Debtfree Issue 202303 - DB SE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SPECIAL<br />

EDITION<br />

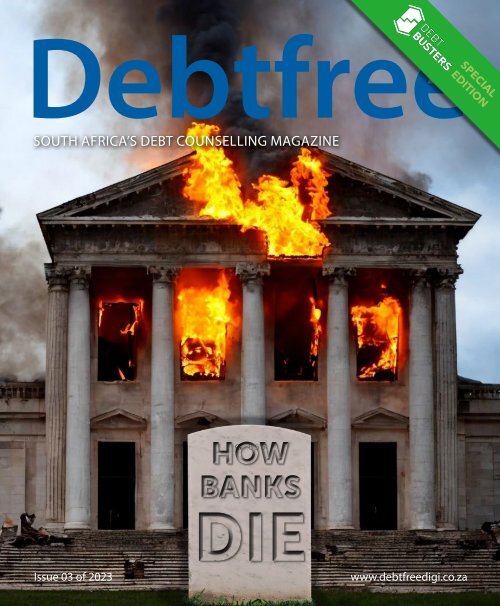

HOW<br />

BANKS<br />

DIE<br />

<strong>Issue</strong> 03 of 2023

EXCELLENCE IS DOING<br />

ORDINARY THINGS<br />

EXTRAORDINARILY<br />

WELL<br />

– John W. Gardner

WHAT MAKES US<br />

EXCELLENT?<br />

/ Unimpaired and automated PDA systems<br />

/ Integration with top-ranked Debt Counsellor systems<br />

/ Best customer support in the country – queries are resolved within 24 hours<br />

/ Strong compliance and best-industry-practice implementation is at our centre<br />

Call Saishen Krishnan<br />

Head of Hyphen PDA | 071 884 7300<br />

Or call our friendly support centre on 011 303 0060 - Option 2<br />

or visit our website www.hyphenpda.co.za

FROM THE EDITOR<br />

For hundreds of years, Swiss banks have been the<br />

“golden child” of banking. They had a reputation<br />

for being the safest place to keep your money.<br />

Through wars and regime changes, plagues and<br />

pandemics, they have stood bastions of banking.<br />

This month that illusion was shattered. And with it we are forced<br />

to realise that banks are just businesses too, and face external and<br />

internal pressures that can derail them. That’s not to say we have<br />

never seen banks collapse. We have, but those banks seemed<br />

reckless and unstable compared to the famous Swiss bank.<br />

It’s been a real eye opener for many people. Banks and banking<br />

have always been something of a shadowy world. Not that banks<br />

are hiding anything sinister, but how they operate is not simple and<br />

most of us were never taught at school about how banks work or<br />

how they could fail.<br />

In this issue we take a bit of a peek below the hood to see how the<br />

banks make their money and how they lose it. We consider what<br />

can be learnt from the current banking crisis that is spilling across<br />

the globe, and we discuss how it will impact us.

FROM THE EDITOR<br />

We also talk about trust, trust is not easily given. So, it can be<br />

hard when you enter debt review and are asked to trust a Debt<br />

Counsellor. We discuss some situations that can test our trust,<br />

and how we can think about things and know who to trust in<br />

that moment.<br />

If you are looking for a Debt Counsellor, Attorney, PDA or credit<br />

provide then head to our service directory section. We also have<br />

other news and great advice. Is it a good idea to pawn your car<br />

with one of those deals where you still get to drive the car? Well,<br />

we talk about that and other tips and tricks.<br />

In 2020 we learned that pandemics can happen overnight. In<br />

2021 we learned that even the American political system can face<br />

a coup. In 2022 we learned that war can break out in the most<br />

unexpected places, and this year we are fast learning that the<br />

institutions we think are so stable, are also open to system shock.<br />

In the midst of all that uncertainty, what can we rely on? Not, Swiss<br />

banks. No but, hopefully you can rely on your family and friends.<br />

You can also rely on prices to increase and your salary to feel like it<br />

is shrinking. You can also rely on debt making you feel stressed and<br />

bad. So, trust those helping you and carry on paying off your debts<br />

as fast as you can. That way you can say you are debt free.

FROM THE<br />

DESK<br />

AMENDMENTS TO THE<br />

NATIONAL CREDIT<br />

ACT COULD HELP<br />

MUNICIPALITIES AND<br />

SCHOOLS RECOVER<br />

BILLIONS<br />

Including municipal rates<br />

and school fees as part of<br />

debt restructuring would be<br />

a win-win for consumers,<br />

schools, municipalities.

Municipalities, schools and body corporates, amongst others, could<br />

see improvements in outstanding payments if adjustments were<br />

made to the National Credit Act to allow the restructuring of these<br />

debts in debt counselling.<br />

Municipal rates, levies, school fees, money owed to medical practices<br />

and attorneys and other similar debts fall outside of the National<br />

Credit Act as it currently stands. This means debt counsellors cannot<br />

renegotiate these debts.<br />

A Statistics SA report on civil cases for debt shows that consumers are<br />

increasingly tending not to repay this kind of debt.<br />

Summonses issued for debt relating to services, which comprise<br />

mainly municipal rates, increased by around 25% in November 2022<br />

both for businesses and individuals, compared to the same month<br />

in 2019. Comparative data for school fees and tuition, for the same<br />

periods, show increases of up to 33% for judgements.<br />

At the same time the volume of overall summonses have decreased.<br />

“It’s likely that some creditors are realising that getting a summons<br />

isn’t the most effective way of recovering what’s owed and financially<br />

stretched consumers are prioritising debtors who shout the loudest.<br />

Typically, these are businesses rather than schools and municipalities,<br />

which is why a lot more people are behind on repaying this kind of<br />

debt,” says Benay Sager, chairman of the National Debt Counsellors<br />

Association, of which DebtBusters is a member.<br />

The 2022 data was compared to 2019 as this is the first pre-Covid years.<br />

Data for 2020 and 2021 is not typical because of Covid-19.

It’s fair to assume that if summonses have increased by 25% over the<br />

past three years that the value of what’s owed has grown by the same<br />

proportion, he says.<br />

Debt counselling is a tried, tested and effective tool for consumers<br />

dealing with high debt levels. Evidence of this is the number of people<br />

to successfully complete debt counselling and get their clearance<br />

certificates, which has increased five-fold over the past six years.<br />

“We also know that from experience that when different debts are<br />

consolidated into a single monthly repayment, as they are in debt<br />

counselling, consumers have a higher repayment ratio because they<br />

don’t pick and choose which debt to repay.”<br />

The NDCA’s view is that including particularly rates and school fees<br />

when amendments to the National Credit Act are considered would<br />

be a win-win, both for consumers struggling with high debt burdens<br />

and debtors currently excluded such as schools and municipalities.<br />

“Expanding the NCA to allowing debt counsellors to renegotiate<br />

municipal rates and similar kinds of debt would be a more effective<br />

way for municipalities and others to recover the billions they’re<br />

currently owed.”

