Wills, Trusts & Estates

Wills, Trusts & Estates

Wills, Trusts & Estates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 2 of 190

Walk by Faith; Serve with Abandon<br />

✅Expect to Win!<br />

Page 3 of 190

Page 4 of 190

The Advocacy Foundation, Inc.<br />

Helping Individuals, Organizations & Communities<br />

Achieve Their Full Potential<br />

Since its founding in 2003, The Advocacy Foundation has become recognized as an effective<br />

provider of support to those who receive our services, having real impact within the communities<br />

we serve. We are currently engaged in community and faith-based collaborative initiatives,<br />

having the overall objective of eradicating all forms of youth violence and correcting injustices<br />

everywhere. In carrying-out these initiatives, we have adopted the evidence-based strategic<br />

framework developed and implemented by the Office of Juvenile Justice & Delinquency<br />

Prevention (OJJDP).<br />

The stated objectives are:<br />

1. Community Mobilization;<br />

2. Social Intervention;<br />

3. Provision of Opportunities;<br />

4. Organizational Change and Development;<br />

5. Suppression [of illegal activities].<br />

Moreover, it is our most fundamental belief that in order to be effective, prevention and<br />

intervention strategies must be Community Specific, Culturally Relevant, Evidence-Based, and<br />

Collaborative. The Violence Prevention and Intervention programming we employ in<br />

implementing this community-enhancing framework include the programs further described<br />

throughout our publications, programs and special projects both domestically and<br />

internationally.<br />

www.Advocacy.Foundation<br />

ISBN: ......... ../2017<br />

......... Printed in the USA<br />

Advocacy Foundation Publishers<br />

Philadelphia, PA<br />

(878) 222-0450 | Voice | Data | SMS<br />

Page 5 of 190

Page 6 of 190

Dedication<br />

______<br />

Every publication in our many series’ is dedicated to everyone, absolutely everyone, who by<br />

virtue of their calling and by Divine inspiration, direction and guidance, is on the battlefield dayafter-day<br />

striving to follow God’s will and purpose for their lives. And this is with particular affinity<br />

for those Spiritual warriors who are being transformed into excellence through daily academic,<br />

professional, familial, and other challenges.<br />

We pray that you will bear in mind:<br />

Matthew 19:26 (NLT)<br />

Jesus looked at them intently and said, “Humanly speaking, it is impossible.<br />

But with God everything is possible.” (Emphasis added)<br />

To all of us who daily look past our circumstances, and naysayers, to what the Lord says we will<br />

accomplish:<br />

Blessings!!<br />

- The Advocacy Foundation, Inc.<br />

Page 7 of 190

Page 8 of 190

The Transformative Justice Project<br />

Eradicating Juvenile Delinquency Requires a Multi-Disciplinary Approach<br />

The Juvenile Justice system is incredibly<br />

overloaded, and Solutions-Based programs are<br />

woefully underfunded. Our precious children,<br />

therefore, particularly young people of color, often<br />

get the “swift” version of justice whenever they<br />

come into contact with the law.<br />

Decisions to build prison facilities are often based<br />

on elementary school test results, and our country<br />

incarcerates more of its young than any other<br />

nation on earth. So we at The Foundation labor to<br />

pull our young people out of the “school to prison”<br />

pipeline, and we then coordinate the efforts of the<br />

legal, psychological, governmental and<br />

educational professionals needed to bring an end<br />

to delinquency.<br />

We also educate families, police, local businesses,<br />

elected officials, clergy, schools and other<br />

stakeholders about transforming whole communities, and we labor to change their<br />

thinking about the causes of delinquency with the goal of helping them embrace the<br />

idea of restoration for the young people in our care who demonstrate repentance for<br />

their mistakes.<br />

The way we accomplish all this is a follows:<br />

1. We vigorously advocate for charges reductions, wherever possible, in the<br />

adjudicatory (court) process, with the ultimate goal of expungement or pardon, in<br />

order to maximize the chances for our clients to graduate high school and<br />

progress into college, military service or the workforce without the stigma of a<br />

criminal record;<br />

2. We then endeavor to enroll each young person into an Evidence-Based, Data-<br />

Driven Transformative Justice program designed to facilitate their rehabilitation<br />

and subsequent reintegration back into the community;<br />

3. While those projects are operating, we conduct a wide variety of ComeUnity-<br />

ReEngineering seminars and workshops on topics ranging from Juvenile Justice<br />

to Parental Rights, to Domestic issues to Police friendly contacts, to Mental<br />

Health intervention, to CBO and FBO accountability and compliance;<br />

Page 9 of 190

4. Throughout the process, we encourage and maintain frequent personal contact<br />

between all parties;<br />

5 Throughout the process we conduct a continuum of events and fundraisers<br />

designed to facilitate collaboration among professionals and community<br />

stakeholders; and finally<br />

6. 1 We disseminate Monthly and Quarterly publications, like our e-Advocate series<br />

Newsletter and our e-Advocate Monthly and Quarterly Electronic Compilations to<br />

all regular donors in order to facilitate a lifelong learning process on the everevolving<br />

developments in both the Adult and Juvenile Justice systems.<br />

And in addition to the help we provide for our young clients and their families, we also<br />

facilitate Community Engagement through the Transformative Justice process,<br />

thereby balancing the interests of local businesses, schools, clergy, social<br />

organizations, elected officials, law enforcement entities, and other interested<br />

stakeholders. Through these efforts, relationships are built, rebuilt and strengthened,<br />

local businesses and communities are enhanced & protected from victimization, young<br />

careers are developed, and our precious young people are kept out of the prison<br />

pipeline.<br />

Additionally, we develop Transformative “Void Resistance” (TVR) initiatives to elevate<br />

concerns of our successes resulting in economic hardship for those employed by the<br />

penal system.<br />

TVR is an innovative-comprehensive process that works in conjunction with our<br />

Transformative Justice initiatives to transition the original use and purpose of current<br />

systems into positive social impact operations, which systematically retrains current<br />

staff, renovates facilities, creates new employment opportunities, increases salaries and<br />

is data-proven to enhance employee’s mental wellbeing and overall quality of life – an<br />

exponential Transformative Social Impact benefit for ALL community stakeholders.<br />

This is a massive undertaking, and we need all the help and financial support you can<br />

give! We plan to help 75 young persons per quarter-year (aggregating to a total of 250<br />

per year) in each jurisdiction we serve) at an average cost of under $2,500 per client,<br />

per year. *<br />

Thank you in advance for your support!<br />

* FYI:<br />

1 In addition to supporting our world-class programming and support services, all regular donors receive our Quarterly e-Newsletter<br />

(The e-Advocate), as well as The e-Advocate Quarterly Magazine.<br />

Page 10 of 190

1. The national average cost to taxpayers for minimum-security youth incarceration,<br />

is around $43,000.00 per child, per year.<br />

2. The average annual cost to taxpayers for maximum-security youth incarceration<br />

is well over $148,000.00 per child, per year.<br />

- (US News and World Report, December 9, 2014);<br />

3. In every jurisdiction in the nation, the Plea Bargaining rate is above 99%.<br />

The Judicial system engages in a tri-partite balancing task in every single one of these<br />

matters, seeking to balance Rehabilitative Justice with Community Protection and<br />

Judicial Economy, and, although the practitioners work very hard to achieve positive<br />

outcomes, the scales are nowhere near balanced where people of color are involved.<br />

