Property Times European Logistics H1 2011 - DTZ

Property Times European Logistics H1 2011 - DTZ

Property Times European Logistics H1 2011 - DTZ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30 September <strong>2011</strong><br />

Contents<br />

Executive summary 1<br />

Economic overview 2-4<br />

Retail, E-retail & logistics 5<br />

Investment market 6-7<br />

Fair value index 8-9<br />

Occupier market<br />

<strong>European</strong> overview 10-12<br />

Market overview 13-26<br />

United Kingdom 13<br />

Ireland 14<br />

Belgium 15<br />

France 16<br />

Germany 17<br />

Netherlands 18<br />

Italy & Spain 19<br />

Nordics & Sweden 20<br />

CEE 21<br />

Poland 22<br />

Czech Republic 23<br />

Hungary & Romania 24<br />

Ukraine & Russia 25<br />

Middle East - Dubai 26<br />

Definitions 28<br />

Contacts 29<br />

Authors<br />

Magali Marton<br />

Head of CEMEA Research<br />

+33 (0)1 49 64 49 54<br />

magali.marton@dtz.com<br />

Matthew Hall<br />

Forecasting & Strategy Research<br />

+44 (0)20 3296 3011<br />

matthew.hall@dtz.com<br />

Contacts<br />

Tony McGough<br />

Forecasting & Strategy Research<br />

+44 (0)20 3296 2314<br />

tony.mcgough@dtz.com<br />

Hans Vrensen<br />

Global Head of Research<br />

+44 (0)20 3296 2159<br />

hans.vrensen@dtz.com<br />

<strong>Property</strong> <strong>Times</strong><br />

<strong>European</strong> <strong>Logistics</strong> <strong>H1</strong> <strong>2011</strong><br />

Good results in <strong>H1</strong> but<br />

uncertainty predicted in H2<br />

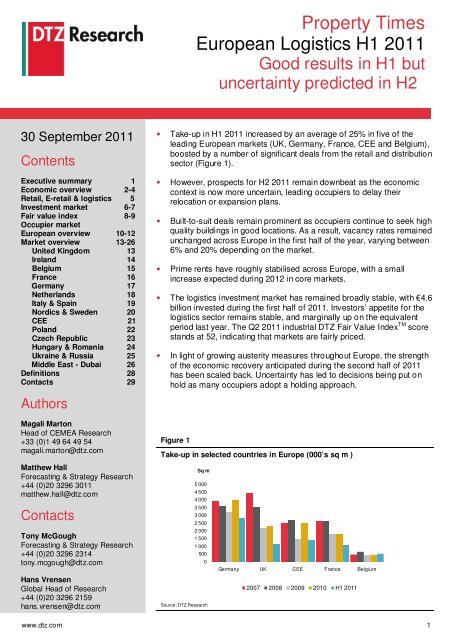

• Take-up in <strong>H1</strong> <strong>2011</strong> increased by an average of 25% in five of the<br />

leading <strong>European</strong> markets (UK, Germany, France, CEE and Belgium),<br />

boosted by a number of significant deals from the retail and distribution<br />

sector (Figure 1).<br />

• However, prospects for H2 <strong>2011</strong> remain downbeat as the economic<br />

context is now more uncertain, leading occupiers to delay their<br />

relocation or expansion plans.<br />

• Built-to-suit deals remain prominent as occupiers continue to seek high<br />

quality buildings in good locations. As a result, vacancy rates remained<br />

unchanged across Europe in the first half of the year, varying between<br />

6% and 20% depending on the market.<br />

• Prime rents have roughly stabilised across Europe, with a small<br />

increase expected during 2012 in core markets.<br />

• The logistics investment market has remained broadly stable, with €4.6<br />

billion invested during the first half of <strong>2011</strong>. Investors’ appetite for the<br />

logistics sector remains stable, and marginally up on the equivalent<br />

period last year. The Q2 <strong>2011</strong> industrial <strong>DTZ</strong> Fair Value Index TM score<br />

stands at 52, indicating that markets are fairly priced.<br />

• In light of growing austerity measures throughout Europe, the strength<br />

of the economic recovery anticipated during the second half of <strong>2011</strong><br />

has been scaled back. Uncertainty has led to decisions being put on<br />

hold as many occupiers adopt a holding approach.<br />

Figure 1<br />

Take-up in selected countries in Europe (000’s sq m )<br />

Sq m<br />

5 000<br />

4 500<br />

4 000<br />

3 500<br />

3 000<br />

2 500<br />

2 000<br />

1 500<br />

1 000<br />

500<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Germany UK CEE France Belgium<br />

