Inglewood Business Magazine May 2019

In This Issue - IBM recognizes Darrell Brown of US Bank. Parker Lighting | Smart Business | Small Business Advice and much more!

In This Issue - IBM recognizes Darrell Brown of US Bank. Parker Lighting | Smart Business | Small Business Advice and much more!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Insurance | <strong>Inglewood</strong> <strong>Business</strong> <strong>Magazine</strong><br />

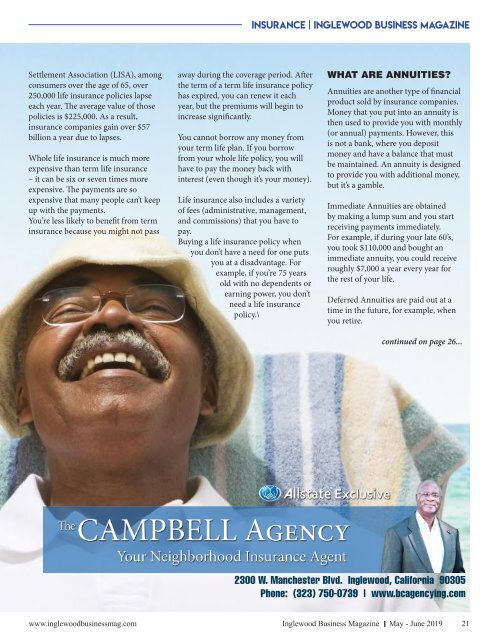

Settlement Association (LISA), among<br />

consumers over the age of 65, over<br />

250,000 life insurance policies lapse<br />

each year. The average value of those<br />

policies is $225,000. As a result,<br />

insurance companies gain over $57<br />

billion a year due to lapses.<br />

Whole life insurance is much more<br />

expensive than term life insurance<br />

– it can be six or seven times more<br />

expensive. The payments are so<br />

expensive that many people can’t keep<br />

up with the payments.<br />

You’re less likely to benefit from term<br />

insurance because you might not pass<br />

away during the coverage period. After<br />

the term of a term life insurance policy<br />

has expired, you can renew it each<br />

year, but the premiums will begin to<br />

increase significantly.<br />

You cannot borrow any money from<br />

your term life plan. If you borrow<br />

from your whole life policy, you will<br />

have to pay the money back with<br />

interest (even though it’s your money).<br />

Life insurance also includes a variety<br />

of fees (administrative, management,<br />

and commissions) that you have to<br />

pay.<br />

Buying a life insurance policy when<br />

you don’t have a need for one puts<br />

you at a disadvantage. For<br />

example, if you’re 75 years<br />

old with no dependents or<br />

earning power, you don’t<br />

need a life insurance<br />

policy.\<br />

WHAT ARE ANNUITIES?<br />

Annuities are another type of financial<br />

product sold by insurance companies.<br />

Money that you put into an annuity is<br />

then used to provide you with monthly<br />

(or annual) payments. However, this<br />

is not a bank, where you deposit<br />

money and have a balance that must<br />

be maintained. An annuity is designed<br />

to provide you with additional money,<br />

but it’s a gamble.<br />

Immediate Annuities are obtained<br />

by making a lump sum and you start<br />

receiving payments immediately.<br />

For example, if during your late 60’s,<br />

you took $110,000 and bought an<br />

immediate annuity, you could receive<br />

roughly $7,000 a year every year for<br />

the rest of your life.<br />

Deferred Annuities are paid out at a<br />

time in the future, for example, when<br />

you retire.<br />

continued on page 26...<br />

2300 W. Manchester Blvd. <strong>Inglewood</strong>, California 90305<br />

Phone: (323) 750-0739 | www.bcagencying.com<br />

www.inglewoodbusinessmag.com<br />

<strong>Inglewood</strong> <strong>Business</strong> <strong>Magazine</strong> <strong>May</strong> - June <strong>2019</strong><br />

21