You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

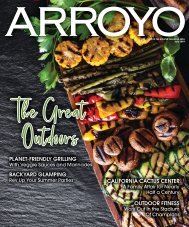

FINE LIVING IN THE GREATER PASADENA AREA<br />

<strong>August</strong> 20<strong>19</strong><br />

Bridging<br />

Generations<br />

AT GRANDPARENTS UNIVERSITY<br />

TOTS ON TECH:<br />

THE NEW CLASS DIVIDE?<br />

GLENDALE GRIEF CAMP<br />

LEARNING TO DEAL WITH<br />

LOSS THROUGH PLAY<br />

DOLLARS AND SENSE<br />

CAN FINANCIAL LITERACY EDUCATION<br />

REDUCE STUDENT LOAN DEBT?

08.<strong>19</strong> | ARROYO | 3

4 | ARROYO | 08.<strong>19</strong>

arroyo<br />

VOLUME 15 | NUMBER 08 | AUGUST 20<strong>19</strong><br />

15<br />

10 46<br />

FAMILY AND EDUCATION<br />

10 TOTS ON TECH: THE NEW CLASS DIVIDE<br />

The rich ban technology for their children, while most of America<br />

embraces it.<br />

—By BETTIJANE LEVINE<br />

15 DOLLARS AND SENSE<br />

Educators are being urged to offer fi nancial literacy courses that could help avoid<br />

future student loan catastrophes.<br />

—By KATHLEEN KELLEHER<br />

37 BACK TO SCHOOL…FOR GRANDPARENTS<br />

Grandparents Universities offer aging baby boomers the chance to bond<br />

with their grandkids in learning environments.<br />

—By KATHLEEN KELLEHER<br />

42 HAPPY CAMPERS<br />

Children beset by grief over the loss of a loved one fi nd solace and strength<br />

at Camp Erin in Glendale.<br />

—By CARL KOZLOWSKI<br />

DEPARTMENTS<br />

08 FESTIVITIES KCET kicks off the PBS “Summer of Space” at The Huntington<br />

and more<br />

<strong>19</strong> ARROYO HOME SALES INDEX<br />

46 KITCHEN CONFESSIONS Root beer fl oats are the ultimate summer refresher.<br />

47 ARROYO COCKTAIL OF THE MONTH Orange Grove<br />

48 THE LIST The Festival of Fruit at the Arboretum, Frankenstein at A Noise Within,<br />

Arcadia Steam+M Festival<br />

08.<strong>19</strong> ARROYO | 5

EDITOR’S NOTE<br />

I’ve long thought that schools don’t prepare<br />

you for three of the most important<br />

tasks of adult life — parenting, interpersonal<br />

politics and personal fi nance.<br />

These days, with student loan debt<br />

spiraling to new heights, threatening the<br />

futures of young adults, it’s more important<br />

than ever to know how to handle<br />

money wisely from an early age.<br />

The good news is that advocates<br />

for personal fi nance education are<br />

fi nally making inroads, as Kathleen Kelleher reports. There’s a bill pending<br />

in Sacramento that would make it a requirement for graduating high<br />

school in California. And while such instruction is currently spotty at best,<br />

the tools are already there — Next Gen Personal Finance offers free curriculums<br />

on its website (ngpf.org). If your child’s school doesn’t cover the<br />

subject, it might be time for a parental nudge.<br />

Another topic parents should keep an eye on is screen time. Bettijane<br />

Levine writes that many tech moguls, concerned about emerging<br />

research on the problematic effects of screen use on young brains, are<br />

keeping their kids in analog mode. That approach is, perhaps counterintuitively,<br />

becoming the province of the elite, while the rest employ<br />

electronic babysitters. But is a digital childhood screening out important<br />

life skills?<br />

Finally, there’s a lot to be said for setting aside a special time and<br />

place for focused experiences, where nothing else matters. In this Family<br />

Issue, we cover two such opportunities for childhood enrichment. Carl<br />

Kozlowski reports on Grief Camp in Glendale, where children who’ve<br />

suffered a personal loss can learn coping techniques and bond with<br />

other kids in similar circumstances. (The next one is coming up in early<br />

September; see the story for application details.) Kelleher writes about<br />

another terrifi c program — Grandparents University, where grandparents<br />

and grandkids share learning experiences on college campuses, mostly<br />

in the Midwest. In addition to fostering the intergenerational bond, GPUs<br />

help entice kids to pursue higher education.<br />

—Irene Lacher<br />

EDITOR-IN-CHIEF Irene Lacher<br />

ART DIRECTOR Stephanie Torres<br />

ASSISTANT ART DIRECTOR Richard Garcia<br />

PRODUCTION DESIGNERS Yumi Kanegawa<br />

EDITOR-AT-LARGE Bettijane Levine<br />

COPY EDITOR John Seeley<br />

CONTRIBUTORS Leslie Bilderback, Léon Bing,<br />

Martin Booe, Michael Cervin, Scarlet Cheng,<br />

Richard Cunningham, Tommy Ewasko, Noela<br />

Hueso, Kathleen Kelleher, Frier McCollister, Brenda<br />

Rees, Jordan Riefe, Ilsa Setziol, John Sollenberger,<br />

Nancy Spiller<br />

ACCOUNT EXECUTIVES Lisa Chase,<br />

Rick Federman, Javier Sanchez<br />

ADVERTORIAL CONTRIBUTING EDITOR<br />

Bruce Haring<br />

HUMAN RESOURCES MANAGER Andrea Baker<br />

PAYROLL Linda Lam<br />

ACCOUNTING Perla Castillo, Quinton Wright<br />

OFFICE MANAGER Ann Turrietta<br />

PUBLISHER Dina Stegon<br />

arroyo<br />

FINE LIVING IN THE GREATER PASADENA AREA<br />

SOUTHLAND PUBLISHING<br />

V.P. OF OPERATIONS David Comden<br />

PRESIDENT Bruce Bolkin<br />

CONTACT US<br />

ADVERTISING<br />

dinas@pasadenaweekly.com<br />

EDITORIAL<br />

editor@arroyomonthly.com<br />

PHONE<br />

(626) 584-1500<br />

FAX<br />

(626) 795-0149<br />

MAILING ADDRESS<br />

50 S. De Lacey Ave., Ste. 200,<br />

Pasadena, CA 91105<br />

ArroyoMonthly.com<br />

©20<strong>19</strong> Southland Publishing, Inc.<br />

All rights reserved.<br />

6 | ARROYO | 08.<strong>19</strong>

08.<strong>19</strong> | ARROYO | 7

FESTIVITIES<br />

Andrew Russell, Sarah Willoughby, Dr. Charles Elachi and Peter Jones<br />

Suzanne Cryer<br />

Beth Grant<br />

Ralph Vartabedian<br />

KCET and PBS SoCal hosted a sneak peak of their “Summer<br />

of Space” programs celebrating the 50th anniversary of the<br />

original moon walk at The Huntington Library, Art Collections<br />

and Botanical Gardens. The July 9 screening was followed by<br />

a panel discussion featuring Emmy-winning filmmaker Peter<br />

Jones, who made the KCET Original documentary miniseries<br />

Blue Sky Metropolis; former JPL Director Charles Elachi; Northrop<br />

Grumman exec Sarah Willoughby; and Los Angeles Times<br />

reporter Ralph Varabedian. Authors M.G. Lord and Wayne<br />

Biddle joined KCET and aerospace luminaries for a prosecco<br />

post-reception…Jason Alexander, Suzanne Cryer and Beth<br />

Grant were among the Hollywood notables who attended the<br />

June 30 opening of Roberto Aguirre-Sacasa‘s prep school<br />

drama Good Boys, starring Betsy Brandt (Breaking Bad), at the<br />

Pasadena Playhouse.<br />

Daena Title and Jason Alexander<br />

Marion Ross Andrew Russell David Zayas Daren Kagasoff<br />

8 | ARROYO | 08.<strong>19</strong><br />

PHOTOS: Courtesy of KCET. (KCET and PBS SoCal); Nick Agro (Pasadena Playhouse)