We must reverse this trend, which is right now working very much against the best<br />

interests of our young.<br />

Our young people do not belong behind bars.<br />

- Jack Johnson<br />

Page 11 of 190

Page 12 of 190

The Advocacy Foundation, Inc.<br />

Helping Individuals, Organizations & Communities<br />

Achieve Their Full Potential<br />

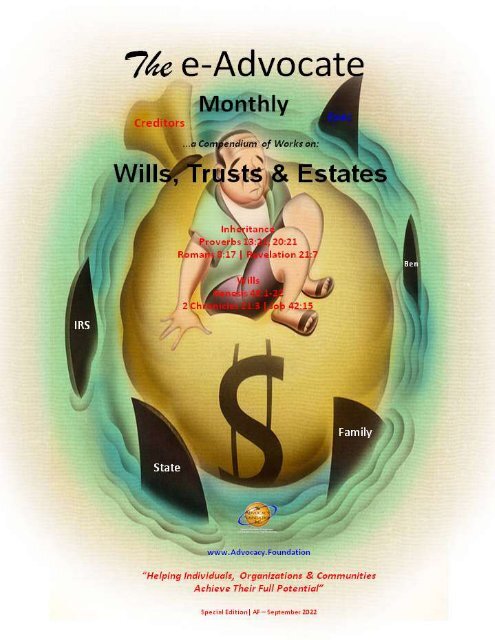

…a compendium of works on<br />

<strong>Wills</strong>, <strong>Trusts</strong> & <strong>Estates</strong><br />

“Turning the Improbable Into the Exceptional”<br />

Atlanta<br />

Philadelphia<br />

______<br />

John C Johnson III<br />

Founder & CEO<br />

(878) 222-0450<br />

Voice | Data | SMS<br />

www.Advocacy.Foundation<br />

Page 13 of 190

Page 14 of 190

Biblical Authority<br />

______<br />

Inheritance<br />

Proverbs 13:22 (NIV)<br />

22<br />

A good person leaves an inheritance for their children’s children,<br />

but a sinner’s wealth is stored up for the righteous.<br />

Proverbs 20:21<br />

21<br />

An inheritance claimed too soon will not be blessed at the end.<br />

Romans 8:17<br />

17<br />

Now if we are children, then we are heirs—heirs of God and co-heirs with Christ, if<br />

indeed we share in his sufferings in order that we may also share in his glory.<br />

Revelation 21:7<br />

7<br />

Those who are victorious will inherit all this, and I will be their God and they will be my<br />

children.<br />

________<br />

<strong>Wills</strong><br />

Genesis 48 (NIV)<br />

Manasseh and Ephraim<br />

Some time later Joseph was told, “Your father is ill.” So he took his two sons Manasseh<br />

and Ephraim along with him. 2 When Jacob was told, “Your son Joseph has come to<br />

you,” Israel rallied his strength and sat up on the bed.<br />

3<br />

Jacob said to Joseph, “God Almighty [a] appeared to me at Luz in the land of Canaan,<br />

and there he blessed me 4 and said to me, ‘I am going to make you fruitful and increase<br />

your numbers. I will make you a community of peoples, and I will give this land as an<br />

everlasting possession to your descendants after you.’<br />

5<br />

“Now then, your two sons born to you in Egypt before I came to you here will be<br />

reckoned as mine; Ephraim and Manasseh will be mine, just as Reuben and Simeon<br />

are mine. 6 Any children born to you after them will be yours; in the territory they inherit<br />

they will be reckoned under the names of their brothers. 7 As I was returning from<br />

Paddan, [b] to my sorrow Rachel died in the land of Canaan while we were still on the<br />

Page 15 of 190

way, a little distance from Ephrath. So I buried her there beside the road to Ephrath”<br />

(that is, Bethlehem).<br />

8<br />

When Israel saw the sons of Joseph, he asked, “Who are these?”<br />

9<br />

“They are the sons God has given me here,” Joseph said to his father.<br />

Then Israel said, “Bring them to me so I may bless them.”<br />

10<br />

Now Israel’s eyes were failing because of old age, and he could hardly see. So<br />

Joseph brought his sons close to him, and his father kissed them and embraced them.<br />

11<br />

Israel said to Joseph, “I never expected to see your face again, and now God has<br />

allowed me to see your children too.”<br />

12<br />

Then Joseph removed them from Israel’s knees and bowed down with his face to the<br />

ground. 13 And Joseph took both of them, Ephraim on his right toward Israel’s left hand<br />

and Manasseh on his left toward Israel’s right hand, and brought them close to him.<br />

14<br />

But Israel reached out his right hand and put it on Ephraim’s head, though he was the<br />

younger, and crossing his arms, he put his left hand on Manasseh’s head, even though<br />

Manasseh was the firstborn.<br />

15<br />

Then he blessed Joseph and said,<br />

“May the God before whom my fathers<br />

Abraham and Isaac walked faithfully,<br />

the God who has been my shepherd<br />

all my life to this day,<br />

16<br />

the Angel who has delivered me from all harm<br />

—may he bless these boys.<br />

May they be called by my name<br />

and the names of my fathers Abraham and Isaac,<br />

and may they increase greatly<br />

on the earth.”<br />

17<br />

When Joseph saw his father placing his right hand on Ephraim’s head he was<br />

displeased; so he took hold of his father’s hand to move it from Ephraim’s head to<br />

Manasseh’s head. 18 Joseph said to him, “No, my father, this one is the firstborn; put<br />

your right hand on his head.”<br />

19<br />

But his father refused and said, “I know, my son, I know. He too will become a people,<br />

and he too will become great. Nevertheless, his younger brother will be greater than he,<br />

and his descendants will become a group of nations.” 20 He blessed them that day and<br />

said,<br />

“In your name will Israel pronounce this blessing:<br />

‘May God make you like Ephraim and Manasseh.’”<br />

Page 16 of 190

So he put Ephraim ahead of Manasseh.<br />

21<br />

Then Israel said to Joseph, “I am about to die, but God will be with you [d] and take<br />

you [e] back to the land of your [f] fathers. 22 And to you I give one more ridge of land [g]<br />

than to your brothers, the ridge I took from the Amorites with my sword and my bow.”<br />

2 Chronicles 21:3<br />

3<br />

Their father had given them many gifts of silver and gold and articles of value, as well<br />

as fortified cities in Judah, but he had given the kingdom to Jehoram because he was<br />

his firstborn son.<br />

Job 42:15<br />

15<br />

Nowhere in all the land were there found women as beautiful as Job’s daughters, and<br />

their father granted them an inheritance along with their brothers.<br />

Hebrews 9:16-17<br />

16<br />

In the case of a will, [a] it is necessary to prove the death of the one who made it,<br />

17<br />

because a will is in force only when somebody has died; it never takes effect while the<br />

one who made it is living.<br />

Page 17 of 190

Page 18 of 190

Table of Contents<br />

…a compilation of works on<br />

<strong>Wills</strong>, <strong>Trusts</strong> & <strong>Estates</strong><br />

Biblical Authority<br />

I. Introduction: Inheritance…………………………………………… 21<br />

II. <strong>Wills</strong>…………………………………………………………………... 39<br />

III. <strong>Trusts</strong>…………………………………………………………………. 51<br />

IV. <strong>Estates</strong>……………………………………………………………….. 73<br />

V. Estate Planning………………………….. ………………………… 75<br />

VI. Probate…………….…………………………………………………. 81<br />

VII. References…………………………………………………….......... 93<br />

______<br />

Attachments<br />

A. A Citizen’s Guide to <strong>Wills</strong>, <strong>Trusts</strong> and <strong>Estates</strong><br />

B. <strong>Trusts</strong>: Common Law and IRC 501(c)(3) and 4947<br />

C. The Basics of Estate Planning<br />

Copyright © 2003 – 2019 The Advocacy Foundation, Inc. All Rights Reserved.<br />

Page 19 of 190

This work is not meant to be a piece of original academic<br />

analysis, but rather draws very heavily on the work of<br />

scholars in a diverse range of fields. All material drawn upon<br />

is referenced appropriately.<br />

Page 20 of 190

I. Introduction<br />

Inheritance<br />

Inheritance is the practice of passing on property, titles, debts, rights, and obligations<br />

upon the death of an individual. The rules of inheritance differ among societies and<br />

have changed over time.<br />

Terminology<br />

In law, an heir is a person who is entitled to receive a share of the deceased's (the<br />

person who died) property, subject to the rules of inheritance in the jurisdiction of which<br />

the deceased was a citizen or where the deceased (decedent) died or owned property<br />

at the time of death.<br />

The inheritance may be either under the terms of a will or by intestate laws if the<br />

deceased had no will. However, the will must comply with the laws of the jurisdiction at<br />

the time it was created or it will be declared invalid (for ex<strong>amp</strong>le, some states do not<br />

recognize holographic wills as valid, or only in specific circumstances) and the intestate<br />

laws then apply.<br />

A person does not become an heir before the death of the deceased, since the exact<br />

identity of the persons entitled to inherit is determined only then. Members of ruling<br />

noble or royal houses who are expected to become heirs are called heirs apparent if<br />

first in line and incapable of being displaced from inheriting by another claim; otherwise,<br />

they are heirs presumptive. There is a further concept of joint inheritance, pending<br />

renunciation by all but one, which is called co-parceny.<br />

Page 21 of 190

In modern law, the terms inheritance and heir refer exclusively to succession to property<br />

by descent from a deceased dying intestate. Takers in property succeeded to under a<br />

will are termed generally beneficiaries, and specifically devisees for real property,<br />

bequestees for personal property (except money), or legatees for money.<br />

Except in some jurisdictions where a person cannot be legally disinherited (such as the<br />

