strong>2019</strong>