August 2021 IDM Special Edition

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

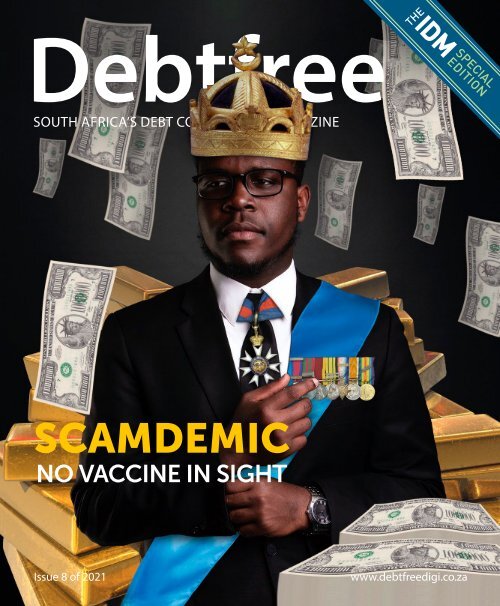

SCAMDEMIC<br />

NO VACCINE IN SIGHT<br />

Issue 8 of <strong>2021</strong>

EXCELLENCE IS DOING<br />

ORDINARY THINGS<br />

EXTRAORDINARILY<br />

WELL<br />

– John W. Gardner

WHAT MAKES US<br />

EXCELLENT?<br />

/ Unimpaired and automated PDA systems<br />

/ Integration with top-ranked Debt Counsellor systems<br />

/ Enhancing Debt Counsellor efficiency and sustainability<br />

/ Best customer support in the country – queries are resolved within 24 hours<br />

/ Strong compliance and best-industry-practice implementation is at our centre<br />

Call Chris van der Straaten<br />

Head of Hyphen PDA | 082 557 0437<br />

Or call our friendly support centre on 011 303 0060 - Option 2<br />

or visit our website www.hyphenpda.co.za

FROM THE EDITOR<br />

It has been rather impressive to see the worlds finest<br />

athletes run around empty stadiums and compete for<br />

Olympic gold. There were some memorable moments,<br />

as always, and it has given us an enjoyable distraction<br />

in the midst of a very hard and scary year.<br />

Here’s to the underdogs who surprised us all, here is to the Haka<br />

dancing, the perfectly synchronized swimming, the meme recreating<br />

Gold medal biting, the 14 year old perfect diving, the home runs hit<br />

into the empty stadiums, the javelins launched across the world,<br />

here’s to the new world records set on track and in the pool.<br />

The biggest winners were probably those who got to watch from<br />

the safety of their homes around the globe, while the biggest losers<br />

must surely have been the host country. As South Africa knows,<br />

hosting an international event of this size costs millions and millions<br />

in building and preparation. To then lose out of any possible revenue<br />

from visiting spectators, must have hurt. It just demonstrates how<br />

vulnerable we all are (even countries) to the effects of the pandemic.<br />

Other than a very expensive distraction, the Olympics is also a<br />

competition between the ‘best of the best’. It is a chance for<br />

those who excel to assess themselves against their peers. It is the<br />

culmination of years of personal preparation and training, of selfdenial<br />

and discipline, this takes razor sharp focus.

This is similar to the annual Debt Review Awards process. It is a<br />

chance for not only the entire industry to shine (and take a moment<br />

to pat one another on the back) but also for individuals, companies<br />

and practices to find out how they stack up against their peers. Be<br />

sure to catch our preview article, as everyone gets ready for the<br />

online Awards show on 10th of September.<br />

This month we consider how the pandemic has not slowed down<br />

unscrupulous people who are out to take advantage of others. Like<br />

true parasites of society, these scammers continue to try leech off of<br />

hard working people, regardless of the consequences.<br />

We hope the articles in this issue help you become more aware of<br />

these types of scams and more wary of other possible scams.<br />

You may not have the muscle bound body of an Olympian in peak<br />

physical condition, but if you are in debt review, then you too have<br />

been working on achieving a truly amazing long-term goal - the goal<br />

of getting out of debt.<br />

Much like a training athlete, success in debt review comes from<br />

staying focused, being willing to cast off distractions, learning to shop<br />

better, to save harder, to make the budget cuts others cannot, or<br />

simply are not prepared to make.<br />

If you can do this, then soon you will lift aloft your gold medal in the<br />

form of a clearance certificate, showing that you are winning at life<br />

and have become debt free!

FROM THE<br />

<strong>IDM</strong> DESK<br />

DEBT<br />

COUNSELLING<br />

DELIVERS AS<br />

DEMAND RISES<br />

Q2 <strong>2021</strong> Debt Index<br />

shows although debt<br />

burden is growing debt<br />

counselling works.<br />

South African consumers’ debt<br />

situation is getting worse with<br />

the average debt-to-income<br />

ratio at its highest level ever, but<br />

there is some good news with<br />

more people seeking help and<br />

a significant increase in those<br />

successfully completing debt<br />

counselling.

This is according to the DebtBusters’ <strong>2021</strong> Q2 Debt Index, which tracks<br />

client trends quarter-on-quarter and over the past five years.<br />

In the second quarter enquiries about debt counselling increased by 18%<br />

compared to a year ago. Benay Sager, head of DebtBusters, attributes<br />

this to the after-effects of the nationwide lockdown and a narrowing of<br />

consumers’ ability to borrow.<br />

He says that the debt levels have increased substantially and the number<br />

of open accounts have decreased for consumers applying for debt<br />

counselling, both of which indicate that consumers are seeking help<br />

sooner.<br />

The pool of consumers borrowing has also shrunk, as supported by<br />

National Credit Regulator data, which indicates average unsecured loan<br />

size has increased by 46% and number of loans has decreased by 31%<br />

over the last four years.<br />

Compared to the same period five years ago the Debt Index found:<br />

• Real income is declining as inflation continues to bite: Nominal<br />

incomes were, on average, 3% higher than in Q2 2016, but when<br />

cumulative inflation growth of 24% is factored in, real incomes have<br />

shrunk by 21%.<br />

• The debt-to-net-income ratio is at an all-time high: Consumers<br />

enquiring about debt counselling are spending around 60% of their<br />

take-home pay to service debt. More concerning is that across all<br />

income bands the debt-to-income ratio is now at 122% and 152%<br />

for those taking home R20 000 or more.

