O TTO M ARINE L IMITED - Microsoft Internet Explorer - SGX

O TTO M ARINE L IMITED - Microsoft Internet Explorer - SGX

O TTO M ARINE L IMITED - Microsoft Internet Explorer - SGX

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

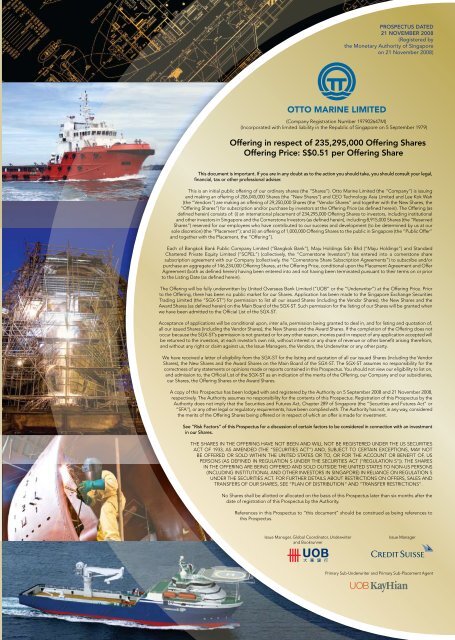

O<strong>TTO</strong> M<strong>ARINE</strong> L<strong>IMITED</strong><br />

PROSPECTUS DATED<br />

21 NOVEMBER 2008<br />

(Registered by<br />

the Monetary Authority of Singapore<br />

on 21 November 2008)<br />

(Company Registration Number 197902647M)<br />

(Incorporated with limited liability in the Republic of Singapore on 5 September 1979)<br />

Offering in respect of 235,295,000 Offering Shares<br />

Offering Price: S$0.51 per Offering Share<br />

This document is important. If you are in any doubt as to the action you should take, you should consult your legal,<br />

financial, tax or other professional adviser.<br />

This is an initial public offering of our ordinary shares (the “Shares”). Otto Marine Limited (the “Company”) is issuing<br />

and making an offering of 206,045,000 Shares (the “New Shares”) and CEO Technology Asia Limited and Lee Kok Wah<br />

(the “Vendors”) are making an offering of 29,250,000 Shares (the “Vendor Shares” and together with the New Shares, the<br />

“Offering Shares”) for subscription and/or purchase by investors at the Offering Price (as defined herein). The Offering (as<br />

defined herein) consists of: (i) an international placement of 234,295,000 Offering Shares to investors, including institutional<br />

and other investors in Singapore and the Cornerstone Investors (as defined herein), including 8,915,000 Shares (the “Reserved<br />

Shares”) reserved for our employees who have contributed to our success and development (to be determined by us at our<br />

sole discretion) (the “Placement”); and (ii) an offering of 1,000,000 Offering Shares to the public in Singapore (the “Public Offer”<br />

and together with the Placement, the “Offering”).<br />

Each of Bangkok Bank Public Company Limited (“Bangkok Bank”), Maju Holdings Sdn Bhd (“Maju Holdings”) and Standard<br />

Chartered Private Equity Limited (“SCPEL”) (collectively, the “Cornerstone Investors”) has entered into a cornerstone share<br />

subscription agreement with our Company (collectively, the “Cornerstone Share Subscription Agreements”) to subscribe and/or<br />

purchase an aggregate of 146,234,000 Offering Shares, at the Offering Price, conditional upon the Placement Agreement and Offer<br />

Agreement (both as defined herein) having been entered into and not having been terminated pursuant to their terms on or prior<br />

to the Listing Date (as defined herein).<br />

The Offering will be fully underwritten by United Overseas Bank Limited (“UOB” or the “Underwriter”) at the Offering Price. Prior<br />

to the Offering, there has been no public market for our Shares. Application has been made to the Singapore Exchange Securities<br />

Trading Limited (the “<strong>SGX</strong>-ST”) for permission to list all our issued Shares (including the Vendor Shares), the New Shares and the<br />

Award Shares (as defined herein) on the Main Board of the <strong>SGX</strong>-ST. Such permission for the listing of our Shares will be granted when<br />

we have been admitted to the Official List of the <strong>SGX</strong>-ST.<br />

Acceptance of applications will be conditional upon, inter alia, permission being granted to deal in, and for listing and quotation of,<br />

all our issued Shares (including the Vendor Shares), the New Shares and the Award Shares. If the completion of the Offering does not<br />

occur because the <strong>SGX</strong>-ST’s permission is not granted or for any other reason, monies paid in respect of any application accepted will<br />

be returned to the investors, at each investor’s own risk, without interest or any share of revenue or other benefit arising therefrom,<br />

and without any right or claim against us, the Issue Managers, the Vendors, the Underwriter or any other party.<br />

We have received a letter of eligibility from the <strong>SGX</strong>-ST for the listing and quotation of all our issued Shares (including the Vendor<br />

Shares), the New Shares and the Award Shares on the Main Board of the <strong>SGX</strong>-ST. The <strong>SGX</strong>-ST assumes no responsibility for the<br />

correctness of any statements or opinions made or reports contained in this Prospectus. You should not view our eligibility to list on,<br />

and admission to, the Official List of the <strong>SGX</strong>-ST as an indication of the merits of the Offering, our Company and our subsidiaries,<br />

our Shares, the Offering Shares or the Award Shares.<br />

A copy of this Prospectus has been lodged with and registered by the Authority on 5 September 2008 and 21 November 2008,<br />

respectively. The Authority assumes no responsibility for the contents of this Prospectus. Registration of this Prospectus by the<br />

Authority does not imply that the Securities and Futures Act, Chapter 289 of Singapore (the “Securities and Futures Act” or<br />

“SFA”), or any other legal or regulatory requirements, have been complied with. The Authority has not, in any way, considered<br />

the merits of the Offering Shares being offered or in respect of which an offer is made for investment.<br />

See “Risk Factors” of this Prospectus for a discussion of certain factors to be considered in connection with an investment<br />

in our Shares.<br />

THE SHARES IN THE OFFERING HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE US SECURITIES<br />

ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) AND, SUBJECT TO CERTAIN EXCEPTIONS, MAY NOT<br />

BE OFFERED OR SOLD WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, US<br />

PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT (“REGULATION S”)). THE SHARES<br />

IN THE OFFERING ARE BEING OFFERED AND SOLD OUTSIDE THE UNITED STATES TO NON-US PERSONS<br />

(INCLUDING INSTITUTIONAL AND OTHER INVESTORS IN SINGAPORE) IN RELIANCE ON REGULATION S<br />

UNDER THE SECURITIES ACT. FOR FURTHER DETAILS ABOUT RESTRICTIONS ON OFFERS, SALES AND<br />

TRANSFERS OF OUR SHARES, SEE “PLAN OF DISTRIBUTION” AND “TRANSFER RESTRICTIONS”.<br />

No Shares shall be allotted or allocated on the basis of this Prospectus later than six months after the<br />

date of registration of this Prospectus by the Authority.<br />

References in this Prospectus to “this document” should be construed as being references to<br />

this Prospectus.<br />

Issue Manager, Global Coordinator, Underwriter<br />

and Bookrunner<br />

Issue Manager<br />

Primary Sub-Underwriter and Primary Sub-Placement Agent

Otto Marine Limited<br />

We are an offshore marine group engaged in shipbuilding, ship repair and<br />

conversion and ship chartering. Headquartered in Singapore, we own and<br />

operate what we believe is one of the largest shipbuilding yards in Batam,<br />

Indonesia. We have a strategic focus on, and have gained recognition in, the<br />

construction of high-specification offshore support vessels. Our customers<br />

are primarily fleet operators who provide logistics support to offshore services<br />

