You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

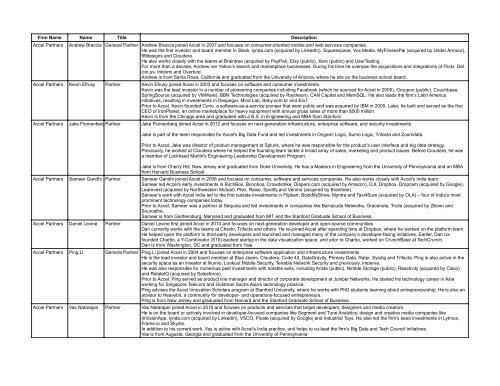

Firm Name Name Title Description<br />

Accel Partners Andrew Braccia General Partner Andrew Braccia joined Accel in 2007 <strong>and</strong> focuses on consumer-oriented mobile <strong>and</strong> web services companies.<br />

He was the first investor <strong>and</strong> board member in Slack, lynda.com (acquired by LinkedIn), Squarespace, Vox Media, MyFitnessPal (acquired by Under Armour),<br />

99designs <strong>and</strong> Cloudera.<br />

He also works closely with the teams at Braintree (acquired by PayPal), Etsy (public), Xero (public) <strong>and</strong> UserTesting.<br />

For more than a decade, Andrew ran Yahoo’s search <strong>and</strong> marketplace businesses. During his time he oversaw the acquisitions <strong>and</strong> integrations of Flickr, Del.<br />

icio.us, Inktomi <strong>and</strong> Overture.<br />

Andrew is from Santa Rosa, California <strong>and</strong> graduated from the University of Arizona, where he sits on the business school board.<br />

Accel Partners Kevin Efrusy Partner Kevin Efrusy joined Accel in 2003 <strong>and</strong> focuses on software <strong>and</strong> consumer investments.<br />

Kevin was the lead investor in a number of pioneering companies including Facebook (which he sourced for Accel in 2005), Groupon (public), Couchbase,<br />

SpringSource (acquired by VMWare), BBN Technologies (acquired by Raytheon), CAN Capital <strong>and</strong> MemSQL. He also leads the firm’s Latin America<br />

initiatives, resulting in investments in Despegar, Mind Lab, Baby.com.br <strong>and</strong> Elo7.<br />

Prior to Accel, Kevin founded Corio, a software-as-a-service pioneer that went public <strong>and</strong> was acquired by IBM in 2005. Later, he built <strong>and</strong> served as the first<br />

CEO of IronPlanet, an online marketplace for heavy equipment with annual gross sales of more than $500 million.<br />

Kevin is from the Chicago area <strong>and</strong> graduated with a B.S. in Engineering <strong>and</strong> MBA from Stanford.<br />

Accel Partners Jake FlomenbergPartner Jake Flomenberg joined Accel in 2012 <strong>and</strong> focuses on next-generation infrastructure, enterprise software, <strong>and</strong> security investments.<br />

Jake is part of the team responsible for Accel's Big Data Fund <strong>and</strong> led investments in Origami Logic, Sumo Logic, Trifacta <strong>and</strong> Zoomdata.<br />

Prior to Accel, Jake was director of product management at Splunk, where he was responsible for the product’s user interface <strong>and</strong> big data strategy.<br />

Previously, he worked at Cloudera where he helped the founding team tackle a broad array of sales, marketing <strong>and</strong> product issues. Before Cloudera, he was<br />

a member of Lockheed Martin's Engineering Leadership Development Program.<br />

Jake is from Cherry Hill, New Jersey <strong>and</strong> graduated from Duke University. He has a Masters in Engineering from the University of Pennsylvania <strong>and</strong> an MBA<br />

from Harvard Business School.<br />

Accel Partners Sameer G<strong>and</strong>hi Partner Sameer G<strong>and</strong>hi joined Accel in 2008 <strong>and</strong> focuses on consumer, software <strong>and</strong> services companies. He also works closely with Accel’s India team.<br />

Sameer led Accel's early investments in BirchBox, Bonobos, Crowdstrike, Diapers.com (acquired by Amazon), DJI, Dropbox, Dropcam (acquired by Google),<br />

Learnvest (acquired by Northwestern Mutual), Plex, Raise, Spotify <strong>and</strong> Venmo (acquired by Braintree).<br />

Sameer's work with Accel India led to the first outside investments in Flipkart, BookMyShow, Myntra <strong>and</strong> Taxi4Sure (acquired by OLA) – four of India’s most<br />

prominent technology companies today.<br />

Prior to Accel, Sameer was a partner at Sequoia <strong>and</strong> led investments in companies like Barracuda Networks, Gracenote, Trulia (acquired by Zillow) <strong>and</strong><br />

Sourcefire.<br />

Sameer is from Gaithersburg, Maryl<strong>and</strong> <strong>and</strong> graduated from MIT <strong>and</strong> the Stanford Graduate School of Business.<br />

Accel Partners Daniel Levine Partner Daniel Levine first joined Accel in 2010 <strong>and</strong> focuses on next-generation developer <strong>and</strong> open-source communities.<br />

Dan currently works with the teams at Checkr, Trifacta <strong>and</strong> others. He re-joined Accel after spending time at Dropbox, where he worked on the platform team.<br />

He helped open the platform to third-party developers <strong>and</strong> launched <strong>and</strong> managed many of the company’s developer-facing initiatives. Earlier, Dan cofounded<br />

Chartio, a Y-Combinator (S10)-backed startup in the data visualization space, <strong>and</strong> prior to Chartio, worked on CrunchBase at TechCrunch.<br />

Dan is from Washington, DC <strong>and</strong> graduated from Yale.<br />

Accel Partners Ping Li General Partner Ping Li joined Accel in 2004 <strong>and</strong> focuses on enterprise software application <strong>and</strong> infrastructure investments.<br />

He is the lead investor <strong>and</strong> board member at Blue Jeans, Cloudera, Code 42, DataGravity, Primary Data, Ratpr, Sysdig <strong>and</strong> Trifacta. Ping is also active in the<br />

security space as an investor at Illumio, Lookout Mobile Security, Tenable Network Security <strong>and</strong> previously, Imperva.<br />

He was also responsible for numerous past investments with notable exits, including Arista (public), Nimble Storage (public), Reactivity (acquired by Cisco)<br />

<strong>and</strong> RelateIQ (acquired by Salesforce).<br />

Prior to Accel, Ping served as product line manager <strong>and</strong> director of corporate development at Juniper Networks. He started his technology career in Asia<br />

working for Singapore Telecom <strong>and</strong> Goldman Sachs Asia's technology practice.<br />

Ping advises the Accel Innovation Scholars program at Stanford University, where he works with PhD students learning about entrepreneurship. He is also an<br />

advisor to Heavybit, a community for developer- <strong>and</strong> operations-focused entrepreneurs.<br />

Ping is from New Jersey <strong>and</strong> graduated from Harvard <strong>and</strong> the Stanford Graduate School of Business.<br />

Accel Partners Vas Natarajan Partner Vas Natarajan joined Accel in 2010 <strong>and</strong> focuses on products <strong>and</strong> services that target developers, designers <strong>and</strong> media creators.<br />

He is on the board or actively involved in developer-focused companies like Segment <strong>and</strong> Tune Analytics; design <strong>and</strong> creative media companies like<br />

InVisionApp, lynda.com (acquired by LinkedIn), VSCO, Pixate (acquired by Google) <strong>and</strong> Industrial Toys. He also led the firm’s seed investments in Lytmus,<br />

Frame.io <strong>and</strong> Skydio.<br />

In addition to his current work, Vas is active with Accel’s India practice, <strong>and</strong> helps to co-lead the firm’s Big Data <strong>and</strong> Tech Council initiatives.<br />

Vas is from Augusta, Georgia <strong>and</strong> graduated from the University of Pennsylvania.