FROM THE <strong>IDM</strong> DESK<br />

• Unsecured debt level continues to increase: The level of unsecured<br />

debt is on average 32% higher than in 2016 and up by 49%<br />

amongst consumers taking home R20 000 or more. This is a direct<br />

result of consumers using unsecured debt to offset the erosion of<br />

their take-home pay.<br />

Sager says despite all the bad news, which is perhaps unsurprising given<br />

the impact of successive lockdowns on an already struggling economy,<br />

there were some positive findings that show debt counselling works:<br />

• More consumers successfully complete debt counselling: There are<br />

now seven times as many consumers completing debt counselling<br />

as there were in 2016.<br />

• Effective mechanism for paying back debt: Consumers who<br />

successfully completed debt counselling in Q2 <strong>2021</strong> paid<br />

back R320m worth of debt to their creditors as part of the debt<br />

counselling process<br />

He says the fact that 56% of applicants for debt counselling are male<br />

is also positive. In Q2 2016 more women (52%) than men (48%) were<br />

applying for help to restructure their debt.<br />

“In a society where men typically tended not to want to talk about or seek<br />

help with debt, it’s encouraging that men are becoming more proactive<br />

about dealing with debt problems.”

DEBT REVIEW<br />

LESSON #1<br />

If you begin to earn significantly more than<br />

when you started debt review, be sure to<br />

talk to your Debt Counsellor about how<br />

you can pay off your debts faster.<br />

You can finish debt review faster and end<br />

up saving thousands on fees and interest<br />

by paying even a bit more each month.

FREE BOOKLET<br />

FOR DEBT COUNSELLORS TO SHARE<br />

Are you being phoned by consumers who<br />

are asking how they can leave debt review?<br />

Is your inbox full of requests to remove a<br />

Debt Review Flag at credit bureaus?<br />

The free booklet, which you can download from the link below ( 1MB<br />

in size) covers many common questions and helps consumers learn<br />

more about the challenges involved with having their debt review<br />

status removed before paying off all their debt.<br />

DOWNLOAD AND SHARE<br />

Save Time<br />

Send Detailed Information<br />

Educate your Clients & Consumers

CONTENTS<br />

SCAMDEMICS: NO VACCINE IN SIGHT<br />

<strong>2021</strong> DEBT<br />

REVIEW AWARDS<br />

POPI BASICS<br />

FOR DEBT<br />

COUNSELLORS<br />

DEBT VADER: WHY<br />

CONSUMERS ARE<br />

STILL NOT GETTING<br />

COURT ORDERS<br />

DEBT REVIEW<br />

SCHOOL<br />

DISCLAIMER<br />

Debtfree Magazine considers its sources reliable and verifies as<br />

much information as possible. However, reporting inaccuracies<br />

can occur, consequently readers using this information do so<br />

at their own risk. Debtfree Magazine makes content available<br />

with the understanding that the publisher is not rendering legal<br />

services or financial advice. Although persons and companies<br />

mentioned herein are believed to be reputable, neither<br />

Debtfree Magazine nor any of its employees, sales executives<br />

or contributors accept any responsibility whatsoever for their<br />

activities. Debtfree Magazine contains material supplied to<br />

us by advertisers which does not necessarily reflect the views<br />

and opinions of the Debtfree Magazine team. No person,<br />

organization or party can copy or re-produce the content<br />

on this site and/or magazine or any part of this publication<br />

without a written consent from the editors’ panel and the<br />

author of the content, as applicable. Debtfree Magazine,<br />

authors and contributors reserve their rights with regards to<br />

copyright of their work.

CONSUMER FRIEND<br />

USES<br />

SOFTWARE TO ENSURE<br />

POPIA COMPLIANCE!<br />

- Secure system-to-system data transfer (no human contact)<br />

- Elimination of data exposure from the use of email<br />

- Data specification is fit for purpose<br />

POPIA COMPLIANCE IS<br />

CRUCIAL THIS YEAR!

BREAKING<br />

NEWS

INDUPLUM CASE TO<br />

PROCEED AT SCA<br />

Back in 2019, the Western Cape High Court issued a landmark<br />

judgment regarding the double up or ‘in Duplum’ law as set<br />

out in the National Credit Act and other laws.<br />

The ruling went in the way of consumers and offered greater<br />

clarity on what fees can and can’t be charged and how these<br />

form part of the overall debt calculations of NCA Section<br />

103(5) in Duplum.<br />

Credit providers who really enjoy charging consumers lots<br />

of extra collections fees appealed the ruling.<br />

The case will soon be heard at the Supreme Court of Appeal<br />

(on the 7th of September <strong>2021</strong>). The Stellenbosch University<br />

Law Clinic will be appearing to once again argue the matter<br />

on behalf of consumers.