08.<strong>19</strong> | ARROYO | 9

TOTS ON<br />

TECH: THE<br />

NEW CLASS<br />

DIVIDE<br />

The rich ban technology<br />

for their children, while<br />

most of America<br />

embraces it.<br />

BY BETTIJANE LEVINE<br />

Steve Jobs and Bill Gates raised their kids substantially<br />

tech-free. That should have told us something. If the guys<br />

who invented the devices wouldn’t let their own kids use<br />

them, there must have been good reason. Yet in more than a decade<br />

since that news was revealed, America has increased its embrace of<br />

technology for children, even for infants and toddlers for whom,<br />

many parents believe, tablets and cellphones are the best babysitters<br />

and pacifiers ever invented.<br />

But not all of America is gung-ho for tech. It’s the middleand<br />

lower-income families whose kids are increasingly immersed<br />

in what many experts now say is too much brain- and psychedamaging<br />

screen time. The superrich, it seems, have declared<br />

war on digital devices. And that’s a total reversal.<br />

In tech’s early days, having technology at home or carrying<br />

it with you was a sign of wealth and status. Only the rich could<br />

afford costly new computers for their children, and worries arose<br />

that only privileged kids would develop essential skills, leaving<br />

the rest to lag behind. Now that tech is commonplace in schools<br />

and homes, its ill effects on children are emerging and a new<br />

kind of digital divide concerns pediatricians and social scientists:<br />

Children of the middle class and poor will be raised and taught<br />

by screens, while children of the elite will have the luxury of<br />

actual life experience with such things as books, toys and, most<br />

important, human interaction.<br />

“Life for anyone but the very rich...is increasingly mediated<br />

by screens,” tech journalist Nellie Bowles recently wrote in The<br />

New York Times. Screens are being foisted on the public as wondrous<br />

innovations for education, but for the multiple millions of<br />

children now exposed to screens from infancy onward, at home<br />

and at school, she writes, “the texture of life, the tactile experience,<br />

is becoming smooth glass.”<br />

The tech titans in Silicon Valley and other top income areas<br />

around the country are so afraid of screens for their kids, Bowles<br />

writes, that many parents now require nannies to sign a pledge<br />

that they will not allow any screen time for the children in<br />

their care, and will not even use their cellphones while with the<br />

children. These high-income parents are also opting for tech-free<br />

private schools, like the Waldorf schools, where no classroom<br />

technology is used until students are 12 or 13, and where parents<br />

are advised against any screen time for children when at home.<br />

(See sidebar.)<br />

They’re backed by studies on screen time’s effects on little ones,<br />

— just beginning to surface in medical journals — which are not<br />

comforting. They indicate that young children exposed to screens<br />

may lag behind in language development, thinking and communication<br />

skills, impulse control, socialization and concentration.<br />

–continued on page 12<br />

10 | ARROYO | 08.<strong>19</strong>

08.<strong>19</strong> | ARROYO | 11

–continued from page 10<br />

Meanwhile, more and more screen time is trending among middle- and<br />

lower-income families. Totally online preschools are reportedly proliferating.<br />

In these free programs, funded by government and nonprofits, 3- and<br />

4-year-olds learn nursery rhymes and letter sounds from a computer in their<br />

home without ever interacting with classmates or a live teacher. Opponents<br />

of such programs say that screen life is a poor substitute for real life. Preschool<br />

is mainly meant to prepare children to work well with others, to curb<br />

antisocial tendencies and to develop creativity, communication and social<br />

skills. None of that can be accomplished online, experts say.<br />

What’s more, child development depends upon utilization of all the<br />

senses, educators agree. Learning by looking at objects behind glass screens<br />

and listening to disembodied voices is no substitute for communicating eye<br />

to eye with other humans and experiencing the sensory stimuli that come,<br />

for example, from playing with real blocks, touching real animals and flowers<br />

or learning to write with pencil and paper rather than on a screen. A toddler<br />

can learn to identify a rose on a screen but will not experience the rose’s<br />

scent, its velvety petals or the prick of a thorn. The rose’s actual properties<br />

will remain unknown. A child learning about a real rose with a caring adult<br />

present will have all the sensory experiences and the benefit of a person to<br />

discuss them with.<br />

In April, the World Health Organization issued a new set of guidelines<br />

stating that babies under 1 should not be exposed to electronic screens, and<br />

“limiting or in some cases eliminating screen time for children under the<br />

age of 5 results in healthier adults.” Meanwhile, a groundbreaking study of<br />

more than 11,000 children is being conducted by the National Institutes of<br />

Health to determine the effects of screen time on children’s brain development.<br />

Preliminary results of children’s brain scans show that those who’ve<br />

spent multiple hours per day glued to a screen experience a thinning of<br />

12 | ARROYO | 08.<strong>19</strong>

The Waldorf Way<br />

To find out more about the Waldorf philosophy on technology,<br />

we talked with Erin Semin, the Pasadena Waldorf School’s pedagogical<br />

administrator. (There’s no title of principal at the school.)<br />

What is the Waldorf policy on tech?<br />

Waldorf is definitely anti-tech for lower grades. With the youngest<br />

children, we ask parents not to expose them to any tech at all. We<br />

work very strongly with parents starting in preschool to advocate for<br />

playtime, social time and creative time over screen time. In school<br />

we use no technology until seventh and eighth grade, when they start<br />

computer-based research projects under a teacher’s guidance.<br />

the cerebral cortex. That’s the layer of neural tissue responsible for processing<br />

information from each of the five senses. Other test results show that thinking<br />

and language-development skills are demonstrably lower for children who spend<br />

two hours a day or more gazing at screens. And a Canadian study released this<br />

year by the University of Calgary’s psychology department indicates that children<br />

ages 2 through 5 who experience high levels of screen time get lower test scores<br />

in communication, problem-solving and social and motor skills than those with<br />

little screen time.<br />

Many, if not most, of America’s families have not yet gotten the message.<br />

Children of middle- and low-income parents, from infancy onward, are increasingly<br />

building with virtual blocks, reading Goodnight Moon on tablets and<br />

learning to draw, spell and identify objects via digital devices. The new online<br />

preschools and public elementary schools use computers in classes and ask that<br />

homework be done on them. At any moderate-price restaurant you’ll see toddlers<br />

in high chairs fiddling with phones and tablets to keep them diverted while<br />

parents dine and chat. Kids traveling in cars watch screens rather than observe<br />

the passing scene while talking with their parents about it. Attachments to cribs<br />

allow infants lying on their backs to stare up at tablets programmed to play ageappropriate<br />

diversions.<br />

Some studies have shown that many grade-school children spend up to seven<br />

hours per day looking at screens in classrooms and then at home. And experts say<br />

that the more technology children are exposed to, the less human engagement<br />

occurs. Or, as one pundit put it: “Human engagement is becoming a luxury item.”<br />

Indeed, middle- and lower-income families, even with two working parents, can<br />

rarely afford private nannies or the cost of a tech-free private school such as the Waldorf<br />

schools, reportedly a favorite with Silicon Valley’s top-tier tech execs. Kindergarten<br />

tuition at the Pasadena Waldorf School in Altadena is about $25,000 per child.<br />

What’s the bottom line? All parents should be mindful of and cut back on children’s<br />

screen time, as well as their own screen time while with their children. But<br />

they needn’t panic. No longterm studies have yet been done to determine whether<br />

brain changes in children are permanent or temporary. And no studies yet address<br />

whether children who are heavy screen users will actually fare worse as adults<br />

than those who are raised without screens. Such research is still in its infancy. But<br />

common sense dictates that children raised with communicative adults and even<br />

the simplest shared real-life experiences will probably be emotionally, socially and<br />

intellectually better off than those who are abandoned by adults to a constant diet<br />

of screens. ||||<br />

What’s so wrong with tech, from the Waldorf perspective?<br />

It runs counter to the way the brain wants to develop. As a child<br />

moves through the world, they’re having sensory, social, movement<br />

and motor planning [the ability to plan and carry out a skilled motor<br />

act] experiences. Each of these experiences creates a pathway in their<br />

brain, an actual physical, neural pathway. There are points in development<br />

where, in order for the brain to grow, the pathways that are<br />

not well used or well traveled have to be cleared away. And so what a<br />

child spends much time doing has long-term effect.<br />

The more you do a certain thing, the more myelenated , or<br />

cemented, that brain pathway becomes. A child who is frequently<br />

outside observing nature, running, jumping and falling has well protected<br />

pathways for motor planning and executive functioning, for<br />

reasoning with the relative dangers in life. One who spends a lot of<br />

time with a screen that’s two or three inches from the face will have a<br />

lot of visual input pathways but few motor ones well established.<br />

A child sitting in a high chair at a dinner table, watching grownups<br />

converse, and every now and then a grownup converses with the<br />

child, who may also be figuring out how big a stack of sugar cubes<br />

they can build, that child is working on patience, learning social<br />

skills and cues and learning a kind of syntax of human conversation<br />

and relationships. A child at a table with a phone in front of him, not<br />

paying attention to anything else, is not using pathways shaped by<br />

their own experiences but only absorbing what the producer of that<br />

program has decided a 2- or 3-year-old would be interested in.<br />

What’s the difference between, say, building with blocks or digging in<br />

sand on a screen and in real life?<br />

To click and drag a cursor on a screen is simply a fine motor and<br />

visual panning activity. Yet the program tells you that you have just<br />

dug a hole or built a castle. A child who is not on a screen but in the<br />

world will learn that you need a shovel and sand and it takes hours to<br />

build a hole that’s big enough to stand in. So the child has a realistic<br />

sense of the physical effort it takes to produce change in the world.<br />

The child also gets a better basis for future physics, chemistry and<br />

math learning when he or she builds with real blocks. Stacking the<br />

blocks, you sense how heavy they are, you know intrinsically that<br />

different size blocks will hurt differently if they fall on your foot,<br />

and that certain ways of building will be more wobbly than others.<br />

This becomes the basis for intellectual learning later on. Students<br />

can work not just with a concept, but can marry that concept to what<br />

they’ve already learned in life.<br />

—B.L. ||||<br />

08.<strong>19</strong> | ARROYO | 13

14 | ARROYO | 08.<strong>19</strong>

DOLLARS AND SENSE<br />

Educators are being urged to offer financial literacy courses<br />

that could help avoid future student loan catastrophes.<br />

BY KATHLEEN KELLEHER<br />

Student loan debt is now at a record high — estimated at more than $1.5 trillion for 20<strong>19</strong><br />