CONTENTS<br />

THIS IS HOW BANKS DIE<br />

LEARNING TO<br />

TRUST YOUR DEBT<br />

COUN<strong>SE</strong>LLOR<br />

SOCIAL MEDIA<br />

AND FEELING<br />

FOMO<br />

NEWS<br />

<strong>SE</strong>RVICE<br />

DIRECTORY<br />

DISCLAIMER<br />

<strong>Debtfree</strong> Magazine considers its sources reliable and verifies as<br />

much information as possible. However, reporting inaccuracies<br />

can occur, consequently readers using this information do so<br />

at their own risk. <strong>Debtfree</strong> Magazine makes content available<br />

with the understanding that the publisher is not rendering legal<br />

services or financial advice. Although persons and companies<br />

mentioned herein are believed to be reputable, neither<br />

<strong>Debtfree</strong> Magazine nor any of its employees, sales executives<br />

or contributors accept any responsibility whatsoever for their<br />

activities. <strong>Debtfree</strong> Magazine contains material supplied to<br />

us by advertisers which does not necessarily reflect the views<br />

and opinions of the <strong>Debtfree</strong> Magazine team. No person,<br />

organization or party can copy or re-produce the content<br />

on this site and/or magazine or any part of this publication<br />

without a written consent from the editors’ panel and the<br />

author of the content, as applicable. <strong>Debtfree</strong> Magazine,<br />

authors and contributors reserve their rights with regards to<br />

copyright of their work.

DEBT REVIEW<br />

Credit Providers often use outside<br />

companies to collect debts for them.<br />

This is why people will say things like:<br />

"I am calling on behalf of Bank X".<br />

If you are unsure who you are<br />

talking to then you can ask them<br />

directly for a name and ID Number<br />

or you can hang up and you can<br />

call the credit provider directly<br />

instead.

No more debt-stress.<br />

Let’s get it sorted.<br />

We’ll get your interest rates right down. You’ll<br />

make one consolidated payment a month. You’ll<br />

have more cash to live on. Your assets will be<br />

legally protected. Sorted.<br />

0861 365 910<br />

www.debtbusters.co.za<br />

info@debtbusters.co.za

THIS IS<br />

HOW<br />

BANKS<br />

DIE

DEBT REVIEW AND YOUR CREDIT SCORE<br />

BANKS CAN<br />

FAIL<br />

Banks are an essential part of our modern economy.<br />

It’s hard to imagine life without banks. They provide<br />

financial services to individuals, businesses, and<br />

governments. They are safe place to store your money,<br />

and a place to get credit when you need more than<br />

you have right now.<br />

Some banks are the biggest and most stable businesses in the entire<br />

world. Some have a bigger income than the countries that they<br />

operate in, they seem so stable.<br />

But, banks can and do collapse.<br />

Even though they seem so essential and stable, like any business,<br />

banks are not immune to failure, and the collapse of a bank can have<br />

serious consequences for the broader economy.<br />

Recently, many banks have found themselves in real trouble, some<br />

have collapsed under the pressure. Banks are in trouble!<br />

Let’s talk about why this is happening and look at some examples, like<br />

Lehman Brothers in 2008 and both Silicon Valley Bank, and Credit<br />

Suisse in 2023 to see how banks could die.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

A DIFFICULT TIME<br />

FOR BANKS<br />

Banks are a safe place to keep your money. When you<br />

have money that you want to save, it is not a great<br />

idea to hide it under the mattress. Much better to take<br />

those funds to a bank, and pay to keep that money safe<br />

(and to have it insured).<br />

The banks, in turn, use that money to run their other business of<br />

investing and trading. They also use some of that money to give<br />

other people loans or credit. They charge interest and thereby make<br />

money.<br />

Because banks no longer have to have gold on hand to match what<br />

they lend out, governments and regulators demand that they at least<br />

have some money on hand (and insurance). The amount they are<br />

allowed to lend out is closely linked to how much they have saved<br />

with them.<br />

These days we all know, that it is hard to save. Very few people are<br />

able to save anything at all.<br />

Banks also have a lot of competition these days, more and more<br />

digital banks are entering the market. This means the banks are<br />

fighting over a small group of clients.

Even giving people credit, which is very profitable for banks, is<br />

becoming harder. These days, the banks have to check that you can<br />

actually afford to repay the money you borrow. They also have to<br />

double check the information you give them when you apply for<br />

credit.<br />

More than that, because so many people do not have jobs, they<br />

cannot really afford credit. Young people in particular are not getting<br />

work, thereby not qualifying for credit.<br />

This results in banks having less money saved with them, fewer<br />

clients, and are making less profit due to fewer people qualifying for<br />

credit.<br />

Banks are experiencing challenges that they have rarely seen before.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

HOW BANKS MAKE<br />

MONEY<br />

You may wonder: How do banks<br />

make their money?<br />

It’s complicated. At its core, they make money<br />

by charging for services like protecting your<br />

money, and charging people who want to<br />

borrow money (eg. initiation fees and interest).<br />

Banks also have shareholders who buy into<br />

their bank, and thereby have a small say in<br />

how the bank is run, and get a bit of the profit<br />

when the bank is doing well.<br />

Investors may take on shares, or may invest in<br />

various types of bonds that the bank offers. This<br />

provides the bank with more money to use.<br />

Let’s dive a little into the mysterious way banks<br />

work, and look at what they do and see how<br />

that can leave them exposed. To start with<br />

let’s figure out what stocks and bonds are, and<br />

how securitisation works. Then let’s see how<br />

banks make money and how they can lose it.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

SHAREHOLDERS VS BONDHOLDERS:<br />

WHAT’S THE<br />

DIFFERENCE?<br />

When you own a share in a bank, you are a<br />

shareholder. This means that you own a small piece of<br />

the bank, and you have a say in how the bank is run.<br />

You might get to vote on important decisions e.g. who sits on the<br />

bank’s board of directors. Shareholders also have the potential to<br />

make money if the bank’s stock price goes up, because they can sell<br />

their shares for a higher price than they paid.<br />

On the other hand, when you own a bond issued by a bank, you are<br />

a bond holder. This means that you have lent money to the bank and<br />

the bank has promised to pay you back with interest.<br />

Bonds are a type of loan that investors make to companies,<br />

governments or other organizations. The bondholder receives regular<br />

interest payments from the bank over a set period of time, and at the<br />

end of that period, the bank repays the initial amount of money that<br />

was borrowed.<br />

The main difference between a shareholder and a bond holder is the<br />

type of ownership they have in the bank.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

WHAT ARE<br />

BONDS?<br />

No, not James Bond, the other bond.<br />

Think of bonds like loans that people or<br />

companies take out. When you buy a bond,<br />

you’re essentially lending money to the person<br />

or company (or bank) that issued the bond. In<br />

return, they promises to pay you the amount<br />

you loaned them, plus interest over a certain<br />

period of time.<br />

So, you lend them money now and you make<br />

a profit over time as they pay you back the<br />

loan amount with interest. It’s kind of how all<br />

credit works these days.<br />

Now, some bonds are considered riskier than<br />

others. For example, if you’re lending money<br />

to a company that’s struggling financially,<br />

there’s a higher chance that they might not be<br />

able to pay you back. So, if you invest in that<br />

risky company’s bonds, you might demand<br />

a higher interest rate to compensate for that<br />

risk.

