Wokingham and Bracknell Lifestyle Dec 2021 - Jan 2022

At last the Christmas editions are here! With festive fun, gifts and interiors, plus kitchen design advice from Interior Design expert Julia Kendell and an interview with the Yorkshire Shepherdess Amanda Owen. Plus, our competition pages return, with staycations, laundry upgrades, festive hampers and a chance to win tickets to see Paloma Faith in concert!

At last the Christmas editions are here! With festive fun, gifts and interiors, plus kitchen design advice from Interior Design expert Julia Kendell and an interview with the Yorkshire Shepherdess Amanda Owen. Plus, our competition pages return, with staycations, laundry upgrades, festive hampers and a chance to win tickets to see Paloma Faith in concert!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

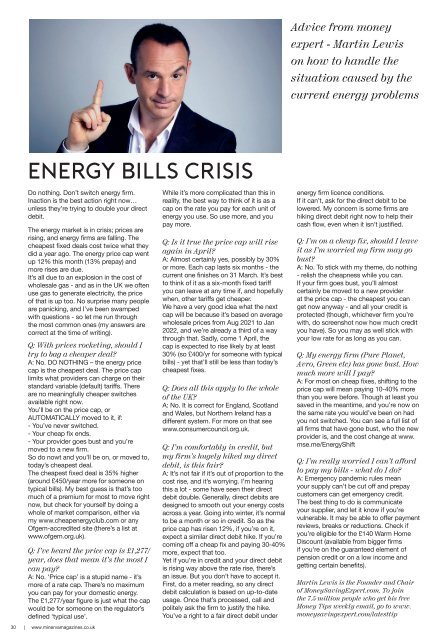

Advice from money<br />

expert - Martin Lewis<br />

on how to h<strong>and</strong>le the<br />

situation caused by the<br />

current energy problems<br />

Energy Bills Crisis<br />

Do nothing. Don’t switch energy firm.<br />

Inaction is the best action right now…<br />

unless they’re trying to double your direct<br />

debit.<br />

The energy market is in crisis; prices are<br />

rising, <strong>and</strong> energy firms are falling. The<br />

cheapest fixed deals cost twice what they<br />

did a year ago. The energy price cap went<br />

up 12% this month (13% prepay) <strong>and</strong><br />

more rises are due.<br />

It’s all due to an explosion in the cost of<br />

wholesale gas - <strong>and</strong> as in the UK we often<br />

use gas to generate electricity, the price<br />

of that is up too. No surprise many people<br />

are panicking, <strong>and</strong> I’ve been swamped<br />

with questions - so let me run through<br />

the most common ones (my answers are<br />

correct at the time of writing).<br />

Q: With prices rocketing, should I<br />

try to bag a cheaper deal?<br />

A: No. DO NOTHING – the energy price<br />

cap is the cheapest deal. The price cap<br />

limits what providers can charge on their<br />

st<strong>and</strong>ard variable (default) tariffs. There<br />

are no meaningfully cheaper switches<br />

available right now.<br />

You’ll be on the price cap, or<br />

AUTOMATICALLY moved to it, if:<br />

- You’ve never switched.<br />

- Your cheap fix ends.<br />

- Your provider goes bust <strong>and</strong> you’re<br />

moved to a new firm.<br />

So do nowt <strong>and</strong> you’ll be on, or moved to,<br />

today’s cheapest deal.<br />

The cheapest fixed deal is 35% higher<br />

(around £450/year more for someone on<br />

typical bills). My best guess is that’s too<br />

much of a premium for most to move right<br />

now, but check for yourself by doing a<br />

whole of market comparison, either via<br />

my www.cheapenergyclub.com or any<br />

Ofgem-accredited site (there’s a list at<br />

www.ofgem.org.uk).<br />

Q: I’ve heard the price cap is £1,277/<br />

year, does that mean it’s the most I<br />

can pay?<br />

A: No. ‘Price cap’ is a stupid name - it’s<br />

more of a rate cap. There’s no maximum<br />

you can pay for your domestic energy.<br />

The £1,277/year figure is just what the cap<br />

would be for someone on the regulator’s<br />

defined ‘typical use’.<br />

30 | www.minervamagazines.co.uk<br />

While it’s more complicated than this in<br />

reality, the best way to think of it is as a<br />

cap on the rate you pay for each unit of<br />

energy you use. So use more, <strong>and</strong> you<br />

pay more.<br />

Q: Is it true the price cap will rise<br />

again in April?<br />

A: Almost certainly yes, possibly by 30%<br />

or more. Each cap lasts six months - the<br />

current one finishes on 31 March. It’s best<br />

to think of it as a six-month fixed tariff<br />

you can leave at any time if, <strong>and</strong> hopefully<br />

when, other tariffs get cheaper.<br />

We have a very good idea what the next<br />

cap will be because it’s based on average<br />