— second only to mortgage debt. Student loans also have higher delinquency rates than<br />

other forms of debt. Call it a trillion-dollar crisis. Democratic presidential hopefuls<br />

like Elizabeth Warren and Bernie Sanders do; both senators describe student loan debt as<br />

a national emergency. A recent Harvard Business School study concludes that burdensome<br />

student loan debt is paralyzing young people, actually stopping them from getting advanced<br />

degrees in pursuit of better-paying jobs, buying homes and getting married — ultimately<br />

diminishing more substantial contributions they should be making to the economy.<br />

It doesn’t have to be this way. Teaching personal financial education in schools is one way<br />

to lower mounting student loan debt by preparing college-bound high school graduates for<br />

the complexities of paying for continued schooling, the first time most will take out loans, say<br />

advocates for mandatory school financial literacy education. Most students do not grasp the<br />

fundamentals of complex financial decisions, particularly those whose parents can’t help them<br />

navigate the maze of loan and aid options. Less than one-third of college-bound high school<br />

grads know how to compare loans, more than half do not pencil out future loan payments and<br />

over half regret student loan choices, wishing they could change college finance commitments,<br />

according to to the National Endowment for Financial Education (NEFE), a nonprofit<br />

dedicated to empowering individuals and families to make sound financial decisions.<br />

“Student loan debt is almost greater than mortgage debt, and it cannot be discharged in<br />

bankruptcy [although] most students think it can be,” said Anthony Zambelli, director of the<br />

San Diego Center for Economic Education and economics professor at Cuyamaca College in<br />

San Diego. “It is humongous and one of the downsides to all of this is an economy driven by<br />

borrowing…okay in the short run, but not the long run.”<br />

Yet personal financial education courses are not a high school graduation requirement and<br />

are not offered in most schools. South Pasadena High School, for example, does not have a<br />

standalone course on personal finance although it teaches an applied-math class that covers<br />

some personal finance elements, according to Next Gen Personal Finance (NGPF), a Palo<br />

Alto–based nonprofit that analyzes content and availability of personal finance courses at<br />

more than 11,000 U.S. high schools (here is the link to the search tool: ngpf.org/advocacy/).<br />

(Arroyoland schools are largely absent from the list, with the exception of Alhambra High,<br />

which offers a course in finance that meets the group’s “silver standard.”)<br />

South Pasadena High also offers an elective virtual business-enterprise class that touches<br />

on personal finance, said Principal Janet Anderson. Pasadena High School has no personal<br />

finance class, according to NGPF. The Waverly School, a progressive private school in<br />

Pasadena, has an applied finance and accounting class in its high school that includes some<br />

personal finance lessons, according to a school representative, speaking off the record.<br />

Only six high schools in California have standalone personal finance courses required for<br />

graduation; NGPF considers a 60-hour standalone semester course to be the gold standard.<br />

California requires a semester-long economics class to graduate, but such courses touch only<br />

briefly on personal finance education, said Zambelli, adding, “The lack of a [California] statewide<br />

test on economics and personal finance means that high school economics teachers can<br />

teach whatever they feel meets the standards.” About 140 California schools offer semesterlong,<br />

standalone personal finance electives, according to NGPF. The rest of the state’s high<br />

schools meet the one-semester economics class requirement, but, Zambelli and other proponents<br />

of personal finance education say, “It is not enough.” California has received an “F” since<br />

2013 for its schools’ weak personal financial education on the Center for Financial Literacy<br />

–continued on page 16<br />

08.<strong>19</strong> | ARROYO | 15

–continued from page 15<br />

(CFL) Report Card, issued biannually by Champlain College in Vermont.<br />

“The definition of an ‘F’ is a state with no, or few, financial ed requirements,” said John Pelletier,<br />

director of the center, which offers a graduate-level summer course in teaching personal<br />

finance. “California has an economics requirement to graduate but no financial ed. What we<br />

know is that educators are as financially illiterate as anyone. There are very few states that require<br />

teachers to show an endorsement on their teaching license that they can teach this stuff. ”<br />

While five states (Virginia, Utah, Missouri, Tennessee and Alabama) require one semester<br />

of personal finance education to graduate from high school, only two states require the 60-<br />

hour gold standard, said Ranzetta, whose data builds on the 2017 Financial Report Card<br />

from the Center for Financial Literacy. One in six high school graduates takes a mandated<br />

personal finance course to graduate in the U.S., NGPF found. In low-income communities,<br />

that number drops to one in 12 students. Tim Ranzetta, cofounder of NGPF, says that<br />

requiring at least one semester of comprehensive, hands-on personal financial education for<br />

high school grads is the most effective way to ensure access for all students. Classes “embedded”<br />

with bits of personal finance info tend to be insufficient, trying to cover the material in<br />

just a few weeks.<br />

“You can’t possibly consider that adequate for a subject as comprehensive as personal<br />

finance,” said Ranzetta, who was inspired to create NGPF in 2014 after volunteering to teach<br />

the subject at a public school. “When personal finance is embedded in another class, it’s much<br />

more likely to be glossed over. If you asked students in those 25 states with personal finance<br />

embedded in other classes, you would hear, ‘I don’t recall ever taking personal finance.’ Their<br />

methodology of embedding it in other courses creates a really low bar.”<br />

Americans, in general, don’t fare well on basic financial literacy tests: nearly two-thirds of<br />

Americans (63 percent) fail a basic five-question financial literacy test, according to a study<br />

conducted by the Financial Industry Regulatory Authority (FINRA), a nonprofit dedicated<br />

to protecting investors. Less than one-third of Americans correctly answered a question about<br />

compound interest. Less than one-sixth of U.S. 15-year-olds understand simple concepts used<br />

in basic decision-making on everyday spending.<br />

Despite a dearth of personal finance knowledge, most college-bound high school grads<br />

must grapple with interest rates, comparing loans, calculating future payment plans, understanding<br />

when loans are due, terms of deferment and costs of defaulting, including hits to<br />

credit scores. Some lenders prey on consumers with low financial literacy, including collegebound<br />

students. Yet California has not done its part to help students become smarter borrowers.<br />

But there is legislation in the works to change that.<br />

A bill introduced last year (AB 1087), sponsored by Assemblyman Jordan Cunningham<br />

(R-San Luis Obispo), would make personal financial education a high school graduation requirement;<br />

whether that would be achieved with comprehensive materials on financial education<br />

baked into an economics class or a standalone personal finance education class is yet to be<br />

decided. Details will be worked out in committee hearings and the bill will be revisited next<br />

January, according to Cunningham’s chief of staff, Nicholas Mirman. But if funding does<br />

not follow the mandate for personal finance education classes in high schools, said Zambelli,<br />

nothing will happen.<br />

“We would like to suggest that in the future, curriculum frameworks for California<br />

high schools will include financial education,” said CFL’s Pelletier. “Right now there are not<br />

standards for financial education. I would argue that the curriculum is free so the only other<br />

cost is teacher training.”<br />

Ranzetta and other advocates have set a new goal of requiring 100 percent of American<br />

high schoolers to complete at least one semester of personal finance education by 2030. In<br />

San Diego County public high schools, students have three to four weeks of personal finance<br />

included in the required economics class, but, he added, it’s too little too late. Zambelli would<br />

like to see the subject built into curriculums from preschool to college. Also, California state<br />

universities’ personal financial education classes do not qualify for their behavioral science<br />

class requirement, yet another failed opportunity, he added. Zambelli just helped orchestrate<br />

three days of financial education training in June at University of San Diego for nearly 40<br />

elementary, high school and college teachers from around the country; the event was presented<br />

by the San Diego Center for Economic Education in partnership with the Federal<br />

Reserve banks of Atlanta, Dallas, San Francisco and St. Louis.<br />

“Our first thrust is to teach the teachers how best to teach those personal finance subjects,<br />

and then we try to improve their own personal finance, because how can you teach it if you<br />

don’t know how to do it yourself?” said Zambelli. He noted that he learned to save when a<br />

bank rep visited his second-grade class and taught students to save 50 cents a week in a bank<br />

account, a saving habit that stuck for life. It taught him how to delay gratification, a lesson he<br />

passed onto his daughter, who saved enough to buy her own first car. “We are not taught to<br />

wait and we are not taught to save,” said Zambelli. “The younger we can get them, the better.”<br />

Surprisingly, there is some debate about whether personal finance education is effective.<br />

One critic is Lauren Willis, a professor of consumer law at Loyola Law School in Los Angeles.<br />

Willis argues that some studies show that financial education does not change behavior<br />

and over time loses any positive impact. “There is virtually a nothing effect averaged over<br />

–continued on page 18<br />

16 | ARROYO | 08.<strong>19</strong>

08.<strong>19</strong> | ARROYO | 17

–continued from page 16<br />

people’s lives,” Willis said. “We expect people to be their own fi nancial planners. My<br />

mom is a weaver. Financial planning is not her area of expertise. I don’t fi x my own<br />

car.”<br />

But other studies support arguments by fi nancial education advocates. A recently<br />

published study in the Journal of Money, Credit and Banking looked at the eff ects of<br />

state-mandated personal fi nancial courses eff ects on fi nancial decisions made by<br />

incoming freshman at four-year colleges. Researchers Christina Stoddard and Carly<br />