Similarly, bonds with longer maturities (the<br />

length of time until the bond matures and<br />

the issuer pays back the loan) also tend to be<br />

riskier, since there’s more time for something<br />

to go wrong. So, investors might demand a<br />

higher interest rate on those bonds too.<br />

The price of a bond can vary depending on<br />

a few factors. For example, if interest rates<br />

in general are low, then investors might be<br />

willing to pay more for a bond that offers a<br />

higher interest rate.<br />

They want something that makes them more<br />

profit than just a boring savings account.<br />

Conversely, if interest rates go up, the price of<br />

existing bonds with lower interest rates might<br />

go down. This means those investments can<br />

lose money.<br />

So, to sum up: different bonds have different<br />

prices and risks because they represent loans<br />

to different borrowers with varying levels of<br />

financial health and different maturities. The<br />

returns on those bonds (the interest rates)<br />

reflect those risks, and can vary depending on<br />

market conditions.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

<strong>SE</strong>CURITISATION<br />

WHAT IS IT?<br />

When you put your money in a bank,<br />

the bank uses that money to make<br />

loans and investments. Sometimes,<br />

the bank might take some of the<br />

loans and investments they’ve made<br />

and package them together into<br />

something called a "security".<br />

A security is basically a bundle of loans or<br />

investments that are sold to other people or<br />

organizations in order to raise money.<br />

For example, let’s say that a bank has made<br />

various home loans to clients. The bank might<br />

take a bunch of those loans and bundle them<br />

together into a security called a "mortgagebacked<br />

security". Then they will sell shares of<br />

that security to investors.<br />

When someone buys a share of a bank<br />

security, they become part-owner of that<br />

bundle of loans or investments. They’ll get

paid a share of the money that’s made from<br />

those loans or investments, either in the form<br />

of interest payments or dividends.<br />

Bank securities are just bundles of loans or<br />

investments that banks sell to investors as<br />

a way to raise money that they then use for<br />

other investments or costs.<br />

There have been many court cases about<br />

this topic and how securitisation impacts on<br />

who really owns consumer’s mortgages and<br />

who can collect on them when people miss<br />

payments. It can be somewhat mysterious and<br />

obscure.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

BORROWING &<br />

LEVERAGING<br />

You “need money to make money”, the saying goes.<br />

One of the main reasons why banks collapse is<br />

because of their heavy reliance on borrowing money<br />

themselves, and then leveraging those funds to make<br />

money before they have to pay it back.<br />

Banks do not have vaults full of gold, like in the old days. In modern<br />

times money is mostly 1’s and 0’s on a computer. In fact, you might<br />

find that banks give people loans that are based almost totally on the<br />

promise of money that the client will eventually pay back. Still, banks<br />

are required to have at least some of the money they lend out or use.<br />

Banks borrow money from depositors (their savings clients) and other<br />

creditors and then in turn, they use that money to grant loans and<br />

investments. This process is known as leveraging, and it can amplify<br />

profits when things are going well.<br />

However, it can also magnify losses when things turn sour. Since<br />

banks have borrowed money, they also have to pay it back. To do that<br />

they need to be making a profit or to borrow even more money (from<br />

the reserve bank or investors) to make payments.<br />

Sound familiar? We all know how hard it can be to repay debts to lots<br />

of different people.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

FAMOUS BANKS THAT HAVE COLLAP<strong>SE</strong>D<br />

LEHMAN BROTHERS<br />

Lehman Brothers is perhaps one of<br />

the most famous example of a bank<br />

collapse.<br />

At the time, it was the 4th biggest bank in the<br />

USA. By 2008, the investment bank had made<br />

a lot of money by investing in different things<br />

like stocks, bonds, and mortgages, but they<br />

had taken on a lot of debt to do so.<br />

Unfortunately, some of the investments that<br />

Lehman Brothers had made were in the overinflated<br />

US housing market. At that time, a lot<br />

of people, too many perhaps, had been given<br />

loans to buy houses, there was a false sense of<br />

euphoria in the market and many people were<br />

"flipping" house after house for a profit.<br />

Lehman Brothers took over many of these<br />

mortgages, then those people realised they<br />

had too much debt and couldn’t afford to<br />

repay them. As sales began to slow, the

problem got worse. As a result, a lot of houses<br />

went into foreclosure (then the property is<br />

repossessed). This caused the bank to end up<br />

with so many repossessed properties, and no<br />

one to buy them (because it had been over<br />

priced in the first place and because no one<br />

had any money to buy anything).<br />

When that happened, the value of those<br />

houses dropped suddenly, which meant that<br />

the investments Lehman Brothers had made<br />

in the housing market also lost value. This was<br />

a big problem for Lehman Brothers, because<br />

now they owed more money than they had,<br />

and they couldn’t repay it.<br />

As a result, the people and companies that<br />

had lent money to Lehman Brothers started<br />

worrying that they might not get their<br />

investments back. They started to pull their<br />

money out of the firm, which made it even<br />

harder for Lehman Brothers to pay off their<br />

debts. Eventually, the firm had to file for<br />

bankruptcy.<br />

That triggering a global financial crisis among<br />

banks and other investment firms that had all<br />

done the same, it was chaos!<br />

We are still feeling the effects decades later.<br />

Photo by David Shankbone used under Creative Commons Licence

DEBT REVIEW AND YOUR CREDIT SCORE<br />

FAMOUS BANKS THAT HAVE COLLAP<strong>SE</strong>D<br />

SAAMBOU<br />

Saambou Bank, was a local South<br />

African bank founded in 1942. In<br />

1970 it merged with Nasionale<br />

Bouvereniging. They went public<br />

in 1987 and traded under the name<br />

Saambou Bank.<br />

Saambou Bank was eventually the 6th biggest<br />

bank in SA, and focused on personal loans<br />

and mortgages to individuals. The bank<br />

experienced financial difficulties in the early<br />

2000s, and ultimately filed for bankruptcy<br />

in 2002.<br />

One of the reasons Saambou Bank<br />

experienced financial difficulties was because<br />

they lent money to high risk customers (kind<br />

of how African Bank did). This meant that<br />

the bank charged higher interest rates to<br />

compensate for the risk, which made their<br />

loans more expensive than those of their<br />

competitors.

