Opportunity Issue 95

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

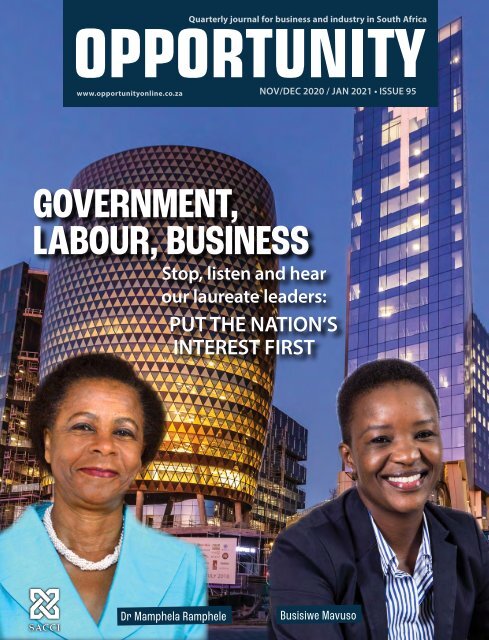

Quarterly journal for business and industry in South Africa<br />

www.opportunityonline.co.za<br />

NOV/DEC 2020 / JAN 2021 • ISSUE <strong>95</strong><br />

GOVERNMENT,<br />

LABOUR, BUSINESS<br />

Stop, listen and hear<br />

our laureate leaders:<br />

PUT THE NATION’S<br />

INTEREST FIRST<br />

Dr Mamphela Ramphele<br />

Busisiwe Mavuso

LEADING<br />

THE FLEET<br />

PROFILE<br />

Strategically located on the West Coast of Africa in Walvis Bay, Namibia,<br />

Namdock is a leader in the West African ship repair market and offshore oil<br />

and gas sector, having gained global recognition for its extensive dry dock<br />

capacities and exceptional client service – even in the face of a global pandemic.<br />

Namdock, or EBH Namibia as it was formerly<br />

known, was founded in 2006 as a joint venture<br />

with the Namibian government, represented<br />

by the Namibian Ports Authority (NAMPORT).<br />

Latterly, a shareholding was taken by a South<br />

African company. In 2018, the South African company<br />

relinquished all shareholding in the former EBH Namibia<br />

when the foreign shareholding was transferred to the<br />

EBH Consortium, a group comprised of prominent<br />

Namibian business leaders. As a result, the organisation<br />

became truly Namibian, with its shareholding held<br />

entirely by NAMPORT and the EBH Consortium.<br />

To reflect this new reality, it was decided to rebrand the<br />

company as Namdock, a name that truly reflects its wholly<br />

Namibian composition. With effect from 31 August 2019,<br />

EBH Namibia changed its name to the Namibia Drydock<br />

and Ship Repair Company Pty Ltd (Namdock). Despite<br />

a drop in the global oil price and its negative knock-on<br />

effect on the offshore repair industry between 2015 and<br />

2019, a still-volatile global oil price, and the knockon<br />

effect of the global Covid-19 pandemic in 2020,<br />

Namdock and its three floating docks continue to<br />

attract local and international clients. However,<br />

there is more to Namdock’s success than a mere<br />

economic recovery.<br />

service and efficiency; but also our inherently strong<br />

relationship with our people and pride in our country,”<br />

says Namdock’s Acting CEO Heritha Nankole Muyoba.<br />

As such, Namdock enjoys the full support of its<br />

majority shareholder, the Namibian Ports Authority<br />

and, by extension, that of the Namibian government. By<br />

reciprocation, Namdock fully supports Namibia’s Vision<br />

2030 and the country’s sustained industrialisation drive.<br />

The next major advantage that Namdock possesses is<br />

that it is situated in Namibia. This country stands out on<br />

the African continent as having a very stable political<br />

dispensation, first-rate and efficiently functioning<br />

infrastructure and a customs and logistics authority that<br />

is user-friendly, corruption-free and swift in operation.<br />

TOP DOCK FACILITIES<br />

It is reported that while there are many ship repair<br />

yards along the West Coast of Africa, in the main, should<br />

a major component be needed, importing such an item<br />

___ __<br />

Strategically situated<br />

in Walvis Bay, Namibia,<br />

the company prides<br />

itself on its on-time<br />

delivery and track<br />

record of consistency<br />

and reliability, making<br />

Namdock a trusted<br />

brand within the<br />

international maritime<br />

sector. A projectorientated<br />

company,<br />

Namdock offers<br />

holistic solutions to<br />

meet all its clients’<br />

requirements.<br />

NAMDOCK’S STRENGTH IS LOCAL<br />

As a nation, Namibia is fiercely proud of its<br />

indepen-dence, and is also strongly focused<br />

on driving economic self-sufficiency and<br />

industrialisation. “We have therefore adopted the<br />

slogan ‘Our Strength Is Local’, which not only<br />

encapsulates our operational ethos of excellence,<br />

Aerial view of Namdock’s<br />

three floating docks.

and having it delivered to the dockside at one of these<br />

yards could take a month or two. By contrast, Namdock,<br />

with the support of the country’s enlightened customs and<br />

logistics system, is able to have similar components on the<br />

dockside within three to four days.<br />

In fact, with three fully operating and well-maintained<br />

floating dry docks, Namdock has the capability to repair<br />

and maintain vessels up to a size that would include<br />

approximately 70% of the global shipping fleet. In addition,<br />

Namdock has reduced its average turnaround time for<br />

ship repairs from 16 days to an extremely impressive 12-<br />

day average.<br />

Namdock’s own facilities include three well-maintained<br />

floating dry docks, seven cranes as well as fully-equipped<br />

workshops for carrying out all aspects of marine repair<br />

and maintenance. As Namdock is part of Namport, which<br />

oversees the port of Walvis Bay, this allows Namdock<br />

access to secure berthing space with the quayside depth<br />

of 12m. In addition, Namdock has access to Namport’s<br />

synchro lift, a facility that can accommodate vessels up to<br />

2 000 tons displacement, 80m in length and 12m in width<br />

overall. The synchro lift area has four 80m repair quays of<br />

8m draft which Namdock uses for alongside-pier repairs<br />

and maintenance. The large natural anchorage at Walvis<br />

Bay has a 14m depth.<br />

SERVICES AND TECHNICAL SKILLS<br />

The removal of marine growth and re-coating of ships’<br />

hulls is a key component of Namdock’s services. This not<br />

only preserves the value of the vessel but also, by reducing<br />

drag in the water, lowers its operating costs.<br />

Namdock employs highly skilled trade professionals<br />

who are dedicated and experienced in a wide variety of<br />

trades, from rigging, piping and coating to fabrication,<br />

carpentry, electrical and propulsion. Namdock’s trade<br />

professionals are well trained to international standards.<br />

In addition to Namdock’s fully equipped workshops<br />

where all the above services can be carried out, the<br />

company constantly works with a range of local highly<br />

experienced and trusted subcontractors and suppliers,<br />

many of the latter from renowned international OEMs.<br />

Clients can therefore access every possible ship repair<br />

service that they might need from Namdock, conducted<br />

in a range of extensive and well-equipped dedicated<br />

fabrication, propulsion, mechanical, electrical, valve and<br />

carpentry workshops, to provide repair and maintenance<br />

services for all potential requirements.<br />

‘SHIPSHAPE’ SAFETY<br />

At Namdock, safety is always the prime and abiding<br />

consideration. For this reason, safety awareness is integral<br />

to Namdock’s management ethos, and forms part of its<br />

day-to-day operations. As such, the company constantly<br />

focuses on creating and enforcing safe and responsible<br />

working conditions for all employees, suppliers and clients<br />

through its safety processes, procedures, certifications<br />

and ongoing training.<br />

The Namdock team were charged with not only restoring the SKD Jaya<br />

to seaworthy condition, but also ensuring that it was safe and fully<br />

compliant with maritime legislation. This project involved the reactivation<br />

