Radiation Hardened Electronics Market Trends

Radiation hardened electronics are manufactured to be radiation resistant to operate in harsh environments. The manufacturing and development of reliable and robust radiation hardened electronic components is expensive. Additionally, the demand for radiation hardened electronics is apparently low, which makes it even more costly. Due to immense cost involved in the testing and development of radiation hardened electronics, the market tends to lack developments.

Radiation hardened electronics are manufactured to be radiation resistant to operate in harsh environments. The manufacturing and development of reliable and robust radiation hardened electronic components is expensive. Additionally, the demand for radiation hardened electronics is apparently low, which makes it even more costly. Due to immense cost involved in the testing and development of radiation hardened electronics, the market tends to lack developments.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

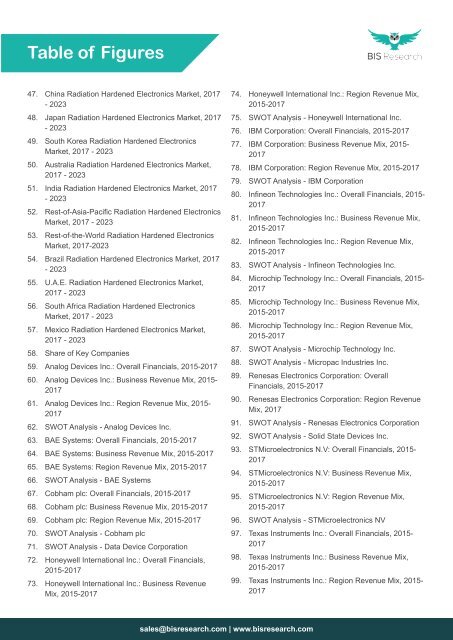

Table of Figures<br />

47. China <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>, 2017<br />

- 2023<br />

48. Japan <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>, 2017<br />

- 2023<br />

49. South Korea <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong><br />

<strong>Market</strong>, 2017 - 2023<br />

50. Australia <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>,<br />

2017 - 2023<br />

51. India <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>, 2017<br />

- 2023<br />

52. Rest-of-Asia-Pacific <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong><br />

<strong>Market</strong>, 2017 - 2023<br />

53. Rest-of-the-World <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong><br />

<strong>Market</strong>, 2017-2023<br />

54. Brazil <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>, 2017<br />

- 2023<br />

55. U.A.E. <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>,<br />

2017 - 2023<br />

56. South Africa <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong><br />

<strong>Market</strong>, 2017 - 2023<br />

57. Mexico <strong>Radiation</strong> <strong>Hardened</strong> <strong>Electronics</strong> <strong>Market</strong>,<br />

2017 - 2023<br />

58. Share of Key Companies<br />

59. Analog Devices Inc.: Overall Financials, 2015-2017<br />

60. Analog Devices Inc.: Business Revenue Mix, 2015-<br />

2017<br />

61. Analog Devices Inc.: Region Revenue Mix, 2015-<br />

2017<br />

62. SWOT Analysis - Analog Devices Inc.<br />

63. BAE Systems: Overall Financials, 2015-2017<br />

64. BAE Systems: Business Revenue Mix, 2015-2017<br />

65. BAE Systems: Region Revenue Mix, 2015-2017<br />

66. SWOT Analysis - BAE Systems<br />

67. Cobham plc: Overall Financials, 2015-2017<br />

68. Cobham plc: Business Revenue Mix, 2015-2017<br />

69. Cobham plc: Region Revenue Mix, 2015-2017<br />

70. SWOT Analysis - Cobham plc<br />

71. SWOT Analysis - Data Device Corporation<br />

72. Honeywell International Inc.: Overall Financials,<br />

2015-2017<br />

73. Honeywell International Inc.: Business Revenue<br />

Mix, 2015-2017<br />

74. Honeywell International Inc.: Region Revenue Mix,<br />

2015-2017<br />

75. SWOT Analysis - Honeywell International Inc.<br />

76. IBM Corporation: Overall Financials, 2015-2017<br />

77. IBM Corporation: Business Revenue Mix, 2015-<br />

2017<br />

78. IBM Corporation: Region Revenue Mix, 2015-2017<br />

79. SWOT Analysis - IBM Corporation<br />

80. Infineon Technologies Inc.: Overall Financials, 2015-<br />

2017<br />

81. Infineon Technologies Inc.: Business Revenue Mix,<br />

2015-2017<br />

82. Infineon Technologies Inc.: Region Revenue Mix,<br />

2015-2017<br />

83. SWOT Analysis - Infineon Technologies Inc.<br />

84. Microchip Technology Inc.: Overall Financials, 2015-<br />

2017<br />

85. Microchip Technology Inc.: Business Revenue Mix,<br />

2015-2017<br />

86. Microchip Technology Inc.: Region Revenue Mix,<br />

2015-2017<br />

87. SWOT Analysis - Microchip Technology Inc.<br />

88. SWOT Analysis - Micropac Industries Inc.<br />

89. Renesas <strong>Electronics</strong> Corporation: Overall<br />

Financials, 2015-2017<br />

90. Renesas <strong>Electronics</strong> Corporation: Region Revenue<br />

Mix, 2017<br />

91. SWOT Analysis - Renesas <strong>Electronics</strong> Corporation<br />

92. SWOT Analysis - Solid State Devices Inc.<br />

93. STMicroelectronics N.V: Overall Financials, 2015-<br />

2017<br />

94. STMicroelectronics N.V: Business Revenue Mix,<br />

2015-2017<br />

95. STMicroelectronics N.V: Region Revenue Mix,<br />

2015-2017<br />

96. SWOT Analysis - STMicroelectronics NV<br />

97. Texas Instruments Inc.: Overall Financials, 2015-<br />

2017<br />

98. Texas Instruments Inc.: Business Revenue Mix,<br />

2015-2017<br />

99. Texas Instruments Inc.: Region Revenue Mix, 2015-<br />

2017<br />

sales@bisresearch.com | www.bisresearch.com