SSgA World SRI Index Equity Fund,Sep2012 - Index People

SSgA World SRI Index Equity Fund,Sep2012 - Index People

SSgA World SRI Index Equity Fund,Sep2012 - Index People

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>SSgA</strong> <strong>Index</strong> <strong>Fund</strong>s<br />

<strong>SSgA</strong> <strong>World</strong> <strong>SRI</strong> <strong>Index</strong> <strong>Equity</strong> <strong>Fund</strong><br />

30 SEPTEMBER 2012<br />

[I] Institutional Investors<br />

<strong>Fund</strong> Objective<br />

The management strategy aims to ensure<br />

a performance comparable to that of the<br />

global equities markets (measured by MSCI<br />

<strong>World</strong> index) with a close control of the risk<br />

taken compared to the index (measured by<br />

the difference of performance of the fund<br />

compared to the performance of its index).<br />

Furthermore, the selection of the securities<br />

takes into account criteria of "sustainable<br />

development" and / or "ethics investment".<br />

Investment Strategy<br />

The management strategy uses the pure<br />

replication method that consists of purchasing<br />

all the securities that make up the reference<br />

index in proportion to their respective<br />

weightings. The structure of the portfolio is<br />

therefore very close to that of its benchmark. It<br />

does not involve any sector-based speculation<br />

or stock-picking. Furthermore, the selection<br />

of the securities takes into account criteria of<br />

"sustainable development " and / or "ethics<br />

investment".<br />

Benchmark<br />

MSCI <strong>World</strong>SM net dividends reinvested<br />

Structure<br />

SICAV Umbrella sub fund<br />

UCITS Compliant<br />

Domicile<br />

France<br />

<strong>Fund</strong> Facts<br />

NAV 126.64 USD as of<br />

28/09/2012<br />

Currency USD<br />

Net Assets (millions) 511.45 USD as of<br />

28/09/2012<br />

Inception Date 31/03/2005<br />

Investment Style Passive<br />

Zone Global<br />

Settlement DD+3<br />

Notification Deadline DD-1 11:00AM Paris<br />

time<br />

Valuation Every trading day in<br />

both France and United<br />

States<br />

Minimum Initial<br />

Investment<br />

Minimum Subsequent<br />

Investment<br />

EUR 300,000 *<br />

EUR 50 *<br />

Management Fees 0.30%<br />

TER Max 0.40%<br />

Charge Subscription Redemption<br />

Due to the fund 0.15% 0.10%<br />

Paid to third parties 5.00% None<br />

<strong>Fund</strong> Identifiers<br />

Share Class ISIN Bloomberg<br />

P FR0010585380 -<br />

I FR0010596718 <strong>SRI</strong>WRLD FP<br />

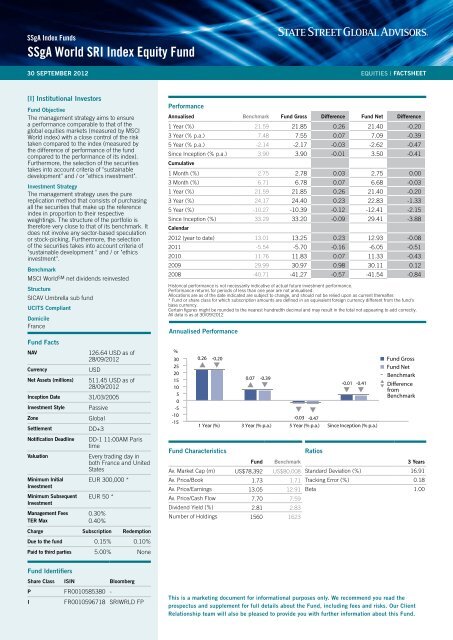

Performance<br />

Annualised Benchmark <strong>Fund</strong> Gross Difference <strong>Fund</strong> Net Difference<br />