of the SKD Jaya rig, a semi-submersible tender assisted drilling unit.<br />

MARINE AND LAND-BASED DIVERSIFICATION<br />

Namdock is currently in the process of diversifying<br />

both in the maritime field and in the land-based heavy<br />

engineering arena. In terms of its marine services, the<br />

company has entered into the field of maintaining and<br />

repairing submersibles and remotely-operated vehicles.<br />

In terms of land-based heavy engineering, Namdock,<br />

as Namibia’s largest engineering company, has the<br />

facilities, design, project management and fabrication<br />

skills to tackle projects of any magnitude.<br />

“Marine engineering has to adhere to exceptionally<br />

high levels of competency, and we would be pleased<br />

to share this skill level with, for example, the coastal<br />

mining industry in Namibia and our neighbouring<br />

countries,” continues Nankole Muyoba.<br />

IN CONCLUSION<br />

“To sum up, at Namdock, we are globally competitive<br />

while also proudly Namibian,” states Nankole Muyoba.<br />

“Our company is a prized national asset, wholly-owned<br />

by all-Namibian entities. With this in mind, Namdock<br />

is sailing ‘full steam ahead’, and navigating a proactive<br />

voyage forward which will benefit not only our valued<br />

clients, our company and our staff, but also the people of<br />

Walvis Bay, and Namibia as a whole,” she concludes.<br />

___ __<br />

Namdock is a highly<br />

successful smart<br />

partnership between<br />

the Namibian<br />

government and<br />

the private sector<br />

and provides the<br />

international shipping<br />

and local industry<br />

with a full-house<br />

capacity in all aspects<br />

of ship repair and<br />

land-based heavy<br />

engineering.<br />

Team work in action! Namdock's take on the popular Jerusalema dance 2020.<br />

PROFILE

Contents<br />

ISSUE <strong>95</strong> | NOV/DEC 2020 / JAN 2021<br />

06<br />

09<br />

10<br />

12<br />

14<br />

18<br />

22<br />

26<br />

30<br />

SACCI FOREWORD<br />

How will South Africa survive this year?<br />

NEWS & SNIPPETS<br />

What has been and what’s to come<br />

THE START OF SOMETHING BIG<br />

If the South African gas market is to take off and thrive,<br />

significant drilling has to take place, says the new CEO<br />

of Petroleum Agency SA, Dr Phindili Masangane<br />

REFINING 2021: WHO WILL BE IN THE GAME<br />

How do oil refineries survive and sustain profitability<br />

in a volatile market?<br />

HEAL OUR PEOPLE, HEAL OUR LAND<br />

Busisiwe Mavuso and Dr Mamphela Ramphele<br />

share their perceptions on how to transform South Africa<br />

TWO TRUTHS ABOUT AFRICA’S AGRICULTURE<br />

Transforming the agricultural value chain is central to any progress in Africa<br />

OPERATIONAL EXCELLENCE IN INFORMATION SECURITY MANAGEMENT<br />

What are organisations doing to ensure that they are securing their data?<br />

HOW TO MAKE PUBLIC TRANSPORT AN ATTRACTIVE OPTION IN YOUR CITY<br />

Introducing the factors needed to realise public transport’s full potential<br />

SURVIVAL STRATEGY<br />

Forward-thinking engineering and construction companies are weathering the<br />

Covid-19 storm by rethinking their strategic choices<br />

10<br />

22<br />

14<br />

26<br />

2 | www.opportunityonline.co.za

LEADERS IN CHEMICAL SUPPLY<br />

INDUSTRIAL CHEMICALS<br />

ChemiCorp is one of the leading raw chemical suppliers<br />

in South Africa.<br />

MINING CHEMICALS<br />

Chemicorp understands the urgency at which mines<br />

operate. We ensure we have stock available at all times.<br />

FOOD AND BEVERAGE INDUSTRY<br />

We supply chemicals of the highest quality suitable for the<br />

manufacture of food products for human consumption.<br />

PAINT INDUSTRY<br />

ChemiCorp is a one-stop-shop for all your architectural<br />

paint manufacturers.<br />

WATER TREATMENT CHEMICALS<br />

ChemiCorp is well-positioned in the water treatment<br />

business and technically geared to tailor-make solutions<br />

to any water treatment requirements.<br />

www.chemicorp.co.za<br />

AGRICULTURAL PRODUCTS<br />

Our agricultural product department is one of the most<br />

innovative. This is mainly due to our partnership with Dagutat<br />

Science, a biological product manufacturer.

EDITOR'S NOTE<br />

Time for<br />

transformation<br />

Covid-19 has exposed just how fractured South Africa’s democracy is,<br />

and how unequal we are as a society. We need rational, pragmatic<br />

choices from government, labour and business, says Busisiwe<br />

Mavuso, CEO of Business Leadership South Africa, on page 14. And<br />

so, in this issue of <strong>Opportunity</strong> magazine, we set out to offer practical<br />

advice in the sectors that the pandemic has impacted most on.<br />

The conventional wisdom of vertical integration as the ideal and sustainable<br />

model for oil refiners is being challenged. Choosing the right operating<br />

model and the required level of integration across the value chain will be<br />

crucial for improving margins and sustaining profitability in the volatile oil<br />

and gas market. Read more on page 12.<br />

If the South African gas market is to take off and thrive, significant<br />

drilling has to take place, says the new CEO of Petroleum Agency SA, Dr<br />

Phindili Masangane. A major discovery has been made at a site south-east<br />

of Mossel Bay called Brulpadda. Dr Masangane says, “The recent discovery<br />

by Total and its JV partners in Block 11B/12B (Brulpadda) is the first giant<br />

step in that direction.”<br />

Agricultural transformation in Africa must build social cohesion, create<br />

beneficial continental trade, provide a platform for global exports and, most<br />

importantly, help generate millions of jobs while pulling subsistence farmers<br />

out of poverty (page 18). <strong>Opportunity</strong> also looks at how we can improve<br />

public transport (page 26) and the engineering and constructions sectors<br />

(page 30).<br />

We all know that it is time to transform South Africa; perhaps Dr Mamphela<br />

Ramphele’s words (page 16) offer a place of where to begin: “Covid-19 has<br />

created an urgent imperative to transform our inequitable society into one<br />

governed by the values of ubuntu – that would help us understand that there<br />

is no ‘I’ without ‘We’. An ubuntu value-based society, with citizens that are<br />

liberated from the impositions of inferiority and superiority complexes, is<br />

urgently needed. Such a society would be driven by healthy relationships with<br />

self, family, community and wider society. Leadership that is self-liberated<br />

would emerge to lead the rebuilding of our broken public institutions in line<br />

with ubuntu values and the prescriptions of our Constitution.”<br />

www.opportunityonline.co.za<br />

Editor: Alexis Knipe<br />

Publishing director: Chris Whales<br />

Managing director: Clive During<br />

Online editor: Christoff Scholtz<br />

Designer: Simon Lewis<br />

Production: Lizel Olivier<br />

Ad sales:<br />

Venesia Fowler<br />

Gabriel Venter<br />

Julies Thaakirah<br />

Tennyson Naidoo<br />

Tahlia Wyngaard<br />

Administration & accounts:<br />

Charlene Steynberg<br />

Kathy Wootton<br />

Printing: FA Print<br />

PUBLISHED BY<br />

Global Africa Network Media (Pty) Ltd<br />

Company Registration No:<br />

2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road,<br />

Rondebosch 7700<br />

Postal address: PO Box 292,<br />

Newlands 7701<br />

Tel: +27 21 657 6200<br />

Fax: +27 21 674 6943<br />

Email: info@gan.co.za<br />

Website: www.gan.co.za<br />

No portion of this book may be reproduced without written consent of<br />

the copyright owner. The opinions expressed are not necessarily those of<br />

<strong>Opportunity</strong>, nor the publisher, none of whom accept liability of any nature<br />

arising out of, or in connection with, the contents of this book. The publishers<br />

would like to express thanks to those who support this publication by their<br />

submission of articles and with their advertising. All rights reserved.<br />

4 | www.opportunityonline.co.za

TEXTILES<br />

The beauty<br />

of mohair<br />

With more than 30 years of experience in the South African mohair and textile industry,<br />

South African Mohair Industries Limited (SAMIL) Natural Fibres has a fully integrated<br />

value chain including farming, processing, trading, yarn spinning and dyeing.<br />