We are the champion<br />

in your corner!<br />

DebtBusters provides a remedy for financially stressed<br />

consumers through effective debt relief solutions.<br />

Over 1 million South Africans who are facing tight<br />

budgets and are struggling with debt, have come to<br />

DebtBusters looking for a financial solution.<br />

086 999 0606<br />

info@debtbusters.co.za<br />

www.debtbusters.co.za

NCR CAMPAIGN ABOUT<br />

DEBT COUNSELLING<br />

Every year the NCR sets aside some time and money to<br />

promote the debt counselling process. At the moment, the<br />

NCR is busy promoting the message of how Debt Counselling<br />

offers a new lease on life for over indebted consumers.<br />

Though their press releases don’t actually discuss the<br />

extensive benefits of the process, the campaign does feature<br />

some extensive warnings pointing out such things as how<br />

debt review is not a savings mechanism, and to encouraging<br />

consumers to avoid people who advertise saying you can<br />

get up to 60% off you usual payments.<br />

They also warn that debt counselling is not for everyone and<br />

some people who apply can be rejected from the process.<br />

They also stress that the process is not free and there<br />

are many fees (which they try explain). They go into the<br />

maximum fees in detail and stress the importance of only<br />

dealing with a counsellor with a certificate.<br />

Hopefully consumers will be won over to this new lease on<br />

life by all the warnings and helpful reminders not to deal<br />

with unregistered persons.

DEBT REVIEW AWARDS<br />

10 SEPTEMBER <strong>2021</strong><br />

The annual Debt Review Awards will be live streamed on<br />

YouTube on September the 10th <strong>2021</strong>. All are welcome to<br />

watch and you can find the links to watch live at<br />

www.debtreviewawards.co.za on the day.<br />

The YouTube Chanel can be found here:<br />

https://bit.ly/3kiIjuQ

NCR’S CREDIT INDUSTRY FORUM DISCUSSING<br />

CHANGES TO DEBT COUNSELLING FEE<br />

GUIDELINE<br />

The NCR from time to time release fee guidelines that it<br />

feels the industry should follow. These fee guidelines are<br />

often matched by debt review proposal software (which<br />

helps Debt Counsellors quickly make proposals to credit<br />

providers).<br />

At present the NCR are asking members of the Credit Industry<br />

Forum to consider a fee structure which asks attorneys to<br />

wait to get paid or to perhaps not get paid if clients drop out<br />

of the process.<br />

They have also proposed a fee structure that would see<br />

Debt Counsellors wait on courts and consumers for a long<br />

time to pay a quarter of their fees.<br />

Many Debt Counsellors and Attorneys are worried that such<br />

a fee structure will prevent them from being able to operate<br />

successfully and could wipe out the industry.<br />

For more information visit: www.debtfreedigi.co.za for a<br />

detailed examination over the next few weeks.

POPI-PROOF<br />

your PROCESSES<br />

WITH DREX<br />

Secure system-to-system data transfer<br />

(no human contact)<br />

Elimination of data exposure from the<br />

use of email<br />

Data specification is fit for purpose<br />

^<br />

DID YOU KNOW?<br />

The President of South Africa has proclaimed the POPIA commencement date to be 1 July <strong>2021</strong>.<br />

POPIA applies to any company or organization processing personal information in South Africa.<br />

Fines for non-compliance with POPIA can range up to 10 million ZAR (South African rands).<br />

POPIA defines personal information broadly as any information relating to not only a living person,<br />

but also a company or legal entity.<br />

^ ^ ^

DRAWING MONEY FROM<br />

PENSIONS TO PAY DEBTS?<br />

There is a lot of discussion, on a government level, about<br />

making changes to current legislation which would allow<br />

consumers (under certain circumstances and to a limited<br />

amount) to draw part of their pensions early.<br />

As soon as mid 2022, changes to laws around pensions<br />

may allow some troubled consumers’ access to some of<br />

their pension funds. While this would have a massive knock<br />

on effect on the future value of peoples’ pensions, cash<br />

strapped consumers are desperate to get at these funds<br />

now and are happy to worry about retirement later.<br />

Government is also looking to lock pension investments into<br />

local infrastructure building in an effort to fund government<br />

projects.

NEW FINANCE MINISTER<br />

President Ramaphosa recently made some significant<br />

changes to his Cabinet. In the midst of all the changes,<br />

Finance Minister Tito Mboweni handed in his resignation.<br />

The President then invited the head of the ANC’s NEC<br />

economic transformation sub-committee, Mr Enoch<br />

Godongwana to take on the role as Finance Minister. He<br />

accepted.<br />

Mr Godongwana has served as a director at Mondi, and<br />

Platinum Group Metals as well as chairperson of the<br />

Development Bank of Southern Africa. He comes from<br />

a trade union background and at one time served as the<br />

general secretary of Numsa. He spent time as Provincial<br />

Minister of Finance in the Eastern Cape before becoming<br />

the Deputy Minister of Economic Development.<br />

In the past, Mr Godongwana has been outspoken about<br />

overspending by Government and made statements about<br />

the need for SA to have better social infrastructure to meet<br />

people’s basic needs.

BANK ZERO FINALLY<br />

GOES LIVE<br />

After delaying for nearly 3 years Bank Zero has finally opened<br />

their doors. Bank Zero says they delayed their launch for so<br />

long to ensure that their digital offerings aimed at businesses<br />

were just right.<br />

The latest, digital only, bank has said that, unlike some of<br />

their competition, they intend to focus primarily on business<br />

banking clients. That said, Bank Zero will also have smaller<br />

accounts for those just looking to save (as it would be foolish<br />

to turn these clients away).<br />

Bank Zero says they will not be offering clients overdrafts<br />

and loans at this point.

DEBT REVIEW<br />

LESSON #2<br />

Talk to your Debt Counsellor about what<br />

would happen if you suddenly lost some<br />

of your income.<br />

They may be able to help you investigate<br />

insurance specifically for people in debt<br />

review which can help in that situation. In<br />

debt review you need to learn to plan for<br />

the unexpected.