Accel Partners Brian O'Malley Partner Brian O’Malley joined Accel in 2013 <strong>and</strong> spearheads Accel's work with next-generation marketplaces <strong>and</strong> consumer-focused companies.<br />

He led the firm’s investments in Amino, Gametime, HotelTonight, Shuddle <strong>and</strong> Sprig, as well as disruptive software-as-a-services businesses, Duetto <strong>and</strong><br />

Narvar.<br />

He joined Accel from Battery Ventures, where as a general partner he led investments in companies like Dollar Shave Club, BazaarVoice (public),<br />

BrightEdge, Coupa <strong>and</strong> Skullc<strong>and</strong>y (public). Prior to Battery, Brian led sales efforts <strong>and</strong> built some of the first web service-based API integrations for<br />

Bowstreet, Inc. (acquired by IBM). He started his career as a developer for Motorola.<br />

Brian lived in eight cities, five states <strong>and</strong> two countries before the age of 18. He graduated from the University of Pennsylvania.<br />

Accel Partners Ryan Sweeney Partner Ryan Sweeney joined Accel in 2008 <strong>and</strong> manages its growth fund.<br />

He i s the first outside investor <strong>and</strong> board member in a number of leading enterprise software companies like Atlassian, Hootsuite , Qualtrics, Squarespace<br />

<strong>and</strong> Xero. Ryan is also active with innovative mobile <strong>and</strong> payments startups like Invoice2go, Lightspeed <strong>and</strong> VSCO.<br />

He was also responsible for numerous investments with notable exits, including AirWatch (acquired by VMware), Braintree/Venmo (acquired by PayPal),<br />

Groupon (public), Lynda.com (acquired by Linkedin) <strong>and</strong> OzForex (public).<br />

Ryan grew up in South Jersey <strong>and</strong> graduated from Notre Dame <strong>and</strong> Harvard Business School.<br />

Accel Partners Eric Wolford Partner Eric Wolford joined Accel in 2014 <strong>and</strong> focuses on enterprise infrastructure companies.<br />

He leverages his infrastructure <strong>and</strong> IT experience in working with founders across the enterprise stack, from next-gen analytics platforms like Jut, to emerging<br />

cloud security <strong>and</strong> threat detection companies like Netskope <strong>and</strong> Vectra. Eric also co-leads the Accel Tech Council.<br />

Prior to Accel, Eric spent years in a variety of product <strong>and</strong> management roles at FastForward Networks, Inktomi <strong>and</strong> most recently, at Riverbed where he was<br />

president of the products group. There, he oversaw the growth of Riverbed’s flagship WAN optimization <strong>and</strong> app acceleration platforms, which grew to be a<br />

USD $1 billion+ business.<br />

Eric is from the Bay Area, graduated from Pepperdine <strong>and</strong> has an MBA from NYU.<br />

Accel Partners Rich Wong General Partner Rich Wong joined Accel in 2006 <strong>and</strong> focuses on software, internet services <strong>and</strong> mobile technologies.<br />

Rich led the investments <strong>and</strong> currently serves on the Boards of Atlassian (TEAM), Checkr, MoLabs, Neumob, Nextbit, Osmo, Qwilt, Sunrun (RUN), Tune <strong>and</strong><br />

URX. Rich also led Accel's investments in Swiftkey <strong>and</strong> Rovio.<br />

Rich previously led Accel's investments <strong>and</strong> served on the Boards of MoPub (acquired by Twitter), Admob (acquired by Google), Airwatch (acquired by<br />

VMWare), Parature (acquired by Microsoft), Dealer.com (acquired by Dealertrak) <strong>and</strong> 3LM (acquired by Motorola).<br />

He was (is) the first outside Board member <strong>and</strong> lead investor in Atlassian, Checkr, MoPub, Neumob, Nextbit, Tune, URX <strong>and</strong> 3LM.<br />

He has been actively involved in the mobile <strong>and</strong> broadb<strong>and</strong> ecosystems for more than a decade, having served as chief marketing officer of Covad<br />

Communications <strong>and</strong> senior vice president of products at Openwave Systems. Rich started his career at McKinsey & Co. <strong>and</strong> as a br<strong>and</strong> manager at Procter<br />

& Gamble.<br />

Rich grew up in Santa Rosa, California <strong>and</strong> has an Engineering degree <strong>and</strong> MBA from MIT.<br />

Accelerator Ventures Alex<strong>and</strong>er Lloyd Managing DirectorAlex<strong>and</strong>er Lloyd is the founder <strong>and</strong> managing partner of Accelerator Ventures, a venture fund focused on seed-stage investments. Prior to founding<br />

Accelerator Ventures, Alex<strong>and</strong>er was a venture partner at Rustic Canyon Partners, where he oversaw the development of their seed-stage investment<br />

strategy. Before working in Venture Capital, Alex<strong>and</strong>er was the Business Development Manager in Microsoft's Silicon Valley office responsible for Microsoft's<br />

relationships with the West Coast venture capital <strong>and</strong> startup community. Alex<strong>and</strong>er has also worked as a Product Manager in SGI's workstation division <strong>and</strong><br />

has held marketing positions at Activision <strong>and</strong> Apple Computer. Alex<strong>and</strong>er began his career at Goldman Sachs, where he spent three years as a financial<br />

analyst.<br />

Born in New York City, Alex<strong>and</strong>er was raised in Paris, France, <strong>and</strong> is fluent in French. Alex<strong>and</strong>er earned a BA in International Relations from the University of<br />

Pennsylvania <strong>and</strong> an MBA in Entrepreneurial Management from The Wharton School. Alex<strong>and</strong>er is very involved in arts <strong>and</strong> education. He recently joined the<br />

board of SlideLuck <strong>and</strong> has previously sat on the boards of SF Camerawork <strong>and</strong> Junior Achievement of San Francisco, as well as the Contemporary<br />

Extension of the San Francisco Museum of Modern Art (SFMoMA). In 1998 he founded the San Francisco Media Arts Council (SMAC) <strong>and</strong> for 3 years he<br />

served as a commissioner for the San Francisco Art Commission.<br />

Accelerator Ventures Ben Smith Venture Partner Ben Smith is a Venture Partner at Accelerator Ventures. Before joining Accelerator Ventures, Ben served as President of Reply Media which acquired<br />

MerchantCircle where he had been a cofounder <strong>and</strong> CEO. Ben cofounded MerchantCircle <strong>and</strong> incubated it at Rustic Canyon Partners while he was an<br />

Entrepreneur in Residence with Alex Lloyd. Prior to cofounding MerchantCircle, Ben was the SVP of Corporate Development at Borl<strong>and</strong> through four<br />

acquisitions <strong>and</strong> drove the spinoff of their subsidiary, CodeGear, as their CEO through the separation <strong>and</strong> startup. Additionally, Ben co-founded the company<br />

Spoke <strong>and</strong> is still serving on its board. Ben also holds a seat on the board of Glu Mobile (Nasdaq: GLUU). He is a long time angel investor with over 40 early<br />

stage investments, often alongside of Accelerator, <strong>and</strong> is an LP at a number of venture funds.<br />

Ben previously served the White House as the Senior Advisor for Strategy <strong>and</strong> Planning to the Secretary of Transportation, assisting with the creation of the<br />

Transportation Security Administration after 9-11. Among his other accomplishments, Ben was a Vice President in Electronic Data System's A.T. Kearney<br />

management consulting subsidiary, leading the West Coast operations of the Kearney/EDS Venture Development Group, was one of the youngest partners in<br />

the history of the firm, <strong>and</strong> was named one of the 25 most influential strategy consultants in 2002.. As a Partner in the High Technology <strong>and</strong> Strategy<br />

Practices at A.T. Kearney, he advised leading technology companies on business, acquisition, investment <strong>and</strong> marketing strategies.<br />

Ben holds a B.S. in Mechanical Engineering from the University of California, Davis <strong>and</strong> a MBA from Carnegie Mellon University's Tepper School of Business.

Accelerator Ventures Tom Cervantez Venture Partner Tom Cervantez is a Venture Partner at Accelerator Ventures. Tom has worked with Accelerator Ventures since its formation <strong>and</strong> with Alex Lloyd on reviewing,<br />

analyzing <strong>and</strong> negotiating angel <strong>and</strong> venture investments since 1999. Tom brings a strong deal background to AVC from the legal perspective, having<br />

practiced law as a venture capital lawyer in Silicon Valley since 1992, as well as being a founder of a corporate/venture law boutique, Business Counsel Law<br />

Group, LLP – in San Francisco.<br />

On the investment side, Tom has been an active angel investor since the early 1990s, with early investments including Open Table (IPO), Friendster<br />

(acquired by MOL Global), Knowledgeweb (acquired by iVillage), Virtual Chips (acquired by Phoenix Techologies), Three Rings (acquired by Sega) <strong>and</strong><br />

Geonet (acquired by Level 3 Networks). Tom also was the co-founder of the HBS Alumni Angels, the global angel alumni group for Harvard Business School.<br />

Tom is also on the Board of the HBS Alumni Association of Northern California <strong>and</strong> is Co-Chair of the Venture Capital SIG of the SV Forum. Tom speaks<br />

frequently on the topics of venture investment <strong>and</strong> deal structuring, <strong>and</strong> has done that at UC Berkeley, Stanford <strong>and</strong> Harvard.<br />

Tom holds a BA in Business Administration from Loyola Marymount University <strong>and</strong> a JD/MBA from Harvard.<br />

Accelerator Ventures John Paul Milciunas Entrepreneur-in-residence John Paul Milciunas is CEO of Enlight Research. Throughout his career he has played key roles in strategy <strong>and</strong> business development for both early stage<br />

startups <strong>and</strong> large technology corporations. He most recently was an Entrepreneur-in-Residence at Accelerator Ventures. Prior to joining Accelerator<br />

Ventures, John Paul was at Yahoo! in Strategic Partnerships <strong>and</strong> Business Development at Yahoo!. While at Yahoo! he was part of the Strategy <strong>and</strong><br />

Emerging Businesses team where he focused on creating innovative strategies for content distribution, audience development, <strong>and</strong> monetization. Before<br />

joining Yahoo!, John Paul worked as a product strategy consultant for Checkfree during the company’s merger <strong>and</strong> integration with Fiserv.<br />

