SCI CRT Awards Issue Oct 19

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Transaction of the Year<br />

TRANSACTION OF THE YEAR<br />

WINNER: SYON SECURITIES 20<strong>19</strong><br />

Lloyds Banking Group’s<br />

synthetic UK RMBS Syon<br />

Securities 20<strong>19</strong> was motivated<br />

by prudent risk management<br />

as part of the bank’s broader<br />

plan to support the UK economy, rather<br />

than potential regulatory capital benefits.<br />

However, Syon’s innovative use of a<br />

capital relief structure to achieve those risk<br />

transfer aims, combined with the deal’s<br />

scalability for the issuer and repeatability<br />

for other UK mortgage lenders gives it<br />

potential benchmark status and makes it<br />

<strong>SCI</strong>’s Transaction of the Year.<br />

Lloyds Bank Corporate Markets (LBCM)<br />

Securitised Products Group acted as sole<br />

arranger and lead manager for Syon, a synthetic<br />

securitisation of a UK owner-occupied<br />

residential mortgage loan book originated by<br />

Bank of Scotland under the Halifax brand.<br />

The £1.07bn reference portfolio comprises<br />

5,674 prime repayment mortgages with LTVs<br />

greater than 90%, originated between <strong>Oct</strong>ober<br />

2018 and June 20<strong>19</strong>. The non-replenishing<br />

transaction provides credit protection for<br />

seven years, with a 2.5-year tail period, subject<br />

to a 10% clean-up call.<br />

“<br />

OVERALL, THE SYNDICATION<br />

PROCESS WAS VERY MUCH AN<br />

EDUCATIONAL ONE, GIVEN THE<br />

ARRAY OF INVESTORS INTERESTED<br />

”<br />

In aggregate, £150m of credit-linked notes<br />

were placed with five investors from both<br />

Europe and the US, comprising a mix of those<br />

familiar with capital relief trades and those<br />

familiar with RMBS and mortgage assets.<br />

During marketing, Lloyds had opened its data<br />

room to 37 accounts and conducted 17 due<br />

diligence sessions.<br />

Overall, the syndication process was very<br />

much an educational one, given the array<br />

of investors interested. Typical cash RMBS<br />

investors were sometimes unfamiliar with<br />

synthetic structures, some were able to use<br />

GSE credit risk transfer deals as a comparable<br />

and regulatory capital investors had typically<br />

not considered transactions featuring<br />

residential mortgages for some time, so had to<br />

re-familiarise themselves with the asset class.<br />

Syon is an economic hedge, including a<br />

modified pro-rata amortisation schedule, where<br />

the protection is reduced at a rate slower than<br />

the amortisation of the portfolio to ensure<br />

adequate coverage for the increased loss density<br />

expected towards the end of the protection<br />

period. Additionally, the transaction allows<br />

for the removal of loans that are considered<br />

‘de-risked’, as a result of customer payments<br />

and house price inflation, and which no longer<br />

contribute to the relevant risk metrics.<br />

As noted above, the transaction does<br />

not provide Lloyds with regulatory capital<br />

benefits, thanks to the minimum risk weight<br />

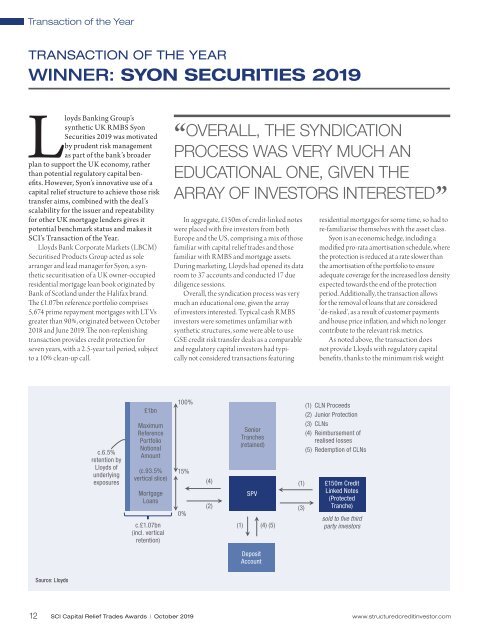

c.6.5%<br />

retention by<br />

Lloyds of<br />

underlying<br />

exposures<br />

£1bn<br />

Maximum<br />

Reference<br />

Portfolio<br />

Notional<br />

Amount<br />

(c.93.5%<br />

vertical slice)<br />

Mortgage<br />

Loans<br />

c.£1.07bn<br />

(incl. vertical<br />

retention)<br />

100%<br />

15%<br />

0%<br />

(4)<br />

Senior<br />

Tranches<br />

(retained)<br />

(1)<br />

SPV<br />

(4) (5)<br />

(1)<br />

(2) (3)<br />

(1) CLN Proceeds<br />

(2) Junior Protection<br />

(3) CLNs<br />

(4) Reimbursement of<br />

realised losses<br />

(5) Redemption of CLNs<br />

£150m Credit<br />

Linked Notes<br />

(Protected<br />

Tranche)<br />

sold to five third<br />

party investors<br />

Deposit<br />

Account<br />

Source: Lloyds<br />

12 <strong>SCI</strong> Capital Relief Trades <strong>Awards</strong> | <strong>Oct</strong>ober 20<strong>19</strong> www.structuredcreditinvestor.com