annual financial statements - Nedbank Group Limited

annual financial statements - Nedbank Group Limited

annual financial statements - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46<br />

NEDNAMIBIA HOLDINGS LIMItED ANNUAL REPORt 2010<br />

STATUTorY ACtUARY’S REPORt<br />

TO THE mEmbERS OF NEDNAmIbIA LIFE ASSURANcE cOmPANY LImITED<br />

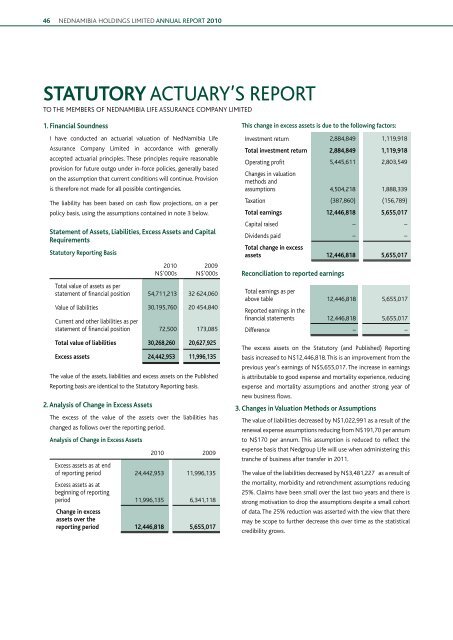

1. Financial Soundness<br />

I have conducted an actuarial valuation of NedNamibia Life<br />

Assurance company <strong>Limited</strong> in accordance with generally<br />

accepted actuarial principles. These principles require reasonable<br />

provision for future outgo under in-force policies, generally based<br />

on the assumption that current conditions will continue. Provision<br />

is therefore not made for all possible contingencies.<br />

The liability has been based on cash flow projections, on a per<br />

policy basis, using the assumptions contained in note 3 below.<br />

Statement of Assets, Liabilities, Excess Assets and Capital<br />

requirements<br />

Statutory reporting Basis<br />

2010<br />

N$’000s<br />

2009<br />

N$’000s<br />

Total value of assets as per<br />

statement of <strong>financial</strong> position 54,711,213 32 624,060<br />

Value of liabilities 30,195,760 20 454,840<br />

current and other liabilities as per<br />

statement of <strong>financial</strong> position 72,500 173,085<br />

Total value of liabilities 30,268,260 20,627,925<br />

Excess assets 24,442,953 11,996,135<br />

The value of the assets, liabilities and excess assets on the Published<br />

Reporting basis are identical to the Statutory Reporting basis.<br />

2. Analysis of Change in Excess Assets<br />

The excess of the value of the assets over the liabilities has<br />

changed as follows over the reporting period.<br />

Analysis of Change in Excess Assets<br />

2010 2009<br />

Excess assets as at end<br />

of reporting period 24,442,953 11,996,135<br />

Excess assets as at<br />

beginning of reporting<br />

period 11,996,135 6,341,118<br />

Change in excess<br />

assets over the<br />

reporting period 12,446,818 5,655,017<br />

This change in excess assets is due to the following factors:<br />

Investment return 2,884,849 1,119,918<br />

Total investment return 2,884,849 1,119,918<br />

Operating profit 5,445,611 2,803,549<br />

changes in valuation<br />

methods and<br />

assumptions 4,504,218 1,888,339<br />

Taxation (387,860) (156,789)<br />

Total earnings 12,446,818 5,655,017<br />

capital raised – –<br />

Dividends paid – –<br />

Total change in excess<br />

assets 12,446,818 5,655,017<br />

reconciliation to reported earnings<br />

Total earnings as per<br />

above table 12,446,818 5,655,017<br />

Reported earnings in the<br />

<strong>financial</strong> <strong>statements</strong> 12,446,818 5,655,017<br />

Difference – –<br />

The excess assets on the Statutory (and Published) Reporting<br />

basis increased to N$12,446,818. This is an improvement from the<br />

previous year’s earnings of N$5,655,017. The increase in earnings<br />

is attributable to good expense and mortality experience, reducing<br />

expense and mortality assumptions and another strong year of<br />

new business flows.<br />

3. Changes in Valuation Methods or Assumptions<br />

The value of liabilities decreased by N$1,022,991 as a result of the<br />

renewal expense assumptions reducing from N$191,70 per annum<br />

to N$170 per annum. This assumption is reduced to reflect the<br />

expense basis that Nedgroup Life will use when administering this<br />

tranche of business after transfer in 2011.<br />

The value of the liabilities decreased by N$3,481,227 as a result of<br />

the mortality, morbidity and retrenchment assumptions reducing<br />

25%. claims have been small over the last two years and there is<br />

strong motivation to drop the assumptions despite a small cohort<br />

of data. The 25% reduction was asserted with the view that there<br />

may be scope to further decrease this over time as the statistical<br />

credibility grows.