John Paul has over 15 years experience working with technology companies. John Paul was CEO of SPI Dynamics, an Atlanta based web security start-up<br />

that was acquired by Hewlett-Packard for $90MM. John Paul also spent 3 years in Silicon Valley working for Scient as a business strategy consultant. He<br />

began his career at S1 <strong>and</strong> was part of the team that created the world’s first Internet bank, SFNB.<br />

John Paul is a graduate of the Georgia Institute of Technology.<br />

Acorn Ventures, Inc. Cliff Girard CEO Mr. Girard has over 25 years experience as a CEO <strong>and</strong> President, Advisory Specialist <strong>and</strong> manager in the software, information technology/services, <strong>and</strong><br />

computer supplier industries. In addition to gaining experience with numerous companies including Network Solutions Corporation, IBM, GMS <strong>and</strong> Acorn<br />

Ventures, Cliff was also the founder <strong>and</strong> CEO of 6 successful high-technology companies, <strong>and</strong> has led numerous corporate internet <strong>and</strong> e-commerce site<br />

implementations.<br />

He was also instrumental in successfully managing the turn-around restructuring operations for ICS, Inc., a company that, at the time, had suffered over 3<br />

years of losses.<br />

Mr. Girard's passion for continuing success includes his strategic marketing <strong>and</strong> technical focuses, corporate positioning strategies, as well as the ability to<br />

execute large operational business plans. Cliff's strong technical <strong>and</strong> marketing skills in software engineering, as well as his skills in creating <strong>and</strong><br />

strengthening a company's organizational purpose <strong>and</strong> goals, has helped companies achieve a highly motivated team of individuals who work at their highest<br />

capacities.<br />

Acorn Ventures, Inc. Charles Duff Executive VP Charles Duff has extensive experience with Electronic Commerce, projects <strong>and</strong> business models. He has performed due diligence on high technology<br />

companies for investment <strong>and</strong> business development since 1983. This included evaluating opportunities for investment by venture capital <strong>and</strong> private equity<br />

investors.<br />

Mr. Duff has excellent software skills <strong>and</strong> has managed total-solution Internet E-Commerce implementations from initial concept to successful conclusion tying<br />

together multiple vendor components<br />

Adams Capital Management, Joel Adams Inc.<br />

In the early 1990's Mr. Duff ran a conference <strong>and</strong> exhibition company with a presence in 42 countries on five continents.<br />

General Partner Joel founded Adams Capital Management in 1994 <strong>and</strong> raised $815 million of capital since inception. Before establishing ACM, Joel served for eight years as<br />

Vice President <strong>and</strong> General Partner of Fostin Capital Corp., a Pittsburgh-based, family-owned investment firm.<br />

Prior to Fostin, Joel served for seven years as a nuclear test engineer for General Dynamics, where he managed chemical, electrical <strong>and</strong> mechanical<br />

engineering teams <strong>and</strong> directed nuclear power plant sea trials. Joel is a member of several charitable organizations, a Trustee of Carnegie Mellon University<br />

<strong>and</strong> a frequently requested speaker on the topic of venture capital.

Adams Capital Management, Harris JonesInc.<br />

Operating PartnerHarris joined Adams Capital Management in 2014 as an Operating Partner. He was previously the Managing Director of Swallow Point Ventures, a<br />

Pittsburgh-based technology growth investor that invested in capital efficient digital technology businesses.<br />

Harris has held several senior management positions in the telecommunications industry both in the U.S. <strong>and</strong> UK, most recently as the CEO of Cable &<br />

Wireless International (CW) operating from London, UK. CW was the second largest fixed line telecom operator in the UK, <strong>and</strong> operated the incumbent<br />

telecommunications company in 33 countries across five continents. Prior to that role, he was CEO of T-Mobile in the UK where he led the turnaround of that<br />

business by doubling revenue to nearly $6 billion in three years. In the late 1990’s, Harris was part of the senior management team of Omnipoint<br />

Communications, a pioneering GSM-based wireless operator operating primarily in the Northeast U.S. He was part of the original management team of<br />

American Personal Communications, a wireless start-up that launched the first digital wireless service in the U.S. <strong>and</strong> became the bellwether for Sprint’s<br />

mobile business. Harris has held board roles with Cable & Wireless PLC, Virgin Mobile, Monaco Telecom, Cable & Wireless Barbados, <strong>and</strong> mBlox over the<br />

past 15 years.<br />

Adams Capital Management, George Ugras Inc. Venture Partner George joined Adams Capital Management in 1999 as a General Partner, from Apax Partners, a private equity firm in New York.<br />

Advanced Technology Steve Ventures Baloff<br />

Prior to joining Apax Partners, George was a Management Consultant at McKinsey & Co. in New York, working closely with clients in the telecommunications<br />

<strong>and</strong> media industries, on strategic <strong>and</strong> operational issues for media <strong>and</strong> technology clients. He is a director of several private companies.<br />

General Partner Steve joined ATV in 1996 <strong>and</strong> focuses on investments in the software, infrastructure <strong>and</strong> internet services markets in the firm's Palo Alto, CA office. He is an<br />

active board member of EndPlay, Cenzic, Cedexis, Host Analytics, Modria, QuickPay, <strong>and</strong> WildTangent. Prior investments include Qumu (acquired by<br />

Rimage), Tripwire (acquired by Thoma Bravo), UpShot (acquired by Siebel Systems), Striva (acquired by Informatica NASDAQ: INFA), ViryaNet (NASDAQ:<br />

VRYA), Velogic (acquired by Keynote NASDAQ: KEYN), Seeker Software (acquired by Concur NASDAQ: CNQR), Epigram (acquired by Broadcom<br />

NASDAQ: BRCM), <strong>and</strong> Omneon Video Networks (acquired by Harmonic NASDAQ: HLIT).<br />

Steve has over 20 years of entrepreneurial, operating <strong>and</strong> venture experience. He founded <strong>and</strong> served as CEO of Worldview Systems, a successful venturebacked<br />

startup. Through a joint venture with Sabre Interactive, Worldview Systems created <strong>and</strong> launched Travelocity.com, the award-winning travel site.<br />

Steve also held executive positions in sales, marketing <strong>and</strong> general management with Covalent Systems, a venture-backed computer systems vendor<br />

focused on the graphic arts industry. His career originated in Booz, Allen & Hamilton’s San Francisco <strong>and</strong> London offices, where he focused on strategy<br />

engagements for a variety of technology companies in the U.S. <strong>and</strong> Europe.<br />

Advanced Technology Ed Frank Ventures<br />

Steve holds an M.B.A. from Stanford Graduate School of Business <strong>and</strong> a B.A. from Harvard College.<br />

Technology Partner Ed focuses on technology investments at ATV. Previously he was Co-founder <strong>and</strong> Executive Vice President of Epigram, Inc., an ATV portfolio company,<br />

which was acquired by Broadcom Corporation (NASDAQ: BRCM) in 1999. At Broadcom he was Vice President of research <strong>and</strong> development <strong>and</strong> an elected<br />

corporate officer. Among other accomplishments, he was responsible for establishing Broadcom as the world’s leading WiFi semiconductor vendor. Prior to<br />

Broadcom Ed was co-founder <strong>and</strong> vice president of research <strong>and</strong> development at NetPower, Inc. As a Sun Microsystems’s Distinguished Engineer, Ed cofounded<br />

<strong>and</strong> served as director of engineering for the "Green Project," which originated <strong>and</strong> developed what became Java. Ed also worked as manager of<br />

advanced development at Austek Pty. Ltd., <strong>and</strong> as a technical consultant for Sutherl<strong>and</strong>, Sproull <strong>and</strong> Associates. He is a member of the IEEE, a Hertz<br />

Foundation Fellow, <strong>and</strong> is a named inventor on more than 40 US patents. He serves on the board of directors of Onstor Inc, <strong>and</strong> Wavesat, Inc.<br />

Advanced Technology Robert Ventures Finocchio Venture Partner<br />

Ed holds a Ph.D. in Computer Science from Carnegie Mellon University where he now serves as a life trustee <strong>and</strong> is a member of the trustee’s executive<br />

committee. He holds a M.S. <strong>and</strong> B.S. in Electrical Engineering from Stanford University.<br />

As a Venture Partner with ATV, Bob focuses on investments in the software <strong>and</strong> internet infrastructure markets in the firm's Palo Alto, CA office. He currently<br />

serves on the boards of Anagran <strong>and</strong> CaseCentral. Bob also serves as a dean’s Executive Professor at Santa Clara University’s Leavey School of Business.<br />

Additionally, he serves on the boards of Altera Corporation, Echelon Corporation, Sun Microsystems, <strong>and</strong> Santa Clara University.<br />

Bob brings over 20 years of operating experience in the software, internet <strong>and</strong> infrastructure markets to ATV. He served as President <strong>and</strong> CEO of Informix<br />

Corporation, an information management software company acquired by IBM, where he also served as Chairman of the Board. Prior to Informix, Bob held<br />

various executive management positions at 3Com <strong>and</strong> the ROLM Corporation.<br />

Bob holds an M.B.A. from the Harvard Business School <strong>and</strong> a B.S. from Santa Clara University.