2007 2008 2009 2010 <strong>H1</strong> <strong>2011</strong><br />

www.dtz.com 1

Economic overview<br />

The improvement in the <strong>European</strong> economic<br />

environment has not lasted the summer as<br />

concerns over the debt crisis are rising. Market<br />

conditions will become more challenging with an<br />

increasingly mixed pictured of economic trends<br />

across Europe.<br />

• Stress tests of the banking system, debt crisis in<br />

Europe, inability of governments to restore market<br />

confidence and downgrading of the US economy: the<br />

global and <strong>European</strong> economy has entered into a<br />

new phase. <strong>European</strong> businesses continue to face<br />

challenging credit conditions as banks are still<br />

cautious about their loan policies.<br />

Restrictive credit conditions will continue to weigh on<br />

consumption and investment, and as a result<br />

industrial production, consumption and retail sales<br />

remain slow across Europe.<br />

• The debt crisis has forced governments in many<br />

<strong>European</strong> countries to put in place austerity<br />

packages to reduce their fiscal deficit. Furthermore,<br />

most of Europe is also facing a reduction in<br />

government led growth, as a result of a slowdown in<br />

private sector demand. In this context, <strong>European</strong><br />

GDP forecasts have been downgraded to 1.9% in<br />

<strong>2011</strong> and 1.6% in 2012 (Figure 2).<br />

• In Europe, those countries most affected by the debt<br />

crisis will post negative GDP growth in <strong>2011</strong> while<br />

Germany, the Nordics and CEE continue to<br />

outperform the <strong>European</strong> average (Figure 3). Neither<br />

the Nordics nor the CEE are part of the Eurozone,<br />

enabling control over monetary policy and hence,<br />

exchange rates. Neither region has particularly high<br />

levels of national debt requiring austerity measures.<br />

• After a strong rebound in 2010, a modest 6.4%<br />

increase of trade growth is anticipated for <strong>2011</strong>,<br />

However, uncertainty remains over the impact of a<br />

number of recent events, including the earthquake<br />

and tsunami in Japan. If achieved, this would be<br />

higher than the 6.0% average yearly increase<br />

witnessed between 1990 and 2008.<br />

Figure 2<br />

GDP growth 2007-2010 and forecasts <strong>2011</strong>-2014<br />

www.dtz.com 2<br />

%<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

2007 2008 2009 2010 <strong>2011</strong>F 2012F 2013F 2014F<br />

Asia Pacific Eurozone United States<br />

Source: Oxford Economics<br />

Figure 3<br />

GDP growth and growth forecasts in selected<br />

<strong>European</strong> countries<br />

%<br />

4<br />

4<br />

3<br />

3<br />

2<br />

2<br />

1<br />

1<br />

0<br />

<strong>2011</strong>F 2012F 2013F 2014F<br />

France Germany Nordics<br />

United Kingdom Eurozone<br />

Source: Oxford Economics<br />

Figure 4<br />

Merchandise exports by region, 2007-<strong>2011</strong><br />

%<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

Source: WTO<br />

14,5<br />

6,4<br />

12,9<br />

World Developed<br />

economies<br />

4,5<br />

16,7<br />

9,5<br />

Developing<br />

economies and<br />

CIS<br />

2007 2008 2009 2010 <strong>2011</strong>F

Economic overview<br />

• Industrial production forecasts suggest that Europe<br />

will be polarised in the short term: Germany, CEE<br />

and the Nordics growing by between 7% and 9% in<br />

<strong>2011</strong> - whilst the UK and France remain well below<br />

the Eurozone average of 5.7% (Figure 5). However,<br />

the latest PMI (Purchasing Manager Index) published<br />

in August <strong>2011</strong> has clearly shown declining<br />

confidence in the industrial sector, posting the<br />

second weakest rate of expansion since the recovery<br />

began in August 2009.<br />

• Consumer confidence has also declined across<br />

Europe with an increasingly negative balance of<br />

opinions, down to -16.5% from -11% in December<br />

2010 (Figure 6). Pressure is increasing on<br />

governments to accelerate austerity programs and<br />

reduce public debt. This is acting as a further drag on<br />

consumer confidence as employees tighten their<br />

belts. This is anticipated to have a significant impact<br />

on the retail sector as consumer spending is forecast<br />

to bear the brunt of austerity measures.<br />

• Consumer spending in Europe will remain subdued in<br />

the medium term with 1.2% pa expected between<br />

<strong>2011</strong> and 2014 (Figure 7). The three major<br />

economies – UK, France and Germany – are slightly<br />

above the regional average whilst CEE and Nordics<br />

will outperform with between 2% and 3% pa over the<br />

same period. There, domestic demand is supported<br />

by strong GDP growth and limited exposure to<br />

austerity measures.<br />

• In conclusion, the logistics market in Europe will be<br />

driven by two opposing economic trends: firstly,<br />

strong prospects for CEE and the Nordics on both<br />

the industrial and consumer side, and secondly,<br />

direct or indirect impacts of austerity measures<br />

across the region. A degradation of the general<br />

sentiment has already become apparent, leading<br />

industrial and logistics companies to act with caution<br />

regarding their expansion or relocation plans.<br />

Figure 5<br />

Industrial production in selected <strong>European</strong> countries<br />

www.dtz.com 3<br />

%<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

2007 2008 2009 2010 <strong>2011</strong>F 2012F 2013F 2014F<br />

CEE France Germany<br />

Nordics United Kingdom Eurozone<br />

Source: Oxford Economics<br />

Figure 6<br />

Eurozone business & consumer confidence<br />

(% balance)<br />

% Balance<br />

1,6<br />

1,4<br />

1,2<br />

1<br />

0,8<br />

0,6<br />

0,4<br />

0,2<br />

0<br />

Source: Oxford Economics<br />

Figure 7<br />

Business (LHS) Consumer (RHS)<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

-12<br />

-14<br />

-16<br />

-18<br />

Consumer spending in selected <strong>European</strong> countries<br />

%<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

2007 2008 2009 2010 <strong>2011</strong>F 2012F 2013F 2014F<br />

CEE France Germany<br />

Nordics United Kingdom Eurozone<br />

Source: Oxford Economics

Economic overview<br />

Figure 8<br />

GDP growth in <strong>2011</strong><br />

GDP growth in <strong>2011</strong><br />

-4.8% - 0%<br />

0.1% - 2.0%<br />

2.1% - 4.0%<br />

4.1% - 6.4%<br />

No data<br />

Portugal<br />

Ireland<br />

Spain<br />

United Kingdom<br />

Source : <strong>DTZ</strong> Research, ESRI, Oxford Economics<br />

Source: Oxford Economics<br />

France<br />

Belgium<br />

Denmark<br />

Netherlands<br />

Luxembourg<br />

Norway<br />

Germany<br />

Switzerland<br />

Sweden<br />

Czech Republic<br />

Italy<br />

Austria<br />

• Figure 8 illustrates the GDP growth anticipated for<br />

<strong>2011</strong>. The 3 major economies – the UK, France and<br />

Germany – will see their GDP figures grow. Germany<br />

will lead with 3.5% growth expected, followed by<br />

France (2.2%) and the UK (1.4%).<br />

Bosnia and Herzegovina<br />

Serbia<br />

Montenegro Kosovo<br />

Russian Federation<br />

www.dtz.com 4<br />

Poland<br />

Slovenia<br />

Croatia<br />

Malta<br />

Slovakia<br />

Hungary<br />

Albania<br />

Finland<br />

Estonia<br />

Latvia<br />

Lithuania<br />

FYR of Macedonia<br />

Greece<br />

Romania<br />

Belarus<br />

Bulgaria<br />

Ukraine<br />

Republic of Moldova<br />

Turkey<br />

Cyprus<br />

• GDP growth is expected to be strongest in the<br />

Nordics and CEE, especially in Poland, Russia and<br />

Turkey, while the PIIGS struggle well below the<br />

<strong>European</strong> average (1.9%).

Retail, E-retail & logistics<br />

Retail & <strong>Logistics</strong><br />

• Although retail sales growth was still in negative<br />

territory at the end of 2010, the declines are much<br />

shallower than in 2009. By the end of <strong>2011</strong>, all the<br />

major markets in Europe are forecast to return to<br />

retail sales growth, with the exceptions of Greece,<br />

Spain, Portugal and Italy (Figure 9).<br />

• As a result of the downturn, retailers have become<br />

extremely selective on their choice of stores and<br />

locations, favouring larger units in new retail formats<br />

located in city centres. These changes, mainly<br />

prevalent in the food sector, will impact their supply<br />

chain and, ultimately, their logistics requirements.<br />

• Increased efficiency in the supply chain and cost<br />

cutting measures will drive retailers and their third<br />

party providers to review their existing networks in<br />

two ways: by relocating to main distribution hubs<br />

across Europe in order to take advantage of good<br />

locations for both production and distribution, and by<br />

identifying hot spots at a local level for the distribution<br />

of goods to the consumers.<br />

E-retail & logistics<br />

• E-commerce is one of the fastest-growing sectors in<br />

Europe, with an average increase of 5.9% during<br />

2010. Online sales are forecast to increase by 14% in<br />

the UK this year. In continental Europe, the pace of<br />

the online retail growth will be higher, ranging from<br />

15% in Germany to a record level of 33.5% in Poland<br />

(Figure 10). Consequently, the market share of online<br />

sales will grow to represent 12% in the UK, and an<br />

average of 6% in Continental Europe.<br />

• The anticipation of business growth linked to eretailing<br />

has already generated new orders from eretailers<br />

in UK, France and more recently Germany,<br />

where Amazon has signed the two biggest<br />

transactions of <strong>H1</strong> <strong>2011</strong>. E-retailer requirements are<br />

focused on large logistics schemes on the periphery<br />

but also medium and small sized warehouses close<br />

to town centres for “last mile” distribution.<br />

Figure 9<br />

Retail sales annual forecasts (<strong>2011</strong>-2020) in Europe<br />

Source: Oxford Economics<br />

Figure 10<br />

Forecast growth in online sales, <strong>2011</strong><br />

Poland<br />

www.dtz.com 5<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

% increase<br />

online<br />

sales 2010-<br />

<strong>2011</strong><br />

Italy<br />

Spain<br />

France<br />

Switzerland<br />

Benelux<br />

UK<br />

Germany<br />

0 3 6 9 12 15<br />

<strong>2011</strong> online share of all retail business (%)<br />

Source: Centre for Retail Research

Investment Market<br />

High investment volumes in the Nordic and<br />

CEE countries.<br />

• The logistics investment market has remained<br />

broadly stable in the first half of <strong>2011</strong> – with €4.6<br />

billion invested. This level is roughly in line with the<br />

€8.4 billion invested during the whole of 2010. As<br />

highlighted previously, the recovery in the logistics<br />

investment market is still on track, but at a slower<br />

pace than the global market, which registered a 13%<br />

increase during the same period.<br />

• The proportion of industrial and logistics assets in<br />

global investment volumes grew by 10% in <strong>H1</strong> <strong>2011</strong>,<br />

up from the 8% recorded in 2010. Despite this<br />

increase in market share, the logistics sector remains<br />

secondary to the market recovery witnessed in the<br />

retail and office sectors.<br />

• The UK market has the highest investment volume in<br />

Europe with €1.3 billion, representing 29% of<br />

<strong>European</strong> deals during <strong>H1</strong> <strong>2011</strong> (Figure 12). Strong<br />

performance in the UK market is mainly linked to<br />

several portfolio purchases and a strong activity in<br />

the €20-50 million range.<br />

• The German investment market remains dynamic<br />

with volumes close to €800 million, well on track to<br />

exceed the €1.2 billion transacted during 2010. Two<br />

deals above €100 million were registered, including<br />

one by Goodman on the ING's Industrial Fund<br />

portfolio (11 properties representing 367,091 sq m<br />

located in or in the vicinity of Bremen and Berlin).<br />

• Market activity has remained subdued in France with<br />

less than €300 million invested, while the CEE<br />

markets registered their best performance in over a<br />

decade with €450 million invested. This strong<br />

performance is mainly linked to the €272 million<br />

Europolis portfolio deal.<br />

• After its peak of H2 2010, with €1.1 billion transacted,<br />

the Nordics has maintained its high performance by<br />

posting one of the highest levels of investment<br />

volumes recorded in <strong>H1</strong> <strong>2011</strong> – near €900 million.<br />

