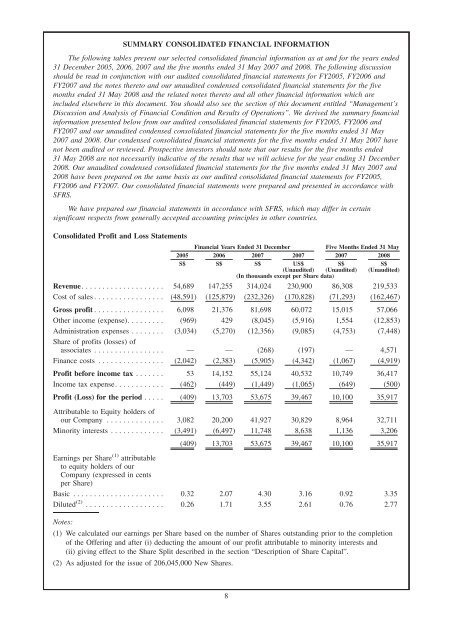

SUMMARY CONSOLIDATED FINANCIAL INFORMATION The following tables present our selected consolidated financial information as at and for the years ended 31 December 2005, 2006, 2007 and the five months ended 31 May 2007 and 2008. The following discussion should be read in conjunction with our audited consolidated financial statements for FY2005, FY2006 and FY2007 and the notes thereto and our unaudited condensed consolidated financial statements for the five months ended 31 May 2008 and the related notes thereto and all other financial information which are included elsewhere in this document. You should also see the section of this document entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. We derived the summary financial information presented below from our audited consolidated financial statements for FY2005, FY2006 and FY2007 and our unaudited condensed consolidated financial statements for the five months ended 31 May 2007 and 2008. Our condensed consolidated financial statements for the five months ended 31 May 2007 have not been audited or reviewed. Prospective investors should note that our results for the five months ended 31 May 2008 are not necessarily indicative of the results that we will achieve for the year ending 31 December 2008. Our unaudited condensed consolidated financial statements for the five months ended 31 May 2007 and 2008 have been prepared on the same basis as our audited consolidated financial statements for FY2005, FY2006 and FY2007. Our consolidated financial statements were prepared and presented in accordance with SFRS. We have prepared our financial statements in accordance with SFRS, which may differ in certain significant respects from generally accepted accounting principles in other countries. Consolidated Profit and Loss Statements Financial Years Ended 31 December Five Months Ended 31 May 2005 2006 2007 2007 2007 2008 S$ S$ S$ US$ (Unaudited) S$ (Unaudited) S$ (Unaudited) (In thousands except per Share data) Revenue. ................... 54,689 147,255 314,024 230,900 86,308 219,533 Cost of sales . ................ (48,591) (125,879) (232,326) (170,828) (71,293) (162,467) Gross profit ................. 6,098 21,376 81,698 60,072 15,015 57,066 Other income (expense). ........ (969) 429 (8,045) (5,916) 1,554 (12,853) Administration expenses ........ Share of profits (losses) of (3,034) (5,270) (12,356) (9,085) (4,753) (7,448) associates . ................ — — (268) (197) — 4,571 Finance costs ................ (2,042) (2,383) (5,905) (4,342) (1,067) (4,919) Profit before income tax ....... 53 14,152 55,124 40,532 10,749 36,417 Income tax expense. ........... (462) (449) (1,449) (1,065) (649) (500) Profit (Loss) for the period ..... (409) 13,703 53,675 39,467 10,100 35,917 Attributable to Equity holders of our Company .............. 3,082 20,200 41,927 30,829 8,964 32,711 Minority interests ............. (3,491) (6,497) 11,748 8,638 1,136 3,206 (409) 13,703 53,675 39,467 10,100 35,917 Earnings per Share (1) attributable to equity holders of our Company (expressed in cents per Share) Basic ...................... 0.32 2.07 4.30 3.16 0.92 3.35 Diluted (2) ................... 0.26 1.71 3.55 2.61 0.76 2.77 Notes: (1) We calculated our earnings per Share based on the number of Shares outstanding prior to the completion of the Offering and after (i) deducting the amount of our profit attributable to minority interests and (ii) giving effect to the Share Split described in the section “Description of Share Capital”. (2) As adjusted for the issue of 206,045,000 New Shares. 8