Advanced Technology Bob Hower Ventures<br />

General Partner Bob is ATV's East Coast lead partner for investments in information technology <strong>and</strong> is primarily focused on the internet, digital media <strong>and</strong> software sectors. He<br />

has been with ATV since 2002 <strong>and</strong> is an active board member of Acme Packet (NASDAQ:APKT), Actifio, Apptegic, ChannelAdvisor (NYSE: ECOM), <strong>and</strong><br />

[x+1]. Named to Forbes’ Midas list for two consecutive years, Bob was instrumental in Acme Packet's public offering, one of the most successful IPOs in the<br />

communications sector of the decade.<br />

Bob has extensive operating experience, including serving as Vice President of sales at LHS Group (EMEA), where he built the company's Enhanced<br />

Services Division for Europe, the Middle East <strong>and</strong> Africa. He was also a member of the senior management team at Priority Call Management (PCM). Prior to<br />

LHS Group’s acquisition of PCM in 1999, Bob helped grow PCM's revenue from approximately $3.5 million to $45 million. Bob’s management background<br />

also includes sales <strong>and</strong> marketing roles at Lotus Development <strong>and</strong> General Mills.<br />

Advanced Technology Bill Wiberg Ventures<br />

Bob first joined the venture capital community as a Director at BancBoston Ventures where he focused on the telecommunications <strong>and</strong> IT infrastructure<br />

sector. Early in his career, Bob worked in commercial real estate development at Cabot, Cabot & Forbes, negotiating lease transactions in excess of $100<br />

million. He earned an M.B.A. from The Amos Tuck School at Dartmouth College <strong>and</strong> a B.A., Cum Laude, from Harvard College.<br />

General Partner Bill is ATV’s lead partner for investments in the cleantech sector. He is an active board member of Aquion, GreatPoint Energy, Coskata, Oasys Water, Rive<br />

Technology, <strong>and</strong> Silicor Materials.<br />

Bill joined ATV in 2003, bringing with him extensive operational <strong>and</strong> venture capital experience, including 19 years with Lucent Technologies. He was<br />

President of Lucent’s Cellular <strong>and</strong> PCS Wireless Networks division from 1997 to 2000, a $5 billion business in 2000. Additionally, Bill served on the Board of<br />

Directors <strong>and</strong> Executive Committee of the Cellular Telecommunications <strong>and</strong> Internet Association (CTIA). Subsequent to Lucent, Bill was a General Partner at<br />

Orange Ventures, a wireless-focused fund backed by Orange, one of the largest mobile service providers in the world. He also served as a General Partner<br />

with Bowman Capital’s Private Equity Group.<br />

Bill earned an M.B.A. from Columbia University, an M.S. from Stanford University, <strong>and</strong> a B.S. from Cornell University.<br />

Allegis Capital Bob Ackerman Founder Bob founded Allegis Capital in 1996 after a successful career as a serial entrepreneur. In founding Allegis, Bob’s mission was to build a seed <strong>and</strong> early-stage<br />

venture firm that would combine operational experience with an entrepreneurial spirit <strong>and</strong> a focus on forging true partnerships with portfolio companies to build<br />

successful <strong>and</strong> sustainable cybertechnology companies. Bob has been recognized as a Fortune 100 cybersecurity executive <strong>and</strong> also as one of<br />

“CyberSecurity’s Money Men”.<br />

As an entrepreneur, Bob was the President <strong>and</strong> CEO of UniSoft Systems, a global leading UNIX Systems House <strong>and</strong> the Founder <strong>and</strong> Chairman of InfoGear<br />

Technology Corporation, a pioneer in the original integration of web <strong>and</strong> telephony technology <strong>and</strong> creator of the original iPhone.<br />

Outside of Allegis, Bob teaches New Venture Finance in the MBA program at the University of California, co-manages his family’s small Napa Valley winery –<br />

Ackerman Family Vineyards, <strong>and</strong> enjoys fly fishing.<br />

Allegis Capital Spencer Tall Managing DirectorSpencer joined Allegis Capital in 2004 as a Managing Director. His focus has been security <strong>and</strong> enterprise SaaS related technologies. Spencer is an<br />

experienced seed <strong>and</strong> early stage investor, who assists young companies <strong>and</strong> their founders in recruiting <strong>and</strong> strategic relationships.<br />

Prior to Allegis, he was co-founder of APV Technology Ventures, an early stage technology fund. He was also co-owner of Asia Pacific Ventures, a business<br />

advisory <strong>and</strong> consulting firm that focused on strategic relationships throughout Asia. During his tenure at APV, he worked with more than 50 companies in the<br />

USA, <strong>and</strong> consulted for large enterprises including Canon, Fujitsu, NEC, Sega, <strong>and</strong> Sony.<br />

When not working with his portfolio, Spencer enjoys snow skiing, fly fishing, running, <strong>and</strong> basketball.<br />

Allegis Capital Pete Bodine Managing DirectorPete joined Allegis Capital in 2006 as a Managing Director. His focus is on cloud-centric technologies, mobile, big data analytics <strong>and</strong> IoT opportunities.<br />

Pete’s focuses on growing his early stage technology companies, <strong>and</strong> using the Allegis Capital network to help leverage marketing channels <strong>and</strong> accelerate<br />

revenues for the portfolio. Pete also has broad experience helping start-up <strong>and</strong> established companies develop business plans, recruiting senior personnel,<br />

<strong>and</strong> procuring <strong>and</strong> structuring equity funding via strategic alliances with corporate partners.<br />

Pete was a member of the Forbes Midas list in 2006 <strong>and</strong> 2007. Prior to Allegis he was a co-founder of APV Technology Partners a seed <strong>and</strong> early stage IT<br />

focused fund. Pete also worked at Asia Pacific Ventures, a consulting <strong>and</strong> technology advisory firm. While at Asia Pacific Ventures, he advised large Asian<br />

companies including Fujitsu, Hitachi Data Systems, <strong>and</strong> NTT.<br />

When Pete is not investing in start ups he enjoys CrossFit, fly fishing <strong>and</strong> attending his kids sporting events.<br />

Allegis Capital Steve Simonian CFO As Allegis Capital’s Chief Financial Officer <strong>and</strong> Chief Compliance Officer, Steve Simonian’s responsibilities include finance, legal, investor relations,<br />

administration <strong>and</strong> compliance. Mr. Simonian joined Allegis in 2015 from his own consulting practice, where he provided finance <strong>and</strong> operational services for<br />

VC, PE <strong>and</strong> operating companies. Prior to his consulting practice, he served as Chief Financial Officer at August Capital. Mr. Simonian previously served as<br />

Chief Financial Officer at Gabriel Venture Partners <strong>and</strong> Meritech Capital Partners.<br />

Mr. Simonian received a BA in Business Economics from the University of California, Santa Barbara. A Certified Public Accountant, Mr. Simonian serves on<br />

the board of directors of the Private Equity CFO Association, <strong>and</strong> is a member of the National Venture Capital Association CFO Task Force <strong>and</strong> the American<br />

Institute of Certified Public Accountants.

Alloy Ventures Ammar Hanafi General Partner Ammar H. Hanafi joined Alloy Ventures as a general partner in 2005. At Alloy, he focuses on investments in cloud computing infrastructure <strong>and</strong> services.<br />

Operating experience<br />

Ammar previously served as Vice President of New Business Ventures at Cisco Systems <strong>and</strong> Vice President of Corporate Business Development prior to<br />

that, where he was responsible for Cisco's acquisitions, acquisition integration, investment, <strong>and</strong> joint venture activity on a global basis. He joined Cisco in<br />

1997 as a member of the Corporate Business Development Group. During his tenure at Cisco, he helped the company complete over 100 investment <strong>and</strong><br />

M&A transactions, including 50 acquisitions <strong>and</strong> over $750 million in venture capital investments. Ammar received a BS in Applied <strong>and</strong> Engineering Physics<br />

from Cornell University (1988) <strong>and</strong> an MBA from Stanford University (1995).<br />

Current board seats<br />

Ammar serves on the board of directors of Hightail, Mavenir Systems (NASDAQ: MVNR), Cortina Systems, GigaOM <strong>and</strong> Agari. He also serves on the board<br />

of directors of American Leadership Forum Silicon Valley (ALF), a non-profit organization.<br />

Alloy Ventures<br />

Michael Hunkapiller General Partner Michael Hunkapiller joined Alloy in 2004 after 30-year career in bioscience research <strong>and</strong> executive management in the life science industry. He focuses on<br />

investments in life science research tools <strong>and</strong> instrumentation, as well as clinical diagnostics.<br />

Operating experience<br />

A renowned scientist, entrepreneur <strong>and</strong> life science industry executive, Mike brings a unique mix of experience to Alloy. He spent 21 years at Applied<br />