Local investors showed strong demand for logistics<br />

assets ranging between €20 and €100 million.<br />

Figure 11<br />

<strong>European</strong> investment activity in logistics<br />

www.dtz.com 6<br />

Bn €<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Figure 12<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

<strong>Logistics</strong> investment Share of logistics investment<br />

<strong>Logistics</strong> investment volume in Europe<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

UK France Germany CEE Nordics Others<br />

Source: <strong>DTZ</strong> Research

Investment Market<br />

Prime yields stabilizing in the UK and<br />

French markets; elsewhere compression is<br />

ongoing<br />

• Contrasting trends between prime <strong>European</strong> logistics<br />

yields have been observed in <strong>H1</strong> <strong>2011</strong>. After strong<br />

compression in 2010, yields in the UK, Sweden and<br />

France have stabilised or increased slightly.<br />

Elsewhere compression is still ongoing but at a<br />

varied pace, depending on the country considered.<br />

Compression is slow in Brussels (-150 bps) and<br />

Germany (-100 bps), as the yields are approaching<br />

their lowest point and more pronounced in Warsaw (-<br />

250 bps), and CEE, where compression has just<br />

begun (Figure 13).<br />

• The range of prime logistics yields across Europe<br />

has been reduced in <strong>H1</strong> <strong>2011</strong> with most of the<br />

markets covered in our analysis now priced between<br />

6 and 8%. However, Bucharest, Budapest, Moscow<br />

and Kiev are priced above 9%. Average prime yields<br />

in Europe are close to 7.50%, with the UK market<br />

slightly below and CEE markets above.<br />

• Looking forward to 2015, prime yields are not<br />

expected to change dramatically, with a modest<br />

annual capital growth of 1.2% anticipated from 2012<br />

to 2015. CEE markets and Spain will outperform with<br />

an increase from 2 to 5% over the same period. The<br />

three major markets – UK, France and Germany –<br />

will see yields moving by 10-15 bps in France, 10-15<br />

bps in Germany and 0-25 bps in UK between <strong>2011</strong><br />

and 2015.<br />

Figure 13<br />

<strong>Logistics</strong> prime yields in Europe, 2000-Q4 2010<br />

www.dtz.com 7<br />

%<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

Source: <strong>DTZ</strong> Research<br />

Brussels Paris<br />

Munich Warsaw<br />

Stockholm London (Heathrow)

Fair Value Index<br />

<strong>Logistics</strong> shown as fairly priced across<br />

Europe in Q2 <strong>2011</strong>, as Fair Value Index<br />

stands at 52<br />

• Based on our Fair Value analysis, both logistics and<br />

retail remain the most attractive sectors with an index<br />

score of 52, compared to only 28 for offices (Figure<br />

14). More than 24 of the 27 <strong>European</strong> logistics<br />

markets covered by our Fair Value Index are<br />

currently attractively priced.<br />

• The number of <strong>European</strong> logistics markets currently<br />

identified as HOT (under-priced by more than 5%)<br />

decreased in the 2 nd quarter <strong>2011</strong>, to five from eight<br />

at the end of 2010.<br />

• Prime industrial yields in most major markets have<br />

held at a relatively high level. Notable exceptions are<br />

London Heathrow and the Greater Paris Region,<br />

where international interest has driven significant<br />

yield compression.<br />

• A wide range of attractive markets across Europe<br />

have been identified in Q2 <strong>2011</strong>: Prague, Antwerp,<br />

Barcelona, Manchester, Brussels and Bucharest. The<br />

latter has posted the largest upgrade of the half year,<br />

moving from twenty fourth place in Q4 2010 to sixth<br />

position in Q2 <strong>2011</strong>. Its attractiveness is explained by<br />

high income returns and expected annualised capital<br />

growth of around 1.6% per year between <strong>2011</strong> and<br />

2015 over a risk free rate of around 5%.<br />

• Some opportunities can still be found in emerging<br />

CEE markets, like Prague (classified as HOT) and<br />

Warsaw (WARM). Budapest is currently classified as<br />

COLD as forecast rent and yield movements of over<br />

the next 5 years fail to deliver returns strong enough<br />

to compensate for the given risks (Table 1).<br />

• Amongst the most mature markets, Germany<br />

(Hamburg and Frankfurt) and France (Greater Paris<br />

Region, Lyon, and Marseilles) are now classified in<br />

the WARM category. Prime yield compression has<br />

not matched the five year government bond yield<br />

movements, restoring some relative attractiveness<br />

for logistics assets.<br />

Figure 14<br />

Fair Value Index – Europe<br />

www.dtz.com 8<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

All property Office Retail <strong>Logistics</strong><br />

Q2 2010 Q3 2010 Q4 2010 Q1 <strong>2011</strong> Q2 <strong>2011</strong><br />

Source: <strong>DTZ</strong> Research<br />

Table 1<br />

Fair Value Classifications – Key Industrial Markets<br />

Q2 <strong>2011</strong><br />

Under/over<br />

Category Market<br />

valuation<br />

HOT<br />

WARM<br />

COLD<br />

Source: <strong>DTZ</strong> Research<br />

Prague -9%<br />

Antwerp -9%<br />

Barcelona -8%<br />

Manchester -8%<br />

Brussels -6%<br />

Greater Paris<br />

Region<br />

-3%<br />

Hamburg -2%<br />

Madrid -0%<br />

Warsaw 2%<br />

Rotterdam 3%<br />

London Heathrow 4%<br />

Amsterdam<br />

Budapest<br />

Oslo<br />

Dublin<br />

6%<br />

6%<br />

6%<br />

8%

Fair Value Index<br />

Map 1<br />

Prime industrial yields in Europe (Q2 <strong>2011</strong>) and yield shift expected in <strong>2011</strong>-2015<br />

Prime yield<br />

5.75% - 6.99%<br />

7.00% - 7.99%<br />

8.00% - 8.99%<br />

9.00% - 10.50%<br />

Yield shift (<strong>2011</strong>-2015)<br />

-75 to -26 bps<br />

-25 to 25 bps<br />

26 to 50 bps<br />

Dublin<br />

Source : <strong>DTZ</strong> Research, ESRI<br />

Glasgow<br />

Bristol<br />

Madrid<br />

Manchester<br />

London (Heathrow)<br />

Amsterdam<br />

Paris (IDF)<br />

Brussels<br />

Lyon<br />

Rotterdam<br />

Antwerp<br />

Marseille<br />

Barcelona<br />

Oslo<br />

Hamburg<br />

Frankfurt<br />

Milan<br />

Gothenburg<br />

Copenhagen<br />

Berlin<br />

Rome<br />

www.dtz.com 9<br />

Prague<br />

Budapest<br />

Helsinki<br />

Warsaw<br />

Bucharest

Occupier market – <strong>European</strong> market overview<br />

Good performance in <strong>H1</strong> <strong>2011</strong> but a high<br />

degree of uncertainty about H2 <strong>2011</strong><br />

• <strong>H1</strong> <strong>2011</strong> witnessed a strong <strong>European</strong> economic<br />