United States state of Louisiana, which allows disinheritance only under specifically<br />

enumerated circumstances), a person who would be an heir under intestate laws may<br />

be disinherited completely under the terms of a will (an ex<strong>amp</strong>le is that of the will of<br />

comedian Jerry Lewis; his will specifically disinherited his six children by his first wife,<br />

and their descendants, leaving his entire estate to his second wife).<br />

History<br />

Detailed anthropological and sociological studies have been made about customs of<br />

patrilineal inheritance, where only male children can inherit. Some cultures also employ<br />

matrilineal succession, where property can only pass along the female line, most<br />

commonly going to the sister's sons of the decedent; but also, in some societies, from<br />

the mother to her daughters. Some ancient societies and most modern states employ<br />

egalitarian inheritance, without discrimination based on gender and/or birth order.<br />

Jewish Laws<br />

The inheritance is patrilineal. The father —that is, the owner of the land— bequeaths<br />

only to his male descendants, so the Promised Land passes from one Jewish father to<br />

his sons.<br />

If there were no living sons and no descendants of any previously living sons, daughters<br />

inherit. In Numbers 27:1-4, the daughters of Zelophehad (Mahlah, Noa, Hoglah, Milcah,<br />

and Tirzah) of the tribe of Manasseh come to Moses and ask for their father's<br />

inheritance, as they have no brothers. The order of inheritance is set out in Numbers<br />

27:7-11: a man's sons inherit first, daughters if no sons, brothers if he has no children,<br />

and so on.<br />

Later, in Numbers 36, some of the heads of the families of the tribe of Manasseh come<br />

to Moses and point out that, if a daughter inherits and then marries a man not from her<br />

paternal tribe, her land will pass from her birth-tribe's inheritance into her marriagetribe's.<br />

So a further rule is laid down: if a daughter inherits land, she must marry<br />

someone within her father's tribe. (The daughters of Zelophehad marry the sons' of their<br />

father's brothers. There is no indication that this was not their choice.)<br />

The tractate Baba Bathra, written during late Antiquity in Babylon, deals extensively with<br />

issues of property ownership and inheritance according to Jewish Law. Other works of<br />

Rabbinical Law, such as the Hilkhot naḥalot : mi-sefer Mishneh Torah leha-Rambam,<br />

and the Sefer ha-yerushot: ʻim yeter ha-mikhtavim be-divre ha-halakhah be-ʻAravit uve-<br />

Page 22 of 190

ʻIvrit uve-Aramit also deal with inheritance issues. The first, often abbreviated to<br />

Mishneh Torah, was written by Maimonides and was very important in Jewish tradition.<br />

All these sources agree that the firstborn son is entitled to a double portion of his<br />

father's estate: Deuteronomy 21:17.<br />

This means that, for ex<strong>amp</strong>le, if a father left five sons, the firstborn receives a third of<br />

the estate and each of the other four receives a sixth. If he left nine sons, the firstborn<br />

receives a fifth and each of the other eight receive a tenth. If the eldest surviving son is<br />

not the firstborn son, he is not entitled to the double portion.<br />

Philo of Alexandria and Josephus also comment on the Jewish laws of inheritance,<br />

praising them above other law codes of their time. They also agreed that the firstborn<br />

son must receive a double portion of his father's estate.<br />

Christian Laws<br />

The New Testament does not specifically mention anything about inheritance rights: the<br />

only story even mentioning inheritance is that of the Prodigal Son, but that involved the<br />

father voluntarily passing his estate to his two sons prior to his death; the younger son<br />

receiving his inheritance (1/3; the older son would have received 2/3 under then existing<br />

Jewish law) and squandering it.<br />

The topic is generally not discussed among doctrinal statements of various<br />

denominations or sects, leaving that to be a matter of secular concern.<br />

Page 23 of 190

Islamic laws<br />

The Quran introduced a number of different rights and restrictions on matters of<br />

inheritance, including general improvements to the treatment of women and family life<br />

compared to the pre-Islamic societies that existed in the Arabian Peninsula at the time.<br />

Furthermore, the Quran introduced additional heirs that were not entitled to inheritance<br />

in pre-Islamic times, mentioning nine relatives specifically of which six were female and<br />

three were male. However, the inheritance rights of women remained inferior to those of<br />

men because in Islam someone always has a responsibility of looking after a woman's<br />

expenses. According to the Quran, for ex<strong>amp</strong>le, a son is entitled to twice as much<br />

inheritance as a daughter. [Quran 4:11] The Quran also presented efforts to fix the laws of<br />

inheritance, and thus forming a complete legal system. This development was in<br />

contrast to pre-Islamic societies where rules of inheritance varied considerably. In<br />

addition to the above changes, the Quran imposed restrictions on testamentary powers<br />

of a Muslim in disposing his or her property. The Quran contains only three verses that<br />

give specific details of inheritance and shares, in addition to few other verses dealing<br />

with testamentary. But this information was used as a starting point by Muslim jurists<br />

who expounded the laws of inheritance even further using Hadith, as well as methods of<br />

juristic reasoning like Qiyas. Nowadays, inheritance is considered an integral part of<br />

Sharia law and its application for Muslims is mandatory, though many peoples (see<br />

Historical inheritance systems), despite being Muslim, have other inheritance customs.<br />

Inequality<br />

Inheritance by amount and distribution received and action taken with inheritances in<br />

Great Britain between 2008 and 2010<br />

The distribution of the inherited wealth has varied greatly among different cultures and<br />

legal traditions. In nations using civil law, for ex<strong>amp</strong>le, the right of children to inherit<br />

wealth from parents in pre-defined ratios is enshrined in law, as far back as the Code of<br />

Hammurabi (ca. 1750 BC). In the US State of Louisiana, the only US state to use<br />

Napoleonic Code for state law, this system is known as "forced heirship" which prohibits<br />

disinheritance of adult children except for a few narrowly-defined reasons that a parent<br />

is obligated to prove. Other legal traditions, particularly in nations using common law,<br />

allow inheritances to be divided however one wishes, or to disinherit any child for any<br />

reason.<br />

In cases of unequal inheritance, the majority might receive little while only a small<br />

number inherit a larger amount, with the lesser amount given to the daughter in the<br />

family. The amount of inheritance is often far less than the value of a business initially<br />

given to the son, especially when a son takes over a thriving multimillion-dollar<br />

business, yet the daughter is given the balance of the actual inheritance amounting to<br />

far less than the value of business that was initially given to the son. This is especially<br />

seen in old world cultures, but continues in many families to this day.<br />

Page 24 of 190

Arguments for eliminating the disparagement of inheritance inequality include the right<br />

to property and the merit of individual allocation of capital over government wealth<br />

confiscation and redistribution, but this does not resolve what some describe as the<br />

problem of unequal inheritance. In terms of inheritance inequality, some economists and<br />

sociologists focus on the inter generational transmission of income or wealth which is<br />

said to have a direct impact on one's mobility (or immobility) and class position in<br />

society. Nations differ on the political structure and policy options that govern the<br />

transfer of wealth.<br />

According to the American federal government statistics compiled by Mark Zandi in<br />

1985, the average US inheritance was $39,000. In subsequent years, the overall<br />

amount of total annual inheritance more than doubled, reaching nearly $200 billion. By<br />