1 Year (%) 21.59 21.85 0.26 21.40 -0.20<br />

3 Year (% p.a.) 7.48 7.55 0.07 7.09 -0.39<br />

5 Year (% p.a.) -2.14 -2.17 -0.03 -2.62 -0.47<br />

Since Inception (% p.a.) 3.90 3.90 -0.01 3.50 -0.41<br />

Cumulative<br />

1 Month (%) 2.75 2.78 0.03 2.75 0.00<br />

3 Month (%) 6.71 6.78 0.07 6.68 -0.03<br />

1 Year (%) 21.59 21.85 0.26 21.40 -0.20<br />

3 Year (%) 24.17 24.40 0.23 22.83 -1.33<br />

5 Year (%) -10.27 -10.39 -0.12 -12.41 -2.15<br />

Since Inception (%) 33.29 33.20 -0.09 29.41 -3.88<br />

Calendar<br />

2012 (year to date) 13.01 13.25 0.23 12.93 -0.08<br />

2011 -5.54 -5.70 -0.16 -6.05 -0.51<br />

2010 11.76 11.83 0.07 11.33 -0.43<br />

2009 29.99 30.97 0.98 30.11 0.12<br />

2008 -40.71 -41.27 -0.57 -41.54 -0.84<br />

Historical performance is not necessarily indicative of actual future investment performance.<br />

Performance returns for periods of less than one year are not annualised.<br />

Allocations are as of the date indicated are subject to change, and should not be relied upon as current thereafter.<br />

* <strong>Fund</strong> or share class for which subscription amounts are defined in an equivalent foreign currency different from the fund's<br />

base currency.<br />

Certain figures might be rounded to the nearest hundredth decimal and may result in the total not appearing to add correctly.<br />

All data is as at 30/09/2012<br />

Annualised Performance<br />

%<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

0.26 -0.20<br />

0.07 -0.39<br />

-0.01 -0.41<br />

1 Year (%) 3 Year (% p.a.)<br />

-0.03 -0.47<br />

5 Year (% p.a.) Since Inception (% p.a.)<br />

<strong>Fund</strong> Characteristics<br />

Ratios<br />

EQUITIES | FACTSHEET<br />

<strong>Fund</strong> Gross<br />

<strong>Fund</strong> Net<br />

Benchmark<br />

Difference<br />

from<br />

Benchmark<br />

<strong>Fund</strong> Benchmark<br />

3 Years<br />

Av. Market Cap (m) US$78,392 US$80,008 Standard Deviation (%) 16.91<br />

Av. Price/Book 1.73 1.71 Tracking Error (%) 0.18<br />

Av. Price/Earnings 13.05 12.91 Beta 1.00<br />

Av. Price/Cash Flow 7.70 7.59<br />

Dividend Yield (%) 2.81 2.83<br />

Number of Holdings 1560 1623<br />

This is a marketing document for informational purposes only. We recommend you read the<br />

prospectus and supplement for full details about the <strong>Fund</strong>, including fees and risks. Our Client<br />

Relationship team will also be pleased to provide you with further information about this <strong>Fund</strong>.

<strong>SSgA</strong> <strong>World</strong> <strong>SRI</strong> <strong>Index</strong> <strong>Equity</strong> <strong>Fund</strong><br />

Top 10 Holdings<br />

A PROSPECTUS FOR THIS FUND CAN BE OBTAINED FROM YOUR ADVISOR OR FUND PLATFORM<br />

Important Information This document has been issued by State Street Global Advisors France. Authorised and regulated by the Autorité des Marchés Financiers. Registered with the Register of<br />

Commerce and Companies of Nanterre under the number 412 052 680. Registered office: Immeuble Défense Plaza, 23-25 rue Delarivière-Lefoullon, 92064 Paris La Défense Cedex, France.<br />

Telephone: (+33) 1 44 45 40 00. Facsimile: (+33) 1 44 45 41 92. Web: www.ssga.fr.<br />

This material is for your private information. The funds are authorised by the Autorité des Marchés Financiers in France. The information we provide does not constitute investment advice and it<br />

should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax<br />

status or investment horizon. We encourage you to consult your tax or financial advisor. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There<br />

is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is no guarantee of future results.<br />

This document should be read in conjunction with its prospectus. All transactions should be based on the latest available prospectus which contains more information regarding the charges,<br />

expenses and risks involved in your investment. This communication is directed at professional clients (this includes eligible counterparties as defined by the AMF) who are deemed both<br />

knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other<br />

description (including retail clients) should not rely on this communication.<br />

TER Max represents the fund's aggregate operating and management fees excluding transaction costs. Transaction costs are billed separately to the fund.<br />

