You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

20 — Vanguard, MONDAY, FEBRUARY 24, 2020<br />

FINANCIAL VANGUARD<br />

Banks’ lending rates defy crash in TB yields<br />

Continues from page 19<br />

COVER<br />

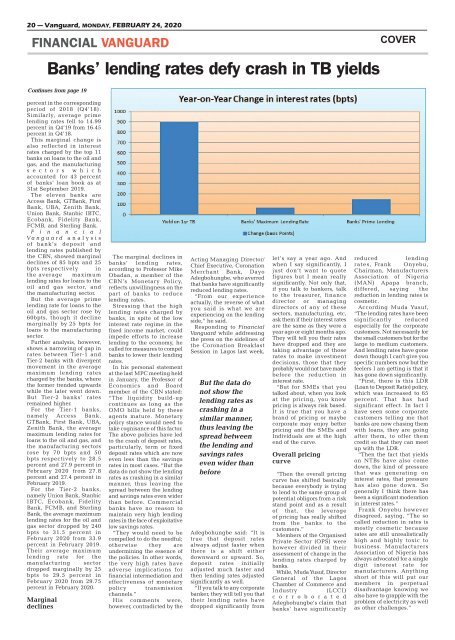

percent in the corresponding<br />

period of 2018 (Q4’18).<br />

Similarly, average prime<br />

lending rates fell to 14.99<br />

percent in Q4’19 from 16.45<br />

percent in Q4’18.<br />

This marginal change is<br />

also reflected in interest<br />

rates charged by the top 11<br />

banks on loans to the oil and<br />

gas, and the manufacturing<br />

s e c t o r s w h i c h<br />

accounted for 43 percent<br />

of banks’ loan book as at<br />

31st September 2019.<br />

The eleven banks are<br />

Access Bank, GTBank, First<br />

Bank, UBA, Zenith Bank,<br />

Union Bank, Stanbic IBTC,<br />

Ecobank, Fidelity Bank,<br />

FCMB, and Sterling Bank.<br />

F i n a n c i a l<br />

Vanguard analysis<br />

of bank’s deposit and<br />

lending rates published by<br />

the CBN, showed marginal<br />

declines of 85 bpts and 25<br />

bpts respectively in<br />

the average maximum<br />

lending rates for loans to the<br />

oil and gas sector, and<br />

the manufacturing sector.<br />

But the average prime<br />

lending rate for loans to the<br />

oil and gas sector rose by<br />

60bpts, though it decline<br />

marginally by 25 bpts for<br />

loans to the manufacturing<br />

sector.<br />

Further analysis, however,<br />

shows a narrowing of gap in<br />

rates between Tier-1 and<br />

Tier-2 banks with divergent<br />

movement in the average<br />

maximum lending rates<br />

charged by the banks, where<br />

the former trended upwards<br />

while the later went down.<br />

But Tier-2 banks’ rates<br />

remained higher.<br />

For the Tier-1 banks,<br />

namely Access Bank,<br />

GTBank, First Bank, UBA,<br />

Zenith Bank, the average<br />

maximum lending rates for<br />

loans to the oil and gas, and<br />

the manufacturing sectors<br />

rose by 70 bpts and 50<br />

bpts respectively to 28.5<br />

percent and 27.9 percent in<br />

February 2020 from 27.8<br />

percent and 27.4 percent in<br />

February 2019.<br />

For the Tier-2 banks,<br />

namely Union Bank, Stanbic<br />

IBTC, Ecobank, Fidelity<br />

Bank, FCMB, and Sterling<br />

Bank, the average maximum<br />

lending rates for the oil and<br />

gas sector dropped by 240<br />

bpts to 31.5 percent in<br />

February 2020 from 33.9<br />

percent in February 2019.<br />

Their average maximum<br />

lending rate for the<br />

manufacturing sector<br />

dropped marginally by 25<br />

bpts to 29.5 percent in<br />

February 2020 from 29.75<br />

percent in February 2020.<br />

Marginal<br />

declines<br />

The marginal declines in<br />

banks’ lending rates,<br />

according to Professor Mike<br />

Obadan, a member of the<br />

CBN’s Monetary Policy,<br />

reflects unwillingness on the<br />

part of banks to reduce<br />

lending rates.<br />

Stressing that the high<br />

lending rates charged by<br />

banks, in spite of the low<br />

interest rate regime in the<br />

fixed income market, could<br />

impede efforts to increase<br />

lending to the economy, he<br />

called for measures to compel<br />

banks to lower their lending<br />

rates.<br />

In his personal statement<br />

at the last MPC meeting held<br />

in January, the Professor of<br />

Economics and Board<br />

member of the CBN stated:<br />

“The liquidity build-up<br />

continues as long as the<br />

OMO bills held by these<br />

agents mature. Monetary<br />

policy stance would need to<br />

take cognisance of this factor.<br />

The above policies have led<br />

to the crash of deposit rates,<br />

particularly, term or fixed<br />

deposit rates which are now<br />

even less than the savings<br />

rates in most cases. “But the<br />

data do not show the lending<br />

rates as crashing in a similar<br />

manner, thus leaving the<br />

spread between the lending<br />

and savings rates even wider<br />

than before. Commercial<br />

banks have no reason to<br />

maintain very high lending<br />

rates in the face of exploitative<br />

low savings rates.<br />

“They would need to be<br />

compelled to do the needful;<br />

otherwise they are<br />

undermining the essence of<br />

the policies. In other words,<br />

the very high rates have<br />

adverse implications for<br />

financial intermediation and<br />

effectiveness of monetary<br />

policy transmission<br />

channels.”<br />

His comments were,<br />

however, contradicted by the<br />

Acting Managing Director/<br />

Chief Executive, Coronation<br />

