Jakarta Retail Market Report - Colliers International

Jakarta Retail Market Report - Colliers International

Jakarta Retail Market Report - Colliers International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2Q 2012 i the knowledge<br />

research & forecast report<br />

jakarta rEtaIL MarkEt<br />

www.colliers.co.id<br />

Property Sector Overview<br />

retail sector<br />

after being relatively flat for several periods, the jakarta retail market finally saw a moderate increase of<br />

almost 9% in asking base rental rates as a result of rent adjustments made by shopping malls with high<br />

occupancy and by shopping centres with recently completed major renovation. the average asking base rental<br />

rate for available typical floors in DkI jakarta is IDr413,382 / sq m / month.<br />

Supply<br />

jakarta<br />

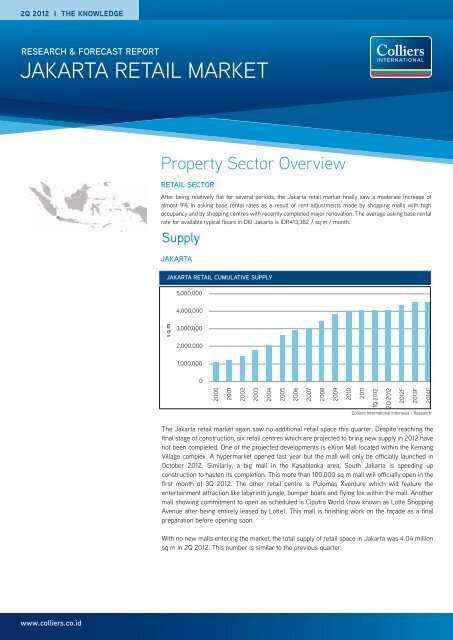

jakarta retail cumulative supply<br />

s q m<br />

5,000,000<br />

4,000,000<br />

3,000,000<br />

2,000,000<br />

1,000,000<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

the jakarta retail market again saw no additional retail space this quarter. Despite reaching the<br />

final stage of construction, six retail centres which are projected to bring new supply in 2012 have<br />

not been completed. One of the projected developments is eXion Mall located within the kemang<br />

Village complex. a hypermarket opened last year but the mall will only be officially launched in<br />

October 2012. Similarly, a big mall in the kasablanka area, South jakarta is speeding up<br />

construction to hasten its completion. this more than 100,000 sq m mall will officially open in the<br />

first month of 3Q 2012. the other retail centre is Pulomas Xventure which will feature the<br />

entertainment attraction like labyrinth jungle, bumper boats and flying fox within the mall. another<br />

mall showing commitment to open as scheduled is Ciputra World (now known as Lotte Shopping<br />

avenue after being entirely leased by Lotte). this mall is finishing work on the façade as a final<br />

preparation before opening soon.<br />

With no new malls entering the market, the total supply of retail space in jakarta was 4.04 million<br />

sq m in 2Q 2012. this number is similar to the previous quarter.<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

1Q 2012<br />

2Q 2012<br />

2012F<br />

2013F<br />

2014F

jakarta | 2q 2012 | retail<br />

p. 2 | colliers international<br />

Overall, from 2000 through 2011, the average<br />

jakarta retail supply showed an annual growth<br />

of 12.2%. this growth demonstrated additional<br />

supply of 249,593 sq m per year during the<br />

s q m<br />

jakarta retail cumulative supply based on region<br />

1,200,000<br />

1,000,000<br />

800,000<br />

600,000<br />

400,000<br />

200,000<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

CBD Central jakarta South jakarta North jakarta East jakarta West jakarta<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