Like Lehman Brothers, who would fall not<br />

too long after, the bank invested heavily in<br />

property and suffered losses when the local<br />

property market went down. As a result, the<br />

bank didn’t have enough cash to repay their<br />

debts.<br />

The bank went into bankruptcy in 2002 after<br />

newspaper articles appeared about it being<br />

bankrupt and customers withdrew R1 billion in<br />

just two days. Trading stopped and eventually<br />

First National Bank took over some of its<br />

business.<br />

Fortunately, many smaller clients eventually<br />

got some of their savings out of the bank but<br />

the bank itself was done and was liquidated<br />

in 2006. A dividend of R7.568 billion, or 4.53c<br />

per share, was paid out to shareholders (the<br />

share had traded at 203c per share before the<br />

bankruptcy).

DEBT REVIEW AND YOUR CREDIT SCORE<br />

FAMOUS BANKS THAT HAVE COLLAP<strong>SE</strong>D<br />

SILICON VALLEY BANK<br />

Another example of a bank that suddenly got into<br />

trouble is Silicon Valley Bank. They specialised in<br />

investing in and assisting tech companies. In 2023,<br />

the bank was hit hard by a series of high-profile tech<br />

company failures.<br />

Many of those companies dealt in cryptocurrency. When the value<br />

of crypto fell suddenly towards the end of the pandemic, so did the<br />

value of those businesses. As their values dropped, people stopped<br />

investing in them, and those firms could not pay back what they<br />

owed the bank or to save money in the bank like they had in the past.<br />

As a result, SVB suffered significant losses on its loans to these<br />

companies. Once people heard the bank wasn’t making as much<br />

profit, they began to quickly withdraw savings and investments in the<br />

bank, and this made other investors and clients nervous, the result<br />

was a "run on the bank".

Photo by Minh Nguyen used under Creative Commons Licence

DEBT REVIEW AND YOUR CREDIT SCORE<br />

FAMOUS BANKS THAT HAVE COLLAP<strong>SE</strong>D<br />

CREDIT SUIS<strong>SE</strong><br />

When you were young, you probably<br />

heard of spies or criminals who<br />

banked in Switzerland. It was long<br />

considered the safest place to bank<br />

on the planet. One of the 30 most<br />

stable banks in the work was based<br />

in Switzerland for the last 160 years<br />

and was called Credit Suisse.<br />

What happened to Credit Suisse is very<br />

interesting, the bank had been having issues<br />

in the background, and was exposed to<br />

some financial losses due to bad deals and<br />

investments in the UK and USA.<br />

They had also been issued big fines and<br />

recently many clients had been withdrawing<br />

funds (for a variety of reasons). This meant the<br />

bank had to ask one of its newest investors for<br />

more money. When they said no, things came<br />

to a head.

Even though the bank had lots of assets and<br />

plenty money in the vaults, the market was<br />

very nervous after the demise of two big<br />

American banks (one of them being Silicone<br />

Valley Bank) and reacted with panic. This sent<br />

the bank’s shares into freefall, losing 30%<br />

value in one day.<br />

That huge and sudden drop made investors<br />

and other clients panic even more! Eventually,<br />

the Swiss banking regulators had to get<br />

involved and brokered a big deal to get<br />

another bigger bank to buy them.<br />

The buy-out deal had some unusual decisions<br />

that have made certain types of bond holders<br />

worldwide very angry and others very nervous.<br />

That chaos is still going on.<br />

Photo by Roland zh used under Creative Commons Licence

DEBT REVIEW AND YOUR CREDIT SCORE<br />

WHAT IS A<br />

"RUN ON THE BANK"?<br />

When news gets out that a bank’s share prices are<br />

dropping, or that some of their investment plans are<br />

not working out as expected, this can make their<br />

clients begin to panic, causing what is known as a run<br />

on the bank.<br />

A "run on the bank" happens when many people all start to worry<br />

that a bank might not have enough money to give back to all of its<br />

customers. They try to withdraw all of their money at the same time,<br />

which can cause big problems for the bank. Often the situation will<br />

snowball from just a few nervous clients, then a few more, then more<br />

and more as the panic spreads.<br />

When too many people try to take out their money all at once, it can<br />

cause the bank to run out of cash. That’s because banks usually keep<br />

only a small amount of their customers’ money on hand, and loan<br />

out the rest to other people or invest it in different ways. If too many<br />

people try to take their money at once, the bank might not be able to<br />

get enough cash in fast enough to return it to everyone.<br />

This can be a big problem because it can cause a bank to go<br />

bankrupt. If a bank runs out of money, it really can’t pay back all of its<br />

customers, and that can lead to a chain reaction of financial problems<br />

for everyone involved. No wonder people panic.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

AS SAFE AS A<br />

SWISS BANK<br />

Recent years have shown that, like any business, banks<br />

can fail. Bankers are some of the smartest people in<br />

dealing with money and investing money but even<br />

they are effected by what is happening around the<br />

world. The world is an unstable and complicated place.<br />

If someone in China gets flu, it can cause the world to go into<br />

lockdown for years. We now have massive and destructive storms<br />

and weird fire tornadoes and that’s before you consider the impact of<br />

wars and climate migration.<br />

Things like the creation of cryptocurrency and even digital banking<br />

have had massive impacts on traditional banking and the profits<br />

banks can make. A shrinking base of new clients, new investors and<br />

a drought of people with money to deposit is putting banks under<br />

pressure. When government agencies like the US Fed or SA Reserve<br />

Bank put up the Repo Rate, this makes it even more expensive for<br />

banks to borrow money or make money on existing investments.<br />

Even the failure of other banks like SVB or Credit Suisse or when<br />

bond holders don’t get paid out when things go wrong means that it<br />

influence other banks to borrow money or insure their money. That in<br />

turn puts all banks under strain, and makes it harder for them to make<br />

a profit.

