SCI CRT Awards Issue Oct 19

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Arranger of the Year<br />

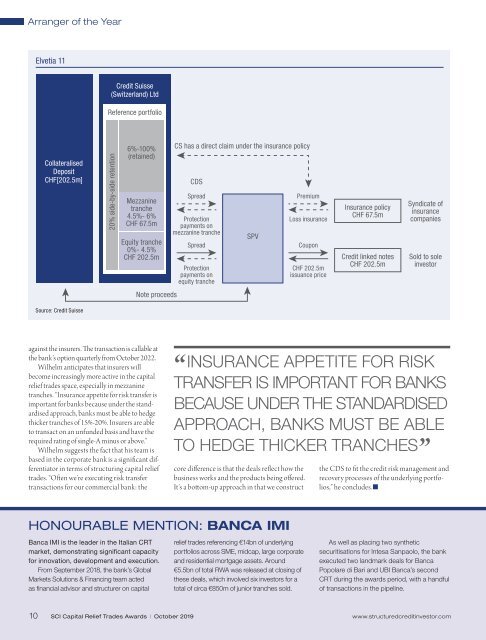

Elvetia 11<br />

Credit Suisse<br />

(Switzerland) Ltd<br />

Reference portfolio<br />

Collateralised<br />

Deposit<br />

CHF[202.5m]<br />

20% side-by-side retention<br />

6%-100%<br />

(retained)<br />

Mezzanine<br />

tranche<br />

4.5%- 6%<br />

CHF 67.5m<br />

Equity tranche<br />

0%- 4.5%<br />

CHF 202.5m<br />

CS has a direct claim under the insurance policy<br />

CDS<br />

Spread<br />

Protection<br />

payments on<br />

mezzanine tranche<br />

Spread<br />

Protection<br />

payments on<br />

equity tranche<br />

SPV<br />

Premium<br />

Loss insurance<br />

Coupon<br />

CHF 202.5m<br />

issuance price<br />

Insurance policy<br />

CHF 67.5m<br />

Credit linked notes<br />

CHF 202.5m<br />

Syndicate of<br />

insurance<br />

companies<br />

Sold to sole<br />

investor<br />

Note proceeds<br />

Source: Credit Suisse<br />

against the insurers. The transaction is callable at<br />

the bank’s option quarterly from <strong>Oct</strong>ober 2022.<br />

Wilhelm anticipates that insurers will<br />

become increasingly more active in the capital<br />

relief trades space, especially in mezzanine<br />

tranches. “Insurance appetite for risk transfer is<br />

important for banks because under the standardised<br />

approach, banks must be able to hedge<br />

thicker tranches of 15%-20%. Insurers are able<br />

to transact on an unfunded basis and have the<br />

required rating of single-A minus or above.”<br />

Wilhelm suggests the fact that his team is<br />

based in the corporate bank is a significant differentiator<br />

in terms of structuring capital relief<br />

trades. “Often we’re executing risk transfer<br />

transactions for our commercial bank: the<br />

“<br />

INSURANCE APPETITE FOR RISK<br />

TRANSFER IS IMPORTANT FOR BANKS<br />

BECAUSE UNDER THE STANDARDISED<br />

APPROACH, BANKS MUST BE ABLE<br />

TO HEDGE THICKER TRANCHES<br />

”<br />

core difference is that the deals reflect how the<br />

business works and the products being offered.<br />

It’s a bottom-up approach in that we construct<br />

the CDS to fit the credit risk management and<br />

recovery processes of the underlying portfolios,”<br />

he concludes.<br />

HONOURABLE MENTION: BANCA IMI<br />

Banca IMI is the leader in the Italian <strong>CRT</strong><br />

market, demonstrating significant capacity<br />

for innovation, development and execution.<br />

From September 2018, the bank’s Global<br />

Markets Solutions & Financing team acted<br />

as financial advisor and structurer on capital<br />

relief trades referencing €14bn of underlying<br />

portfolios across SME, midcap, large corporate<br />

and residential mortgage assets. Around<br />

€5.5bn of total RWA was released at closing of<br />

these deals, which involved six investors for a<br />

total of circa €850m of junior tranches sold.<br />

As well as placing two synthetic<br />

securitisations for Intesa Sanpaolo, the bank<br />

executed two landmark deals for Banca<br />

Popolare di Bari and UBI Banca’s second<br />

<strong>CRT</strong> during the awards period, with a handful<br />

of transactions in the pipeline.<br />

10 <strong>SCI</strong> Capital Relief Trades <strong>Awards</strong> | <strong>Oct</strong>ober 20<strong>19</strong> www.structuredcreditinvestor.com