Urban, professors of economics at Montana State University, compared students<br />

from three states with a personal fi nance graduation requirement to students from<br />

states without one; they also assessed students in the same state before and after these<br />

courses became requirements.<br />

Th ey found that mandated personal fi nancial education classes “shifted students<br />

from high-cost to low-cost fi nancing.” Th e mandated courses also led to increased<br />

aid to incoming freshmen and acceptance of federally subsidized loans (with lower<br />

interest rates). And they reduced the likelihood that students would carry credit card<br />

balances. Students from a ffl uent families took out smaller private loans, and those<br />

from less wealthy families were also less likely to work while enrolled as students<br />

(more study time, better outcomes). (A “plausible explanation” for lower-income students<br />

working less is that they had less fi nancial need to work because they borrowed<br />

wisely, but the researchers could not specifi cally “pin down the why.”) Th e re searchers<br />

followed the students from ages 18 to 22, and in a study published last year, Urban<br />

found that mandated personal fi nance education in high schools resulted in higher<br />

credit scores and fewer severe delinquencies in that age group. She compared three<br />

states (Georgia, Idaho and Texas) that had passed legislation requiring personal<br />

fi nancial education courses for graduation to a neighboring state with no such<br />

requirement. She also compared credit scores and delinquency rates among students<br />

within the same state before and after the state mandated fi nancial education. Th e<br />

latter comparison shows the causal eff ect, she said.<br />

“Students shift their borrowing to more responsible borrowing,” Urban said in<br />

an interview. “Students are getting more grants and scholarships after they get more<br />

fi nancial education. We think it has to be required to have an eff ect.”<br />

In sum, Urban and Stoddard’s study suggests mandated personal fi nance education<br />

in high school makes college-bound grads smarter and better borrowers, and<br />

decreases their overall debt. Th at’s encouraging, considering a record 7 million<br />

Americans are falling three months behind on car loan payments, and U.S. credit<br />

card debt, now $870 billion, is the highest it has ever been. And one-fourth of Americans<br />

admit that they cannot pay their bills on time, according to the Federal Reserve<br />

Bank of New York and the National Foundation for Credit Counseling. “I love this<br />

study because it measures what we want to measure — behavior…not how they do on<br />

fi n lit tests,” said Pelletier.<br />

Exacerbating college debt is the rise in tuition rates. Over the past decade states<br />

have slashed college funding by an average of 16 percent per student; that necessitates<br />

tuition increases which in turn force students to take on ever-larger debt loads. Average<br />

student loan debt for borrowers ages 24 to 32 jumped from about $5,000 in 2005<br />

to $10,000 in 2014, according to the Federal Reserve Bank of New York. Borrowers<br />

in the class of 2017, on average, owe $28,650, according to the Institute for College<br />

Access and Success, a nonprofi t that works to make higher education in the U.S.<br />

more aff ordable.<br />

Ranzetta, whose NGPF off ers free teaching material on personal fi nance, emphasizes<br />

the enduring value of communicating simple basics: Establishing good credit by<br />

paying bills and loan payments on time and avoiding credit card balances with added<br />

interest can save hundreds of thousands of dollars on a mortgage loan. Even avoiding<br />

overdraft fees on a bank account, which earn banks $30 billion a year, is covered<br />

in basic personal fi nance instruction. Overdraft fees can turn a $3.75 cup of coff ee<br />

charged to an overdrawn bank account into a $38.75 cup of java.<br />

“What gives me hope is that there are 600 schools in the nation that require<br />

personal fi nance that are not located in states that require it,” said Ranzetta. “So there<br />

are teachers, students, parents, administrators and board members who have stood up<br />

and demanded fi nancial education in their local high schools. Th ere are just too many<br />

important decisions for it to be an ‘Oops, now how am I going to sort this out’” | ||<br />

18 | ARROYO | 08.<strong>19</strong>

arroyo<br />

~HOME SALES INDEX~<br />

HOME SALES<br />

-0.46%<br />

AVG. PRICE/SQ. FT.<br />

2.09.%<br />

June<br />

2018<br />

436HOMES<br />

SOLD<br />

ALHAMBRA JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 39 18<br />

Median Price $680,000 $739,000<br />

Median Sq. Ft. 1347 15<strong>19</strong><br />

ALTADENA JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 41 16<br />

Median Price $760,000 $842,000<br />

Median Sq. Ft. 1507 1507<br />

ARCADIA JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 35 17<br />

Median Price $1,032,000 $775,000<br />

Median Sq. Ft. 1675 1352<br />

EAGLE ROCK JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 14 15<br />

Median Price $931,250 $902,000<br />

Median Sq. Ft. 1384 1352<br />

GLENDALE JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 96 36<br />

Median Price $830,000 $742,500<br />

Median Sq. Ft. 1520 1300<br />

LA CAÑADA JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 27 20<br />

Median Price $1,701,500 $1,924,000<br />

Median Sq. Ft. 1540 3022<br />

PASADENA JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 148 94<br />

Median Price $822,500 $902,500<br />

Median Sq. Ft. 1540 1660<br />

SAN MARINO JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 9 6<br />

Median Price $1,930,000 $1,926,500<br />

Median Sq. Ft. 2163 2250<br />

SIERRA MADRE JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 8 4<br />

Median Price $1,434,000 $713,500<br />

Median Sq. Ft. 2163 1064<br />

SOUTH PASADENA JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold <strong>19</strong> 8<br />

Median Price $1,430,000 $1,472,750<br />

Median Sq. Ft. <strong>19</strong>17 2103<br />

TOTAL JUNE ’18 JUNE ’<strong>19</strong><br />

Homes Sold 436 234<br />

Avg Price/Sq. Ft. $1893 $613<br />

<br />

June<br />

20<strong>19</strong><br />

234HOMES<br />

SOLD<br />

HOME SALES ABOVE $850,000<br />

source: CalREsource<br />

ADDRESS CLOSE DATE PRICE BDRMS. SQ. FT. YR. BUILT PREV. PRICE PREV. SOLD<br />

ALHAMBRA<br />

932 North Electric Ave. 6/5/<strong>19</strong> $4,820,000 3 1,236 <strong>19</strong>07<br />

1816 West Grand Ave. 6/26/<strong>19</strong> $1,130,000 4 2,894 <strong>19</strong>25 $800,000 11/2/12<br />

405 North 3rd St. 6/27/<strong>19</strong> $1,110,000 4 2,132 <strong>19</strong>28<br />

501 North El Molino St. 6/6/<strong>19</strong> $1,030,000 5 2,2<strong>19</strong> <strong>19</strong>30 $899,000 8/24/16<br />

ALTADENA<br />

2010 Midwick Dr. 6/26/<strong>19</strong> $2,500,000 5 3,699 <strong>19</strong>22 $2,000,000 9/23/14<br />

960 Alta Pine Dr. 6/21/<strong>19</strong> $1,168,000 2 1,484 <strong>19</strong>48 $270,000 8/20/98<br />

1005 Parkman St. 6/25/<strong>19</strong> $1,090,000 4 1,960 <strong>19</strong>25 $715,500 11/7/08<br />

2174 Mar Vista Ave. 6/<strong>19</strong>/<strong>19</strong> $1,087,000 3 1,685 <strong>19</strong>49 $760,000 10/30/18<br />

2828 North Mount Curve Ave. 6/20/<strong>19</strong> $1,050,000 3 2,062 <strong>19</strong>95 $681,000 10/29/09<br />

1807 North Altadena Dr. 6/20/<strong>19</strong> $1,010,000 3 2,154 <strong>19</strong>40<br />

805 New York Dr. 6/25/<strong>19</strong> $887,000 2 1,355 <strong>19</strong>47 $485,000 3/18/13<br />

ARCADIA<br />

1620 South 4th Ave. 6/3/<strong>19</strong> $1,860,500 2 985 <strong>19</strong>47 $875,000 8/12/14<br />

2039 Elkins Place 6/17/<strong>19</strong> $1,700,000 3 1,813 <strong>19</strong>55 $1,388,000 3/<strong>19</strong>/14<br />

1327 Linda Way 6/3/<strong>19</strong> $1,200,000 4 1,834 <strong>19</strong>63 $880,000 3/16/16<br />

909 North Santa Anita Ave. 6/24/<strong>19</strong> $1,150,000 4 1,896 <strong>19</strong>49<br />

1029 Encino Ave. 6/26/<strong>19</strong> $1,109,000 3 1,776 <strong>19</strong>56 $761,000 11/26/07<br />

220 Eldorado St. 6/<strong>19</strong>/<strong>19</strong> $1,045,000 3 1,973 2003 $528,000 6/4/03<br />

322 Diamond St. #2 6/<strong>19</strong>/<strong>19</strong> $860,000 3 1,936 2000 $360,000 8/2/00<br />

E AGLE ROCK<br />

5148 Dahlia Dr. 6/18/<strong>19</strong> $1,495,000 3 1,795 <strong>19</strong>23 $549,000 5/22/08<br />

2411 Langdale Ave. 6/3/<strong>19</strong> $1,425,000 2 807 <strong>19</strong>22 $500,000 1/8/18<br />

4326 York Blvd. 6/<strong>19</strong>/<strong>19</strong> $1,380,000 2 861 <strong>19</strong>27 $1,100,000 6/22/17<br />