DEBT REVIEW AND YOUR CREDIT SCORE<br />

BANKS CAN<br />

DIE<br />

Banks need our money to make money. They have<br />

investors who give them money, but only if the bank<br />

will make them a good return on their investment.<br />

Global markets and global conditions are hard to predict, thereby<br />

making consistent profit from investments almost impossible.<br />

These days, investors are fickle and only want the most profitable<br />

investments.<br />

Investing has always been volatile and with the increases in<br />

government regulation and the incredible speed of communication, it<br />

is harder and harder to hide even the smallest financial difficulties and<br />

it has become harder to keep investors calm.<br />

These days fickle, nervous, demanding investors and easily panicked<br />

clients can quickly withdraw their support and their cash in just<br />

minutes. Runs on the bank are becoming more common.<br />

The picture of the banks being too big to fail has truly been shattered.<br />

We now live in the time when banks can easily die.

LEARNING<br />

TO TRUST<br />

YOUR DEBT<br />

COUN<strong>SE</strong>LLOR

LEARNING TO TRUST YOUR DC<br />

TRUST MUST BE<br />

EARNED<br />

As children we first learn to trust our<br />

parents. We develop this trust based<br />

on their loving attention and care<br />

for us, they feed us, come when we<br />

call and catch us when we fall. They<br />

provide a basis for all our future<br />

dealings with other people.<br />

Then later, as we age, we learn to trust our<br />

friends, our friends’ parents and our teachers.<br />

Along the way, we also learn who not to trust.<br />

We get hurt, tricked and lied to. People break<br />

our heart and our trust. We make deals and<br />

agreements with people and they don’t stick<br />

to their side of the bargain.<br />

This is why trust has to be earned.

LEARNING TO TRUST YOUR DC<br />

WHEN TIMES ARE<br />

HARD<br />

They say: when days are dark friends<br />

are few.<br />

Perhaps you have experienced this when you<br />

hit hard financial times. Some of your friends<br />

disappeared and sometimes institutions you<br />

have banked with for years and years suddenly<br />

turned on you and set their collections agents<br />

on you.<br />

This behaviour hurts your feelings and breaks<br />

trust.<br />

If your financial situation becomes very<br />

difficult to deal with, then getting professional<br />

advice is a good idea. Turning to NCR<br />

registered Debt Counsellors who are trained<br />

to help can be just what you need.

LEARNING TO TRUST YOUR DC<br />

GETTING<br />

HELP<br />

The process of finding the right Debt<br />

Counsellor is an important one, and<br />

there are many factors which you<br />

should take into account. You need<br />

to find the right person to help.<br />

Do your homework before you commit. Ask<br />

to see the NCR certificate from whoever you<br />

talk to, and make good choices!<br />

When you do eventually find the right person<br />

to help, and you sign those forms and send in<br />

all your information and get that form 17.1 that<br />

says you have applied for debt review, it can<br />

feel like a huge weight has been lifted from<br />

our shoulders.<br />

Now instead of trying to deal with all the<br />

stress and challenges on your own, you<br />

now have somebody, who can be trusted, in<br />

your corner. They help to put an end to the<br />

persistent collections calls, ease your fear of<br />

the Sherriff showing up at your door to take

all your stuff, and you no longer have to be<br />

scared of letters of demand in the post of by<br />

email.<br />

But…<br />

The challenge is that you suddenly have<br />

to trust this individual or debt counselling<br />

practice a lot. Your entire financial future<br />

depends on it.<br />

Also, the Debt Counsellor is going to be<br />

asking you to make some big changes. What<br />

you were doing, was not working, so it’s time<br />

to make a change.<br />

You might be asked to stick to a new,<br />

improved budget. You may be advised about<br />

where and how to bank. You might need to<br />

make serious changes to your life - maybe<br />

where you live or how you live, in order to<br />

cover the debt repayments.<br />

All this is hard.

LEARNING TO TRUST YOUR DC<br />

TRUSTING<br />

THE PLAN<br />

Other than a new budget, you will<br />

also be presented with a whole new<br />

plan on how to settle your debts.<br />

Normally, that new plan and repayment<br />

figure is much more manageable than before<br />

(maybe even half of what you used to pay).<br />

And what’s more, in a few years, if you stick to<br />

the plan, your debts will be totally gone.<br />

Amazing!<br />

But the snag is that for a long time you have<br />

been making your own plans. You have been<br />

doing whatever you want, and now you are<br />

asked to stick closely to this tight budget<br />

and to make payments every month without<br />

missing a month.<br />

This is a big change to how you may have<br />

done things before.

LEARNING TO TRUST YOUR DC<br />

PAYING THE<br />

MONEY<br />

Debt Counsellors never actually<br />

touch your money. They help to<br />

structure the plan for the courts and<br />

they give instructions to the people<br />

who do handle the money, but they<br />

never touch it themselves.<br />

The National Credit Regulator has registered<br />

4 companies who handle the payment side<br />

of debt review. You make one payment to<br />

them, and then they split up the money and<br />

distribute it on the right day, to the right<br />

account, using the right references. These<br />

companies are the Payment Distribution<br />

Agencies or PDAs.<br />

So, you deposit money into this new account,<br />

or set up the debit, and you have to trust that<br />

your money will get to your credit providers.

LEARNING TO TRUST YOUR DC<br />

IT’S HARD TO TRUST A<br />

STRANGER<br />

Even if we have done our<br />

homework, and even if we know<br />

that the person who is helping us is<br />

a professional Debt Counsellor with<br />

a good reputation, it takes a lot of<br />

trust to allow a relative stranger to<br />

tell you how to live and what to do.<br />

We listen because we are desperate, and the<br />

situation is out of control as is. Surely anything<br />

is better than living like that.<br />

But the truth is that we have had limited<br />

dealings with this new person and with the<br />

entire debt review process and the debt<br />

counselling practice so we might find it<br />

hard to trust when certain situations arise,<br />

especially at first.<br />

Let’s briefly look at some things that might test<br />

our trust and make us second guess the debt<br />

review process or Debt Counsellor.

LEARNING TO TRUST YOUR DC<br />

THE COLLECTION<br />

CALL<br />

You may get a call from a collections<br />

agent who wants money. You calmly<br />

tell them that you are under debt<br />

review and they must talk to your<br />

Debt Counsellor.<br />

It gives us a feeling of satisfaction after all<br />

those pesky calls to finally be able to tell<br />

someone essentially: “talk to my lawyer”. You<br />

will probably feel vindicated that you have the<br />

situation under control.<br />

But the collections agent might say something<br />

to the effect that debt review isn’t showing on<br />

their system, or that the payments you have<br />

made are not reflecting.<br />

Immediately your feeling of comfort is<br />

shattered, you may begin to panic.

