Guide du Membre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

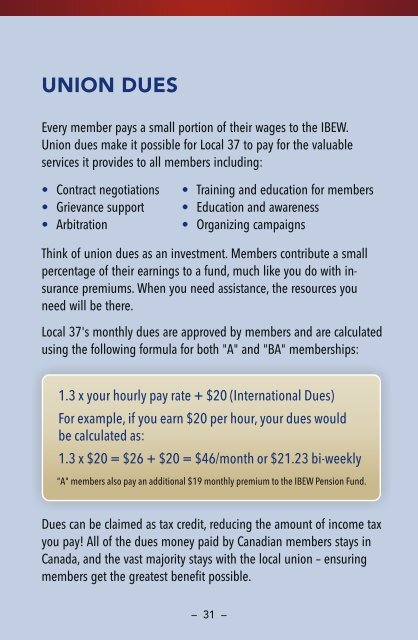

UNION DUES<br />

Every member pays a small portion of their wages to the IBEW.<br />

Union <strong>du</strong>es make it possible for Local 37 to pay for the valuable<br />

services it provides to all members including:<br />

•<br />

•<br />

•<br />

Contract negotiations<br />

Grievance support<br />

Arbitration<br />

•<br />

•<br />

•<br />

Training and e<strong>du</strong>cation for members<br />

E<strong>du</strong>cation and awareness<br />

Organizing campaigns<br />

Think of union <strong>du</strong>es as an investment. Members contribute a small<br />

percentage of their earnings to a fund, much like you do with insurance<br />

premiums. When you need assistance, the resources you<br />

need will be there.<br />

Local 37's monthly <strong>du</strong>es are approved by members and are calculated<br />

using the following formula for both "A" and "BA" memberships:<br />

1.3 x your hourly pay rate + $20 (International Dues)<br />

For example, if you earn $20 per hour, your <strong>du</strong>es would<br />

be calculated as:<br />

1.3 x $20 = $26 + $20 = $46/month or $21.23 bi-weekly<br />

"A" members also pay an additional $19 monthly premium to the IBEW Pension Fund.<br />

Dues can be claimed as tax credit, re<strong>du</strong>cing the amount of income tax<br />

you pay! All of the <strong>du</strong>es money paid by Canadian members stays in<br />

Canada, and the vast majority stays with the local union – ensuring<br />

members get the greatest benefit possible.<br />

– 31 –