Based on region, the retail supply in West<br />

jakarta showed the lowest average growth at<br />

6.5% per year between 2000 and 2Q 2012.<br />

after Central Park in 2009, there were no new<br />

malls opened and the cumulative supply stayed<br />

at 597,210 sq m. New retail space will only<br />

become available in 2013 with the opening of St<br />

Moritz Mall.<br />

In the South jakarta area, kota kasablanka Mall<br />

and eXion Mall at kemang Village are expected<br />

to operate in the future. another mall is Pondok<br />

Indah Street Gallery, which is an extension of<br />

Pondok Indah Mall 1 on which construction<br />

started last year. Should these future malls<br />

open, they will contribute 175,152 sq m new<br />

supply.<br />

Since 2010, there have been no new malls<br />

completed in North jakarta. the total supply<br />

stayed at 935,199 sq m and there will be no<br />

new supply in North jakarta up to the end of<br />

2012. the only future mall in the region will be<br />

the Baywalk at Green Bay providing 52,000 sq<br />

m of new retail space in 2013.<br />

although East jakarta had the smallest<br />

cumulative supply as of 2Q 2012, i.e. 299,348<br />

sq m, the region showed growth of 14.6% per<br />

year from 2000 to 2Q 2012. after two smallscale<br />

retail centres came onto the market with<br />

a total of 22,663 sq m in 2010 - 2011, Pulomas<br />

XVenture and Cipinang Indah Mall are anticipated<br />

to bring 45,200 sq m of new supply in two<br />

years.<br />

Central jakarta, which covers retail areas like<br />

Menteng, Gajah Mada, Senen and tanah abang<br />

showed 18.2% average growth from 2000 to<br />

2Q 2012. the golden age of the retail supply in<br />

period. With 282,827 sq m of new retail supply<br />

entering the market in 2012, it will maintain an<br />

average growth above 200,000 sq m per year.<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

1Q 2012<br />

2Q 2012<br />

2012F<br />

2013F<br />

2014F<br />

Central jakarta occurred from 2002 to 2005<br />

when there was 566,173 sq m. the total supply<br />

for the region was 747,410 sq m as of 2Q 2012.<br />

However, due to limited land, no new retail<br />

centres have been opened in Central jakarta<br />

since last year. It seems that the trend will<br />

continue until the end of 2014.<br />

Unlike Central jakarta, the scarcity of vacant<br />

land currently does not impact the influx of<br />

retail supply in the CBD. the total cumulative<br />

retail space was 719,593 sq m in 2Q 2012,<br />

reflecting an annual growth of 12.8%. the latest<br />

shopping centre was kuningan City Lifestyle<br />

Mall in late 2011. Ciputra World Mall in jalan<br />

Satrio is projected to open in the second<br />

semester of 2012.<br />

Several under-construction retail centres<br />

projected to enter the market in 2013 are<br />

rushing their work progress to meet the<br />

completion schedule. Cipinang Indah Mall and<br />

the Baywalk at Green Bay Pluit have almost<br />

completed the construction of building<br />

structures. Meanwhile, only just starting work<br />

on the basement, St Moritz Mall confidently<br />

stated that they will be completed next year.<br />

these future malls will add another 129,200 sq<br />

m of retail space in jakarta.<br />

apart from construction activities, other issues<br />

like supply reduction will occur in jakarta. a<br />

retail centre located in tendean, South jakarta,<br />

will close in the next quarter of 2012. the<br />

landlord is planning an apartment development<br />

and will replace the mall which has been in<br />

operation since 2002. another supply reduction<br />

will probably happen in one year. a mall located<br />

in jalan thamrin will cease operations and as a<br />

result, an office tower is planned to replace the

list of future shopping centres in jakarta<br />

existing mall. Still around the thamrin area, a<br />

retail centre which has been in operation since<br />

1962 is planned to be revamped. Later on the<br />

shopping centres name location region<br />

nla<br />

(sq m)<br />

status<br />

2012<br />

kota kasablanka kasablanka South jakarta 110,000 Under Construction<br />

eXion Mall kemang Village antasari South jakarta 56,052 Under Construction<br />

Ciputra World jakarta Satrio South jakarta 78,000 Under Construction<br />

Menteng Square Proklamasi Central jakarta 4,475 Under Construction<br />

Pulomas X’Venture Pulomas East jakarta 25,200 Under Construction<br />

Pondok Indah Mall Street Gallery Pondok Indah South jakarta 9,100 Under Construction<br />

2013<br />

Cipinang Indah Mall Cipinang East jakarta 20,000 Under Construction<br />

the Baywalk @Green Bay Pluit Pluit North jakarta 52,000 Under Construction<br />

St. Moritz Puri Indah West jakarta 129,200 Under Construction<br />

2014<br />

Mall at the City Centre kH Mas Mansyur Central jakarta 35,000 Under Planning<br />

the Gateway Pondok Gede East jakarta 10,000 Under Planning<br />

Pantai Indah kapuk Mall Pantai Indah kapuk North jakarta 30,000 Under Planning<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