and equipment companies operating globally in the oil and gas industry.<br />

Our Business Segments<br />

ShiPBUilDiNg ShiP ChARTERiNg ShiP REPAiR<br />

AND CONVERSiON<br />

• Strategic focus on the<br />

construction of high specification<br />

offshore support vessels<br />

• Provide customers with turnkey<br />

solutions<br />

• Capability to build a range<br />

of small, medium and large<br />

offshore support vessels:<br />

> Anchor Handling Tug Supply<br />

(“AHTS”) vessels<br />

> Platform Supply Vessels<br />

(“PSV”)<br />

> Work barges with<br />

accommodation for 300<br />

people<br />

> Work maintenance boats<br />

• Order book of S$937.1 million as<br />

at 8 August 2008<br />

• Selective outsourcing to China<br />

shipyards<br />

• Launched in April 2007<br />

• Largely focused on the<br />

chartering of offshore support<br />

vessels<br />

• Two types of business models:<br />

Own charters<br />

> Current fleet: five tugboats<br />

and five barges<br />

> Nine vessels being built, to<br />

be completed by 2009<br />

Strategic partnerships<br />

> We own minority interests in<br />

the vessels<br />

> One vessel currently in<br />

operation<br />

> Nine vessels under<br />

construction, sold to<br />

strategic partners<br />

> 10 vessels under<br />

construction, intended for<br />

sale to strategic partners<br />

• Our Batam shipyard offers<br />

comprehensive “one stop”<br />

facilities for both ship repair and<br />

conversion works<br />

• Service a wide range of vessels<br />

including offshore support<br />

vessels, ocean-going tugs, car<br />

ferries and general cargo ships

Our Financial Highlights<br />

Over the last three financial years ended 31 December 2007, our revenue grew at a compounded annual growth rate of 139.6%<br />

per annum from S$54.7 million in FY2005 to S$314.0 million in FY2007.<br />

Revenue<br />

S$ million<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

54.7<br />

FY2005<br />

147.3<br />

FY2006<br />

Industry Prospects<br />

The outlook for offshore marine industry is positive driven by the following factors:<br />

• Growing demand for energy and oil products worldwide, resulting in higher activity level in offshore oil exploration,<br />

development and production.<br />

• The exhaustion/maturing of economically viable oil and gas fields has led to the increase of deep sea exploration activities<br />

and the subsequent demand for offshore vessels.<br />

• Offshore oil and gas exploration is taking place in many geographic areas of the world and well over 95.0% of all cargo<br />

going to offshore drilling units and platforms is transported by vessel.<br />

Source: Braemar Seascope Offshore<br />

314.0<br />

FY2007<br />

86.3<br />

5M2007<br />

219.5<br />

5M2008<br />

Profit Attributable to Equity Holders<br />

S$ million<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

3.1<br />

FY2005<br />

20.2<br />

FY2006<br />

41.9<br />

9.0<br />

32.7<br />

FY2007 5M2007 5M2008<br />

Financial year ended 31 December (“FY”)<br />

Five months ended 31 May (“5M”)

Our Strengths<br />

Specialised focus on complex, sophisticated and environment friendly offshore support vessels<br />

• Strategic focus on the construction and engineering of offshore support vessels which comply with technical<br />

specifications required to operate in the North Sea. This focus has been beneficial to us as these vessels have<br />

generally produced higher margins for us than less complex vessels.<br />

• Specialised focus allows us to improve production quality and efficiency and develop a competitive cost structure.<br />

An efficient and strategically located shipyard<br />

• We believe we have one of the largest shipyards in Batam, with approximately 40 hectares of land area and 450 metres<br />

of usable waterfront.<br />

• Strategically located shipyard allows for easy access to Singapore’s marine and offshore support and expertise, and<br />

Indonesia’s ready supply of workers.<br />

• Shipyard equipped with Syncrolift® which enables completion of construction and repair of vessels in greater numbers<br />

within a shorter timeframe thus increasing productivity and economies of scale.<br />

Strong engineering and technical capabilities and turnkey approach<br />

• Turnkey approach enables provision of value-added customised solutions that command higher margins.<br />

• Ability to deliver turnkey solutions due to established relationships with suppliers and strong engineering and<br />

technical capabilities.<br />

• In-house capability in operation of TRIBON® software allows for a more efficient shipbuilding process through the<br />

development of a precise virtual model of vessels for review and testing prior to production thereby minimising<br />

errors.<br />

Experienced management team<br />

• Key executive officers with operating functions have in-depth experience in the offshore marine industry, with an<br />

average of 34 years of experience.<br />

• Management has developed strong relationships with our customers, designers and suppliers.<br />

• Reputation for quality service and high operational standards.

Our Strategies<br />

We intend to consolidate our current market position by<br />

capitalising on opportunities in the global marine and<br />

offshore industry and to enhance our competitiveness.<br />

Key elements of our business strategy include:<br />

Diversify sources of income by expanding ship chartering<br />

• Expanding ship chartering business that we expect will provide<br />

us with a long-term stable source of income.<br />

• Building nine vessels to be completed by 2009 for our own<br />

charter fleet.<br />

• Building 10 vessels, to be completed by 2010, for sale to<br />

strategic partners.<br />

• Reallocate our resources and capacity to increase our<br />

ship repair and conversion business in the event of a<br />

slowdown in the shipbuilding business.<br />

Upgrading technology and processes<br />

• Continuously upgrade technical capabilities in order<br />

to strengthen overall competitiveness, shorten the<br />

vessel delivery period and minimise project costs.<br />

• Invest further in advanced equipment and<br />

technology to enhance processes and improve<br />

efficiency and productivity through better project<br />

management control.<br />

Increasing capacity<br />

• Progressively increase shipyard capacity to take<br />

on more and larger projects and to carry out the<br />

projects already recorded in our expanding order<br />

book.<br />

• Expand the usable waterfront of Batam shipyard from<br />

450 metres to approximately 800 metres and extend<br />

our Syncrolift® berthside by 32 metres x 245 metres,<br />

among other upgrades to our Batam shipyard facilities<br />

by end FY2009.<br />

• Pending relevant approvals and our evalution of<br />

commercial viability of building a shipyard in China, we<br />

may build a shipyard in China.<br />

Strengthening engineering and middle-level management teams<br />

• Recruiting, developing and retaining talent through aggressive<br />

recruiting policy, training programmes and mentoring schemes,<br />

as well as competitive compensation packages and career<br />

opportunities.<br />

Enhancing competitive cost structure through selective outsourcing<br />

• Increase capacity and maintain competitive cost structure by outsourcing<br />

certain shipbuilding work to regional shipyards.<br />

• Deploy our personnel to monitor the construction to ensure adherence to<br />

stringent quality controls and procedures.<br />

• Allows our Batam shipyard to focus on more complex and sophisticated vessels.

Use of Proceeds<br />

Based on the Offering Price of S$0.51 for each Offering Share, our net proceeds from the Offering are estimated to be<br />

approximately S$97.7 million.<br />

Use of net proceeds:<br />

• S$43.4 million for funding of strategic investments;<br />

• S$27.2 million for funding of the expansion of our fleet of vessels for charter;<br />

• S$23.1 million for capital expenditure related to the development of our yard, infrastructure facilities and equipment; and<br />

• S$4.0 million the balance for general working capital requirements.<br />

Indicative IPO Timetable<br />

Date and Time Event<br />

22 November 2008 at 9.00 a.m. Opening date and time for the Public Offer<br />

26 November 2008 at 12.00 noon Closing date and time for the Application List<br />

28 November 2008 at 9.00 a.m. Commence trading on a “ready” basis<br />

Applications for the Shares in the Public Offer may be made through:<br />

• ATMs of DBS Bank (including POSB), OCBC and UOB Group;<br />

• internet banking websites of DBS Bank and UOB Group; or<br />

• printed application forms which form part of the Prospectus.