Here are some things to keep in mind:<br />

They may call right at the start of the process<br />

when you’ve only paid money through the PDA<br />

once or twice. Debt review is a legal process<br />

and all your credit providers know that in<br />

month 1 and 2, your payment amount is set<br />

aside to cover professional fees for the Debt<br />

Counsellor, and your attorney. This is normal.<br />

If someone says they are calling from the<br />

“bank” and they are not getting any money,<br />

stop and think about it. How can that be? You<br />

know you paid. You know that the National<br />

Credit Regulator checks on the 4 registered<br />

PDAs each quarter and audits them regularly.<br />

Also, you know that the Debt Counsellor<br />

doesn’t touch the money so, they are not<br />

stealing it.<br />

You are probably dealing with a collections<br />

agent, who works for commission based on<br />

however much they can get people to pay<br />

immediately. This can motivate them to say<br />

things that are less than accurate.<br />

Don’t stop trusting your NCR registered Debt<br />

Counsellor because of a 2 minute phone<br />

call from a stranger. That would be foolish,<br />

rather get all the facts and speak to your Debt<br />

Counsellor before doing anything rash.

LEARNING TO TRUST YOUR DC<br />

WHEN YOUR DEBT<br />

COUN<strong>SE</strong>LLOR IS NOT GREAT<br />

AT COMMUNICATING<br />

It can be stressful if your Debt<br />

Counsellor is not great at<br />

communicating.<br />

Good Debt Counsellors will keep in regular<br />

contact with you, and make sure you get<br />

updates about the process.<br />

Some Debt Counsellors are however, not that<br />

great at staying in touch, and not that great at<br />

keeping you updated.<br />

If they are bad at communicating with you<br />

then… improve your communication with<br />

them. Be specific and explain the situation in<br />

a detailed way that makes what you need and<br />

want very clear. Don’t give up on the process<br />

because they are very busy and take a while to<br />

return your calls or emails.<br />

Pester them if you must, but stay in touch and<br />

always let them know if you change email<br />

address or phone numbers.

LEARNING TO TRUST YOUR DC<br />

A MISLEADING<br />

STATEMENT<br />

What if you get a statement from your creditor that<br />

shows you owe more money than before?<br />

What if you have been paying for a while, and the debt is not<br />

getting considerably smaller? Should you start to doubt your Debt<br />

Counsellor?<br />

It is important to realise that because your creditor charges interest,<br />

each month your debt can grow if you pay less than the amount of<br />

monthly interest.<br />

Normally, this will not be part of your debt repayment plan. It is very<br />

unlikely.<br />

Right at the start of the process however, you will cover the Debt<br />

Counsellor’s fee and the attorney’s fees in month 1 and 2. This means<br />

that your debts might climb slightly those first two months.<br />

Still, if you see a balance going up, you should definitely talk to your<br />

Debt Counsellor because maybe the credit provider has not updated<br />

their computer system to reflect the correct figures under debt<br />

review.

LEARNING TO TRUST YOUR DC<br />

DEBT SHRINKING TOO<br />

SLOWLY<br />

If you have been paying for around two years and you<br />

are seeing that the debt is taking a long time to reduce,<br />

you may begin to feel your Debt Counsellor is not<br />

doing their job. You begin to lose trust in them.<br />

Before you decide to do anything drastic, go have a look at the<br />

official court order for debt restructuring (ask for it, if you don’t have<br />

a copy). The court order shows you how many months each debt will<br />

take to be paid off at the new arrangements. Often these plans are set<br />

out over 60 months (or 5 years).<br />

Debt review is often designed so that all your credit providers get paid<br />

a fair amount each month. This can mean that even accounts with<br />

small balances take a long time to get paid because they only receive<br />

small monthly payments. If you are able to, then you can help speed<br />

things up and begin to settle your debts sooner. How?<br />

If you are able to pay off a small debt, then funds that were being<br />

allocated to that account can now be shifted to another small debt.<br />

This can settle that debt faster too. And so, more funds can be<br />

allocated to another account, this snowball effect can make a big<br />

difference.

LEARNING TO TRUST YOUR DC<br />

LEARN WHO TO<br />

TRUST<br />

Most important is to get to know<br />

more about the debt review process<br />

and how it works. Educate yourself.<br />

Get to know more about your Debt<br />

Counsellor. Don’t let them be a<br />

mystery to you.<br />

TRUS<br />

DE<br />

COUN<br />

Learn their name, their email address. Learn<br />

where your Debt Counsellor’s offices are, who<br />

works there, go visit them or interact with<br />

them regularly.<br />

This will build your trust in these professional<br />

strangers, who are helping you get out of a<br />

bad situation.

T YOUR<br />

BT<br />

<strong>SE</strong>LLOR

LEARNING TO TRUST YOUR DC<br />

LEARN WHO NOT TO<br />

TRUST<br />

Please beware of trusting a total<br />

stranger who calls and says strange<br />

things about your debt review that<br />

may not be true.<br />

Also please beware of anyone who calls you<br />

and says that you can get out of debt review<br />

sooner… as long as you pay money into a<br />

different bank account.<br />

Always contact your Debt Counsellor if you<br />

get a call like that. It might be a scammer who<br />

wants you to pay money into their account,<br />

guess what happens if you do that… nothing<br />

good.<br />

If you have doubts or concerns about<br />

anything during the debt review process, go<br />

to your Debt Counsellor and discuss matters<br />

with them.<br />

Beware of strangers and learn to trust your<br />

Debt Counsellor.

DEBT REVIEW<br />

Because debt review is a legal<br />

process that happens via the<br />

courts there is no benefit to talking<br />

to collections agents and credit<br />

providers on the phone. It is<br />

a waste of time.<br />

It is better if they send court<br />

documents to your attorneys<br />

or submit those documents<br />

to the courts.

FREE BOOKLET<br />

TO DOWNLOAD AND SHARE<br />

How do you leave Debt Review?<br />

How do you have the Credit Bureau remove<br />

the Debt Review listing on your credit report?<br />

Leaving Debt Review Is Not As Simple As To Simply Stop Paying.<br />

Consumers can only leave the debt review process at certain times<br />

and in certain ways.<br />

This free e book will help you navigate this process and avoid many<br />

of the common mistakes people make when wanting to leave debt<br />

review.<br />

If you are curious about how you can leave debt review properly and<br />

with no risk to your assets then be sure to download and read this<br />

free booklet<br />

DOWNLOAD AND SHARE

SOCIAL<br />

MEDIA AND<br />

FEELING<br />

FOMO

SOCIAL MEDIA AND FEELING FOMO<br />

THE DANGER OF<br />

SOCIAL MEDIA<br />

We all love social media. It might<br />

be as simple as looking at peoples’<br />

statuses on Whatsapp or scrolling<br />

Facebook, Insta or TikTok for some<br />

entertainment.<br />

Scrolling social media can be addictive,<br />

and there is a hidden danger that might be<br />

influencing how you spend your money and<br />

live your life.<br />

The danger is the FOMO that social media can<br />

give you and how that impacts what you do<br />

with your money.