recovery, until further escalation of the debt crisis<br />

during the summer. Growth in consumption and the<br />

resulting uptick in industrial production led to an<br />

increasingly positive outlook. The first half year of<br />

<strong>2011</strong> saw an increased level of take-up, with 6.9<br />

million sq m registered in five of the leading<br />

<strong>European</strong> markets, up from 5.5 million sq m during<br />

the same period a year ago (Figure 15).<br />

• German and CEE logistics markets, especially in<br />

Poland, have been boosted by a strong economic<br />

recovery. Retailers and manufacturers were quick to<br />

take advantage of improving sentiment and<br />

opportunities. Take-up in Germany and the CEE has<br />

seen an increase of 42% and 28% respectively. In<br />

France and Belgium, increased activity has been<br />

concentrated in core markets, whilst secondary<br />

markets are still struggling with flat occupier demand.<br />

Finally, the UK market is experiencing a huge decline<br />

of Grade A supply while the demand from the retail<br />

and manufacturing sectors, although subdued<br />

relative to historical averages, remains constant.<br />

• Expansion plans were beginning to return to the<br />

agenda of many retail and manufacturing companies.<br />

However, their market approach remains cautious as<br />

most are unwilling to compromise on either quality or<br />

location, given their perception of current market<br />

conditions. Built-to-suit schemes have grown in<br />

popularity as occupiers have fewer good quality<br />

buildings to choose from within the existing supply.<br />

This “flight to quality” has kept vacancy rates roughly<br />

unchanged, varying between 6 and 20% depending<br />

on the market.<br />

• The financial crisis of the summer has led to a large<br />

number of requirements being put on hold.<br />

Furthermore, the crisis will negatively impact levels of<br />

speculative development of logistics space. H2 <strong>2011</strong><br />

results will depend on the capacity of the <strong>European</strong><br />

Union to deal with the sovereign debt crisis and<br />

restore confidence. This process should take several<br />

months; we therefore expect to see more challenging<br />

market conditions leading to a decrease in take-up<br />

levels during the second half of <strong>2011</strong>.<br />

Figure 15<br />

Take-up in selected* countries in Europe<br />

in 000 of sq m<br />

www.dtz.com 10<br />

Sq m<br />

5 000<br />

4 500<br />

4 000<br />

3 500<br />

3 000<br />

2 500<br />

2 000<br />

1 500<br />

1 000<br />

500<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Germany UK CEE France Belgium<br />

2007 2008 2009 2010 <strong>H1</strong> <strong>2011</strong>

Occupier market – <strong>European</strong> overview<br />

Map 2<br />

Prime industrial rents in Europe (Q2 <strong>2011</strong>) and annual growth expected between <strong>2011</strong> and 2015<br />

Prime rent (€/sq m/year)<br />

41 - 50<br />

51 - 75<br />

76 - 100<br />

101 - 151<br />

Annual rental growth (<strong>2011</strong>-2015)<br />

2.1% - 3.5%<br />

1.1% - 2.0%<br />

0.0% - 1.0%<br />

Dublin<br />

Source : <strong>DTZ</strong> Research, ESRI<br />

Glasgow<br />

Rotterdam<br />

Bristol Antwerp<br />

Madrid<br />

Manchester<br />

London (Heathrow)<br />

Amsterdam<br />

Paris (IDF)<br />

Brussels<br />

Lyon<br />

Marseille<br />

Barcelona<br />

Milan<br />

Oslo<br />

Hamburg<br />

Frankfurt<br />

Gothenburg<br />

Copenhagen<br />

www.dtz.com 11<br />

Berlin<br />

Rome<br />

Prague<br />

Helsinki<br />

Warsaw<br />

Budapest<br />

Bucharest

Occupier market – <strong>European</strong> overview<br />

Prime rents stabilising in <strong>H1</strong> <strong>2011</strong><br />

• After strong decreases registered in 2009 and 2010,<br />

prime rents are now stabilising. Occupier demand<br />

has been growing after two years of stagnation, but<br />

many <strong>European</strong> markets are still suffering from a<br />

high level of vacant space. Therefore rents remain<br />

under pressure (Figure 16).<br />

• 41 <strong>European</strong> markets out of the 50 covered by our<br />

analysis have seen prime logistics rents remain<br />

stable during the first half of <strong>2011</strong>. Behind this<br />

apparent rental stability, landlords are still flexible<br />

over incentives, especially in the markets where<br />

supply is abundant and demand is limited.<br />

• Among the major markets, Dublin has posted the<br />

largest decrease (-7%) in rents over the period, while<br />

Greater Paris Region, Istanbul and Brussels saw<br />

their rents increase by 2%, 6% and 10% respectively.<br />

Marginal upward trend in rents expected<br />

across Europe by the end of <strong>2011</strong><br />

• <strong>2011</strong> will see prime industrial rental growth returning<br />

to positive territory, following the recovery already<br />

experienced in the office and retail sectors during<br />

2010. Prime <strong>European</strong> industrial rents are forecast<br />

to increase on average by just over 1.5% pa,<br />

compared to 1.7% for retail and 2.5% for the office<br />

sector. Despite this positive forecast for the<br />

<strong>European</strong> market, prime rents will stay below their<br />

historical peaks.<br />

• The rental recovery seen in some markets in <strong>H1</strong><br />

<strong>2011</strong> should gradually spread across Europe, as<br />

most markets are expecting to see rental growth by<br />

the end of <strong>2011</strong>.<br />

• Berlin, Bucharest, Rome and Copenhagen are the<br />

only markets on the periphery of the recovery. At the<br />

other end of the scale, the biggest increases are<br />

expected in Barcelona (3.6%), partially reversing the<br />

8% decrease registered between 2006 and 2010.<br />

Prime rents in the Greater Paris Region are forecast<br />

to increase by 2.2% to return to 2009 levels. CEE<br />

markets will benefit from the upward trend with a 2%<br />

rise anticipated in Warsaw and Prague (Figure 17).<br />

Figure 16<br />

<strong>European</strong> prime rents, 2000- Q2 <strong>2011</strong><br />

Base 100 = Q4 2000<br />

www.dtz.com 12<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Source: <strong>DTZ</strong> Research<br />

Figure 17<br />

Barcelona Birmingham<br />

Frankfurt Greater Paris Region<br />

Rotterdam Warsaw<br />

<strong>European</strong> prime rents, <strong>2011</strong> and 2015, biggest<br />

increases<br />

Marseille<br />

Greater Paris<br />

Region<br />

Brussels<br />

Prague<br />

Birmingham<br />

Manchester<br />

Warsaw<br />

Barcelona<br />

€ per sq m per<br />

year<br />

Source: <strong>DTZ</strong> Research<br />

30 40 50 60 70 80<br />

Q2 <strong>2011</strong> 2015F

Occupiers market – Country overview<br />

United Kingdom<br />

Manufacturing and retail sectors boost occupier<br />

demand<br />

• Take-up during the first half of <strong>2011</strong> came in at<br />

approximately 1.1m sq m, showing a slowdown<br />

compared to the 2.6m sq m achieved in 2010. The<br />

slowdown has been more visible in Q2 <strong>2011</strong> with<br />

492,000 sq m let (Figure 18). Occupiers seem<br />

inclined to place decisions on hold as uncertainty<br />

over the economic climate, including the revision to<br />

the UK outlook, dictate caution.<br />

• The drop in activity was mainly due to a fall in<br />

average deal size, since the number of transactions<br />

in Q2 was fairly similar to the number in Q1. This<br />

reduction in the average deal size was a result of a<br />

change in the profile of occupiers. Large distribution<br />

deals were rare during the quarter as manufacturing<br />

occupiers, which take smaller units than logistics<br />

users, demonstrated increased activity. Although<br />

manufacturing gains have dominated headlines, retail<br />

and internet retail requirements continue to provide a<br />

significant proportion of market demand for big sheds.<br />

• Supply side conditions continue to tighten as<br />

speculative construction is yet to return in any<br />

meaningful volume, despite a notable shortage of the<br />

best quality space (Figure 19). Many tenants are<br />

resorting to built to suit as the only option for new<br />

space. Additionally diminishing supply of large,<br />

Grade A buildings is likely to encourage a number of<br />

deals as occupiers bring forward requirements to<br />

secure space in the few remaining buildings.<br />

• There was no appreciable rental movement during<br />

<strong>H1</strong> <strong>2011</strong>, but it is clear that the market is returning to<br />

a more balanced position. However, before any<br />

rental movement takes place, incentives will have to<br />

undergo some significant tightening. Although the<br />

overall rental growth forecast remains consistent with<br />

the previous forecast, spikes of undersupply in some<br />

markets have, in turn, prompted uplifts in rental<br />

growth. Despite the rental growth acceleration<br />

throughout the forecast period, the overall average,<br />

as well as the growth peaks, remains below historical<br />

values.<br />

Figure 18<br />

Aggregate regional take-up in UK<br />

Sq m<br />

1 200 000<br />

1 000 000<br />

www.dtz.com 13<br />

800 000<br />

600 000<br />

400 000<br />

200 000<br />

Source: <strong>DTZ</strong> Research<br />

Figure 19<br />

-<br />

A B C<br />

National availability by grade<br />

Sq m<br />

25 000 000<br />

20 000 000<br />

15 000 000<br />

10 000 000<br />

5 000 000<br />

Source: <strong>DTZ</strong> Research<br />

Figure 20<br />

-<br />

Q4<br />

2009<br />

Q1<br />

2010<br />

Q2<br />

2010<br />

Q3<br />

2010<br />

Q4<br />

2010<br />

Prime Secondary<br />

Q1<br />

<strong>2011</strong><br />

<strong>DTZ</strong> prime industrial annual rental growth<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