Merchant Bank, Dayo<br />

Adegbohungbe, who averred<br />

that banks have significantly<br />

reduced lending rates.<br />

“From our experience<br />

actually, the reverse of what<br />

you said is what we are<br />

experiencing on the lending<br />

side,” he said.<br />

Responding to Financial<br />

Vanguard while addressing<br />

the press on the sidelines of<br />

the Coronation Breakfast<br />

Session in Lagos last week,<br />

But the data do<br />

not show the<br />

lending rates as<br />

crashing in a<br />

similar manner,<br />

thus leaving the<br />

spread between<br />

the lending and<br />

savings rates<br />

even wider than<br />

before<br />

Adegbohungbe said: “It is<br />

true that deposit rates<br />

always adjust faster when<br />

there is a shift either<br />

downward or upward. So,<br />

deposit rates initially<br />

adjusted much faster and<br />

then lending rates adjusted<br />

significantly as well.<br />

“If you talk to any corporate<br />

banker, they will tell you that<br />

their lending rates have<br />

dropped significantly from<br />

let’s say a year ago. And<br />

when I say significantly, I<br />

just don’t want to quote<br />

figures but I mean really<br />

significantly. Not only that,<br />

if you talk to bankers, talk<br />

to the treasurer, finance<br />

director or managing<br />

directors of any of these<br />

sectors, manufacturing, etc,<br />

ask them if their interest rates<br />

are the same as they were a<br />

year ago or eight months ago.<br />

They will tell you their rates<br />

have dropped and they are<br />

taking advantage of those<br />

rates to make investment<br />

decisions, those that they<br />

probably would not have made<br />

before the reduction in<br />

interest rate.<br />

“But for SMEs that you<br />

talked about, when you look<br />

at the pricing, you know<br />

pricing is always risk based.<br />

It is true that you have a<br />

brand of pricing or maybe<br />

corporate may enjoy better<br />

pricing and the SMEs and<br />

Individuals are at the high<br />

end of the curve.<br />

Overall pricing<br />

curve<br />

“Then the overall pricing<br />

curve has shifted basically<br />

because everybody is trying<br />

to lend to the same group of<br />

potential obligors from a risk<br />

stand point and as a result<br />

of that, the leverage<br />

of pricing has really shifted<br />

from the banks to the<br />

customers.”<br />

Members of the Organised<br />

Private Sector (OPS) were<br />

however divided in their<br />

assessment of change in the<br />

lending rates charged by<br />

banks.<br />

While, Muda Yusuf, Director<br />

General of the Lagos<br />

Chamber of Commerce and<br />

Industry<br />

(LCCI)<br />

c o r r o b o r a t e d<br />

Adegbohungbe’s claim that<br />

banks’ have significantly<br />

reduced<br />

lending<br />

rates, Frank Onyebu,<br />

Chairman, Manufacturers<br />

Association of Nigeria<br />

(MAN) Apapa branch,<br />

differed, saying the<br />

reduction in lending rates is<br />

cosmetic.<br />

According Muda Yusuf,<br />

“The lending rates have been<br />

significantly reduced<br />

especially for the corporate<br />

customers. Not necessarily for<br />

the small customers but for the<br />

large to medium customers.<br />

And lending rates have gone<br />

down though I can't give you<br />

specific numbers now but the<br />

feelers I am getting is that it<br />

has gone down significantly.<br />

“First, there is this LDR<br />

(Loan to Deposit Ratio) policy,<br />

which was increased to 65<br />

percent. That has had<br />

significant effect. In fact I<br />

have seen some corporate<br />

customers telling me that<br />

banks are now chasing them<br />

with loans, they are going<br />

after them, to offer them<br />

credit so that they can meet<br />

up with the LDR.<br />

“Then the fact that yields<br />

on NTBs have also come<br />

down, the kind of pressure<br />

that was generating on<br />

interest rates, that pressure<br />

has also gone down. So<br />

generally I think there has<br />

been a significant moderation<br />

in interest rates.”<br />

Frank Onyebu however<br />

disagreed, saying, “The so<br />

called reduction in rates is<br />

mostly cosmetic because<br />

rates are still unrealistically<br />

high and highly toxic to<br />

business. Manufacturers<br />

Association of Nigeria has<br />

always advocated for a single<br />

digit interest rate for<br />

manufacturers. Anything<br />

short of this will put our<br />

members in perpetual<br />

disadvantage knowing we<br />

also have to grapple with the<br />

problem of electricity as well<br />

as other challenges.”