SOCIAL MEDIA AND FEELING FOMO<br />

FOMO & EMOTIONAL<br />

SPENDING<br />

FOMO: the Fear Of Missing Out<br />

is one of the leading culprits that<br />

drives what is known as ‘emotional<br />

spending’.<br />

Emotional spending refers to the act of<br />

spending money in response to emotions,<br />

such as stress, anxiety, sadness, boredom, or<br />

excitement, rather than a deliberate intention<br />

to purchase something.<br />

Emotional spending can also occur as a result<br />

of social pressure or the desire to keep up<br />

with others’ lifestyles. This type of spending<br />

can lead to impulsive and unnecessary<br />

purchases and relates to how we feel more<br />

than what we actually need or can afford.

SOCIAL MEDIA AND FEELING FOMO<br />

HOW COOL<br />

ARE YOU?<br />

We all want to have a nice life and be<br />

liked and respected by others. We all<br />

want to be one of the ‘cool’ kids.<br />

In today’s world, social media presents<br />

you with an endless 24/7 global stream of<br />

aspirational living featuring a curated group<br />

of friends, wealthy celebrities, and influencers<br />

who eat expensive brunches, buy fancy<br />

gadgets, and wear luxury clothing, all of which<br />

can make us feel like our modest lifestyle is<br />

inferior to theirs.<br />

It’s hard not to feel the pressure to “keep up<br />

with the Joneses” when social media gives<br />

you a front-row seat to everyone’s highlight<br />

reel.

SOCIAL MEDIA AND FEELING FOMO<br />

FIGHTING<br />

FOMO<br />

If you are living on less, you probably have to stick to a<br />

pretty tight budget each month in order to ensure that<br />

you make your debt repayments. The danger then is<br />

that FOMO might throw you off your game and wreck<br />

your plans.<br />

So how do you fight FOMO?<br />

Limiting the time that you spend on social media is one key to taming<br />

emotional spending. Look at who you follow and ask yourself: “Does<br />

this person give me financial anxiety?” “Am I comparing my self-worth<br />

to others?” If so, then unfollow or mute that feed.<br />

If you want to go hardcore then removing social apps like Facebook,<br />

Twitter, Instagram, and Pinterest from your phone is a solid way to<br />

kill the source of emotional bankruptcy, relativity bias, and social<br />

comparisons elevated through social media.<br />

Or perhaps simply adjusting your online circle and social feeds to<br />

less showy people and stuff can boost your relative happiness (and<br />

hopefully decrease FOMO) since your source of comparison is gone.<br />

By simply avoiding those who are showing off you might feel better<br />

while you are on social media.

SOCIAL MEDIA AND FEELING FOMO<br />

THE IMPORTANCE OF<br />

ACKNOWLEDGING SOCIAL<br />

MEDIA REALITIES<br />

It’s important to acknowledge that<br />

social media is not a reflection of<br />

reality. The heavily curated images<br />

and messages we see online are<br />

often far from the truth, and it is<br />

unrealistic to compare our lives to<br />

others on social media.<br />

What we are seeing in a few seconds may<br />

give us the impression that the person we are<br />

seeing has those circumstances all day every<br />

day. We don’t get to see all the hard work that<br />

lies hidden in the background getting that<br />

perfect shot.<br />

We need to realise that what we are seeing<br />

is not the full, realistic picture. It is a moment<br />

frozen in time and well planned to give a<br />

particular impression.

SOCIAL MEDIA AND FEELING FOMO<br />

CAN YOU GIVE IT<br />

24 HOURS?<br />

Before making a purchase online<br />

because of something nice that you<br />

have seen or come across can you<br />

give yourself a full 24 hours to get<br />

over the initial impulse to buy?<br />

By allowing your brain this time to get rid of<br />

the initial comparative urge and influence of<br />

the media you have seen advertising whatever<br />

it is you can avoid a purely emotional<br />

response and engage some of your rational<br />

intellectual thinking.<br />

Give yourself time to think about if you really<br />

need the thing or service. Weigh up if it falls<br />

within your budget or if you can afford it now.<br />

Perhaps you might realise it will take a little<br />

saving up to afford the purchase and you can<br />

then plan and budget better for it.

SOCIAL MEDIA AND FEELING FOMO<br />

DON’T LET SOCIAL MEDIA<br />

OR FOMO DERAIL YOUR<br />

FINANCIAL HABITS<br />

Social media FOMO is a real problem<br />

for many people, and it can be costly.<br />

By limiting the time you spend on social media<br />

and being mindful of who you follow, you can<br />

avoid feeling like you need to keep up with<br />

the Joneses. Remember, social media is not a<br />

reflection of reality, and it’s important to keep<br />

this that before making any quick purchases.<br />

So next time you feel the urge to follow that<br />

link and spend those bucks, consider if you<br />

can maybe just wait a little bit and decide if<br />

you really need that thing tomorrow.

PAWN YOUR<br />

CAR AND<br />

DRIVE IT

PAWN YOUR CAR AND DRIVE IT<br />

WHAT IS A<br />

PAWN-WHILE-YOU-DRIVE<br />

SCHEME<br />

For many years ‘pawn-while-youdrive’<br />

schemes have come into<br />

conflict with the National Credit<br />

Regulator (NCR) who say that these<br />

are not proper pawn transactions<br />

but are actually just cleverly hidden<br />

credit agreements. Most may even be<br />

totally illegal.<br />

A ‘pawn-while-you-drive’ scheme is a type<br />

of loan where a lender (who is probably<br />

not registered as a credit provider) takes<br />

ownership of a customer’s vehicle for the<br />

duration of the loan period.<br />

The lender and customer then enter into a<br />

formal sale agreement. The agreement will<br />

say that the lender is buying the customer’s<br />

vehicle. The customer then leases the car until<br />

the loan amount is repaid.

The customer is required to pay a monthly<br />

"rental fee" towards their car and they get to<br />

still drive around in their car, as long as they<br />

pay the monthly instalment/fee.<br />

The repayment amount very much depends<br />

on whether the arrangement is done over a<br />

short or long time period but can be very high<br />

if it is done over a short term.<br />

The lender will often install a tracking device<br />

to the vehicle to keep an eye on its location<br />

especially if the costumer misses a payment.<br />

Then they will be swift to come and get the<br />

car, wherever it is.<br />

This is where things get tricky. If the customer<br />

fails to repay the loan, the lender gets to keep<br />

the car and the customer loses their asset.