<strong>Opportunity</strong> sat down with Michael Brosnahan,<br />

the CEO of SAMIL, to find out more about the<br />

mohair and textile industry.<br />

How do you view the short-, medium- and<br />

long-term future for SAMIL and the mohair industry?<br />

SAMIL and the mohair industry has suffered – and<br />

continues to suffer in the short term – depressed trading<br />

conditions due to Covid-19, but believe me, the mohair<br />

industry is as strong and resilient as both the fibre itself<br />

and the brave, industrious farmers who produce this<br />

magnificent fibre.<br />

What are the biggest challenges caused by Covid-19?<br />

In my view, the biggest challenges caused by Covid-19<br />

are related to ensuring the health and safety of all our<br />

employees while endeavouring to keep our business<br />

going. We have put in place, sadly at not too small a<br />

cost, all the measures required to keep our people as<br />

safe as practically possible while we continue to supply<br />

mohair to the world.<br />

Have any opportunities emerged from Covid-19?<br />

There are always opportunities, if you look hard<br />

enough. The opportunities for SAMIL came through the<br />

lockdown, as unbelievable as that may sound. During<br />

the lockdown, crafters and knitters globally took refuge<br />

in their art, some of them returning to their passion due<br />

to the extra time on their hands. The demand for hand<br />

knitting and crochet yarns increased dramatically, with<br />

the spin-off, please forgive the pun, being that many<br />

of the knitters and crafters have rediscovered their<br />

passion and now make time in their busy schedules to<br />

continue enjoying their hobby.<br />

What was required for SAMIL to become Responsible<br />

Mohair Standard (RMS) certified?<br />

SAMIL is well structured and organised, so the upgrade<br />

to RMS certified was relatively painless. This was due<br />

mainly to the dedication of my staff, in particular Evert<br />

Vermeulen, the head of Mohair Tops Trading Division who<br />

spearheaded the task team on implementation. The detail<br />

of what is required to become certified is contained in<br />

the RMS guidelines available from the Textile Exchange.<br />

What value does the RMS accreditation provide for<br />

mohair suppliers, textile manufacturers, retailers<br />

and consumers?<br />

The RMS accreditation is critical to all associated<br />

with the mohair value chain. The requirement for the<br />

certification is driven by the new environmentally<br />

consciousness consumer, who makes purchase<br />

decisions not only on price but moreover on their<br />

understanding of the ethicality of the manufacturing<br />

process. They want to know that the goods they intend<br />

to purchase have not harmed the environment in any<br />

way. This concern extends further to the welfare of<br />

the people producing the items and, in our case, the<br />

treatment of the animals who have produced the raw<br />

material for the goods.<br />

_____ ___ __ _ _<br />

The requirement for<br />

the RMS certification<br />

is driven by the new<br />

environmentally<br />

consciousness consumer<br />

___ __ __ ___ __ _ _<br />

What are the prospects for RMS?<br />

In my view, the RMS is not a fad, it is reality and it is<br />

here to stay. Very soon, mohair that is not produced by<br />

an RMS-accredited farmer will no longer be marketable.<br />

Today’s young consumer is not prepared to purchase<br />

goods that impact the world environment and, I am<br />

sure, they will instil this value in their children.<br />

___ __<br />

Michael Brosnahan,<br />

CEO, SAMIL<br />

____ __<br />

Mohair is a renewable<br />

natural resource<br />

that contributes to<br />

the Karoo’s longterm<br />

prosperity<br />

www.opportunityonline.co.za | 5

FOREWORD<br />

We don’t know,<br />

what we<br />

don’t know<br />

How does South Africa come out of the three evils of a recession,<br />

a ratings agency downgrade and the Covid-19 pandemic lockdown?<br />

As we ended 2019, the business community<br />

had laid plans for the New Year ahead, not<br />

knowing what was coming. Covid-19 laid bare<br />

our forecasting and plans for the road ahead.<br />

Within months South Africa would<br />

experience an unprecedented loss of jobs, businesses<br />

closing and austerity measures that cut to the very bone<br />

of economic activity.<br />

Social distancing became a norm, wearing masks and<br />

sanitising surfaces and hands is now a legal obligation<br />

in public spaces. Who would have thought this was<br />

coming just months earlier?<br />

Over the past eight months, SACCI has witnessed the<br />

damage within its own ranks. Our Trade Conditions<br />

Survey, which has for many years served as a barometer<br />

of the business community, lost some of the participants<br />

to the severe economic climate. According to the latest<br />

Quarterly Labour Force Survey Quarter 2 released by<br />

Statistics South Africa on 29 September 2020, the South<br />

African economy shed 2,2-million jobs.<br />

Against this background, SACCI had to do something<br />

to turn things around. We cannot rely on government to<br />

pull the country out of this malaise so the SACCI Board<br />

gave a directive that SACCI must filter this down to<br />

grassroots level by implementing programmes of action<br />

to assist our business sectors on a trajectory towards<br />

economic growth and sustainability.<br />

___ __ ___ __ _ _<br />

We cannot rely on<br />

government to pull<br />

the country out of<br />

this malaise so the<br />

SACCI Board gave a<br />

directive that SACCI<br />

must filter this down<br />

to grassroots level<br />

___ __ ___ __ _ _<br />

6 | www.opportunityonline.co.za

FOREWORD<br />

While we know that this is no easy task ahead, SACCI<br />

decided that it is the only way in assisting government<br />

to bring the economy back on stream and create jobs.<br />

The SACCI Board decided that 11 work streams<br />

should be created. The three fundamental areas raised<br />

in the formulation of an action plan must be centred on:<br />

Inclusivity<br />

Innovation<br />

Collaboration<br />

Significant among these action programmes are<br />

small business, mining, construction, manufacturing<br />

and agriculture.<br />

The Terms of References were developed, and<br />

support functions engineered from within SACCI’s own<br />

membership and the SACCI team.<br />

Leading experts from various business sectors,<br />

institutions and academia have volunteered to give of<br />

their time and expertise to help the country get back<br />

on its feet.<br />

This is a giant task but not impossible to achieve<br />

as the commitment is solid, and the involvement has<br />

been forthcoming as the people involved see this as<br />

impacting at a granular level and hence they are keen<br />

to participate.<br />

▲ ▲ ▲<br />

___ ___ __ _ _<br />

The road ahead will<br />

take us all on a path<br />

where hard decisions<br />

will need to be made<br />

___ __ ___ __ _ _<br />

The directive is that milestones<br />

will be set and reviewed regularly<br />

to track progress and ensure that<br />

the various workstreams remain<br />

on track.<br />

The road ahead will take us all<br />

on a path where hard decisions<br />

will need to be made. But, with<br />

the quality of people committed<br />

to this project, and the gravitas<br />

that these people carry, we are<br />

confident that changes will be<br />

made to stimulate the economy<br />

and our business community will<br />

work together with government,<br />

labour and civil society.<br />

These partnerships will ensure<br />

that the country’s economy grows<br />

from a solid platform and will be more resilient to the<br />

shocks of the past and future. By charting a roadmap,<br />

we will ensure a positive path, and produce gains in<br />

the sectors affected.<br />

SACCI further believes that this will build the<br />

confidence in the country to the extent that investors<br />

will review their strategies and return to South Africa<br />

as an investment destination.<br />

We conclude with an extension of our encouragement<br />

to government to remain firm in its commitment to root<br />

out and deal with corruption that has blighted our public<br />

sector and our business community. SACCI believes<br />

these workstreams have the opportunity to raise the<br />

hopes of all South Africans for a brighter future and<br />

together we can turn our economy around.<br />

Alan Mukoki,<br />

SACCI CEO<br />

www.opportunityonline.co.za | 7

TRADE<br />

Unlocking trade and transport<br />

facilitation bottlenecks<br />

Botswana, Namibia, South Africa and beyond.<br />

The governments of Botswana, Namibia and<br />

South Africa, recognising the need to eradicate<br />

poverty and place their countries on the path<br />

of sustainable economic development and<br />

growth, established the Trans Kalahari Corridor<br />

Management Committee (TKCMC). This move was<br />

influenced by the need to achieve the transport and<br />