Biosystems (NASDAQ: LIFE), which he co-founded <strong>and</strong> helped grow from startup to almost $2 billion in annual revenues supplying instrument <strong>and</strong> reagent<br />

systems for life science research. At ABI, he held several positions, most recently president <strong>and</strong> general manager. He was also a founder of ABI's sister<br />

company Celera Genomics (NASDAQ: CRA) <strong>and</strong> senior vice president of Applera Corp. (their parent company). Prior to joining ABI, Mike was a senior<br />

research fellow in the Division of Biology at the California Institute of Technology. He has authored more than 100 scientific publications, is an inventor on<br />

more than two dozen patents <strong>and</strong> has served on the editorial boards of several scientific journals. He has received several awards for his contributions to life<br />

science research, especially for his invention of the automated Gene <strong>and</strong> Protein Sequencer used to sequence the human genome. He was elected in 2008<br />

to the National Academy of Engineering for his life-long dedication to the human genome mapping project <strong>and</strong> the field of comparative genetics. He received<br />

a B.S. in Chemistry from Oklahoma Baptist University in 1970 <strong>and</strong> a Ph.D. in Chemical Biology from the Division of Chemistry <strong>and</strong> Chemical Engineering at<br />

Caltech in 1974.<br />

Current board seats<br />

Mike serves on the board of directors of Pacific Biosciences (NASDAQ: PACB), NuGEN <strong>and</strong> RainDance Technologies.<br />

Past Board Seats<br />

Mike served on the board of Fluidigm which completed its IPO in February, 2011 (NASDAQ: FLDM), <strong>and</strong> Verinata Health which was acquired in January 2013<br />

by Illumina (NASDAQ: ILMN).<br />

Alloy Ventures Doug Kelly General Partner Doug Kelly has worked with the partners of Alloy Ventures since 1993 <strong>and</strong> was a founding member of the firm. He currently focuses on investments in<br />

medical device companies.<br />

Operating experience<br />

Trained as a physician, Doug is a long-time venture investor with 20 years of experience in bridging the needs of the business <strong>and</strong> medical communities with<br />

novel applications of technology to create world-class companies. Prior to joining Alloy Ventures, he worked for two European venture capital firms, in<br />

business development at Lig<strong>and</strong> Pharmaceuticals, <strong>and</strong> as an independent consultant. Additionally, Doug teaches "Business 16 Financing The Startup" at<br />

Stanford Univeristy. Doug received a BA in Biochemistry <strong>and</strong> Cell Biology from the University of California at San Diego (1983), an MD from the Albert<br />

Einstein College of Medicine in 1988, <strong>and</strong> an MBA from Stanford University (1990).<br />

Current board seats<br />

Doug serves on the board of directors of Aegea,<br />

CoAlign Innovations, <strong>and</strong> Restoration Robotics.<br />

Past Board Seats<br />

Doug has invested in many leading medical device <strong>and</strong> biotech companies, <strong>and</strong> previously served on the boards of Sapient Health Network (acquired by<br />

WebMD/Healtheon in 1999), Camitro (acquired by Arqule in 2001), Fusion Medical (acquired by Baxter in 2002), Integrated Biosystems (acquired by Stedim<br />

SA in 2004), Adiana (acquired by Cytyc/Hologic in 2007), Pharsight (acquired by Tripos in 2008), Barrx Medical (acquired by Covidien in January 2012),<br />

Cameron Health (acquired by Boston Scientific in June 2012), Crux Biomedical (acquired by Volcano Corp. in December 2012),<br />

Alloy Ventures Daniel Rubin General Partner Daniel I. Rubin joined Alloy Ventures in 1999 after a 15-year career in business development, marketing <strong>and</strong> sales at leading technology companies. At Alloy,<br />

he focuses on investments in semiconductors, cleantech, <strong>and</strong> software-as-a-service.<br />

Operating experience<br />

Before becoming a venture capitalist in 1999, Dan was a successful technology entrepreneur <strong>and</strong> also held a variety of executive-level sales, marketing <strong>and</strong><br />

business development jobs in the IT industry. In 1991, he was a co-founder of Artisan Components <strong>and</strong> served as the initial VP of sales <strong>and</strong> marketing. He<br />

was the VP of business development through the company’s initial public offering in 1998. The company was later acquired by ARM Ltd. for $1 billion.<br />

Prior to Artisan Components, Dan worked at semiconductor capital equipment company Ultratech Stepper in many roles, including director of product<br />

marketing <strong>and</strong> managing director of Asian operations. He received a BA in Physics from Pomona College (1982).<br />

Current board seats<br />

Dan serves on the board of directors of Ensenda, Molecular Imprints, Gradient Design Automation, Scifiniti, <strong>and</strong> Teradici.<br />

Past Board Seats<br />

Dan previously served on the board of directors for Ciranova (acquired by Synopsys in 2012), Integrated Materials (acquired by Ferrotec in 2010) <strong>and</strong> as a<br />

board observer at Ellie Mae, which completed its IPO in April, 2011 (NASDAQ: ELLI).

Alloy Ventures John Shoch General Partner John F. Shoch, PhD, became a venture capitalist in 1985, first working with Craig Taylor to manage venture investments at Asset Management Associates,<br />

<strong>and</strong> then co-founding Alloy Ventures in 1996. At Alloy, he focuses on investments in enterprise software, communications infrastructure, semiconductors <strong>and</strong><br />

all aspects of the Internet.<br />

Operating experience<br />

Before becoming a venture capitalist, John worked as a computer scientist, technology executive <strong>and</strong> inventor. He gained deep h<strong>and</strong>s-on, operational<br />

experience at Xerox, which he joined in 1971. For many years, he worked at the Xerox Palo Alto Research Center (PARC), where he helped develop the<br />

Ethernet, a local area network system. In 1980, he became the assistant to the CEO of Xerox. In 1982, John became President of the Office Systems<br />

Division, developing networked office systems derived from Xerox PARC research. John received a BA (1971) in Political Science, an MS (1977), <strong>and</strong> a PhD<br />

(1979) in Computer Science, all from Stanford.<br />

Past Board Seats<br />

John was previously a director of semiconductor firm Conductus, which was acquired by Superconductor Technologies Inc. in 2002; <strong>and</strong> Remedy, a leading<br />

enterprise software company that completed a successful IPO on NASDAQ in 1995 <strong>and</strong> was later acquired by Peregrine Systems. John also served on the<br />

board of Polimetrix (acquired by YouGov in 2007) <strong>and</strong> MontaVista (acquired by Cavium Networks in 2009) <strong>and</strong> Knowledge Networks (acquired by GfK in<br />

2012).<br />

Alloy Ventures Craig Taylor General Partner Craig C. Taylor has been an active venture capitalist since 1977, <strong>and</strong> co-founded Alloy Ventures with John Shoch in 1996. At Alloy, he focuses on<br />

investments in laboratory instrumentation, diagnostics <strong>and</strong> cleantech, especially green-focused companies that sit at the intersection of biotech, nanotech <strong>and</strong><br />

IT.<br />

Operating experience<br />

Craig is a veteran venture capital investor with a focus on technology transfer from leading research institutions. Before co-founding Alloy Ventures, he<br />

worked at Asset Management Co., which he joined in 1977. Previously, Craig worked in the Office of Technology Licensing at Stanford University from 1975<br />

to 1977. He is a past member of the Board of Directors of the National Venture Capital Association, <strong>and</strong> serves on the Board of Advisors of the MIT/Stanford<br />

Venture Laboratory. He earned a BS (1972) <strong>and</strong> an MS (1974) in physics from Brown University, <strong>and</strong> an MBA from Stanford (1977).<br />

Current board seats<br />

Craig serves on the board of directors of Labcyte, Zyomyx, <strong>and</strong> KFx Medical.<br />

Past board seats<br />

Craig has led successful investments in, <strong>and</strong> served on the boards of, dozens of leading life science companies. He was a founding board member of Applied<br />

Biosystems, the pioneering biotechnology company founded in 1981 that was later became a division of Applera <strong>and</strong> was recently sold for $6.7 billion to<br />

Invitrogen Corp. He was also a founding board member of Adeza Biomedical, a woman's health company that completed a public offering on Nasdaq in 2004<br />

<strong>and</strong> was later acquired by Cytec. He also served on the board of Lynx Therapeutics, a provider of genetic analysis tools for biological research that completed<br />

an IPO on Nasdaq in 2000, <strong>and</strong> later merged with Solexa Ltd., before it was acquired by Illumina for $600 million 2006. Craig also served on the board of<br />

ForteBio which was acquired by Pall Corporation in 2012 <strong>and</strong> on Optimedica which was acquired by Abbott in August 2013.<br />

Alsop Louie Partners Gilman Louie Partner Gilman Louie is a Partner. He is the founder <strong>and</strong> former CEO of In-Q-Tel, a strategic venture fund created to help enhance national security by connecting the<br />