For Investors In Switzerland: Prospective investors may obtain the current sales prospectus, the articles of incorporation, the KIID as well as the latest annual and semiannual report free of charge from<br />

the Swiss representative, State Street <strong>Fund</strong> Management Ltd., Beethovenstrasse 19, 8027 Zurich, from the Swiss paying agent, State Street Bank GmbH Munich, Zurich Branch, Beethovenstrasse<br />

19, 8027 Zurich as well as from the main distributor in Switzerland, State Street Global Advisors AG , Beethovenstrasse 19, 8027 Zurich. Before investing please read the prospectus and KIID, copies<br />

of which can be obtained from the Swiss representative, or at www.ssga.com.<br />

The MSCI <strong>World</strong> <strong>Index</strong> is a trademark of MSCI Inc.<br />

Weight<br />

(%)<br />

APPLE INC 2.49<br />

EXXON MOBIL CORP 1.82<br />

GENERAL ELECTRIC CO 0.99<br />

INTL BUSINESS MACHINES CORP 0.93<br />

MICROSOFT CORP 0.91<br />

AT&T INC 0.91<br />

NESTLE SA-REG 0.86<br />

JOHNSON & JOHNSON 0.80<br />

GOOGLE INC-CL A 0.79<br />

PROCTER & GAMBLE CO/THE 0.78<br />

Sector Allocation<br />

<strong>Fund</strong><br />

(%)<br />

Benchmark<br />

(%)<br />

Financials 19.29 19.14<br />

Information Technology 12.56 12.62<br />

Consumer Discretionary 10.82 10.70<br />

Health Care 10.77 10.68<br />

Consumer Staples 10.73 10.87<br />

Industrials 10.64 10.65<br />

Energy 10.48 10.84<br />

Materials 6.86 6.85<br />

Telecommunication 4.11 4.11<br />

Utilities 3.75 3.55<br />

Total 100.00 100.00<br />

Country Allocation<br />

<strong>Fund</strong><br />

(%)<br />

Benchmark<br />

(%)<br />

United States 54.08 54.06<br />

United Kingdom 9.48 9.51<br />

Japan 8.17 8.21<br />

Canada 4.95 5.02<br />

France 3.69 3.76<br />

Australia 3.64 3.65<br />

Switzerland 3.52 3.52<br />

Germany 3.48 3.51<br />

Sweden 1.32 1.32<br />

Hong Kong 1.27 1.28<br />

Other 6.40 6.15<br />

Total 100.00 100.00<br />

%<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

%<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

%<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

APPLE INC<br />

Financials<br />

United States<br />

EXXON MOBIL CORP<br />

Information Technology<br />

United Kingdom<br />

GENERAL ELECTRIC CO<br />

INTL BUSINESS MACHINES<br />

CORP<br />

Consumer Discretionary<br />

Japan<br />

© 2012 STATE STREET CORPORATION. ALL RIGHTS RESERVED. 05/10/2012 Expiration Date:20/11/2012<br />

MICROSOFT CORP<br />

Health Care<br />

Canada<br />

AT&T INC<br />

Consumer Staples<br />

France<br />

NESTLE SA-REG<br />

Industrials<br />

Australia<br />

JOHNSON & JOHNSON<br />

Energy<br />

Switzerland<br />

GOOGLE INC-CL A<br />

Materials<br />

PROCTER & GAMBLE CO/THE<br />

Germany<br />

Telecommunication<br />

Sweden<br />

Utilities<br />

Hong Kong<br />

Other<br />

For More Information<br />

Visit our website www.<br />

ssga.com or contact your<br />

representative <strong>SSgA</strong> office.<br />

<strong>SSgA</strong> Belgium<br />

+32 (0) 2 663 2016<br />

<strong>SSgA</strong> France<br />

+33 (0) 1 44 45 40 54<br />

<strong>SSgA</strong> Germany<br />

+49 (0) 69 66 77 45 016<br />

<strong>SSgA</strong> Ireland<br />

+353 1 776 3036<br />

<strong>SSgA</strong> Italy<br />

+39 02 3206 6130<br />

<strong>SSgA</strong> Middle East & North Africa<br />

+971 (0) 4 437 2800<br />

<strong>SSgA</strong> Netherlands<br />

+31 (0) 20 708 56 12<br />

<strong>SSgA</strong> Switzerland<br />

+41 (0) 44 245 7099<br />

<strong>SSgA</strong> United Kingdom<br />

+44 (0) 20 3395 6184