2050, there will be an estimated $25 trillion inheritance transmitted across generations.<br />

Some researchers have attributed this rise to the baby boomer generation. Historically,<br />

the baby boomers were the largest influx of children conceived after WW2. For this<br />

reason, Thomas Shapiro suggests that this generation "is in the midst of benefiting from<br />

the greatest inheritance of wealth in history." Inherited wealth may help explain why<br />

many Americans who have become rich may have had a "substantial head start". In<br />

September 2012, according to the Institute for Policy Studies, "over 60 percent" of the<br />

Forbes richest 400 Americans "grew up in substantial privilege", and often (but not<br />

always) received substantial inheritances. The French economist Thomas Piketty<br />

studied this phenomenon in his best-selling book Capital in the Twenty-First Century,<br />

published in 2013.<br />

Page 25 of 190

Other research has shown that many inheritances, large or small, are rapidly<br />

squandered. Similarly, analysis shows that over two-thirds of high-wealth families lose<br />

their wealth within two generations, and almost 80% of high-wealth parents "feel the<br />

next generation is not financially responsible enough to handle inheritance."<br />

Social Stratification<br />

It has been argued that inheritance plays a significant effect on social stratification.<br />

Inheritance is an integral component of family, economic, and legal institutions, and a<br />

basic mechanism of class stratification. It also affects the distribution of wealth at the<br />

societal level. The total cumulative effect of inheritance on stratification outcomes takes<br />

three forms, according to scholars who have examined the subject.<br />

The first form of inheritance is the inheritance of cultural capital (i.e. linguistic styles,<br />

higher status social circles, and aesthetic preferences). The second form of inheritance<br />

is through familial interventions in the form of inter vivos transfers (i.e. gifts between the<br />

living), especially at crucial junctures in the life courses. Ex<strong>amp</strong>les include during a<br />

child's milestone stages, such as going to college, getting married, getting a job, and<br />

purchasing a home. The third form of inheritance is the transfers of bulk estates at the<br />

time of death of the testators, thus resulting in significant economic advantage accruing<br />

to children during their adult years. The origin of the stability of inequalities is material<br />

(personal possessions one is able to obtain) and is also cultural, rooted either in varying<br />

child-rearing practices that are geared to socialization according to social class and<br />

economic position. Child-rearing practices among those who inherit wealth may center<br />

around favoring some groups at the expense of others at the bottom of the social<br />

hierarchy.<br />

Sociological and Economic Effects of Inheritance Inequality<br />

It is further argued that the degree to which economic status and inheritance is<br />

transmitted across generations determines one's life chances in society. Although many<br />

have linked one's social origins and educational attainment to life chances and<br />

opportunities, education cannot serve as the most influential predictor of economic<br />

mobility. In fact, children of well-off parents generally receive better schooling and<br />

benefit from material, cultural, and genetic inheritances. Likewise, schooling attainment<br />

is often persistent across generations and families with higher amounts of inheritance<br />

are able to acquire and transmit higher amounts of human capital. Lower amounts of<br />

human capital and inheritance can perpetuate inequality in the housing market and<br />

higher education. Research reveals that inheritance plays an important role in the<br />

accumulation of housing wealth. Those who receive an inheritance are more likely to<br />

own a home than those who do not regardless of the size of the inheritance.<br />

Often, racial or religious minorities and individuals from socially disadvantaged<br />

backgrounds receive less inheritance and wealth. As a result, mixed races might be<br />

excluded in inheritance privilege and are more likely to rent homes or live in poorer<br />

Page 26 of 190

neighborhoods, as well as achieve lower educational attainment compared with whites<br />

in America. Individuals with a substantial amount of wealth and inheritance often<br />

intermarry with others of the same social class to protect their wealth and ensure the<br />

continuous transmission of inheritance across generations; thus perpetuating a cycle of<br />

privilege.<br />

Nations with the highest income and wealth inequalities often have the highest rates of<br />

homicide and disease (such as obesity, diabetes, and hypertension). A The New York<br />

Times article reveals that the U.S. is the world's wealthiest nation, but "ranks twentyninth<br />

in life expectancy, right behind Jordan and Bosnia." This has been regarded as<br />

highly attributed to the significant gap of inheritance inequality in the country, although<br />

there are clearly other factors such as the affordability of healthcare.<br />

When social and economic inequalities centered on inheritance are perpetuated by<br />

major social institutions such as family, education, religion, etc., these differing life<br />

opportunities are argued to be transmitted from each generation. As a result, this<br />

inequality is believed to become part of the overall social structure.<br />

Dynastic Wealth<br />

Dynastic wealth is monetary inheritance that is passed on to generations that didn't earn<br />

it. Dynastic wealth is linked to the term Plutocracy. Much has been written about the rise<br />

Page 27 of 190

and influence of dynastic wealth including the bestselling book Capital in the Twenty-<br />

First Century by the French economist Thomas Piketty.<br />

Bill Gates uses the term in his article "Why Inequality Matters".<br />

Taxation<br />

Many states have inheritance taxes or death duties, under which a portion of any estate<br />

goes to the government.<br />

________<br />

Inheritance Tax<br />

An inheritance or estate tax is a tax paid by a person who inherits money or property<br />

or a levy on the estate (money and property) of a person who has died.<br />

International tax law distinguishes between an estate tax and an inheritance tax—an<br />

estate tax is assessed on the assets of the deceased, while an inheritance tax is<br />

assessed on the legacies received by the estate's beneficiaries. However, this<br />

distinction is not always observed; for ex<strong>amp</strong>le, the UK's "inheritance tax" is a tax on the<br />

assets of the deceased, and strictly speaking is therefore an estate tax.<br />

For historical reasons, the term death duty is still used colloquially (though not legally)<br />

in the UK and some Commonwealth countries.<br />

Varieties of Inheritance and Estate Taxes<br />

<br />

<br />

<br />

<br />

<br />

Belgium, droits de succession or successierechten (Inheritance tax).<br />

Collected at the federal level but distributed to the regional level.<br />

Bermuda: st<strong>amp</strong> duty<br />

Brazil: Imposto sobre Transmissão "Causa Mortis" e Doação de Quaisquer<br />

Bens ou Direitos (Tax on Causa Mortis Transmission and as Donation of any<br />

Property and Rights). Collected at the state level. The Brazilian Senate limited<br />

the maximum rate to 8%,.<br />

Czech Republic: daň dědická (Inheritance tax)<br />

Denmark: Boafgift (estate duty). Collected at state level. Different rates<br />

depending on the relation to the deceased. Spouse: 0%. Children: 15%. Other<br />

relatives: 15% of the estate sum + additional 25% of the individual sum. The<br />

estate duty is calculated on the sum of the estate after deducting a free<br />

allowance on the estate (289,000 DKK in 2018).<br />

Page 28 of 190

Finland: perintövero (Finnish) or arvsskatt (Swedish) (Inheritance tax) is a state<br />

tax. Inheritance to the close family is tax free up to the worth of 20 000 €, and<br />

increasing from there via several steps (for instance, being 13% for 60 000 € -<br />

200 000 €) to the maximum of 19% that must be paid for the portion of the<br />

inheritance that exceeds one million euros. Taxation is more severe in case of<br />

remote relatives or those with no family connection at all (19-33%).<br />

<br />

<br />

<br />

<br />

<br />

France: droits de succession (Inheritance tax)<br />

Germany: Erbschaftsteuer (Inheritance tax). Smaller bequests are exempt, i.e.,<br />

€20,000–€500,000 depending on the family relation between the deceased and<br />

the beneficiary. Bequests larger than these values are taxed from 7% to 50%,<br />

depending on the family relationship between the deceased and the beneficiary<br />

and the size of the taxable amount<br />

Ghana: Inheritance tax on intangible assets<br />

Ireland: Inheritance tax (Cáin Oidhreachta)<br />

Italy: tassa di successione (Inheritance tax). Abolished in 2001 and<br />

reestablished in 2006. €1,000,000 exemption on a bequest to a spouse or child,<br />

and a maximum rate of 8%.<br />

Japan: souzokuzei 相 続 税 (Inheritance tax) paid as a national tax (between 10<br />

and 55% after an exemption of ¥30 million + ¥6 million per heir is deducted from<br />

the estate)<br />

The Netherlands: Successierecht (Inheritance tax) NB. as per 1 January 2010<br />