NOTICE TO INVESTORS. .................. ii<br />

CORPORATE INFORMATION ................ v<br />

SUMMARY ........................... 1<br />

RISK FACTORS ........................ 12<br />

USE OF PROCEEDS ..................... 30<br />

DIVIDEND POLICY. ..................... 32<br />

EXCHANGE RATES AND EXCHANGE CONTROLS ... 33<br />

CAPITALISATION AND INDEBTEDNESS. ......... 35<br />

DILUTION ........................... 36<br />

SELECTED CONSOLIDATED FINANCIAL<br />

INFORMATION ....................... 38<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS OF<br />

FINANCIAL CONDITION AND RESULTS OF<br />

OPERATIONS ........................ 41<br />

INDUSTRY OVERVIEW. ................... 73<br />

OUR RESTRUCTURING AND CORPORATE<br />

STRUCTURE ........................ 94<br />

OUR BUSINESS ........................ 100<br />

DIRECTORS AND SENIOR MANAGEMENT ....... 127<br />

SHARE AWARD SCHEME .................. 137<br />

SUBSTANTIAL SHAREHOLDERS AND VENDORS .... 143<br />

INTERESTED PERSON TRANSACTIONS AND<br />

CONFLICTS OF INTERESTS ............... 150<br />

DESCRIPTION OF SHARE CAPITAL. ........... 170<br />

DESCRIPTION OF OUR SHARES ............. 173<br />

TAXATION ........................... 177<br />

PLAN OF DISTRIBUTION .................. 179<br />

TRANSFER RESTRICTIONS ................. 187<br />

TABLE OF CONTENTS<br />

i<br />

CLEARANCE AND SETTLEMENT ............. 188<br />

LEGAL MATTERS ...................... 189<br />

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS. . 190<br />

GENERAL AND STATUTORY INFORMATION ...... 191<br />

DEFINITIONS ......................... 203<br />

GLOSSARY OF TECHNICAL TERMS ........... 211<br />

APPENDIX 1—INDEPENDENT AUDITORS’ REPORT<br />

AND THE CONSOLIDATED FINANCIAL<br />

STATEMENTS FOR THE YEARS ENDED<br />

DECEMBER 31, 2005, DECEMBER 31, 2006<br />

AND DECEMBER 31,2007.............. A1-1<br />

APPENDIX 2—INDEPENDENT AUDITORS’<br />

REVIEW REPORT AND THE CONDENSED<br />

CONSOLIDATED FINANCIAL STATEMENTS FOR<br />

THE FIVE MONTHS ENDED MAY 31, 2008 . . . A2-1<br />

APPENDIX 3—SUMMARY OF OUR<br />

MEMORANDUM AND ARTICLES OF<br />

ASSOCIATION ....................... A3-1<br />

APPENDIX 4—SUMMARY OF THE RELEVANT<br />

LAWS AND REGULATIONS APPLICABLE TO<br />

US .............................. A4-1<br />

APPENDIX 5—RULES OF THE O<strong>TTO</strong> M<strong>ARINE</strong><br />

SHARE AWARD SCHEME ................ A5-1<br />

APPENDIX 6—LETTER FROM INDEPENDENT<br />

FINANCIAL ADVISER TO THE INDEPENDENT<br />

DIRECTORS ........................ A6-1<br />

APPENDIX 7—TERMS, CONDITIONS AND<br />

PROCEDURES FOR APPLICATION AND<br />

ACCEPTANCE ....................... A7-1

NOTICE TO INVESTORS<br />

You should rely only on the information contained in this document or to which we have referred<br />

you. We have not authorised anyone to provide you with information that is different. This document<br />

may only be used where it is legal to sell our Shares. The information in this document may only be<br />

accurate on the date of this document.<br />

No person is authorised to give any information or to make any representation not contained in this<br />

document and any information or representation not so contained must not be relied upon as having been<br />

authorised by or on behalf of us, the Vendors, the Issue Managers or the Underwriter. Neither the delivery of<br />

this document nor any offer, sale or transfer made hereunder shall under any circumstances imply that the<br />

information herein is correct as at any date subsequent to the date hereof or constitute a representation that<br />

there has been no change or development reasonably likely to involve a material adverse change in our or the<br />

Vendors’ affairs, conditions and prospects or our Shares since the date hereof. Where such changes occur and<br />

are material or required to be disclosed by law, the <strong>SGX</strong>-ST and/or any other regulatory or supervisory body<br />

or agency, we and/or the Vendors will make an announcement of the same to the <strong>SGX</strong>-ST and, if required,<br />

issue and lodge an amendment to this document or a supplementary document or replacement document<br />

pursuant to Section 240 or, as the case may be, Section 241 of the Securities and Futures Act and take<br />

immediate steps to comply with the said sections. Investors should take notice of such announcements and<br />

documents and, upon release of such announcements or documents, shall be deemed to have notice of such<br />

changes. No representation, warranty or covenant, express or implied, is made by us, the Vendors, the Issue<br />

Managers or the Underwriter or any of our or their respective affiliates, directors, officers, employees, agents,<br />

representatives or advisers as to the accuracy or completeness of the information contained herein, and nothing<br />

contained in this document is, or shall be relied upon as, a promise, representation or covenant by us, the<br />

Vendors, the Issue Managers or the Underwriter or their affiliates, directors, officers, employees, agents,<br />

representatives or advisers.<br />

None of us, the Vendors, the Issue Managers or the Underwriter nor any of our or their respective<br />

affiliates, directors, officers, employees, agents, representatives or advisers are making any representation or<br />

undertaking to any investors in our Shares regarding the legality of an investment by such investor under<br />

relevant securities, investment or similar laws. The Issue Managers and the Underwriter have not independently<br />

verified the information contained in this document and no representation or warranty is made as to its<br />

accuracy. The information should not be assumed to have been updated at any time after the date shown on<br />

the cover of this document. In addition, investors in our Shares should not construe the contents of this<br />

document as legal, business, financial or tax advice. Investors should be aware that they may be required to<br />

bear the financial risks of an investment in our Shares for an indefinite period of time. Investors should consult<br />

their own professional advisers as to the legal, tax, business, financial and related aspects of an investment in<br />

our Shares.<br />

The distribution of this document and the offering, purchase, sale or transfer of our Shares in certain<br />

jurisdictions may be restricted by law. We, the Vendors, the Issue Managers and the Underwriter require<br />

persons into whose possession this document comes to inform themselves about and to observe any such<br />

restrictions at their own expense and without liability to us, the Vendors, the Issue Managers or the<br />

Underwriter. This document does not constitute an offer of, or an invitation to purchase, any of our Shares in<br />

any jurisdiction in which such offer or invitation would be unlawful. Persons to whom a copy of this document<br />

has been issued shall not circulate to any other person, reproduce or otherwise distribute this document or any<br />

information herein for any purpose whatsoever nor permit or cause the same to occur.<br />

USE OF CERTAIN TERMS<br />

In this document, all references to our “Company” are to Otto Marine Limited, without its consolidated<br />

subsidiaries and associated companies. The terms “Group”, “we”, “us”, “our” and “our Group” refer to Otto<br />

Marine Limited, its consolidated subsidiaries and its associated companies. Unless the context otherwise<br />

requires, references to “Management” are to the directors and executive officers and senior management team<br />

of Otto Marine Limited as at the date of this document, and statements in this document as to beliefs,<br />

expectations, estimates and opinions of Otto Marine Limited are those of the Management.<br />

As used in this document, all references to “Indonesia” are references to the Republic of Indonesia, and<br />

all references to “Singapore” are references to the Republic of Singapore. As used in this document, all<br />

references to “Rupiah”, “IDR” and “Rp” are to Indonesian Rupiah, the lawful currency of Indonesia, all<br />

references to “US$”, “USD” and “US Dollars” are to the lawful currency of the United States of America, and<br />

all references to “S$”, “SGD” and “Singapore Dollars” are to the lawful currency of Singapore.<br />

ii

All references to the “Latest Practicable Date” are to 22 August 2008, being the Latest Practicable Date<br />

prior to the lodgement of this document with the Authority. The term “Period Under Review” refers to the the<br />

last three financial years ended 31 December 2007 and the period from 1 January 2008 to the Latest<br />

Practicable Date.<br />

The terms “Depositor”, “Depository Agent” and “Depository Register” shall have the same meanings<br />

ascribed to them, respectively, in Section 130A of the Companies Act, Chapter 50 of Singapore (the “Act”).<br />

Any reference to a time of day in this document refers to Singapore time unless otherwise stated.<br />

Words importing the singular shall, where applicable, include the plural and vice versa. Words importing<br />

the masculine gender shall, where applicable, include the feminine and neuter genders and vice versa.<br />

References to persons shall, where applicable, include corporations.<br />

PRESENTATION OF FINANCIAL AND OTHER DATA<br />

Financial Data<br />

Our consolidated financial statements presented in this document are prepared and presented in<br />

accordance with financial reporting standards in Singapore (“SFRS”).<br />

We maintain our accounts in Singapore Dollars. Solely for the convenience of the reader, certain<br />

Singapore Dollar amounts presented in this document have been translated into US Dollars at specified rates.<br />