911 La Loma Rd. 6/6/<strong>19</strong> $990,000 4 2,235 <strong>19</strong>47 $490,000 8/27/09<br />

4949 Genevieve Ave. 6/28/<strong>19</strong> $965,000 4 2159 <strong>19</strong>41 $550,000 7/12/07<br />

2330 Yosemite Dr. 6/25/<strong>19</strong> $9<strong>19</strong>,000 5 1882 <strong>19</strong>08<br />

4336 Toland Way 6/25/<strong>19</strong> $910,000 4 1856 <strong>19</strong>30<br />

2537 Hyler Ave. 6/4/<strong>19</strong> $902,000 3 1,308 <strong>19</strong>27 $575,000 3/26/07<br />

4911 Algoma Ave. 6/5/<strong>19</strong> $866,500 3 1,980 <strong>19</strong>85 $172,000 6/1/87<br />

1490 Silverwood Dr. 6/17/<strong>19</strong> $853,000 2 1,352 <strong>19</strong>52<br />

1042 Glen Arbor Ave. 6/25/<strong>19</strong> $850,000 3 2055 <strong>19</strong>50 $415,000 11/2/10<br />

GLENDALE<br />

1609 San Gabriel Ave. 6/5/<strong>19</strong> $1,700,000 3 2,<strong>19</strong>2 <strong>19</strong>50<br />

1633 Santa Barbara Ave. 6/4/<strong>19</strong> $1,423,000 2 2,467 <strong>19</strong>25 $1,350,000 6/7/18<br />

<strong>19</strong>60 El Arbolita Dr. 6/6/<strong>19</strong> $1,408,000 3 2,596 <strong>19</strong>36 $1,175,000 11/8/13<br />

1444 East Maple St. 6/17/<strong>19</strong> $1,315,000 4 2,640 <strong>19</strong>23 $1,090,000 11/9/17<br />

3000 North Verdugo Rd. 6/25/<strong>19</strong> $1,250,000 4 2,177 <strong>19</strong>50 $718,000 3/7/<strong>19</strong><br />

206 Allen Ave. 6/25/<strong>19</strong> $1,215,000 2 2,068 <strong>19</strong>20 $230,000 7/16/98<br />

953 Calle La Primavera 6/20/<strong>19</strong> $1,040,000 4 2,548 <strong>19</strong>92 $980,000 3/23/15<br />

1315 Romulus Dr. 6/17/<strong>19</strong> $1,030,000 2 1,096 <strong>19</strong>27 $880,000 11/8/16<br />

<strong>19</strong><strong>19</strong> Canada Blvd. 6/24/<strong>19</strong> $930,000 4 2,594 <strong>19</strong>31<br />

1109 Green St. 6/28/<strong>19</strong> $915,000 3 1,503 <strong>19</strong>29 $688,000 6/6/16<br />

1858 Caminito Del Cielo 6/24/<strong>19</strong> $900,000 2 2,146 <strong>19</strong>90 $825,000 4/28/16<br />

3535 Rosemary Ave. 6/17/<strong>19</strong> $885,000 2 1,045 <strong>19</strong>25 $269,000 2/1/89<br />

1600 Marion Dr. 6/28/<strong>19</strong> $850,000 3 1,250 <strong>19</strong>63 $654,500 3/3/16<br />

LA CAÑADA<br />

5350 Harter Lane 6/18/<strong>19</strong> $5,100,000 5 8,797 2005 $350,000 11/12/99<br />

635 Berkshire Ave. 6/6/<strong>19</strong> $4,250,000 6 6,107 <strong>19</strong>49 $10,000 1/1/92<br />

384 Meadow Grove St. 6/<strong>19</strong>/<strong>19</strong> $3,700,000 5 5,255 <strong>19</strong>31<br />

4257 Woodleigh Lane 6/<strong>19</strong>/<strong>19</strong> $3,070,000 6 3,056 <strong>19</strong>24 $2,900,000 12/29/14<br />

4228 Chula Senda Lane 6/6/<strong>19</strong> $2,750,000 2 2,357 <strong>19</strong>50<br />

4284 Hampstead Rd. 6/4/<strong>19</strong> $2,600,000 3 3,039 <strong>19</strong>76<br />

4736 Gould Ave. 6/4/<strong>19</strong> $2,500,000 5 3,792 <strong>19</strong>41 $2,220,000 6/4/07<br />

5525 Stardust Rd. 6/26/<strong>19</strong> $2,400,000 4 3,004 <strong>19</strong>58 $1,245,000 3/1/06<br />

–continued on page 21<br />

The Arroyo Home Sales Index is calculated from residential home sales in Pasadena and the surrounding communities of South Pasadena, San Marino, La Canada Flintridge, Eagle Rock, Glendale (including Montrose), Altadena, Sierra<br />

Madre, Arcadia and Alhambra. Individual home sales data provided by CalREsource. Arroyo Home Sales Index © Arroyo 20<strong>19</strong>. Complete home sales listings appear each week in Pasadena Weekly.<br />

08.<strong>19</strong> ARROYO | <strong>19</strong>

20 | ARROYO | 08.<strong>19</strong>

–continued from page <strong>19</strong><br />

ADDRESS CLOSE DATE PRICE BDRMS. SQ. FT. YR. BUILT PREV. PRICE PREV. SOLD<br />

LA CAÑADA<br />

4730 Hayman Ave. 6/27/<strong>19</strong> $2,310,500 4 3,258 <strong>19</strong>54 $1,900,000 2/8/17<br />

4810 Fairlawn Dr. 6/17/<strong>19</strong> $1,948,000 4 2,917 <strong>19</strong>50 $766,000 4/4/01<br />

1304 Journeys End Dr. 6/20/<strong>19</strong> $1,900,000 3 1,666 <strong>19</strong>57 $990,000 9/11/15<br />

660 Pomander Place 6/<strong>19</strong>/<strong>19</strong> $1,842,500 4 2,606 <strong>19</strong>51 $1,200,000 10/28/09<br />

933 Coral Way 6/28/<strong>19</strong> $1,815,000 5 3,231 <strong>19</strong>56 $530,000 4/26/00<br />

5025 Ocean View Blvd. 6/28/<strong>19</strong> $1,560,000 3 2,296 <strong>19</strong>63 $880,000 2/25/05<br />

547 Meadowview Dr. 6/4/<strong>19</strong> $1,492,000 4 2,509 <strong>19</strong>73 $1,760,000 2/14/<strong>19</strong><br />

515 Starlight Crest Dr. 6/4/<strong>19</strong> $1,492,000 4 4,266 <strong>19</strong>66 $1,700,000 3/29/12<br />

5156 Redwillow Lane 6/4/<strong>19</strong> $1,492,000 4 4,707 <strong>19</strong>90 $750,000 12/1/89<br />

2020 Manistee Dr. 6/21/<strong>19</strong> $1,417,000 3 1,912 <strong>19</strong>61 $1,145,000 10/3/16<br />

2104 Normanton Dr. 6/28/<strong>19</strong> $1,165,000 3 1,888 <strong>19</strong>61<br />

PASADENA<br />

890 Huntington Circle 6/3/<strong>19</strong> $6,300,000 7 7184 <strong>19</strong>33 $3,430,000 7/20/04<br />

801 South San Rafael Ave. 6/18/<strong>19</strong> $3,850,000 4 3310 <strong>19</strong>47 $750,000 5/1/87<br />

325 South Grand Ave. 6/5/<strong>19</strong> $3,300,000 7 5908 1893 $2,310,000 4/25/03<br />

1112 Wellington Ave. 6/28/<strong>19</strong> $3,150,000 3 3473 <strong>19</strong>12 $1,716,000 10/12/11<br />

1235 Linda Ridge Rd. 6/18/<strong>19</strong> $2,800,000 4 2641 <strong>19</strong>57 $1,600,000 4/16/10<br />

1010 Old Mill Rd. 6/28/<strong>19</strong> $2,550,000 5 2909 <strong>19</strong>22 $1,720,000 6/30/11<br />

420 South Greenwood Ave. 6/5/<strong>19</strong> $2,150,000 4 2888 <strong>19</strong>26 $1,112,000 5/21/03<br />

929 South Oakland Ave. 6/5/<strong>19</strong> $2,145,000 4 2617 <strong>19</strong>20 $995,000 3/12/04<br />

537 Michigan Blvd. 6/18/<strong>19</strong> $2,050,000 6 5856 <strong>19</strong>25<br />

112 South Orange Grove Blvd. #2086/28/<strong>19</strong> $2,050,000 2 2530 2016 $1,678,045 5/25/16<br />

1313 North Hill Ave. 6/28/<strong>19</strong> $1,798,000 5000 <strong>19</strong>24<br />

1340 East California Blvd. 6/4/<strong>19</strong> $1,755,000 3 3600 <strong>19</strong>31 $956,500 3/14/<strong>19</strong><br />

80 South Sunnyslope Ave. 6/<strong>19</strong>/<strong>19</strong> $1,715,000 9 4948 <strong>19</strong>66<br />

3675 Yorkshire Rd. 6/20/<strong>19</strong> $1,680,000 3 1440 <strong>19</strong>47 $760,000 7/22/17<br />

1590 Oakdale St. 6/27/<strong>19</strong> $1,615,000 4 3034 <strong>19</strong>23<br />

85 Glen Summer Rd. 6/28/<strong>19</strong> $1,560,000 4 2301 <strong>19</strong>47 $1,512,000 8/17/16<br />

2750 San Pasqual St. 6/3/<strong>19</strong> $1,535,500 3 1770 <strong>19</strong>52 $489,500 9/3/99<br />

385 South Bonnie Ave. 6/<strong>19</strong>/<strong>19</strong> $1,529,000 3 2091 <strong>19</strong>36 $585,000 10/18/00<br />

