Henderson Strata Investments plc - Henderson Global Investors

Henderson Strata Investments plc - Henderson Global Investors

Henderson Strata Investments plc - Henderson Global Investors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Highlights Financialof<br />

the Year<br />

Highlights<br />

Performance<br />

to 31 October 2006<br />

Performance<br />

Chairman’s<br />

Comment<br />

<strong>Henderson</strong> <strong>Strata</strong> <strong>Investments</strong> <strong>plc</strong> Report & Accounts 2006 1<br />

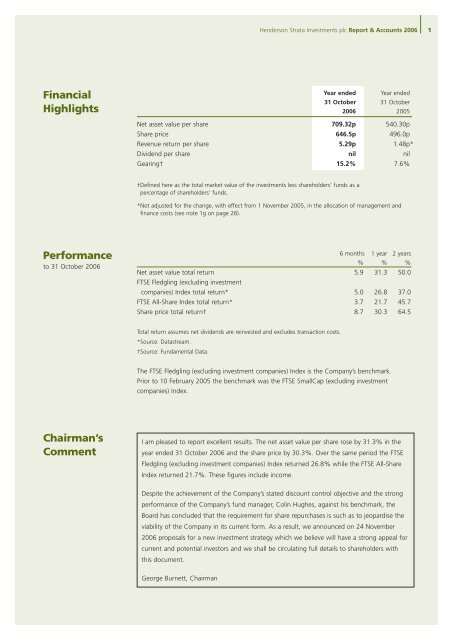

Year ended Year ended<br />

31 October 31 October<br />

2006 2005<br />

Net asset value per share 709.32p 540.30p<br />

Share price 646.5p 496.0p<br />

Revenue return per share 5.29p 1.48p*<br />

Dividend per share nil nil<br />

Gearing† 15.2% 7.6%<br />

†Defined here as the total market value of the investments less shareholders’ funds as a<br />

percentage of shareholders’ funds.<br />

*Not adjusted for the change, with effect from 1 November 2005, in the allocation of management and<br />

finance costs (see note 1g on page 28).<br />

6 months 1 year 2 years<br />

% % %<br />

Net asset value total return<br />

FTSE Fledgling (excluding investment<br />

5.9 31.3 50.0<br />

companies) Index total return* 5.0 26.8 37.0<br />

FTSE All-Share Index total return* 3.7 21.7 45.7<br />

Share price total return† 8.7 30.3 64.5<br />

Total return assumes net dividends are reinvested and excludes transaction costs.<br />

*Source: Datastream.<br />

†Source: Fundamental Data.<br />

The FTSE Fledgling (excluding investment companies) Index is the Company’s benchmark.<br />

Prior to 10 February 2005 the benchmark was the FTSE SmallCap (excluding investment<br />

companies) Index.<br />

I am pleased to report excellent results. The net asset value per share rose by 31.3% in the<br />

year ended 31 October 2006 and the share price by 30.3%. Over the same period the FTSE<br />

Fledgling (excluding investment companies) Index returned 26.8% while the FTSE All-Share<br />

Index returned 21.7%. These figures include income.<br />

Despite the achievement of the Company’s stated discount control objective and the strong<br />

performance of the Company’s fund manager, Colin Hughes, against his benchmark, the<br />

Board has concluded that the requirement for share repurchases is such as to jeopardise the<br />

viability of the Company in its current form. As a result, we announced on 24 November<br />

2006 proposals for a new investment strategy which we believe will have a strong appeal for<br />

current and potential investors and we shall be circulating full details to shareholders with<br />

this document.<br />

George Burnett, Chairman