Unless otherwise indicated, US Dollar equivalent information for amounts in Singapore Dollars is based on<br />

the Noon Buying Rate in New York as at 31 May 2008, which was S$1.36 to US$1.00. No representation is<br />

made that the US Dollar or Singapore Dollar amounts shown herein could have been or could be converted<br />

into US Dollars or Singapore Dollars, as the case may be, at any particular rate or at all. See “Exchange Rates<br />

and Exchange Controls”.<br />

Any discrepancies in the tables included herein between the listed amounts and the totals thereof are due<br />

to rounding; accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the<br />

figures that precede them.<br />

Non-GAAP Financial Measures<br />

EBITDA refers to income (loss) from operations before interest, taxation, depreciation and amortisation.<br />

EBITDA and related ratios presented in this document are supplemental measures of our performance and<br />

liquidity that are not required by, or presented in accordance with, SFRS, International Financial Reporting<br />

Standards (“IFRS”). Further, EBITDA is not a measurement of our financial performance or liquidity under<br />

SFRS or IFRS and should not be considered as an alternative to net income, operating income or any other<br />

performance measures derived in accordance with SFRS or IFRS or as an alternative to cash flow from<br />

operations or as a measure of our liquidity.<br />

We believe EBITDA facilitates operating performance comparisons from period to period and from<br />

company to company by eliminating potential differences caused by variations in capital structures (affecting<br />

interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates<br />

or net operating losses) and the age and book depreciation of tangible assets (affecting relative depreciation<br />

expense). In particular, EBITDA eliminates non-cash depreciation expense that arises from the capital-intensive<br />

nature of our business. We also believe that EBITDA is a supplemental measure of our ability to meet debt<br />

service requirements. Finally, we present EBITDA and related ratios because we believe these measures are<br />

frequently used by securities analysts and investors in evaluating similar issuers.<br />

Industry Data<br />

Industry data and certain other information used throughout this document were obtained from the<br />

Braemar Seascope Limited report set out in the section “Industry Overview” of this document, internal<br />

surveys, market research, publicly available information, government data and industry publications. Industry<br />

publications generally state that the information that they contain has been obtained from sources believed to<br />

be reliable but that the accuracy and completeness of that information is not guaranteed. Similarly, internal<br />

surveys and market research, while believed to be reliable, have not been independently verified, and none of<br />

us, the Vendors, the Issue Managers or the Underwriter make any representation as to the accuracy or<br />

completeness of this information.<br />

iii

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS<br />

All statements contained in this document, statements made in press releases and oral statements that may<br />

be made by us or our Directors, Executive Officers or employees acting on our behalf that are not statements<br />

of historical fact constitute “forward-looking statements”. Some of these statements can be identified by<br />

forward-looking terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “if”, “intend”, “may”,<br />

“plan”, “possible”, “probable”, “project”, “should”, “will” and “would” or similar words. However, these<br />

words are not the exclusive means of identifying forward-looking statements. All statements regarding our<br />

expected financial position, business strategies, plans and prospects and the future prospects of our industry<br />

are also forward-looking statements. These forward-looking statements, including but not limited to statements<br />

as to our revenue and profitability, prospects, future plans, other expected industry trends and other matters<br />

discussed in this document regarding matters that are not historic facts, are only predictions.<br />

These forward-looking statements involve known and unknown risks, uncertainties and other factors that<br />

may cause our actual future results, performance or achievements to be materially different from any future<br />

results, performance or achievements expected, expressed or implied by such forward-looking statements.<br />

These factors include, amongst others, global economic conditions, political and regulatory conditions,<br />

currency exchange fluctuations, adverse conditions in the oil and gas and offshore marine industry, changes in<br />

the political, social and economic conditions and regulatory environment in Singapore, Indonesia, China and<br />

other countries where we may conduct our business, changes in competitive conditions and other factors<br />

beyond our control. Some of these factors are discussed in more detail in “Management’s Discussion and<br />

Analysis of Financial Condition and Results of Operations” and “Risk Factors”.<br />

All forward-looking statements made by or attributable to us or persons acting on our behalf, contained in<br />

this document are expressly qualified in their entirety by such factors. Given the risks and uncertainties that<br />

may cause our actual future results, performance or achievements to be materially different from that expected,<br />

expressed or implied by the forward-looking statements in this document, undue reliance must not be placed<br />

on these statements. Our actual results may differ materially from those anticipated in these forward-looking<br />

statements.<br />

Neither we, the Vendors, the Issue Managers, the Underwriter, their respective advisers nor any other<br />

person represents or warrants that our actual future results, performance or achievements will be as discussed<br />

in these forward-looking statements.<br />

These forward-looking statements speak only as at the date of this document. Further, we, the Vendors,<br />

the Issue Managers and the Underwriter disclaim any responsibility to update any of these forward-looking<br />

statements or publicly announce any revisions to these forward-looking statements to reflect future developments,<br />

events or circumstances, even if new information becomes available or other events occur in the future.<br />

We are, however, subject to the provisions of the Securities and Futures Act and the Listing Manual regarding<br />

corporate disclosure. In particular, pursuant to Section 241 of the Securities and Futures Act, if, after this<br />

document is registered but before the close of this Offering, we become aware of: (i) a false or misleading<br />

statement or matter in this document; (ii) an omission from this document of any information that should have<br />

been included in it under Section 243 of the Securities and Futures Act; or (iii) a new circumstance that has<br />

arisen since this document was lodged with the Authority and would have been required by Section 243 of the<br />

Securities and Futures Act to be included in this document, if it had arisen before this document was lodged<br />

and that is materially adverse from the point of view of an investor, we may lodge a supplementary or<br />