Consolidated Balance Sheets As at As at 31 December 31 May 2005 2006 2007 2007 2008 S$ S$ S$ US$ S$ (Unaudited) (Unaudited) (In thousands except per Share data) ASSETS Current assets Cash and bank balances ....................... 1,285 14,238 18,186 13,372 10,082 Pledged deposits ............................. 138 40,969 195,718 143,910 151,183 Trade receivables ............................ 20,430 4,239 25,538 18,778 19,370 Gross amount due from customers for contract work . . — 27,418 94,300 69,338 177,055 Deposits, prepayments and other receivables ........ 7,675 21,803 61,757 45,410 115,503 Inventories ................................. 21,373 25,769 81,465 59,901 67,056 Total current assets ........................... Non-current assets 50,901 134,436 476,964 350,709 540,249 Investments in associates ....................... — — 4,709 3,463 8,692 Available-for-sale investments ................... — — 4,080 3,000 4,187 Goodwill .................................. — 922 5,101 3,750 40,370 Property, plant and equipment ................... 11,717 18,527 91,011 66,920 96,123 Total non-current assets ....................... 11,717 19,449 104,901 77,133 149,372 Total assets ................................ 62,618 153,885 581,865 427,842 689,621 LIABILITIES AND EQUITY Current liabilities Loans and overdraft .......................... 25,754 38,237 136,847 100,623 134,426 Trade payables .............................. 20,619 39,594 168,765 124,092 224,603 Gross amount due to customers for contract work .... 277 35,070 97,341 71,574 84,637 Other payables .............................. 3,805 6,210 6,561 4,824 7,152 Deferred gain — short term ..................... — — 482 354 482 Current portion of finance leases ................. — 25 80 60 80 Income tax payable ........................... 513 905 2,122 1,560 2,005 Total current liabilities ........................ Non-current liabilities 50,968 120,041 412,198 303,087 453,385 Loans and overdraft .......................... — — 47,516 34,938 41,526 Deferred gain — long term ..................... — — 12,619 9,279 12,218 Loan from related parties ...................... 52,170 27,872 51,381 37,780 102,828 Finance leases ............................... — 170 347 255 315 Total non-current liabilities ..................... Capital, reserves and minority interests 52,170 28,042 111,863 82,252 156,887 Issued capital ............................... 500 32,500 32,500 23,897 32,500 Capital reserve .............................. 294 1,162 1,656 1,218 1,666 Translation reserve ........................... 13 (1,158) (5,249) (3,860) (20,441) Accumulated profits (losses) .................... Equity attributable to equity holders of our (29,223) (9,023) 32,904 24,194 65,615 Company ................................ (28,416) 23,481 61,811 45,449 79,340 Minority interests ............................ (12,104) (17,679) (4,007) (2,946) 9 Total equity (capital deficiency) .................. (40,520) 5,802 57,804 42,503 79,349 Total liabilities and equity ..................... 62,618 153,885 581,865 427,842 689,621 9

- Page 1 and 2: OTTO MARINE LIMITED PROSPECTUS DATE

- Page 3 and 4: Our Financial Highlights Over the l

- Page 5 and 6: Our Strategies We intend to consoli

- Page 7 and 8: NOTICE TO INVESTORS. ..............

- Page 9 and 10: All references to the “Latest Pra

- Page 11 and 12: CORPORATE INFORMATION Board of Dire

- Page 13 and 14: United Overseas Bank Limited 80 Raf

- Page 15 and 16: SUMMARY The following summary is qu

- Page 17 and 18: Strategies We intend to consolidate

- Page 19 and 20: The Offering The Issuer ...........