2016<br />

Pondok Indah Mall 3 Pondok Indah South jakarta 40,000 Under Planning<br />

bodetabek<br />

bodetabek retail cumulative supply<br />

s q m<br />

3,000,000<br />

2,400,000<br />

1,800,000<br />

1,200,000<br />

600,000<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

Cimanggis Square is the latest shopping centre<br />

in the jabodetabek area and there will be no<br />

new retail centres afterwards in the outside<br />

jakarta area (Bodetabek). two retail centres in<br />

tangerang, Mall Bale kota and alam Sutera<br />

shopping malls will only be completed at the<br />

end of 2012.<br />

2006<br />

2007<br />

jakarta | 2q 2012 | retail<br />

landlord will extend its leasable area and the<br />

whole compound will remain as a commercial<br />

centre with a hotel.<br />

2008<br />

2009<br />

2010<br />

2011<br />

1Q 2012<br />

2Q 2012<br />

2012F<br />

2013F<br />

2014F<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

the absence of new shopping centres<br />

maintained the cumulative supply in Bodetabek<br />

area at 1.93 million sq m however, this area is<br />

still perceived as a potential area for the retail<br />

market to grow. today, there are several areas<br />

with growing business and residential areas in<br />

the outside of jakarta which have potential for<br />

retail businesses.<br />

colliers international | p. 3

jakarta | 2q 2012 | retail<br />

list of future shopping centres in bodetabek<br />

In Bekasi, there will be 138,285 sq m of new<br />

retail centres projected to be completed in 2013<br />

and as of this quarter, all retail centres are<br />

reported to have reached the final stages of<br />

construction.<br />

In 2Q 2012, some shopping malls were<br />

bodetabek cumulative supply based on region<br />

1,200,000<br />

1,000,000<br />

800,000<br />

600,000<br />

400,000<br />

200,000<br />

0<br />

hastening construction to meet their completion<br />

dates. Some of these malls are Cibinong Citymal<br />

in Bogor and four retail centres in Bekasi<br />

including Bekasi junction, Grand Metropolitan<br />

Mall and Grand Galaxy Mall while the extension<br />

of Citra Gran Mall is scheduled for completion<br />

in early 2013.<br />

Bogor Depok tangerang Bekasi<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

nla<br />

shopping centres name location region<br />

(sq m)<br />

status<br />

2012<br />

Shopping Mall at alam Sutera alam Sutera tangerang 68,000 Under Construction<br />

Mall Balekota tangerang tangerang 25,000 Under Construction<br />

2013<br />

Grand Galaxy Mall Bekasi Bekasi 23,000 Under Construction<br />

Bekasi junction Bekasi Bekasi 42,000 Under Construction<br />

Grand Metropolitan Mall kalimalang Bekasi 40,000 Under Construction<br />

Urbana Cinere Cinere Depok 30,000 Under Planning<br />

Cibinong City Mall Cibinong Bogor 30,000 Under Construction<br />

Mall Ciputra Citra Gran Cibubur Bekasi 26,000 Under Construction<br />

Plaza Cibubur extension Cibubur Depok 2,000 Under Construction<br />

2014<br />

Bintaro Xchange Bintaro tangerang 45,000 Under Planning<br />

Lippo Cikarang Citywalk (phase 2) Cikarang Bekasi 10,000 Under Planning<br />

Summarecon Bekasi (phase 1) Bekasi Bekasi 35,000 Under Planning<br />

Mal Harapan Indah Bekasi Bekasi 44,420 Under Planning<br />

the Breeze Sinar Mas Land Serpong tangerang 24,300 Under Planning<br />

Bekasi trade Center 2 Bekasi Bekasi 30,000 Under Planning<br />

2016<br />

Cimandala City trade Center Bogor Bogor 30,000 Under Planning<br />

Summarecon Bekasi (phase 2) Bekasi Bekasi 40,000 Under Planning<br />

p. 4 | colliers international<br />

s q m<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

1Q 2012<br />

2Q 2012<br />

2012F<br />

2013F<br />

2014F<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research

Demand<br />

existing retail performance<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