722 East California Blvd. 6/6/<strong>19</strong> $1,467,000 5 <strong>19</strong>05 <strong>19</strong>22 $1,050,000 2/15/07<br />

1052 Pine Oak Lane 6/18/<strong>19</strong> $1,435,000 4 2379 <strong>19</strong>68<br />

1151 South Los Robles Ave. 6/6/<strong>19</strong> $1,421,000 3 2036 <strong>19</strong>48 $799,000 1/24/05<br />

99 Annandale Rd. 6/5/<strong>19</strong> $1,396,000 3 2148 <strong>19</strong>36 $1,049,000 6/18/12<br />

1424 Linda Vista Ave. 6/18/<strong>19</strong> $1,370,000 3 1803 <strong>19</strong>46 $908,000 7/31/12<br />

3695 Greenhill Rd. 6/<strong>19</strong>/<strong>19</strong> $1,275,000 2 2090 <strong>19</strong>50<br />

745 La Loma Rd. 6/25/<strong>19</strong> $1,245,000 4 1757 <strong>19</strong>08<br />

1098 North Los Robles Ave. 6/25/<strong>19</strong> $1,200,000 5 2949 <strong>19</strong>38<br />

1573 North Hill Ave. 6/27/<strong>19</strong> $1,<strong>19</strong>5,000 2 2047 <strong>19</strong>24 $525,000 3/24/17<br />

ADDRESS CLOSE DATE PRICE BDRMS. SQ. FT. YR. BUILT PREV. PRICE PREV. SOLD<br />

PASADENA<br />

3840 Canfi eld Rd. 6/5/<strong>19</strong> $1,181,000 2 1850 <strong>19</strong>50<br />

981 Worcester Ave. 6/6/<strong>19</strong> $1,149,500 4 <strong>19</strong>11 <strong>19</strong>12 $905,000 3/12/15<br />

946 East Topeka St. 6/20/<strong>19</strong> $1,127,000 3 2407 <strong>19</strong>81 $339,000 3/23/98<br />

1436 Paloma St. 6/4/<strong>19</strong> $1,125,000 5 2434 <strong>19</strong>24<br />

1424 Wesley Ave. 6/21/<strong>19</strong> $1,105,000 4 2060 <strong>19</strong>24<br />

1390 Riviera Dr. 6/6/<strong>19</strong> $1,100,000 3 2095 <strong>19</strong>55 $310,000 8/1/90<br />

2186 Las Lunas St. 6/24/<strong>19</strong> $1,090,000 3 2058 <strong>19</strong>52 $695,000 9/21/10<br />

3696 Yorkshire Rd. 6/28/<strong>19</strong> $1,070,000 3 2048 <strong>19</strong>47 $810,000 12/12/18<br />

108 South El Molino Ave. #302 6/20/<strong>19</strong> $1,050,000 3 1811 2004 $800,000 7/9/12<br />

1465 Washburn Rd. 6/24/<strong>19</strong> $1,031,000 3 1218 <strong>19</strong>58 $660,000 1/25/13<br />

383 South Marengo Ave. #102 6/21/<strong>19</strong> $1,020,000 3 1660 $874,500 7/18/17<br />

135 Backus Ave. 6/4/<strong>19</strong> $1,000,000 5 2054 <strong>19</strong>24 $305,000 6/3/09<br />

2174 Casa Grande St. 6/6/<strong>19</strong> $990,000 3 1518 <strong>19</strong>31 $610,000 11/16/09<br />

2<strong>19</strong>3 Loma Vista St. 6/<strong>19</strong>/<strong>19</strong> $975,000 4 1474 <strong>19</strong>28 $235,000 4/1/92<br />

1693 East Elizabeth St. 6/21/<strong>19</strong> $970,000 4 2070 <strong>19</strong>39 $849,000 11/15/16<br />

1851 Fiske Ave. 6/25/<strong>19</strong> $950,000 3 1789 <strong>19</strong>48 $740,000 4/5/17<br />

2212 East Crary St. 6/3/<strong>19</strong> $945,000 3 1614 <strong>19</strong>50 $710,000 11/17/05<br />

1545 Knollwood Terrace 6/3/<strong>19</strong> $945,000 4 2159 <strong>19</strong>54 $1,800,000 5/3/<strong>19</strong><br />

2245 East Dudley St. 6/3/<strong>19</strong> $941,000 3 1736 <strong>19</strong>28 $247,500 3/1/89<br />

87 Columbia St. 6/4/<strong>19</strong> $905,000 2 1142 <strong>19</strong>25<br />

125 Hurlbut St. #107 6/27/<strong>19</strong> $900,000<br />

3576 Thorndale Rd. 6/26/<strong>19</strong> $890,000 2 1241 <strong>19</strong>38 $805,000 6/6/14<br />

1432 North Harding Ave. 6/<strong>19</strong>/<strong>19</strong> $875,000 2 1780 <strong>19</strong>33<br />

1131 South Orange Grove Blvd. 6/27/<strong>19</strong> $870,000 2 1618 <strong>19</strong>64 $800,000 2/21/17<br />

1758 Kenneth Way 6/<strong>19</strong>/<strong>19</strong> $855,000 2 837 <strong>19</strong>49 $530,000 9/18/18<br />

SAN MARINO<br />

1450 Westhaven Rd. 6/24/<strong>19</strong> $2,993,500 3 2207 <strong>19</strong>52 $1,846,000 6/3/16<br />

811 South Santa Anita Ave. 6/6/<strong>19</strong> $2,108,000 4 32<strong>19</strong> <strong>19</strong>49<br />

1836 Sharon Place 6/20/<strong>19</strong> $1,928,000 3 2294 <strong>19</strong>50 $650,000 7/1/90<br />

2865 Lorain Rd. 6/5/<strong>19</strong> $1,925,000 3 2369 <strong>19</strong>53 $540,000 12/5/00<br />

1710 Rubio Dr. 6/27/<strong>19</strong> $1,728,000 3 <strong>19</strong>73 <strong>19</strong>40 $1,251,000 6/1/06<br />

2285 Longden Dr. 6/28/<strong>19</strong> $1,360,000 2 1434 <strong>19</strong>47<br />

SIERRA MADRE<br />

407 West Orange Grove Ave. 6/18/<strong>19</strong> $1,225,000 2 1735 <strong>19</strong>60 $900,000 9/9/18<br />

SOUTH PASADENA<br />

803 Columbia St. 6/<strong>19</strong>/<strong>19</strong> $3,951,500 6 4785 <strong>19</strong>25 $1,635,000 5/15/02<br />

238 Saint Albans Ave. 6/18/<strong>19</strong> $1,745,500 4 3846 <strong>19</strong>86 $1,500,000 1/18/17<br />

1233 Brunswick Ave. 6/28/<strong>19</strong> $1,600,000 4 2292 <strong>19</strong>63 $1,615,000 7/25/17<br />

807 Bank St. 6/21/<strong>19</strong> $1,545,500 2 <strong>19</strong>13 <strong>19</strong>59<br />

835 Rollin St. 6/5/<strong>19</strong> $1,400,000 4 2334 <strong>19</strong>60 $720,000 6/15/11<br />

2002 Oak St. 6/27/<strong>19</strong> $1,335,000 3 1309 <strong>19</strong>24<br />

08.<strong>19</strong> ARROYO | 21

ARROYO<br />

HOME & DESIGN<br />

SPECIAL ADVERTISING SUPPLEMENT<br />

THE ART OF<br />

DORM ROOM DESIGN<br />

Whether On A Budget Or Going For Luxury, College Students Are<br />

Paying More Attention Than Ever To What Goes In Their Rooms<br />

By Bruce Haring<br />

It’s that time of year again. After a summer spent working,<br />

playing and generally relaxing, the young adults in your home are<br />

heading back to college life. Some are going away for the first time,<br />

while veterans of the campus are busy planning their schedules and<br />

looking forward to greeting old friends.<br />

Whatever the status of your student, one thing they have<br />

in common is their living conditions. Most are in college dorms,<br />

although some opt for off-campus apartments or fraternity/sorority<br />

life. And that means they will occupy a room that needs to be made<br />

livable for studying and relaxing.<br />

Most dorm rooms will provide the standard issue furniture - a<br />

bed, a thin mattress, a desk and chair, maybe a mirror, and perhaps<br />

a trash can. The rest is usually up to you. Some trendy and wealthy<br />

college students are actually enlisting interior decorators to come up<br />

with dorm room ideas, and there’s no shortage of designer websites<br />

that are inspiring students to reach a bit with their budget.<br />

The US Census reports that 18.4 million students are enrolled in<br />

college as of 2017, the last year numbers are available. Women are<br />

the majority at 54.0 percent of undergraduates and 59.8 percent of<br />

graduate students.<br />

continued on page 25<br />

22 | ARROYO | 08.<strong>19</strong>

08.<strong>19</strong> | ARROYO | 23

24 | ARROYO | 08.<strong>19</strong>

—ADVERTISING SUPPLEMENT—<br />

continued from page 22<br />

Most dorm rooms will provide the standard issue furniture - a bed, a thin<br />

mattress, a desk and chair, maybe a mirror, and perhaps a trash can. The rest<br />