YOU SHOULD BE<br />

SAVING<br />

BUT YOU ARE<br />

SCAMDEMIC<br />

NO<br />

NOT<br />

VACCINE IN SIGHT

SCAMDEMIC: NO VACCINE IN SIGHT<br />

DEAR FRIEND...<br />

How many times can you win the UK lottery without<br />

even entering?<br />

How many distant relatives (who you’ve never heard<br />

of) have left you the sole beneficiary of their massive<br />

estate?<br />

How many former finance minister’s sons or daughters<br />

have contacted you, asking for help to move money or<br />

gold out of their country?<br />

Sometimes your phone goes ahead and wins a<br />

competition without you. Well done smart phone!<br />

Heck, sometimes Elon Musk is giving away crypto<br />

currency and wants your help to hide the profits from<br />

the IRS. You never realized he even knew who you<br />

were, amazing!

Our email and sms in-boxes are relentlessly full of horrible scams<br />

from unscrupulous crooks who simply want to con you out of your<br />

hard earned money.<br />

Covid-19 has not slowed these scammers down, they are as<br />

active now as ever, perhaps even more so. There are even specific<br />

scams that target people who are in debt review, and can be very<br />

convincing.<br />

What are some common scams to watch out for, and how can you<br />

protect yourself from being taken to the cleaners?

SCAMDEMIC: NO VACCINE IN SIGHT<br />

419– THE ORIGINAL<br />

INTERNET SCAM<br />

The “419 Scam” or “Nigerian Prince” scam, is one of<br />

the oldest tricks in the book. You may think this scam<br />

is fairly new, but in its infancy it was carried out via<br />

faxes and then letters. The invention of email has really<br />

helped these scam artists extend their reach globally.<br />

How it works:<br />

A mysterious person claims to have a way for you to get lots of<br />

money, all you need to do is pay a small fee upfront to get access to<br />

those funds.<br />

For example, a foreign prince wants to send you gold bars via the<br />

postal service, or through their “lawyers” but a small release fee is<br />

needed to facilitate some government paperwork. They ask if you can<br />

please pay this fee (or part of it) into an account they give you and<br />

then the deal can go ahead.

After the target pays the fee, the conman either immediately ghosts<br />

them, or create excuses for delays and try to get you to pay a little<br />

more before disappearing.<br />

The FBI often refer to these scams by the number ‘419’ since it is the<br />

section of the Nigerian Criminal Code that deals with fraud.<br />

James Vietch the comedian has become famous over the years for<br />

answering these types of messages and messing around with the<br />

conman on the other side of the scam.<br />

He leads them on for days or weeks, even months with ridiculous<br />

comments, requests or even promises wasting their time so they<br />

cannot go after vulnerable people.<br />

Have a laugh at their expense here:<br />

www.ted.com/talks/james_veitch_this_is_what_happens_when_you_reply_to_spam_email?language=en

SCAMDEMIC: NO VACCINE IN SIGHT<br />

I WILL DO AN EFT<br />

Selling things via Gumtree, OLX or other public<br />

platforms is super convenient and can help you raise<br />

some much needed cash when your ends don’t meet.<br />

A common scam is to contact you from “far away”, and ask you to<br />

send the sale item to them via the post. The person sends proof of<br />

payment and then waits for you to send the item.<br />

More brazen crooks might even show up in person after convincing<br />

you that they have made the bank payment.<br />

How it works:<br />

The person makes a payment that reflects on your online banking<br />

(you may even call the bank and check) and then later reverse the<br />

payment, or they made the payment in such a way that it bounces<br />

back to them.<br />

They then end up with the item and you end up with nothing.

SCAMDEMIC: NO VACCINE IN SIGHT<br />

BANKING SCAMS<br />

You may often receive emails that look like they are<br />

from your bank asking you to sign in using your log in<br />

and password to confirm some information.<br />

When you type in those details, criminals use that information to try<br />

get access to your accounts.<br />

The banks have worked really hard to prevent these scams, and<br />

these days banking apps ask you to confirm things with your finger<br />

print or via one time passwords. Even so, with access to only basic<br />

information about you, scammers can try to get access to your<br />

accounts.<br />

OTP Scams<br />

Since the banks have made it harder for scammers to gain access to<br />

your accounts without one time pins, scammers have had to change<br />

their tactics. They now try to convince you to give them your OTP<br />

while they try make withdrawals.<br />

How it Works:<br />

You receive a call from a “bank employee” (scammer) who tells you<br />

they are from the bank and maybe even asks if you are the account<br />

holder and mentions some details like your address or the account<br />

number.

Impressed that they have some of this info you begin to trust them.<br />

They may even ask you some security questions to harvest more<br />

information from you. Wow, these people are serious about your<br />

safety (or so it seems).<br />

They then tell you that someone is performing suspicious<br />

transactions on your account. Oh no, what must I do?<br />

They tell you that they are going to send you some One Time Pins or<br />

passcodes to stop the transactions.<br />

Then your phone starts to get OTPs they are busy making transfers or<br />

purchases on your account.<br />

They ask you to tell them the code you just received, so that they can<br />

stop the payments being made. In the mean time they are actually<br />

using those OTPs to complete the transaction themselves, with your<br />

help!<br />

A big part of this scam is to pressure you, and make you feel the<br />

urgency of stopping such payments. They do not give you time to<br />

think or time to hang up and call the bank directly (which is what you<br />

should actually do).

SCAMDEMIC: NO VACCINE IN SIGHT<br />

DEBT REVIEW SCAMS<br />

Some scams target people who are in debt review.<br />

The scammers know a little about the process, and may even have<br />

access to some information about your debt review, such as who<br />

your Debt Counsellor is, or how much you pay towards your debt<br />

each month.<br />

What are some of the most common scams?