jakarta<br />

2007 2008 2009 2010 2011 1Q 2012 2Q 2012<br />

as of 2Q 2012, the occupancy rates of retail<br />

centres for lease in jakarta improved moderately<br />

to 89.5% Q-o-Q. thanks to middle-class retail<br />

centres like tebet Green, Pasaraya Blok M,<br />

Plaza Semanggi, kalibata City, POINS and f’X<br />

Lifestyle x’nter which maintained the overall<br />

performance.<br />

Occupancy rates for middle- to upper-class<br />

malls achieved an average of 93.3% in 2Q 2012<br />

up mildly compared to the previous quarter.<br />

kuningan City, a new mall which has been<br />

operating since last year, has a good occupancy<br />

rate together with other middle- to upper-class<br />

malls.<br />

On the other hand, middle- to low-class malls<br />

showed a moderate decline in occupancy<br />

during the quarter. In 2Q 2012, the average<br />

occupancy rate of this class was 85%. the high<br />

competition among the electronics and gadget<br />

retailers located in Mangga Dua. Has created<br />

rivalry among stores which caused some<br />

tenants (fashion and accessories) to pull out.<br />

this was also seen in a mall located in the Blok<br />

M area of South jakarta. all in all, it is not<br />

always market competition which causes some<br />

retailers to terminate their business which<br />

decrease the occupancy level of a mall. Some<br />

landlords are now quite selective in sorting out<br />

their existing tenants (low performing tenants<br />

are replaced). Other than that, some renovation<br />

work at a mall may also affect the overall<br />

occupancy.<br />

the food and beverage (F&B) businesses are<br />

some of the most active retailers which help<br />

maintain the level of occupancy. the industry<br />

has grown faster in the second quarter after<br />

slowing in the prior quarter. they are likely<br />

jakarta | 2q 2012 | retail<br />

jakarta BoDetaBek<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

speeding up expansion in anticipation of the<br />

Islamic holiday, Idul Fitri, when people usually<br />

spend more for both F&B and fashion. Plaza<br />

Semanggi, kalibata City Square, tebet Green,<br />

f’X Lifestyle x’nter, Plaza e’X, kuningan City,<br />

Central Park and Plaza Festival are malls with<br />

F&B domination which opened in 2Q 2012. For<br />

example, roppan and kenny rogers restaurant,<br />

which are located in the main entrance of Plaza<br />

Semanggi, have been open since May 2012.<br />

Likewise, the Coffee Bean & tea Leaf opened<br />

at tebet Green and Central Park Mall. the<br />

largest F&B invasion was at Plaza Festival<br />

(now known as Passer koeningan), a mall that<br />

combines sport, entertainment and culinary<br />

concepts which welcomed Betawi tempo<br />

Doeloe as an anchor tenant during 2Q 2012<br />

with 2,200 sq m of space.<br />

Fashion retailers of shoes, bags and accessories<br />

are the second most active. Some brands are<br />

quite active this quarter including Color Box,<br />

atmosphere, Gallop, armani jeans, Hugo Boss,<br />

the Little things She Needs, Crocs, rococo,<br />

Barbara Shoes, Class room and Furla.<br />

In addition to F&B and fashion, other retailers<br />

like home equipment, gadgets and electronics,<br />

entertainment, beauty, health and personal care<br />

were active tenants in 2Q 2012. In the home<br />

equipment category, three retailers have taken<br />

large spaces between 1,000 and 7,000 sq m at<br />

malls located in South jakarta. ace Hardware<br />

and Informa, two retailers in the kawan Lama<br />

Sejahtera group of companies, opened at tebet<br />

Green and Pasaraya Blok M while Home<br />

Solution will open at Plaza Semanggi. During<br />

2Q 2012, ace Hardware has been operating<br />

while Informa and Home Solution are doing fitout<br />

work.<br />

colliers international | p. 5

jakarta | 2q 2012 | retail<br />

list of new major tenants during 2q 2012<br />

occupancy rates based on class<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

shopping centres name location region retailers line of business<br />

Plaza Festival Hr rasuna Said South jakarta Passer koeningan Food and Beverages Ope<br />

Pasaraya Blok M Blok M South jakarta Informa Home appliances Fitti<br />

tebet Green Mall Mt Haryono South jakarta ace Hardware Home appliances Ope<br />

Plaza Semanggi Sudirman South jakarta Home Solution Home appliances Fitti<br />

kuningan City Satrio South jakarta ace Hardware Home appliances Ope<br />

list of new tenants during 2q 2012<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

shopping centres name location region retailers line of business status<br />

Plaza Semanggi Sudirman South jakarta roppan Food and Beverages Open<br />

kenny rogers Food and Beverages Open<br />

Dapoer Selera Food and Beverages Fitting Out<br />

Color Box Fashion and accessories Fitting Out<br />

athmosphere Fashion and accessories Fitting Out<br />

tebet Green Mt Haryono South jakarta the Coffee Bean and tea Leaf Food and Beverages Open<br />

kuningan City Satrio South jakarta kay Collection Fashion and accessories Open<br />