trade facilitation objectives as well as deeper regional<br />

integration as espoused in the SACU, SADC and AUDA<br />

– NEPAD Agenda. In 2007, the Trans Kalahari Corridor<br />

Secretariat (TKCS) was established to coordinate the<br />

functions and decisions taken by the TKCMC. South<br />

Africa is the current chair of the TKCMC.<br />

The objectives of the TKCMC are to simplify crossborder<br />

transactions and customs operations along the<br />

Corridor; facilitate the movement of goods and persons<br />

on the TKC by simplifying and harmonising the<br />

requirements and controls that govern the movement of<br />

goods and persons with a view to reducing transportation<br />

costs and transit times; integrate the spatial, economic<br />

and transportation planning for the contracting<br />

parties; promote deeper integration by harmonisation<br />

of conflicting regulations and policies of the three<br />

countries in line with the SADC Regional Indicative<br />

Strategic Development Plan (RISDP); integration of<br />

trade, transport, logistics and travel systems of the three<br />

countries with the objective of providing quality services<br />

at minimal costs, thereby increasing competitiveness of<br />

the SADC and SACU region.<br />

In 2016, a new strategic plan was developed with<br />

a goal to have the TKCMC be the leading corridor in<br />

trade facilitation to achieve socio-economic integration<br />

and development. The strategy is underpinned by four<br />

pillars which are organisational efficiency; border<br />

management; stakeholder management; and safety and<br />

security. The strategic objectives for the TKCMC work<br />

programme include accelerating economic integration<br />

and development; enhancing stakeholder capacity; having<br />

a responsive border regulatory framework; as well<br />

as improving border infrastructure, road safety and<br />

security along the TKC, road infrastructure, stakeholder<br />

relations and communication infrastructure.<br />

The TKCMC work programme is a robust trade<br />

facilitation programme that supports effective trade<br />

facilitation and eventually lower trading costs. The<br />

TKCMC is cognisant of the fact that transport operators<br />

and traders choose their routes based on the performance<br />

of the corridor, and these performance indicators<br />

are the distance-related operating costs; travel time;<br />

predictability of transit; reliability of services along the<br />

corridor; safety and security as well as the “hospitability”<br />

of the route. These are therefore paramount for the TKC<br />

to remain a corridor of choice and thereby achieve its<br />

vision of being a leading corridor in trade facilitation for<br />

socioeconomic integration and development.<br />

Covid-19 impacted the TKCMC work programme. Most<br />

programmes could not be executed because negotiations<br />

could not continue as the member states’ focus was on<br />

addressing the spread of the coronavirus. Movement<br />

on the corridor was also affected as borders were only<br />

open for essential goods. However, as restrictions eased<br />

all types of cargo could move. The TKCS is optimistic<br />

that the downward spiral in growth and volumes due to<br />

Covid-19 by all TKCMC member states and the region<br />

will change for the better as countries ease their Covid-19<br />

restrictions. This recovery will be influenced by:<br />

• Regional integration (harmonisation of conflicting<br />

regulations. Covid-19 has exposed this problem)<br />

• Development of regional industrial policy (accelerate<br />

the industrialisation with a focus to improve local<br />

production capacity within the region)<br />

• Innovation in the facilitation of trade and SMART<br />

corridors (less human contact is required, virtual<br />

queuing of vehicles at the borders, pre-clearance,<br />

cargo and vehicles)<br />

• Linking Africa to allow Africa to trade with Africa<br />

• African Continental Free Trade Area (AfCFTA)<br />

• Need to build back better with private sector as the<br />

driving force. The resilience of the private sector<br />

• Deliberate effort to support private sector empowerment<br />

recovery schemes (youth and women).<br />

The TKCMC’s<br />

objectives<br />

are to<br />

simplify<br />

crossborder<br />

transactions<br />

and customs<br />

operations<br />

along the<br />

Corridor<br />

___ __<br />

Leslie Mpofu,<br />

Executive Director<br />

8 | www.opportunityonline.co.za

BUSINESS UPDATE<br />

BUSINESS UPDATE<br />

News & snippets<br />

Industry Industry insights insights from from the the past past quarter quarter<br />

Volatility in in manufacturing<br />

The<br />

The<br />

latest<br />

latest<br />

production<br />

production<br />

data<br />

data<br />

for<br />

for<br />

the<br />

the<br />

manufacturing<br />

manufacturing<br />

sector released by Statistics South Africa reflects<br />

the<br />

the<br />

resilience<br />

resilience<br />

of<br />

of<br />

the<br />

the<br />

Metals<br />

Metals<br />

and<br />

and<br />

Engineering<br />

Engineering (M&E)<br />

(M&E)<br />

cluster<br />

cluster<br />

of<br />

of<br />

sub-industries<br />

sub-industries<br />

on<br />

on a<br />

month-on-month<br />

month-on-month basis,<br />

basis,<br />

says says Steel Steel and and Engineering Engineering Industries Industries Federation Federation of of<br />

Southern Southern Africa Africa Chief Chief Economist Michael Ade. The The<br />

figures painted a worrisome annual trend as the<br />

recession deepened amid the pandemic. Unadjusted<br />

recession deepened amid the pandemic. Unadjusted<br />

manufacturing<br />

manufacturing<br />

production<br />

production<br />

decreased<br />

decreased<br />

on<br />

on<br />

an<br />

an<br />

annual<br />

annual<br />

basis<br />

basis<br />

by<br />

by<br />

10,8%<br />

10,8%<br />

in<br />

in<br />

August<br />

August<br />

when<br />

when<br />

compared<br />

compared<br />

with<br />

with<br />

August<br />

August<br />

2019.<br />

2019.<br />

The<br />

The<br />

largest<br />

largest<br />

contributors<br />

contributors<br />

to<br />

to<br />

this<br />

this<br />

decrease<br />

decrease<br />

year-on-year<br />

year-on-year<br />

in<br />

in<br />

the<br />

the<br />

M&E<br />

M&E<br />

industry<br />

industry<br />

were<br />

were<br />

the<br />

the<br />

motor<br />

motor<br />

subindustries,<br />

which which recorded recorded -30.6%, -30.6%, followed followed by by the the<br />

sub-<br />

steel, metals and and machinery sub-industries at at -11.7%. -11.7%.<br />

Supporting the DRIVING South African SOUTH aerospace, AFRICA’S defence AEROSPACE and marine INDUSTRY manufacturing sectors<br />

The Aerospace Industry Support Initiative (AISI) is a South<br />

African government initiative with the specific aim of improving<br />

the competitiveness of the local aeronautics, space, defence<br />

and marine advanced manufacturing sectors.<br />

The AISI takes its strategic direction from government’s<br />

objectives with a specific emphasis on industrialisation of<br />

technology and technology-based supplier development.<br />

The Department of Trade, Industry and Competition<br />

(the dtic) utilises the CSIR and its position in the National<br />

System of Innovation (NSI) as an independent, strategic<br />

directed R&D entity to give industry access to national<br />

expertise and infrastructure in order to improve its capabilities<br />

and offerings.<br />

Established in in 2006, the the AISI AISI has has supported the the South South African African<br />

industry both directly and and indirectly through interventions<br />

implemented by by the the following programmes:<br />

• Technology-based Technology-Based Supplier Development<br />

• Industry Development and Technology Support<br />

• Marine Manufacturing, Associated Services and and Other<br />

Manufacturing Industries<br />

Supplier Development Programme<br />

• Supplier Sector Strategic Development Support<br />

Programme<br />

Initiatives<br />

• Sector Coordination, Strategic Promotion Support<br />

Initiatives and Awareness<br />

See • Coordination, page 9 of this issue Promotion for<br />

more and information Awareness about AISI<br />

Building PPE capacity<br />

Owned and managed by Ntombekaya (Ntombie)<br />

Nonxuba, Rise Uniforms is a manufacturer and<br />

supplier of high-quality uniforms, corporate wear<br />

and medical PPE. Based in Philippi, Cape Town,<br />

they manufacture locally as per client specifications<br />

and supply nationally. In operation since 2007 and<br />

formally registered in 2010, the company has an<br />

established track record of consistently supplying<br />

uniforms to to well-known brands such as Pick n Pay<br />

and and Boxer superstores.<br />

Beyond simply meeting a product need, Rise<br />

Uniforms is is 100% black female-owned and<br />

employs employs 52 52 people from the township. With a<br />

strong strong desire desire to to see see transformation in in the Philippi<br />

