BankVic Annual Report 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

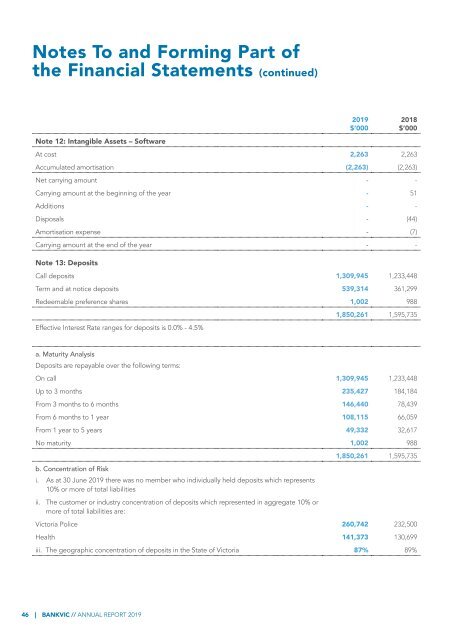

Notes To and Forming Part of<br />

the Financial Statements (continued)<br />

Note 12: Intangible Assets – Software<br />

<strong>2019</strong><br />

$’000<br />

2018<br />

$’000<br />

At cost 2,263 2,263<br />

Accumulated amortisation (2,263) (2,263)<br />

Net carrying amount - -<br />

Carrying amount at the beginning of the year - 51<br />

Additions - -<br />

Disposals - (44)<br />

Amortisation expense - (7)<br />

Carrying amount at the end of the year - -<br />

Note 13: Deposits<br />

Call deposits 1,309,945 1,233,448<br />

Term and at notice deposits 539,314 361,299<br />

Redeemable preference shares 1,002 988<br />

Effective Interest Rate ranges for deposits is 0.0% - 4.5%<br />

1,850,261 1,595,735<br />

a. Maturity Analysis<br />

Deposits are repayable over the following terms:<br />

On call 1,309,945 1,233,448<br />

Up to 3 months 235,427 184,184<br />

From 3 months to 6 months 146,440 78,439<br />

From 6 months to 1 year 108,115 66,059<br />

From 1 year to 5 years 49,332 32,617<br />

No maturity 1,002 988<br />

b. Concentration of Risk<br />

i. As at 30 June <strong>2019</strong> there was no member who individually held deposits which represents<br />

10% or more of total liabilities<br />

ii. The customer or industry concentration of deposits which represented in aggregate 10% or<br />

more of total liabilities are:<br />

1,850,261 1,595,735<br />

Victoria Police 260,742 232,500<br />

Health 141,373 130,699<br />

iii. The geographic concentration of deposits in the State of Victoria 87% 89%<br />

46 | BANKVIC // ANNUAL REPORT <strong>2019</strong>