SCAMDEMIC: NO VACCINE IN SIGHT<br />

DEBT REVIEW SCAMS<br />

NEW ACCOUNT<br />

DETAILS<br />

This is actually a fairly common scam in many<br />

industries and involves someone telling you that the<br />

PDA banking details have changed, and asking you to<br />

make a payment into the new account.<br />

How it Works:<br />

Someone from your “Debt Counsellors office” (the scammer) calls<br />

and says that they have good news for you, your payment amount<br />

has been reduced. What good news!!! This is the bait to draw you<br />

in. Who wouldn’t want to pay less? Then they tell you that all you<br />

now need to do is pay the reduced amount into a different account<br />

number (for one reason or another).<br />

It is important to note that the PDAs have not changed their bank<br />

details for years and years, and this is unlikely to happen. If someone<br />

tells you this, they are trying to scam you.<br />

What you should immediately do, is pick up the phone and call your<br />

Debt Counsellor directly (the person you actually know by voice<br />

and perhaps face to face) and ask if any such change has actually<br />

happened.

Call their Bluff:<br />

Since debt review is very paperwork heavy they should be able to<br />

send you the restructured payment plan with the reduced payment<br />

amount, and perhaps even the documents from the credit providers<br />

who are now happy to get paid less each month (these don’t exist<br />

obviously).<br />

Debt Counsellors also get targeted by these types of scams. For<br />

example, some scammers contacted many Debt Counsellors and told<br />

them the National Credit Regulator (NCR) had changed bank details,<br />

and they should pay their annual renewal fees into the new account.<br />

It was, of course, the scammers own account and not that of the<br />

NCR. Same scam but a slightly different target group.

SCAMDEMIC: NO VACCINE IN SIGHT<br />

DEBT REVIEW SCAMS<br />

YOU CAN GET<br />

A NEW LOAN<br />

A common scam is to target people in debt review<br />

who are not actually serious about getting out of debt.<br />

The scammer gets in touch and promises the consumer that they can<br />

get access to a new loan even though they are in debt review. They<br />

appeal to the desperation or greed of the person in debt review, very<br />

similar to the classic 419 scam.<br />

How it Works:<br />

Once again, the idea is that the scammer promises you could get<br />

access to a loan, but only if you pay a small upfront fee. They say<br />

that their business is not worried about things like “black listing” (a<br />

nonsense expression) or “debt review”. They promise not to do any<br />

credit bureau checks before giving out the credit (even though the<br />

law requires it).

SCAMDEMIC: NO VACCINE IN SIGHT<br />

DEBT REVIEW SCAMS<br />

YOU CAN GET OUT<br />

OF DEBT REVIEW<br />

A growing scam is to tell people they can magically<br />

leave debt review before they have paid off all their<br />

debt. This is not legally possible.*<br />

Being in debt review is saving you thousands in fees and interest, but<br />

some people find it hard to stick to the tight budgets and to never<br />

miss payments. They long for the days when they used to owe people<br />

lots and being chased by collections agents 24/7 (we don’t know<br />

why).<br />

They miss having access to money they had not earned, and<br />

sometimes find themselves in need of more money to pay for<br />

something urgent. Instead of turning to their Debt Counsellor for<br />

advice, they begin to search the internet for a new loan and fall into<br />

the hands of scammers.

How it Works:<br />

You go online and Google “how to leave debt review” (for one reason<br />

or another) instead of talking to your Debt Counsellor about it. You<br />

find a Facebook page or website with promises of getting you out of<br />

debt review. It seems easy and they promise quick results.<br />

They ask for a fee upfront to get you out of debt review. They advise<br />

you not to pay your debt review this month and rather pay them their<br />

fees.<br />

Much like a classic 419 scam they then either try do a little bit of work<br />

and get you to pay them again or they simply disappear.<br />

*Except if the only debt left is your bond. In such a case, the Debt Counsellor is the best<br />

person to help you leave debt review safely so that you do not lose your home. If a consumer<br />

has never received a court order saying they are over indebted then a court may also decide<br />

that the consumer now has enough money each month that they don’t need debt review. In<br />

such a case, once again, your Debt Counsellor is the best person to help you sort this out via<br />

the courts but it takes some time.

SCAMDEMIC: NO VACCINE IN SIGHT<br />

WHY ARE SOME<br />

SCAMS SO TOTALLY<br />

RIDICULOUS AND<br />

OBVIOUSLY A SCAM?<br />

Sometimes scams seem so obvious. Why do scammers<br />

send poorly written emails with promises of ridiculous<br />

large amounts of money?<br />

They do this because they are targeting people who do not see the<br />

danger, those who overlook the obvious warning signs and still go<br />

ahead. These gullible people are their targets, not the ones who see<br />

the danger.<br />

So they continue to use this shotgun approach, sending out<br />

thousands of emails or sms, and see who takes the bait.

SCAMDEMIC: NO VACCINE IN SIGHT<br />

PROTECT YOURSELF<br />

FROM SCAMS<br />

Rather than following links to dodgy websites you find<br />

in suspicious emails, go directly to your banks website.<br />

Type the link into the address bar on your computer or<br />

phone. If the offer is real, you will find what you need<br />

on your banks legitimate site.<br />

If someone calls you and says they are calling on behalf of the banks<br />

fraud department, thank them for their call, hang up and call the bank<br />

yourself. Never give anyone an OTP, the banks all assure us that their staff<br />

will never ever ask you for these details (or your account passwords).<br />

If you are in debt review, then the number one way to avoid scams<br />

is to regularly communicate directly with your Debt Counsellor. If<br />

approached by strangers with offers that seem too good to be true,<br />

reach out directly to your DC and discuss the offer with them. Don’t<br />

be desperate to take on more debt or be in a hurry to get out of the<br />

process for no good reason. After all, you want less debt and not<br />

more.<br />

If you are struggling to make ends meet each month, or are faced<br />

with an emergency, then contact your Debt Counsellor for the best<br />

advice. Also, please remember the Payment Distribution Agencies do<br />

not change their bank details.