Successierecht has been abolished for the erfbelasting regime, and is replaced<br />

Page 29 of 190

with Erfbelasting with rates from 10% to 40%. for brackets by amounts and<br />

separation<br />

<br />

<br />

<br />

<br />

Switzerland has no national inheritance tax. Some cantons impose estate taxes<br />

or inheritance taxes.<br />

United Kingdom: see inheritance tax (United Kingdom) (actually an estate tax)<br />

United States: see estate tax in the United States<br />

Spain: Impuesto sobre Sucesiones (Inheritance Tax). The amendment of<br />

Spanish law has been put into practice, in compliance with the European Court<br />

ruling of September 3 of last year, and on December 31, 2014 Order<br />

HAP/2488/2014, of December 29, was published in the Official State Bulletin,<br />

which approve the Inheritance and Gift Tax self-assessment forms 650, 651 y,<br />

and establishes the place, forma an term for its submission.<br />

Some jurisdictions formerly had estate or inheritance taxes, but have abolished them:<br />

<br />

<br />

Australia abolished the federal estate tax in 1979, but capital gains tax is levied<br />

on the sale of an asset or its transfer of ownership and if this occurs upon the<br />

death of the owner it constitutes a "crystalising action", and capital gains tax<br />

becomes assessable.<br />

Austria abolished the Erbschaftssteuer in 2008. This tax had some of the<br />

features of the gift tax, which was abolished at the same time.<br />

Canada: abolished inheritance tax in 1972. However, capital gains are 50%<br />

taxable and added to all other income of the deceased on their final return.<br />

Hong Kong: abolished estate duty in 2006 for all deaths occurring on or after 11<br />

February 2006. (See Estate Duty Ordinance Cap.111)<br />

India: had an estate tax from 1953 to 1985<br />

<br />

<br />

<br />

Israel: abolished inheritance tax in 1981, but inherited assets are subject to a<br />

20% to 45% capital gains tax upon their sale<br />

Kenya: abolished estate duty tax by virtue of the Estate Duty (Abolition) Act No.<br />

10 of 1982<br />

Malaysia<br />

New Zealand abolished estate duty in 1992<br />

Norway: abolished inheritance tax in 2014<br />

Page 30 of 190

Russia "abolished" "inheritance tax" in 2006, but have "fee" with rates of 0,3%<br />

but no more than 100 000 rubles and 0,6% but no more than 1 000 000 rubles.<br />

Singapore: abolished estate tax in 2008, for deaths occurring on or after 15<br />

February 2008.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Sweden: abolished inheritance tax in 2005. A retroactive decision exempted<br />

deaths during late December 2004 from inheritance tax, due to the many<br />

Swedish casualties in the 2004 Indian Ocean earthquake.<br />

Luxembourg<br />

Serbia<br />

Estonia<br />

Mexico<br />

Portugal<br />

Slovak Republic<br />

Page 31 of 190

Hungary<br />

Bahamas<br />

Some jurisdictions have never levied any form of tax in the event of death:<br />

<br />

<br />

<br />

Cayman Islands<br />

Jersey<br />

Guernsey<br />

United Kingdom<br />

Inheritance tax was introduced with effect from 18 March 1986.<br />

History (Succession Duty)<br />

Succession duty, in the English fiscal system, is "a tax placed on the gratuitous<br />

acquisition of property which passes on the death of any person, by means of a transfer<br />

from one person (called the predecessor) to another person (called the successor)". In<br />

order properly to understand the present state of the English law it is necessary to<br />

describe shortly the state of affairs prior to the Finance Act 1894 — an act which<br />

effected a considerable change in the duties payable and in the mode of assessment of<br />

those duties.<br />

The Succession Duty Act 1853 was the principal act that first imposed a succession<br />

duty in England. By that act a duty varying from 1% to 10% according to the degree of<br />

consanguinity between the predecessor and successor was imposed upon every<br />

succession which was defined as "every past or future disposition of property by reason<br />

whereof any person has or shall become beneficially entitled to any property, or the<br />

income thereof, upon the death of any person dying after the time appointed for the<br />

commencement of this act, either immediately or after any interval, either certainly or<br />

contingently, and either originally or by way of substitutive limitation and every<br />

devolution by law of any beneficial interest in property, or the income thereof, upon the<br />

death of any person dying after the time appointed for the commencement of this act to<br />

any other person in possession or expectancy". The property which is liable to pay the<br />

duty is in realty or leasehold estate in the UK and personalty—not subject to legacy<br />

duty—which the beneficiary claims by virtue of English, Scottish, or Irish law. Personalty<br />

in England bequeathed by a person domiciled abroad is not subject to succession duty.<br />

Successions of a husband or a wife, successions where the principal value is under<br />

£100, and individual successions under £20, are exempt from duty. Leasehold property<br />

and personalty directed to be converted into real estate are liable to succession, not to<br />

legacy duty.<br />

Special provision is made for the collection of duty in the cases of joint tenants and<br />

where the successor is also the predecessor. The duty is a first charge on property, but<br />

Page 32 of 190

if the property be parted with before the duty is paid the liability of the successor is<br />

transferred to the alienee. It is, therefore, usual in requisitions on title before<br />

conveyance, to demand for the protection of the purchaser the production of receipts for<br />

succession duty, as such receipts are an effectual protection notwithstanding any<br />

suppression or misstatement in the account on the footing of which the duty was<br />

assessed or any insufficiency of such assessment. The duty is by this act directed to be<br />

assessed as follows: on personal property, if the successor takes a limited estate, the<br />

duty is assessed on the principal value of the annuity or yearly income estimated<br />

according to the period during which he is entitled to receive the annuity or yearly<br />

income, and the duty is payable in four yearly installments free from interest. If the<br />

successor takes absolutely he pays in a lump-sum duty on the principal value. On real<br />

property the duty is payable in eight half-yearly installments without interest on the<br />

capital value of an annuity equal to the annual value of the property. Various minor<br />

changes were made. The Customs and Inland Revenue Act 1881 exempted personal<br />

estates under 300. The Customs and Inland Revenue Act 1888 charged an additional<br />

1% on successions already paying 1% and an additional 11% on successions paying<br />

more than 1%. By the Customs and Inland Revenue Act 1889, an additional duty of 1%<br />

called an "estate duty" was payable on successions over 10,000.<br />

The Finance Acts 1894 and 1909 effected large changes in the duties payable on<br />

death. As regards the succession duties they enacted that payment of the estate duties<br />

thereby created should include payment of the additional duties mentioned above.<br />

<strong>Estates</strong> under £1,000 (£2,000 in the case of widow or child of deceased) are exempted<br />

from payment of any succession duties. The succession duty payable under the<br />

Succession Duty Act 1853 was in all cases to be calculated according to the principal<br />

value of the property, i.e., its selling value, and though still payable by installments<br />

interest at 3% is chargeable. The additional succession duties are still payable in cases<br />

Page 33 of 190

where the estate duty is not charged, but such cases are of small importance and in<br />

practice are not as a rule charged.<br />

United States<br />

The United States imposed a succession duty by the War Revenue Act of 1898 on all<br />

legacies or distributive shares of personal property exceeding $10,000. This was a tax<br />

on the privilege of succession, and devises and land distributions of land were<br />

unaffected. The duty ran from 75 cents on the $100 to $5 on the $100, if the legacy or<br />

share in question did not exceed $25,000. On those over that value, the rate was<br />

multiplied 11 times on estates up to $100,000, twofold on those from $100,000 to<br />

$200,000, 21 times on those from $500,000 to a $1 million, and threefold for those<br />

exceeding a million. This statute was upheld as constitutional by the U.S. Supreme<br />