-1%<br />

-2%<br />

-3%<br />

-4%<br />

Source: <strong>DTZ</strong> Research<br />

Q2<br />

<strong>2011</strong>

Occupiers market – Country overview<br />

Ireland<br />

A positive sign of recovery but the market is still<br />

under pressure<br />

• In line with the signs of recovery noticed at the end of<br />

2010, the Dublin industrial market registered a strong<br />

performance both in terms of total transacted space<br />

and individual deals completed in <strong>H1</strong> <strong>2011</strong> with<br />

80,900 sq m (Figure 21), posting a modest increase<br />

compared to the same period in 2010. Levels,<br />

however, remain significantly lower relative to the<br />

long run annual average level of transactions.<br />

• The opening six months of the year witnessed further<br />

improvements in both sentiment and activity<br />

indicators such as enquiry levels and requirements,<br />

albeit off a low base.<br />

• Since the onset of the downturn, the appetite for<br />

freehold purchases has been limited. Occupiers have<br />

instead been opting for more flexible leasehold<br />

transactions as an occupational preference. However,<br />

<strong>2011</strong> has seen renewed interest in purchase options,<br />

with approximately 39% of floorspace transacted<br />

during the first six months of the year.<br />

• Supply levels in the Dublin industrial market declined<br />

to 971,600 sq m at the end of June <strong>2011</strong>. This<br />

represents the first reduction in availability in three<br />

years and follows a leveling off in the upward trend<br />

noted in the previous quarter. While this marks a<br />

positive development for the industrial market, given<br />

the current economic climate, supply levels are<br />

expected to fluctuate over the coming quarters. In<br />

line with a modest decrease in supply levels, the<br />

vacancy rate declined to 23.9% at the end of June,<br />

down from 24% recorded at the end of 2010.<br />

• Rents have continued on their downward spiral as<br />

landlords continue to compete for the few active<br />

requirements in the market at present. Prime<br />

headline rents are now in the region of €60 per sq m.<br />

However incentives are only playing a minimal part<br />

during negotiations as landlords have reduced the<br />

rent from lease commencement and have not kept<br />

the rents artificially high while including incentives.<br />

• The construction of logistics/industrial<br />

accommodation has completely ceased; however,<br />

there is a limited amount of good quality<br />

accommodation available with the potential that new<br />

requirements will have to opt for expensive design<br />

and build solutions in the short to medium term.<br />

Figure 21<br />

Take-up & availability ratio in Ireland<br />

www.dtz.com 14<br />

Sq m<br />

400 000<br />

350 000<br />

300 000<br />

250 000<br />

200 000<br />

150 000<br />

100 000<br />

50 000<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Figure 22<br />

Prime rents in Dublin<br />

€/ sq m /y<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Source: <strong>DTZ</strong> Research<br />

Take-up Availability ratio<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%

Occupiers market – Country overview<br />

Belgium<br />

High level of take-up in <strong>H1</strong> <strong>2011</strong> but modest<br />

growth of prime rents anticipated until 2015<br />

• The first half of <strong>2011</strong> has seen the Belgian logistics<br />

market reaching a record level of 520,000 sq m<br />

taken-up, compared to an annual average of 490,000<br />

sq m (Figure 23). These better than average results<br />

are mainly linked to strong activity in the Flanders<br />

region, which accounted for approximately 465,000<br />

sq m of take-up. Over the first half, this region has<br />

attracted major deals, such as Maxeda Brico on<br />

34,000 sq m of logistics space in Willebroek and<br />

more recently Spar Retail and Nike Europe on<br />

premises above 40,000 sq m.<br />

• The top five deals of the first half of the year included<br />

four purchases for owner occupation. All these deals<br />

were for facilities between 20,000 sq m and 50,000<br />

sq m.<br />

• The high level of activity seen in <strong>H1</strong> <strong>2011</strong> has dried<br />

up the supply and a large portion of the vacant stock<br />

has been let during the last 12 -18 months. Grade A<br />

supply has shrunk as speculative construction has<br />

remained subdued. The quality of the remaining<br />

supply is becoming an issue, leading many occupiers<br />

to a built-to-suit solution.<br />

• The rental value decline registered since the end of<br />

2007 has halted in <strong>H1</strong> <strong>2011</strong> and prime rents are<br />

stabilising at €48 per sq m in Antwerp. Brussels has<br />

seen its rents coming back to a level of €55 per sq m<br />

while the rental adjustment is still ongoing in Liege<br />

(Figure 24). Going forward, we don’t expect any<br />

major changes to prime rents with a forecast 2.2% pa<br />

in Brussels and 1.6% pa in Antwerp from <strong>2011</strong> to<br />

2015.<br />

Figure 23<br />

Aggregate regional take-up in Belgium<br />

600 000<br />

500 000<br />

400 000<br />

300 000<br />

200 000<br />

100 000<br />

www.dtz.com 15<br />

Sq m<br />

-<br />

Source: <strong>DTZ</strong> Research<br />

Figure 24<br />

Flanders Brussels (incl. Brabant) Wallonia<br />

Prime rents in Belgium<br />

€/ sq m /<br />

year<br />

60<br />

50<br />

40<br />

30<br />

Source: <strong>DTZ</strong> Research<br />

Antwerp Brussels Liege

Occupiers market – Country overview<br />

France<br />

Falling supply as a result of strong levels of<br />

activity in core markets<br />

• The French logistics market recorded strong levels of<br />

activity in the first half of <strong>2011</strong>, with take-up reaching<br />

1.1 m sq m, representing a 31% increase compared<br />

to <strong>H1</strong> 2010. The four core markets (Greater Paris<br />

Region, Lille, Lyon and Marseilles) witnessed higher<br />

levels of activity than previous quarters. The biggest<br />

increase in take up was registered in Lyon where,<br />

after a difficult 2010 (with take-up only reaching<br />

236,000 sq m), was recorded 198,000 sq m of takeup<br />

in <strong>H1</strong> <strong>2011</strong> alone. The level of activity in the<br />

Greater Paris Region market remained unchanged at<br />

414,000 sq m.<br />

• Meanwhile, the continuous increase of immediately<br />

available supply seen since the end of 2007 has<br />

stopped. The first signs of decline (-10% during the<br />

last 6 months) has seen supply fall to 2.7 m of sq m,<br />

compared to 3 m sq m at the end of 2010. This<br />

decline is a common trend in the 4 core markets but<br />

in variable proportions: from -7% in the Greater Paris<br />

Region (903,000 sq m) to -29% in Marseilles<br />

(133,000 sq m). Despite stronger take up, the Lyon<br />

market is still suffering from a high level of vacancy,<br />

with 500,000 sq m immediately available, at a<br />

vacancy ratio of 12% (Figure 26).<br />

• Prime logistics rents remained stable at €41-43 per<br />

sq m in Marseille and Lyon and close to €50 per sq m<br />

in the Greater Paris Region at the end of <strong>H1</strong> <strong>2011</strong>.<br />

The trend of increased take-up noticed in the first half<br />

of the year and strong prospects for the second half,<br />

allow some optimism regarding further rental growth,<br />

firstly in the Greater Paris Region and Marseille for<br />

the end of the year, and in Lyon in 2012. However,<br />

rents will not return to their pre-crisis level before<br />

2013/2014. Meanwhile, landlords will continue to<br />

offer incentives in the markets where immediate<br />

supply is large, especially on medium-sized buildings<br />

Figure 25<br />

Take-up in France<br />

Sq m<br />

2 500 000<br />

2 000 000<br />

1 500 000<br />

1 000 000<br />

www.dtz.com 16<br />

500 000<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Figure 26<br />

2004 2005 2006 2007 2008 2009 2010 <strong>H1</strong><br />

<strong>2011</strong><br />

Greater Paris Region Outside GPR<br />

Vacancy rates in France<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Source: <strong>DTZ</strong> Research<br />