Woman photo created by wayhomestudio - www.freepik.com

SCAMDEMIC: NO VACCINE IN SIGHT<br />

AVOID THE<br />

SCAMDEMIC<br />

Sadly even now, scammers are out there and they want<br />

to rip you off. They will promise you the world, as long<br />

as you pay upfront.<br />

Never let anyone trick you in to paying upfront for a service you have<br />

not yet received.<br />

While there is no 100% way to be safe, you can avoid the most<br />

common scams out there with a little bit of caution and a dash of<br />

common sense.

DEBT REVIEW<br />

AWARDS<br />

<strong>2021</strong><br />

IS COMING

THE DEBT REVIEW AWARDS IS COMING<br />

IT’S A HARDKNOCK<br />

LIFE...<br />

Since the Zoom-demic began, time has become hard<br />

to keep track of. One minute it’s April 2020 and the<br />

next it is almost 2022.<br />

But before this year ends, we must spend a few moments celebrating<br />

debt review, the hard working companies, practices and individuals<br />

who work in the industry.<br />

The annual Debt Review Awards will be online again this year, and<br />

we invite everybody to tune in and enjoy the show with us. Friday, 10<br />

September is just a few weeks away, so let’s take a look at what the<br />

awards are, why they matter and how you can watch this year.

THE DEBT REVIEW AWARDS IS COMING<br />

WHAT ARE THE DEBT<br />

REVIEW AWARDS?<br />

The Debt Review Awards originated in 2014, when<br />

Debtfree Magazine Editor, Zak King brought the<br />

industry together in various committees to identify<br />

which credit providers, Debt Counsellors and Payment<br />

Distribution Agencies were performing well.<br />

A small red carpet gala was held, and leaders in the industry were<br />

invited to attend. It was a celebration of all the good that debt review<br />

does for consumers and the economy.<br />

On that occasion, the very first Golden Piggy Bank awards were<br />

handed out, and so the Annual Debt Review Awards were initiated.<br />

The processes are being refined each year, and the award recipients<br />

are now based on the results of online peer reviews. Different NCR<br />

registrants are able to complete each year.<br />

The results of the combined reviews are revealed on the day of the<br />

Debt Review Awards Gala. In 2020, the Gala shifted to an online show<br />

(due to the pandemic), and will be live streamed again this year.

YOU HAVE TO SEE IT FOR YOURSELF...

THE DEBT REVIEW AWARDS IS COMING<br />

WHY DO WE NEED<br />

THE AWARDS?<br />

While it is great for credit providers and Debt<br />

Counsellors to receive the highest ratings in the peer<br />

reviews, and to receive a Golden Piggy Bank, the<br />

Awards are more than a popularity contest.<br />

There is a tendency, in any industry, to focus on the ongoing<br />

problems. This is because those problems often slow down the<br />

process, and cause extra work and headaches. So, when there<br />

is an industry meeting, it is often with the goal of identifying and<br />

deliberating these problems to overcome them.<br />

This is a great idea, but it very quickly turns into a big gripe session,<br />

with a negative tone. So, when do you celebrate all the good being<br />

accomplished in the industry? Sadly, this is done rarely, if ever.<br />

Due to the many challenges with a complex and developing<br />

industry, like debt counselling, there are plenty of occasions to<br />

moan and attempt to rectify issues. In fact, it is a vital focus of many<br />

conferences, forums and other meetings.

This is why the Annual Debt Review Awards are so important for<br />

the debt review industry! It provides all who work in the industry, a<br />

chance to reflect on all the good that has been accomplished. This is<br />

not to be minimized, Debt review saves lives and has helped cushion<br />

the local impact of the global financial crises.<br />

It also gives those who work in the industry a chance to pause, and<br />

focus on what is making some of their colleagues businesses work<br />

smoother, more efficiently.<br />

It poses the important question:<br />

What does it mean to be a good debt counsellor, a good<br />

credit provider, a good payment distribution agent?

THE DEBT REVIEW AWARDS IS COMING<br />

THE PEER REVIEW<br />

PROCESS<br />

You may wonder how does the peer review process<br />

work?<br />

Here is a quick chart explaining how the process takes place during<br />

the year leading up to the Awards Show.

THE DEBT REVIEW AWARDS IS COMING<br />

WHAT TO EXPECT<br />

DURING THE<br />

AWARDS SHOW<br />

Based off the experiences of the live streamed Awards<br />

show of 2020, the organizers are running a preshow<br />

around midday and the Awards Show itself from 2pm<br />

on Friday the 10th of September.<br />

The idea behind holding the event during the afternoon, rather than<br />

on a Saturday evening (as was the case with the red carpet gala in<br />

the past) is to give as many people who work within the industry the<br />

chance to enjoy the show.<br />

Most of the larger Debt Counselling practices and credit provider<br />

debt review offices will close their phone lines a bit early that day, and<br />

invite their entire team to enjoy the show.<br />

For those who work remotely, this may be done over a shared Zoom<br />

or Teams session or perhaps just on their own device at home while<br />

Whatsapping with others are the office.

For those who are working in offices across the country, managers<br />

are arranging socially distanced group viewings on big screens or<br />

computers at work (there may even be snacks).<br />

The Preshow will feature group chats by some within the<br />

industry, where we can be a fly on the wall and see what they<br />

discuss. There will also be interviews with previous winners,<br />

presentations and some recaps regarding the process and<br />

candidates who are in line to take the top spots this year.<br />

The Preshow also gives the streaming team time to sort out<br />

any possible glitches and hiccups that might otherwise ruin<br />

the fun.<br />

The Main Awards Show will begin at 2pm. There will be<br />

speeches by familiar faces (including the National Credit<br />

Regulator and National Debt Counsellors Association). There<br />

will also be some entertainment (with a chance for you to<br />

sharpen up some of your skills). We will also find out who<br />

the 2 winners of the Significant Contribution to Debt Review<br />

awards will be, as well as the new Technology Adoption<br />

Award.<br />

After the speeches and a presentation about the debt review<br />

process, (including consumers getting out of debt) the results<br />

of the Peer reviews will be announced.<br />

The show should wrap up around 4pm so that those who<br />

commute will be able to do so around their normal transport<br />

times.