Court.<br />

Many of the states also impose succession duties, or transfer taxes; generally, however,<br />

on collateral and remote successions; sometimes progressive, according to the amount<br />

of the succession. The state duties generally touch real estate successions as well as<br />

those to personal property. If a citizen of state A owns registered bonds of a corporation<br />

chartered by state B, which he has put for safe keeping in a deposit vault in state C, his<br />

estate may thus have to pay four succession taxes, one to state A, to which he belongs<br />

and which, by legal fiction, is the seat of all his personal property; one to state B, for<br />

permitting the transfer of the bonds to the legatees on the books of the corporation; one<br />

to state C, for allowing them to be removed from the deposit vault for that purpose; and<br />

one to the United States.<br />

The different U.S. states all have other regulations regarding inheritance tax:<br />

o<br />

o<br />

Louisiana: abolished inheritance tax in 2008, for deaths occurring on or<br />

after 1 July 2004<br />

New H<strong>amp</strong>shire: abolished state inheritance tax in 2003; abolished<br />

surcharge on federal estate tax in 2005<br />

o Utah: abolished inheritance tax in 2005<br />

Some U.S. states impose inheritance or estate taxes (see inheritance tax at the state<br />

level):<br />

Indiana: abolished the state inheritance on December 31, 2012<br />

<br />

Iowa: Inheritance is exempt if passed to a surviving spouse, parents, or<br />

grandparents, or to children, grandchildren, or other "lineal" descendants. Other<br />

recipients are subject to inheritance tax, with rates varying depending on the<br />

relationship of the recipient to the deceased.<br />

Page 34 of 190

Kentucky: The inheritance tax is a tax on a beneficiary's right to receive property<br />

from a decedent's estate. It is imposed as a percentage of the amount<br />

transferred to the beneficiary:<br />

o<br />

Transfers to "Class A" relatives (spouses, parents, children, grandchildren,<br />

and siblings) are exempt<br />

o<br />

o<br />

Transfers to "Class B" relatives (nieces, nephews, daughters-in-law, sonsin-law,<br />

aunts, uncles, and great-grandchildren) are taxable<br />

Transfers to "Class C" recipients (all other persons) are taxable at a higher<br />

rate. Kentucky imposes an estate tax in addition to its inheritance tax.<br />

<br />

<br />

<br />

Maryland<br />

Nebraska<br />

New Jersey: New Jersey law puts inheritors into different groups, based on their<br />

family relationship to the deceased person:<br />

o<br />

Class A beneficiaries are exempt from the inheritance tax. They includes<br />

the deceased person’s spouse, domestic partner, or civil union partner<br />

Page 35 of 190

parent, grandparent, child (biological, adopted, or mutually<br />

acknowledged), stepchild (but not step-grandchild or great-stepgrandchild),<br />

grandchild or other lineal descendant of a child<br />

o<br />

o<br />

o<br />

o<br />

Class B was deleted when New Jersey law changed<br />

Class C includes the deceased person’s: brother or sister, spouse or civil<br />

union partner of the deceased person's child, surviving spouse or civil<br />

union partner of the deceased person's child. The first $25,000 inherited<br />

by someone in Class C is not taxed. On amounts exceeding $25,000, the<br />

tax rates are: 11% on the next $1,075,000, 13% on the next $300,000,<br />

14% on the next $300,000, and 16% for anything over $1,700,000<br />

Class D includes everyone else. There is no special exemption amount,<br />

and the applicable tax rates are: 15% on the first $700,000, and 16% on<br />

anything over $700,000<br />

Class E includes the State of New Jersey or any of its political<br />

subdivisions for public or charitable purposes, an educational institution,<br />

church, hospital, orphan asylum, public library, and other nonprofits.<br />

These beneficiaries are exempt from inheritance tax.<br />

<br />

<br />

<br />

Oklahoma<br />

Pennsylvania: Inheritance tax is a flat tax on the value of the decedent's taxable<br />

estate as of the date of death, less allowable funeral and administrative<br />

expenses and debts of the decedent. Pennsylvania does not allow the six-monthafter-date-of-death<br />

alternate valuation method that is available at the federal<br />

level. Transfers to spouses are exempt; transfers to grandparents, parents, or<br />

lineal descendants are taxed at 4.5%. Transfers to siblings are taxed at 12%.<br />

Transfers to any other persons are taxed at 15%. Some assets are exempted,<br />

including life insurance proceeds. The inheritance tax is imposed on both<br />

residents and nonresidents who owned real estate and tangible personal<br />

property in Pennsylvania at the time of their death. The Pennsylvania Inheritance<br />

Tax Return (Form Rev-1500) must be filed within nine months of the date of<br />

death.<br />

Tennessee<br />

Other Taxation Applied to Inheritance<br />

In some jurisdictions, when assets are transferred by inheritance, any unrealized<br />

increase in asset value is subject to capital gains tax, payable immediately. This is the<br />

case in Canada, which has no inheritance tax.<br />

Page 36 of 190

When a jurisdiction has both capital gains tax and inheritance tax, inheritances are<br />

generally exempt from capital gains tax.<br />

In some jurisdictions, like Austria, death gives rise to the local equivalent of gift tax.<br />

This was the UK model before the Inheritance Tax in 1986 was introduced, when<br />

estates were charged to a form of gift tax called Capital Transfer Tax. Where a<br />

jurisdiction has both gift tax and inheritance tax, it is usual to exempt inheritances from<br />

gift tax. Also, it is common for inheritance taxes to share some features of gift taxes, by<br />

taxing some transfers which happen during the lifetime of the giver rather than on death.<br />

The UK, for ex<strong>amp</strong>le, subjects "lifetime chargeable transfers" (usually gifts to trusts) to<br />

inheritance tax.<br />

Historical<br />

Ancient Rome<br />

No inheritance tax was<br />

recorded for the Roman<br />

Republic, despite abundant<br />

evidence for testamentary<br />

law. The vicesima<br />

hereditatium ("twentieth of<br />

inheritance") was levied by<br />

Rome's first emperor,<br />

Augustus, in the last decade<br />

of his reign. The 5% tax<br />

applied only to inheritances<br />

received through a will, and<br />

close relatives were exempt<br />

from paying it, including the<br />

deceased's grandparents,<br />

parents,<br />

children,<br />

grandchildren, and siblings.<br />

The question of whether a<br />

spouse was exempt was complicated—from the late Republic on, husbands and wives<br />

kept their own property scrupulously separate, since a Roman woman remained part of<br />

her birth family and not under the legal control of her husband. Roman social values on<br />

marital devotion probably exempted a spouse. <strong>Estates</strong> below a certain value were also<br />

exempt from the tax, according to one source, but other evidence indicates that this was<br />

only the case in the early years of Trajan's reign.<br />

Tax revenues went into a fund to pay military retirement benefits (aerarium militare),<br />

along with those from a new sales tax (centesima rerum venalium), a 1 tax% on goods<br />

sold at auction. The inheritance tax is extensively documented in sources pertaining to<br />

Roman law, inscriptions, and papyri. It was one of three major indirect taxes levied on<br />

Roman citizens in the provinces of the Empire.<br />

Page 37 of 190

Page 38 of 190

II. <strong>Wills</strong><br />

A Will or Testament is a legal document by which a person, the testator, expresses<br />

their wishes as to how their property is to be distributed at death, and names one or<br />

more persons, the executor, to manage the estate until its final distribution. For the<br />

devolution of property not disposed of by will, see inheritance and intestacy.<br />

Though it has at times been thought that a "will" was historically limited to real property<br />

while "testament" applies only to dispositions of personal property (thus giving rise to<br />

the popular title of the document as "Last Will and Testament"), the historical records<br />

show that the terms have been used interchangeably. Thus, the word "will" validly<br />

applies to both personal and real property.<br />

A will may also create a testamentary trust that is effective only after the death of the<br />

testator.<br />

History<br />

Throughout most of the world, disposal of an estate has been a matter of social custom.<br />

According to Plutarch, the written will was invented by Solon. Originally, it was a device<br />

intended solely for men who died without an heir.<br />

The English phrase "will and testament" is derived from a period in English law when<br />

