You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> International News Weekly INDIA<br />

July 12, 2019 | Toronto 10<br />

Why high income tax rates<br />

are so unjust in India<br />

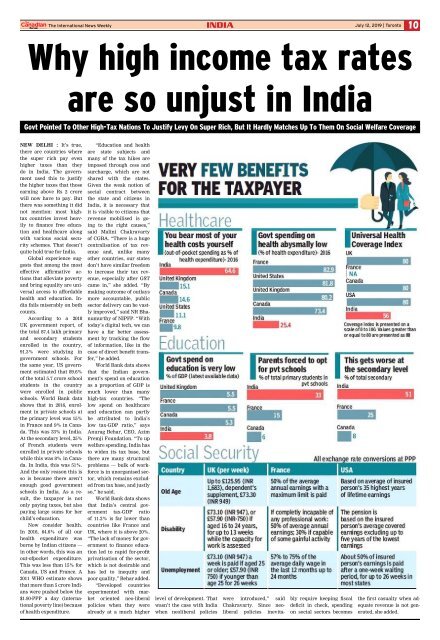

Govt Pointed To Other High-Tax Nations To Justify Levy On Super Rich, But It Hardly Matches Up To <strong>The</strong>m On Social Welfare Coverage<br />

New Delhi : It’s true,<br />

there are countries where<br />

the super rich pay even<br />

higher taxes than they<br />

do in India. <strong>The</strong> government<br />

used this to justify<br />

the higher taxes that those<br />

earning above Rs 2 crore<br />

will now have to pay. But<br />

there was something it did<br />

not mention: most hightax<br />

countries invest heavily<br />

to finance free education<br />

and healthcare along<br />

with various social security<br />

schemes. That doesn’t<br />

quite hold true for India.<br />

Global experience suggests<br />

that among the most<br />

effective affirmative actions<br />

that alleviate poverty<br />

and bring equality are universal<br />

access to affordable<br />

health and education. India<br />

fails miserably on both<br />

counts.<br />

According to a 2018<br />

UK government report, of<br />

the total 87.4 lakh primary<br />

and secondary students<br />

enrolled in the country,<br />

91.3% were studying in<br />

government schools. For<br />

the same year, US government<br />

estimated that 89.6%<br />

of the total 5.7 crore school<br />

students in the country<br />

were enrolled in public<br />

schools. World Bank data<br />

shows that in 2016, enrolment<br />

in private schools at<br />

the primary level was 15%<br />

in France and 9% in Canada.<br />

This was 33% in India.<br />

At the secondary level, 25%<br />

of French students were<br />

enrolled in private schools<br />

while this was 8% in Canada.<br />

In India, this was 51%.<br />

And the only reason this is<br />

so is because there aren’t<br />

enough good government<br />

schools in India. As a result,<br />

the taxpayer is not<br />

only paying taxes, but also<br />

paying large sums for her<br />

child’s education.<br />

Now consider health.<br />

In 2016, 64.6% of all our<br />

health expenditure was<br />

borne by Indian citizens —<br />

in other words, this was an<br />

out-ofpocket expenditure.<br />

This was less than 15% for<br />

Canada, US and France. A<br />

2011 WHO estimate shows<br />

that more than 5 crore Indians<br />

were pushed below the<br />

$1.90-PPP a day (international<br />

poverty line) because<br />

of health expenditure.<br />

“Education and health<br />

are state subjects and<br />

many of the tax hikes are<br />

imposed through cess and<br />

surcharge, which are not<br />

shared with the states.<br />

Given the weak notion of<br />

social contract between<br />

the state and citizens in<br />

India, it is necessary that<br />

it is visible to citizens that<br />

revenue mobilised is going<br />

to the right causes,”<br />

said Malini Chakravarty<br />

of CGBA. “<strong>The</strong>re is a huge<br />

centralisation of tax revenue<br />

and, unlike many<br />

other countries, our states<br />

don’t have similar freedom<br />

to increase their tax revenue,<br />

especially after GST<br />

came in,” she added. “By<br />

making outcome of outlays<br />

more accountable, public<br />

sector delivery can be vastly<br />

improved,” said NR Bhanumurthy<br />

of NIPFP. “With<br />

today’s digital tech, we can<br />

have a far better assessment<br />

by tracking the flow<br />

of information, like in the<br />

case of direct benefit transfer,”<br />

he added.<br />

World Bank data shows<br />

that the Indian government’s<br />

spend on education<br />

as a proportion of GDP is<br />

much lower than many<br />

high-tax countries. “<strong>The</strong><br />

low spend on healthcare<br />

and education can partly<br />

be attributed to India’s<br />

low tax-GDP ratio,” says<br />

Anurag Behar, CEO, Azim<br />

Premji Foundation. “To up<br />

welfare spending, India has<br />

to widen its tax base, but<br />

there are many structural<br />

problems — bulk of workforce<br />

is in unorganised sector,<br />

which remains excluded<br />

from tax base, and justly<br />

so,” he said.<br />

World Bank data shows<br />

that India’s central government<br />

tax-GDP ratio<br />

of 11.2% is far lower than<br />

countries like France and<br />

UK, where it is above 20%.<br />

“<strong>The</strong> lack of money for government<br />

to finance education<br />

led to rapid for-profit<br />

privatisation of the sector,<br />

which is not desirable and<br />

has led to inequity and<br />

poor quality,” Behar added.<br />

“Developed countries<br />

experimented with market<br />

oriented neo-liberal<br />

policies when they were<br />

already at a much higher<br />

level of development. That<br />

wasn’t the case with India<br />

when neoliberal policies<br />

were introduced,” said<br />

Chakravarty. Since neoliberal<br />

policies inevitably<br />

require keeping fiscal<br />

deficit in check, spending<br />

on social sectors becomes<br />

the first casualty when adequate<br />

revenue is not generated,<br />

she added.