is usually up to you. Some trendy and wealthy college students are actually<br />

enlisting interior decorators to come up with dorm room ideas, and there’s no<br />

shortage of designer websites that are inspiring students to reach a bit with their<br />

budget.<br />

The US Census reports that 18.4 million students are enrolled in college as<br />

of 2017, the last year numbers are available. Women are the majority at 54.0<br />

percent of undergraduates and 59.8 percent of graduate students.<br />

Overall, about 40 percent of full-time students live on campus, with 40<br />

percent living off-campus and 20 percent living with their parents. However, in<br />

some private schools, as much as 90 percent to 100 percent of students live on<br />

campus.<br />

The art of college room decoration is a highly subjective one, made all the<br />

more complicated by the fact that your scholar may be sharing a room with one<br />

or more people. Tastes vary, and the space students have is generally small and<br />

utilitarian, designed to accommodate the basic necessities of living rather than<br />

luxuriating in a plush space.<br />

Statistics on how much people are spending on dorm décor are hard<br />

to come by. The National Retail Federation indicates that around $1,000<br />

is in the ballpark of what the average student will spend, but obviously<br />

that’s a vested interest in getting you to load up. That figure undoubtedly<br />

includes some things that the average student can easily live without. US<br />

dorm spending totals more than $50 million per year, though, so someone is<br />

digging deep into their pockets.<br />

WORK WITH THE SPACE<br />

To take full advantage of the limited space, dorm rooms need to be<br />

organized. You need a space for studying, one for sleeping, and then hopefully<br />

there’s room for a comfortable chair or two to make it easier to have a guest or<br />

two visit.<br />

Setting the mood in a dorm room all starts with light. Most dorms have one<br />

window and fluorescent bulbs as their basics. Neither are particularly inviting.<br />

Thus, it’s smart to have a lamp that can bend in several directions. A good desk<br />

lamp that can be repositioned is ideal, as the desk will likely adjoin your sleeping<br />

space and can serve two purposes if you read laying down.<br />

You may also consider a stand-alone pole lamp that can be used for<br />

ambient lighting in the room. You can also create a more festive feel with string<br />

lights. These will have to wrap around something for support, so perhaps some<br />

adhesive backed hooks will be needed.<br />

Posters can also help set a mood, although it’s wise to stay away from<br />

Che Guevara and other potentially inflammatory depictions. A landscape<br />

can provide some calming moments in hectic times, and prints are easily<br />

found on websites like Etsy and Society6 that have many thousands of<br />

unique art prints.<br />

Storage is at a premium in tight quarters. A three-drawer vertical cart on<br />

wheels can be positioned wherever there is space in the room. There are also<br />

continued on page 29<br />

08.<strong>19</strong> | ARROYO | 25

26 | ARROYO | 03.<strong>19</strong>

03.<strong>19</strong> | ARROYO | 27

28 | ARROYO | 08.<strong>19</strong>

—ADVERTISING SUPPLEMENT—<br />

continued from page 25<br />

pieces of furniture that can provide storage options and not take up a lot of<br />

room. Consider the unused spaces in the dorm room as well – places like under<br />

the bed or on top of the dresser. Both are ripe for storage containers that can<br />

hold various items.<br />

THE LUXURY ITEMS<br />

The above are the items that you need to live a basic existence. But a<br />

Spartan existence, while budget conscious, isn’t really conducive to enjoyment.<br />

There are a few other items to consider that will bring some vibrant qualities to<br />

make the room feel more like home.<br />

First and foremost, get a dorm-size refrigerator. Yes, as attested to by the<br />

infamous “freshman 15” that most students gain in their first year away from<br />

home, the catering at colleges is quite good. But you’ll also need some drinks<br />

and snacks in your room for the wee, small hours of the morning, and a dorm<br />

room refrigerator is the godsend that will help you get through some of those<br />

times. Most small units start below $200, going up from there, depending on what<br />

else you want. Keep in mind that space is at a premium and this isn’t a kitchen,<br />

so plan for something that will provide a maximum of enjoyment in a minimum of<br />

space.<br />

In the old days, a television in the dorm was a luxury. Now, thanks to<br />

streaming, most students can watch whatever they want on their laptops. Since<br />

there are subscription costs for many sites, plan accordingly for what you really,<br />

really need to watch.<br />

Music can also be streamed from your phones, but consider adding to the<br />

ambience with some wireless speakers that can pump the bass and the party<br />

when necessary. Sonos and Logitech are two brands that are popular, but<br />

review what’s out there on Amazon and adjust your budget accordingly.<br />

Finally, consider a small area rug to give a touch of warmth to the cold, tile<br />

floors that will undoubtedly be a part of dorm life. Small rugs can be found for<br />

$100 or less, and they add considerable charm to your living space.<br />

All of the above are something of an investment in your life, and four years<br />

will go by pretty rapidly. If you’ve chosen quality items, the dorm room style can<br />

become a part of your first post-college apartment. That’s when the real testing<br />

begins.<br />

08.<strong>19</strong> | ARROYO | 29

30 | ARROYO | 08.<strong>19</strong>

—ADVERTISING SUPPLEMENT—<br />

Education<br />

A DIRECTORY OF LEARNING OPTIONS<br />

Altadena Children’s Center<br />

At Altadena Children’s Center, the families of the children in our programs who range<br />

in age from 2 months to prekindergarten fi nd programs that meet the needs of the<br />

whole child within a developmentally appropriate framework. Our family-centered<br />

approach helps to nurture healthy partnerships between teachers and parents as<br />

we all work together to support the children. We are eager to help families from<br />

diverse backgrounds to discover that Altadena Children’s Center is the best place<br />

for their child’s early education.<br />

Contact Director Toni Boucher at (626) 797-6142 or visit accc-kids.org.<br />

Barnhart School<br />

We believe that education is a lifelong comprehensive human experience; that social<br />

and emotional learning is as important as academic learning. Accredited by the<br />

California Association of Independent Schools and Western Association of Schools<br />

and Colleges, Barnhart is distinguished through its focus on Early Literacy, Writers’<br />

Workshop, the Virtues Program, conversational Spanish at all grade levels, daily PE<br />

and a stellar middle school program where students are graduating with acceptance<br />

to their top choice high schools. In addition to a robust and rigorous academic<br />

base of subjects, we provide a full range of co-curricular programs including<br />

music, art, technology, Spanish and PE. In middle school, we further extend learning<br />

to include classes in public speaking, life skills, woodshop, theater arts, yearbook<br />

production, student leadership and much more. Barnhart is known as a “down to<br />

earth”, diverse community. We invite you to take a tour and talk with our parents<br />

and students. Come meet our dedicated team of professionals, spend some time in<br />

our community, and watch our students in action!<br />

240 W. Colorado Blvd., Arcadia (626)446-5588 barnhartschool.org<br />

California School of the Arts – San Gabriel Valley<br />

The mission of California School of the Arts – San Gabriel Valley (CSArts-SGV) is to provide<br />

an unparalleled arts and academic education to a diverse group students who<br />

are passionate about the arts, preparing them to reach their highest potential. Our<br />

dynamic school culture enables students to fl ourish in a uniquely challenging and<br />

nurturing environment that celebrates creativity, individual growth and supportive<br />

learning. Students receive a robust and rigorous college-preparatory curriculum in<br />

addition to pre-professional arts conservatory training in their chosen discipline of<br />

dance, fi ne and media arts, music or theatre. CSArts-SGV is a tuition-free, donationdependent<br />

program serving 1,200 seventh through 12th grade students from across<br />

the San Gabriel Valley.<br />

Come learn more at our Preview Days coming up on October 12, December 7 and January<br />

11. www.sgv.csarts.net/previewday<br />

–continued on page 32<br />

08.<strong>19</strong> | ARROYO | 31

—ADVERTISING SUPPLEMENT—<br />

Education<br />

A DIRECTORY OF LEARNING OPTIONS<br />

–continued from page 31<br />

The Gooden School: A Values Driven Community<br />

At The Gooden School, a K-8 independent, co-ed day school nestled in the foothills<br />

of Sierra Madre, strong and clearly expressed values create identity, focus, unity,<br />

and drive. Gooden’s new head, Jo-Anne Woolner, is proud to be leading a community<br />

where the school’s motto, “Respect for self, others, and the world” answers<br />

the questions, ‘what do we belong to?’, ‘what’s important to us?’, ‘what holds us<br />

together?’ and ‘why do our collective efforts matter?’ The school’s values, rooted<br />

in its Episcopal identity, inspire its students to try harder as individuals so that collectively<br />

the school community thrives. The curriculum facilitates cooperative and<br />

independent learning, promotes unconditional acceptance of self and others,<br />

recognizes the interdependence of mind and body, inspires a love of learning, encourages<br />

self-determination, and develops global awareness. Open houses will be<br />

held on Saturday, November 2, 20<strong>19</strong> from 10:00 a.m. - 12:00 p.m. and Wednesday,<br />