Figure 27<br />

Greater Paris Region Lyon Marseille<br />

Prime rents in France<br />

€/ sqm<br />

/year<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

Source: <strong>DTZ</strong> Research<br />

Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q2<br />

2001 2002 20032004<br />

2005 2006 2007 2008 2009 2010 <strong>2011</strong><br />

Greater Paris Region Lyon Marseille Lille

Occupiers market – Country overview<br />

Germany<br />

Record level of take-up, boosted by major<br />

transactions on built-to-suit developments<br />

• On the back of a positive economic outlook, the<br />

German market has continued to see growth in takeup<br />

to 2.7 m sq m in <strong>H1</strong> <strong>2011</strong> from 1.9 m sq m in <strong>H1</strong><br />

2010. The market posted a 41% increase on an<br />

annual basis, thus ranking one of the most active<br />

markets throughout Europe. Food retailers are keen<br />

to move from old warehouses to new developments,<br />

especially on built-to-suit premises; whereas demand<br />

from the manufacturing sector is more focused on<br />

existing and second-hand buildings.<br />

• The economic troubles dominating Europe since the<br />

summer could impact negatively on the level of<br />

demand for logistics space in Germany as<br />

uncertainty increases. Therefore we anticipate a<br />

lower level of take-up for the rest of the year, but<br />

despite this, <strong>2011</strong> should remain one of the best<br />

years in terms of take-up levels (Figure 28).<br />

• Construction activity is slowly returning in Germany,<br />

even if pre-letting of these new developments is still<br />

required. Thus, Goodman has signed with e-retailer<br />

Amazon for a built-to-suit development of 110,000 sq<br />

m in Rheinberg and another one of 110,000 sq m in<br />

Bavaria. These buildings will be delivered within 5<br />

months.<br />

• During the first half of <strong>2011</strong>, headline rents in the five<br />

major markets of Germany remained unchanged<br />

compared to their levels at the end of 2010. Prime<br />

rents of modern logistics space stand at €74 per sq<br />

m in Munich and at €68 per sq m in Frankfurt, making<br />

these two regions the most expensive in Germany.<br />

(Figure 29). Strong performance in the Frankfurt<br />

logistics market will have a positive impact on prime<br />

rents with a 3.8% increase anticipated in <strong>2011</strong> - to<br />

reach €71 per sq m, while Hamburg will see prime<br />

rents rising at a slower pace, at around 1.8% per<br />

annum from <strong>2011</strong> to 2013.<br />

Figure 28<br />

Take-up in Germany<br />

Sq m<br />

3 000 000<br />

2 500 000<br />

2 000 000<br />

1 500 000<br />

1 000 000<br />

500 000<br />

www.dtz.com 17<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Figure 29<br />

2004 2005 2006 2007 2008 2009 2010 <strong>H1</strong><br />

<strong>2011</strong><br />

Top 5 markets Outside top 5 markets<br />

Prime rents in Germany<br />

€/ sq m<br />

/year<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

Source: <strong>DTZ</strong> Research<br />

Berlin Dusseldorf Frankfurt<br />

Hamburg Munich

Occupiers market – Country overview<br />

The Netherlands<br />

Strong activity outside the three main markets<br />

• After a strong rebound in H2 2010 with take-up<br />

reaching 200,000 sq m in the three major markets<br />

(Amsterdam, Rotterdam and Utrecht), the Dutch<br />

logistics market returned to lower levels of activity in<br />

<strong>H1</strong> <strong>2011</strong>, with take-up reaching 100,000 sq m only.<br />

(Figure 30). Market activity has been particularly<br />

subdued in Amsterdam and Rotterdam since the<br />

beginning of the year, whilst Utrecht recorded 50% of<br />

total transactions. At a national level, the market is<br />

more dynamic with take-up close to 453,000 sq m; a<br />

similar level to that reached for the whole of 2010<br />

(512,000 sq m). Most of the main transactions over<br />

the period took place outside the three main markets,<br />

with important deals including that of TNT Fashion<br />

Group B.V. and Plus 100 B.V.in the Brabant region.<br />

• <strong>Logistics</strong> providers such as Kuehne & Nagel, as well<br />

as retailers, have supported the market with<br />

requirements of above 10,000 sq m. Clearly identified<br />

as a hub for the <strong>European</strong> market, the Dutch logistics<br />

market benefits from its strategic position with the<br />

ports of Rotterdam and Amsterdam. A revival of the<br />

logistics market is expected in the surrounding area<br />

of the Schipol airport thanks to a new urban<br />

development project.<br />

• Rents have remained stable, with values in<br />

Amsterdam close to €65 per sq m (Figure 31). No<br />

rental growth is expected for the rest of the year, with<br />

a slight increase of 1.5% expected in 2012 at the<br />

earliest.<br />

Figure 30<br />

Take-up in main city regions in the Netherlands<br />

000 sq m<br />

www.dtz.com 18<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Figure 31<br />

2007 2008 2009 2010 <strong>H1</strong> <strong>2011</strong><br />

Amsterdam Rotterdam Utrecht<br />

Prime rents in the Netherlands<br />

€/ sq m<br />

/year<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

Source: <strong>DTZ</strong> Research<br />

Amsterdam Rotterdam Utrecht

Occupiers market – Country overview<br />

Italy<br />

Economic turmoil postpones the rental recovery<br />

• No major changes have been noticed in the Italian<br />

logistics market where the level of take-up is still well<br />

below the long term average. Most of the lettings<br />

registered in <strong>H1</strong> <strong>2011</strong> were built-to-suit deals,<br />

keeping the vacancy ratio at around 7%.<br />

Approximately 450,000 sq m is currently available on<br />

the Milanese logistics market.<br />

• Prime rents remained stable during <strong>H1</strong> <strong>2011</strong> (Figure<br />

32). The austerity measures put in place by the<br />

Italian government to reduce its public debt will<br />

impact negatively on consumption and therefore a<br />

decline in industrial production and foreign trade is<br />

expected. In this context, the rental recovery<br />

expected in 2012 will be delayed until 2013, with a<br />

modest 1.8% annual increase.<br />

Spain<br />

Take-up slows but new developments stops<br />

• The beginning of <strong>2011</strong> did not confirm the rebound<br />

noticed at the end of 2010 and the Spanish market<br />

has maintained a low level of activity with only 92,000<br />

of take-up in Madrid and 65,000 sq m in Barcelona.<br />

The absence of construction starts during this period<br />

adds further evidence of a tightening market, on the<br />

back of an increasingly negative economic outlook.<br />

• Vacancy rates have risen in the two main markets of<br />

Spain, reaching 9% in Madrid and 12% in Barcelona.<br />

• In this context, rents have stabilized in <strong>H1</strong> <strong>2011</strong> at<br />

€70 per sq m in Madrid and €63 per sq m in<br />

Barcelona (Figure 33). Based on our forecasts, prime<br />

rents will increase to €72 per sq m in Madrid, and<br />

€68 per sq m in Barcelona in 2012 at the earliest.<br />

Despite this recovery, rental values will not return to<br />

previous peaks within the next five years.<br />

Figure 32<br />

Prime rents in Italy<br />

€/ sq m<br />

/year<br />

65<br />

www.dtz.com 19<br />

60<br />

55<br />

50<br />

45<br />

Source: <strong>DTZ</strong> Research<br />

Figure 33<br />

Prime rents in Spain<br />

€/ sq m<br />

/year<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Source: <strong>DTZ</strong> Research<br />