area,<br />

area,<br />

Nonxuba<br />

Nonxuba<br />

deliberately<br />

deliberately<br />

chose<br />

chose<br />

this<br />

this<br />

location<br />

location<br />

for the production facility and offers a significant<br />

number<br />

number<br />

of<br />

of<br />

employment<br />

employment<br />

and<br />

and<br />

business<br />

business opportunities<br />

opportunities<br />

in<br />

in<br />

an<br />

an<br />

area<br />

area<br />

that<br />

that<br />

has<br />

has a<br />

staggering<br />

staggering 38%<br />

38%<br />

unemployment rate. They also offer training<br />

opportunities to groups of women. Over the years,<br />

opportunities to groups of women. Over the years,<br />

Rise has improved their production processes and<br />

Rise has improved their production processes and<br />

built their production capacity substantially.<br />

built their production capacity substantially.<br />

Find us on www.chemicorp.co.za

OIL AND GAS<br />

The start of<br />

something<br />

Light oil and gas condensate<br />

discoveries could be a<br />

game-changer for South<br />

African oil and gas<br />

BiG<br />

If the South African gas market is to take off and<br />

thrive, significant drilling has to take place, says<br />

the new CEO of Petroleum Agency SA, Dr Phindili<br />

Masangane. A major discovery has been made at a<br />

site south-east of Mossel Bay called Brulpadda. Dr<br />

Masangane says, “The recent discovery by Total and its<br />

JV partners in Block 11B/12B (Brulpadda) is the first<br />

giant step in that direction.”<br />

Total’s first attempt to drill the Brulpadda Prospect<br />

in 2014 was suspended before reaching target due to<br />

difficulties experienced by the drilling rig in the harsh<br />

deepwater environment. After an extensive review of<br />

the challenging surface conditions, Total contracted<br />

the Odfjell Deepsea Stavanger semi-submersible rig to<br />

drill the Brulpadda-1AX re-entry well commencing in<br />

December 2018.<br />

The Brulpadda well was drilled in approximately<br />

1 400 metres of water by the Odfjell Deepsea Stavanger<br />

semi-submersible rig. The well targeted two objectives<br />

in a deep marine fan sandstone system within combined<br />

stratigraphic/structural closure. Following the success<br />

of the main objective, the well was deepened to a<br />

final depth of 3 633 metres and was successful in the<br />

Brulpadda-deep prospect.<br />

The well encountered oil pay and a total of 57 metres<br />

of net gas condensate pay over two Middle to Lower<br />

Cretaceous high-quality reservoirs. Core samples were<br />

taken in the upper reservoir, and a comprehensive<br />

logging and sampling programme was performed over<br />

both reservoirs. The success at both the Brulpadda<br />

primary and secondary targets significantly de-risks<br />

other similar prospects on Block 11B/12B.<br />

In March and April 2019, the operator acquired 570<br />

square kilometres of 3D seismic with the Polarcus<br />

Asima vessel. The first phase of 3D seismic covered<br />

the Brulpadda discovery and the Luiperd prospect. The<br />

fully processed 3D seismic dataset validates the direct<br />

hydrocarbon indicators and thick reservoir development<br />

___ __<br />

The success at<br />

both the Brulpadda<br />

primary and<br />

secondary targets<br />

significantly de-risks<br />

other similar<br />

prospects on<br />

Block 11B/12B.

OIL AND GAS<br />

at the main objective and illuminates the deep target,<br />

confirming the large resource potential of the Paddavissie<br />

Fairway. The 3D seismic also increases PASA’s confidence in<br />

the sedimentological and structural interpretation and has<br />

been integral in selecting the location for the next exploration<br />

well on Block 11B/12B, Luiperd-1.<br />

The joint venture partnership continues to analyse and<br />

integrate the fully processed 3D seismic with the analysis of<br />

the core samples and the modular formation dynamics tester<br />

(“MDT”) samples. The core indicates a high net to gross in<br />

the main objective with good intergranular porosity and<br />

permeability. The pressure, volume and temperature (“PVT”)<br />

analysis performed on the MDT samples confirmed the high<br />

liquid yield in the main gas condensate zone of the main and<br />

deep reservoirs.<br />

In July 2019, the operator of Block 11B/12B, Total, executed<br />

a multi-well drilling contract with Odfjell Drilling for the<br />

Deepsea Stavanger semi-submersible rig, the same rig that<br />

drilled the Brulpadda discovery in February 2019. The rig<br />

recently mobilised to South Africa from Norway.<br />

In May 2020, the Block 11B/12B<br />

joint venture received the fasttrack<br />

2D seismic dataset from<br />

Shearwater GeoServices Holding<br />

AS for the 7 033 linear kilometre<br />

2D seismic programme completed<br />

earlier in the year on Block<br />

11B/12B, where the Company<br />

holds an effective 4.9% interest.<br />

Initial interpretative work has<br />

confirmed the Kloofpadda Play<br />

Trend, which consists of several large and encouraging leads.<br />

The Block 11B/12B joint venture expects the fully processed<br />

2D seismic dataset in late August 2020 and will then begin full<br />

prospect analysis for the eastern part of the block.<br />

In June 2020, the Block 11B/12B joint venture received the<br />

fast-track 3D seismic dataset from Petroleum Geo-Services<br />

ASA (“PGS”) for the 2 305 square kilometres 3D seismic<br />

programme completed earlier in the year on Block 11B/12B.<br />

Initial interpretive work has identified some additional leads,<br />

including a potential northern extension to the Luiperd<br />

prospect.<br />

Africa Energy holds a 4.9% effective interest in the<br />

Exploration Right for Block 11B/12B. The Company owns 49% of<br />

the shares in Main Street 1549 Proprietary Limited, which has<br />

a 10% participating interest in the block. Total as the operator<br />

holds a 45% participating interest in Block 11B/12B, while<br />

Qatar Petroleum and CNRI hold 25% and 20%, respectively.<br />

“Further development of the discovery is highly dependent<br />

on the success of this further drilling,” attests Dr Masangane.<br />

“Possible development could see condensate being piped to the<br />

PetroSA facility in Mossel Bay,” she adds, but these decisions<br />

are ultimately up to the operator, Total, and its partners.<br />

DR PHINDILE C MASANGANE<br />

PHD CHEMISTRY, MBA, BSC. (MATHEMATICS & CHEMISTRY)<br />

Dr Masangane was appointed as the CEO of the South African<br />

upstream oil and gas regulatory authority, Petroleum Agency South<br />

Africa, in May 2020.<br />

Before then, Dr Masangane was an executive at the South<br />

African state-owned energy company, CEF (SOC) Ltd, which is the<br />

holding company of PASA. Dr Masangane was responsible for clean,<br />

renewable and alternative energy projects. In partnership with private<br />

companies, she led the development of energy projects including the<br />

deal structuring, project economic modelling and financing on behalf<br />

of the CEF Group of Companies.<br />

Her responsibilities also include supporting the national government<br />

in developing energy policy and regulations for diversifying the<br />

country’s energy mix. In 2019, Dr Masangane was Head of Strategy<br />

for the CEF Group of Companies where she led the development<br />

of the Group’s long-term strategic plan, Vision 2040+ as well as<br />

the Group’s gas strategy. From 2010 to 2013, Dr Masangane was<br />

a partner and director at KPMG, responsible for the Energy Advisory<br />

Division. In this capacity, she successfully led the capital raising of<br />

$2-billion for the Zimbabwe power utility, ZESA/ZPC’s hydro and coal<br />

power plants expansion programmes.<br />

PASA has successfully attracted major explorers to South Africa<br />

and facilitated the acquisition of many new large<br />

seismic surveys and some exploratory drilling,<br />

through a period affected by legislative<br />

issues and a major oil price crash.<br />

“PASA’s challenge is to ensure that both<br />

international and local energy companies<br />

see this value proposition with South Africa<br />

and choose our country. In this low oil and<br />

gas price environment, companies are inclined<br />

to cut back on capital investments and we<br />

need to partner with them to sustain the<br />

momentum,” says Dr Masangane.<br />

___ __ _<br />

Dr Phindile C. Masangane

OIL AND GAS<br />

Refining 2021: who<br />

will be in the game?<br />

To keep up with change, refineries will have to restructure, strategically reposition their assets, or leave<br />

the market. With one in five oil refineries expected to cease operations over the next five years, choosing<br />

the right operating model and level of integration will be crucial for survival and sustained profitability.<br />