replacement prospectus with the Authority.<br />

iv

CORPORATE INFORMATION<br />

Board of Directors ................ YawChee Siew (Executive Chairman)<br />

Lee Kok Wah (Group Managing Director)<br />

William Edward Alastair Morrison (Non-executive Director)<br />

Craig Foster Pickett (Non-executive Director)<br />

Reggie Thein (Independent Director)<br />

Ng Chee Keong (Independent Director)<br />

Joint Company Secretaries ......... LoKimSeng, LLB (Hons)<br />

See Kian Heng, CPA<br />

Registered Office and Principal Place<br />

of Business ...................... 9Temasek Boulevard<br />

#33-01 Suntec Tower Two<br />

Singapore 038989<br />

Company Registration Number ...... 197902647M<br />

Vendors ........................ LeeKokWah<br />

22 Ramsgate Road<br />

Singapore 437468<br />

CEO Technology Asia Limited<br />

OMC Chambers<br />

P.O. Box 3152<br />

Road Town, Tortola<br />

British Virgin Islands<br />

Share Registrar and Share Transfer<br />

Agent .......................... M&CServices Private Limited<br />

138 Robinson Road<br />

#17-00 The Corporate Office<br />

Singapore 068906<br />

Global Coordinator, Underwriter and<br />

Bookrunner ..................... United Overseas Bank Limited<br />

80 Raffles Place<br />

UOB Plaza<br />

Singapore 048624<br />

Issue Managers .................. United Overseas Bank Limited<br />

80 Raffles Place<br />

UOB Plaza<br />

Singapore 048624<br />

Credit Suisse (Singapore) Limited<br />

1 Raffles Link #03/#04-01<br />

South Lobby<br />

Singapore 039393<br />

Primary Sub-Underwriter and<br />

Primary Sub-Placement Agent ...... UOBKayHian Private Limited<br />

80 Raffles Place<br />

#30-01 UOB Plaza 1<br />

Singapore 048624<br />

Independent Auditors and Reporting<br />

Accountants ..................... Deloitte & Touche LLP<br />

6 Shenton Way<br />

#32-00 DBS Building Tower 2<br />

Singapore 068809<br />

Partner-in-charge: Ng Peck Hoon<br />

(a member of the Institute of Certified Public Accountants of<br />

Singapore)<br />

v

Legal Advisers to our Company as to<br />

Singapore law ................... Arfat Selvam Alliance LLC<br />

55 Market Street<br />

#08-01<br />

Singapore 048941<br />

Legal Advisers to the Issue Managers,<br />

Global Coordinator, Underwriter and<br />

Bookrunner as to Singapore law ..... TSMPLawCorporation<br />

6 Battery Road<br />

#33-01<br />

Singapore 049909<br />

Legal Advisers to the Issue Managers,<br />

Global Coordinator, Underwriter and<br />

Bookrunner as to New York and US<br />

federal securities law .............. Clifford Chance Wong Pte Ltd<br />

One George Street<br />

19th Floor<br />

Singapore 049145<br />

Legal Advisers to our Company as to<br />

Indonesian law. .................. Adnan Kelana Haryanto and Hermanto<br />

Chase Plaza, 18th Floor<br />

Jl. Jendral Sudirman Kav. 21<br />

Jakarta 12920<br />

Indonesia<br />

Yudha Bahri Sihombing & Setiawan<br />

Sona Topas Tower, 8th Floor<br />

Jl. Jendral Sudirman Kav. 26<br />

Jakarta 12920<br />

Indonesia<br />

Legal Advisers to the Issue Managers,<br />

Global Coordinator, Underwriter and<br />

Bookrunner as to Indonesian law .... Bahar & Partners<br />

Menara Prima, 18th Floor<br />

Jl Lingkar Mega Kuningan Blok 6.2.<br />

Jakarta 12950<br />

Indonesia<br />

Principal Bankers ................ Bangkok Bank Public Company Limited<br />

180 Cecil Street<br />

Bangkok Bank Building<br />

Singapore 069546<br />

The HongKong & Shanghai Banking Corporation<br />

21 Collyer Quay<br />

#14-01 HSBC Building<br />

Singapore 049320<br />

Standard Chartered Bank<br />

6 Battery Road<br />

Standard Chartered Bank Building<br />

Singapore 049909<br />

CIMB Bank Berhad<br />

50 Raffles Place<br />

#09-01 Singapore Land Tower<br />

Singapore 048623<br />

vi

United Overseas Bank Limited<br />

80 Raffles Place<br />

UOB Plaza<br />

Singapore 048624<br />

PT Bank CIMB Niaga, Tbk<br />

Graha Niaga LT.6<br />

JL. Jendral Sudirman Kav. 58<br />

Jakarta 12190<br />

Indonesia<br />

RHB Bank Berhad<br />

90 Cecil Street<br />

#03-00 RHB Bank Building<br />

Singapore 069531<br />

Receiving Bank .................. United Overseas Bank Limited<br />

80 Raffles Place<br />

UOB Plaza<br />

Singapore 048624<br />

Independent Financial Adviser ...... Provenance Capital Pte. Ltd.<br />

138 Cecil Street<br />

#09-01 Cecil Court<br />

Singapore 069538<br />

vii

(This page is intentionally left blank)

SUMMARY<br />

The following summary is qualified in its entirety by, and is subject to, the more detailed information and<br />

the financial information contained or referred to elsewhere in this document. The meanings of terms not<br />

defined in this summary can be found elsewhere in this document.<br />

Introduction<br />

We are an offshore marine group engaged in shipbuilding, ship repair and conversion and ship chartering.<br />

Our customers are primarily fleet operators who provide logistics support to offshore services and equipment<br />

companies operating globally in the oil and gas industry.<br />

We are headquartered in Singapore and we own and operate what we believe to be one of the largest<br />

shipbuilding yards in Batam, Indonesia. Our location provides us with a strategic advantage as a result of<br />

Singapore’s position as a hub for the regional marine and offshore industry and enables us to tap into a ready<br />

supply of workers from Indonesia and management talent and marine and offshore support and expertise from<br />

Singapore. Our shipyard has a well-organised infrastructure along with comprehensive facilities, advanced<br />

equipment and an experienced team of engineers.<br />

We build a range of small, medium and large offshore support vessels at our shipyard in Batam, Indonesia<br />

and outsourced third party shipyards in China. Our strategic focus is on building offshore support vessels such<br />

as AHTS vessels and PSVs which comply with the technical specifications required to operate in the North<br />

Sea, including the requirements of Norwegian Maritime Directorate and Det Norske Veritas. We also construct<br />

other types of offshore support vessels including, work barges with accommodation for 300 people as well as<br />

work maintenance boats and plan to build offshore construction vessels. In addition, we provide ship repair<br />

and conversion services primarily for offshore support vessels. We have recently signed agreements to build<br />

offshore construction vessels.<br />

Our specialised focus has allowed us to build up our expertise in constructing high-specification offshore<br />

support vessels, to improve our production quality and efficiency and to develop a competitive cost structure.<br />

It has also enabled us to gain recognition in the construction of complex and sophisticated offshore vessels.<br />

We retain ownership and charter out some of the vessels that we build. In addition, through our associated<br />

companies, we hold minority interests in some of the vessels that we sell to our strategic partners for<br />

chartering purposes.<br />

Over the last three financial years ended 31 December 2007, our revenue grew at a compounded annual<br />

growth rate of 139.6% per annum, from S$54.7 million in FY2005 to S$314.0 million in FY2007. Over the<br />

same period, the profit attributable to our Shareholders grew from S$3.1 million in FY2005 to S$41.9 million<br />

in FY2007. For the five months ended 31 May 2008, our revenue and profit attributable to our Shareholders<br />

was S$219.5 million and S$32.7 million, respectively, compared to revenue and profit attributable to our<br />

Shareholders of S$86.3 million and S$9.0 million, respectively, for the same period in 2007.<br />

As at 8 August 2008, our order book was S$937.1 million.<br />

Our Strengths and Strategies<br />

Strengths<br />

We have a history in shipbuilding and ship repair and conversion dating back to the early 1980s. Since<br />

2004, we have specialised in the building of offshore support vessels. We believe that we benefit from a<br />

number of strengths that together differentiate us from our competitors in the offshore marine industry. They<br />

include the following:<br />

Specialised focus on complex, sophisticated and environment friendly offshore support vessels.<br />

We focus on the construction and engineering of complex, sophisticated and environment friendly<br />

offshore support vessels which comply with technical specifications required to operate in the North<br />

Sea, including the requirements of Norwegian Maritime Directorate and Det Norske Veritas. This focus<br />

has been beneficial to us as these vessels have generally produced higher margins for us than less<br />

complex vessels.<br />

We believe that the demand for offshore support vessels will continue to shift towards vessels that are<br />

larger and more sophisticated in terms of their engine capacity, bollard pull and navigational equipment,<br />

as the search for and production of offshore oil and gas become more demanding both in terms of<br />

1

increasing water depths and severe weather conditions. In addition, current industry trends call for<br />

vessels with improved design on stability capabilities and inherently safer and environment friendly<br />

operation. We believe these favourable industry trends will provide strong support for the vessels that<br />

we build.<br />

We work with Norwegian ship design firms to tap into their expertise in the design of sophisticated<br />

offshore support vessels. We believe that our shipbuilding yard is the only one in Asia which builds<br />

21,000 bhp AHTS vessels on a turnkey basis using the VS491 design from renowned Norwegian ship<br />

design house Vik-Sandvik. In addition, we have entered into an arrangement with Marin Teknikk AS<br />

for the exclusive use of one of their proprietary PSV designs in selected countries in Asia and the<br />

Middle East until December 2008.<br />

Our specialised focus has allowed us to build up our expertise in constructing high-specification<br />

offshore support vessels, to improve our production quality and efficiency and to develop a competitive<br />

cost structure. It has also enabled us to gain recognition in the construction of complex and<br />

sophisticated offshore vessels. We have been able to build a sizable order book which, as at 8 August<br />

2008 was S$937.1 million.<br />

An efficient and strategically located shipyard.<br />

We believe we have one of the largest shipyards in Batam, an island in Indonesia located approximately<br />

20 kilometres from Singapore. Our shipyard has approximately 40 hectares of land area and 450 metres<br />

of usable waterfront.<br />

Batam is a major hub for the shipbuilding industry in South-east Asia. Our proximity to Singapore<br />

provides us with a strategic advantage as a result of Singapore’s position as a hub for the regional<br />

marine and offshore industry, which provides us with access to the marine and offshore support and<br />

expertise from Singapore. Our location in Batam also enables us to tap into a ready supply of workers<br />

from Indonesia.<br />

Our Syncrolift» allows for the construction of up to twelve 5,000 bhp to 10,800 bhp vessels at any one<br />

time. More importantly, the Syncrolift» is able to move vessels in and out of the water efficiently for<br />

test launches, ship repair or underwater works. As a result, we are able to complete the construction of<br />

a larger number of newbuildings and the repair of vessels in greater numbers within a shorter<br />

timeframe. Consequently, we enjoy higher productivity and economies of scale.<br />

