Surrey Homes | SH60 | October 2019 | Kitchen & Bathroom supplement inside

The lifestyle magazine for Surrey - Inspirational Interiors, Fabulous Fashion, Delicious Dishes

The lifestyle magazine for Surrey - Inspirational Interiors, Fabulous Fashion, Delicious Dishes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Education<br />

“Setting up a bare trust is the most tax efficient method for grandparents to pay<br />

the fees. The pros for this are that it is potentially inheritance tax free, can be<br />

relatively straightforward to set up and makes use of the child’s tax allowances”<br />

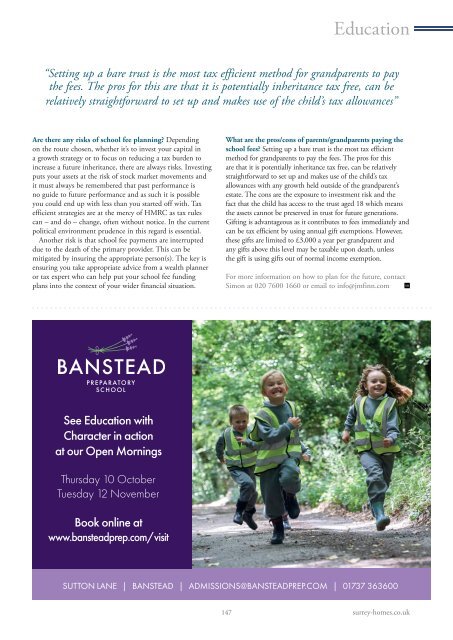

Are there any risks of school fee planning? Depending<br />

on the route chosen, whether it’s to invest your capital in<br />

a growth strategy or to focus on reducing a tax burden to<br />

increase a future inheritance, there are always risks. Investing<br />

puts your assets at the risk of stock market movements and<br />

it must always be remembered that past performance is<br />

no guide to future performance and as such it is possible<br />

you could end up with less than you started off with. Tax<br />

efficient strategies are at the mercy of HMRC as tax rules<br />

can – and do – change, often without notice. In the current<br />

political environment prudence in this regard is essential.<br />

Another risk is that school fee payments are interrupted<br />

due to the death of the primary provider. This can be<br />

mitigated by insuring the appropriate person(s). The key is<br />

ensuring you take appropriate advice from a wealth planner<br />

or tax expert who can help put your school fee funding<br />

plans into the context of your wider financial situation.<br />

What are the pros/cons of parents/grandparents paying the<br />

school fees? Setting up a bare trust is the most tax efficient<br />

method for grandparents to pay the fees. The pros for this<br />

are that it is potentially inheritance tax free, can be relatively<br />

straightforward to set up and makes use of the child’s tax<br />

allowances with any growth held outside of the grandparent’s<br />

estate. The cons are the exposure to investment risk and the<br />

fact that the child has access to the trust aged 18 which means<br />

the assets cannot be preserved in trust for future generations.<br />

Gifting is advantageous as it contributes to fees immediately and<br />

can be tax efficient by using annual gift exemptions. However,<br />

these gifts are limited to £3,000 a year per grandparent and<br />

any gifts above this level may be taxable upon death, unless<br />

the gift is using gifts out of normal income exemption.<br />

For more information on how to plan for the future, contact<br />

Simon at 020 7600 1660 or email to info@jmfinn.com<br />

See Education with<br />

Character in action<br />

at our Open Mornings<br />

Thursday Friday 2010 September <strong>October</strong><br />

Tuesday Thursday 12 10 November <strong>October</strong><br />

Book online at<br />

www.bansteadprep.com/visit<br />

SUTTON LANE | BANSTEAD | ADMISSIONS@BANSTEADPREP.COM | 01737 363600<br />

147 surrey-homes.co.uk<br />

BansteadPrepS601/2.indd 1 09/09/<strong>2019</strong> 16:35