Central Intelligence Agency <strong>and</strong> U.S. intelligence community with venture-backed entrepreneurial companies. Previously Gilman built a career as a pioneer in<br />

the interactive entertainment industry, with accomplishments that include the design <strong>and</strong> development of the Falcon F-16 flight simulator as well as being the<br />

person who licensed Tetris, the world’s most popular computer game, from its developers in the Soviet Union. During that career, Gilman founded <strong>and</strong> ran a<br />

publicly traded company called Spectrum HoloByte which ultimately was acquired by Hasbro Corporation, where he served as chief creative officer of Hasbro<br />

Interactive <strong>and</strong> general manager of the Games.com group before founding In-Q-Tel.<br />

Gilman has served on a number of boards of directors, including Wizards of the Coast, Netwitness, Ribbit, Zephyr Technologies, the National Venture Capital<br />

Association, the CIA Officers Memorial Fund <strong>and</strong> currently chairs the M<strong>and</strong>arin Institute <strong>and</strong> the Federation of American Scientists. He serves as a member of<br />

the Markle Foundation Task Force on National Security in the Information Age, serves as a member of the Technical Advisory Group for the United States<br />

Senate Select Committee on Intelligence, chairs the committee on Persistent Forecasting of Disruptive Technologies for the National Academies, <strong>and</strong> was<br />

recently appointed as member of the National Commission for Review of Research <strong>and</strong> Development Programs of the United States Intelligence Community.<br />

In 2006, Gilman was presented with the Directors Award by the Director of the Central Intelligence Agency for his service in creating In-Q-Tel <strong>and</strong> providing<br />

service to the intelligence community. In 2002, he was listed as one of fifty scientific visionaries by Scientific American. Gilman completed the Advanced<br />

Management program/International Seniors Management Program at Harvard Business School <strong>and</strong> received a Bachelor of Science in Business<br />

Administration from San Francisco State University.

Alsop Louie Partners Stewart Alsop Partner Stewart is a Partner. He spent the first 20 years of his professional career as a business journalist <strong>and</strong> commentator. It did not start well: he earned a<br />

bachelor’s degree in English from Occidental College in Los Angeles in 1975, but had to stay the summer to complete his credits. Then he couldn’t find a job,<br />

so he went to bartending school. But bars weren’t hiring. He persisted <strong>and</strong>, from 1975 to 1996, had a series of jobs in which he learned how to be a business<br />

editor, including Executive Editor of Inc. Magazine, where he became fascinated by both entrepreneurship <strong>and</strong> personal computers <strong>and</strong> as the third editor of<br />

InfoWorld, the job that got him moved from Boston to Silicon Valley in 1983.<br />

In 1985, having been fired from two jobs, he started his own business, a newsletter called P.C. Letter, which became widely read in the executive ranks of the<br />

major hardware <strong>and</strong> software companies that formed <strong>and</strong> grew the personal computer industry. He also started two conferences, Agenda <strong>and</strong> Demo <strong>and</strong><br />

published the “Social Register to the PC Industry”.<br />

In 1996, Stewart changed careers to become a venture capitalist, joining New Enterprise Associates, a top-tier venture capital firm with a long track record of<br />

success in investing in early stage <strong>and</strong> growth companies. He was a general partner with New Enterprise Associates <strong>and</strong> led that firm’s investments in<br />

companies such as TiVo, Portola Communications (sold to Netscape), Netcentives, Glu Mobile, <strong>and</strong> Xfire. From 1996 to 2003, he wrote Alsop On InfoTech for<br />

Fortune.<br />

Stewart left NEA in 2005 <strong>and</strong> invited Gilman Louie to become his partner in a new venture capital firm designed to put to use everything the partners had<br />

learned about entrepreneurship, technology <strong>and</strong> innovation over the prior 25 years. From 2005-2013, Stewart was a member of the board of directors of<br />

Sonos Inc., which has become a thought leader in the world of digital audio <strong>and</strong> the digital living room.<br />

Alsop Louie Partners Bill Crowell Partner William P. Crowell is a Partner. He is also an Independent Consultant specializing in Information Technology, Security <strong>and</strong> Intelligence Systems. He is a<br />

director at SafeNet, Inc., encryption, data protection <strong>and</strong> authentication solutions, which is in the process of being acquired by Gemalto. He is also a director<br />

at DeviceAuthority, device authentication; SAP NS2, a subsidiary of SAP; <strong>and</strong> Toopher, multifactor authentication. He is Chairman of the Board of Centripetal,<br />

a startup in the rule-based packet gateway <strong>and</strong> filter area. Until its acquisition by Cisco in June 2007, he was Chairman of Broadware Technologies, a video<br />

surveillance software company. He was also a director at ArcSight, Inc. (ARST), which was acquired by HP in October 2010; Narus, Inc. which was acquired<br />

by Boeing in July 2010; Six3 Systems which was acquired by CACI in November 2013, Air Patrol, wireless network security company acquired by Sysorex in<br />

May 2014, <strong>and</strong> Fixmo, Inc., a mobile device security company acquired by Good Technologies in June 2014.<br />

Crowell served as President <strong>and</strong> Chief Executive Officer of Santa Clara, California-based Cylink Corporation, a public company <strong>and</strong> leading provider of e-<br />

business security solutions from November 1998 to February 2003, when Cylink was acquired by SafeNet, Inc.<br />

Crowell came to Cylink from the National Security Agency, where he held a series of senior positions in operations, analysis, strategic planning, research <strong>and</strong><br />

development, <strong>and</strong> finance. He served as Deputy Director of Operations from 1991 to 1994 running its core signals intelligence mission. In February 1994 he<br />

was appointed by President Clinton as the Deputy Director of NSA <strong>and</strong> served in that post until his retirement in September 1997. From 1989 to 1990, Crowell<br />

served as a vice president at Atlantic Aerospace Electronics Corporation, later acquired by Titan Corp, leading business development in space technology,<br />

signal processing <strong>and</strong> intelligence systems. In April 1999, Crowell was appointed to the President’s Export Council (PEC), which advised the administration on<br />

trade <strong>and</strong> export policy.<br />

After 9/11, he served on the Markle Foundation Task Force on National Security in the Information Age, which published three l<strong>and</strong>mark studies on Homel<strong>and</strong><br />

Security <strong>and</strong> information sharing. He has also served on numerous panels to investigate <strong>and</strong> improve military comm<strong>and</strong> <strong>and</strong> control, intelligence <strong>and</strong> security<br />

systems <strong>and</strong> served as Chairman of the Director of National Intelligence (DNI) Senior Advisory Group from 2007 – 2014.<br />

Crowell is an expert on network <strong>and</strong> information security issues. In December 2008 Security Magazine selected him as one of the 25 most influential people in<br />

the security industry. In May 2007 he co-authored the book, “Physical <strong>and</strong> Logical Security Convergence,” published by Elsevier. He has been quoted in many<br />

trade <strong>and</strong> business publications including the Wall Street Journal, Business Week, USA Today, Information Week, Network World, Computer World, Federal<br />

Computer Week, CIO Magazine <strong>and</strong> the San Jose Mercury News. Crowell has also appeared on CBS MarketWatch, CNET News, CNBC, <strong>and</strong> The Charlie<br />

Rose Show. He was the technical advisor to the TV series, “Threat Matrix” during its run on ABC in the 2003 season.<br />

Alsop Louie Partners Jim Whims Partner Jim Whims is a Partner. For the last decade, Jim was a partner at Techfund Capital in the U.S. <strong>and</strong> Europe, where he invested in companies like 3DFX <strong>and</strong><br />

Portal Player. Jim was a co-founder of Worlds of Wonder <strong>and</strong> was a key executive at Software Toolworks <strong>and</strong> Sony Computer Entertainment. In 1996,<br />

Adweek/Br<strong>and</strong>week recognized him as the Marketing Executive of the Year for driving revenues from zero to $1B in one year at Sony, where Jim managed<br />

the launch of the Playstation in North America. Jim also serves on the Board of Directors at THQ <strong>and</strong> Synaptics. He received his MBA in Finance from the<br />

University of Arizona <strong>and</strong> a BS from Northwestern University.<br />

Alsop Louie Partners Joel Addiego Partner Joe Addiego is a Partner. Prior to joining Alsop Louie Partners, Joe was an investment partner at In-Q-Tel, the strategic venture arm of the U.S. intelligence<br />

community. While there, Joe lead investments in LensVector, Pixim, ThinKom, <strong>and</strong> LanguageWeaver, among others. Prior to that, Joe was the Executive VP<br />

of Marketing <strong>and</strong> Sales for Talarian through its IPO in August, 2000. Joe was the CEO of TakeFive Software, a Salzburg Austria-based development tools<br />

company. He also spent 14 years growing Integrated Systems Inc., <strong>and</strong> later Wind River Systems, from a start-up to a $400 million NASDAQ traded company<br />

where he held a variety of positions including VP of Marketing <strong>and</strong> Sales <strong>and</strong> VP of International Operations. Joe spent his early career at Hewlett-Packard<br />

<strong>and</strong> AT&T in sales <strong>and</strong> sales management roles.<br />

Alsop Louie Partners Nancy Lee Partner Nancy Lee is our Chief Financial Officer <strong>and</strong> a Partner. She is a veteran bean counter for venture capital firms, having spent 20 years with Walden<br />

International, a firm with a long <strong>and</strong> distinguished history <strong>and</strong> multiple funds in North America <strong>and</strong> Asia. Her job is to keep Gilman <strong>and</strong> Stewart out of trouble<br />

<strong>and</strong> help our investors make the most of their investment.<br />

Alsop Louie Partners Joel Alsop Venture Partner Joseph Alsop is a Venture Partner. He was the founder <strong>and</strong> until 2009 the CEO of Progress Software Inc., a public company (PRGS) selling application<br />

infrastructure technology, including application development tools <strong>and</strong> the world’s leading imbedded database. He graduated from MIT in 1967 with a BSEE<br />

degree. He is investing in <strong>and</strong> working with companies in Massachusetts applying information technology in various areas.