Strong engineering and technical capabilities and turnkey approach.<br />

We adopt a proactive, total solutions approach, in which we provide our customers with turnkey<br />

solutions, ranging from the selection of design to project specification, procurement, construction,<br />

system installation and integration, testing, commissioning to warranty support. We believe that our<br />

turnkey approach enables us to provide value-added customised solutions that command higher margins<br />

and which distinguish us from our competitors.<br />

We are able to deliver our turnkey solutions as a result of our established relationships with our<br />

suppliers and our strong engineering and technical capabilities.<br />

Our operations benefit from a dedicated, skilled and experienced team of naval architects and engineers<br />

who are specially trained to operate the TRIBON» software, a three-dimensional product model naval<br />

architecture programme originally created for designing commercial and naval vessels. This in-house<br />

capability enables us to build a precise virtual model of the vessel, which can be reviewed and tested<br />

prior to production, thereby minimising errors and resulting in a more efficient shipbuilding process.<br />

Experienced management team.<br />

Our key executive officers with operating function have in-depth experience in the offshore marine<br />

industry, with an average of 34 years of experience.<br />

Our management team remains focused on continually identifying market opportunities and achieving<br />

improved operating efficiency and returns.<br />

Through the years, our management team has developed strong relationships with our customers,<br />

designers and our suppliers. We have also established a reputation among our customers for providing<br />

quality service and maintaining high operational standards. This reputation has benefited our shipbuilding<br />

and ship repair and conversion businesses in terms of quality and on the execution of our<br />

customers’ delivery schedules.<br />

2

Strategies<br />

We intend to consolidate our current market position by capitalising on opportunities in the global marine<br />

and offshore industry and to enhance our competitiveness. Key elements of our business strategy are as<br />

follows:<br />

Diversify sources of income by expanding ship chartering while maintaining focus on construction of<br />

higher value vessels.<br />

While shipbuilding remains our main focus, we intend to diversify our sources of income by expanding<br />

our ship chartering business.<br />

As at the Latest Practicable Date, our chartering fleet comprises five 3,600 bhp tugboats and five<br />

10,000 dwt high deck loading barges. We are building nine vessels to be completed by 2009, which we<br />

intend to add to our chartering fleet. We intend to retain ownership of these vessels and deploy them<br />

on bareboat or time charters.<br />

We currently have one work barge with accommodation for 300 people in operation with a strategic<br />

partner. We are also building nine vessels that we have sold to our strategic partners to be completed<br />

by 2010. In addition, we are building 10 vessels to be completed by 2010 that we intend to sell to our<br />

strategic partners.<br />

We expect that our ship chartering business will provide us with a source of income that is more stable<br />

over the long term than shipbuilding alone. In addition, in the event of a slowdown in the shipbuilding<br />

business, we intend to reallocate our resources and capacity to increase our ship repair and conversion<br />

business.<br />

With regard to our shipbuilding operations, we intend to continue expanding our operations with a<br />

particular focus on complex, sophisticated and environment friendly offshore support vessels, which we<br />

believe will continue to command higher prices within the industry.<br />

Upgrading technology and processes to enhance our competitive position.<br />

We plan to continuously upgrade our technical capabilities in order to strengthen our overall<br />

competitiveness. We are also constantly seeking to shorten the vessel delivery period and minimise<br />

project costs.<br />

We also intend to invest further in advanced equipment and technology and to enhance our production<br />

planning, sequencing, and inventory management processes. We have acquired a project management<br />

software which enables us to track project management schedules and the progress in the construction<br />

of vessels efficiently. This in turn will increase our efficiency and productivity in terms of project<br />

management control.<br />

Increasing capacity to construct more higher value vessels.<br />

We intend to progressively increase our shipyard capacity in order to be able to take on more and<br />

larger projects and to carry out the projects already recorded in our expanding order book. See “Our<br />

Business — Significant Shipbuilding Projects — Order Book”.<br />

We intend to expand the usable waterfront of our Batam shipyard from 450 metres to approximately<br />

800 metres, extend our Syncrolift» berthside by 32 metres � 245 metres and purchase additional<br />

gantry cranes, among other upgrades to our Batam shipyard facilities. We have also commenced<br />

construction of one slipway. All of these will enable us to increase our shipbuilding capacity in Batam.<br />

We intend to complete the expansion and installation of these facilities by the end of FY2009.<br />

We are currently evaluating the commercial viability of building a shipyard in China. Subject to our<br />

evaluation of the commercial viability of the project and us obtaining all relevant approvals, licenses<br />

and permits, we may build a shipyard in China (see “Our Business — Expansion and Upgrading<br />

Plans”).<br />

Strengthening our engineering and middle-level management teams to support our expanding<br />

operations.<br />

We believe that our strong engineering and management teams have been critical factors in building<br />

the reputation we have in the market. As our operations expand, we will need to strengthen our<br />

engineering and middle-level management team by recruiting, developing and retaining talent.<br />

3

We believe we have an aggressive recruiting policy both laterally in the industry and at the entry level<br />

from Indonesian universities. We intend to continue offering training programmes and mentoring<br />

schemes to our staff and new recruits. In addition, we intend to offer competitive compensation<br />

packages and career opportunities to performing engineers and middle-level managers.<br />

Enhancing competitive cost structure through selective outsourcing.<br />

We strive to increase our capacity and maintain our competitive cost structure particularly in the<br />

offshore support vessels market by outsourcing certain shipbuilding work to other regional shipyards in<br />

South-east Asia and China. To ensure that our stringent procedures and quality controls are properly<br />

observed, we deploy our personnel to such other shipyards to monitor the construction through to precommissioning<br />

and delivery.<br />

We expect that this strategy will enable us to build more vessels and to allocate our resources and<br />

capacity more efficiently by allowing us to focus on more complex and sophisticated vessels in our<br />

Batam shipyard.<br />

In order to support the work that we outsource to shipyards in China, we established a representative<br />

office in Foshan, China in 2007.<br />

Company Background<br />

We were incorporated in Singapore on 5 September 1979 under the Act as a private limited company<br />

under the name of “Otto Industrial Co (Pte) Ltd”. With effect from 5 October 2006, we changed our name to<br />

“Otto Marine Pte. Ltd.”. On 17 March 2008, we converted to a public limited company and changed our name<br />

to “Otto Marine Limited”. Our registered address and principal place of business is 9 Temasek Boulevard,<br />

#33-01 Suntec Tower Two, Singapore 038989. Our telephone and fax numbers are (65) 6863 2366 and<br />

(65) 6863 1127, respectively. Our registration number is 197902647M. Our website address is<br />

http://www.ottomarine.com. Information contained in our website does not constitute part of this document.<br />

4

The Offering<br />

The Issuer ...................... Otto Marine Limited, a company incorporated with limited liability<br />

under the laws of Singapore.<br />

The Vendors. .................... LeeKokWahandCEOTechnology Asia Limited.<br />

The Offering .................... 235,295,000 Offering Shares offered through the Placement and the<br />

Public Offer, comprising 206,045,000 New Shares and 29,250,000<br />

Vendor Shares.<br />

The completion of the Public Offer is conditional upon the completion<br />

of the Placement. The Shares in the Offering are being offered<br />

and sold outside the United States to non-US persons (including<br />

Cornerstone Investors, institutional and other investors in Singapore)<br />

in reliance on Regulation S under the Securities Act. The<br />

Shares in the Offering have not been and will not be registered<br />

under the Securities Act and, subject to certain exceptions, may not<br />

be offered or sold within the United States or to, or for the account<br />

or benefit of, US persons (as defined in Regulation S).<br />

Offering Price ................... S$0.51 for each Offering Share. The Offering Price was determined<br />

by agreement among our Company, the Vendors and the Underwriter.<br />

See “Plan of Distribution”.<br />

Purchasers of and subscribers for the Offering Shares may be<br />

required to pay a brokerage fee (and, if so required, such brokerage<br />

fee will be up to 1.0% of the Offering Price).<br />

Cornerstone Investors ............. Each of Bangkok Bank Public Company Limited (“Bangkok<br />

Bank”), Maju Holdings Sdn Bhd (“Maju Holdings”) and Standard<br />

Chartered Private Equity Limited (“SCPEL”) (collectively, the<br />

“Cornerstone Investors”) has entered into a cornerstone share subscription<br />

agreement with our Company (collectively, the “Cornerstone<br />

Share Subscription Agreements”) to subscribe and/or<br />

purchase an aggregate of 146,234,000 Offering Shares, at the<br />

Offering Price, conditional, inter alia, upon the Placement Agreement<br />

and Offer Agreement (both as defined herein) having been<br />

entered into and not having been terminated pursuant to their terms<br />

on or prior to the date of listing of our Shares on the <strong>SGX</strong>-ST<br />

