BankVic Annual Report 2019

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

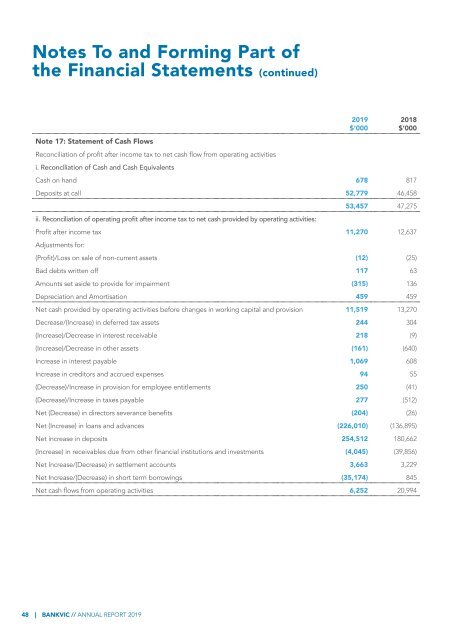

Notes To and Forming Part of<br />

the Financial Statements (continued)<br />

Note 17: Statement of Cash Flows<br />

Reconciliation of profit after income tax to net cash flow from operating activities<br />

i. Reconciliation of Cash and Cash Equivalents<br />

<strong>2019</strong><br />

$’000<br />

2018<br />

$’000<br />

Cash on hand 678 817<br />

Deposits at call 52,779 46,458<br />

ii. Reconciliation of operating profit after income tax to net cash provided by operating activities:<br />

53,457 47,275<br />

Profit after income tax 11,270 12,637<br />

Adjustments for:<br />

(Profit)/Loss on sale of non-current assets (12) (25)<br />

Bad debts written off 117 63<br />

Amounts set aside to provide for impairment (315) 136<br />

Depreciation and Amortisation 459 459<br />

Net cash provided by operating activities before changes in working capital and provision 11,519 13,270<br />

Decrease/(Increase) in deferred tax assets 244 304<br />

(Increase)/Decrease in interest receivable 218 (9)<br />

(Increase)/Decrease in other assets (161) (640)<br />

Increase in interest payable 1,069 608<br />

Increase in creditors and accrued expenses 94 55<br />

(Decrease)/Increase in provision for employee entitlements 250 (41)<br />

(Decrease)/Increase in taxes payable 277 (512)<br />

Net (Decrease) in directors severance benefits (204) (26)<br />

Net (Increase) in loans and advances (226,010) (136,895)<br />

Net increase in deposits 254,512 180,662<br />

(Increase) in receivables due from other financial institutions and investments (4,045) (39,856)<br />

Net Increase/(Decrease) in settlement accounts 3,663 3,229<br />

Net Increase/(Decrease) in short term borrowings (35,174) 845<br />

Net cash flows from operating activities 6,252 20,994<br />

48 | BANKVIC // ANNUAL REPORT <strong>2019</strong>