CONTACT Magazine (Vol.19 No. 3 — September 2019)

The sixth issue of the rebranded CONTACT Business Magazine — with a brand new editorial and design direction — produced by MEP Publishers for the Trinidad & Tobago Chamber of Industry & Commerce

The sixth issue of the rebranded CONTACT Business Magazine — with a brand new editorial and design direction — produced by MEP Publishers for the Trinidad & Tobago Chamber of Industry & Commerce

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

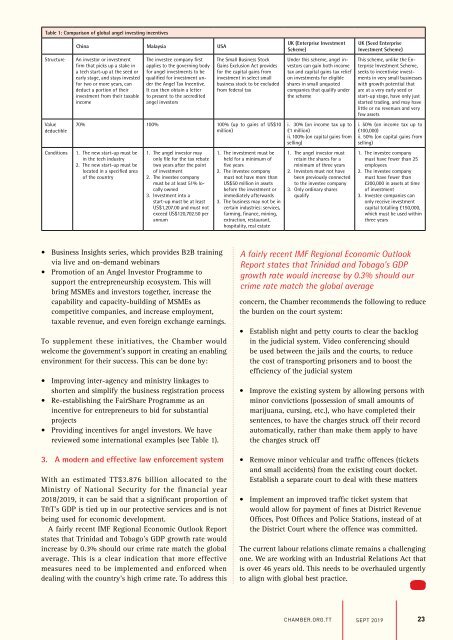

Table 1: Comparison of global angel investing incentives<br />

Structure<br />

Value<br />

deductible<br />

Conditions<br />

China Malaysia USA<br />

An investor or investment<br />

firm that picks up a stake in<br />

a tech start-up at the seed or<br />

early stage, and stays invested<br />

for two or more years, can<br />

deduct a portion of their<br />

investment from their taxable<br />

income<br />

The investee company first<br />

applies to the governing body<br />

for angel investments to be<br />

qualified for investment under<br />

the Angel Tax Incentive.<br />

It can then obtain a letter<br />

to present to the accredited<br />

angel investors<br />

The Small Business Stock<br />

Gains Exclusion Act provides<br />

for the capital gains from<br />

investment in select small<br />

business stock to be excluded<br />

from federal tax<br />

70% 100% 100% (up to gains of US$10<br />

million)<br />

1. The new start-up must be<br />

in the tech industry<br />

2. The new start-up must be<br />

located in a specified area<br />

of the country<br />

1. The angel investor may<br />

only file for the tax rebate<br />

two years after the point<br />

of investment<br />

2. The investee company<br />

must be at least 51% locally<br />

owned<br />

3. Investment into a<br />

start-up must be at least<br />

US$1,207.00 and must not<br />

exceed US$120,702.50 per<br />

annum<br />

1. The investment must be<br />

held for a minimum of<br />

five years<br />

2. The investee company<br />

must not have more than<br />

US$50 million in assets<br />

before the investment or<br />

immediately afterwards<br />

3. The business may not be in<br />

certain industries: services,<br />

farming, finance, mining,<br />

extraction, restaurant,<br />

hospitality, real estate<br />

UK (Enterprise Investment<br />

Scheme)<br />

Under this scheme, angel investors<br />

can gain both income<br />

tax and capital gains tax relief<br />

on investments for eligible<br />

shares in small unquoted<br />

companies that qualify under<br />

the scheme<br />

i. 30% (on income tax up to<br />

£1 million)<br />

ii. 100% (on capital gains from<br />

selling)<br />

1. The angel investor must<br />

retain the shares for a<br />

minimum of three years<br />

2. Investors must not have<br />

been previously connected<br />

to the investee company<br />

3. Only ordinary shares<br />

qualify<br />

UK (Seed Enterprise<br />

Investment Scheme)<br />

This scheme, unlike the Enterprise<br />

Investment Scheme,<br />

seeks to incentivise investments<br />

in very small businesses<br />

with growth potential that<br />

are at a very early seed or<br />

start-up stage, have only just<br />

started trading, and may have<br />

little or no revenues and very<br />

few assets<br />

i. 50% (on income tax up to<br />

£100,000)<br />

ii. 50% (on capital gains from<br />

selling)<br />

1. The investee company<br />

must have fewer than 25<br />

employees<br />

2. The investee company<br />

must have fewer than<br />

£200,000 in assets at time<br />

of investment<br />

3. Investee companies can<br />

only receive investment<br />

capital totalling £150,000,<br />

which must be used within<br />

three years<br />

• Business Insights series, which provides B2B training<br />

via live and on-demand webinars<br />

• Promotion of an Angel Investor Programme to<br />

support the entrepreneurship ecosystem. This will<br />

bring MSMEs and investors together, increase the<br />

capability and capacity-building of MSMEs as<br />

competitive companies, and increase employment,<br />

taxable revenue, and even foreign exchange earnings.<br />

To supplement these initiatives, the Chamber would<br />

welcome the government’s support in creating an enabling<br />

environment for their success. This can be done by:<br />

• Improving inter-agency and ministry linkages to<br />

shorten and simplify the business registration process<br />

• Re-establishing the FairShare Programme as an<br />

incentive for entrepreneurs to bid for substantial<br />

projects<br />

• Providing incentives for angel investors. We have<br />

reviewed some international examples (see Table 1).<br />

3. A modern and effective law enforcement system<br />

With an estimated TT$3.876 billion allocated to the<br />

Ministry of National Security for the financial year<br />

2018/<strong>2019</strong>, it can be said that a significant proportion of<br />

T&T’s GDP is tied up in our protective services and is not<br />

being used for economic development.<br />

A fairly recent IMF Regional Economic Outlook Report<br />

states that Trinidad and Tobago’s GDP growth rate would<br />

increase by 0.3% should our crime rate match the global<br />

average. This is a clear indication that more effective<br />

measures need to be implemented and enforced when<br />

dealing with the country’s high crime rate. To address this<br />

A fairly recent IMF Regional Economic Outlook<br />

Report states that Trinidad and Tobago’s GDP<br />

growth rate would increase by 0.3% should our<br />

crime rate match the global average<br />

concern, the Chamber recommends the following to reduce<br />

the burden on the court system:<br />

• Establish night and petty courts to clear the backlog<br />

in the judicial system. Video conferencing should<br />

be used between the jails and the courts, to reduce<br />

the cost of transporting prisoners and to boost the<br />

efficiency of the judicial system<br />

• Improve the existing system by allowing persons with<br />

minor convictions (possession of small amounts of<br />

marijuana, cursing, etc.), who have completed their<br />

sentences, to have the charges struck off their record<br />

automatically, rather than make them apply to have<br />

the charges struck off<br />

• Remove minor vehicular and traffic offences (tickets<br />

and small accidents) from the existing court docket.<br />

Establish a separate court to deal with these matters<br />

• Implement an improved traffic ticket system that<br />

would allow for payment of fines at District Revenue<br />

Offices, Post Offices and Police Stations, instead of at<br />

the District Court where the offence was committed.<br />

The current labour relations climate remains a challenging<br />

one. We are working with an Industrial Relations Act that<br />

is over 46 years old. This needs to be overhauled urgently<br />

to align with global best practice.<br />

chamber.org.tt<br />

SEPT <strong>2019</strong> 23