wholesale prices from Aug <strong>2021</strong> to <strong>Jan</strong><br />

<strong>2022</strong>, <strong>and</strong> we’re already a third of a way<br />

through that. Sadly, come 1 April, the<br />

cap is expected to rise likely by at least<br />

30% (so £400/yr for someone with typical<br />

bills) - yet that’ll still be less than today’s<br />

cheapest fixes.<br />

Q: Does all this apply to the whole<br />

of the UK?<br />

A: No. It is correct for Engl<strong>and</strong>, Scotl<strong>and</strong><br />

<strong>and</strong> Wales, but Northern Irel<strong>and</strong> has a<br />

different system. For more on that see<br />

www.consumercouncil.org.uk.<br />

Q: I’m comfortably in credit, but<br />

my firm’s hugely hiked my direct<br />

debit, is this fair?<br />

A: It’s not fair if it’s out of proportion to the<br />

cost rise, <strong>and</strong> it’s worrying. I’m hearing<br />

this a lot - some have seen their direct<br />

debit double. Generally, direct debits are<br />

designed to smooth out your energy costs<br />

across a year. Going into winter, it’s normal<br />

to be a month or so in credit. So as the<br />

price cap has risen 12%, if you’re on it,<br />

expect a similar direct debit hike. If you’re<br />

coming off a cheap fix <strong>and</strong> paying 30-40%<br />

more, expect that too.<br />

Yet if you’re in credit <strong>and</strong> your direct debit<br />

is rising way above the rate rise, there’s<br />

an issue. But you don’t have to accept it.<br />

First, do a meter reading, so any direct<br />

debit calculation is based on up-to-date<br />

usage. Once that’s processed, call <strong>and</strong><br />

politely ask the firm to justify the hike.<br />

You’ve a right to a fair direct debit under<br />

energy firm licence conditions.<br />

If it can’t, ask for the direct debit to be<br />

lowered. My concern is some firms are<br />

hiking direct debit right now to help their<br />

cash flow, even when it isn’t justified.<br />

Q: I’m on a cheap fix, should I leave<br />

it as I’m worried my firm may go<br />

bust?<br />

A: No. To stick with my theme, do nothing<br />

- relish the cheapness while you can.<br />

If your firm goes bust, you’ll almost<br />

certainly be moved to a new provider<br />

at the price cap - the cheapest you can<br />

get now anyway - <strong>and</strong> all your credit is<br />

protected (though, whichever firm you’re<br />

with, do screenshot now how much credit<br />

you have). So you may as well stick with<br />

your low rate for as long as you can.<br />

Q: My energy firm (Pure Planet,<br />

Avro, Green etc) has gone bust. How<br />

much more will I pay?<br />

A: For most on cheap fixes, shifting to the<br />

price cap will mean paying 10-40% more<br />

than you were before. Though at least you<br />

saved in the meantime, <strong>and</strong> you’re now on<br />

the same rate you would’ve been on had<br />

you not switched. You can see a full list of<br />

all firms that have gone bust, who the new<br />

provider is, <strong>and</strong> the cost change at www.<br />

mse.me/EnergyShift<br />

Q: I’m really worried I can’t afford<br />

to pay my bills - what do I do?<br />

A: Emergency p<strong>and</strong>emic rules mean<br />

your supply can’t be cut off <strong>and</strong> prepay<br />

customers can get emergency credit.<br />

The best thing to do is communicate<br />

your supplier, <strong>and</strong> let it know if you’re<br />

vulnerable. It may be able to offer payment<br />

reviews, breaks or reductions. Check if<br />

you’re eligible for the £140 Warm Home<br />

Discount (available from bigger firms<br />

if you’re on the guaranteed element of<br />

pension credit or on a low income <strong>and</strong><br />

getting certain benefits).<br />

Martin Lewis is the Founder <strong>and</strong> Chair<br />

of MoneySavingExpert.com. To join<br />

the 7.5 million people who get his free<br />

Money Tips weekly email, go to www.<br />

moneysavingexpert.com/latesttip