January 15, 2020 from 4:00-5:30 p.m.<br />

For more information please call (626) 355-2410 or go to the school’s website at goodenschool.org<br />

High Point Academy<br />

High Point’s mission is to awaken the joy of learning by inspiring students to their<br />

fullest potential in a collaborative, stimulating community of caring and academic<br />

excellence. Dedicated, talented faculty provide a strong K-8 curriculum enriched<br />

by world languages, music, art, library, technology, and daily physical education.<br />

High Point’s 20<strong>19</strong> graduates gained entrance into acclaimed independent high<br />

schools, earning over $700,000 in merit scholarships. Experience why High Point<br />

instills self-confi dence, good character, and an exceptional foundation for success.<br />

For more information, attend an Open House or sign-up for a tour.<br />

HighPointAcademy.org<br />

Immaculate Heart High School & Middle School<br />

A Catholic, independent, college preparatory school, Immaculate Heart educates<br />

and empowers young women in grades sixth through 12th grades. Founded in <strong>19</strong>06,<br />

Immaculate Heart offers a distinguished history, with more than 10,000 graduates.<br />

Its hillside campus, centrally located in Los Angeles near Griffi th Park, welcomes<br />

students of geographic, ethnic and religious diversity. Virtually 100 percent matriculate<br />

to college, including the most prestigious universities in the country. The high<br />

school’s curriculum offers 14 honors classes and 18 Advanced Placement courses,<br />

including the new two-year AP Capstone course. IH fi elds teams in basketball, cross<br />

country, diving, equestrian, soccer, softball, swimming, tennis, track & fi eld, and<br />

volleyball. Students participate in community service, retreats and liturgies, theatrical<br />

productions, the visual arts, and more than 30 clubs. Bus transportation serves<br />

Pasadena!<br />

5515 Franklin Avenue, Los Angeles, CA 90028. immaculateheart.org (323) 461-3651<br />

Los Angeles Children’s Chorus<br />

An introduction to vocal instruction from an award-winning children’s chorus.<br />

Children are introduced to the wonder and excitement of singing and key music<br />

concepts in First Experiences in Singing (FES), a non-auditioned, non-performing<br />

class for 6-7-year-olds. New singers develop vocal and musical skills, are exposed to<br />

general tonal and rhythmic concepts, and introduced to bel canto singing. Through<br />

the FES program, children gain experience and confi dence singing in bel canto<br />

technique in group, small group, and solo settings; learn tonal and rhythmic skills<br />

through Kodály-based sequential lessons, from master teachers; become familiar<br />

32 | ARROYO | 08.<strong>19</strong><br />

–continued on page 35

08.<strong>19</strong> | ARROYO | 33

34 | ARROYO | 08.<strong>19</strong>

—ADVERTISING SUPPLEMENT—<br />

Education<br />

A DIRECTORY OF LEARNING OPTIONS<br />

–continued from page 32<br />

with high-quality folk songs, singing games, and dances; demonstrate the skills<br />

learned through a fi nal demonstration for parents, family, and friends, followed by a<br />

social gathering.<br />

585 E. Colorado Blvd. Pasadena (626) 793-4231 lachildrenschorus.org<br />

Pacifica Graduate Institute<br />

Pacifi ca Graduate Institute is an accredited graduate school offering masters and<br />

doctoral degree programs in the traditions of depth psychology. Our educational<br />

environment nourishes respect for cultural diversity and individual differences, and<br />

our students have access to an impressive array of educational resources on Pacifi<br />

ca’s two campuses, both of which are located a few miles south of Santa Barbara,<br />

California. Join us for our Information Day and learn about our various degree programs<br />

in the tradition of Depth Psychology informed by the teachings of C.G. Jung,<br />

Joseph Campbell, Marion Woodman, James Hillman, and others.<br />

Saturday, <strong>August</strong> 24th from 10:00am-4:00pm. Pacifica.edu.<br />

Realtime Captioning<br />

DIANA BRANDIN REALTIME CAPTIONING & ASL! - Communication Access Realtime<br />

Translation and Sign Language (ASL, SEE, Tactile, Spanish - on-site and remote).We<br />

now do LIVE-STREAMED EVENTS to YouTube, FB, or other platforms. We specialize in<br />

in K-12, colleges, & university CARTcaptioning, large and small organization conferences,<br />

non-profi ts and more. ADA Compliance. Communication access for public/<br />

private academic institutions (universities, colleges, K-12, special events, on-site and<br />

online learning), businesses, corporations, non-profi ts, for-profi ts, corporate meetings,<br />

conferences, conference calls, live-streamed webinars, legal, court, hearings,<br />

medical, hospitals, doctor appointments, social services, weddings, funerals.<br />

Realtime captioning and American Sign Language plus transcription of recorded<br />

media, closed-captioning or subtitles for videos, webinars, DVDs, YouTube clips, and<br />

other media. Live captions displayed via tablet, smartphone, laptop, fl at-screen TV,<br />

projector-to-screen, jumbotron and more. We hire only seasoned professionals! Local<br />

small business and woman-owned business. FREE DEMOS onsite and remotely.<br />

OnPointCaptions.com | (818) 279-8136<br />

South Pasadena Music Center<br />

South Pasadena Music Center & Conservatory offers lessons and classes in the<br />

European classical tradition, combined with cutting edge instruction in jazz, rock,<br />

and modern music. Our instructors are professionals in their fi elds and have masters<br />

–continued on page 36<br />

08.<strong>19</strong> | ARROYO | 35

—ADVERTISING SUPPLEMENT—<br />

Education<br />

A DIRECTORY OF LEARNING OPTIONS<br />

Stowell Learning Center<br />

Weak underlying processing skills can cause even very bright students to have<br />

to work harder or longer than expected. These skills are not usually addressed at<br />

school, but they are essential for reading and comprehending words on a page. An<br />

estimated 30% of students in school have some diffi culty with auditory processing;<br />

20% are dyslexic; and 50% of those who are ADHD are said to have hidden auditory<br />

processing challenges. At Stowell Learning Center, We Have “A System - Not<br />

a Program. We have helped over 10,000 struggling students become successful in<br />

school and in life through our proprietary brain training approach, and we believe<br />

we can help you and your struggling student too. When a child is working harder<br />

than he/she should, it’s time to look at why, and what can be done differently and<br />

more effectively. At Stowell Learning Center, Students Experience Results that Last A<br />

Lifetime!<br />

Come visit us at our new Pasadena location! 572 E. Green St., Suite 200 (626) 808-4441<br />

stowellcenter.com.<br />

–continued from page 35<br />

or doctoral degrees in music. We also offer Early Childhood Music and Movement<br />

classes for children 15 mos to 2 years and ages 3 – 5 years. These classes are fun,<br />

energetic, and encourage kids to play with sounds, pitch, and rhythm. It’s a great<br />

way to prepare young ones for instrumental instruction. With the start of the school<br />

year around the corner, our instructor schedules begin to fi ll up. Call soon to reserve<br />

your spot. Come make music with us this fall!<br />

1509 Mission Street, South Pasadena (626) 403-2300 southpasadenamusic.com<br />

Stratford Schools<br />

Stratford School provides an unparalleled education where children are inspired<br />

to be creative problem solvers, innovators, and leaders. These 21st century qualities<br />

provide children with the knowledge, confi dence, and ingenuity to help them excel<br />

in future careers! Stratford’s accelerated curriculum from preschool through eighth<br />

grade emphasizes STEAM (Science, Technology, Engineering, Arts, Mathematics)<br />

while incorporating music, physical education, foreign language, and social skills<br />

development. By combining a safe and nurturing learning environment, Stratford<br />

teachers ensure a stimulating and balanced curriculum while cultivating a child’s<br />

natural joy of learning. Evident at all its schools is the Stratford motto, “Summa spes,<br />

summa res,” meaning “Highest hopes, highest things.” Grades: Preschool-8th.<br />

2046 Allen Ave., Altadena (626) 794-1000 stratfordschools.com ||||<br />

36 | ARROYO | 08.<strong>19</strong>

BACK TO SCHOOL…<br />

FOR GRANDPARENTS<br />

Grandparents Universities offer aging baby boomers the chance to bond with their<br />

grandkids in learning environments.<br />

BY KATHLEEN KELLEHER<br />

DEBBIE MERCER WENT BACK TO<br />

COLLEGE WITH HER THEN 8-YEAR-OLD<br />

GRANDDAUGHTER, KADENCE, IN TOW. THE<br />

2013 EXPERIENCE WAS A CONTINUATION<br />

OF HER INTENSE LOVE FOR BOTH HER ALMA<br />

MATER AND HER GRANDDAUGHTER, AND<br />

A DESIRE TO INTRODUCE KADENCE TO THE<br />

PHOTOS: Courtesy of Kansas State University<br />

KSU’s Debbie Mercer shares quality time with Kadence<br />

JOYS OF FUTURE COLLEGE LIFE.<br />

“I wanted to share my love of Kansas State [University]<br />

with her and provide an opportunity for her to see and<br />

experience K-State through the eyes of the student,” Mercer,<br />

dean of the College of Education at Kansas State University,<br />

said in an email interview. “The expectation to go on to<br />

college needs to be nurtured and supported.”<br />

The program Mercer and her granddaughter participated<br />

in is Grandparents University, a shared college learning<br />