(“Listing Date”).<br />

The Placement ................... 234,295,000 Offering Shares offered by way of an international<br />

placement to investors at the Offering Price, including institutional<br />

and other investors in Singapore and the Cornerstone Investors.<br />

The Placement will include the Reserved Shares.<br />

The Public Offer ................. 1,000,000 Offering Shares offered in Singapore at the Offering<br />

Price by way of an offering to the public in Singapore. The completion<br />

of the Public Offer is conditional upon the completion of<br />

the Placement.<br />

The Reserved Shares .............. 8,915,000 Offering Shares will be reserved for our employees who<br />

have contributed to our success and development (to be determined<br />

by us at our sole discretion).<br />

Clawback and re-allocation ......... Offering Shares may be re-allocated between the Placement and<br />

the Public Offer at the sole discretion of the Underwriter.<br />

Application Procedures in Singapore. . Investors applying for the Offering Shares under the Public Offer<br />

must follow the application procedures set out in “Appendix 7 —<br />

Terms, Conditions and Procedures for Application and Acceptance”<br />

which constitutes part of this document registered with the Authority.<br />

Applications must be paid for in Singapore Dollars. The minimum<br />

initial application is for 1,000 Offering Shares. An applicant<br />

5

may apply for a larger number of Shares in integral multiples of<br />

1,000 Offering Shares.<br />

Lock-ups ....................... Wehaveagreed that we will not, subject to certain exceptions,<br />

issue, offer, sell, contract to sell, pledge or otherwise dispose of,<br />

directly or indirectly, or file with the United States Securities and<br />

Exchange Commission a registration statement under the Securities<br />

Act relating to, any Shares or securities convertible into or<br />

exchangeable or exercisable for any Shares or warrants or other<br />

rights to purchase or subscribe for Shares, or enter into a transaction<br />

which would have the same effect, or enter into any swap,<br />

hedge or other arrangement that transfers, in whole or in part, any<br />

of the economic consequences of ownership of our Shares, whether<br />

any of these transactions are to be settled by delivery of our Shares<br />

or such other securities, in cash or otherwise, or publicly disclose<br />

our intention to make any offer, sale, pledge, disposition or filing,<br />

without, in each case, the prior written consent of the Issue Managers<br />

until six months after the Listing Date.<br />

Certain of our Shareholders have also agreed that, subject to certain<br />

exceptions, they will not offer, sell, contract to sell, pledge or otherwise<br />

dispose of, directly or indirectly, any Shares, without, in<br />

each case, the prior written consent of the Issue Managers until six<br />

months after the Listing Date. See “Plan of Distribution — Restrictions<br />

on Disposals and Issue of Shares”.<br />

Dividends ....................... Inconsidering the level of dividend payments, if any, we intend to<br />

take into account various factors, including (but not limited to):<br />

the level of our cash, gearing, return on equity and retained<br />

earnings;<br />

our expected financial performance;<br />

our projected levels of capital expenditure and other investment<br />

plans;<br />

tax positions of our Company and our subsidiaries;<br />

laws or regulations in issuing dividends; and<br />

any restrictions on payment of dividends that may be imposed on<br />

us by our financing arrangements.<br />

See “Dividend Policy” for a description of our dividend policy.<br />

Listing and Trading ............... Prior to the Offering, there has been no public market for our<br />

Shares. Application has been made to the <strong>SGX</strong>-ST for permission<br />

to list all our issued Shares (including the Vendor Shares), the New<br />

Shares and the Award Shares on the Main Board of the <strong>SGX</strong>-ST.<br />

Such permission will be granted when we have been admitted to<br />

the Official List of the <strong>SGX</strong>-ST. Acceptance of applications for the<br />

Offering Shares will be conditional upon, among other things, permission<br />

being granted to deal in and for quotation for all our issued<br />

Shares (including the Vendor Shares), the New Shares and the<br />

Award Shares. We have not applied to any other exchange to list<br />

our Shares.<br />

Our Shares are expected to commence trading on a “ready” basis<br />

as early as 9.00 a.m. on 28 November 2008 (Singapore time). See<br />

“— Indicative Timetable”.<br />

Our Shares will, upon their issue, listing and quotation on the<br />

<strong>SGX</strong>-ST, be traded on the <strong>SGX</strong>-ST under the book-entry (scripless)<br />

settlement system of CDP. Dealing in and quotation of our Shares<br />

6

on the <strong>SGX</strong>-ST will be in Singapore Dollars. Our Shares will be<br />

traded in board lot sizes of 1,000 Shares on the <strong>SGX</strong>-ST.<br />

Voting rights .................... Registered owners of our Shares will be entitled to full voting<br />

rights, as described in “Description of our Shares”.<br />

Settlement ...................... WeandtheVendors expect to receive payment for all the Offering<br />

Shares in the Placement and the Public Offer on or about<br />

28 November 2008. We will, and we expect the Vendors will,<br />

deliver global share certificates representing the Offering Shares to<br />

CDP for deposit into the securities accounts of successful applicants<br />

on or about 28 November 2008. See “Clearance and<br />

Settlement”.<br />

Transfer Restrictions .............. TheShares will be subject to certain restrictions described in<br />

“Transfer Restrictions”.<br />

Use of Proceeds .................. Based on the Offering Price of S$0.51 for each Offering Share, our<br />

net proceeds from the issuance of the New Shares after deducting<br />

our share of the underwriting fees, commissions and other estimated<br />

expenses payable in relation to the Offering are estimated to<br />

be approximately S$97.7 million. We intend to use these net proceeds<br />

to fund our strategic investments, our fleet expansion of vessels<br />

available for charter and to develop our yard, infrastructure<br />

facilities and equipment, and the remainder for general working<br />

requirements purposes. We will not receive any of the proceeds<br />

from the sale of Vendor Shares. See “Use of Proceeds”.<br />

Risk Factors. .................... Prospective investors should carefully consider certain risks connected<br />

with an investment in our Shares as discussed under “Risk<br />

Factors”.<br />

7

SUMMARY CONSOLIDATED FINANCIAL INFORMATION<br />

The following tables present our selected consolidated financial information as at and for the years ended<br />

31 December 2005, 2006, 2007 and the five months ended 31 May 2007 and 2008. The following discussion<br />

should be read in conjunction with our audited consolidated financial statements for FY2005, FY2006 and<br />

FY2007 and the notes thereto and our unaudited condensed consolidated financial statements for the five<br />

months ended 31 May 2008 and the related notes thereto and all other financial information which are<br />

included elsewhere in this document. You should also see the section of this document entitled “Management’s<br />

Discussion and Analysis of Financial Condition and Results of Operations”. We derived the summary financial<br />

information presented below from our audited consolidated financial statements for FY2005, FY2006 and<br />

FY2007 and our unaudited condensed consolidated financial statements for the five months ended 31 May<br />

2007 and 2008. Our condensed consolidated financial statements for the five months ended 31 May 2007 have<br />

not been audited or reviewed. Prospective investors should note that our results for the five months ended<br />

31 May 2008 are not necessarily indicative of the results that we will achieve for the year ending 31 December<br />

2008. Our unaudited condensed consolidated financial statements for the five months ended 31 May 2007 and<br />

2008 have been prepared on the same basis as our audited consolidated financial statements for FY2005,<br />

FY2006 and FY2007. Our consolidated financial statements were prepared and presented in accordance with<br />

SFRS.<br />

We have prepared our financial statements in accordance with SFRS, which may differ in certain<br />

significant respects from generally accepted accounting principles in other countries.<br />

Consolidated Profit and Loss Statements<br />

Financial Years Ended 31 December Five Months Ended 31 May<br />

2005 2006 2007 2007 2007 2008<br />

S$ S$ S$ US$<br />

(Unaudited)<br />

S$<br />

(Unaudited)<br />

S$<br />

(Unaudited)<br />

(In thousands except per Share data)<br />

Revenue. ................... 54,689 147,255 314,024 230,900 86,308 219,533<br />

Cost of sales . ................ (48,591) (125,879) (232,326) (170,828) (71,293) (162,467)<br />