Samasara reflexology Beauty and Health Care Open<br />

Plaza e’X MH thamrin Central jakarta Chrysler automotive Fitting Out<br />

Energy Massage reflexology Beauty, Health and Personal Care Fitting Out<br />

NYX Cosmetics Beauty and Health Care Fitting Out<br />

f’X lifestyle x’nter Sudirman Central jakarta Sukasuki Food and Beverages Opening Soon<br />

p. 6 | colliers international<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

2007 2008 2009 2010 2011 1Q 2012 2Q 2012<br />

Middle Upper Middle Middle Low<br />

Watsons Beauty and Health Care Fitting Out<br />

Optik Melawai Optical Opening Soon<br />

the Little things She Needs Shoes, Bags and accessories Fitting Out<br />

Crocs Shoes, Bags and accessories Fitting Out<br />

rococo rack Shoes, Bags and accessories Fitting Out<br />

Steps Education and Entertainment Fitting Out<br />

continued

shopping centres<br />

name<br />

location region retailers line of business status<br />

continuation<br />

Mall taman anggrek S. Parman West jakarta the Little things She Needs Shoes, Bags and accessories Open<br />

Erafone Megastore Gadget and Electronics Open<br />

X.to.X Plus Fashion Open<br />

Babara Shoes, Bags and accessories Open<br />

tony & Moly Beauty and Health Care Open<br />

Citraland Daan Mogot West jakarta Gallop Fashion Fitting Out<br />

Samsung Electronics Fitting Out<br />

tX travel Others Fitting Out<br />

Central Park S. Parman West jakarta the Coffee Bean and tea Leaf Food and Beverages Open<br />

armani jeans Fashion Open<br />

Hugo Boss Fashion Fitting Out<br />

Furla Shoes, Bags and accessories Open<br />

Bose Gadget and Electronics Open<br />

Class room Shoes, Bags and accessories Open<br />

Pizza e Birra Food and Beverages Fitting Out<br />

Black Canyon Coffee Food and Beverages Fitting Out<br />

Play House Land kids, Hobbies and toys Opening Soon<br />

Mall artha Gading kelapa Gading North jakarta Optik Melawai Optical, jewellery and Watches Fitting Out<br />

Graha Cijantung Cijantung East jakarta Inul Vizta Entertainment Open<br />

list of new tenants during 2q 2012<br />

bodetabek<br />

the occupancy rate in the Bodetabek area is<br />

relatively stagnant at 86.3%. Overall, the retail<br />

market in Bodetabek saw both leasing activities<br />

and leasing terminations keeping the occupancy<br />

rate the same. the closure of several stores in<br />

some retail centres in Serpong, tangerang has<br />

brought more vacant space. tenants like beauty,<br />

health and personal care, tour and travel, and<br />

money changers ceased operations at the mall<br />

which is located in Serpong main road. Business<br />

competition among retailers has pushed several<br />

tenants to move out of the shopping centre.<br />

again, due to tight competition, several retailers<br />

in a shopping centre located in the BSD,<br />

tangerang could not survive and have vacated<br />

their premises. to anticipate further vacancy,<br />

the landlord tried to approach owners of store<br />

jakarta | 2q 2012 | retail<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

units that have been purchased to convince<br />

them to lease the units like retail space (like a<br />

mall) and finding lessees for the space. after<br />

three to five years of operations, the landlord<br />

will return the units to the unit owner. Such<br />

strategy is expected to save the whole premises<br />

from becoming vacant and will boost the<br />

landlord’s reputation.<br />

apart from a declining trend in occupancy,<br />

some leasing activities helped to fuel the overall<br />

performance in the Debotabek area. Living<br />

World, which is located in alam Sutera,<br />

tangerang has increased its occupancy after<br />

one year of operations. Currently the remaining<br />

vacant space is only 20% of the total leasable<br />

area.<br />

shopping centres<br />

name<br />

location region retailers line of business status<br />

Living World alam Sutera tangerang Bebek tepi Sawah Food and Beverages Fitting Out<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