PAWN YOUR CAR AND DRIVE IT<br />

PAWN OR CREDIT<br />

TRANSACTIONS<br />

The National Credit Act (NCA) says that a pawn<br />

transaction as an agreement where one party advances<br />

money (or grants credit) to another, and at the time of<br />

doing so, takes possession of goods as security for the<br />

money advanced or credit granted.<br />

The party that advanced the money or granted the credit is entitled,<br />

on expiry of a defined period, to sell the goods and retain all the<br />

proceeds of the sale in settlement of the consumer’s obligations<br />

under the agreement.<br />

This is what those who offer these ‘pawn while you drive’ deals say<br />

they are doing. They say it is a regular pawn arrangement. This is how<br />

they have been doing business for years.<br />

But the NCR say that all these schemes are not actually pawn<br />

transactions. Instead, they say that these deals are actually hidden<br />

credit agreements. Which, in turn, means they fall subject to the NCA.<br />

They say that these agreements are unlawful and so they are void<br />

because when offering credit, the NCA says you have to conduct<br />

affordability assessments, have to give pre-agreement statements<br />

and quotations, and limits what interest, charges, and fees can be<br />

charged. Also, those who offer credit need to be registered.

PAWN YOUR CAR AND DRIVE IT<br />

DESPERATE<br />

PEOPLE<br />

With the high risk of losing your car,<br />

you might wonder why people are<br />

using these arrangements to access<br />

funds.<br />

Well, these schemes offer consumers who<br />

might not meet the banks’ requirements<br />

(under the NCA) the ability to get a loan by<br />

using their car as security. This is true of most<br />

pawn arrangements. It opens access to quick<br />

cash but comes at significant risk.<br />

The NCR has decided to try turn the screws<br />

on these transactions and protect consumers<br />

by making it harder for those offering this type<br />

of loan (or scam).<br />

The NCR are asking consumers who have been<br />

approached by these schemes to report them<br />

to the NCR, and that those who have already<br />

fallen prey to them should lodge a complaint<br />

with the credit ombud. By doing so, maybe<br />

these consumers can help prevent other<br />

consumers from falling into the same trap.

BREAKING<br />

NEWS

ESKOM’S PRICES<br />

ARE GOING UP<br />

As of April 2023, Eskom will be charging an extra 18.65% on<br />

their rates. So get ready to pay 20% more on your electricity<br />

bill.<br />

In some good news for vulnerable consumers, the National<br />

Energy Regulator of South Africa (Nersa) has approved a<br />

lower electricity tariff increase for low-income households.<br />

Instead of a 18.65% increase they will have a 10% increase.<br />

This means that township residents and those living in rural<br />

areas won’t be hit quite as hard by the price hike.<br />

Still, municipalities will have to pay the full 18.6% tariff increase<br />

on their bulk electricity purchases from Eskom regardless<br />

of what they end up charging their different residents. This<br />

basically forces them to cover some of the cost.

DEBT COUN<strong>SE</strong>LLOR FINED<br />

R10 000 FOR <strong>SE</strong>NDING<br />

FORMS LATE<br />

The National Consumer Tribunal (NCT) has ruled that a<br />

Debt Counsellor at one of SA’s biggest Debt Counselling<br />

practices did not contravene the National Credit Act (NCA)<br />

in all the ways the National Credit Regulator (NCR) said she<br />

had.<br />

The ruling followed a 2018 complaint by the NCR relating to<br />

the Debt Counsellor’s alleged failure to distribute payments<br />

to credit providers and obtain court orders within 60 days.<br />

The NCT pointed out that the Act does not require that the<br />

court matters be resolved within 60 days.<br />

The NCT also found that the Debt Counsellor did not<br />

contravene General Condition 2, which requires that Debt<br />

Counsellors not to delegate their duties to unregistered<br />

persons. The NCR argued that because there were no notes<br />

about the matter other than the official forms (and emails<br />

and PDA records) they did not think the Debt Counsellor did<br />

her job. The NCT were very specific about what documents<br />

the NCA requires are kept on file and ruled in favour of the<br />

Debt Counsellor, namely:

(59.1) Applications for debt review.<br />

(59.2) Copies of documents submitted by consumers.<br />

(59.3) Copies of rejection letters (if applicable).<br />

(59.4) Debt restructuring proposals.<br />

(59.5) Copies of any order made by the Tribunal or the<br />

Court; and<br />

(59.6) Copies of clearance certificates.<br />

They ruled that an absence of notes does not mean the work<br />

was not done and that only the above documents need to<br />

be recorded. The NCT found that the Debt Counsellor did<br />

not contravene General Conditions 5 and 6, which require<br />

Debt Counsellors to act in the best interests of consumers<br />

and inform the NCR of changes in employment.<br />

The Debt Counsellor had not changed her work but had<br />

asked the NCR to update information about which Debt<br />

Counsellor within the Debt Counsellor’s practice was<br />

now primarily handling the consumer’s matters. The NCR<br />

themselves failed to do so. This led to their confusion about<br />

who was doing what.<br />

However, it wasn’t all plain sailing for the Debt Counsellor.<br />

In two consumer’s matters, the Debt Counsellor was found<br />

to have messed up by failing to submit 2 forms (the Form<br />

17.1 and Form 17.2) to all credit bureaus and credit providers<br />

fast enough. The Debt Counsellor conceded that these<br />

were sent late due to administrative errors. This resulted in<br />

a R10 000 fine.

FINCHOICE DEBIT ORDER<br />

CANCELLATIONS<br />

After a meeting between The Debt Counsellors Association<br />

(DCASA) and Finchoice/Homechoice it was confirmed that<br />

Finchoice/Homechoice debit orders cancellations will be<br />

swiftly actioned as long as Finchoice/Homechoice have<br />

already sent their CoB and the Debt Counsellor has sent<br />

(1) a Form 17.2, (2) the Debt Cancellation Form and (3) a<br />

proposal.<br />

Timing is key as Finchoice/Homechoice are unable to stop<br />

the debit run if these forms are submitted to close to when<br />

the debit runs (5 days).<br />

The good news is that, because Finchoice/Homechoice<br />

have up to 10 days to implement the proposal, it was agreed<br />

that as long as they have received the proposal 5 days prior<br />

to the debit order running they will refund the payment<br />

either direct to client or PDA.<br />

DCASA strongly suggest the refund goes to the PDA for<br />

distribution rather than to consumers, who may use the<br />

refund unwisely.

DEBT REVIEW<br />

Each year Debt Counsellors<br />

complete reviews about how credit<br />

providers are cooperating with the<br />

debt review process. In turn, credit<br />

providers complete reviews about<br />

Debt Counsellors. The results are<br />

announced at the Annual Debt<br />

Review Awards.<br />

The Debt Review Awards will be held<br />

in October this year.