Old English and Law French were used side by side for maximum clarity. Other such<br />

legal doublets include "breaking and entering" and "peace and quiet".<br />

Page 39 of 190

Freedom of Disposition<br />

The conception of the freedom of disposition by will, familiar as it is in modern England<br />

and the United States, both generally considered common law systems, is by no means<br />

universal. In fact, complete freedom is the exception rather than the rule. Civil law<br />

systems often put some restrictions on the possibilities of disposal; see for ex<strong>amp</strong>le<br />

"Forced heirship".<br />

Advocates for gays and lesbians have pointed to the inheritance rights of spouses as<br />

desirable for same-sex couples as well, through same-sex marriage or civil unions.<br />

Opponents of such advocacy rebut this claim by pointing to the ability of same-sex<br />

couples to disperse their assets by will. Historically, however, it was observed that<br />

"[e]ven if a same-sex partner executes a will, there is risk that the survivor will face<br />

prejudice in court when disgruntled heirs challenge the will", with courts being more<br />

willing to strike down wills leaving property to a same-sex partner on such grounds as<br />

incapacity or undue influence.<br />

Types of <strong>Wills</strong><br />

Types of wills generally include:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Nuncupative (Non-Culpatory) - oral or dictated; often limited to sailors or military<br />

personnel.<br />

Holographic Will - written in the hand of the testator; in many jurisdictions, the<br />

signature and the material terms of the holographic will must be in the<br />

handwriting of the testator.<br />

Self-Proved - in solemn form with affidavits of subscribing witnesses to avoid<br />

probate.<br />

Notarial - will in public form and prepared by a civil-law notary (civil-law<br />

jurisdictions and Louisiana, United States).<br />

Mystic - sealed until death.<br />

Serviceman's Will - will of person in active-duty military service and usually<br />

lacking certain formalities, particularly under English law.<br />

Reciprocal/Mirror/Mutual/Husband And Wife <strong>Wills</strong> - wills made by two or more<br />

parties (typically spouses) that make similar or identical provisions in favor of<br />

each other.<br />

Unsolemn Will - will in which the executor is unnamed.<br />

Will In Solemn Form - signed by testator and witnesses.<br />

Page 40 of 190

Some jurisdictions recognize a holographic will, made out entirely in the testator's own<br />

hand, or in some modern formulations, with material provisions in the testator's hand.<br />

The distinctive feature of a holographic will is less that it is handwritten by the testator,<br />

and often that it need not be witnessed. In Louisiana this type of testament is called an<br />

Olographic or Mystic will. It must be entirely written, dated, and signed in the<br />

handwriting of the testator. Although the date may appear anywhere in the testament,<br />

the testator must sign the testament at the end of the testament. Any additions or<br />

corrections must also be entirely hand written to have effect. In England, the formalities<br />

of wills are relaxed for soldiers who express their wishes on active service; any such will<br />

is known as a serviceman's will. A minority of jurisdictions even recognize the validity of<br />

nuncupative wills (oral wills), particularly for military personnel or merchant sailors.<br />

However, there are often constraints on the disposition of property if such an oral will is<br />

used.<br />

Terminology<br />

<br />

<br />

<br />

Administrator - person appointed or who petitions to administer an estate in an<br />

intestate succession. The antiquated English term of administratrix was used to<br />

refer to a female administrator but is generally no longer in standard legal usage.<br />

Beneficiary - anyone receiving a gift or benefiting from a trust<br />

Bequest - testamentary gift of personal property, traditionally other than money.<br />

Page 41 of 190

Codicil - (1) amendment to a will; (2) a will that modifies or partially revokes an<br />

existing or earlier will.<br />

Decedent - the deceased (U.S. term)<br />

Demonstrative Legacy - a gift of a specific sum of money with a direction that is<br />

to be paid out of a particular fund.<br />

Descent - succession to real property.<br />

Devise - testamentary gift of real property.<br />

Devisee - beneficiary of real property under a will.<br />

Distribution - succession to personal property.<br />

Executor/executrix or personal representative [PR] - person named to<br />

administer the estate, generally subject to the supervision of the probate court, in<br />

accordance with the testator's wishes in the will. In most cases, the testator will<br />

nominate an executor/PR in the will unless that person is unable or unwilling to<br />

serve. In some cases a literary executor may be appointed to manage a literary<br />

estate.<br />

Exordium clause is the first paragraph or sentence in a will and testament, in<br />

which the testator identifies himself or herself, states a legal domicile, and<br />

revokes any prior wills.<br />

Inheritor - a beneficiary in a succession, testate or intestate.<br />

Intestate - person who has not created a will, or who does not have a valid will at<br />

the time of death.<br />

Legacy - testamentary gift of personal property, traditionally of money. Note:<br />

historically, a legacy has referred to either a gift of real property or personal<br />

property.<br />

Legatee - beneficiary of personal property under a will, i.e., a person receiving a<br />

legacy.<br />

Probate - legal process of settling the estate of a deceased person.<br />

Specific legacy (or specific bequest) - a testamentary gift of a precisely<br />

identifiable object.<br />

Testate - person who dies having created a will before death.<br />

Page 42 of 190

Testator - person who executes or signs a will; that is, the person whose will it is.<br />

The antiquated English term of Testatrix was used to refer to a female.<br />

Trustee - a person who has the duty under a will trust to ensure that the rights of<br />

the beneficiaries are upheld.<br />

Requirements for Creation<br />

Any person over the age of majority and having "testamentary capacity" (i.e., generally,<br />

being of sound mind) can make a will, with or without the aid of a lawyer. Additional<br />

requirements may vary, depending on the jurisdiction, but generally include the<br />

following requirements:<br />

<br />

<br />

The testator must clearly identify themselves as the maker of the will, and that a<br />

will is being made; this is commonly called "publication" of the will, and is<br />

typically satisfied by the words "last will and testament" on the face of the<br />

document.<br />

The testator should declare that he or she revokes all previous wills and codicils.<br />

Otherwise, a subsequent will revokes earlier wills and codicils only to the extent<br />

to which they are inconsistent. However, if a subsequent will is completely<br />

inconsistent with an earlier one, the earlier will is considered completely revoked<br />

by implication.<br />

Page 43 of 190

The testator may demonstrate that he or she has the capacity to dispose of their<br />

property ("sound mind"), and does so freely and willingly.<br />

The testator must sign and date the will, usually in the presence of at least two<br />

disinterested witnesses (persons who are not beneficiaries). There may be extra<br />

witnesses, these are called "supernumerary" witnesses, if there is a question as<br />

to an interested-party conflict. Some jurisdictions, notably Pennsylvania, have<br />

long abolished any requirement for witnesses. In the United States, Louisiana<br />

requires both attestation by two witnesses as well as notarization by a notary<br />

public. Holographic wills generally require no witnesses to be valid, but<br />

depending on the jurisdiction may need to be proved later as to the authenticity<br />

of the testator's signature.<br />

If witnesses are designated to receive property under the will they are witnesses<br />

to, this has the effect, in many jurisdictions, of either (i) disallowing them to<br />

receive under the will, or (ii) invalidating their status as a witness. In a growing<br />

number of states in the United States, however, an interested party is only an<br />

improper witness as to the clauses that benefit him or her (for instance, in<br />

Illinois).<br />

The testator's signature must be placed at the end of the will. If this is not<br />

observed, any text following the signature will be ignored, or the entire will may<br />

be invalidated if what comes after the signature is so material that ignoring it<br />

would defeat the testator's intentions.<br />

One or more beneficiaries (devisees, legatees) must generally be clearly stated<br />

in the text, but some jurisdictions allow a valid will that merely revokes a previous<br />

will, revokes a disposition in a previous will, or names an executor.<br />

There is no legal requirement that a will be drawn up by a lawyer, although there are<br />

pitfalls into which home-made wills can fall. The person who makes a will is not<br />

available to explain him or herself, or to correct any technical deficiency or error in<br />

expression, when it comes into effect on that person's death, and so there is little room<br />

for mistake. A common error, for ex<strong>amp</strong>le, in the execution of home-made wills in<br />