colliers international | p. 7

jakarta | 2q 2012 | retail<br />

future retail performance<br />

after having intensive approach and doing a<br />

preliminary study into expanding operations<br />

into Indonesia, German-based giant retailer,<br />

Metro Group has decided to terminate the plan<br />

because they want focus more on improving<br />

sales figures. the cancellation was announced<br />

almost a year after Metro announced their plan<br />

to open their first outlet in jakarta by 2012.<br />

Nevertheless, this action does not affect the<br />

plans of other foreign retailers to expand into<br />

Indonesia. Parkson retail asia (Pra) will open<br />

its first store in jakarta by September 2013,<br />

list of new committed tenants in the future retail centers<br />

pre-commitment level during 2011 - 2014<br />

after successfully negotiating a 10-year lease<br />

agreement for retail space at St. Moritz Mall,<br />

located in the Puri Indah, West jakarta. the<br />

stores, which will occupy 17,101 sq m of retail<br />

space, will target the upper-income market<br />

segment. the new Parkson store will<br />

complement Pra’s existing Centro department<br />

store brand, which has been operating in<br />

Indonesia for around eight years. the firm also<br />

plans to expand the Centro brand to other<br />

regions with rapid growth in the middle-class<br />

population.<br />

shopping centres<br />

name<br />

location region retailers line of business size (sq m) status<br />

St. Moritz Mall Puri Indah West jakarta Parkson Department Stores 17,101 Open in September 2013<br />

