KLC 2020 Legislative Update

The 2020 Legislative Update provides a review of measures passed in the 2020 Regular Session of the Kentucky General Assembly that impact cities.

The 2020 Legislative Update provides a review of measures passed in the 2020 Regular Session of the Kentucky General Assembly that impact cities.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1) ALCOHOLIC BEVERAGES<br />

House Bill 415<br />

DIRECT SHIPMENT OF ALCOHOLIC BEVERAGES<br />

Sponsor: Representative Adam Koenig (R-Erlanger)<br />

HB 415 creates new sections of KRS Chapter 243 to permit direct shipper licenses to be issued by<br />

the Department of Alcoholic Beverage Control to a manufacturer in Kentucky or any other state for<br />

shipment of alcoholic beverages directly to consumers of legal age. The manufacturer shall: (1) ship only<br />

alcoholic beverages produced by the manufacturer and sold under a brand name owned or exclusively<br />

licensed to the manufacturer; (2) pay an annual license fee of $100; and (3) if located out of state, provide a<br />

copy of the manufacturer’s current license, permit, or other authorization to manufacture alcoholic<br />

beverages in the state where the manufacturer is located.<br />

Each direct shipper licensee shall file a quarterly report with the Department of Alcoholic Beverage<br />

Control and the Department of Revenue showing: (1) the total amount of alcoholic beverages shipped into<br />

the state per consumer; (2) the name and address of each consumer; (3) the purchase price of the alcoholic<br />

beverages shipped and the amount of taxes charged to the consumer for the alcoholic beverages shipped;<br />

and (4) the name and address of each common carrier.<br />

A direct shipper licensee may sell or ship to a consumer all types of alcoholic beverages that the<br />

licensee is authorized to sell with the following limits: (1) distilled spirits, including souvenir packages, in<br />

quantities not to exceed 10 liters per consumer per month; (2) wine in quantities not to exceed 10 cases per<br />

consumer per month; and (3) malt beverages in quantities not to exceed the 10 cases per consumer per<br />

month. Small farm wineries and microbreweries holding a direct shipper license may also sell or ship to<br />

consumers. All shipments or deliveries must be made through a licensed common carrier.<br />

All shipments must be conspicuously labeled, “Contains alcohol: Signature of person age 21 or<br />

older required for delivery.” The recipient of the shipment must provide valid identification. A direct<br />

shipper licensee may not sell or ship alcoholic beverages to a consumer if the consumer’s address is in an<br />

area in which alcoholic beverages may not be sold or received.<br />

For tax purposes, each sale and delivery of alcoholic beverages pursuant to a direct shipper license<br />

is considered a sale at the address of the consumer. All applicable taxes must be included in the selling<br />

price and separately identified on the consumer’s invoice for collection by the direct shipper licensee from<br />

the consumer. Applicable taxes include sales and use tax, excise tax, wholesale tax, and local government<br />

regulatory license fees.<br />

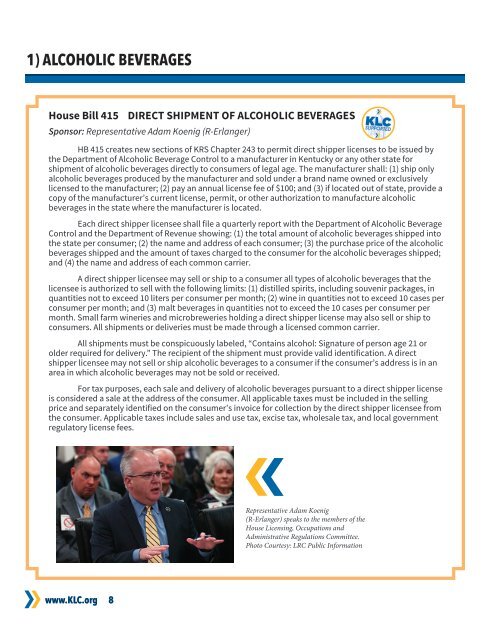

Representative Adam Koenig<br />

(R-Erlanger) speaks to the members of the<br />

House Licensing, Occupations and<br />

Administrative Regulations Committee.<br />

Photo Courtesy: LRC Public Information<br />

www.<strong>KLC</strong>.org<br />

8