Notice of Annual General Meeting - Company Announcements ...

Notice of Annual General Meeting - Company Announcements ...

Notice of Annual General Meeting - Company Announcements ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

HWANG-DBS (MALAYSIA) BERHAD (238969-K)<br />

12 <strong>Annual</strong> Report 2009<br />

Chairman’s Statement (cont’d)<br />

During the financial year under review, HDBSIM continued<br />

to bring new funds to complement the existing line-up <strong>of</strong><br />

funds, bringing it to a total <strong>of</strong> 38 funds. This represents an<br />

increase <strong>of</strong> 11 funds over the course <strong>of</strong> 12 months.<br />

FINANCIAL PERFORMANCE<br />

In view <strong>of</strong> the financial markets volatility and unfavorable capital market conditions during the financial year under review, the operating revenue <strong>of</strong> the<br />

Group for FY2009 decreased by 15% to RM295.80 million against RM348.59 million recorded in the previous financial year. HDBSIB continues to be the key<br />

revenue contributor to the Group, accounting for 69% (2008: 75%) <strong>of</strong> the Group’s revenue.<br />

The pretax pr<strong>of</strong>it <strong>of</strong> the Group for FY2009 is 18% lower at RM45.52 million compared to RM55.56 million achieved in the preceding financial year. The<br />

lower pr<strong>of</strong>itability is mainly attributed to lower brokerage generated by the stockbroking division in line with lower Bursa Securities value traded during the<br />

financial year under review. The Group’s pre-tax pr<strong>of</strong>it is further diluted by lower unit trust management and initial service fees, net losses on derivatives<br />

trading and net unrealised losses arising from marked-to-market valuation <strong>of</strong> derivatives. These were, however, cushioned by higher net interest income<br />

from treasury and consumer financing activities, unrealised gain on marked-to-market valuation <strong>of</strong> private debt securities and lower other operating<br />

expenses.<br />

The Group recorded a lower pr<strong>of</strong>it after tax <strong>of</strong> RM34.36 million (2008: RM40.84 million) and lower earnings per share <strong>of</strong> 12.26 sen per share (2008: 14.23<br />

sen per share) in line with reduction in pr<strong>of</strong>itability in the financial year under review. The Group’s balance sheet remains healthy with shareholders’ funds<br />

increasing to RM770.76 million (2008: RM746.33 million) as at 31 July 2009.<br />

DIVIDEND<br />

The Board is pleased to recommend a first and final dividend <strong>of</strong> 5 sen less tax at 25% for approval by the shareholders at the forthcoming <strong>Annual</strong> <strong>General</strong><br />

<strong>Meeting</strong> <strong>of</strong> the <strong>Company</strong> (2008 : 10 sen).<br />

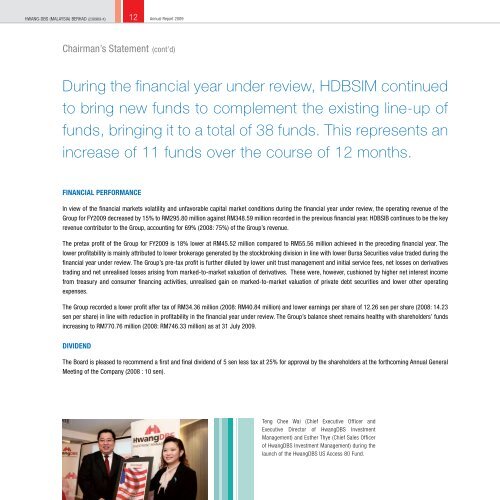

Teng Chee Wai (Chief Executive Officer and<br />

Executive Director <strong>of</strong> HwangDBS Investment<br />

Management) and Esther Thye (Chief Sales Officer<br />

<strong>of</strong> HwangDBS Investment Management) during the<br />

launch <strong>of</strong> the HwangDBS US Access 80 Fund.