p. 8 | colliers international<br />

2014F<br />

2013F<br />

2012F<br />

2011<br />

jakarta bodetabek<br />

Space absorbed annual Supply<br />

0 100,000 200,000 300,000<br />

sq m<br />

2014F<br />

2013F<br />

2012F<br />

2011<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

Space absorbed annual Supply<br />

0 100,000 200,000 300,000<br />

sq m<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research

ental rates and Service Charge<br />

rental rates<br />

rental rates in jakarta and bodetabek area<br />

rp450,000<br />

rp400,000<br />

rp350,000<br />

rp300,000<br />

rp250,000<br />

rp200,000<br />

rp150,000<br />

rp100,000<br />

rp50,000<br />

rp0<br />

after having operated from 2009 to 2011, some<br />

malls which are targeted at the middle- to<br />

upper-class segment increased their rental<br />

rates during 2Q 2012. the increase is in line<br />

with the performance of the mall, i.e. those with<br />

less vacant space will ask for higher rents.<br />

Some newly-opened malls located in Gandaria,<br />

jalan Satrio and jalan S. Parman have reported<br />

that they will adjust the rental rates due to<br />

increasing occupancy. a shopping centre<br />

located in West jakarta which has done some<br />

renovation work has adjusted the asking rents<br />

upward. traffic flow to the mall will be one of<br />

criteria for the landlord to increase or maintain<br />

the current rents.<br />

an increase in the average asking rent was also<br />

seen at the middle-class malls. a shopping<br />

centre located in kramat jati, East jakarta<br />

repositioned itself by having a facelift, redesign,<br />

new interior works and improvement of the<br />

public facilities like tiles, toilets and elevators.<br />

With this additional capital expenditure, the<br />

shopping centre could attract branded retailers<br />

as their new tenants and increase the rental<br />

rates. Still in East jakarta, a long-operating<br />

jakarta | 2q 2012 | retail<br />

2005 2006 2007 2008 2009 2010 2011 1Q 2012 2Q 2012<br />

jakarta BoDetaBek<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

mall in jalan Pemuda has succeeded in raising<br />

the asking rental rates after maintaining high<br />

occupancy.<br />

Other ways to increase income in local currency<br />

(rupiah) is to adjust the pegged rate. the<br />

pegged rate is the nominal exchange rate of<br />

local currency against the US Dollar set by the<br />

shopping centre management and it is generally<br />

below market value. this pegged rate is used<br />

by quite a few malls. a mall located in Senen,<br />

Central jakarta adjusted their pegged rate by<br />

IDr500 compared to the previous quarter<br />

which increased the occupancy cost in rupiah<br />

become higher.<br />

Driven by increasing rental rates, the overall<br />

average asking rental rate in jakarta was<br />

IDr413,382/sq m/month. the rental rates are<br />

projected to go higher over the next period<br />

particularly due to the influx of new malls which<br />

come with higher offering rental rates above<br />

the average market. according to our records,<br />

the upcoming malls will have asking rental rates<br />

of between IDr400,000 and 500,000/sq m/<br />

month when they are launched.<br />

colliers international | p. 9

jakarta | 2q 2012 | retail<br />

p. 10 | colliers international<br />

rental rates of shopping centres in jakarta and bodetabek<br />

rp800,000<br />

rp700,000<br />

rp600,000<br />

rp500,000<br />

rp400,000<br />

rp300,000<br />

rp200,000<br />

rp100,000<br />

rp0<br />

service charge<br />

2005 2006 2007 2008 2009 2010 2011 1Q 2012 2Q 2012<br />

the average rental rates for Bodetabek also<br />

showed an increasing trend in 2Q 2012. For<br />

example, a mall in Bekasi has adjusted the<br />

pegged rate which increased the asking rent in<br />

rupiah. Some efforts were made to achieve<br />

higher rental rates. a mall in Depok and two<br />

In 2Q 2012, both jakarta and Bodetabek area<br />

saw an increase in the service charge from<br />

IDr545 to 640/sq m/month. In jakarta, the<br />

Middle Up Middle Middle Low<br />

<strong>Colliers</strong> <strong>International</strong> Indonesia - research<br />

malls in tangerang increased the offering rental<br />

rates for the remaining leasable area. Overall,<br />

some of the rent changes have caused the<br />

rental rates in Bodetabek to go higher Q-o-Q to<br />

IDr252,159/sq m/month.<br />

service charge was an average of IDr77,795/sq<br />

m/month while in the Bodetabek area the<br />

service charge is IDr60,956/sq m/month.

jakarta | 2q 2012 | industrial estate<br />

Outlook<br />

the retail market has been gradually performing<br />

better with more leasing activities both in the<br />

operating and upcoming shopping centres.<br />

Landlords are generally quite concerned with<br />

the improving economy which leads to creating<br />

more retail sales and they are quite aware that<br />

amid increasingly high competition level in the<br />

market, they have to follow the dynamics of the<br />

market. thus, quite a few mall owners (in<br />

particular old malls) make capital expenditures<br />

to improve the looks of the mall, change the<br />

interiors, replace non-performing retailers and<br />

adjust the tenancy mix in order to attract more<br />

www.colliers.co.id<br />

crowds so they can ask for higher rents. Even<br />

more, one strata-title retail owner is quite<br />

concerned with the low performance at the<br />

shopping centre and is willing to take unpopular<br />

action to save the performance and the image<br />

of the shopping centre.<br />

Indonesia, as the fourth largest population in<br />

the world, will remain as an interesting market<br />

for investors and retailers. New foreign retailers<br />

have invaded Indonesia and we will see more<br />

foreign retailers particularly from asian<br />

countries expand operations into this country.<br />

512 offices in<br />

61 countries on<br />

6 continents<br />

United States: 125<br />

Canada: 38<br />

Latin america: 18<br />

asia Pacific: 214<br />

EMEa: 117<br />

• $1.5 billion in annual revenue<br />

• 979 billion square feet under management<br />

• Over 12,500 professionals<br />

colliers international indonesia:<br />

World trade Centre 10th & 14th floor<br />

jalan jenderal Sudirman kav. 29 - 31<br />

jakarta 12920<br />

Indonesia<br />

tel 62 21 521 1400<br />

fax 62 21 521 1411<br />

Michael Broomell<br />

Managing Director<br />

World trade Centre 10th & 14th floor<br />

jalan jenderal Sudirman kav. 29 - 31<br />

jakarta 12920<br />

Indonesia<br />

tel 62 21 521 1400 ext 131<br />

fax 62 21 521 1411<br />

Ferry Salanto<br />

associate Director, research<br />

World trade Centre 10th & 14th floor<br />

jalan jenderal Sudirman kav. 29 - 31<br />

jakarta 12920<br />

Indonesia<br />

tel 62 21 521 1400 ext 134<br />

fax 62 21 521 1411<br />

Copyright 2012 <strong>Colliers</strong> <strong>International</strong><br />

the information contained herein has been obtained<br />

from sources deemed reliable. While every reasonable<br />

effort has bee made to ensure its accuracy, we cannot<br />

guarantee it. No responsibility is assumed for any inaccuracies.<br />

readers are encouraged to consult their professional<br />

advisors prior to acting on any of the material<br />

contained in this report.<br />

accelerating success.