These stark prospects are among the findings of<br />

a recent Kearney study of the global refining<br />

market. In North America and Western Europe,<br />

the current trend of refinery closings is expected<br />

to continue, with one in five refining assets being<br />

squeezed out of the market over the next five years.<br />

Meanwhile, the boom in demand in Asia and the Middle<br />

East will lead to substantial changes in capacity and<br />

partnership structures.<br />

The conventional wisdom of vertical integration as<br />

the ideal and sustainable model for refiners is being<br />

challenged. Choosing the right operating model and<br />

the required level of integration across the value chain<br />

– for each asset and each region – will be crucial for<br />

improving margins and sustaining profitability in a<br />

volatile market. For assets that are not financially viable,<br />

regardless of their model, a decision about whether to<br />

exit will need to be made early on to prevent financial<br />

losses later in the decade.<br />

VALUE DRIVERS IN REFINING<br />

In the face of such rapid regional and global change,<br />

refiners need to re-examine what creates value in their<br />

industry to ensure they capture the most value from<br />

their asset portfolios. The value an asset generates<br />

depends on factors related to input, output and the<br />

asset itself.<br />

Value related to input factors includes crude<br />

fungibility, trading and hedging, energy imports and<br />

blending components. Output value relates to the choice<br />

of product and market sectors, for example, lubricants,<br />

petrochemicals, specialities (aviation and marine), or<br />

fuel and energy (domestic or industrial). Asset value<br />

relates to scale and technology, the fiscal and regulatory<br />

(regime) environment, supply chain management and<br />

slate flexibility.<br />

The value derived from each barrel of oil consumed<br />

varies from day to day and over the long term, as does<br />

the risk to that value. Risk factors relate to supply<br />

and demand fluctuations and arbitrage, price and<br />

time exposure, volatility and availability, political<br />

and regulatory instability and uncertainty, and<br />

interdependencies along the value chain.<br />

In such a complex and changing environment,<br />

refiners must be confident that they are participating in<br />

the market most productively – ensuring that a refinery<br />

asset has both the right flexibility and the ability to<br />

capture multiple marketing options.<br />

OPERATING MODELS FOR REFINERS — A DIVERSE PALETTE<br />

Four principal operating models are currently in play<br />

in the industry, with no single model dominating. The<br />

picture is evolving constantly, as companies adopt<br />

models they feel are best suited to the times. The<br />

operating models can be defined briefly as follows:<br />

• Upstream integration. A single source of crude oil<br />

accounts for more than 50% of the upstream integrated<br />

refiner’s supply; the crude source can be either equity<br />

crude or a long-term contractual arrangement.<br />

___ __<br />

Adapting to local or<br />

regional conditions,<br />

while making the most<br />

of global synergies, is<br />

the name of the game.<br />

12 | www.opportunityonline.co.za

Refinery value drivers<br />

OIL AND GAS<br />

Input<br />

Crude fungibility<br />

• Local or regional<br />

balances<br />

• Pipeline or imports<br />

by ship<br />

• Multiple asset<br />

optimisation<br />

Trading and hedging<br />

• Feedstock<br />

• Products<br />

• Currency<br />

Energy imports<br />

• Electricity<br />

• Steam<br />

Blending components<br />

• Gasoline<br />

• Biofuel<br />

• Gas to liquids<br />

Source: A.T. Kearney analysis<br />

Asset-related<br />

Output<br />

Scale and technology<br />

• World-scale or<br />

sub-scale<br />

• Distillation and<br />

conversion<br />

• Technology<br />

Fuel and energy<br />

• Merchant only<br />

versus retail<br />

• Export versus<br />

local sales<br />

Fiscal and<br />

regulatory regime<br />

• Tax<br />

• Regulation<br />

• Environment<br />

Specialties<br />

• Specialist markets<br />

(marine, aviation,<br />

asphalt) with<br />

dedicate assets<br />

• Brand equity<br />

Supply chain<br />

management<br />

• Location<br />

• Logistics infrastructure<br />

• Working capital<br />

optimisation<br />

Petrochemicals<br />

• Which value chain<br />

•Joint venture or<br />

sole ownership<br />

• Export versus<br />

local sales<br />

State flexibility<br />

• Dedication of<br />

technology<br />

• Ability to<br />

change baskets<br />

• Operational flexibility<br />

Lubricants<br />

• Base oil plant<br />

• Blending plant<br />

and storage<br />

www.kearney.com<br />

• Merchant refiner. Lacking both upstream and<br />

downstream integration, the merchant refiner has<br />

the flexibility to react quickly to both crude and<br />

downstream supply opportunities and to adjust<br />

operations or integrate into a larger logistics hub.<br />

• Downstream integration. Dedicated marketing<br />

channels take more than 50% of the downstream<br />

integrated refiner’s production. These trades are<br />

secured either through equity or long-term contracts.<br />

• Vertical integration. Fulfilling the requirements for<br />

upstream and downstream integrated refiners at<br />

the same time, the vertically integrated refiner can<br />

capture value by making the most of advantages across<br />

the value chain.<br />

MAXIMISING VALUE: DIFFERENT STRATEGIES<br />

FOR DIFFERENT REGIONS<br />

In such a diverse landscape, there is no one-size-fitsall<br />

approach to business. Adapting to local or regional<br />

conditions, while making the most of global synergies,<br />

is the name of the game. The only given in this shifting<br />

landscape is that refining excellence is imperative in all<br />

input, output and asset-related dimensions.<br />

Eastern European and Russian refiners are investing<br />

in technologies and scale to overcome the limitations of<br />

their dated structures and to pursue asset excellence.<br />

However, infrastructure and output issues around<br />

the still-underinvested and not yet upgraded refining<br />

technology landscape are hindering integration with<br />

the local market and are favouring fuels export instead.<br />

Asia Pacific has the highest activity in terms of<br />

numbers of refineries opened and closed, even as small,<br />

polluting and less efficient refineries are being closed<br />

and world-scale state-of-the-art facilities are coming<br />

online. In this highly attractive market, international<br />

oil majors are becoming much more involved in joint<br />

ventures to build petrochemical plants, attracted by<br />

relatively high economic growth in many countries.<br />

THE ONLY CERTAINTY: A REQUIREMENT FOR EXCELLENCE<br />

We expect further significant upscaling in global<br />

refining, which will result in divestment and closure of<br />

lagging assets in North America and Western Europe.<br />

The changing global supply-and-demand situation will<br />

push Middle East refiners to intensify their partnering<br />