THE DEBT REVIEW AWARDS IS COMING<br />

HOW TO WATCH THE<br />

AWARDS<br />

All you need to be part of the action this year, is a device<br />

and access online. The Debt Review Awards show will<br />

be live streamed via YouTube.<br />

Step One: For up-to-date info visit www.debtreviewawards.co.za.<br />

Besides having information about the process, previous winners and<br />

the criteria used the site will feature links you can click to watch the<br />

show live.<br />

Step Two: You can also subscribe to the Debt Review Awards<br />

YouTube Channel HERE.<br />

Step Three: Check your email. Closer to the time the organizers<br />

will be sending out emails with reminders to those who have been<br />

participating in the peer reviews and those who have signed up to the<br />

mailing list.<br />

Step Four: Follow Debt Review Awards (and Debtfree Magazine) on<br />

social media to get access to all the reminders, links and even up to<br />

date results as the show streams out live.<br />

Check out our other social media channels:<br />

youtube facebook instagra twitter

A BIG THANK YOU<br />

Each year the sponsors help to cover the costs of running the<br />

peer reviews, maintaining the website, auditing and preparing

TO OUR SPONSORS<br />

the results and organizing the Awards gala/show. This year we<br />

want to particularly thank the following Supporters and Sponsors.

DEBT REVIEW<br />

LESSON #3<br />

You should discuss your monthly budget<br />

with your Debt Counsellor from time to<br />

time.<br />

Your budget needs to adjust and you need<br />

to adjust your monthly spending to ensure<br />

that you never miss a court ordered debt<br />

review payment.

POPI ACT<br />

PROTECTION OF PERSONAL INFORMATION<br />

P e r s o n a l i n f o r m a t i o n i s d a t a t h a t c a n b e u s e d t o<br />

i d e n t i f y a s p e c i f i c p e r s o n<br />

IDENTIFYING<br />

DETAILS<br />

CONTACT<br />

DETAILS<br />

DEMOGRAPHICS<br />

BACKGROUND<br />

INFORMATION<br />

FINANCIAL<br />

SOCIAL<br />

MEDICAL AND<br />

HEALTH<br />

D o n o t l e a v e d o c u m e n t s o r s c r e e n s t h a t c o n t a i n p e r s o n a l i n f o r m a t i o n o p e n f o r a n y o n e t o s e e .<br />

S h r e d o r p r o p e r l y d e s t r o y / d e - i d e n t i f y d o c u m e n t s t h a t a r e n o l o n g e r r e q u i r e d f o r w o r k p u r p o s e s .<br />

R e g u l a r l y u p d a t e y o u r p a s s w o r d s t o s y s t e m s a n d a p p l i c a t i o n s t h a t c o n t a i n p e r s o n a l i n f o r m a t i o n .<br />

A v o i d s e n d i n g s e n s i t i v e i n f o r m a t i o n o v e r e m a i l a n d c o m m u n i c a t i o n d e v i c e s .<br />

D o n o t s t o r e s e n s i t i v e i n f o r m a t i o n o n d e s k t o p s o r f l a s h d r i v e s t h a t c a n b e e a s i l y i n t e r c e p t e d .

POPI BASICS<br />

FOR DEBT COUNSELLORS

POPI BASICS FOR DEBT COUNSELLORS<br />

INTRODUCTION<br />

Debt review is an information rich process with<br />

personal information at its core. Introduce the<br />

Protection of Personal Information Act, 2013 (‘POPIA’)<br />

to the mix and suddenly the information obligations<br />

upon Debt Counsellors become that much heavier.<br />

Your Client is now<br />

the “Data Subject”<br />

There is a lot to consider from a processing perspective when<br />

undertaking a debt review process for a consumer, who is now<br />

known as the ‘data subject’ in the PoPI Act.<br />

Personal information is processed from the start of a debt review and<br />

continues for an extended period of time until the consumer is finally<br />

cleared by the Debt Counsellor.<br />

Even after the review ends, data has to be stored for some time. What<br />

are some things you need to know about the PoPI Act if you are a<br />

Debt Counsellor?

POPI BASICS FOR DEBT COUNSELLORS<br />

THE PURPOSE<br />

FOR PROCESSING<br />

PERSONAL DATA<br />

Firstly, defining the purpose for processing of<br />

consumer personal data is captured in the National<br />

Credit Act, 2005 (‘NCA’).<br />

Simply put ,the information of the consumer is collected and<br />

processed in order for the debt counsellor to fulfill its statutory<br />

obligation under the NCA; both a contractual and legal purpose.<br />

The NCA sets forth the information required in order to support<br />

a debt review application from simple identity information to the<br />

complexities of credit account numbers, balances and other financial<br />

information.<br />

This info needs to be added into your PoPI Manual.

POPI BASICS FOR DEBT COUNSELLORS<br />

THIRD PARTY<br />

SERVICE PROVIDERS<br />

Secondly, debt counsellors make use of third-party<br />

service providers in order to either interact with credit<br />

providers, credit bureaus or other role players in the<br />

debt review process.<br />

Service providers are used to process debt reviews on systems and via<br />

PDAs to distribute payments to credit providers.<br />

An important compliance step would be understanding these<br />

role players and defining which relationships amount to ‘operator’<br />

relationships and formulating agreements to manage your<br />

compliance together with your operators.<br />

You may need to update some agreements with 3rd Party Suppliers<br />

and reflect the use of 3rd Parties in your paperwork with clients.

