KLC 2020 Legislative Update

The 2020 Legislative Update provides a review of measures passed in the 2020 Regular Session of the Kentucky General Assembly that impact cities.

The 2020 Legislative Update provides a review of measures passed in the 2020 Regular Session of the Kentucky General Assembly that impact cities.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6) LOCAL GOVERNMENT PROCEDURES<br />

the SPGE is proposing the levy of a rate that is projected to generate more revenue than would<br />

be generated by the levy of the compensating tax rate;<br />

3.<br />

4.<br />

Approve a rate that is less than the proposed rate when the SPGE is proposing the levy of an ad<br />

valorem tax for the first time; or<br />

Disapprove the entire proposed rate by a majority vote of the governing body.<br />

Approved rates may be implemented after all other statutory requirements, if any, for levying the<br />

rate are met such as statutory rate limits, public hearing requirements, and recall provisions.<br />

If the entire proposed rate is disapproved by the SPGE, the SPGE may levy a rate for the upcoming<br />

year that does not exceed the compensating tax rate if the SPGE levied an ad valorem tax during the current<br />

year. If the SPGE is proposing an ad valorem tax for the first time, the levy shall not be imposed and the<br />

SPGE shall wait at least one year before proposing another ad valorem tax levy. The Department for Local<br />

Government shall calculate rates upon request by a SPGE.<br />

The following fees and charges are excluded from the requirement to submit proposed rates to<br />

the city or county that established a SPGE: (1) rental fees; (2) fees established by contractual arrangement;<br />

(3) admission fees; (4) fees or charges to recover costs incurred by a SPGE for the connection, restoration,<br />

relocation, or discontinuation of any service requested by any person; (5) any penalty, interest, sanction, or<br />

other fee or charge imposed by a SPGE for a failure to pay a charge or fee; (6) amounts charged to customers<br />

or contractual partners for nonessential services provided on a voluntary basis; (7) fees or charges<br />

authorized under federal law that pursuant to federal law may not be regulated by the Commonwealth<br />

or local governments within the Commonwealth; (8) purchased water or sewage treatment adjustments<br />

made by a SPGE as a direct result of a rate increase by its wholesale water supplier or wholesale sewage<br />

treatment provider; (9) any new fee or fee increase for which a SPGE must obtain prior approval from the<br />

Public Service Commission; (10) other charges or fees imposed by a SPGE for the provision of any service<br />

that is also available on the open market; and (11) fees or charges imposed by municipal utilities for the<br />

provision of power, water, wastewater, natural gas, or telecommunications services, unless submission is<br />

otherwise required by statute or an ordinance adopted by the establishing entity.<br />

KRS 65A.100 is repealed. The statute currently requires SPGEs that adopt a new fee or ad valorem<br />

tax, or increase the rate at which an existing fee or tax is imposed, to report the fee or tax to the governing<br />

body of the establishing entity for informational purposes only. The Act takes effect January 1, 2021.<br />

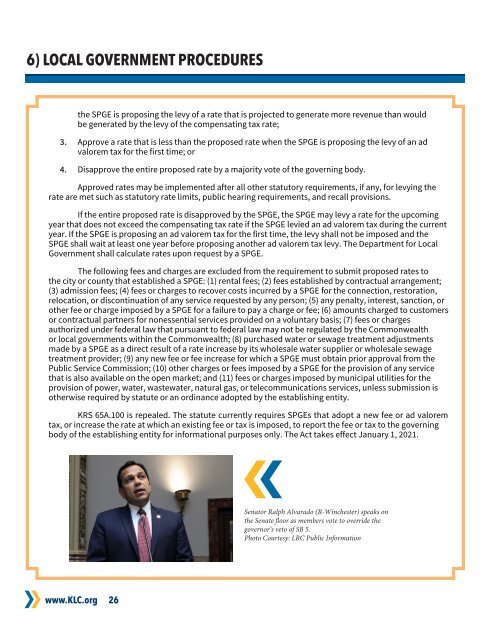

Senator Ralph Alvarado (R-Winchester) speaks on<br />

the Senate floor as members vote to override the<br />

governor’s veto of SB 5.<br />

Photo Courtesy: LRC Public Information<br />

www.<strong>KLC</strong>.org<br />

26