Alsop Louie Partners Bill Coleman Venture Partner Bill Coleman is a Venture Partner. Previously Bill was Founder, Chairman <strong>and</strong> CEO of Cassatt, Inc. an enterprise cloud software company which was<br />

acquired by CA, Inc. in 2009. In 1995, he founded BEA Systems, Inc. for which he developed the vision <strong>and</strong> business plan, recruited the other two other<br />

principals, Ed Scott <strong>and</strong> Alfred Chuang <strong>and</strong> raised the Series A funding from Warburg Pincus (the only funding round required until the IPO in 1997). Bill was<br />

Chairman <strong>and</strong> CEO of the company from its founding through September 2001 during which BEA became the fastest software company ever to reach a<br />

billion dollars in annual revenue, a record that still st<strong>and</strong>s today.<br />

Prior to BEA, Bill held various management positions at Sun Microsystems, Inc., including: co-founder of Sun Federal; founder, vice president <strong>and</strong> general<br />

manager of Sun Professional Services; <strong>and</strong> vice president of system software overseeing SunOS, the initial development of Solaris <strong>and</strong> related system<br />

administration, networking <strong>and</strong> management products.<br />

Before his work at Sun, Coleman co-founded <strong>and</strong> was vice president of engineering at Dest Systems. Prior to that, he was the director of product<br />

development at VisiCorp where he oversaw publishing of the first spreadsheet, VisiCalc; development of the first office suite of personal computer productivity<br />

applications, the “Visi Series”; <strong>and</strong> development of the first personal computer window system, VisiOn. As general manager of the high frequency systems<br />

group at GTE Sylvania he grew his systems business from $12m to $36M in less than three years. Coleman began his career in the U.S. Air Force as chief of<br />

satellite operations in the Office of the Secretary of the Air Force supporting the National Reconnaissance Organization.<br />

Coleman has a bachelor’s degree in computer science from the U.S. Air Force Academy <strong>and</strong> master’s degrees in computer science <strong>and</strong> computer<br />

engineering from Stanford University. He also has an honorary doctorate from the University of Colorado.<br />

Mr. Coleman is the founder <strong>and</strong> president of the Coleman Colorado Foundation which founded <strong>and</strong> supports the University of Colorado Coleman Institute for<br />

Cognitive Disabilities. He is a member of the board of directors of Framehawk, iControl, Seagate, Resilient Network Systems <strong>and</strong> Business Executives for<br />

National Security <strong>and</strong> a Trustee of the University of Santa Clara. He was a member of the Board of the Silicon Valley Leadership Group from 1999 to 2009,<br />

<strong>and</strong> Chairman from 2004 – 2006 <strong>and</strong> has served on the boards of the following public companies: BEA Systems, Palm Inc, Symantec, Skillsoft Inc <strong>and</strong> Portal<br />

Software Inc as well as numerous private companies.<br />

Both Ernst & Young <strong>and</strong> the Robert H. <strong>and</strong> Beverly A. Deming Center for Entrepreneurship at the University of Colorado named Mr. Coleman their 2001<br />

“Entrepreneur of the Year,” <strong>and</strong> Business Week named him one of 2001’s ebiz 25 top executives.<br />

Alsop Louie Partners Ernestine Fu Venture Partner Ernestine Fu is a Venture Partner. She joined Alsop Louie Partners in March 2011 <strong>and</strong> then led her first investment within two months. She currently leads the<br />

investment thesis in 3D printing. Companies she is involved with include: Jetlore, Keyssa, MXD3D, New Matter, Wickr, WiFiSLAM, <strong>and</strong> others. She also<br />

oversees the campus associate outreach program.<br />

Ernestine’s publications include: Civic Work, Civic Lessons (a book on public service with Stanford professor Thomas Ehrlich), The State Clean Energy<br />

Cookbook (a report with former U.S. Senator Jeff Bingaman, Secretary George Shultz, etc), <strong>and</strong> others. She also blogs for Forbes.<br />

Ernestine holds a BS <strong>and</strong> MS from Stanford University <strong>and</strong> is a graduate of the Kauffman Fellows Program. At Stanford, she was recognized for the top<br />

honors thesis in engineering <strong>and</strong> multiple honor societies. She currently teaches two courses: one on entrepreneurship <strong>and</strong> venture capital, <strong>and</strong> another on<br />

circular economy.<br />

Alsop Louie Partners Tom Kalinske Venture Partner Tom Kalinske is a Venture Partner. He is currently Chairman of Global Education Learning, a start-up dedicated to helping young children in China learn<br />

various subjects. Tom also serves on the board of Cambium Learning Group (NASDAQ-ABCD) <strong>and</strong> is Vice Chairman of LeapFrog Inc, of which he was<br />

previously CEO <strong>and</strong>/or Chairman at different times starting in 1997, helping LeapFrog grow from a start-up specialty toy company to the largest educational<br />

toy company in the world.<br />

Tom joined Knowledge Universe (KU) at its founding in 1996 as its President <strong>and</strong> on its Board of Directors. From 1990 to 1996, Tom was president <strong>and</strong> CEO<br />

of Sega of America, Inc. From 1987 to 1990, Tom was President <strong>and</strong> CEO of Universal Matchbox Group. Previously, Tom was President <strong>and</strong> Co-CEO of<br />

Mattel, where he worked on Barbie & Hot Wheels in addition to other business lines.<br />

Tom also serves on the board of Genyous Omnitura a cancer drug development company, The M<strong>and</strong>arin Institute, <strong>and</strong> the National Board of Advisors of the<br />

University of Arizona School of Business. Tom is a graduate of the University of Wisconsin. He earned an MBA from the University of Arizona, <strong>and</strong> attended<br />

the Harvard Business School’s Strategic Management Program. He is married with six children.<br />

Alsop Louie Partners Stephen Mendel Venture Partner<br />

Stephen Mendel is a Venture Partner. He has served in a wide variety of leadership roles in public <strong>and</strong> private technology based organizations – managing<br />

director <strong>and</strong> executive vice president of In-Q-Tel in charge of its venture capital activities, vice chairman of Knowledge Revolution (acquired by MSC<br />

Software), CEO <strong>and</strong> president of Ithaca Software (acquired by Autodesk NASDAQ:ADSK), executive vice president of Maxwell Communication Corporation<br />

(MCC), executive vice president of Spectrum-Holobyte (NASDAQ: MPRS, then acquired by Hasbro) <strong>and</strong> executive vice president of MDL (acquired by MCC,<br />

then NASDAQ: MDLI, then acquired by Symyx Technologies). He has also served as a member of the board of directors of AXS, Ithaca Software, Spectrum-<br />

Holobyte, MDL, Simmedia, Verso, Futurize Now, Knowledge Revolution, Direct Language, Site Technologies, DuckDuckGo, Motive Medical Intelligence,<br />

2lemetry, <strong>and</strong> BeBop Sensors.<br />

Stephen’s management style <strong>and</strong> business acumen have been recognized both regionally <strong>and</strong> nationally. Under his leadership, Ithaca Software was<br />

recognized by Inc. Magazine as one of the fastest growing private companies in America. Stephen’s h<strong>and</strong>s-on approach to mentoring young management<br />

teams has generated an enviable track record of successful investments. He has spoken at numerous national <strong>and</strong> international conferences on topics<br />

ranging from entrepreneurship to exit strategies.<br />

Stephen began his career as an attorney at Feldman Waldman <strong>and</strong> Kline, where he represented clients in corporate, securities, intellectual property <strong>and</strong><br />

commercial matters. He received his Juris Doctor with highest honors from Hofstra University <strong>and</strong> his Bachelor of Arts in Philosophy from the University of<br />

Rochester.<br />

Alsop Louie Partners Jim Ward Venture Partner Jim Ward is a Venture Partner. He is on the board of directors of Gowalla, an Alsop Louie Partners portfolio company. Jim is the former president of<br />

LucasArts, the videogame division of LucasFilm Ltd, where he was also the senior vice president of marketing, distribution <strong>and</strong> online. Before he joined<br />

LucasFilm in 1997, he spent his career in advertising where he worked closely with Apple Computer, Microsoft <strong>and</strong> then Nike over a period of 15 years.