Milan Rome<br />

Barcelona Madrid

Occupiers market – Country overview<br />

Nordics<br />

Positive economic prospects but market<br />

structure discouraging speculative construction<br />

• On the back of strong economic prospects with GDP<br />

growth forecast at 2.5% per annum between <strong>2011</strong><br />

and 2015 and consumer spending growth of 2.3%<br />

per annum over the same period, the Nordic region<br />

should see demand for logistics spaces growing in<br />

the short term. However, the market remains<br />

characterised by a high ratio of owner occupation<br />

and the attempts of developers to enter these<br />

markets have not been successful.<br />

• Occupiers are reluctant to move away from the<br />

suburbs of the main cities across the region where<br />

large land banks are available for new developments.<br />

In the Danish market, occupier demand is mainly<br />

focused on the triangle area on the German border<br />

which allows the distribution of products in the whole<br />

country. The 18 kilometers bridge between Denmark<br />

and Germany planned for opening in 2018 should<br />

impact positively on the market; however some<br />

relocation from Sweden is expected.<br />

Sweden<br />

• In many ways, Sweden is the geographical centre of<br />

the Nordic region, with a relatively sparse population<br />

and widely spread industry. This has dictated the<br />

structure of Sweden’s domestic logistics operations,<br />

and spurred infrastructure investments to meet the<br />

needs of home-grown multinationals such as Atlas<br />

Copco, Electrolux, Ericsson, IKEA, Saab, Scania,<br />

SKF and Volvo.<br />

• The vacancy situation in logistics property is very<br />

heterogeneous with a divider between prime and<br />

more secondary buildings. In general, very few<br />

projects are built on speculative basis in Sweden,<br />

and consequently, the vacancy of newly built prime<br />

logistics premises in good locations is virtually nonexisting<br />

at the moment.<br />

• Rents on new logistics properties are mainly<br />

determined by the cost of land and construction.<br />

Since there is an adequate supply of available land in<br />

many locations in Sweden, there is never a great<br />

imbalance between the supply and demand, which is<br />

a prerequisite for strong increases in the logistics<br />

rents (Figure 34).<br />

Figure 34<br />

Prime rents in Nordic countries<br />

€ / sq m /<br />

year<br />

150<br />

www.dtz.com 20<br />

125<br />

100<br />

75<br />

50<br />

Source: <strong>DTZ</strong> Research<br />

Copenhagen Helsinki Oslo Stockholm

Occupiers market – Country overview<br />

Central and Eastern Europe<br />

• The CEE markets – namely the Czech Republic,<br />

Hungary, Poland and Romania – are expected to<br />

lead the economic recovery in <strong>2011</strong> and in 2012.<br />

Poland continues to outperform Europe with GDP<br />

growth above 4% per year from <strong>2011</strong> to 2013,<br />

compared to a modest 1.7% pa in the Eurozone.<br />

Although forecasts for <strong>2011</strong> in Romania remain<br />

negative, medium-term forecasts indicate a strong<br />

recovery (Figure 35).<br />

• Once again, the Polish economy outperforms the<br />

Eurozone and the other CEE markets in terms of<br />

consumer spending with a 4% per annum. increase<br />

over the next three years. Still in trouble, Hungary is<br />

expected to post a decline in industrial production<br />

whilst in Romania, acceleration is expected in 2012<br />

and 2013 with a 6% pa growth.<br />

• Positive signals from the industrial production sector<br />

should also be mentioned. In this area, the CEE<br />

appears as the most attractive region, with a 6.2%<br />

increase on average anticipated from <strong>2011</strong> to 2013,<br />

following a 10% rise in 2010.<br />

• A favorable economic context had a positive impact<br />

on prime rents which have now been stable for 6<br />

months (Figure 36). Prime rental values stand<br />

between €42 per sq m in Budapest, €48 per sq m in<br />

Bucharest, €52 per sq m in Prague and €66 per sq m<br />

in Warsaw (Figure 36). These rents are expected to<br />

increase by 2% in Prague in <strong>2011</strong> and then the<br />

growth will spread in 2012 to Poland and Hungary.<br />

Figure 35<br />

GDP growth (%) in selected countries in CEE<br />

www.dtz.com 21<br />

%<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

2007 2008 2009 2010 <strong>2011</strong>F 2012F 2013F<br />

Czech Rep. Hungary Poland<br />

Romania Eurozone<br />

Source: Oxford Economics<br />

Figure 36<br />

Prime rents in CEE<br />

€/ sq m /<br />

year<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

Source: <strong>DTZ</strong> Research<br />

Budapest Prague Warsaw Bucharest

Occupiers market – Country overview<br />

Poland<br />

Strong occupier demand for built-to-suit<br />

schemes<br />

• Poland has been one of the most resilient economies<br />

in Europe during the financial crisis of 2009 and 2010.<br />

Its large domestic base as well as its strong position<br />

in foreign trade has sustained the recovery (4% p.a.<br />

increase in GDP until 2013).<br />

• After its strong performance in 2010 with 1.5 m sq m<br />

let, take-up has kept the same pace with 800,000 sq<br />

m of transactions registered in <strong>H1</strong> <strong>2011</strong>, mostly<br />

during the 2 nd quarter (Figure 37). Market activity is<br />

still dominated by built-to-suit schemes taken by<br />

industrial and logistics companies.<br />

• Greater Warsaw has seen its market share growing<br />

over <strong>H1</strong> <strong>2011</strong> to reach 40% of take-up from 30% in<br />

2010, whilst the Silesia region accounted for another<br />

30%.<br />

• Relatively strong demand translated into a gradual<br />

decline of vacancy rates to 13.5% in <strong>H1</strong> <strong>2011</strong> from<br />

15.3% at the end of 2010. The available modern<br />

logistics stock amounted to approximately 900,000<br />

sq m, which represents a decrease of over 100,000<br />

sq m in comparison with Q4 2010. The fall in vacancy<br />

rates should continue as speculative construction<br />

remains limited with only 100,000 of completions in<br />

<strong>H1</strong> <strong>2011</strong> and only 400,000 sq m anticipated for <strong>2011</strong><br />

in total.<br />

• In <strong>H1</strong> <strong>2011</strong>, prime rents have remained unchanged in<br />

the Warsaw market and stand at €66 per sq m. In the<br />

regional markets, rental values grew slightly to €40-<br />

42 per sq m. Going forward, the positive economic<br />

outlook combined with an ongoing low level of new<br />

supply should support prime rental growth in Warsaw<br />

from 2012 (3% p.a. increase on average until 2014).<br />

Figure 37<br />

Take-up & new supply in Poland<br />

1 800 000<br />

1 600 000<br />

1 400 000<br />

1 200 000<br />

1 000 000<br />

800 000<br />

600 000<br />

400 000<br />

200 000<br />

0<br />

2005 2006 2007 2008 2009 2010 <strong>H1</strong><br />

<strong>2011</strong><br />

www.dtz.com 22<br />

Sq m<br />

Source: <strong>DTZ</strong> Research<br />

Take-up New supply

Occupiers market – Country overview<br />

Czech Republic<br />

Net take-up declines but rental prospects<br />

remains positive<br />

• The Czech Republic performed well in <strong>H1</strong> <strong>2011</strong>, with<br />

gross take-up close to 400,000 sq m, a level in line<br />

with the 800,000 sq m registered in 2010. However a<br />

large part of market activity has been concentrated<br />

on renegotiations and renewals, thus net take-up<br />

reached a modest level of 200,000 sq m (Figure 38).<br />

In light of weaker occupier demand, landlords grant<br />

lower rents in order to retain the occupation of their<br />

buildings on a longer term.<br />

• Apart from this phenomenon, occupiers have<br />

continued to be selective over the quality of their new<br />

buildings showing a limited appeal for the existing<br />

stock. As in other countries across Europe, built-tosuit<br />

schemes are preferred by industrial and logistics<br />

companies for their relocation and expansion.<br />

• The low level of immediately available supply and<br />

longer periods of lease renegotiations on built-to-suit<br />

projects will slow down the level of take up for the<br />

rest of <strong>2011</strong>.<br />

• The vacancy rate has declined significantly, falling to<br />

8.6% at the end of <strong>H1</strong> <strong>2011</strong> from 10.4% at the end of<br />