with Asia Pacific players.<br />

Meanwhile, more refineries in Asia Pacific – especially<br />

China and India – will integrate with petrochemical<br />

plants, as a combined build-or-buy reverse integration.<br />

Changes in crude availability and discounts will affect<br />

refining capacity and profitability of some players in<br />

the region.<br />

Companies can respond to these changes by choosing<br />

among different operating models and methods of<br />

value-chain integration. Each model has its strengths<br />

and weaknesses; for instance, the pure merchantrefining<br />

model ranges from vulnerable to high volatility<br />

in absolute oil price.<br />

For new investors, integration with a competitively<br />

positioned upstream player or a secure downstream<br />

business will be important. Deep integration of refining<br />

with petrochemicals can add value but comes with its<br />

complexity and economic factors..<br />

The only given in this shifting landscape is that<br />

refining excellence is imperative in all input, output,<br />

and asset-related dimensions. The market gives no-one<br />

a free ride, and it has become more important than ever<br />

to manage risk exposure.<br />

___ __<br />

The value derived<br />

from each barrel of<br />

oil consumed varies<br />

from day to day<br />

and over the long<br />

term, as does the<br />

risk to that value.<br />

www.opportunityonline.co.za | 13

LAUREATE LEADERS<br />

Heal our people,<br />

lead our land<br />

Busisiwe Mavuso and Dr Mamphela Ramphele<br />

declare that national interest must be placed<br />

first. It is time to transform South Africa.<br />

Covid-19 has exposed just how fractured South<br />

Africa’s democracy is and how unequal we are<br />

as a society. We need rational, pragmatic choices<br />

from government, labour and business, says<br />

Busisiwe Mavuso, CEO, Business Leadership<br />

South Africa. “If this pandemic doesn’t make us, as<br />

leaders, carefully think about how we sustainably<br />

start to deal with our structural economic flaws, then<br />

I don’t know what will.” Mavuso avers the 2020 economic<br />

outlook was bleak with a projected 0.3% economic<br />

growth. Unemployment data recently released a recorded<br />

2.2-million job losses in the second quarter of the<br />

year, and that the economy shrank simultaneously by<br />

an annualised 51%.<br />

South Africa is hampered in its response to the<br />

pandemic because many citizens lack access to<br />

running water, have no money for sanitiser, and live in<br />

overcrowded housing.<br />

Countries that will bounce<br />

back quickly are those<br />

with a “diamond” economic<br />

structure, with<br />

an 80% middle class.<br />

“It is the middle class<br />

that carries the economies,<br />

not the rich,”<br />

articulates Mavuso.<br />

“The biggest ticking<br />

time bomb in this country is inequality, which<br />

undermines social stability, and means the quest of<br />

attaining a sustainable and conducive environment<br />

within which business should operate will continue to<br />

be elusive. It is for this reason that, as business, we need<br />

to be more intentional and deliberate about the role we<br />

play in society.<br />

“The question we need to be asking is what now,<br />

where to from here, and what is required from each<br />

of the social partners in moving the country forward.<br />

All of our efforts need to be geared towards economic<br />

recovery, and what the country needs right now is<br />

rational, pragmatic choices to guide our actions.”<br />

Mavuso acknowledged that government controls the<br />

policy environment within which all operate. “We need<br />

the government to come up with a president-led and<br />

cabinet-backed plan that we can all get behind with<br />

a common issue.” Nedlac partners had presented the<br />

president with a proposed economic recovery strategy,<br />

and “what is required now is clear and decisive<br />

leadership from the top”.<br />

Businesses can choose to work with fewer people,<br />

or with more machines, to increase productivity. “A<br />

great deal of cost is created by regulation. Employers<br />

spend a great deal on labour disputes that end up in<br />

the CCMA or court, a lot of production is lost to strikes,<br />

and many employers sit with unproductive or even<br />

destructive staff members because it is too difficult<br />

___ __<br />

Countries that will<br />

bounce back quickly<br />

are those with a<br />

“diamond” economic<br />

structure, with an<br />

80% middle class.<br />

“It is the middle<br />

class that carries<br />

the economies,<br />

not the rich,”<br />

articulates Mavuso.<br />

Let us agree that as a country we seem to<br />

lack the political courage to address some<br />

of the stringent labour regulations, and to<br />

have an honest and frank discussion with<br />

our labour constituents in this regard

LAUREATE LEADERS<br />

to fire them.” An economy able to quickly replace<br />

unproductive workers at minimal cost will be one that<br />

employs many more workers, because on average they<br />

will be more productive, and the all-in cost of hiring<br />

them would be lower.<br />

“Let us agree that as a country we seem to lack<br />

the political courage to address some of the stringent<br />

labour regulations, and to have a honest and frank<br />

discussion with our labour constituents in this<br />

regard. It is about time that labour came to the party<br />

by working with business to preserve and create more<br />

jobs. There needs to be serious consideration around<br />

short time and amendment of some of the rigid labour<br />

regulations.” [Short time is working fewer hours as an<br />

alternative to retrenchment.]<br />

“South Africa’s social injustice is business’ crisis<br />

as much as it is the government’s crisis. It is our<br />

crisis because, as a grouping that has levers to<br />

economic power, we have a special responsibility<br />

to work firmly towards this agenda. Let us agree,<br />

as business, that some things are bigger than selfinterest<br />

and the profit motive. And those are issues of<br />

national interest that need to be elevated above all,”<br />

Mavuso concludes.<br />

“It cannot just be left to government to fix our<br />

structural inequalities as a country because,<br />

unfortunately for us, government’s failure is South<br />

Africa’s failure. And South Africa’s failure is business’<br />

failure. As the adage goes, show me a failed state, and<br />

I’ll show you a failed nation.”<br />

___ __<br />

“Let us agree, as<br />

business, that some<br />

things are bigger<br />

than self-interest and<br />

the profit motive.<br />

And those are issues<br />

of national interest<br />

that need to be<br />

elevated above all.”<br />

The Covid-19 crisis offers South Africans opportunities to tackle the unfinished agenda of transforming our society into a<br />

more equitable, resilient and prosperous democracy that promotes the wellbeing of all people and our planet. This call to<br />

action was made by academic, businesswoman and political thinker, Dr Mamphela Ramphele, co-founder of ReimagineSA.<br />