Alsop Louie Partners Will Jack Associate Will Jack is an associate at MIT, where he is a c<strong>and</strong>idate for a bachelors degree in Physics <strong>and</strong> EECS. He grew up in suburban Ohio where most of his days<br />

were spent tinkering in his basement workshop.<br />

In 8th grade, he combined his love for building things with his interest in high energy physics <strong>and</strong> began building a particle collider capable of carrying out<br />

nuclear fusion reactions between hydrogen nuclei. Will completed this collider in 10th grade, presenting his work at two international science fairs, <strong>and</strong> in a<br />

keynote speech at the EHSM conference in Berlin. Will continued his trek into plasma physics research by working as a researcher on the Lithium Tokamak<br />

Experiment at the Princeton Plasma Physics Lab the summer before coming to MIT.<br />

At MIT, Will developed his already present passion for entrepreneurship <strong>and</strong> innovation through starting the MIT Innovation Committee, an organization<br />

devoted to uniting resources for innovation across campus <strong>and</strong> making them accessible to undergraduates. He worked to create <strong>and</strong> organize MakeMIT, MIT’<br />

s first <strong>and</strong> largest hardware hackathon, <strong>and</strong> has also worked on developing intelligent medical equipment at the MIT Media Lab.<br />

Alsop Louie Partners David Mace Associate David Mace is an associate at Caltech, where he is a c<strong>and</strong>idate for a bachelors degree in Computer Science.<br />

At 17 years old, David published a novel machine learning technique to classify gesture interface motions in a major computer science journal (ACM IUI) as<br />

one of its youngest ever authors. At 18, he sold a war prediction algorithm to USAID. At 19, he was offered the Thiel Fellowship to drop out of Caltech <strong>and</strong><br />

pursue real-world prediction algorithms full-time, but decided to return to Caltech.<br />

He has been the youngest member of IBM Watson’s core research team developing natural language processing algorithms for text underst<strong>and</strong>ing <strong>and</strong> the<br />

youngest member of Facebook’s Applied Machine Learning Group leveraging text underst<strong>and</strong>ing to improve Facebook’s ad-targeting models.<br />

He spends most of his time trying to convince people that in a century, war will not exist because algorithms will allow us to forecast population-level effects of<br />

our political actions. He has spoken on the topic at TEDx Teen, Young President’s Organization LA, <strong>and</strong> SXSW (accepted March 2016). He has also<br />

delivered a joint Q&A with Ray Kurzweil on the future of AI at SAP Global CEO Summit.<br />

As a freshman at Caltech, he co-founded Hacktech, the first large-scale college hackathon on the West Coast, which raised a quarter million dollars <strong>and</strong> was<br />

attended by over 1200 students.<br />

David has also worked at NASA JPL building a Mars telemetry data analysis tool used daily by JPL scientists to detect early indications of critical malfunctions<br />

in the Mars rover, at Mousera making automated feature detection systems for lab mice in pharmaceutical drug testing centers, <strong>and</strong> at Zekira building systems<br />

for near real-time search <strong>and</strong> display of massive amounts of diverse user data. Before joining Alsop Louie, David held a similar role for Lightspeed Venture<br />

Partners.<br />

David is an avid traveller <strong>and</strong> has solo backpacked around five continents since entering college two years ago. He also once starred in a pilot for a TBS<br />

reality TV show about pranking people with science, but quickly realized that he should stick to technology rather than acting.

Altos Ventures Han Kim Managing DirectorHan Kim is a Managing Director <strong>and</strong> co-founder of Altos Ventures, focusing on investments in the areas of mobile <strong>and</strong> software services. He also<br />

concentrates on companies with significant business in Asia, leveraging the firm’s substantial contacts in the region, particularly in Korea. Han currently<br />

serves on the boards of numerous Korea based private companies. Before co-founding Altos Ventures in 1996, Han worked at Booz Allen & Hamilton solving<br />

strategic <strong>and</strong> operational issues for global media, retail <strong>and</strong> distribution companies. Previously, he was at Procter & Gamble. Han also served as a Captain in<br />

the U.S. Army Corps of Engineers. Han served two years in Korea, comm<strong>and</strong>ing both U.S. <strong>and</strong> Korean soldiers. Han received an MBA from Stanford<br />

University <strong>and</strong> a BS from the U.S. Military Academy at West Point.<br />

Current Investments<br />

ADOP<br />

Beatpacking<br />

Bluehole<br />

Bookjam<br />

Brideasmart<br />

Coupang<br />

Hyperconnect<br />

I-UM<br />

JobPlanet<br />

LendIt<br />

P<strong>and</strong>ora.TV<br />

Retrica<br />

Viva Republica<br />

VonVon<br />

Woowa Brothers<br />

Past Companies<br />

BCNX: Acquired by Yello Mobile<br />

CalmSea: Acquired by Coupang<br />

Dem<strong>and</strong>Tec: IPO (DMAN), now part of IBM<br />

Digital Market: Acquired by Agile Software (AGIL), now part of Oracle (ORCL)<br />

Evant: Acquired by Manhattan Associates (MANH)<br />

Green Car: Acquired by Lotte Group<br />

Instill: Merged with iTrade Networks<br />

Nable Communication: IPO (KOSDAQ15340)<br />

Provade: Acquired Pinnacle<br />

SeeControl: Acquired by Autodesk (ADSK)

Altos Ventures Anthony Lee Managing DirectorAnthony Lee is a Managing Director of Altos Ventures, where he focuses on software <strong>and</strong> digital media investments. Before joining Altos, Anthony led<br />

marketing efforts for three start-up companies including Evolve Software (Nasdaq:EVLV, later acquired by Oracle). Anthony began his career as a strategy<br />

consultant at McKinsey & Company <strong>and</strong> has published a national magazine. Anthony serves as Chairman of TechSoup, the world’s largest non-profit<br />

distributor of computer software <strong>and</strong> hardware. He co-founded <strong>and</strong> co-chairs the C100, a network of top Canadian technology leaders dedicated to supporting<br />

Canadian entrepreneurs. Anthony is a member of the Pacific Council on International Policy <strong>and</strong> served as a term member of the Council on Foreign<br />

Relations. He is a founding member of the Full Circle Fund, a venture philanthropy group based in San Francisco. Anthony received his MBA from Stanford<br />

University <strong>and</strong> earned a BA in Politics <strong>and</strong> Economics from Princeton University.<br />

Current Investments<br />

Allocadia<br />

Bench Accounting<br />

BrightEdge<br />

Dem<strong>and</strong>base<br />

Joya Communication<br />

OneUp<br />

Outbound Engine<br />

Netbase Solutions<br />

Piqora<br />

ROBLOX<br />

Testlio<br />

Upsight<br />

Xignite<br />

Past Companies<br />

CrownPeak: Acquired by K1 Capital<br />

Evolve Software: IPO (EVLV), now part of Oracle (ORCL)<br />

GuardianEdge: Acquired by Symantec (SYMC)<br />

Altos Ventures Hodong Nam Managing DirectorHo Nam is a Managing Director of Altos Ventures, focusing on investments in the areas of software, mobile, <strong>and</strong> internet technologies. Ho began his VC<br />

career at Trinity Ventures <strong>and</strong> began his professional career at Bain & Company where he advised clients in technology, media <strong>and</strong> consumer products<br />

industries. Before co-founding Altos Ventures, Ho worked at Silicon Graphics <strong>and</strong> Octel Communications. Ho received an MBA from Stanford University <strong>and</strong> a<br />

BS in Engineering from Harvey Mudd College.<br />

Current Investments<br />

DigitalPath<br />

HireMojo<br />

Lohika<br />

P<strong>and</strong>aDoc<br />

Quizlet<br />

Trilibis Mobile<br />

TVU Networks<br />

Vesta<br />

WhiteHat Security<br />

Past Companies<br />

Axis Systems: Acquired by Verisity (VRST), now part of Cadence (CDNS)<br />

Enwisen: Acquired by Lawson Software (LWSN), now part of Infor<br />

Evolve Software: IPO (EVLV), now part of Oracle (ORCL)<br />

Immunet: Acquired by Sourcefire (FIRE), now part of Cisco (CSCO)<br />

Listen.com: Acquired by Real Networks (REAL)<br />

Nishan Systems: Acquired by McData (MCDT), now part of Brocade (BRCD)<br />

OtherInbox: Acquired by ReturnPath<br />

Pixo : Acquired by Sun Microsystems, now part of Oracle (ORCL)<br />

Provato: Acquired by iMany (IMNY), now Revitas<br />

SayNow: Acquired by Google (GOOG)<br />

Soundpipe: Acquired by Comdial (CMDZ)<br />

Yosemite Technologies: Acquired by Barracuda Networks (CUDA)

Altos Ventures Hee-Eun Park Principal Hee-Eun Park (“Baki”) focuses on mobile <strong>and</strong> software investments in Korea. Before joining Altos Ventures, she was a co-founder <strong>and</strong> CEO of IUM, an Altosfunded<br />

company in Korea. She took the company from a business plan to the largest mobile dating service in Korea, serving over one million subscribers.<br />