- Page 21: on the SGX-ST will be in Singapore

- Page 25 and 26: INDICATIVE TIMETABLE The indicative

- Page 27 and 28: Risks Relating to Our Business and

- Page 29 and 30: companies and their affiliates acco

- Page 31 and 32: more of the administrative tasks an

- Page 33 and 34: Labour problems may disrupt our ope

- Page 35 and 36: Our operations may be adversely aff

- Page 37 and 38: The exchange price for the first tr

- Page 39 and 40: American-led military campaigns in

- Page 41 and 42: liquidity, the price of such shares

- Page 43 and 44: Over Code. A take-over offer is als

- Page 45 and 46: able to use the net proceeds to mak

- Page 47 and 48: EXCHANGE RATES AND EXCHANGE CONTROL

- Page 49 and 50: CAPITALISATION AND INDEBTEDNESS The

- Page 51 and 52: (2) As at 1 January 2005, Yaw Chee

- Page 53 and 54: Consolidated Balance Sheets As at A

- Page 55 and 56: MANAGEMENT’S DISCUSSION AND ANALY

- Page 57 and 58: uilding such vessels. Higher demand

- Page 59 and 60: Demand for and Supply of Skilled La

- Page 61 and 62: Deferred Gain Deferred gain arises

- Page 63 and 64: Cost of Sales Our cost of sales con

- Page 65 and 66: Recognition — Deferred Gain”. O

- Page 67 and 68: evenue from the Middle East region

- Page 69 and 70: In FY2007, our revenue from the Mid

- Page 71 and 72: Cost of Sales Our cost of sales inc

- Page 73 and 74:

In FY2007, our net cash from operat

- Page 75 and 76:

Facility Lender Amount of Facility

- Page 77 and 78:

Hong Leong Finance We have obtained

- Page 79 and 80:

staff members who were hired from 2

- Page 81 and 82:

amounting to S$2.3 million. Capital

- Page 83 and 84:

The percentage of our revenue denom

- Page 85 and 86:

ange from 3.75% per annum to 8.0% p

- Page 87 and 88:

INDUSTRY OVERVIEW This section is p

- Page 89 and 90:

2.0 Description of Vessel Types 2.1

- Page 91 and 92:

Graph 2: Primary types of offshore

- Page 93 and 94:

5.1 Main Markets for Offshore Marin

- Page 95 and 96:

Canada features a relatively small

- Page 97 and 98:

6.0 Fleet Sizes As of January 2008

- Page 99 and 100:

With many oil and gas fields maturi

- Page 101 and 102:

share, with Dubai Drydocks combinin

- Page 103 and 104:

Number of vessels built in given ye

- Page 105 and 106:

Number of vessels built in given ye

- Page 107 and 108:

600 500 400 300 200 100 0 Graph 18:

- Page 109 and 110:

In preparation for the admission of

- Page 111 and 112:

On 18 December 2007, our Company en

- Page 113 and 114:

(4) WAIL was incorporated in Saint

- Page 115 and 116:

operation. We believe these favoura

- Page 117 and 118:

We believe we have an aggressive re

- Page 119 and 120:

20.0% to 30.0% of the contract valu

- Page 121 and 122:

Launching The completed hull and pr

- Page 123 and 124:

Our initial costs of investment for

- Page 125 and 126:

Year of Delivery Tonnage/ Power/ Ca

- Page 127 and 128:

Vessels for Our Own Chartering Flee

- Page 129 and 130:

Leases We currently lease the follo

- Page 131 and 132:

In FY2007, the production capacity

- Page 133 and 134:

Accounting Policies — Revenue and

- Page 135 and 136:

the entering into new contracts wit

- Page 137 and 138:

Employees The geographical distribu

- Page 139 and 140:

Type Activity Date Granted Expiry D

- Page 141 and 142:

Management Reporting Structure PROC

- Page 143 and 144:

and special advisor of PSA Internat

- Page 145 and 146:

attain the position of general mana

- Page 147 and 148:

companies both in Singapore and ove

- Page 149 and 150:

Our Board believes that Yaw Chee Si

- Page 151 and 152:

SHARE AWARD SCHEME On 2 September 2

- Page 153 and 154:

such Awards will receive in lieu of

- Page 155 and 156:

However, as the Share Award Scheme

- Page 157 and 158:

SUBSTANTIAL SHAREHOLDERS AND VENDOR

- Page 159 and 160:

Information on Cornerstone Investor

- Page 161 and 162:

Memorandum and Articles of Associat

- Page 163 and 164:

Change of Control of Our Company To

- Page 165 and 166:

Interested Person Relationship With

- Page 167 and 168:

As of the Latest Practicable Date t

- Page 169 and 170:

inflation rate) for the remaining t

- Page 171 and 172:

PT Lestari became our subsidiary in

- Page 173 and 174:

delivered in 2005 and one vessel wa

- Page 175 and 176:

These inter-company payments and ad

- Page 177 and 178:

provision subordinating our indebte

- Page 179 and 180:

In October 2006, we started engagin

- Page 181 and 182:

Transactions with interested person

- Page 183 and 184:

Opinion of the Independent Financia

- Page 185 and 186:

At an EGM held on 19 November 2008,

- Page 187 and 188:

DESCRIPTION OF OUR SHARES The follo

- Page 189 and 190:

Unless otherwise directed, dividend

- Page 191 and 192:

TAXATION The following is a discuss

- Page 193 and 194:

PLAN OF DISTRIBUTION The Offering U

- Page 195 and 196:

convertible into or exchangeable or

- Page 197 and 198:

egulations. Persons into whose poss

- Page 199 and 200:

including any corporation or other

- Page 201 and 202:

TRANSFER RESTRICTIONS Because the f

- Page 203 and 204:

LEGAL MATTERS The validity of the O

- Page 205 and 206:

GENERAL AND STATUTORY INFORMATION I

- Page 207 and 208:

Name Present Directorships Past Dir

- Page 209 and 210:

2. None of our Directors, Executive

- Page 211 and 212:

Company Name Date of Incorporation

- Page 213 and 214:

(viii) subscription agreement dated

- Page 215 and 216:

Consents 1. Deloitte & Touche LLP a

- Page 217 and 218:

DEFINITIONS For the purpose of this

- Page 219 and 220:

“LSH Trading” .................

- Page 221 and 222:

“Composite Document” ..........

- Page 223 and 224:

“Participants” ................

- Page 225 and 226:

GLOSSARY OF TECHNICAL TERMS To faci

- Page 227 and 228:

“project manager” .............

- Page 229 and 230:

APPENDIX 1 INDEPENDENT AUDITORS’

- Page 231 and 232:

A. Consolidated Balance Sheets As a

- Page 233 and 234:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 235 and 236:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 237 and 238:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 239 and 240:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 241 and 242:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 243 and 244:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 245 and 246:

Concentrations of credit risk exist

- Page 247 and 248:

8 Construction Contracts OTTO MARIN

- Page 249 and 250:

12 Associates 2007 2006 2005 $’00

- Page 251 and 252:

15 Property, Plant and Equipment OT

- Page 253 and 254:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 255 and 256:

20 Finance Leases OTTO MARINE LIMIT

- Page 257 and 258:

26 Other (Expense) Income OTTO MARI

- Page 259 and 260:

The net assets acquired in the tran

- Page 261 and 262:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 263 and 264:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 265 and 266:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 267 and 268:

APPENDIX 2 INDEPENDENT AUDITORS’

- Page 269 and 270:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 271 and 272:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 273 and 274:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 275 and 276:

8. Goodwill OTTO MARINE LIMITED AND

- Page 277 and 278:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 279 and 280:

OTTO MARINE LIMITED AND ITS SUBSIDI

- Page 281 and 282:

APPENDIX 3 SUMMARY OF OUR MEMORANDU

- Page 283 and 284:

Voting Rights Every member (other t

- Page 285 and 286:

fees and current receipts shall, su

- Page 287 and 288:

APPENDIX 4 SUMMARY OF THE RELEVANT

- Page 289 and 290:

espective implementation regulation

- Page 291 and 292:

vessels would be responsible for co

- Page 293 and 294:

instructions and procedures in an e

- Page 295 and 296:

1. APPENDIX 5 RULES OF THE OTTO MAR

- Page 297 and 298:

2.5 Any reference in the Share Awar

- Page 299 and 300:

5.9 As soon as reasonably practicab

- Page 301 and 302:

accordance with Rule 7.1(a) and, th

- Page 303 and 304:

11.3 Any notice or other communicat

- Page 305 and 306:

16.2 The Participants shall be resp

- Page 307 and 308:

APPENDIX 6 LETTER FROM INDEPENDENT

- Page 309 and 310:

usiness, provided that all such tra

- Page 311 and 312:

will not be prejudicial to the inte

- Page 313 and 314:

APPENDIX 7 TERMS, CONDITIONS AND PR

- Page 315 and 316:

(ii) deem your application as withd

- Page 317 and 318:

18. In the event that an interim st

- Page 319 and 320:

(d) you will not be entitled to exe

- Page 321 and 322:

with an ATM card which is not issue

- Page 323 and 324:

(2) If you make your Internet Elect

- Page 325 and 326:

6: Read and understand the followin

- Page 327 and 328:

6. board rates at the time of the a

- Page 329 and 330:

(This page is intentionally left bl

- Page 332:

Otto Marine Limited 9 Temasek Boule