POPI BASICS FOR DEBT COUNSELLORS<br />

DATA SECURITY<br />

Lastly, but definitely not least, data security is an<br />

important aspect of POPIA and a vital compliance step<br />

in your compliance program.<br />

Debt counsellors need to understand their IT infrastructure and the<br />

security parameters around that infrastructure.<br />

As you become more familiar with your IT operations, you put<br />

yourself in a position to understand the internal and external<br />

risks to your data security, enabling you to update your security<br />

where necessary. This may involve a little spending, to ensure your<br />

compliance.<br />

Debtfree Magazine would like to thank SupraLex<br />

for their help in compiling this article. If you would<br />

like to learn more about PoPIA Compliance or find<br />

resources head over to:<br />

https://www.linkedin.com/in/supra-lex-70456316a/

DEBT VADER

WHY CONSUMERS ARE<br />

STILL NOT GETTING<br />

COURT ORDERS<br />

When they wrote the National Credit Act (“the NCA”)<br />

the lawmakers envisioned a debt review system that<br />

would ensure over indebted consumers could obtain<br />

assistance in rearranging their debt obligations (in a<br />

harmonised manner) that would lead to the eventual<br />

satisfaction of all their debt obligations.<br />

It was meant to be simple, and they thought everyone would just<br />

follow the regulations set out by the NCA and consumers would get<br />

their court order in a reasonable time. Instead, what we saw from the<br />

outset, and are still seeing, is the opposite. Thousands of consumers<br />

who have applied for debt review still do not have a court order and<br />

feel that the debt review process has failed them. The harsh reality<br />

is that this is true for more than 50% of consumers who have ever<br />

applied for debt review.<br />

Having identified that there is obviously a problem; we should try<br />

to identify the causes and then try to rectify them as best we can.<br />

Looking at the challenges in the current debt review process, there is<br />

not just one guilty party causing all the problems that can be blamed<br />

for everything. No, across the industry many different role players<br />

have to share at least some of the blame.

DEBT VADER<br />

Here are just a few of the problems that we commonly see:<br />

Debt Counsellors:<br />

Debt review, like most businesses, is driven by profit. Debt<br />

Counsellors would not bother to work in the industry if it was not<br />

possible to sustain a living from doing this work. With the current fee<br />

structure, signing up a consumer is more profitable than keeping a<br />

consumer, this means that when a consumer first gets introduced to<br />

debt review, he is often promised the moon and the stars.<br />

As soon as the consumer pays the Debt Counsellors’ fees, the<br />

incentive for the DC to continue providing excellent service,<br />

disappears. So, what happens? Disappointed consumers, who are<br />

entitled to the very best, especially when it come to their livelihood,<br />

often try to cancel the debt review process because of bad service.<br />

Credit Providers:<br />

The Act envisioned a debt review system where credit providers<br />

would act in good faith and eagerly participate in the debt review<br />

process. Credit providers however often fail to respond to Debt<br />

Counsellors’ requests for even a simple certificate of balance, and<br />

many simply fail to respond to restructuring proposals.<br />

Failure on the part of credit providers with these basic things,<br />

hinders the debt review process, which then leads to termination of<br />

accounts (by these same credit providers or others) and often results<br />

in consumers not being able to place certain accounts under debt<br />

review, which in most cases was the reason they applied in the first<br />

place.

Credit providers also commonly fail to cancel debt order requests,<br />

and allow their collections arms to continue harassing consumers<br />

even after they have applied for debt review. These actions on the<br />

part of credit providers lead the consumers to feel like the debt<br />

review process has failed them, and so they incorrectly blame Debt<br />

Counsellors and then try cancel their applications.<br />

The Courts:<br />

The courts play a crucial part and must ensure that the interest of<br />

all the parties are protected when hearing the matter. Certain courts<br />

however, focus more on technicalities than the merits of the case.<br />

These courts have very strict requirements that need to be complied<br />

with, before the court even bothers to look at the merits of the case.<br />

Certain courts for instance, require a certified copy of the consumers<br />

ID, even though all the other documents, (including those of the<br />

credit providers), confirm the identification of the consumer.<br />

These additional requests, even though they are within the<br />

Magistrates discretion, give the consumer the impression that they<br />

are not receiving the protection offered in the NCA. Many consumers<br />

struggle to find the time and finances required to meet these extra<br />

demands which they would not face in a different court. This can<br />

result in massive delays and many extra trips to the courts for the<br />

Attorneys trying to help the consumers and banks.<br />

National Credit Regulator:<br />

The NCR has a mandate to regulate the industry and, inter alia ensure<br />

the debt review process works. Years after the inception of the NCA,<br />

the problems mentioned above sadly still persist.

DEBT VADER<br />

The last task team report about debt review was done all the way<br />

back in 2009, over 12 years ago. Unscrupulous Debt Counsellors,<br />

who are well known to credit providers and other hard working Debt<br />

Counsellors, still somehow manage to operate in the industry. Greedy<br />

and inefficient credit providers still get away with debiting consumers<br />

after they applied for debt review, and courts seem to just add more<br />

and more requirements daily due to the Act not being amended to<br />

address such issues.<br />

These are just some of the reasons why so many consumers are still<br />

not getting court orders. There are others, of course. The result is that<br />

so many who have entered the process and are loyally paying off their<br />

debts can unfortunately end up thinking the process is not working<br />

(even though it actually is). This can make them think about dropping<br />

out of the process – which is an incredibly bad idea.<br />

All parties in the debt review industry have an obligation to try<br />

and help desperate, debt stressed South African consumers. It will<br />

take a concerted and ongoing effort focused on solving problems<br />

rather than personal rights or convenience to ensure that the NCA’s<br />

envisioned process is actually achieved. The question is, will it happen<br />

or will these issues simply continue to drag on and on?<br />

*The views expressed by Debt Vader do not necessarily reflect those of the Debtfree<br />

Magazine team. The purpose of the article is to spark debate and conversations around this<br />

topic for the betterment of the industry.<br />

To give Debt Vader a piece of your mind, send us a message for him at:<br />

DebtVader@debtfreedigi.co.za