England is to use a beneficiary (typically a spouse or other close family members) as a<br />

witness—which may have the effect in law of disinheriting the witness regardless of the<br />

provisions of the will.<br />

A will may not include a requirement that an heir commit an illegal, immoral, or other act<br />

against public policy as a condition of receipt.<br />

In community property jurisdictions, a will cannot be used to disinherit a surviving<br />

spouse, who is entitled to at least a portion of the testator's estate. In the United States,<br />

children may be disinherited by a parent's will, except in Louisiana, where a minimum<br />

share is guaranteed to surviving children except in specifically enumerated<br />

circumstances. Many civil law countries follow a similar rule. In England and Wales from<br />

Page 44 of 190

1933 to 1975, a will could disinherit a spouse; however, since the Inheritance (Provision<br />

for Family and Dependants) Act 1975 such an attempt can be defeated by a court order<br />

if it leaves the surviving spouse (or other entitled dependent) without "reasonable<br />

financial provision".<br />

International <strong>Wills</strong><br />

In 1973 an international convention, the Convention providing a Uniform Law on the<br />

Form of an International Will, was concluded in the context of UNIDROIT. The<br />

Convention provided for a universally recognised code of rules under which a will made<br />

anywhere, by any person of any nationality, would be valid and enforceable in every<br />

country which became a party to the Convention. These are known as "international<br />

wills". Belgium, Bosnia-Herzegovina, Canada (for 9 provinces, not Quebec), Cyprus,<br />

Ecuador, France, Italy, Libya, Niger, Portugal Slovenia, The Holy See, Iran, Laos, the<br />

Page 45 of 190

Russian Federation, Sierra Leone, the United Kingdom, and the United States have<br />

signed but not ratified. International wills are only valid where the convention applies.<br />

Although the US has not ratified on behalf of any state, the Uniform law has been<br />

enacted in 23 states and the District of Columbia.<br />

For individuals who own assets in multiple countries and at least one of those countries<br />

are not a part of the Convention, it may be appropriate for the person to have multiple<br />

wills, one for each country. In some nations, multiple wills may be useful to reduce or<br />

avoid taxes upon the estate and its assets. Care must be taken to avoid accidental<br />

revocation of prior wills, conflicts between the wills, to anticipate jurisdictional and<br />

choice of law issues that may arise during probate.<br />

Methods and Effect<br />

Revocation<br />

Intentional physical destruction of a will by the testator will revoke it, through deliberately<br />

burning or tearing the physical document itself, or by striking out the signature. In most<br />

jurisdictions, partial revocation is allowed if only part of the text or a particular provision<br />

is crossed out. Other jurisdictions will either ignore the attempt or hold that the entire will<br />

was actually revoked.<br />

A testator may also be able to revoke by the physical act of another (as would be<br />

necessary if he or she is physically incapacitated), if this is done in their presence and in<br />

the presence of witnesses. Some jurisdictions may presume that a will has been<br />

destroyed if it had been last seen in the possession of the testator but is found mutilated<br />

or cannot be found after their death.<br />

A will may also be revoked by the execution of a new will. However, most wills contain<br />

stock language that expressly revokes any wills that came before them, because<br />

otherwise a court will normally still attempt to read the wills together to the extent they<br />

are consistent.<br />

In some jurisdictions, the complete revocation of a will automatically revives the nextmost<br />

recent will, while others hold that revocation leaves the testator with no will, so that<br />

their heirs will instead inherit by intestate succession.<br />

In England and Wales, marriage will automatically revoke a will, for it is presumed that<br />

upon marriage a testator will want to review the will. A statement in a will that it is made<br />

in contemplation of forthcoming marriage to a named person will override this.<br />

Divorce, conversely, will not revoke a will, but in many jurisdictions will have the effect<br />

that the former spouse is treated as if they had died before the testator and so will not<br />

benefit.<br />

Where a will has been accidentally destroyed, on evidence that this is the case, a copy<br />

will or draft will may be admitted to probate.<br />

Page 46 of 190

Dependent Relative Revocation<br />

Many jurisdictions exercise an equitable doctrine known as "dependent relative<br />

revocation" ("DRR"). Under this doctrine, courts may disregard a revocation that was<br />

based on a mistake of law on the part of the testator as to the effect of the revocation.<br />

For ex<strong>amp</strong>le, if a testator mistakenly believes that an earlier will can be revived by the<br />

revocation of a later will, the court will ignore the later revocation if the later will comes<br />

closer to fulfilling the testator's intent than not having a will at all. The doctrine also<br />

applies when a testator executes a second, or new will and revokes their old will under<br />

the (mistaken) belief that the new will would be valid. However, if for some reason the<br />

new will is not valid, a court may apply the doctrine to reinstate and probate the old will,<br />

if the court holds that the testator would prefer the old will to intestate succession.<br />

Before applying the doctrine, courts may require (with rare exceptions) that there have<br />

been an alternative plan of disposition of the property. That is, after revoking the prior<br />

will, the testator could have made an alternative plan of disposition. Such a plan would<br />

show that the testator intended the revocation to result in the property going elsewhere,<br />

rather than just being a revoked disposition. Secondly, courts require either that the<br />

testator have recited their mistake in the terms of the revoking instrument, or that the<br />

mistake be established by clear and convincing evidence. For ex<strong>amp</strong>le, when the<br />

testator made the original revocation, he must have erroneously noted that he was<br />

revoking the gift "because the intended recipient has died" or "because I will enact a<br />

new will tomorrow".<br />

DRR may be applied to restore a gift erroneously struck from a will if the intent of the<br />

testator was to enlarge that gift, but will not apply to restore such a gift if the intent of the<br />

testator was to revoke the gift in favor of another person. For ex<strong>amp</strong>le, suppose Tom<br />

has a will that bequeaths $5,000 to his secretary, Alice Johnson. If Tom crosses out that<br />

clause and writes "$7,000 to Alice Johnson" in the margin, but does not sign or date the<br />

Page 47 of 190

writing in the margin, most states would find that Tom had revoked the earlier provision,<br />

but had not effectively amended his will to add the second; however, under DRR the<br />

revocation would be undone because Tom was acting under the mistaken belief that he<br />

could increase the gift to $7,000 by writing that in the margin. Therefore, Alice will get<br />

5,000 dollars. However, the doctrine of relative revocation will not apply if the<br />

interlineation decreases the amount of the gift from the original provision (e.g., "$5,000<br />

to Alice Johnson" is crossed out and replaced with "$3,000 to Alice Johnson" without<br />

Testator's signature or the date in the margin; DRR does not apply and Alice Johnson<br />

will take nothing).<br />

Similarly, if Tom crosses out that clause and writes in the margin "$5,000 to Betty<br />

Smith" without signing or dating the writing, the gift to Alice will be effectively revoked. In<br />

this case, it will not be restored under the doctrine of DRR because even though Tom<br />

was mistaken about the effectiveness of the gift to Betty, that mistake does not affect<br />

Tom's intent to revoke the gift to Alice. Because the gift to Betty will be invalid for lack of<br />

proper execution, that $5,000 will go to Tom's residuary estate.<br />

Election Against the Will<br />

Also referred to as "electing to take against the will". In the United States, many states<br />

have probate statutes which permit the surviving spouse of the decedent to choose to<br />

receive a particular share of deceased spouse's estate in lieu of receiving the specified<br />

share left to him or her under the deceased spouse's will. As a simple ex<strong>amp</strong>le, under<br />

Iowa law (see Code of Iowa Section 633.238 (2005)), the deceased spouse leaves a<br />

will which expressly devises the marital home to someone other than the surviving<br />

spouse. The surviving spouse may elect, contrary to the intent of the will, to live in the<br />

home for the remainder of his/her lifetime. This is called a "life estate" and terminates<br />

immediately upon the surviving spouse's death.<br />

The historical and social policy purposes of such statutes are to assure that the<br />

surviving spouse receives a statutorily set minimum amount of property from the<br />

decedent. Historically, these statutes were enacted to prevent the deceased spouse<br />

from leaving the survivor destitute, thereby shifting the burden of care to the social<br />

welfare system.<br />

In New York, a surviving spouse is entitled to one-third of her deceased spouse's<br />

estate. The decedent's debts, administrative expenses and reasonable funeral<br />

expenses are paid prior to the calculation of the spousal elective share. The elective<br />

share is calculated through the "net estate".<br />