2010. Vacancy decreased mainly in West Bohemia<br />

and in Moravia-Silesia although only marginally, in<br />

most other submarkets it remained stable. Until the<br />

end of <strong>2011</strong> we expect to see a continuous decline of<br />

the vacancy rate as there is currently only 242,000 sq<br />

m of modern class-A warehouse space under<br />

construction, of which only 31 000 sq m is not preleased.<br />

• Headline rents for modern logistics space have<br />

remained stable at €43-52 per sq m. It is forecast that<br />

prime headline rents will increase towards the yearend<br />

to around €53 per sq m.<br />

Figure 38<br />

Take-up & supply in the Czech Republic<br />

1 200 000<br />

1 000 000<br />

800 000<br />

600 000<br />

400 000<br />

200 000<br />

www.dtz.com 23<br />

Sq m<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

2005 2006 2007 2008 2009 2010 <strong>H1</strong><br />

<strong>2011</strong><br />

Gross take up Supply

Occupiers market – Country overview<br />

Hungary<br />

Renewals the main driver of the market<br />

recovery<br />

• The Hungarian logistics market has registered a<br />

strong performance in <strong>H1</strong> <strong>2011</strong>, as gross take-up<br />

reached a record level of 180,000 sq m. Behind this<br />

figure, the reality of the market shows a high level of<br />

renewals (around 50%) whilst new lettings accounted<br />

for only 30% of this volume (Figure 39).<br />

Requirements for small or medium-sized buildings<br />

are numerous, although some larger deals have also<br />

been registered.<br />

• 2010 has seen companies in the light<br />

industry/assembly sector accounting for 34% of<br />

annual take-up. In <strong>H1</strong> <strong>2011</strong> the logistics sector has<br />

been dominant, accounting for 56% of total<br />

transactions.<br />

• Despite the fact that there were no completions of<br />

vacant buildings in <strong>H1</strong> <strong>2011</strong>, the vacancy rate has<br />

continued to increase to reach 21.8%. Several larger<br />

industrial units and the former Spar distribution<br />

centre (43,000 sq m) have become vacant.<br />

• We don’t expect any major changes to the market in<br />

H2 <strong>2011</strong>, as the consolidation trend of occupiers,<br />

seen since the beginning of the year, will continue.<br />

However the vacancy rate should start to decrease,<br />

as construction activity of speculative schemes is<br />

mainly frozen.<br />

Romania<br />

Still challenging but a little bit better…<br />

• Mainly characterised by medium-sized requirements<br />

(from 3,000 to 5,000 sq m), the Romanian logistics<br />

market has been strong during the first half of the<br />

year with an estimated 150,000 sq m taken up (for<br />

both class A and B facilities), of which 100,000 sq m<br />

was transacted in Bucharest. The largest deals done<br />

over the period were by a local IT distribution<br />

company ASE SOFT in Bucharest on approx. 9,000<br />

sq m of storage logistics space and a 13,000 sq m<br />

built to suit deal signed in Ploiesti, by the American<br />

irrigation company Toro.<br />

Figure 39<br />

Take-up & new supply in Hungary<br />

www.dtz.com 24<br />

Sq m<br />

350 000<br />

300 000<br />

250 000<br />

200 000<br />

150 000<br />

100 000<br />

50 000<br />

0<br />

Source: <strong>DTZ</strong> Research<br />

Take-up New supply<br />

• However, the second part of the year should follow a<br />

similar trend with industrial companies searching for<br />

premises between 5,000 and 10,000 sq m in<br />

Bucharest and other secondary cities.<br />

• Amongst developers and investors active in Romania,<br />

cautiousness is still required and a return of<br />

speculative projects is not expected until 2012/2013.

Occupiers market – Country overview<br />

Ukraine<br />

New building development is still frozen<br />

• While GDP growth could still be close to 5% this year,<br />

downside risks are growing as the main export<br />

markets slow and gas import prices continue to rise.<br />

The mixed picture of the Ukrainian economy explains<br />

the wait-and-see attitude of investors and developers.<br />

• Construction activity is still frozen but the return to a<br />

stronger market will require a firmer recovery in<br />

demand. Meanwhile occupiers seeking space<br />

remain cautious, therefore current levels of<br />

occupancy, despite lack of new development, will<br />

remain generally stable throughout <strong>2011</strong>.<br />

• Prime warehouse rents vary between €47 per sq m<br />

and €57 per sq m, depending on quality. Although<br />

there has been a change in the demand/supply<br />

balance, current forecasts are for rents to remain<br />

generally unchanged in the short term.<br />

Russia<br />

Strong demand in Moscow<br />

• The logistics market in Russia is structured around<br />

the international corridors and roads (M10 /<br />

Leningradskoe in the North West, M3 / Kievskoe, in<br />

South West, MA and M2 in the South). Moscow and<br />

its suburbs are the main market in Russia. Land<br />

around the city of Moscow is currently the most<br />

attractive region in the country for the logistics sector<br />

due to the availability of land and the proximity of the<br />

national and international corridors to Southern<br />

Russia, Ukraine and the Black Sea ports.<br />

• The logistics stock in Moscow is estimated at 6.3<br />

million of sq m, including 3.5 million of Grade A<br />

space. After its peak in 2009, the vacancy rate has<br />

declined rapidly to 10% in 2010 and only 3% of<br />

vacancy is expected at the end of <strong>2011</strong>. New supply<br />

is still limited while the demand of retailers and<br />

manufacturing companies has remained dynamic.<br />

• In this context, prime rents have increased since<br />

2010 to reach $120-135 per sq m per annum in<br />

Moscow and $150-160 inside the city.<br />

Figure 40<br />

<strong>Logistics</strong> rents in Moscow<br />

US $<br />

per sq m<br />

www.dtz.com 25<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

Source: <strong>DTZ</strong> IMS Research<br />

2006 2007 2008 2009 2010 <strong>2011</strong>F<br />

Grade A Grade B

Occupiers market – Country overview<br />

Middle East - Dubai<br />

Limited market activity in <strong>H1</strong> <strong>2011</strong><br />

• In terms of scale, Dubai dominates the logistics<br />

sector in the UAE and is likely to do so for the<br />

foreseeable future. This is primarily because the<br />

major infrastructure is already in place and Dubai is<br />

seen as a regional hub over and above servicing the<br />

domestic market. This situation is illustrated by the<br />

fact that the majority of the logistics operators (parcel<br />

couriers and 3PLs) use Dubai as their regional hub.<br />

• There is approximately 2 m sq m of “good quality”<br />

logistics warehouse stock in Dubai. There is a<br />

significant amount of lesser quality stock on the<br />

market located throughout the established industrial<br />

areas; however it is difficult to confirm the total stock<br />

figure for this type of product. The majority of good<br />

quality stock is within Jebel Ali Free Zone (JAFZA)<br />

with a substantial proportion in the Dubai Airport Free<br />

Zone (DAFZA) and Dubai Investment Park. This<br />

trend is expected to continue as JAFZA and the<br />

newer industrial areas within southern Dubai are<br />

likely to become the dominant warehouse locations in<br />

the medium term with the opening of the new Al<br />

Maktoum airport and the existing interface with the<br />

Jebel Ali port.<br />

• Rents in Dubai have been subject to downward<br />

pressure since late 2008 with this trend set to<br />

continue for poorer quality accommodation in<br />

secondary locations. However, signs of stability have<br />

been witnessed in recent months with logistical<br />

fundamentals prevalent in the Emirate providing<br />

stability for better quality and well located stock.<br />

• Limited rental activity for larger industrial complexes<br />

within the Ras Al Khor area has been noticed in <strong>H1</strong><br />

<strong>2011</strong>. We are aware of the letting of a brand new<br />

industrial facility of 14,000 sq m including 929 sq m of<br />

office accommodation situated in Ras Al Khor 1 for<br />

AED 3,250,000 pa net plus 15% tax. The rental<br />

transaction reflects a rent of AED 237 per sq m over<br />

total building area and a good indication of high<br />

quality, larger complex industrial rental rates within<br />

the surrounding area (Figure 41).<br />

Figure 41<br />

Prime rents in Dubai<br />

AED<br />

per sq m<br />

Umm Ramool<br />

DAFZA<br />

Al Qusais<br />

Al Quoz<br />

DIP<br />

Jebel Ali<br />

Ras Al Khor<br />

DIC<br />

Dubai Silicon Oasis<br />

JAFZA<br />

DLC<br />

Source: <strong>DTZ</strong> Research<br />

0 200 400 600 800 1000 1200<br />

www.dtz.com 26

www.dtz.com 27

Definitions<br />

Availability: Marketed space (usually available to move into within 6 months) that may or may<br />

not be vacant.<br />

Availability ratio: Industrial space currently available as a percentage of stock.<br />

Newly available: Floor space placed on the open market including both developments within six<br />

months of completion and units of second-hand space.<br />

Stock: The latest commercial industrial floor space statistics (warehouses).<br />

Building grade: Grade A: newly developed or comprehensively refurbished to new standard,<br />

including sublet space in new/refurbished buildings not previously occupied<br />

Grade B: buildings of good specification, floor plate efficiency and image usually<br />

but not exclusively ten years old or less<br />

Grade C: remaining poorer quality stock<br />

Speculative development: A newly developed or comprehensively refurbished building undertaken without<br />

the benefit of a secured tenant.<br />

Development start: A development in which work has started on the main contract. This usually<br />

excludes demolition and site clearance contracts.<br />

Development completion: A development in which the main contract has been completed, whether this be<br />

to shell and core or developer's finish.<br />