The greatest leaders in extraordinary times in<br />

world history are not necessarily those who had<br />

demonstrated their capacity to lead in normal<br />

times, asserts Dr Rhamphele. “On the contrary,<br />

leaders who rise to the demands of extraordinary<br />

crises tend to be those willing to take the risk to be<br />

creative, inventive and courageous. Such leaders<br />

succeed because they dare to break from the known<br />

to the unknown, from the familiar to the unfamiliar,<br />

from traditional to non-traditional ways to open up new<br />

pathways to more promising futures.”<br />

LEADERSHIP IN CHALLENGING TIMES<br />

Racism, sexism and inequity “that have reared their<br />

ugly heads with a vengeance over the past few years”<br />

are warning signs that unless we address these legacy<br />

issues, future generations will be hampered by the<br />

burden of these ghosts.<br />

Corporate South Africa can lead the charge in this<br />

healing work as businesses return to the workplace,<br />

says Dr Ramphele. “There is an imperative to initiate<br />

processes of deep conversation in safe spaces between<br />

leaders, managers and workers about how to work<br />

together to create a new normal in the workspace.<br />

Healing conversations have to go beyond the wounds<br />

of the past to embrace the fragilities in work, family,<br />

community and public life that Covid-19 has laid bare.<br />

“Critical, responsible and accountable citizenship<br />

is a key success factor of stable societies across the<br />

world. We now know that where there is trust between<br />

people in the workplace, productivity, creativity and<br />

innovation thrive.”<br />

LEADING THE EMERGENCE FROM POST-COVID EMERGENCY<br />

Humanity is consuming 1.7 times the resources we<br />

should, and the world is approaching a tipping point<br />

on climate change. Protecting the future of human<br />

civilisation and the wellbeing of our planet requires<br />

dramatic interventions. These include human and<br />

economic transformation, with a radical overhaul of<br />

corporate governance, finance, policymaking and<br />

energy systems towards greater transparency and<br />

accountability. We need to address three obstacles:<br />

• Shareholder- instead of stakeholder-driven business<br />

• Finance used in inadequate and inappropriate ways<br />

• Governance based on outdated economic thinking<br />

and faulty assumptions<br />

Enterprises need to listen to trade unions and<br />

workers’ collectives, consumer advocates and others in<br />

the rest of society. Corporate governance must reflect<br />

stakeholders’ needs instead of shareholders’ whims.<br />

Government assistance to business should be less about<br />

subsidies, guarantees and bailouts, and more about<br />

building partnerships. Strict requirements should be<br />

attached to any corporate or state-owned enterprise<br />

bailouts so that taxpayers’ money is used productively<br />

and generates long-term public value.<br />

“We need to reimagine and rebuild governance<br />

systems from the local, provincial and national levels<br />

and to strengthen critical citizenship to ensure that<br />

we, the people, relentlessly demand accountability<br />

in a responsible manner within the ambit of the law.<br />

Destruction of public property in the name of public<br />

anger and rage must end. Citizen accountability must<br />

rest on taking ownership of these public assets and<br />

www.opportunityonline.co.za | 15

LAUREATE LEADERS<br />

_____ __ ___ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _<br />

Leaders who rise to the demands of extraordinary<br />

crisis tend to be those willing to take the risk<br />

to be creative, inventive and courageous<br />

___ __ ___ __ _ _ _ _ _ _ _ _ _ _ _ _<br />

needs to be complemented by severe punishment for<br />

those who continue to be destructive.”<br />

Dr Ramphele advocates robust plans for a transition<br />

to renewable energy, with timelines towards zero<br />

emissions. “We have much to gain by kick-starting<br />

our economy through accelerating investments in<br />

enterprises that promote regenerative economic<br />

production systems.”<br />

South African SMMEs are largely in survival mode.<br />

We require nimble and integrative approaches that<br />

collapse the bureaucracy of existing organisations into<br />

a high-impact platform to identify and significantly<br />

invest financial and business skills support, she says.<br />

We need to move away from GDP as a measure of<br />

progress. “GDP is an inadequate measure given that it<br />

largely accounts for, and values, only consumption. GDP<br />

does not consider the ecological costs in the production<br />

of goods and services that have a major impact on the<br />

wellbeing of people and our planet.”<br />

Public services should be reimagined to ensure<br />

high-quality, sustainable solutions. “The pernicious<br />

tender system that has turned public servants into<br />

administrators of interminable tender processes<br />

needs to be ended.” Social and physical infrastructure<br />

development must be driven by skilled personnel, with<br />

capable leaders at local, provincial and national levels<br />

to ensure that they can negotiate value for money for all<br />

public-private partnerships.<br />

“We urgently need to transform and revitalise<br />

infrastructure to kick-start our moribund economy. Wellplanned<br />

and well-executed infrastructure development<br />

programmes are the only guarantor of training<br />

opportunities for the millions of young unemployed<br />

people to become artisans and maintenance workers.”<br />

A FAILING EDUCATION WHEN EXCELLENCE IS ATTAINABLE<br />

Our education system is the best-resourced in Africa,<br />

yet by all measures is among the worst performers<br />

globally. In the 2018-2019 fiscal year, 16.5% of<br />

government expenditure went to basic education;<br />

overall, 20% of our national resources are spent on<br />

basic and higher education annually, yet we have “a<br />

hopelessly underperforming system that has failed<br />

generations of young people since 1994”.<br />

“It would be much cheaper to let go of all default<br />

teachers, 50 years and older, with attractive packages.<br />

We would then be able to hire young people from our<br />

higher education and training system, who are assessed<br />

to have the aptitude and commitment to become 21stcentury<br />

teachers. In-service training of scores of young<br />

people would enable us to reimagine and build a 21stcentury<br />

education system.”<br />

Dr Ramphele concludes: “Covid-19 has created an<br />

urgent imperative to transform our inequitable society<br />

into one governed by the values of ubuntu – that<br />

would help us understand that there is no ‘I’ without<br />

‘We’. An ubuntu value-based society, with citizens<br />

that are liberated from the impositions of inferiority<br />

and superiority complexes, is urgently needed. Such<br />

a society would be driven by healthy relationships<br />

with self, family, community and wider society.<br />

Leadership that is self-liberated would emerge to<br />

lead the rebuilding of our broken public institutions<br />

in line with ubuntu values and the prescriptions of<br />

our Constitution.”<br />

___ ___<br />

“We have much to gain<br />

by kick-starting our<br />

economy through<br />

accelerating investments<br />

in enterprises that promote<br />

regenerative economic<br />

production systems.”

GLOBAL TRADE<br />

More than beer<br />

and chocolates<br />

Flanders, the northern Dutch-speaking region of Belgium, has a lot to offer<br />

South African companies that want to enter the European market.<br />

Since the Middle Ages, Flanders was a textile<br />

region, making tapestries and clothing. The<br />

textile sector diversified into flooring products<br />

from carpets to wooden flooring, technical textiles<br />

and artificial grass. Flanders is now expanding<br />

in new areas of expertise such as smart textiles and new<br />

materials, where for example, microchips are integrated<br />

in the textile fabrics.<br />

In the golden Sixties, Flanders was successful in<br />

attracting multinational chemical companies to the port of<br />

Antwerp. The port is an ideal gateway to the international<br />

markets and the European hinterland. The different plants<br />

are interconnected with pipelines and connected with<br />

other ports (such as Zeebrugge and Amsterdam) making it<br />

a very efficient production location. Sasol of South Africa is<br />

present in Flanders with a distribution facility in Antwerp.<br />

Another wave of investments in the Sixties came from<br />

the automotive sector. Today Volvo (XC40 model) and<br />

Audi (E-Tron model) in the Brussels region have flexible<br />

production plants. Flanders also attracts automotive<br />

suppliers as well as truck and coach/bus manufacturers.<br />

Volvo trucks has the largest manufacturing plant in Ghent.<br />

New investments also stem from the pharmaceutical<br />

sector. The pharmaceutical development started in<br />

1<strong>95</strong>3 with Dr Paul Janssen, who founded Janssen<br />

Pharmaceuticals in Beerse. His challenge was to merge<br />

pharmacology and chemistry knowledge: 80 medicines<br />

were discovered in different fields, including Opiod<br />

(Fentanyl – pain medication), Mikonazole (Daktarin<br />

– antifungal medication) and Loperamide (Imodium –<br />

diarrhea medication) to name a few.<br />

Green biotech was introduced to Flanders by the<br />

company PGS (Plant Genetic Systems) in 1992. The<br />

founders, Prof Mantagu and Dr Jeff Schell, were the first<br />

to develop plants resistant to insects, pests and herbicides<br />

by genetically engineering the plants. Many of the corn,<br />

cotton, yellow maize and soybeans currently available in<br />

South Africa are GM (genetically modified) crops.<br />

Medical biotechnology (red biotech) has developed<br />

rapidly in Flanders, mostly at the five universities and<br />

four academic hospitals for clinical trials. More than 140<br />

companies have been formed over the years.<br />

In the ICT space, Flanders is one of the worldwide pioneers<br />

in nanotechnology (chip technology) thanks to the<br />

InterUniversity Micro Electronics Center (IMEC), linked to<br />

the oldest university of Europe: KU Leuven. IMEC expanded<br />

its expertise in nanotechnology and chip technology<br />

to application domains such as healthcare, smart cities,<br />

mobility and manufacturing, logistics and energy.<br />

Flanders is now on the forefront of high-tech research and<br />

the digital economy. More than 120 companies have spun<br />

off since IMEC was established in 1986.<br />

The food-processing sector is well-established: the<br />

beverage sector boasts 224 breweries, 1 000 types<br />

of beers and the largest brewing company, ABInbev.<br />

Chocolate production is the highest in Europe, but the<br />

region also excels in the production of frozen vegetables,<br />

fries and bakery products.<br />

Flanders is strategically located in<br />

the middle of Europe, making it an ideal<br />

location for an European Distribution Centre<br />

(EDC). More than 250 companies (including<br />

Nike, Bose, Black & Decker, Volvo, Mazda,<br />

Scania, Ikea, Ingram Micro, Greenspan and<br />

Chiquita) selected Flanders as an EDC.<br />

South African companies should consider<br />

Flanders as an R&D location or distribution<br />

hub for a variety of sectors. Flanders excels<br />

in developing the “Triple Helix’’ (company: education:<br />

government). Building your presence in Europe reduces<br />

your dependence on the rand, your company becomes<br />

part of the various ecosystems and you can tap into<br />

qualified personnel and a broad range of incentives.<br />

www.flandersinvestmentandtrade.com<br />

___ __<br />

Luc Fabry<br />

Trade and Investment<br />

Commissioner,<br />

Flanders Investment<br />

& Trade<br />

___ __<br />

IMEC has 2 clean<br />

rooms and is at<br />

the forefront of<br />

chip design and the<br />

digital economy.<br />

www.opportunityonline.co.za | 17

AGRICULTURE<br />

Two truths about<br />

Africa’s agriculture<br />

There are two truths today about African agriculture: significant progress<br />

has been made, and there is potential for much more.<br />