Gross profit ................. 6,098 21,376 81,698 60,072 15,015 57,066<br />

Other income (expense). ........ (969) 429 (8,045) (5,916) 1,554 (12,853)<br />

Administration expenses ........<br />

Share of profits (losses) of<br />

(3,034) (5,270) (12,356) (9,085) (4,753) (7,448)<br />

associates . ................ — — (268) (197) — 4,571<br />

Finance costs ................ (2,042) (2,383) (5,905) (4,342) (1,067) (4,919)<br />

Profit before income tax ....... 53 14,152 55,124 40,532 10,749 36,417<br />

Income tax expense. ........... (462) (449) (1,449) (1,065) (649) (500)<br />

Profit (Loss) for the period ..... (409) 13,703 53,675 39,467 10,100 35,917<br />

Attributable to Equity holders of<br />

our Company .............. 3,082 20,200 41,927 30,829 8,964 32,711<br />

Minority interests ............. (3,491) (6,497) 11,748 8,638 1,136 3,206<br />

(409) 13,703 53,675 39,467 10,100 35,917<br />

Earnings per Share (1) attributable<br />

to equity holders of our<br />

Company (expressed in cents<br />

per Share)<br />

Basic ...................... 0.32 2.07 4.30 3.16 0.92 3.35<br />

Diluted (2) ................... 0.26 1.71 3.55 2.61 0.76 2.77<br />

Notes:<br />

(1) We calculated our earnings per Share based on the number of Shares outstanding prior to the completion<br />

of the Offering and after (i) deducting the amount of our profit attributable to minority interests and<br />

(ii) giving effect to the Share Split described in the section “Description of Share Capital”.<br />

(2) As adjusted for the issue of 206,045,000 New Shares.<br />

8

Consolidated Balance Sheets<br />

As at<br />

As at 31 December<br />

31 May<br />

2005 2006 2007 2007 2008<br />

S$ S$ S$ US$ S$<br />

(Unaudited) (Unaudited)<br />

(In thousands except per Share data)<br />

ASSETS<br />

Current assets<br />

Cash and bank balances ....................... 1,285 14,238 18,186 13,372 10,082<br />

Pledged deposits ............................. 138 40,969 195,718 143,910 151,183<br />

Trade receivables ............................ 20,430 4,239 25,538 18,778 19,370<br />

Gross amount due from customers for contract work . . — 27,418 94,300 69,338 177,055<br />

Deposits, prepayments and other receivables ........ 7,675 21,803 61,757 45,410 115,503<br />

Inventories ................................. 21,373 25,769 81,465 59,901 67,056<br />

Total current assets ...........................<br />

Non-current assets<br />

50,901 134,436 476,964 350,709 540,249<br />

Investments in associates ....................... — — 4,709 3,463 8,692<br />

Available-for-sale investments ................... — — 4,080 3,000 4,187<br />

Goodwill .................................. — 922 5,101 3,750 40,370<br />

Property, plant and equipment ................... 11,717 18,527 91,011 66,920 96,123<br />

Total non-current assets ....................... 11,717 19,449 104,901 77,133 149,372<br />

Total assets ................................ 62,618 153,885 581,865 427,842 689,621<br />

LIABILITIES AND EQUITY<br />

Current liabilities<br />

Loans and overdraft .......................... 25,754 38,237 136,847 100,623 134,426<br />

Trade payables .............................. 20,619 39,594 168,765 124,092 224,603<br />

Gross amount due to customers for contract work .... 277 35,070 97,341 71,574 84,637<br />

Other payables .............................. 3,805 6,210 6,561 4,824 7,152<br />

Deferred gain — short term ..................... — — 482 354 482<br />

Current portion of finance leases ................. — 25 80 60 80<br />

Income tax payable ........................... 513 905 2,122 1,560 2,005<br />

Total current liabilities ........................<br />

Non-current liabilities<br />

50,968 120,041 412,198 303,087 453,385<br />

Loans and overdraft .......................... — — 47,516 34,938 41,526<br />

Deferred gain — long term ..................... — — 12,619 9,279 12,218<br />

Loan from related parties ...................... 52,170 27,872 51,381 37,780 102,828<br />

Finance leases ............................... — 170 347 255 315<br />

Total non-current liabilities .....................<br />

Capital, reserves and minority interests<br />

52,170 28,042 111,863 82,252 156,887<br />

Issued capital ............................... 500 32,500 32,500 23,897 32,500<br />

Capital reserve .............................. 294 1,162 1,656 1,218 1,666<br />

Translation reserve ........................... 13 (1,158) (5,249) (3,860) (20,441)<br />

Accumulated profits (losses) ....................<br />

Equity attributable to equity holders of our<br />

(29,223) (9,023) 32,904 24,194 65,615<br />

Company ................................ (28,416) 23,481 61,811 45,449 79,340<br />

Minority interests ............................ (12,104) (17,679) (4,007) (2,946) 9<br />

Total equity (capital deficiency) .................. (40,520) 5,802 57,804 42,503 79,349<br />

Total liabilities and equity ..................... 62,618 153,885 581,865 427,842 689,621<br />

9

As at<br />

As at 31 December<br />

31 May<br />

2005 2006 2007 2007 2008<br />

S$ S$ S$ US$<br />

(Unaudited)<br />

S$<br />

(Unaudited)<br />

(In thousands except per Share data)<br />

NAV per Share (1) (in cents) ..................... (2.91) 2.41 6.34 4.66 8.14<br />

NTA per Share (2) (in cents) ..................... (2.91) 2.31 5.82 4.28 4.00<br />

Notes:<br />

(1) We calculated our NAV per Share based on the number of Shares outstanding prior to the completion of<br />

the Offering and after (i) deducting the amount attributable to minority interests and (ii) giving effect to<br />

the Share Split described in the section “Description of Share Capital”.<br />

(2) We calculated our NTA per Share based on the number of Shares outstanding prior to the completion of<br />

the Offering and after (i) deducting the amount attributable to minority interests and goodwill and (ii) giving<br />

effect to the Share Split described in the section “Description of Share Capital”.<br />

Consolidated Statements of Cash Flows<br />

Financial Years Ended 31 December Five Months Ended 31 May<br />

2005 2006 2007 2007 2007 2008<br />

S$ S$ S$ US$<br />

(Unaudited)<br />

(In thousands)<br />

S$<br />

(Unaudited)<br />

S$<br />

(Unaudited)<br />

Net cash (used in) from operating<br />

activities .................... (12,460) 43,067 71,865 52,842 89,361 (43,281)<br />

Net cash used in investing activities . . (8,320) (7,938) (76,862) (56,517) (10,136) (16,782)<br />

Net cash from financing activities . . .<br />

Net increase (decrease) in cash and<br />

21,848 21,902 165,457 121,660 12,100 14,671<br />

cash equivalents. ..............<br />

Cash and cash equivalents at<br />

1,068 57,031 160,460 117,985 91,325 (45,392)<br />

beginning of period ............<br />

Effects of exchange rate changes on<br />

the balance of cash held in foreign<br />

(4,643) (3,575) 53,456 39,306 53,456 213,904<br />

currencies ...................<br />

Cash and cash equivalents at end of<br />

— — (12) (9) 1 (7,247)<br />

period. ..................... (3,575) 53,456 213,904 157,282 144,782 161,265<br />

10

INDICATIVE TIMETABLE<br />

The indicative timetable for trading in our Shares is set out below for reference of applicants for our<br />

Shares in Singapore:<br />

Date and Time (Singapore)<br />

Event<br />

22 November 2008 at 9.00 a.m. Opening date and time for the Public Offer.<br />

26 November 2008 at 12.00 noon Close of Application List.<br />

27 November 2008 Balloting of applications, if necessary (in the event of over-subscription<br />

for the Offer Shares).<br />

28 November 2008 at 9.00 a.m. Commence trading on a “ready” basis.<br />

3 December 2008 Settlement date for all trades done on a “ready” basis on 28 November<br />

2008.<br />

The above timetable is only indicative as it assumes that the date of closing of the Application List is<br />

26 November 2008, the date of admission of our Company to the Official List of the <strong>SGX</strong>-ST is 28 November<br />

2008, the <strong>SGX</strong>-ST’s shareholding spread requirement will be complied with and the New Shares will be issued<br />

and fully paid-up prior to 9.00 a.m. on 28 November 2008.<br />

The above timetable and procedures may be subject to such modification as the <strong>SGX</strong>-ST may, in its<br />